UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): March 3, 2016

IDT CORPORATION

(Exact name of registrant as specified

in its charter)

| Delaware |

|

1-16371 |

|

22-3415036 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 520 Broad Street Newark, New Jersey |

|

07102 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number,

including area code: (973) 438-1000

Not Applicable

(Former name or former address, if

changed since last report.)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results

of Operations and Financial Condition

On March 3, 2016,

IDT Corporation (the “Registrant”) posted an earnings release to the investor relations page of its website (www.idt.net

) announcing its results of operations for its fiscal quarter ended January 31, 2016. A copy of the earnings release concerning

the foregoing results is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The Registrant is

furnishing the information contained in this Report, including Exhibit 99.1, pursuant to Item 2.02 of Form 8-K promulgated

by the Securities and Exchange Commission (the “SEC”). This information shall not be deemed to be “filed”

with the SEC or incorporated by reference into any other filing with the SEC unless otherwise expressly stated in such filing.

In addition, this Report and the press release contain statements intended as “forward-looking statements” that are

subject to the cautionary statements about forward-looking statements set forth in the press release.

Item 8.01. Other Events

The

earnings release referenced in Item 2.02 above also discloses the Registrant’s declaration of a dividend. The earnings release,

furnished herewith as Exhibit 99.1, is also incorporated herein by reference.

Item 9.01.

Financial Statements and Exhibits.

| Exhibit No. |

|

Document |

| 99.1 |

|

Earnings Release, dated March 3, 2016, reporting the results of operations for IDT Corporation’s fiscal quarter ended January 31, 2016. |

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

IDT CORPORATION |

| |

|

|

| |

By: |

/s/ Shmuel Jonas |

| |

Name: |

Shmuel Jonas |

| |

Title: |

Chief Executive Officer |

Dated: March 3, 2016

EXHIBIT INDEX

| Exhibit Number |

|

Document |

| 99.1 |

|

Earnings Release, dated March 3, 2016, reporting the results of operations for IDT Corporation’s fiscal quarter ended January 31, 2016. |

Exhibit 99.1

IDT

Corporation Reports Second Quarter Fiscal 2016 Results

NEWARK,

NJ — March 3, 2016: IDT Corporation (NYSE: IDT) reported diluted earnings per share (EPS) of $0.18 and Non-GAAP diluted

EPS* of $0.39 on revenue of $382.5 million for the second quarter of its fiscal year 2016, the three months ended January 31,

2016.

2Q16

HIGHLIGHTS

(Results

for 2Q16 are compared to 2Q15)

| |

● |

Consolidated

revenue decreased to $382.5 million from $394.2 million primarily as a result of reduced traffic on the US to Mexico corridor; |

| |

|

|

| |

● |

IDT

improved its results of operations year over year increasing Adjusted EBITDA to $11.7 million from $8.0 million, income from

operations to $6.4 million from $3.7 million, and diluted EPS to $0.18 from $0.11; |

| |

|

|

| |

● |

IDT

continues to benefit from efforts to right size overhead. SG&A expense decreased to $51.1 million, its lowest

level in over three years; |

| |

|

|

| |

● |

Zedge,

which IDT plans to spin-off in the current fiscal year, had an outstanding quarter. Revenue increased to $3.5 million

from $2.4 million. Income from operations increased to $1.7 million compared to a loss from operations of $610

thousand. |

Management

Remarks

IDT’s

Chief Executive Officer Shmuel Jonas said, “IDT performed well in the second quarter, generating $11.7 million in Adjusted

EBITDA, up from $8.0 million in the year ago quarter and increasing diluted EPS to $0.18 from $0.11 a year ago.

“A sharp reduction in industry-wide call termination

costs in Mexico implemented by regulatory authorities there last year and slowing revenue growth generated by Boss Revolution’s

prepaid calling service contributed to year over year and sequential revenue declines. However, we expect that the impact on our

bottom line will dissipate in coming quarters.

“Looking ahead, we are committed to invest significantly

in longer term growth initiatives throughout the Company. Individually and in their totality, these initiatives have very promising

prospects and will gradually transform our business while we continue to focus on improving the efficiency of our operations.

*Throughout

this release, Adjusted EBITDA, Non-GAAP net income and Non-GAAP diluted EPS for all periods presented are non-GAAP measures intended

to provide useful information that supplements IDT’s or the relevant segment’s core results in accordance with GAAP.

Please refer to the Reconciliation of Non-GAAP Financial Measures at the end of this release for an explanation of these terms

and their respective reconciliation to the most directly comparable GAAP measure.

2Q16

CONSOLIDATED RESULTS

| $ in millions, except EPS | |

| 2Q16 | | |

| 2Q15 | | |

| 1Q16 | | |

| 2Q16 - 2Q15 Change (%/$) | |

| Revenue | |

$ | 382.5 | | |

$ | 394.2 | | |

$ | 390.6 | | |

| (3.0 | )% |

| Direct cost | |

$ | 319.7 | | |

$ | 328.7 | | |

$ | 324.5 | | |

| (2.7 | )% |

| Direct cost as a percentage of revenue | |

| 83.6 | % | |

| 83.4 | % | |

| 83.1 | % | |

| +20 BP | |

| SG&A expense | |

$ | 51.1 | | |

$ | 57.4 | | |

$ | 53.1 | | |

| (11.0 | )% |

| Depreciation and amortization | |

$ | 5.0 | | |

$ | 4.4 | | |

$ | 5.1 | | |

| +12.0% | |

| Severance | |

| - | | |

$ | 0.4 | | |

| - | | |

$ | (0.4 | ) |

| Adjusted EBITDA* | |

$ | 11.7 | | |

$ | 8.0 | | |

$ | 13.0 | | |

| +$3.7 | |

| Income from operations | |

$ | 6.4 | | |

$ | 3.7 | | |

$ | 7.9 | | |

| +$2.7 | |

| Net income attributable to IDT | |

$ | 4.1 | | |

$ | 2.5 | | |

$ | 4.2 | | |

| +$1.6 | |

| Diluted EPS | |

$ | 0.18 | | |

$ | 0.11 | | |

$ | 0.18 | | |

| +$0.07 | |

| Non-GAAP net income* | |

$ | 9.0 | | |

$ | 7.5 | | |

$ | 8.1 | | |

$ | 1.5 | |

| Non-GAAP diluted EPS* | |

$ | 0.39 | | |

$ | 0.33 | | |

$ | 0.35 | | |

$ | 0.06 | |

| Net cash provided by operating activities | |

$ | 11.2 | | |

$ | 12.7 | | |

$ | 14.0 | | |

$ | (1.5 | ) |

2Q16

OPERATING RESULTS BY SEGMENT

(Results are for 2Q16 and comparisons are to 2Q15 unless otherwise

noted)

TPS

IDT’s

Telecom Platform Services (TPS) segment accounted for 98.5% of IDT’s revenue in 2Q16. TPS markets and distributes multiple

communications and payment services across four broad business verticals: Retail Communications, Wholesale Carrier Services, Payment

Services and Hosted Platform Solutions.

TPS’

quarterly minutes of use were 7.03 billion compared to 7.53 billion (-6.7%) in 2Q15 and to 7.16 billion (-1.9%) in 1Q16. The decreases

primarily reflect a decline in Retail Communications minutes, led primarily by the decline in Boss Revolution voice traffic over

the US-to-Mexico corridor and reduced sales of traditional disposable calling cards.

TPS’

revenue was $376.7 million compared to $389.0 million (-3.2%) in the year ago quarter and $385.7 million (-2.3%) in the prior

quarter. The decreases are primarily the result of declines in revenue within the Retail Communications vertical.

|

TPS Revenue by Business Vertical

($ in millions) |

|

|

2Q16 |

|

|

|

2Q15 |

|

|

|

1Q16 |

|

|

|

2Q16 - 2Q15

% Change in Revenue |

|

|

|

2Q16-2Q15

% Change in Minutes of Use |

|

|

|

2Q16 Revenue as a % of all TPS Revenue |

|

| Retail Communications |

|

$ |

168.6 |

|

|

$ |

182.6 |

|

|

$ |

173.7 |

|

|

|

(7.7 |

)% |

|

|

(13.5 |

)% |

|

|

44.8 |

% |

| Wholesale Carrier Services |

|

$ |

147.2 |

|

|

$ |

146.6 |

|

|

$ |

148.1 |

|

|

|

+0.5% |

|

|

|

(3.1 |

)% |

|

|

39.1 |

% |

| Payment Services |

|

$ |

53.3 |

|

|

$ |

49.8 |

|

|

$ |

55.5 |

|

|

|

+6.9% |

|

|

|

n/a |

|

|

|

14.1 |

% |

| Hosted Platform Solutions |

|

$ |

7.6 |

|

|

$ |

9.9 |

|

|

$ |

8.4 |

|

|

|

(24.0 |

)% |

|

|

(11.6 |

)% |

|

|

2.0 |

% |

| Total TPS |

|

$ |

376.7 |

|

|

$ |

389.0 |

|

|

$ |

385.7 |

|

|

|

(3.2 |

)% |

|

|

(6.7 |

)% |

|

|

100.0 |

% |

Retail

Communications – Sales of IDT’s flagship Boss Revolution international calling service, which is the dominant offering

in the Retail Communications vertical, declined 1.8% year over year and 1.3% sequentially. Traditional prepaid cards and other,

smaller product lines also contributed significantly to the decline in Retail Communications’ revenues. The revenue decline

at Boss Revolution reflects, in part, regulatory changes that dramatically reduced the cost of terminating calls from the US to

Mexico - Boss Revolution’s largest calling corridor. This dynamic is likely to continue at least for the remainder of the

year but become progressively less impactful to prior period comparisons over time. Exclusive of the US-to-Mexico route, revenue

generated by Boss Revolution’s international calling service increased in 2Q16 by approximately 5% compared to the year

ago quarter and was unchanged sequentially.

Wholesale

Carrier Services – Revenue increased slightly year over year on a traffic mix-shift to higher revenue per minute corridors.

The increase was partially offset by a decline in minutes of use.

Payment

Services – Revenue increased year over year on growth in sales of international airtime top-up, which is the dominant

product line in this vertical.

Hosted

Platform Solutions - Revenue decreased in-line with expectations reflecting reductions in rates for telephony services provided

by IDT to its cable operator customers.

TPS’

direct cost of revenue as a percentage of TPS’ revenue was 84.6% in 2Q16, an increase of 40 basis points year over year

and 80 basis points sequentially. The increases were driven primarily by the wholesale carrier vertical.

TPS’

SG&A expense decreased to $46.8 million from $50.5 million (-7.3%) in 2Q15 and from $48.2 million (-3.0%) in 1Q16. Expressed

as a percentage of TPS’ revenue, TPS’ 2Q16 SG&A decreased to 12.4% from 13.0% in 2Q15 and from 12.5% in 1Q16.

The year over year decrease primarily reflects reduced employee compensation costs after headcount reductions implemented in fiscal

2015, and reduced marketing and advertising expense compared to the year ago quarter.

TPS’

Adjusted EBITDA increased to $11.3 million from $11.1 million (+1.4%) in 2Q15 and decreased from $14.1 million (-20.2%) in 1Q16.

The year over year increase was attributable to the decrease in SG&A expense partially offset by the decline in revenue less

direct costs. Sequentially, the decline in revenue was only partially offset by the reduction in direct costs and SG&A expense.

TPS’

depreciation and amortization expense was $4.7 million in 2Q16, an increase from $3.9 million (+18.2%) in 2Q15 and $4.4 million

(+5.5%) in 1Q16. Depreciation increased due to higher levels of capital expenditures in recent periods to support new product

development, including IDT Messaging, Net2Phone Office, and the Boss Revolution Calling App.

TPS’

income from operations decreased to $6.3 million from $6.9 million (-8.3%) in 2Q15 and $9.7 million (-35.2%) in 1Q16. Income from

operations in 2Q16 and 2Q15 included the impact of a loss on disposal of property, plant and equipment of $326 thousand and severance

expense of $316 thousand, respectively.

CPS

Consumer

Phone Services (CPS) sells local and long distance services domestically in 11 states, marketed under the brand name IDT America.

CPS has been in harvest mode for the last decade, maximizing revenue from current customers while maintaining SG&A and other

expenses at the minimum levels essential to operate the business. Results this quarter conformed to expectations.

CPS’

revenue was $1.8 million compared to $2.2 million (-21.2%) in 2Q15 and $1.8 million (-3.4%) in the prior quarter. CPS’ income

from operations was $290 thousand in 2Q16, compared to $307 thousand (-5.5%) in 2Q15 and $339 thousand (-14.6%) in 1Q16.

ALL

OTHER

All

Other includes Zedge, one of the most popular content platforms for mobile device personalization including ringtones, wallpapers,

home screen icons and game recommendations, as well as IDT’s real estate holdings and other small businesses.

As

of January 31, 2016, Zedge’s app surpassed 189 million cumulative installs on Android, iOS and Windows Mobile, increasing

from 130 million (+45%) a year earlier and 173 million (+9%) at October 31, 2015. Zedge has averaged among the top thirty most

popular apps in the Google Play store in the U.S. for the last five years. As a result of Zedge’s large, active user base,

it offers advertisers, game developers, musicians and artists a scalable, non-incentivized, user acquisition platform with global

reach.

Zedge’s

revenue in 2Q16 was $3.5 million, an increase from $2.4 million (+47.0%) in 2Q15 and from $2.6 million (+37.9%) in 1Q16. The year

over year and sequential revenue increases were driven by continued user growth, increased customer engagement and increased revenue

per impression. Zedge generated income from operations of $1.7 million compared to a loss from operations of $610 thousand in

the year ago quarter, and income from operations of $350 thousand in 1Q16.

All

Other’s revenue was $4.0 million in 2Q16 compared to $3.0 million (+35.0%) in 2Q15 and $3.1 million (+30.5%) in 1Q16. Zedge

and IDT’s real estate holdings generate all of All Other’s revenue.

All

Other’s income from operations, generated primarily by Zedge, was $1.8 million in 2Q16 compared to a loss from operations

of $602 thousand in 2Q15 and income from operations of $430 thousand in 1Q16.

OTHER

CONSOLIDATED RESULTS

Consolidated

results for all periods presented include corporate overhead. In 2Q16, corporate G&A expense was $2.1 million compared to

$2.8 million (-27.4%) in the year ago quarter and $2.6 million (-19.8%) in the prior quarter.

2Q16

net income attributable to IDT increased to $4.1 million from $2.5 million in the year ago quarter and decreased from $4.2 million

in the prior quarter. The year over year improvement was driven by Zedge’s increased profitability and the reduction in

corporate G&A expense. Net income attributable to IDT in 2Q16 included income tax expense of $2.0 million compared to $1.9

million in 2Q15 and $2.9 million in 1Q16. Net income in 2Q15 included a gain on the sale of IDT’s interest in Fabrix Systems

of $484 thousand for working capital and other adjustments.

At

January 31, 2016, IDT had $146.3 million in unrestricted cash, cash equivalents and marketable securities. Additionally, at that

date, IDT reported $88.8 million in current restricted cash and cash equivalents, nearly all of which represents customer deposits

held by IDT’s Gibraltar-based bank. Current assets totaled $323.5 million and current liabilities were $326.4 million.

Net

cash provided by operating activities during 2Q16 was $11.2 million compared to $12.7 million during 2Q15 and $14.0 million in

1Q16. For the same periods, capital expenditures were $3.7 million compared to $7.8 million and $5.5 million, respectively.

IDT

repurchased $4.6 million of its Class B Common Stock during 2Q16.

DIVIDEND

IDT’s

Board of Directors has declared a dividend of $0.19 per share of Class A and Class B common stock for the second quarter of its

fiscal year 2016. The dividend will be paid on or about March 25, 2016 to stockholders of record as of the close of business on

March 15th. The ex-dividend date will be March 11th. This distribution will be an ordinary dividend for

tax purposes.

IDT

EARNINGS ANNOUNCEMENT & SUPPLEMENTAL INFORMATION

IDT

will host a conference call at 5:30 PM ET today, March 3rd, beginning with management’s discussion of results,

outlook and strategy followed by Q&A with investors.

To

listen to the call and participate in the Q&A, dial toll-free 1-888-348-8417 (from U.S.) or 1-412-902-4243 (international)

and request the IDT Corporation call.

An

audio replay of the conference call will be available one hour after the call concludes through March 10, 2016 by dialing 1-877-870-5176

(toll free from the U.S.) or 1-858-384-5517 (international) and providing the following replay conference code: 1007809. The replay

can also be streamed from the IDT investor relations website (www.idt.net/ir) beginning shortly after the call.

Copies

of the complete earnings release - including the financial statements and reconciliation of the non-GAAP financial measures that

are used herein and referenced during management’s discussion of results – were filed on a Form 8-K and are available

in the Investor Relations portion of IDT’s website.

About

IDT Corporation:

IDT

Corporation (NYSE: IDT), through its IDT Telecom division, provides telecommunications and payment services to individuals and

businesses primarily through its flagship Boss Revolution® and Net2Phone® brands. IDT Telecom’s

wholesale business is a leading global carrier of international long distance calls. IDT also holds a majority interest in Zedge

(www.zedge.net), developer of the popular eponymous app for mobile content discovery and acquisition. For more information on

IDT, visit www.idt.net.

All

statements above that are not purely about historical facts, including, but not limited to, those in which we use the words “believe,”

“anticipate,” “expect,” “plan,” “intend,” “estimate,” “target”

and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. While these forward-looking statements represent our current judgment of what may happen in the future, actual results may

differ materially from the results expressed or implied by these statements due to numerous important factors. Our filings with

the SEC provide detailed information on such statements and risks, and should be consulted along with this release. To the extent

permitted under applicable law, IDT assumes no obligation to update any forward-looking statements.

Contact:

IDT

Corporation Investor Relations

Bill

Ulrey

william.ulrey@idt.net

973-438-3838

IDT

CORPORATION

CONSOLIDATED BALANCE SHEETS

| | |

January 31,

2016 | | |

July 31,

2015 | |

| | |

(Unaudited) | | |

| |

| | |

(in thousands) | |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 99,514 | | |

$ | 110,361 | |

| Restricted cash and cash equivalents | |

| 88,792 | | |

| 91,035 | |

| Marketable securities | |

| 46,797 | | |

| 40,287 | |

| Trade accounts receivable, net of allowance for doubtful accounts of $4,939 at January 31, 2016 and $5,645 at July 31, 2015 | |

| 55,384 | | |

| 58,543 | |

| Receivable from sale of interest in Fabrix Systems Ltd. | |

| 3,702 | | |

| 8,471 | |

| Prepaid expenses | |

| 13,769 | | |

| 17,304 | |

| Other current assets | |

| 15,530 | | |

| 14,344 | |

| Total current assets | |

| 323,488 | | |

| 340,345 | |

| Property, plant and equipment, net | |

| 90,394 | | |

| 91,316 | |

| Goodwill | |

| 13,452 | | |

| 14,388 | |

| Other intangibles, net | |

| 1,050 | | |

| 1,277 | |

| Investments | |

| 11,292 | | |

| 12,344 | |

| Deferred income tax assets, net | |

| 8,654 | | |

| 13,324 | |

| Other assets | |

| 7,513 | | |

| 12,688 | |

| Total assets | |

$ | 455,843 | | |

$ | 485,682 | |

| | |

| | | |

| | |

| Liabilities and equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Trade accounts payable | |

$ | 28,687 | | |

$ | 29,140 | |

| Accrued expenses | |

| 122,190 | | |

| 139,272 | |

| Deferred revenue | |

| 86,269 | | |

| 86,302 | |

| Customer deposits | |

| 85,129 | | |

| 84,454 | |

| Income taxes payable | |

| 550 | | |

| 391 | |

| Notes payable—current portion | |

| — | | |

| 6,353 | |

| Other current liabilities | |

| 3,563 | | |

| 3,000 | |

| Total current liabilities | |

| 326,388 | | |

| 348,912 | |

| Other liabilities | |

| 1,765 | | |

| 1,830 | |

| Total liabilities | |

| 328,153 | | |

| 350,742 | |

| Commitments and contingencies | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| IDT Corporation stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $.01 par value; authorized shares—10,000; no shares issued | |

| — | | |

| — | |

| Class A common stock, $.01 par value; authorized shares—35,000; 3,272 shares issued and 1,574 shares outstanding at January 31, 2016 and July 31, 2015 | |

| 33 | | |

| 33 | |

| Class B common stock, $.01 par value; authorized shares—200,000; 25,287 and 25,276 shares issued and 21,356 and 21,755 shares outstanding at January 31, 2016 and July 31, 2015, respectively | |

| 253 | | |

| 253 | |

| Additional paid-in capital | |

| 404,790 | | |

| 403,146 | |

| Treasury stock, at cost, consisting of 1,698 and 1,698 shares of Class A common stock and 3,931 and 3,521 shares of Class B common stock at January 31, 2016 and July 31, 2015, respectively | |

| (115,316 | ) | |

| (110,543 | ) |

| Accumulated other comprehensive (loss) income | |

| (2,744 | ) | |

| 771 | |

| Accumulated deficit | |

| (160,196 | ) | |

| (159,829 | ) |

| Total IDT Corporation stockholders’ equity | |

| 126,820 | | |

| 133,831 | |

| Noncontrolling interests | |

| 870 | | |

| 1,109 | |

| Total equity | |

| 127,690 | | |

| 134,940 | |

| Total liabilities and equity | |

$ | 455,843 | | |

$ | 485,682 | |

IDT

CORPORATION

CONSOLIDATED

STATEMENTS OF INCOME

(Unaudited)

| | |

Three Months Ended

January 31, | | |

Six Months Ended

January 31, | |

| | |

2016 | | |

2015 | | |

2016 | | |

2015 | |

| | |

(in thousands, except per share data) | |

| Revenues | |

$ | 382,454 | | |

$ | 394,173 | | |

$ | 773,032 | | |

$ | 807,051 | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Direct cost of revenues (exclusive of depreciation and amortization) | |

| 319,724 | | |

| 328,737 | | |

| 644,235 | | |

| 672,544 | |

| Selling, general and administrative (i) | |

| 51,054 | | |

| 57,394 | | |

| 104,143 | | |

| 114,392 | |

| Depreciation and amortization | |

| 4,973 | | |

| 4,440 | | |

| 10,025 | | |

| 8,845 | |

| Research and development | |

| — | | |

| — | | |

| — | | |

| 1,656 | |

| Severance | |

| — | | |

| 351 | | |

| — | | |

| 1,899 | |

| Total costs and expenses | |

| 375,751 | | |

| 390,922 | | |

| 758,403 | | |

| 799,336 | |

| Loss on disposal of property, plant and equipment | |

| (326 | ) | |

| — | | |

| (326 | ) | |

| — | |

| Gain on sale of interest in Fabrix Systems Ltd. | |

| — | | |

| 484 | | |

| — | | |

| 75,629 | |

| Income from operations | |

| 6,377 | | |

| 3,735 | | |

| 14,303 | | |

| 83,344 | |

| Interest income (expense), net | |

| 534 | | |

| (40 | ) | |

| 692 | | |

| (131 | ) |

| Other (expense) income, net | |

| (234 | ) | |

| 967 | | |

| (844 | ) | |

| 2,290 | |

| Income before income taxes | |

| 6,677 | | |

| 4,662 | | |

| 14,151 | | |

| 85,503 | |

| Provision for income taxes | |

| (2,014 | ) | |

| (1,905 | ) | |

| (4,911 | ) | |

| (2,392 | ) |

| Net income | |

| 4,663 | | |

| 2,757 | | |

| 9,240 | | |

| 83,111 | |

| Net income attributable to noncontrolling interests | |

| (598 | ) | |

| (247 | ) | |

| (981 | ) | |

| (445 | ) |

| Net income attributable to IDT Corporation | |

$ | 4,065 | | |

$ | 2,510 | | |

$ | 8,259 | | |

$ | 82,666 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share attributable to IDT Corporation common stockholders: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.18 | | |

$ | 0.11 | | |

$ | 0.36 | | |

$ | 3.63 | |

| Diluted | |

$ | 0.18 | | |

$ | 0.11 | | |

$ | 0.36 | | |

$ | 3.57 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average number of shares used in calculation of earnings per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 22,799 | | |

| 22,818 | | |

| 22,867 | | |

| 22,783 | |

| Diluted | |

| 22,799 | | |

| 23,225 | | |

| 22,884 | | |

| 23,155 | |

| | |

| | | |

| | | |

| | | |

| | |

| Dividends declared per common share | |

$ | 0.19 | | |

$ | 0.82 | | |

$ | 0.37 | | |

$ | 1.67 | |

| | |

| | | |

| | | |

| | | |

| | |

| (i) Stock-based compensation included in selling, general and administrative expenses | |

$ | 873 | | |

$ | 2,172 | | |

$ | 1,644 | | |

$ | 3,020 | |

IDT

CORPORATION

CONSOLIDATED

STATEMENTS OF CASH FLOWS (Unaudited)

| | |

Six Months Ended

January 31, | |

| | |

2016 | | |

2015 | |

| | |

(in thousands) | |

| Operating activities | |

| | |

| |

| Net income | |

$ | 9,240 | | |

$ | 83,111 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 10,025 | | |

| 8,845 | |

| Deferred income taxes | |

| 4,708 | | |

| 2,441 | |

| Provision for doubtful accounts receivable | |

| 486 | | |

| 35 | |

| Gain on sale of interest in Fabrix Systems Ltd. | |

| — | | |

| (75,629 | ) |

| Realized (gain) loss on marketable securities | |

| (543 | ) | |

| 54 | |

| Interest in the equity of investments | |

| (79 | ) | |

| (1,459 | ) |

| Stock-based compensation | |

| 1,644 | | |

| 3,020 | |

| Change in assets and liabilities: | |

| | | |

| | |

| Restricted cash and cash equivalents | |

| (5,360 | ) | |

| (7,912 | ) |

| Trade accounts receivable | |

| (1,366 | ) | |

| 3,285 | |

| Prepaid expenses, other current assets and other assets | |

| 7,644 | | |

| 5,787 | |

| Trade accounts payable, accrued expenses, other current liabilities and other liabilities | |

| (10,814 | ) | |

| (7,478 | ) |

| Customer deposits | |

| 8,200 | | |

| 8,193 | |

| Income taxes payable | |

| 159 | | |

| (292 | ) |

| Deferred revenue | |

| 1,202 | | |

| (1,047 | ) |

| Net cash provided by operating activities | |

| 25,146 | | |

| 20,954 | |

| Investing activities | |

| | | |

| | |

| Capital expenditures | |

| (9,223 | ) | |

| (13,946 | ) |

| Proceeds from sale of interest in Fabrix Systems Ltd., net of cash and cash equivalents sold. | |

| 4,769 | | |

| 36,039 | |

| Purchase of investments | |

| (350 | ) | |

| (125 | ) |

| Proceeds from sale and redemption of investments | |

| 626 | | |

| 43 | |

| Purchases of marketable securities | |

| (24,480 | ) | |

| (18,382 | ) |

| Proceeds from maturities and sales of marketable securities | |

| 18,720 | | |

| 12,104 | |

| Net cash (used in) provided by investing activities | |

| (9,938 | ) | |

| 15,733 | |

| Financing activities | |

| | | |

| | |

| Dividends paid | |

| (8,626 | ) | |

| (38,891 | ) |

| Distributions to noncontrolling interests | |

| (1,220 | ) | |

| (750 | ) |

| Proceeds from exercise of stock options. | |

| — | | |

| 2,896 | |

| Repayments of revolving credit loan payable and other borrowings | |

| (6,353 | ) | |

| (13,132 | ) |

| Repurchases of Class B common stock | |

| (4,773 | ) | |

| (703 | ) |

| Net cash used in financing activities | |

| (20,972 | ) | |

| (50,580 | ) |

| Effect of exchange rate changes on cash and cash equivalents | |

| (5,083 | ) | |

| (6,789 | ) |

| Net (decrease) increase in cash and cash equivalents | |

| (10,847 | ) | |

| (20,682 | ) |

| Cash and cash equivalents at beginning of period | |

| 110,361 | | |

| 153,823 | |

| Cash and cash equivalents at end of period | |

$ | 99,514 | | |

$ | 133,141 | |

| Supplemental schedule of non-cash investing and financing activities | |

| | | |

| | |

| Net liabilities excluding cash and cash equivalents of Fabrix Systems Ltd. sold | |

$ | — | | |

$ | 14,333 | |

Reconciliation

of Non-GAAP Financial Measures for the Second Quarter Fiscal 2016 and 2015

In

addition to disclosing financial results that are determined in accordance with generally accepted accounting principles in the

United States of America (GAAP), IDT also disclosed, for the second quarters of fiscal 2016 and 2015, Adjusted EBITDA, non-GAAP

net income and non-GAAP diluted earnings per share, or EPS, which are non-GAAP measures. Generally, a non-GAAP financial measure

is a numerical measure of a company’s performance, financial position, or cash flows that either excludes or includes amounts

that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with

GAAP.

IDT’s

measure of Adjusted EBITDA consists of revenues less direct cost of revenues, selling, general and administrative expense and

research and development expense. Another way of calculating Adjusted EBITDA is to start with income from operations, add depreciation

and amortization, severance expense, and loss on disposal of property, plant and equipment, and subtract the gain on the sale

of interest in Fabrix Systems Ltd.

IDT’s

measure of non-GAAP net income starts with net income in accordance with GAAP and adds depreciation and amortization, severance

expense, stock-based compensation, and loss on disposal of property, plant and equipment, and subtracts the gain on the sale of

interest in Fabrix Systems Ltd.

IDT’s

measure of non-GAAP diluted EPS is calculated by dividing non-GAAP net income by the diluted weighted-average shares.

These

additions and subtractions are non-cash and/or non-routine items in the relevant fiscal 2016 and fiscal 2015 periods.

Management

believes that IDT’s Adjusted EBITDA, non-GAAP net income and non-GAAP EPS measures provide useful information to both management

and investors by excluding certain expenses and non-routine gains that may not be indicative of IDT’s or the relevant segment’s

core operating results. Management uses Adjusted EBITDA, among other measures, as a relevant indicator of core operational strengths

in its financial and operational decision making. In addition, management uses Adjusted EBITDA, non-GAAP net income and non-GAAP

EPS to evaluate operating performance in relation to IDT’s competitors. Disclosure of these financial measures may be useful

to investors in evaluating performance and allows for greater transparency to the underlying supplemental information used by

management in its financial and operational decision-making. In addition, IDT has historically reported similar financial measures

and believes such measures are commonly used by readers of financial information in assessing performance, therefore the inclusion

of comparative numbers provides consistency in financial reporting at this time.

Management

refers to Adjusted EBITDA, as well as the GAAP measures income (loss) from operations and net income, on a segment and/or consolidated

level to facilitate internal and external comparisons to the segments’ and IDT's historical operating results, in making

operating decisions, for budget and planning purposes, and to form the basis upon which management is compensated.

While

depreciation and amortization are considered operating costs under GAAP, these expenses primarily represent the non-cash current

period allocation of costs associated with long-lived assets acquired or constructed in prior periods. IDT’s operating results

exclusive of depreciation and amortization charges are useful indicators of its current performance.

Severance

expense is also excluded from the calculation of Adjusted EBITDA, non-GAAP net income and non-GAAP EPS. Severance expense is reflective

of decisions made by management in each period regarding the aspects of IDT’s and its segments’ businesses to be focused

on in light of changing market realities and other factors. While there may be similar charges in other periods, the nature and

magnitude of these charges can fluctuate markedly and do not reflect the performance of IDT’s core and continuing operations.

Loss

on disposal of property, plant and equipment and gain on the sale of interest in Fabrix Systems Ltd., which are components of

income from operations, are excluded from the calculation of Adjusted EBITDA, non-GAAP net income and non-GAAP EPS. From time-to-time,

IDT will dispose of certain assets, and IDT will select and incubate promising early stage businesses outside of its core business

for eventual sale or spin-off to its stockholders. However, such losses or gains do not occur each quarter nor are they part of

IDT’s or the relevant segment’s core operating results.

The

other calculation of Adjusted EBITDA consists of revenues less direct cost of revenues, selling, general and administrative expense

and research and development expense. As the other excluded items are not reflected in this calculation, they are excluded automatically

and there is no need to make additional adjustments. This calculation results in the same Adjusted EBITDA amount and its utility

and significance is as explained above.

Stock-based

compensation recognized by IDT and other companies may not be comparable because of the variety of types of awards as well as

the various valuation methodologies and subjective assumptions that are permitted under GAAP. Stock-based compensation is excluded

from IDT’s calculation of non-GAAP net income and non-GAAP EPS because management believes this allows investors to make

more meaningful comparisons of the operating results per share of IDT’s core business with the results of other companies.

However, stock-based compensation will continue to be a significant expense for IDT for the foreseeable future and an important

part of employees’ compensation that impacts their performance.

Adjusted

EBITDA, non-GAAP net income and non-GAAP EPS should be considered in addition to, not as a substitute for, or superior to, income

(loss) from operations, cash flow from operating activities, net income, basic and diluted earnings per share or other measures

of liquidity and financial performance prepared in accordance with GAAP. In addition, IDT’s measurements of Adjusted EBITDA,

non-GAAP net income and non-GAAP EPS may not be comparable to similarly titled measures reported by other companies.

Following

are reconciliations of Adjusted EBITDA, non-GAAP net income and non-GAAP EPS to the most directly comparable GAAP measure, which

are, (a) for Adjusted EBITDA, income (loss) from operations for IDT’s reportable segments and net income for IDT on a consolidated

basis, (b) for non-GAAP net income, net income and, (c) for non-GAAP EPS, basic and diluted earnings per share.

|

IDT Corporation

Reconciliation of Adjusted EBITDA to Net Income

(unaudited)

in millions

Figures may not foot or cross-foot due to rounding to millions. |

| | |

Total IDT Corporation | |

| |

Telecom Platform Services | | |

Consumer Phone Services | | |

All Other | | |

Corporate | |

Three Months Ended January 31, 2016 (2Q16) | |

| |

| |

| | |

| | |

| | |

| |

| Adjusted EBITDA | |

$ | 11.7 | |

| |

$ | 11.3 | | |

$ | 0.3 | | |

$ | 2.2 | | |

$ | (2.1 | ) |

| Subtract: | |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 5.0 | |

| |

| 4.7 | | |

| - | | |

| 0.3 | | |

| - | |

| Loss on disposal of property, plant and equipment | |

| 0.3 | |

| |

| 0.3 | | |

| - | | |

| - | | |

| - | |

| Income (loss) from operations | |

| 6.4 | |

| |

$ | 6.3 | | |

$ | 0.3 | | |

$ | 1.9 | | |

$ | (2.1 | ) |

| Interest income, net | |

| 0.5 | |

| |

| | | |

| | | |

| | | |

| | |

| Other expense, net | |

| (0.2 | ) |

| |

| | | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 6.7 | |

| |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| (2.0 | ) |

| |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 4.7 | |

| |

| | | |

| | | |

| | | |

| | |

| Net income attributable to noncontrolling interests | |

| (0.6 | ) |

| |

| | | |

| | | |

| | | |

| | |

| Net income attributable to IDT Corporation | |

$ | 4.1 | |

| |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | |

| | |

Total IDT Corporation | |

| |

Telecom Platform Services | | |

Consumer Phone Services | | |

All Other | | |

Corporate | |

Three Months Ended October 31, 2015 (1Q16) | |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

$ | 13.0 | |

| |

$ | 14.1 | | |

$ | 0.3 | | |

$ | 1.1 | | |

$ | (2.5 | ) |

| Subtract: | |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 5.1 | |

| |

| 4.4 | | |

| - | | |

| 0.7 | | |

| - | |

| Severance expense | |

| - | |

| |

| - | | |

| - | | |

| - | | |

| - | |

| Income (loss) from operations | |

| 7.9 | |

| |

$ | 9.7 | | |

$ | 0.3 | | |

$ | 0.4 | | |

$ | (2.5 | ) |

| Interest income, net | |

| 0.2 | |

| |

| | | |

| | | |

| | | |

| | |

| Other expense, net | |

| (0.6 | ) |

| |

| | | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 7.5 | |

| |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| (2.9 | ) |

| |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 4.6 | |

| |

| | | |

| | | |

| | | |

| | |

| Net income attributable to noncontrolling interests | |

| (0.4 | ) |

| |

| | | |

| | | |

| | | |

| | |

| Net income attributable to IDT Corporation | |

$ | 4.2 | |

| |

| | | |

| | | |

| | | |

| | |

IDT

Corporation

Reconciliation

of Adjusted EBITDA to Net Income

(unaudited)

in

millions

Figures

may not foot or cross-foot due to rounding to millions.

| | |

| | |

| | |

| | |

| | |

| |

| | |

Total

ID T Corporation | | |

Telecom Platform Services | | |

Consumer Phone Services | | |

All Other | | |

Corporate | |

Three Months Ended January 31, 2015 (2Q15) | |

| | |

| | |

| | |

| | |

| |

| Adjusted EBITDA | |

$ | 8.0 | | |

$ | 11.1 | | |

$ | 0.3 | | |

$ | (0.6 | ) | |

$ | (2.8 | ) |

| Subtract (Add): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 4.4 | | |

| 3.9 | | |

| - | | |

| 0.5 | | |

| - | |

| Severance expense | |

| 0.4 | | |

| 0.3 | | |

| - | | |

| - | | |

| - | |

| Gain on sale of interest in Fabrix Systems Ltd. | |

| (0.5 | ) | |

| - | | |

| - | | |

| (0.5 | ) | |

| - | |

| Income (loss) from operations | |

| 3.7 | | |

$ | 6.9 | | |

$ | 0.3 | | |

$ | (0.6 | ) | |

$ | (2.8 | ) |

| Other income, net | |

| 1.0 | | |

| | | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 4.7 | | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| (1.9 | ) | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 2.8 | | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to noncontrolling interests | |

| (0.3 | ) | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to IDT Corporation | |

$ | 2.5 | | |

| | | |

| | | |

| | | |

| | |

IDT

Corporation

Reconciliation

of Adjusted EBITDA to Net Income

(unaudited)

in

millions

Figures

may not foot or cross-foot due to rounding to millions.

| | |

Total IDT Corporation | | |

Telecom Platform Services | | |

Consumer Phone Services | | |

All Other | | |

Corporate | |

| Six Months Ended January 31, 2016 | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

$ | 24.6 | | |

$ | 25.4 | | |

$ | 0.6 | | |

$ | 3.2 | | |

$ | (4.6 | ) |

| Subtract: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 10.0 | | |

| 9.1 | | |

| - | | |

| 0.9 | | |

| - | |

| Loss on disposal of property, plant and equipment | |

| 0.3 | | |

| 0.3 | | |

| - | | |

| - | | |

| - | |

| Income (loss) from operations | |

| 14.3 | | |

$ | 16.0 | | |

$ | 0.6 | | |

$ | 2.3 | | |

$ | (4.6 | ) |

| Interest income, net | |

| 0.7 | | |

| | | |

| | | |

| | | |

| | |

| Other expense, net | |

| (0.8 | ) | |

| | | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 14.2 | | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| (4.9 | ) | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 9.3 | | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to noncontrolling interests | |

| (1.0 | ) | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to IDT Corporation | |

$ | 8.3 | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Total IDT Corporation | | |

Telecom Platform Services | | |

Consumer Phone Services | | |

All Other | | |

Corporate | |

| Six Months Ended January 31, 2015 | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

$ | 18.5 | | |

$ | 22.1 | | |

$ | 0.7 | | |

$ | 1.4 | | |

$ | (5.8 | ) |

| Subtract (Add): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 8.8 | | |

| 7.7 | | |

| - | | |

| 1.1 | | |

| - | |

| Severance expense | |

| 1.9 | | |

| 1.9 | | |

| - | | |

| - | | |

| - | |

| Gain on sale of interest in Fabrix Systems Ltd. | |

| (75.6 | ) | |

| - | | |

| - | | |

| (75.6 | ) | |

| - | |

| Income (loss) from operations | |

| 83.3 | | |

$ | 12.5 | | |

$ | 0.7 | | |

$ | 75.9 | | |

$ | (5.8 | ) |

| Interest expense, net | |

| (0.1 | ) | |

| | | |

| | | |

| | | |

| | |

| Other income, net | |

| 2.3 | | |

| | | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 85.5 | | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| (2.4 | ) | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 83.1 | | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to noncontrolling interests | |

| (0.4 | ) | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to IDT Corporation | |

$ | 82.7 | | |

| | | |

| | | |

| | | |

| | |

|

IDT Corporation

Reconciliations of Net Income to Non-GAAP Net Income and Diluted

EPS to Non-GAAP Diluted EPS

(unaudited)

in millions, except per share data

Figures may not foot due to rounding to millions. |

| | |

| 2Q16 | | |

| 1Q16 | | |

| 2Q15 | | |

| Six

Months Ended January

31, 2016 | | |

| Six

Months Ended January

31, 2015 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 4.7 | | |

$ | 4.6 | | |

$ | 2.8 | | |

$ | 9.2 | | |

$ | 83.1 | |

| Adjustments (add) subtract: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation | |

| (0.9 | ) | |

| (0.8 | ) | |

| (2.2 | ) | |

| (1.6 | ) | |

| (3.0 | ) |

| Depreciation and amortization | |

| (5.0 | ) | |

| (5.0 | ) | |

| (4.4 | ) | |

| (10.0 | ) | |

| (8.8 | ) |

| Gain on sale of interest in Fabrix Systems Ltd. | |

| - | | |

| - | | |

| 0.5 | | |

| - | | |

| 75.6 | |

| Severance expense | |

| - | | |

| - | | |

| (0.4 | ) | |

| - | | |

| (1.9 | ) |

| Loss on disposal of property,

plant and equipment | |

| (0.3 | ) | |

| - | | |

| - | | |

| (0.3 | ) | |

| - | |

| Total adjustments | |

| (6.2 | ) | |

| (5.8 | ) | |

| (6.4 | ) | |

| (11.9 | ) | |

| 61.9 | |

| Income tax effect of total

adjustments | |

| 1.9 | | |

| 2.3 | | |

| 1.7 | | |

| 4.0 | | |

| 3.3 | |

| | |

| 4.3 | | |

| 3.5 | | |

| 4.7 | | |

| 7.9 | | |

| (65.2 | ) |

| Non-GAAP net income | |

$ | 9.0 | | |

$ | 8.1 | | |

$ | 7.5 | | |

$ | 17.1 | | |

$ | 17.9 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Earnings per share: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.18 | | |

$ | 0.18 | | |

$ | 0.11 | | |

$ | 0.36 | | |

$ | 3.63 | |

| Total adjustments | |

| 0.21 | | |

| 0.17 | | |

| 0.22 | | |

| 0.39 | | |

| (2.84 | ) |

| Non-GAAP EPS - basic | |

$ | 0.39 | | |

$ | 0.35 | | |

$ | 0.33 | | |

$ | 0.75 | | |

$ | 0.79 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted-average number of shares used in calculation of basic earnings per share | |

| 22.8 | | |

| 22.9 | | |

| 22.8 | | |

| 22.9 | | |

| 22.8 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted | |

$ | 0.18 | | |

$ | 0.18 | | |

$ | 0.11 | | |

$ | 0.36 | | |

$ | 3.57 | |

| Total adjustments | |

| 0.21 | | |

| 0.17 | | |

| 0.22 | | |

| 0.39 | | |

| (2.80 | ) |

| Non-GAAP EPS - diluted | |

$ | 0.39 | | |

$ | 0.35 | | |

$ | 0.33 | | |

$ | 0.75 | | |

$ | 0.77 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted-average number of

shares used in calculation of diluted earnings per share | |

| 22.8 | | |

| 23.0 | | |

| 23.2 | | |

| 22.9 | | |

| 23.2 | |

13

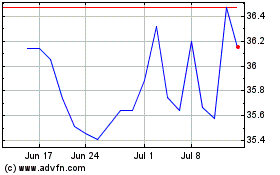

IDT (NYSE:IDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

IDT (NYSE:IDT)

Historical Stock Chart

From Apr 2023 to Apr 2024