Current Report Filing (8-k)

March 02 2016 - 6:05PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of report (Date of earliest

event reported):

|

March

2, 2016

|

|

|

THE ST. JOE COMPANY

|

|

|

|

(Exact Name of Registrant as

Specified in Its Charter)

|

|

|

Florida

|

|

1-10466

|

|

59-0432511

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

133 South WaterSound Parkway

WaterSound, FL

|

|

32413

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

|

|

(850) 231-6400

|

|

|

|

(Registrant’s Telephone Number, Including Area Code)

|

|

|

|

Not Applicable

|

|

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

|

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

⃞

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

⃞

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

⃞

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

ITEM

2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On March 2,

2016, The St. Joe Company issued a press release announcing its

financial results for the quarter and year ended December 31, 2015. A

copy of the press release is furnished with this Current Report on Form

8-K as Exhibit 99.1.

ITEM

9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

The

following exhibit is furnished as part of this Current Report on Form

8-K.

99.1 Press

Release dated March 2, 2016

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

THE ST. JOE COMPANY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

March

2, 2016

|

|

By:

|

/s/ Marek Bakun

|

|

|

|

|

|

Name:

|

Marek Bakun

|

|

|

|

|

Title:

|

Chief Financial Officer

|

Exhibit 99.1

The St.

Joe Company Reports Fourth Quarter and Full Year 2015 Results

WATERSOUND, Fla.--(BUSINESS WIRE)--March 2, 2016--The St. Joe Company

(NYSE:JOE) (the “Company”) today announced Net Loss for the fourth

quarter of 2015 of $(2.5) million, or $(0.03) per share, compared with

Net Loss of $(11.1) million, or $(0.12) per share, for the fourth

quarter of 2014. For the full year ended December 31, 2015, the Company

reported Net Loss of $(1.7) million, or $(0.02) per share compared to

Net Income of $406.5 million, or $4.40 per share for the same period

last year. The 2014 earnings included the Company’s AgReserves and

RiverTown transactions and the Company’s Pension Plan termination.

Fourth Quarter and Full Year 2015 update includes:

-

Total revenue for the quarter was $21.1 million as compared to $15.7

million in the fourth quarter of 2014 due to increases in real estate

sales, resorts and leisure revenues and leasing revenues partially

offset by a decrease in timber sales. For the full year 2015, total

revenue was $103.9 million compared to $701.9 million for the same

period in 2014. Excluding the Company’s AgReserves and RiverTown

transactions, 2014 revenue was $87.4 million.

-

Real estate sales increased to $9.4 million in the fourth quarter of

2015 as compared to $4.4 million in the fourth quarter of 2014. This

increase was due to increased volume and price of lots in the

Company’s primary and resort home communities and the sale of a

non-strategic commercial 3.1 acre parcel for $2.5 million.

-

Resorts and leisure revenue increased approximately $0.8 million, or

10%, in the fourth quarter of 2015 as compared to the fourth quarter

of 2014. The increase relates to continuing growth in visitors

particularly for the fall school break, due in part to favorable

weather conditions, and increases in wedding and corporate functions

business.

-

Timber sales decreased to $0.7 million during the fourth quarter of

2015 as compared to $1.2 million in the fourth quarter of 2014 due to

lower tons sold.

-

During the fourth quarter of 2015, the Company, through the Pier Park

North joint venture, refinanced the construction loan and entered into

a $48.2 million, 10 year, term loan secured by a first lien and

security interest in the joint venture property and a short term $6.62

million letter of credit with limited guarantees. In addition, in

October 2015, the Company’s defeased debt of $25.3 million was repaid

utilizing the cash from previously pledged treasury securities.

-

As of December 31, 2015, the Company had cash, cash equivalents and

investments of $404.0 million, as compared to $671.4 million as of

December 31, 2014, a decrease of $267.4 million. The decrease was

related to the $305.0 million of cash used for stock repurchases

offset by net receipts from the Company’s operations and other

activities.

Jorge Gonzalez, the Company’s President and Chief Executive Officer,

said, “We had a constructive year at St. Joe with a number of

initiatives we can build upon such as the approval of the Bay-Walton

Sector Plan, return to our shareholders of over $300 million in cash

through our share buy-backs, and a seamless management transition.” Mr.

Gonzalez added, “We are poised to focus our resources and energy on

maximizing the value of our assets as we move forward into the new year.”

|

FINANCIAL DATA

|

|

|

|

Consolidated Results

|

|

($ in millions except share and per share amounts)

|

|

|

|

|

Quarter Ended

December 31,

|

|

|

Year Ended

December 31,

|

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real estate sales

|

|

|

$9.4

|

|

|

$4.4

|

|

|

$33.7

|

|

|

$634.9

|

|

|

Resorts and leisure revenues

|

|

|

8.8

|

|

|

8.0

|

|

|

54.5

|

|

|

48.5

|

|

|

Leasing revenues

|

|

|

2.2

|

|

|

2.1

|

|

|

9.0

|

|

|

7.0

|

|

|

Timber sales

|

|

|

0.7

|

|

|

1.2

|

|

|

6.7

|

|

|

11.5

|

|

|

Total revenues

|

|

|

21.1

|

|

|

15.7

|

|

|

103.9

|

|

|

701.9

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of real estate sales

|

|

|

4.2

|

|

|

2.5

|

|

|

16.4

|

|

|

87.1

|

|

|

Cost of resorts and leisure revenues

|

|

|

8.8

|

|

|

8.5

|

|

|

47.1

|

|

|

42.9

|

|

|

Cost of leasing revenues

|

|

|

0.8

|

|

|

0.8

|

|

|

2.8

|

|

|

2.3

|

|

|

Cost of timber sales

|

|

|

0.2

|

|

|

0.2

|

|

|

0.8

|

|

|

4.5

|

|

|

Other operating and corporate expenses

|

|

|

8.7

|

|

|

6.2

|

|

|

33.4

|

|

|

26.2

|

|

|

Administrative costs associated with special purpose entities

|

|

|

--

|

|

|

--

|

|

|

--

|

|

|

3.7

|

|

|

Depreciation, depletion and amortization

|

|

|

2.2

|

|

|

2.2

|

|

|

9.5

|

|

|

8.4

|

|

|

Pension charge

|

|

|

--

|

|

|

11.3

|

|

|

--

|

|

|

13.5

|

|

|

Total expenses

|

|

|

24.9

|

|

|

31.7

|

|

|

110.0

|

|

|

188.6

|

|

|

Operating (loss) income

|

|

|

(3.8)

|

|

|

(16.0)

|

|

|

(6.1)

|

|

|

513.3

|

|

|

Other (loss) income

|

|

|

(0.1)

|

|

|

5.1

|

|

|

5.0

|

|

|

8.5

|

|

|

Loss (income) from operations before equity in income from

unconsolidated affiliates and income taxes

|

|

|

(3.9)

|

|

|

(10.9)

|

|

|

(1.1)

|

|

|

521.8

|

|

|

Income tax (benefit) expense

|

|

|

(1.2)

|

|

|

0.3

|

|

|

0.8

|

|

|

115.5

|

|

|

Net (loss) income

|

|

|

(2.7)

|

|

|

(11.2)

|

|

|

(1.9)

|

|

|

406.3

|

|

|

Net gain attributable to non-controlling interest

|

|

|

0.2

|

|

|

0.1

|

|

|

0.2

|

|

|

0.2

|

|

|

Net (loss) income attributable to the Company

|

|

|

$(2.5)

|

|

|

$(11.1)

|

|

|

$(1.7)

|

|

|

$406.5

|

|

|

Net (loss) income per share attributable to the Company

|

|

|

$(0.03)

|

|

|

$(0.12)

|

|

|

$(0.02)

|

|

|

$4.40

|

|

|

Weighted average shares outstanding

|

|

|

75,329,557

|

|

|

92,297,467

|

|

|

87,827,869

|

|

|

92,297,467

|

|

|

|

|

Revenues by Segment

|

|

|

($ in millions)

|

|

|

|

|

|

|

|

Quarter Ended

December 31,

|

|

Year Ended

December 31,

|

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

Real estate sales

|

|

|

|

|

|

|

|

|

|

|

Residential

|

|

$6.9

|

|

$4.3

|

|

$21.1

|

|

$17.8

|

|

|

RiverTown Sale

|

|

--

|

|

--

|

|

--

|

|

43.6

|

|

|

Commercial

|

|

2.5

|

|

--

|

|

7.2

|

|

3.3

|

|

|

AgReserves Sale and other rural land sales

|

|

--

|

|

0.1

|

|

5.4

|

|

570.2

|

|

|

Total real estate sales

|

|

9.4

|

|

4.4

|

|

33.7

|

|

634.9

|

|

|

Resorts and leisure revenues

|

|

8.8

|

|

8.0

|

|

54.5

|

|

48.5

|

|

|

Leasing revenues

|

|

2.2

|

|

2.1

|

|

9.0

|

|

7.0

|

|

|

Timber sales

|

|

0.7

|

|

1.2

|

|

6.7

|

|

11.5

|

|

|

Total revenues

|

|

$21.1

|

|

$15.7

|

|

$103.9

|

|

$701.9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary Balance Sheet

|

|

|

($ in millions)

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2015

|

|

December 31, 2014

|

|

|

Assets

|

|

|

|

|

|

|

Investment in real estate, net

|

|

$313.6

|

|

$321.8

|

|

|

Cash and cash equivalents

|

|

212.8

|

|

34.5

|

|

|

Investments

|

|

191.2

|

|

636.9

|

|

|

Restricted investments

|

|

7.1

|

|

7.9

|

|

|

Notes receivable, net

|

|

2.6

|

|

24.3

|

|

|

Pledged cash and treasury securities

|

|

--

|

|

25.7

|

|

|

Property and equipment, net

|

|

10.1

|

|

10.2

|

|

|

Other assets

|

|

38.6

|

|

32.0

|

|

|

Investments held by special purpose entities

|

|

208.8

|

|

209.8

|

|

|

Total assets

|

|

$984.8

|

|

$1,303.1

|

|

|

|

|

|

|

|

|

|

Liabilities and Equity

|

|

|

|

|

|

|

Debt

|

|

$55.2

|

|

$63.8

|

|

|

Accounts payable, accrued liabilities and deferred credits

|

|

41.9

|

|

47.5

|

|

|

Deferred tax liabilities

|

|

36.8

|

|

34.8

|

|

|

Senior Notes held by special purpose entity

|

|

177.5

|

|

177.3

|

|

|

Total liabilities

|

|

311.4

|

|

323.4

|

|

|

Total equity

|

|

673.4

|

|

979.7

|

|

|

Total liabilities and equity

|

|

$984.8

|

|

$1,303.1

|

|

|

|

|

Debt Schedule

|

|

|

($ in millions)

|

|

|

|

|

|

|

|

December 31, 2015

|

|

December 31, 2014

|

|

|

Pier Park North

|

|

$48.2

|

|

$31.6

|

|

|

Community Development District debt

|

|

7.0

|

|

6.5

|

|

|

In substance defeased debt

|

|

--

|

|

25.7

|

|

|

Total debt

|

|

$55.2

|

|

$63.8

|

|

|

|

|

Other Operating and Corporate Expenses

|

|

|

($ in millions)

|

|

|

|

|

|

|

|

Quarter Ended

December 31,

|

|

Year Ended

December 31,

|

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

|

Employee costs

|

|

$3.8

|

|

$1.5

|

|

$13.8

|

|

$8.4

|

|

|

AgReserves Sale severance

|

|

--

|

|

--

|

|

--

|

|

1.2

|

|

|

401(k) contribution / pension costs

|

|

0.1

|

|

--

|

|

1.3

|

|

--

|

|

|

Non-cash stock compensation costs

|

|

--

|

|

--

|

|

0.2

|

|

0.2

|

|

|

Property taxes and insurance

|

|

1.4

|

|

1.5

|

|

5.7

|

|

6.3

|

|

|

Professional fees

|

|

1.8

|

|

1.4

|

|

7.4

|

|

5.2

|

|

|

Marketing and owner association costs

|

|

0.4

|

|

0.5

|

|

1.4

|

|

1.6

|

|

|

Occupancy, repairs and maintenance

|

|

0.6

|

|

0.3

|

|

1.3

|

|

0.9

|

|

|

Other

|

|

0.6

|

|

1.0

|

|

2.3

|

|

2.4

|

|

|

Total other operating and corporate expense

|

|

$8.7

|

|

$6.2

|

|

$33.4

|

|

$26.2

|

|

|

|

Important Notice Regarding Forward-Looking Statements

This press release includes forward-looking statements, including

statements regarding the Company’s expectations regarding its business

strategy, future operations and pursuit of value creation for its

shareholders. The Company wishes to caution readers that certain

important factors may have affected and could in the future affect the

Company’s actual results and could cause the Company’s actual results

for subsequent periods to differ materially from those expressed in any

forward-looking statement made by or on behalf of the Company, including

(1) changes in the Company’s strategic objectives and its ability to

implement such strategic objectives; (2) economic or other conditions

that affect the future prospects for the Southeastern region of the

United States and the demand for the Company’s products, including a

slowing of the population growth in Florida, inflation, or unemployment

rates or declines in consumer confidence or the demand for, or the

prices of, housing; (3) any potential negative impact of the Company’s

longer-term property development strategy, including losses and negative

cash flows for an extended period of time if the Company continues with

the self-development of recently granted entitlements; (4) the impact of

natural or man-made disasters or weather conditions, including

hurricanes and other severe weather conditions, on the Company’s

business; (5) the Company’s ability to capitalize on its leasing

operations in the Pier Park North joint venture; (6) the Company’s

ability to capitalize on opportunities relating to its mixed use and

active adult communities, including its ability to successfully and

timely obtain land-use entitlements and construction financing, maintain

compliance with state law requirements and address issues that arise in

connection with the use and development of its land, including the

permits required for the mixed use and active adult communities; (7) the

impact of market volatility on the value of the Company’s investments,

including potential unrealized losses or the realization of losses on

its investments; (8) the Company’s use of its share repurchase

authorization and its ability to carry out the Stock Repurchase Program

in accordance with applicable securities laws; (9) the Company’s ability

to realize the anticipated benefits of its Stock Repurchase Program; and

(10) the Company’s ability to effectively deploy and invest its assets,

including available-for-sale securities; as well as, the cautionary

statements and risk factor disclosures contained in the Company’s

Securities and Exchange Commission filings including the Company’s

Annual Report on Form 10-K filed with the Commission on February 26,

2015 as updated by subsequent Quarterly Reports on Form 10-Qs and other

current report filings.

About The St. Joe Company

The St. Joe Company together with its consolidated subsidiaries is a

real estate development, asset management and operating company

concentrated primarily between Tallahassee and Destin, Florida. More

information about the Company can be found on its website at www.joe.com.

© 2016, The St. Joe Company. “St. Joe®”, “JOE®”, the “Taking Flight”

Design®, “St. Joe (and Taking Flight Design)®” are registered service

marks of The St. Joe Company.

CONTACT:

The St. Joe Company

Investor Relations:

Marek Bakun,

1-866-417-7132

Chief Financial Officer

Marek.Bakun@Joe.Com

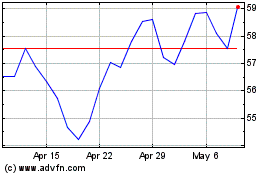

St Joe (NYSE:JOE)

Historical Stock Chart

From Mar 2024 to Apr 2024

St Joe (NYSE:JOE)

Historical Stock Chart

From Apr 2023 to Apr 2024