Current Report Filing (8-k)

March 04 2016 - 11:56AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 2, 2016

VAALCO Energy, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-32167

|

|

76-0274813

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

9800 Richmond Avenue, Suite 700

Houston, Texas

|

|

77042

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (713) 623-0801

Not Applicable

(Former Name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01Other Events.

On March 2, 2016, VAALCO Energy, Inc. (the “Company”) issued a press release announcing that the borrowing base under its revolving credit facility was set at $20.1 million effective December 31, 2015. The redetermination was a result of the regular semi-annual review conducted by the International Finance Corporation (the “IFC”), the lender under the facility. All covenants under the facility remain unchanged.

The borrowing base is supported solely by the Company's Etame Marin producing assets in Gabon. The next scheduled redetermination date is at June 30, 2016. Currently, the Company has $15 million drawn under this facility which was also the amount drawn at December 31, 2015. The IFC communicated to the Company that if VAALCO were to seek additional drawdowns before the next redetermination, the IFC could elect, under the terms of the loan agreement, to conduct an interim redetermination which it believes would result in a borrowing base of less than $20.1 million due to commodity prices being lower than they were at December 31, 2015.

A copy of the press release issued by the Company is filed herewith as Exhibit 99.1 and is incorporated herein by reference in its entirety.

Item 9.01Financial Statements and Exhibits.

(d)Exhibits.

|

|

|

|

Exhibit Number

|

Description

|

|

99.1

|

Press Release of VAALCO Energy, Inc. dated March 2, 2016

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

VAALCO Energy, Inc.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

Date: March 4, 2016

|

By:

|

/s/ Eric J. Christ

|

|

|

|

Eric J. Christ

Vice President, General Counsel and Corporate Secretary

|

|

|

|

|

|

|

Exhibit Index

|

4

|

|

|

Exhibit Number

|

Description

|

|

99.1

|

Press Release of VAALCO Energy, Inc. dated March 2, 2016

|

VAALCO ENERGY ANNOUNCES RESULTS OF ITS SEMI-ANNUAL BORROWING BASE REDETERMINATION

HOUSTON, March 2, 2016 -- VAALCO Energy, Inc. (NYSE: EGY) (“VAALCO” or “the Company”) announced today that the borrowing base under its revolving credit facility was set at $20.1 million effective December 31, 2015. The redetermination was a result of the regular semi-annual review conducted by the International Finance Corporation (IFC), the lender under the facility. All covenants under the facility remain unchanged.

The borrowing base is supported solely by the Company's Etame Marin producing assets in Gabon. The next scheduled redetermination date is at June 30, 2016. Currently, the Company has $15 million drawn under this facility which was also the amount drawn at December 31, 2015. The IFC communicated to the Company that if VAALCO were to seek additional drawdowns before the next redetermination, the IFC could elect, under the terms of the loan agreement, to conduct an interim redetermination which it believes would result in a borrowing base of less than $20.1 million due to commodity prices being lower today than they were at December 31, 2015.

Steve Guidry, VAALCO's Chief Executive Officer, commented, “The significant downturn in oil prices was the primary reason that the IFC decided to lower our borrowing base. We are actively exploring a variety of options to supplement VAALCO’s potential liquidity needs in conjunction with our strategic alternatives review process announced January 26, 2016.”

About VAALCO

VAALCO Energy, Inc. is a Houston-based independent energy company principally engaged in the acquisition, exploration, development and production of crude oil. The Company's properties and exploration acreage are located primarily in Gabon, Angola and Equatorial Guinea in West Africa.

This news release includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those concerning VAALCO's plans, expectations, and objectives for future drilling, completion and other operations and activities, including statements relating to a potential strategic alternative transaction, or the terms, timing or

structure of any such transactions (or whether any such transaction will take place at all) and VAALCO’s future performance if any such transaction is completed. All statements, other than statements of historical facts, included in this news release that address activities, events or developments that VAALCO expects, believes or anticipates will or may occur in the future are forward-looking statements. These statements include expected capital expenditures, future drilling plans, prospect evaluations, liquidity, negotiations with governments and third parties, expectations regarding processing facilities, and reserve growth. These statements are based on assumptions made by VAALCO based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond VAALCO's control. These risks include, but are not limited to, oil and gas price volatility, inflation, general economic conditions, the Company's success in discovering, developing and producing reserves, lack of availability of goods, services and capital, environmental risks, drilling risks, foreign operational risks, and regulatory changes. These and other risks are further described in VAALCO's annual report on Form 10-K for the year ended December 31, 2014, subsequent quarterly reports on Form 10-Q, and other reports filed with the SEC, which can be reviewed at http://www.sec.gov, or which can be received by contacting VAALCO at 9800 Richmond Avenue, Suite 700, Houston, Texas 77042, (713) 623-0801. Investors are cautioned that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements. VAALCO disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. VAALCO assumes no obligation to update any forward-looking statement as of any future date.

Investor Contacts

Don McCormackAl Petrie

Chief Financial OfficerInvestor Relations Coordinator

713-212-1038713-543-3422

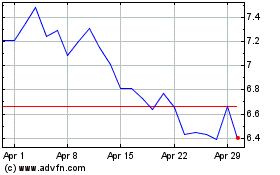

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

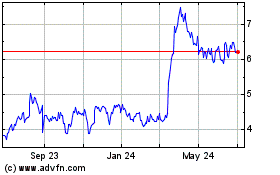

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Apr 2023 to Apr 2024