UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 1, 2016

PRESSURE

BIOSCIENCES, INC.

(Exact

name of registrant as specified in its charter)

| Massachusetts |

|

000-21615 |

|

04-2652826 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

14

Norfolk Avenue

South

Easton, Massachusetts 02375

(Address

of principal executive offices)(Zip Code)

Registrant’s

telephone number, including area code: (508) 230-1828

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Cautionary

Note on Forward-Looking Statements

This

Current Report on Form 8-K (this “Report”) contains, or may contain, among other things, certain “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking

statements involve significant risks and uncertainties. Such statements may include, without limitation, statements with respect

to the Company’s plans, objectives, projections, expectations and intentions and other statements identified by words such

as “projects,” “may,” “will,” “could,” “would,” “should,”

“believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,”

or similar expressions. These statements are based upon the current beliefs and expectations of the Company’s management

and are subject to significant risks and uncertainties, including those detailed in the Company’s filings with the Securities

and Exchange Commission (the “SEC”). Actual results may differ significantly from those set forth in the forward-looking

statements. These forward-looking statements involve certain risks and uncertainties that are subject to change based on various

factors (many of which are beyond the Company’s control). The Company undertakes no obligation to publicly update any forward-looking

statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

Item

1.01 Entry into a Material Definitive Agreement.

Amendment

to Terms of Private Placement Equity Financing

Pressure

BioSciences Inc. (the “Company”) previously disclosed a private placement equity financing on its Current Report

on Form 8-K filed by the Company on July 28, 2015 (the “July 28 Current Report”), which is incorporated by

reference herein (excluding Exhibit 99.1 thereto). As disclosed in the July 28 Current Report, the total amount of the private

placement equity financing could be up to $5,000,000 with an over-subscription amount of $1,250,000.

As

previously disclosed on its Current Report on Form 8-K filed by the Company on January 15, 2016 (the “January 15 Current

Report”), which is incorporated by reference herein (excluding Exhibit 99.1 thereto), the Company approved the over-subscription

amount of $1,250,000, increasing the capacity of the private placement equity financing to a maximum of $6,250,000.

In

order to continue to raise funds through the private placement equity financing, the Company and its placement agent agreed to

extend the offering from January 31, 2016 to March 31, 2016 and increase the over-subscription amount by an additional $1,250,000

such that the maximum amount of the offering is $7,500,000. The Company and placement agent received consent to these changes

from 100% of the existing investors in the private placement equity financing.

Closing

of Private Placement Equity Financing

On

March 1, 2016, in connection with the sixth closing (the “Sixth Closing”) of the private placement equity financing

previously disclosed by the Company on the July 28 Current Report and pursuant to the Subscription Agreements, dated as of January

20, 2016, January 29, 2016 and February 26, 2016 by and among the Company and various individuals (each, a “Purchaser”

and together “Purchasers”) the Company sold and issued to the Purchasers Senior Secured Convertible Debentures

(the “Debentures”) and warrants to purchase shares of common stock equal to 50% of the number of shares issuable

pursuant to the subscription amount (the “Warrants”) for an aggregate purchase price of $550,000 (the “Purchase

Price”) for the Sixth Closing, bringing the total raised in the Offering to $5,560,000. For the Sixth Closing, the Company

netted $495,000 in cash after taking into account fees related to the offering.

In

connection with the Subscription Agreement and Debentures, the Company entered into a Security Agreement with the Purchasers and

a FINRA-registered broker dealer that acted as the placement agent whereby the Company agreed to grant to Purchasers an unconditional

and continuing, first priority security interest in all of the assets and property of the Company to secure the prompt payment,

performance and discharge in full of all of Company’s obligations under the Debentures, Warrants and the other transaction

documents. The form of Subscription Agreement, form of Debenture, form of Warrant, and Security Agreement were filed as Exhibit

10.1, 4.1, 4.2, and 10.2 to the July 28 Current Report respectively, each of which is incorporated by reference herein.

Item

3.02 Unregistered Sales of Equity Securities.

Reference

is made to the disclosure set forth under Item 1.01 of this Report, which disclosure is incorporated herein by reference.

The

issuance of the securities described above were completed in accordance with the exemption provided by Section 4(a)(2) of the

Securities Act of 1933, as amended.

Item

8.01 Other Items

On

March 1, 2016, we issued a press release relating to this Sixth Closing. The press release is attached hereto as Exhibit 99.1.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

Exhibit

Number

|

|

Exhibit

Description |

| |

|

|

| 4.1 |

|

Form

of Debenture (incorporated by reference to the Current Report on Form 8-K, dated July 28, 2015) |

| |

|

|

| 4.2 |

|

Form

of Warrant (incorporated by reference to the Current Report on Form 8-K, dated July 28, 2015) |

| |

|

|

| 10.1 |

|

Subscription

Agreement (incorporated by reference to the Current Report on Form 8-K, dated July 28, 2015) |

| |

|

|

| 10.2 |

|

Security

Agreement (incorporated by reference to the Current Report on Form 8-K, dated July 28, 2015) |

| |

|

|

| 99.1 |

|

Press

Release |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

PRESSURE

BIOSCIENCES, INC. |

| |

|

|

| Dated:

March 7, 2016 |

By: |

/s/

Richard T. Schumacher |

| |

|

Richard

T. Schumacher |

| |

|

President |

FOR

IMMEDIATE RELEASE

| Investor

Contacts: |

|

|

| Richard

T. Schumacher, President & CEO, PBI |

|

(508)

230-1828 (T) |

| Jeffrey

N. Peterson, Chairman, PBI |

|

(650)

812-8121 (T) |

| Redwood

Investment Group |

|

(714)

978-4425 (T) |

Pressure

BioSciences Closes $550,000 First Tranche

of

$5 Million PIPE Over-Subscription Amount

South

Easton, MA, March 1, 2016 – Pressure BioSciences, Inc. (OTCQB: PBIO) (“PBI” and the “Company”),

a leader in the development and sale of broadly enabling, pressure cycling technology (“PCT”)-based sample preparation

solutions to the worldwide life sciences industry, today announced it has closed the first tranche of the over-subscription amount

of its $5 million Private Placement (the “Offering”) following the receipt of $550,000 in gross proceeds from the

sixth overall closing of the Offering. This closing increased the total amount raised in the Offering to $5,560,000.

The

initial terms of the Offering limited the amount that could be raised in the Offering to $6.25 million ($5 million plus a $1.25

million over-subscription amount). The Company recently approved an increase in the over-subscription amount to $2.5 million,

which increased the capacity of the Offering to a maximum of $7.5 million. Following the sixth closing, $1,940,000 remains available

in the Offering.

Pursuant

to the terms of the Offering, the Company will issue to the investors, senior secured convertible debentures with a fixed conversion

price of $0.28 per restricted common share, and common stock purchase warrants exercisable into shares of restricted common stock

at an exercise price of $0.40 per share. The Company is under no obligation to file a registration statement to register the shares

underlying the Debentures and Warrants.

Mr.

Richard T. Schumacher, President and CEO of PBI, commented: “In mid-January 2016, SCIEX, a global leader in life science

analytical technologies and a wholly-owned subsidiary of the Danaher Corporation, announced an exclusive co-marketing agreement

with PBI. Under the agreement, the companies will jointly promote PBI’s PCT-based sample preparation systems and SCIEX’s

mass spectrometry equipment, with a focus on improved sample preparation, a crucial step performed by tens of thousands of research

scientists worldwide.”

Mr.

Schumacher continued: “We believe the combination of PBI and SCIEX technologies could result in superior biological insights

and discoveries in the life sciences industry, and in rapid and sustainable revenue growth for PBI. It is therefore important

to do everything possible to strongly support the PBI-SCIEX co-marketing agreement. Consequently, we decided to increase the over-subscription

amount to help ensure that we fulfill our obligations under the co-marketing agreement, and to enable us to take full advantage

of the opportunities that the co-marketing agreement and new working relationship with SCIEX will most certainly offer.”

This

press release is not an offer to sell or a solicitation of offers to participate in the Offering. The units, including the shares

underlying the Debentures and Warrants, have not been registered under the Securities Act and may not be sold in the United States

absent registration under the Securities Act or an applicable exemption from registration.

For

more information on the Offering, please see the Form 8-K filed by the Company on July 28, 2015.

About

Pressure BioSciences, Inc.

Pressure

BioSciences, Inc. (“PBI”) (OTCQB: PBIO) develops, markets, and sells proprietary laboratory instrumentation and associated

consumables to the estimated $6 billion life sciences sample preparation market. Our products are based on the unique properties

of both constant (i.e., static) and alternating (i.e., pressure cycling technology, or PCT) hydrostatic pressure. PCT is a patented

enabling technology platform that uses alternating cycles of hydrostatic pressure between ambient and ultra-high levels to safely

and reproducibly control bio-molecular interactions. To date, we have installed over 250 PCT systems in approximately 160 sites

worldwide. There are over 100 publications citing the advantages of the PCT platform over competitive methods, many from key opinion

leaders. Our primary application development and sales efforts are in the biomarker discovery and forensics areas. Customers also

use our products in other areas, such as drug discovery & design, bio-therapeutics characterization, soil & plant biology,

vaccine development, histology, and forensic applications.

Forward

Looking Statements

Statements

contained in this press release regarding PBI’s intentions, hopes, beliefs, expectations, or predictions of the future are

“forward-looking’’ statements within the meaning of the Private Securities Litigation Reform Act of 1995. These

statements are based upon the Company’s current expectations, forecasts, and assumptions that are subject to risks, uncertainties,

and other factors that could cause actual outcomes and results to differ materially from those indicated by these forward-looking

statements. These risks, uncertainties, and other factors include, but are not limited to, the risks and uncertainties discussed

under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31,

2014, in the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2015, and other reports filed by

the Company from time to time with the SEC. The Company undertakes no obligation to update any of the information included in

this release, except as otherwise required by law.

For

more information about PBI and this press release, please click on the following website link:

http://www.pressurebiosciences.com

Please

visit us on Facebook, LinkedIn, and Twitter

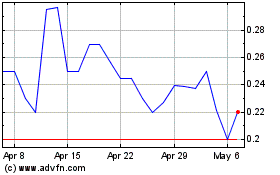

Pressure Biosciences (QB) (USOTC:PBIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pressure Biosciences (QB) (USOTC:PBIO)

Historical Stock Chart

From Apr 2023 to Apr 2024