UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): February 26, 2016

BROADWIND ENERGY, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

001-34278 |

|

88-0409160 |

|

(State or Other Jurisdiction of |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

Incorporation) |

|

|

|

|

3240 South Central Avenue, Cicero, Illinois 60804

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (708) 780-4800

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On February 26, 2016, Broadwind Energy, Inc. (the “Company”) issued a press release announcing its financial results as of and for the quarter and year ended December 31, 2015. The press release is incorporated herein by reference and is attached hereto as Exhibit 99.1.

The information contained in, or incorporated into, this Item 2.02 of this Current Report on Form 8-K (this “Report”), including Exhibit 99.1, is furnished under Item 2.02 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act regardless of any general incorporation language in such filings.

Item 7.01. Regulation FD Disclosure.

An investor presentation dated February 26, 2016 is incorporated herein by reference and attached hereto as Exhibit 99.2.

The information contained in, or incorporated into, this Item 7.01 of this Report, including Exhibit 99.2, is furnished under Item 7.01 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act or the Exchange Act regardless of any general incorporation language in such filings.

This Report shall not be deemed an admission as to the materiality of any information in this Report that is being disclosed pursuant to Regulation FD.

Please refer to Exhibit 99.2 for a discussion of certain forward-looking statements included therein and the risks and uncertainties related thereto.

Item 9.01. Financial Statements and Exhibits.

|

EXHIBIT

NUMBER |

|

DESCRIPTION |

|

99.1 |

|

Press Release dated February 26, 2016 |

|

99.2 |

|

Investor Presentation dated February 26, 2016 |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BROADWIND ENERGY, INC. |

|

|

|

|

February 26, 2016 |

By: |

/s/ Stephanie K. Kushner |

|

|

|

Stephanie K. Kushner |

|

|

|

Chief Financial Officer |

|

|

|

(Principal Financial Officer) |

3

EXHIBIT INDEX

|

EXHIBIT

NUMBER |

|

DESCRIPTION |

|

|

|

|

|

99.1 |

|

Press Release dated February 26, 2016 |

|

99.2 |

|

Investor Presentation dated February 26, 2016 |

4

Exhibit 99.1

Broadwind Energy Announces Fourth-Quarter and

Full-Year 2015 Results

Highlights:

· Revenue of $199 million for full-year 2015, down 12% from full-year 2014 due to operational challenges in Towers business and weaker demand from oil & gas customers

· Cash assets totaled $13 million at 2015 year-end; $2 million of term debt repaid

· Inventory totaled $24 million at 2015 year-end, down $10 million from end of Q3 2015

· Net loss from continuing operations of $10.7 million, or $.73 per share, in Q4 2015

· Completed sale of majority of unprofitable Services segment assets

Cicero, Ill., February 26, 2016 — Broadwind Energy, Inc. (NASDAQ: BWEN) reported sales of $37.6 million in Q4 2015, down 24% compared to $49.2 million in Q4 2014 due mainly to lower tower production resulting from production challenges in the Abilene tower facility, and reduced demand for gearing.

The Company reported a net loss from continuing operations of $10.7 million, or $.73 per share, in Q4 2015, compared to $4.1 million, or $.28 per share, in Q4 2014. The $.45 per share increase in net loss was due primarily to significantly lower Towers and Weldments segment results due to production challenges associated with a challenging contract in the Abilene tower facility as previously announced.

The Company reported a net loss from discontinued operations of $.1 million, or $.00 per share, in Q4 2015, compared to $1.1 million or $.08 per share, in Q4 2014. In Q4 2015, the Company sold the majority of the Services segment assets.

The Company reported a non-GAAP adjusted EBITDA (earnings before interest, taxes, depreciation, amortization, share-based payments and restructuring costs) loss of $8.1 million in Q4 2015 compared to a loss of $1.1 million in Q4 2014 (see attached reconciliation of non-GAAP financial measure). The $7.0 million increased loss was mainly attributable to losses associated with the production challenges in the Abilene tower facility during Q4 2015.

For the full-year 2015, the Company reported sales of $199.2 million, compared to $225.8 million for the full-year 2014. The 12% reduction was due primarily to production challenges in the Towers and Weldments segment and a shortfall in the Gearing segment as a result of weaker demand from oil & gas and mining customers in 2015.

Net loss from continuing operations for the full-year 2015 totaled $12.2 million or $.83 per share, compared to $1.8 million or $.12 per share for the full-year 2014.

The Company reported a full-year 2015 non-GAAP adjusted EBITDA loss of $.4 million compared to non-GAAP adjusted EBITDA of $11.9 million for the full-year 2014.

Broadwind Interim CEO Stephanie Kushner stated, “2015 was a challenging year for Broadwind. Our Towers and Weldments segment experienced production challenges and supply chain issues and our Gearing segment suffered from weak demand due to the downturn in the oil & gas and mining markets. Despite these significant challenges, in the fourth quarter we sold the unprofitable Services business, significantly reduced our working capital, paid down debt and built up our cash balance. Our Abilene tower production returned to plant-design levels in the current quarter. In Gearing we applied strict cost control practices and were able to reduce the annual operating loss by $1 million despite 30% less revenue in this segment. In addition, we reduced our annual corporate expenses by $2 million.”

Ms. Kushner continued, “In 2016, we will continue our focus on improving production and tightly managing costs across the Company. As we look to Q1, we expect $45-47 million in revenue and an improvement to a $1.5-$2.0 million operating loss with a return to positive EBITDA generation.”

Orders and Backlog

The Company booked $4.9 million of net new orders in Q4 2015, down significantly from $27.9 million booked in Q4 2014 due primarily to the timing of large tower orders. Towers and Weldments orders, which vary considerably from quarter to quarter, totaled $2.8 million in Q4 2015, down from $21.1 million in Q4 2014. Gearing orders totaled $2.1 million in Q4 2015, down from $6.9 million in Q4 2014 mainly due to weaker demand from oil & gas and mining customers.

Orders for the full-year 2015 totaled $94.0 million, down from $120.5 million or 22% compared to the full-year 2014. Towers and Weldments orders, which vary considerably from quarter to quarter, totaled $69.1 million in 2015, down from $77.6 million in 2014 due to a reduction in steel pricing passed through to customers and lower weldments orders in 2015. Gearing orders totaled $24.9 million in 2015, down from $42.9 million in 2014 due to weaker demand from oil & gas and mining customers.

At December 31, 2015, total backlog was $93.9 million, representing about six months of projected 2016 shipments. This is down significantly from backlog of $201.4 million at December 31, 2014, as a portion of 2016 tower volume is not yet booked.

Segment Results

Towers and Weldments

Broadwind Energy produces fabrications for wind, oil and gas, mining and other industrial applications, specializing in the production of wind turbine towers.

Towers and Weldments segment sales totaled $31.9 million in Q4 2015, compared to $38.6 million in Q4 2014. The 17% decrease was due primarily to production challenges at the Abilene facility associated with a difficult contract. The segment experienced an operating loss of $5.8 million in the quarter (the first quarterly operating loss since Q4 2012) compared to operating income of $.5 million in Q4 2014. The poor results were attributable to low production in the Company’s Abilene tower facility and losses related to labor overruns and increased logistics and contractor fees associated with a challenging contract from a long-term customer. Non-GAAP adjusted EBITDA loss totaled $4.2 million, compared to non-GAAP adjusted EBTIDA of $1.6 million in Q4 2014, as a result of the factors described above.

2

Towers and Weldments segment sales for the full-year 2015 totaled $170.9 million, compared to $184.9 million in 2014. The 8% reduction was primarily due to lower steel prices, which are generally passed through to customers, the absence of a greater mix of larger, more-complex towers in 2015, and $3.4 million of lower weldments revenue compared to 2014. Operating income for 2015 totaled $4.7 million, down significantly from $18.1 million in 2014. The $12.8 million decrease was primarily due to the production inefficiencies associated with an unprofitable tower contract in the Company’s Abilene facility, as described above. Non-GAAP adjusted EBITDA for 2015 totaled $9.5 million, compared to $22.3 million in 2014, as a result of the factors described above.

Gearing

Broadwind Energy engineers, builds and remanufactures precision gears and gearboxes for oil and gas, mining, steel and wind applications.

Gearing segment sales totaled $5.8 million in Q4 2015, compared to $10.7 million in Q4 2014. The reduction was due to lower production volumes associated with weaker demand from oil & gas and mining customers. Gearing segment operating loss was $2.9 million in Q4 2015, compared to $2.4 million in Q4 2014. The increased loss was due to lower volumes, offset by strong cost control efforts in response to sharply lower revenues as well as the absence of restructuring costs in Q4 2015. Non-GAAP adjusted EBITDA loss for Q4 2015 was $1.5 million, compared to $.7 million in Q4 2014, as a result of the factors described above.

Gearing segment sales for the full-year 2015 totaled $29.6 million, compared to $42.3 million in 2014. The 30% decrease was attributable to weaker demand from oil & gas and mining customers, partially offset by increased sales to wind energy customers. Gearing segment operating loss for the full-year 2015 was $8.2 million, compared to $9.4 million in 2014. The $1.2 million improvement was due to successful cost management in response to sharply lower revenues, lower depreciation and the benefits of completing the consolidation investment. This was partially offset by $.9 million of additional environmental remediation expenses incurred earlier in 2015 associated with a closed plant which is being readied for sale, and the impact of the lower sales volume. Non-GAAP adjusted EBITDA loss was $2.1 million in 2015, compared to $1.0 million in 2014. The increased loss was due to the impact of lower sales volume and the $.9 million environmental remediation expense, partially offset by the impact of successful cost management.

Corporate

Corporate and other expenses totaled $2.3 million for Q4 2015, essentially unchanged as compared to Q4 2014.

For the full-year 2015, Corporate and other expenses totaled $8.4 million, compared to $10.1 million in 2014. The 17% decrease was primarily due to the absence of a $1.6 million regulatory settlement charge in 2015, lower incentive compensation and strong cost management, partially offset by a $1.2 million cost related to the separation of the Company’s former CEO.

Cash and Liquidity

During Q4 2015, operating working capital (accounts receivable and inventory, net of accounts payable and customer deposits) decreased sharply by $16.8 million to $10.2 million or 7% of Q4 2015 annualized sales, mainly due to a $9.9 million decrease in inventory and a $7.3 million decrease in receivables during Q4 2015. The reduction in receivables reflects shorter payment terms for the mix of towers produced.

3

Full-year 2015 capital expenditures totaled $2.8 million, down from $6.3 million in 2014.

Cash assets (cash and short-term investments) totaled $12.7 million at December 31, 2015, compared to $4.8 million at September 30, 2015. The Company paid down $2 million of term debt during Q4 2015 and its credit line was undrawn at December 31, 2015. The Company was not in compliance with the adjusted EBITDA covenant under its loan agreement with AloStar Bank of Commerce as of December 31, 2015. On February 23, 2016, the Company and AloStar executed a ninth amendment to the loan agreement waiving compliance with this covenant and amending the covenant going forward. In connection therewith, the Company’s credit facility was reduced from $15 million to $10 million, with a liquidity requirement of $3.5 million. The amendment also extended the credit facility until February 28, 2017.

At year-end, debt and capital lease obligations totaled $5.8 million, down from $8.1 million at September 30, 2015.

About Broadwind Energy, Inc.

Broadwind Energy (NASDAQ: BWEN) applies decades of deep industrial expertise to innovate integrated solutions for customers in the energy and infrastructure markets. From gears and gearing systems for wind, oil and gas and mining applications, to wind towers and industrial weldments, we have solutions for the energy needs of the future. With facilities throughout the central U.S., Broadwind Energy’s talented team is committed to helping customers maximize performance of their investments—quicker, easier and smarter. Find out more at www.bwen.com

Forward-Looking Statements

This release contains “forward-looking statements”—that is, statements related to future, not past, events—as defined in Section 21E of the Securities Exchange Act of 1934, as amended, that reflect our current expectations regarding our future growth, results of operations, financial condition, cash flows, performance, business prospects and opportunities, as well as assumptions made by, and information currently available to, our management. Forward-looking statements include any statement that does not directly relate to a current or historical fact. We have tried to identify forward-looking statements by using words such as “anticipate,” “believe,” “expect,” “intend,” “will,” “should,” “may,” “plan” and similar expressions, but these words are not the exclusive means of identifying forward-looking statements. Our forward-looking statements may include or relate to the following: (i) our expectations relating to state, local and federal regulatory frameworks affecting the industries in which we compete, including the wind energy industry, and the related extension, continuation or renewal of federal tax incentives and grants and state renewable portfolio standards; (ii) our expectations with respect to our customer relationships and efforts to diversify our customer base and sector focus and leverage customer relationships across business units; (iii) our plans to continue to grow our business organically; (iv) our beliefs with respect to the sufficiency of our liquidity and our plans to evaluate alternate sources of funding if necessary; (v) our plans and assumptions, including estimated costs and saving opportunities, regarding our restructuring efforts; (vi) our ability to realize revenue from customer orders and backlog; (vii) our ability to operate our business efficiently, manage capital expenditures and costs effectively, and generate cash flow; (viii) our beliefs and expectations relating to the economy and the potential impact it may have on our business, including our customers; (ix) our beliefs regarding the state of the wind energy market and other energy and industrial markets generally and the impact of competition and economic volatility in those markets; (x) our beliefs and expectations relating to the effects of market disruptions and regular market volatility, including the fluctuations in the price of oil, gas and other commodities; and (xi)

4

the potential loss of tax benefits if we experience an “ownership change” under Section 382 of the Internal Revenue Code of 1986, as amended. These statements are based on information currently available to us and are subject to various risks, uncertainties and other factors that could cause our actual growth, results of operations, financial condition, cash flows, performance, business prospects and opportunities to differ materially from those expressed in, or implied by, these statements. We are under no duty to update any of the forward-looking statements after the date of this release to conform such statements to actual results. You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties or potentially inaccurate assumptions that could cause our current expectations or beliefs to change.

BWEN INVESTOR CONTACT: Joni Konstantelos, 708.780.4819 joni.konstantelos@bwen.com

5

BROADWIND ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(IN THOUSANDS)

(UNAUDITED)

|

|

|

As of December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

6,436 |

|

$ |

12,057 |

|

|

Short-term investments |

|

6,179 |

|

8,024 |

|

|

Restricted cash |

|

83 |

|

83 |

|

|

Accounts receivable, net |

|

9,784 |

|

17,043 |

|

|

Inventories, net |

|

24,219 |

|

31,144 |

|

|

Prepaid expenses and other current assets |

|

1,530 |

|

1,587 |

|

|

Current assets held for sale |

|

4,403 |

|

7,805 |

|

|

Total current assets |

|

52,634 |

|

77,743 |

|

|

LONG-TERM ASSETS: |

|

|

|

|

|

|

Property and equipment, net |

|

51,906 |

|

58,529 |

|

|

Intangible assets, net |

|

5,016 |

|

5,459 |

|

|

Other assets |

|

351 |

|

413 |

|

|

Long-term assets held for sale |

|

— |

|

4,473 |

|

|

TOTAL ASSETS |

|

$ |

109,907 |

|

$ |

146,617 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

Current maturities of long-term debt |

|

$ |

2,799 |

|

$ |

118 |

|

|

Current portions of capital lease obligations |

|

447 |

|

767 |

|

|

Accounts payable |

|

13,822 |

|

17,547 |

|

|

Accrued liabilities |

|

8,134 |

|

9,260 |

|

|

Customer deposits |

|

9,940 |

|

22,397 |

|

|

Current liabilities held for sale |

|

1,613 |

|

1,579 |

|

|

Total current liabilities |

|

36,755 |

|

51,668 |

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

Long-term debt, net of current maturities |

|

2,600 |

|

2,646 |

|

|

Long-term capital lease obligations, net of current portions |

|

— |

|

426 |

|

|

Other |

|

3,060 |

|

3,467 |

|

|

Long-term liabilities held for sale |

|

— |

|

30 |

|

|

Total long-term liabilities |

|

5,660 |

|

6,569 |

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized; no shares issued or outstanding |

|

— |

|

— |

|

|

Common stock, $0.001 par value; 30,000,000 shares authorized; 15,012,789 and 14,844,307 shares issued as of December 31, 2015 and 2014, respectively |

|

15 |

|

15 |

|

|

Treasury stock, at cost, 273,937 shares and 0 shares at December 31, 2015 and 2014, respectively |

|

(1,842 |

) |

(1,842 |

) |

|

Additional paid-in capital |

|

378,104 |

|

377,185 |

|

|

Accumulated deficit |

|

(308,785 |

) |

(286,978 |

) |

|

Total stockholders’ equity |

|

67,492 |

|

88,380 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

109,907 |

|

$ |

146,617 |

|

6

BROADWIND ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

|

|

|

Three Months Ended December 31, |

|

For the Years Ended December 31, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

37,573 |

|

$ |

49,193 |

|

$ |

199,156 |

|

$ |

225,829 |

|

|

Cost of sales |

|

43,781 |

|

48,370 |

|

191,289 |

|

204,852 |

|

|

Restructuring |

|

— |

|

329 |

|

— |

|

1,281 |

|

|

Gross profit |

|

(6,208 |

) |

494 |

|

7,867 |

|

19,696 |

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

4,519 |

|

4,508 |

|

18,271 |

|

18,931 |

|

|

Intangible amortization |

|

111 |

|

111 |

|

444 |

|

444 |

|

|

Regulatory settlement |

|

— |

|

— |

|

— |

|

1,566 |

|

|

Restructuring |

|

186 |

|

11 |

|

1,060 |

|

233 |

|

|

Total operating expenses |

|

4,816 |

|

4,630 |

|

19,775 |

|

21,174 |

|

|

Operating loss |

|

(11,024 |

) |

(4,136 |

) |

(11,908 |

) |

(1,478 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

OTHER (EXPENSE) INCOME, net: |

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

(188 |

) |

(189 |

) |

(799 |

) |

(656 |

) |

|

Other, net |

|

461 |

|

83 |

|

425 |

|

73 |

|

|

Gain on sale of assets and restructuring |

|

— |

|

(84 |

) |

— |

|

36 |

|

|

Total other expense, net |

|

273 |

|

(190 |

) |

(374 |

) |

(547 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) before (benefit) for income taxes |

|

(10,751 |

) |

(4,326 |

) |

(12,282 |

) |

(2,025 |

) |

|

(Benefit) for income taxes |

|

(25 |

) |

(271 |

) |

(36 |

) |

(232 |

) |

|

(LOSS) FROM CONTINUING OPERATIONS |

|

(10,726 |

) |

(4,055 |

) |

(12,246 |

) |

(1,793 |

) |

|

(LOSS) FROM DISCONTINUED OPERATIONS, NET OF TAX (INCLUDING IMPAIRMENT OF $1,500 RECORDED IN THE YEAR ENDED DECEMBER 31, 2015) |

|

(66 |

) |

(1,117 |

) |

(9,561 |

) |

(4,375 |

) |

|

NET LOSS |

|

$ |

(10,792 |

) |

$ |

(5,172 |

) |

$ |

(21,807 |

) |

$ |

(6,168 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

NET (LOSS) PER COMMON SHARE - BASIC AND DILUTED: |

|

|

|

|

|

|

|

|

|

|

(Loss) from continuing operations |

|

$ |

(0.73 |

) |

$ |

(0.28 |

) |

$ |

(0.83 |

) |

$ |

(0.12 |

) |

|

(Loss) from discontinued operations |

|

(0.00 |

) |

(0.08 |

) |

(0.65 |

) |

(0.30 |

) |

|

Net loss |

|

$ |

(0.73 |

) |

$ |

(0.35 |

) |

$ |

(1.48 |

) |

$ |

(0.42 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING - BASIC AND DILUTED |

|

14,738 |

|

14,677 |

|

14,677 |

|

14,715 |

|

7

BROADWIND ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS)

(UNAUDITED)

|

|

|

Twelve Months Ended December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net loss |

|

$ |

(21,807 |

) |

$ |

(6,168 |

) |

|

Loss from discontinued operations |

|

(9,561 |

) |

(4,375 |

) |

|

Loss from continuing operations |

|

(12,246 |

) |

(1,793 |

) |

|

|

|

|

|

|

|

|

Adjustments to reconcile net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization expense |

|

9,179 |

|

10,944 |

|

|

Impairment charges |

|

183 |

|

84 |

|

|

Stock-based compensation |

|

919 |

|

888 |

|

|

Allowance for doubtful accounts |

|

35 |

|

65 |

|

|

Common stock issued under defined contribution 401(k) plan |

|

— |

|

163 |

|

|

Gain on disposal of assets |

|

(98 |

) |

(157 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

7,223 |

|

498 |

|

|

Inventories |

|

6,925 |

|

1,599 |

|

|

Prepaid expenses and other current assets |

|

(25 |

) |

2,091 |

|

|

Accounts payable |

|

(3,625 |

) |

(8,872 |

) |

|

Accrued liabilities |

|

(1,126 |

) |

1,330 |

|

|

Customer deposits |

|

(12,457 |

) |

(253 |

) |

|

Other non-current assets and liabilities |

|

(399 |

) |

(472 |

) |

|

Net cash (used in) provided by operating activities of continued operations |

|

(5,512 |

) |

6,115 |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

Purchases of available for sale securities |

|

(8,062 |

) |

(15,088 |

) |

|

Sales of available for sale securities |

|

5,082 |

|

1,101 |

|

|

Maturities of available for sale securities |

|

4,825 |

|

7,106 |

|

|

Purchases of property and equipment |

|

(2,789 |

) |

(6,297 |

) |

|

Proceeds from disposals of property and equipment |

|

1,156 |

|

1,009 |

|

|

Net cash provided by (used in) by investing activities of continued operations |

|

212 |

|

(12,169 |

) |

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

Net proceeds from issuance of stock |

|

— |

|

9 |

|

|

Net proceeds used in repurchasing of common stock |

|

— |

|

(1,842 |

) |

|

Payments on lines of credit and notes payable |

|

(118,212 |

) |

(15,850 |

) |

|

Proceeds from lines of credit and notes payable |

|

118,212 |

|

15,850 |

|

|

Proceeds from long-term debt |

|

5,000 |

|

— |

|

|

Payments on long-term debt |

|

(2,201 |

) |

— |

|

|

Principal payments on capital leases |

|

(747 |

) |

(934 |

) |

|

Net cash provided by (used in) financing activities of continued operations |

|

2,052 |

|

(2,767 |

) |

|

|

|

|

|

|

|

|

DISCONTINUED OPERATIONS: |

|

|

|

|

|

|

Operating cash flows |

|

(5,327 |

) |

(3,613 |

) |

|

Investing cash flows |

|

2,864 |

|

(151 |

) |

|

Financing cash flows |

|

(3 |

) |

(201 |

) |

|

Net cash used in discontinued operations |

|

(2,466 |

) |

(3,965 |

) |

|

|

|

|

|

|

|

|

Add: Cash balance of discontinued operations, beginning of period |

|

93 |

|

185 |

|

|

Less: Cash balance of discontinued operations, end of period |

|

— |

|

93 |

|

|

|

|

|

|

|

|

|

NET DECREASE IN CASH AND CASH EQUIVALENTS |

|

(5,621 |

) |

(12,694 |

) |

|

CASH AND CASH EQUIVALENTS, beginning of the period |

|

12,057 |

|

24,751 |

|

|

CASH AND CASH EQUIVALENTS, end of the period |

|

$ |

6,436 |

|

$ |

12,057 |

|

|

|

|

|

|

|

|

|

Supplemental cash flow information: |

|

|

|

|

|

|

Interest paid |

|

$ |

652 |

|

$ |

601 |

|

|

Income taxes paid |

|

$ |

48 |

|

$ |

62 |

|

|

Non-cash investing and financing activities: |

|

|

|

|

|

|

Issuance of restricted stock grants |

|

$ |

919 |

|

$ |

888 |

|

|

Common stock issued under defined contibution 401(k) plan |

|

$ |

— |

|

$ |

163 |

|

9

BROADWIND ENERGY, INC. AND SUBSIDIARIES

SELECTED SEGMENT FINANCIAL INFORMATION

(IN THOUSANDS)

(UNAUDITED)

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

|

|

December 31, |

|

December 31, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

ORDERS: |

|

|

|

|

|

|

|

|

|

|

Towers and Weldments |

|

$ |

2,816 |

|

$ |

21,051 |

|

$ |

69,146 |

|

$ |

77,570 |

|

|

Gearing |

|

2,088 |

|

6,858 |

|

24,881 |

|

42,910 |

|

|

Total orders |

|

$ |

4,904 |

|

$ |

27,909 |

|

$ |

94,027 |

|

$ |

120,480 |

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES: |

|

|

|

|

|

|

|

|

|

|

Towers and Weldments |

|

$ |

31,916 |

|

$ |

38,620 |

|

$ |

170,919 |

|

$ |

184,904 |

|

|

Gearing |

|

5,830 |

|

10,720 |

|

29,588 |

|

42,253 |

|

|

Corporate and Other |

|

(173 |

) |

(148 |

) |

(1,351 |

) |

(1,328 |

) |

|

Total revenues |

|

$ |

37,573 |

|

$ |

49,192 |

|

$ |

199,156 |

|

$ |

225,829 |

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING (LOSS) PROFIT: |

|

|

|

|

|

|

|

|

|

|

Towers and Weldments |

|

$ |

(5,823 |

) |

$ |

542 |

|

$ |

4,702 |

|

$ |

18,065 |

|

|

Gearing |

|

(2,855 |

) |

(2,364 |

) |

(8,235 |

) |

(9,423 |

) |

|

Corporate and Other |

|

(2,347 |

) |

(2,315 |

) |

(8,375 |

) |

(10,120 |

) |

|

Total operating (loss) profit |

|

$ |

(11,025 |

) |

$ |

(4,137 |

) |

$ |

(11,908 |

) |

$ |

(1,478 |

) |

Non-GAAP Financial Measure

The Company provides non-GAAP adjusted EBITDA (earnings before interest, income taxes, depreciation, amortization, and stock compensation) as supplemental information regarding the Company’s business performance. The Company believes that this non-GAAP financial measure is useful to investors because it provides investors with a better understanding of the Company’s past financial performance and future results. The Company’s management uses adjusted EBITDA when it internally evaluates the performance of the Company’s business, reviews financial trends and makes operating and strategic decisions. The Company believes that providing this non-GAAP financial measure to its investors is useful because it allows investors to evaluate the Company’s performance using the same methodology and information as Company management. The Company’s definition of adjusted EBITDA may be different from similar non-GAAP financial measures used by other companies and/or analysts.

10

BROADWIND ENERGY, INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(IN THOUSANDS)

(UNAUDITED)

Consolidated

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (Loss) |

|

$ |

(11,024 |

) |

$ |

(4,137 |

) |

$ |

(11,908 |

) |

$ |

(1,478 |

) |

|

Depreciation and Amortization |

|

2,319 |

|

2,300 |

|

9,179 |

|

10,944 |

|

|

Share-based Compensation and Other Stock Payments |

|

(4 |

) |

355 |

|

893 |

|

852 |

|

|

Other Income |

|

461 |

|

83 |

|

425 |

|

73 |

|

|

Restructuring Expense |

|

186 |

|

340 |

|

1,060 |

|

1,514 |

|

|

Adjusted EBITDA (Non-GAAP) |

|

$ |

(8,062 |

) |

$ |

(1,059 |

) |

$ |

(351 |

) |

$ |

11,905 |

|

Towers and Weldments Segment

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (Loss) Profit |

|

$ |

(5,823 |

) |

$ |

542 |

|

$ |

4,702 |

|

$ |

18,065 |

|

|

Depreciation |

|

992 |

|

941 |

|

3,954 |

|

3,993 |

|

|

Share-based Compensation and Other Stock Payments |

|

6 |

|

54 |

|

111 |

|

99 |

|

|

Other Income |

|

445 |

|

84 |

|

560 |

|

71 |

|

|

Restructuring Expense |

|

186 |

|

7 |

|

186 |

|

47 |

|

|

Adjusted EBITDA (Non-GAAP) |

|

$ |

(4,194 |

) |

$ |

1,628 |

|

$ |

9,513 |

|

$ |

22,275 |

|

Gearing Segment

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Loss |

|

$ |

(2,855 |

) |

$ |

(2,364 |

) |

(8,235 |

) |

(9,423 |

) |

|

Depreciation |

|

1,164 |

|

1,193 |

|

4,588 |

|

6,372 |

|

|

Amortization |

|

111 |

|

111 |

|

444 |

|

444 |

|

|

Share-based Compensation and Other Stock Payments |

|

45 |

|

62 |

|

228 |

|

191 |

|

|

Other Income |

|

16 |

|

— |

|

18 |

|

3 |

|

|

Restructuring Expense |

|

— |

|

333 |

|

874 |

|

1,466 |

|

|

Adjusted EBITDA (Non-GAAP) |

|

$ |

(1,519 |

) |

$ |

(665 |

) |

$ |

(2,083 |

) |

$ |

(947 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate and Other

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Loss |

|

$ |

(2,347 |

) |

$ |

(2,315 |

) |

(8,375 |

) |

(10,120 |

) |

|

Depreciation |

|

52 |

|

55 |

|

194 |

|

135 |

|

|

Share-based Compensation and Other Stock Payments |

|

(55 |

) |

238 |

|

553 |

|

562 |

|

|

Other (Expense) |

|

— |

|

— |

|

(153 |

) |

— |

|

|

Adjusted EBITDA (Non-GAAP) |

|

$ |

(2,350 |

) |

$ |

(2,022 |

) |

$ |

(7,781 |

) |

$ |

(9,423 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

Exhibit 99.2

Q4 2015 Earnings Conference Call February 26, 2016

Industry Data and Forward-Looking Statements Disclaimer Broadwind obtained the industry and market data used throughout this presentation from our own research, internal surveys and studies conducted by third parties, independent industry associations or general publications and other publicly available information. Independent industry publications and surveys generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy or completeness of such information. Forecasts are particularly likely to be inaccurate, especially over long periods of time. We are not aware of any misstatements in the industry data we have presented herein, but estimates involve risks and uncertainties and are subject to change based on various factors beyond our control. This presentation contains “forward-looking statements”—that is, statements related to future, not past, events—as defined in Section 21E of the Securities Exchange Act of 1934, as amended, that reflect our current expectations regarding our future growth, results of operations, financial condition, cash flows, performance, business prospects and opportunities, as well as assumptions made by, and information currently available to, our management. Forward-looking statements include any statement that does not directly relate to a current or historical fact. We have tried to identify forward-looking statements by using words such as “anticipate,” “believe,” “expect,” “intend,” “will,” “should,” “may,” “plan” and similar expressions, but these words are not the exclusive means of identifying forward-looking statements. Our forward-looking statements may include or relate to the following: our expectations relating to the regulatory frameworks affecting the industries in which we compete and the applicability of tax incentives, grants and renewable portfolio standards; our expectations with respect to our customer relationships; our plans to grow our business organically; our beliefs with respect to the sufficiency and availability of funding; our restructuring efforts; our ability to realize revenue from customer orders and backlog, to operate our business efficiently, manage capital expenditures and costs effectively, and generate cash flow; our expectations relating to the economy and its impact on our business; our beliefs regarding the state of the wind energy and other markets and the related impact of competition and economic volatility; our expectations relating to the effects of market disruptions and regular market volatility, including the fluctuations in the price of oil, gas and other commodities; and the potential loss of tax benefits if we experience an “ownership change” under Section 382 of the Internal Revenue Code of 1986, as amended. These statements are based on information currently available to us and are subject to various risks, uncertainties and other factors that could cause our actual growth, results of operations, financial condition, cash flows, performance, business prospects and opportunities to differ materially from those expressed in, or implied by, these statements. We are under no duty to update any of the forward-looking statements after the date of this presentation to conform such statements to actual results. You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. This presentation contains non-GAAP financial information. We believe that certain non-GAAP financial measures may provide users of this financial information with meaningful comparisons between current results and results in prior operating periods. We believe that these non-GAAP financial measures can provide additional meaningful reflection of underlying trends of the business because they provide a comparison of historical information that excludes certain infrequently occurring or non-operational items that impact the overall comparability. Non-GAAP financial measures should be viewed in addition to, and not as an alternative to, our reported results prepared in accordance with GAAP. Please see our earnings release dated February 26, 2016 for a reconciliation of certain non-GAAP measures presented in this presentation. 2/26/16 © 2016 Broadwind Energy, Inc. All rights reserved. 2

2016 Priorities Double order intake Maintain consistent tower production Aggressively manage costs 2/26/16 © 2016 Broadwind Energy, Inc. All rights reserved. 3

Wind Market Update 2/26/16 © 2016 Broadwind Energy, Inc. All rights reserved. 4 U.S. Market Outlook, 2015-2021e (GW) Longest planning horizon in industry history Eliminates costly start/stop inefficiencies Economics/ potential CPP become installation drivers as PTC expires Shift toward direct buys by corporations 5-Year PTC extension adds ~16GW of additional installations into forecast for 2017-2021

Orders and Backlog Orders – $M $69M in Towers & Weldments orders in 2015 – reduction in steel prices passed through to customers and lower weldments orders 2015 Gearing orders down sharply from PY – weaker demand from oil & gas and mining customers Order Backlog – $M Ending backlog $93.9M ~ 6 months of projected 2016 shipments included in backlog PTC extension has caused slight pause in turbine orders – working to fill remaining 2016 capacity 2014 2015 % Change Book : Bill Towers & Weldments $77.6 $69.1 -11% .40 Gearing 42.9 24.9 -42% .84 Total 120.5 94.0 -22% .47 2/26/16 © 2016 Broadwind Energy, Inc. All rights reserved. 5 Record-high backlog; Tower orders placed ahead of PTC expiration - 50 100 150 200 250 300 350 Millions

Liquidity 2/26/16 © 2016 Broadwind Energy, Inc. All rights reserved. 6 Inventories declined $10M in Q4 2015 Operating working capital declined $17M in Q4 2015 primarily due to inventory reduction and reduced receivables reflecting shorter payment terms for towers produced Paid down $2M of debt in Q4 2015; outstanding debt at 12/31/15 totaled $5.4M, including $2.6M New Markets Tax Credit financing Gross Inventory Operating Working Capital* ¢/$ Sales *Operating Working Capital = Trade A/R + Inventories – Trade Payables – Customer Deposits - 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 Dec-13 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Raw Materials WIP Finished Goods - 2 4 6 8 10 12 14 16

Consolidated Financial Results 2/26/16 © 2016 Broadwind Energy, Inc. All rights reserved. 7 Sales down 24%; Towers and Weldments -17%, Gearing -46% Gross margin, profit and EPS declines all due primarily to Abilene Towers production challenges and weaker Gearing volumes from oil & gas and mining customers Q4 Results 2015 Results Sales down 12%; Towers and Weldments -8%, Gearing -30% Gross margin, profit and EPS declines all due primarily to Towers production challenges and weaker Gearing volumes from oil & gas and mining customers * Reconciliation to non-GAAP measure included in Appendix Q4 Full Year 2014 2015 2014 2015 Revenue-$M $ 49.2 $ 37.6 $ 225.8 $ 199.2 Gross Profit/(Loss)-$M 0.5 (6.2) 19.7 7.9 -% (ex. Restructuring) 1.0% -16.5% 8.7% 4.0% Operating Expense-$M 4.6 4.8 21.2 19.8 -% (ex. Restructuring) 9.4% 12.3% 9.3% 9.4% Operating Income(Loss)-$M (4.1) (11.0) (1.5) (11.9) *Non-GAAP Adj. EBITDA-$M (1.1) (8.1) 11.9 (0.4) EPS, Continuing Operations (0.28) (0.73) (0.12) (0.83) Memo: NI including Disc. Operations (5.2) (10.8) (6.2) (21.8)

Towers and Weldments Q4 2014 Q4 2015 FY 2014 FY 2015 Orders ($M) $21.1 $2.8 $77.6 $69.1 Towers Sold (#) 101 93 435 450 Revenue ($M) 38.6 31.9 184.9 170.9 Operating Inc/(Loss) ($M) 0.5 -5.8 18.1 4.7 -% of Sales 1.4% -18.2% 9.8% 2.8% *Non-GAAP Adj. EBITDA ($M) 1.6 -4.2 22.3 9.5 - % of Sales 4.2% -13.1% 12.0% 5.6% Q4 Results Towers sold down 8% from Q4 2014 – Abilene throughput issues Q4 revenue down 17% due to production challenges in Abilene Operating loss -$6M; first quarterly operating loss since Q4 2012 2016 Objectives Sell remaining 2016-17 tower capacity; build and diversify Weldments backlog Reduce tower production cost through improved welding and paint productivity Improve management of tower model changeovers 2/26/16 © 2016 Broadwind Energy, Inc. All rights reserved. 8 FY Results Towers sold up 3% vs. 2014 Revenue down 8% due to lower steel prices and richer mix in 2014 and lower Weldments revenue Operating income impacted by production challenges * Reconciliation to non-GAAP measure included in Appendix 0 100 200 300 400 500 2012 2013 2014 2015 # of Towers Annual Tower Sales

Gearing Q4 2014 Q4 2015 FY 2014 FY 2015 Orders ($M) 6.9 2.1 42.9 24.9 Revenue ($M) 10.7 5.8 42.3 29.6 Operating Loss ($M) -2.4 -2.9 -9.4 -8.2 * Non-GAAP Adj. EBITDA ($M) -0.7 -1.5 -1.0 -2.1 Q4 Results Orders down – oil & gas orders down $3M, industrial down $1.5M Revenue down 46% – oil & gas and mining down Operating Loss worse by $.5M on significantly lower revenue – cost management, end of restructuring, lower depreciation all contributed 2/26/16 © 2016 Broadwind Energy, Inc. All rights reserved. 9 2014 2015 Orders by Industry 2016 Objectives Continue cross-training to improve labor productivity Continue aggressive cost management Expand sales efforts to improve capacity utilization and offset oil & gas decline 2015 Results Orders down – oil & gas down 85% or $18M Revenue down 30% – oil & gas and mining down Operating loss narrowed by 13% on significantly less revenue due to aggressive cost management, end of restructuring and lower depreciation * Reconciliation to non-GAAP measure included in Appendix Wind Industrial Oil & Gas Mining Steel Wind Industrial Oil & Gas Mining Steel

Consolidated Outlook 2/26/16 © 2016 Broadwind Energy, Inc. All rights reserved. 10 Estimate Q1 16 Outlook Assumptions Tower production stabilized in late January Gearing continues to manage well through oil & gas and mining downturn; savings from consolidation in effect, aggressive cost management continues Cost reduction and continuous improvement remain primary focus Expect to close one or more significant tower orders in Q1 * Reconciliation to non-GAAP measure included in Appendix Q1 15 Q1 16E Revenue-$M $ 49.2 $45-47 Gross Profit-$M 2.7 Revenue Low High -% (ex. Restructuring) 5.6% Towers 55 57 Operating Expense-$M 5.0 Gears 8 9 4,500 5,000 -% (ex. Restructuring) 10.2% Services 3 4 270 270 Operating Loss-$M (2.4) (1.5-2.0) 396 396 *Non-GAAP Adj. EBITDA-$M 0.2 0.5 EPS, Continuing - $ (0.34) 492 992 *estimates as of 9.18.15 Op Inc 189 189 weighted shares out Towers 5.5 5.7 303 803 Gears -2 -1 0.02 0.06 Revenue-$M Services -0.7 -0.5 Gross Profit-$M Corp -2 -2.5 -% (ex. Restructuring) 0.8 1.7 Operating Expense-$M -% (ex. Restructuring) 14597 Impairment Exp. -$M 0.054806 0.11646229 Operating Profit (Loss)-$M Adj. EBITDA-$M EPS, Continuing - $

NOL Rights Plan Amendment Update 2/26/15 © 2015 Broadwind Energy, Inc. All rights reserved. 11 Amendment adopted by BOD, will be voted on at annual stockholders meeting Designed to protect $202 million NOL carry-forward assets Triggered upon certain beneficial ownership changes; increases in stock ownership above 4.9% as defined by Section 382 of the Internal Revenue Code

Appendix – Non-GAAP Financial Measure Non-GAAP Financial Measure The Company provides non-GAAP adjusted EBITDA (earnings before interest, income taxes, depreciation, amortization, and stock compensation) as supplemental information regarding the Company’s business performance. The Company believes that this non-GAAP financial measure is useful to investors because it provides investors with a better understanding of the Company’s past financial performance and future results. The Company’s management uses adjusted EBITDA when it internally evaluates the performance of the Company’s business, reviews financial trends and makes operating and strategic decisions. The Company believes that providing this non-GAAP financial measure to its investors is useful because it allows investors to evaluate the Company’s performance using the same methodology and information as Company management. The Company's definition of adjusted EBITDA may be different from similar non-GAAP financial measures used by other companies and/or analysts. 2/26/16 © 2016 Broadwind Energy, Inc. All rights reserved. 12 Consolidated Three Months Ended December 31, Twelve Months Ended December 31, 2015 2014 2015 2014 Operating (Loss) $ (11,024) # $ (4,137) # $ (11,908) $ (1,478) Depreciation and Amortization 2,319 2,300 9,179 10,944 Share-based Compensation and Other Stock Payments (4) 355 893 852 Other Income ... 461 83 425 73 Restructuring Expense ... 186 340 1,060 1,514 Adjusted EBITDA Adjusted EBITDA (Non-GAAP) $ (8,062) $ (1,059) $ (351) $ 11,905 Towers and Weldments Segment Three Months Ended December 31, Twelve Months Ended December 31, 2015 2014 2015 2014 Operating (Loss) Profit .. $ (5,823) $ 542 $ 4,702 $ 18,065 Depreciation . 992 941 3,954 3,993 Share-based Compensation and Other Stock Payments 6 54 111 99 Other Income .. .. 445 84 560 71 Restructuring Expense 186 7 186 47 Adjusted EBITDA (Non-GAAP) $ (4,194) $ 1,628 $ 9,513 $ 22,275 Three Months Ended December 31, Twelve Months Ended December 31, Gearing Segment 2015 2014 2015 2014 Operating Loss . $ (2,855) $ (2,364) (8,235) (9,423) Depreciation 1,164 1,193 4,588 6,372 Amortization .. 111 111 444 444 Share-based Compensation and Other Stock Payments 45 62 228 191 Other Income . . 16 - 18 3 Restructuring Expense - 333 874 1,466 Adjusted EBITDA (Non-GAAP) . $ (1,519) $ (665) $ (2,083) $ (947)

Click to edit Master title style Click to edit Master text styles Second level Third level Fourth level Fifth level Broadwind Energy is committed to helping customers maximize performance of their energy and infrastructure investments— quicker, easier and smarter. 2/26/16 © 2016 Broadwind Energy, Inc. All rights reserved. 13

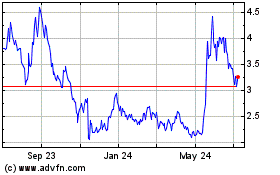

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

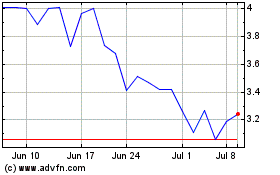

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Apr 2023 to Apr 2024