UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 8-K

———————

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 25, 2016 (February 22, 2016)

———————

EVOLUTIONARY GENOMICS, INC.

(Exact name of registrant as specified in its charter)

———————

| | |

Nevada

| 000-54129

| 41-1683548

|

(State or Other Jurisdiction

| (Commission

| (I.R.S. Employer

|

of Incorporation)

| File Number)

| Identification No.)

|

1026 Anaconda Drive, Castle Rock, Colorado 80108

(Address of Principal Executive Office) (Zip Code)

(720) 900-8666

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 3.02

Unregistered Sale of Equity Securities.

Series A-1 Convertible Preferred Stock

From February 22, 2016 through February 24, 2016, Evolutionary Genomics, Inc. (the “Company”) conducted closings of its best efforts private offering (the “Offering”) of Series A-1 Convertible Preferred Stock (the “Series A-1 Preferred Stock”) with certain accredited investors for an aggregate of $2,159,566.50. Pursuant to a stock purchase agreement (the “Stock Purchase Agreement”) with the purchasers (the “Purchasers”) of the Series A-1 Preferred Stock, the Company conducted closings for an aggregate of $2,159,566.50 from a total of 15 accredited investors through the issuance of an aggregate of 411,346 shares of Series A-1 Preferred Stock. The information set forth under Item 5.03 with respect to the rights and preferences related to the Series A-1 Preferred Stock is incorporated herein by reference.

The issuance of the Series A-1 Preferred Stock qualified for exemption under Rule 506(b) promulgated under Section 4(a)(2) of the Securities Act of 1933, as amended, since the issuance of the Series A-1 Preferred Stock by the Company did not involve a “public offering.”

The description of the Offering is qualified in its entirety by reference to the complete text of the Form of Stock Purchase Agreement, which is filed as Exhibit 10.1 hereto.

Item 5.03.

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On February 22, 2016, Evolutionary Genomics, Inc. (the “Company”) filed a Certificate of Designations, Preferences and Rights of Series A-1 Preferred Stock (the “Certificate of Designation”) with the Nevada Secretary of State, whereby the Company designated 600,000 shares as Series A-1 Preferred Stock, par value $0.001 per share (the “Series A-1 Preferred Stock”). The Series A-1 Preferred Stock shall have a stated value of $5.25 per share (the “Stated Value”). The Certificate of Designation sets forth the powers, preferences, rights, qualifications, limitations and restrictions applicable to the Series A-1 Preferred Stock.

Upon any liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary (a “Liquidation”), the holders of the Series A-1 Preferred Stock (the “Holders”) shall be entitled to receive out of the assets of the Company, whether such assets are capital or surplus, for each share of Series A-1 Preferred Stock an amount equal to its Stated Value plus any accrued but unpaid dividends (the “Liquidation Preference”) before any distribution or payment shall be made to the holders of any other class or series of stock of the Company that ranks junior to the Series A-1 Preferred Stock, and if the assets of the Company shall be insufficient to pay in full such amounts, then the entire assets to be distributed to the Holders shall be distributed among the Holders ratably in accordance with the respective amounts that would be payable on such shares if all amounts payable thereon were paid in full.

The Company shall pay to the holders of the Series A-1 Preferred Stock dividends from net profits or net assets of the Company legally available for the payment of such dividends, which shall begin to accrue on and be cumulative from the date of issuance of the Series A-1 Preferred (whether or not such dividends have been declared) in an annual amount equal to the product of (x) the Stated Value of such Series A-1 Preferred Stock and (y) eight percent (8%) per annum (the “Dividend Amount”). The Dividend Amount shall accrue and shall be payable in shares of common stock of the Company, par value $0.001 per share (“Common Stock”) upon the conversion of the Series A-1 Preferred Stock, or upon the redemption of the Series A-1 Preferred Stock, in each case pursuant to the terms the Certificate of Designation. No dividends shall be paid on any Common Stock or any capital stock of the Company that ranks junior to the Series A-1 Preferred Stock during any fiscal year of the Company until dividends in the aggregate Dividend Amount per share (as adjusted for any stock dividends, combinations or splits with respect to such shares) of Series A-1 Preferred Stock for the current and each prior Dividend payment date shall have been paid or declared and set apart for payment to the holders of the Series A-1 Preferred Stock.

In the event that the Company shall at any time pay a dividend on the Common Stock, it shall, at the same time, pay to each Holder a dividend equal to the dividend that would have been payable to such Holder if the shares of Series A-1 Preferred Stock held by such Holder had been converted into Common Stock on the date of determination of holders of Common Stock entitled to receive such dividends; and provided, further, that so long as any shares of the Series A-1 Preferred Stock are outstanding, no dividends shall be declared or paid or set apart for payment on any other preferred stock of the Company of any series ranking, as to dividends, junior to or on a parity with the Series A-1 Preferred Stock, unless a dividend shall be paid at the same time to each holder of Series A-1 Preferred Stock, in an amount such that the holders of such other series of preferred stock, on the one hand, and the Holders, on the other, receive dividends in the same relative proportions that each would have received had all such shares of preferred stock been converted into Common Stock immediately prior to the declaration of a dividend on such preferred stock.

At any time after the issuance of the Series A-1 Preferred Stock, the Company may deliver a notice to the Holders of its irrevocable election to redeem some or all of the then outstanding shares of Series A-1 Preferred Stock, (i) for cash in an amount equal to the Liquidation Preference per share and (ii) by issuing such number of shares of Common Stock as is obtained by multiplying (x) the number of shares of Series A Preferred Stock so to be redeemed by (y) the Liquidation Preference per share of the Series A Preferred Stock, and then by dividing such product by (z) the Conversion Price (as defined below) per share.

The Company shall establish a segregated non-interest bearing trust account (the “Sinking Fund Account”) for the benefit of the Holders. 50% of all licensing fees received by the Company following the issuance of the Series A-1 Preferred Stock shall be deposited in the Sinking Fund Account. In the event that the amount of cash in the Sinking Fund Account exceeds the Liquidation Preference of all issued and outstanding shares of Series A-1 Preferred Stock not previously redeemed or converted pursuant to the terms hereof, the Company shall deliver a notice to the Holders of its obligation to redeem all of the then outstanding shares of Series A-1 Preferred Stock (i) for cash in an amount equal to the Liquidation Preference per share and (ii) by issuing such number of shares of Common Stock as is obtained by multiplying (x) the number of shares of Series A-1 Preferred Stock so to be redeemed by (y) the Liquidation Preference per share of the Series A-1 Preferred Stock, and then by dividing such product by (z) the Conversion Price per share.

The Holder of any shares of Series A-1 Preferred Stock shall have the right, at its option at any time, to convert any such shares of Series A-1 Preferred Stock into such number of Common Stock as is obtained by multiplying (i) the number of shares of Series A-1 Preferred Stock so to be converted by (ii) the Liquidation Preference per share, and then by dividing such product by (iii) the conversion price of $5.25 per share or, if there has been an adjustment of the conversion price, by the conversion price as last adjusted and in effect at the date any share or shares of Series A-1 Preferred Stock are surrendered for conversion (such price, or such price as last adjusted, the “Conversion Price”).

The Holder of each share of Series A-1 Preferred Stock shall be entitled to the number of votes equal to the number of shares of Common Stock into which such share of Series A-1 Preferred Stock could be converted for purposes of determining the shares entitled to vote at any regular, annual or special meeting of stockholders of the Company, and shall have voting rights and powers equal to the voting rights and powers of the Common Stock (except as otherwise expressly provided herein or as required by law, voting together with the Common Stock as a single class).

A copy of the Certificate of Designation as filed with the Secretary of State of Nevada is attached as Exhibit 3.1 hereto and is incorporated herein by reference. The foregoing description of the material terms of the Certificate of Designation and Series A-1 Preferred Stock does not purport to be complete and is qualified in its entirety by reference to such exhibit.

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits.

| | |

Exhibit No.

|

| Description

|

|

|

|

3.1

|

| Certificate of Designations, Preferences and Rights of Series A-1 Preferred Stock

|

10.1

|

| Form of Stock Purchase Agreement

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| EVOLUTIONARY GENOMICS, INC.

|

| |

|

| | |

Dated: February 25, 2016

| By:

| /s/ Steve B. Warnecke

|

| Name:

| Steve B. Warnecke

|

| Title:

| Chief Executive Officer, Chief Financial Officer, President and Chairman of the Board

|

EXHIBIT 3.1

EVOLUTIONARY GENOMICS, INC.

CERTIFICATE OF DESIGNATION OF PREFERENCES,

RIGHTS AND LIMITATIONS

OF

SERIES A-1 CONVERTIBLE PREFERRED STOCK

The undersigned, the Chief Executive Officer of Evolutionary Genomics, Inc., a Nevada corporation (the “Corporation”), in accordance with the provisions of the Nevada Revised Statutes, does hereby certify:

That pursuant to the authority conferred upon the Board of Directors by the Articles of Incorporation of the Corporation, a series of preferred stock, par value $0.001 per share, designated as “Series A-1 Convertible Preferred Stock” and consisting of Six Hundred Thousand (600,000) shares, is hereby created by means of the filing of this Certificate of Designation of Preferences, Rights and Limitations of Series A-1 Convertible Preferred Stock of the Corporation (the “Certificate of Designation”) with the Secretary of State of the State of Nevada; and

That this Certificate of Designation was duly approved by the Corporation’s Board of Directors in accordance with the provisions of Section 78.195 of the Nevada Revised Statutes and by the requisite holders of the Corporation’s Series A-1 Convertible Preferred Stock in accordance with the Certificate of Designation.

NOW, THEREFORE, BE IT RESOLVED, that the Board of Directors does hereby provide for the issuance of a series of Series A-1 Convertible Preferred Stock for cash or exchange of other securities, rights or property and does hereby fix and determine the rights, preferences, restrictions and other matters relating to such series of Series A-1 Convertible Preferred Stock as follows:

TERMS OF SERIES A-1 CONVERTIBLE PREFERRED STOCK

Section 1.

Definitions. For the purposes hereof, the following terms shall have the following meanings:

“Business Day” means any day except Saturday, Sunday, any day which is a federal legal holiday in the United States or any day on which banking institutions in the State of New York are authorized or required by law or other governmental action to close.

“Common Stock" means the Corporation's common stock, par value $0.001 per share, and stock of any other class into which such shares may hereafter have been reclassified or changed.

“Conversion Shares” shall have the meaning given such term is Section 5(b)(i) hereof.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Excluded Stock” shall mean Common Stock or other securities of the Corporation issued or to be issued (i) pursuant to the conversion, exercise or exchange of securities outstanding on the Issuance Date, (ii) pursuant to the exercise of any equity securities at an exercise or conversion price greater than the Conversion Price, (iii) in accordance with the Corporation’s stock option plan or stock purchase plan, or otherwise issued to the Corporation’s employees, consultants or directors in transactions not primarily for equity financing purposes and approved by a majority of the members of the Compensation Committee of the Corporation or the Board of Directors, (iv) securities issued in connection with bona fide strategic license agreements or other partnering arrangements so long as such issuances are not for the primary purpose of raising capital, (v) except as otherwise provided herein, and following any applicable adjustment in the Conversion Price, upon the actual issuance of Common Stock or securities convertible into Common Stock at the time of exercise of any rights, options or warrants to purchase Common Stock or any securities convertible into Common Stock, as appropriate, or upon conversion or exchange of

securities convertible into Common Stock, or (vi) to the extent provided for herein, any shares of Series A-1 Preferred Stock or dividends thereon issued on or after the Issuance Date pursuant to the terms herein.

“Holder” shall have the meaning given such term in Section 2 hereof.

“Issuance Date” means the initial issuance date of the Series A-1 Preferred Stock.

“Person” means a corporation, an association, a partnership, an organization, a business, an individual, a government or political subdivision thereof or a governmental agency.

“Securities Act” means the Securities Act of 1933, as amended.

“Trading Day” means a day on which the principal Trading Market is open for trading; provided, that in the event that the Common Stock is not listed or quoted on a Trading Market, then Trading Day shall mean a Business Day.

“Trading Market” means whichever of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the New York Stock Exchange, the NYSE MKT, the NASDAQ Global Select Market, the NASDAQ Global Market, the NASDAQ Capital Market, the OTC Bulletin Board or any tier of the OTC Markets Group, Inc. (or any successors to any of the foregoing).

Section 2.

Designation and Amount; Rank; and Dividends.

a)

Designation and Amount. The series of preferred stock shall be designated as its Series A-1 Convertible Preferred Stock (the “Series A-1 Preferred Stock”) and the number of shares so designated shall be six hundred thousand (600,000) shares (which shall not be subject to increase without the consent of a majority of the holders of the Series A-1 Preferred Stock (each, a “Holder” and collectively, the “Holders”). Each share of Series A-1 Preferred Stock shall have a stated value equal to $5.25 (as may be adjusted for any stock dividends, combinations or splits with respect to such shares) (the “Stated Value”). Capitalized terms not otherwise defined herein shall have the meaning given such terms in Section 1 hereof.

b)

Rank. All shares of the Series A-1 Preferred Stock shall rank (i) senior to the Corporation’s Common Stock, (ii) pari passu with any class or series of capital stock of the Corporation hereafter created and specifically ranking, by its terms, on par with the Series A-1 Preferred Stock and (iii) junior to any class or series of capital stock of the Corporation hereafter created specifically ranking, by its terms, senior to the Series A-1 Preferred Stock, in each case as to distribution of assets upon liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary.

c)

Dividends.

i.

The Corporation shall pay to the holders of the Series A-1 Preferred Stock dividends from net profits or net assets of the Corporation legally available for the payment of such dividends, which shall begin to accrue on and be cumulative from the date of issuance of the Series A-1 Preferred (whether or not such dividends have been declared) in an annual amount equal to the product of (x) the Stated Value of such Series A-1 Preferred and (y) eight percent (8%) per annum (the “Dividend Amount”). The Dividend Amount shall accrue and shall be payable in shares of Common Stock upon the conversion of the Series A-1 Preferred Stock, or upon the redemption of the Series A-1 Preferred Stock, in each case pursuant to the terms hereof. No dividends shall be paid on any Common Stock of the Corporation or any capital stock of the Corporation that ranks junior to the Series A-1 Preferred Stock during any fiscal year of the Corporation until dividends in the aggregate Dividend Amount per share (as adjusted for any stock dividends, combinations or splits with respect to such shares) of Series A-1 Preferred Stock for the current and each prior Dividend Payment Date shall have been paid or declared and set apart for payment to the Holders.

ii.

In the event that the Corporation shall at any time pay a dividend on the Common Stock, it shall, at the same time, pay to each Holder a dividend equal to the dividend that would have been payable

to such Holder if the shares of Series A-1 Preferred Stock held by such Holder had been converted into Common Stock on the date of determination of holders of Common Stock entitled to receive such dividends; and provided, further, that so long as any shares of the Series A-1 Preferred Stock are outstanding, no dividends shall be declared or paid or set apart for payment on any other preferred stock of the Corporation of any series ranking, as to dividends, junior to or on a parity with the Series A-1 Preferred, unless a dividend shall be paid at the same time to each holder of Series A-1 Preferred, in an amount such that the holders of such other series of preferred stock, on the one hand, and the Holders, on the other, receive dividends in the same relative proportions that each would have received had all such shares of preferred stock been converted into Common Stock immediately prior to the declaration of a dividend on such preferred stock.

Section 3.

Voting Rights. Subject to the limitations set forth in Section 8 herein, the holder of each share of Series A-1 Preferred Stock shall be entitled to the number of votes equal to the number of shares of Common Stock into which such share of Series A-1 Preferred Stock could be converted for purposes of determining the shares entitled to vote at any regular, annual or special meeting of stockholders of the Corporation, and shall have voting rights and powers equal to the voting rights and powers of the Common Stock (except as otherwise expressly provided herein or as required by law, voting together with the Common Stock as a single class) and shall be entitled to notice of any stockholders’ meeting in accordance with the bylaws of the Corporation. Fractional votes shall not, however, be permitted and any fractional voting rights resulting from the above formula (after aggregating all shares into which shares of Series A-1 Preferred Stock held by each Holder could be converted) shall be rounded to the nearest whole number (with one-half being rounded upward).

Section 4.

Liquidation. Upon any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary (a “Liquidation”), the Holders shall be entitled to receive out of the assets of the Corporation, whether such assets are capital or surplus, for each share of Series A-1 Preferred Stock an amount equal to its Stated Value plus any accrued but unpaid dividends (the “Liquidation Preference”) before any distribution or payment shall be made to the holders of any other class or series of stock of the Corporation that ranks junior to the Series A-1 Preferred Stock, and if the assets of the Corporation shall be insufficient to pay in full such amounts, then the entire assets to be distributed to the Holders shall be distributed among the Holders ratably in accordance with the respective amounts that would be payable on such shares if all amounts payable thereon were paid in full. The Corporation shall mail written notice of any such Liquidation, not less than 45 days prior to the payment date stated therein, to each record Holder and the Holders shall be entitled to convert their shares of Series A-1 Preferred Stock into Common Stock pursuant to Section 5 hereof at any time prior to the consummation of a Liquidation.

Section 5.

Conversion.

a)

Conversions at Option of Holder. The Holder of any share or shares of Series A-1 Preferred Stock shall have the right, at its option at any time, to convert any such shares of Series A-1 Preferred Stock into such number of fully paid and nonassessable whole shares of Common Stock as is obtained by multiplying (i) the number of shares of Series A-1 Preferred Stock so to be converted by (ii) the Liquidation Preference per share, and then by dividing such product by (iii) the conversion price of $5.25 per share or, if there has been an adjustment of the conversion price, by the conversion price as last adjusted and in effect at the date any share or shares of Series A-1 Preferred are surrendered for conversion (such price, or such price as last adjusted, being referred to herein as the “Conversion Price”). Holders shall effect conversions by providing the Corporation with the form of conversion notice attached hereto as Annex A (a “Notice of Conversion”). Each Notice of Conversion shall specify the number of shares of Series A-1 Preferred Stock to be converted, the number of shares of Series A-1 Preferred Stock owned prior to the conversion at issue, the number of shares of Series A-1 Preferred Stock owned subsequent to the conversion at issue and the date on which such conversion is to be effected, which date may not be prior to the date the Holder delivers such Notice of Conversion to the Corporation by facsimile or electronic mail (email) (the “Conversion Date”). If no Conversion Date is specified in a Notice of Conversion, the Conversion Date shall be the date that such Notice of Conversion to the Corporation is deemed delivered hereunder. The calculations and entries set forth in the Notice of Conversion shall control in the absence of manifest or mathematical error. To effect conversions, as the case may be, of shares of Series A-1 Preferred Stock, a Holder shall not be required to surrender the certificate(s) representing such shares of Series A-1 Preferred Stock to the Corporation unless all of the shares of Series A-1 Preferred Stock represented thereby are so converted, in which case the Holder shall deliver the

certificate representing such shares of Series A-1 Preferred Stock promptly following the Conversion Date at issue. Shares of Series A-1 Preferred Stock converted or redeemed in accordance with the terms hereof shall be canceled and may not be reissued.

b)

Mechanics of Conversion.

i.

Delivery of Certificate Upon Conversion. Not later than five (5) Trading Days after each Conversion Date (the “Share Delivery Date”), the Corporation shall deliver to the Holder a certificate or certificates representing the number of shares of Common Stock being acquired upon the conversion of shares of Series A-1 Preferred Stock (the “Conversion Shares”). If in the case of any Notice of Conversion such certificate or certificates are not delivered to or as directed by the applicable Holder by the Share Delivery Date, the Holder shall be entitled to elect by written notice to the Corporation at any time on or before its receipt of such certificate or certificates thereafter, to rescind such conversion, in which event the Corporation shall immediately return the certificates representing the shares of Series A-1 Preferred Stock tendered for conversion.

ii.

Obligation Absolute. The Corporation’s obligations to issue and deliver the Conversion Shares upon conversion of Series A-1 Preferred Stock in accordance with the terms hereof are absolute and unconditional, irrespective of any action or inaction by the Holder to enforce the same, any waiver or consent with respect to any provision hereof, the recovery of any judgment against any Person or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation or termination.

iii.

Reservation of Shares Issuable Upon Conversion. The Corporation covenants that it will at all times reserve and keep available out of its authorized and unissued shares of Common Stock solely for the purpose of issuance upon conversion of the Series A-1 Preferred Stock, free from preemptive rights or any other actual contingent purchase rights of persons other than the Holders, not less than such number of shares of the Common Stock as shall be issuable (taking into account the adjustments and restrictions of herein) upon the conversion or redemption of all outstanding shares of Series A-1 Preferred Stock. The Corporation covenants that all shares of Common Stock that shall be so issuable shall, upon issue, be duly and validly authorized, issued and fully paid, nonassessable.

iv.

Transfer Taxes. The issuance of certificates for shares of the Common Stock on conversion of the Series A-1 Preferred Stock shall be made without charge to the Holders thereof for any documentary stamp or similar taxes that may be payable in respect of the issue or delivery of such certificate, provided that the Corporation shall not be required to pay any tax that may be payable in respect of any transfer involved in the issuance and delivery of any such certificate upon conversion in a name other than that of the Holder of such shares of Series A-1 Preferred Stock so converted and the Corporation shall not be required to issue or deliver such certificates unless or until the person or persons requesting the issuance thereof shall have paid to the Corporation the amount of such tax or shall have established to the satisfaction of the Corporation that such tax has been paid.

Section 6.

Optional Redemption; Sinking Fund Account.

(a)

At any time after the Issuance Date, the Corporation may deliver a notice to the Holders (the “Optional Redemption Notice” and the date such notice is deemed delivered hereunder, the “Optional Redemption Notice Date”) of its irrevocable election to redeem some or all of the then outstanding shares of Series A Preferred Stock, (i) for cash in an amount equal to the Liquidation Preference per share and (ii) by issuing such number of fully paid and nonassessable whole shares of Common Stock as is obtained by multiplying (x) the number of shares of Series A Preferred Stock so to be redeemed by (y) the Liquidation Preference per share of the Series A Preferred Stock, and then by dividing such product by (z) the Conversion Price per share, payable and issuable, respectively, in full on the 5th Trading Day following the Optional Redemption Notice Date. To be clear, upon redemption pursuant to this Section 6(a), Holders will receive a cash redemption and shares of common stock.

(b)

The Corporation shall, within five (5) Business Days following the Issuance Date, establish a segregated non-interest bearing trust account (the “Sinking Fund Account”) for the benefit of the Holders. 50% of all licensing fees received by the Corporation following the Issuance Date shall be deposited in the Sinking Fund

Account within five (5) Business Days of receipt of any such fees by the Corporation. In the event that the amount of cash in the Sinking Fund Account exceeds the Liquidation Preference of all issued and outstanding shares of Series A Preferred Stock not previously redeemed or converted pursuant to the terms hereof, the Corporation shall deliver a notice to the Holders (the “Mandatory Redemption Notice” and the date such notice is deemed delivered hereunder, the “Mandatory Redemption Notice Date”) of its obligation to redeem all of the then outstanding shares of Series A Preferred Stock (i) for cash in an amount equal to the Liquidation Preference per share and (ii) by issuing such number of fully paid and nonassessable whole shares of Common Stock as is obtained by multiplying (x) the number of shares of Series A Preferred Stock so to be redeemed by (y) the Liquidation Preference per share of the Series A Preferred Stock, and then by dividing such product by (z) the Conversion Price per share, payable and issuable, respectively, in full on the 5th Trading Day following the Mandatory Redemption Notice Date.

Section 7.

Certain Adjustments.

a)

Stock Dividends and Stock Splits. If the Corporation, at any time while the Series A-1 Preferred Stock is outstanding: (A) shall pay a stock dividend or otherwise make a distribution or distributions on shares of its Common Stock or any other equity or equity equivalent securities payable in shares of Common Stock (which, for avoidance of doubt, shall not include any shares of Common Stock issued by the Corporation pursuant to this Series A-1 Preferred Sock), (B) subdivide outstanding shares of Common Stock into a larger number of shares, (C) combine (including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares, or (D) issue by reclassification of shares of the Common Stock any shares of capital stock of the Corporation, then the Holders shall receive, upon conversion, the number of shares of Common Stock such Holder would have been entitled to receive assuming such Holder converted such Series A-1 Preferred Stock immediately prior to the applicable event. Any adjustment made pursuant to this Section shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision, combination or re-classification.

b)

Adjustments for Issuance of Additional Shares of Common Stock. In the event the Corporation, shall, at any time, from time to time, issue or sell any additional shares of Common Stock (otherwise than as provided in the foregoing subsection (a) or pursuant to Common Stock Equivalents (hereafter defined) granted or issued prior to the Issuance Date) (“Additional Shares of Common Stock”), other than Excluded Stock, at a price per share less than the Conversion Price then in effect or without consideration, then the Conversion Price upon each such issuance shall be reduced concurrently with such issue, to a price (calculated to the nearest cent) determined in accordance with the following formula:

CP2 = CP1* (A + B) ÷ (A + C).

For purposes of the foregoing formula, the following definitions shall apply:

(i)

“CP2” shall mean the Conversion Price in effect immediately after such issue of Additional Shares of Common Stock;

(ii)

“CP1” shall mean the Conversion Price in effect immediately prior to such issue of Additional Shares of Common Stock;

(iii)

“A” shall mean the number of shares of Common Stock outstanding immediately prior to such issue of Additional Shares of Common Stock;

(iv)

“B” shall mean the number of shares of Common Stock that would have been issued if such Additional Shares of Common Stock had been issued at a price per share equal to CP1 (determined by dividing the aggregate consideration received by the Corporation in respect of such issue by CP1); and

(v)

“C” shall mean the number of such Additional Shares of Common Stock issued in such transaction.

c)

Issuance of Common Stock Equivalents. The provisions of this Section 7(c) shall apply if (a) the Corporation, at any time after the Issuance Date, shall issue any securities convertible into or exchangeable for, directly or indirectly, Common Stock ("Convertible Securities"), other than Excluded Stock, or (b) any rights or warrants or options to purchase any such Common Stock or Convertible Securities (collectively, the "Common Stock Equivalents"), other than Excluded Stock, shall be issued or sold. If the price per share for which Additional Shares of Common Stock may be issuable pursuant to any such Common Stock Equivalent shall be less than the applicable Conversion Price then in effect, or if, after any such issuance of Common Stock Equivalents, the price per share for which Additional Shares of Common Stock may be issuable thereafter is amended or adjusted, and such price as so amended shall be less than the applicable Conversion Price in effect at the time of such amendment or adjustment, then the applicable Conversion Price upon each such issuance or amendment shall be adjusted as provided in Section 7(b). No adjustment shall be made to the Conversion Price upon the issuance of Common Stock pursuant to the exercise, conversion or exchange of any Convertible Security or Common Stock Equivalent where an adjustment to the Conversion Price was made as a result of the issuance or purchase of any Convertible Security or Common Stock Equivalent.

d)

Certain Issues Excepted. Anything herein to the contrary notwithstanding, the Corporation shall not be required to make any adjustment to the Conversion Price in connection with any issuance of Excluded Stock.

e)

Pro Rata Distributions. If the Corporation, at any time while Series A-1 Preferred Stock is outstanding, shall distribute to all holders of Common Stock (and not to Holders) evidences of its indebtedness or assets or rights or warrants to subscribe for or purchase any security, then in each such case, the Holders shall receive, upon conversion, the number of shares of Common Stock or other property such Holder would have been entitled to receive assuming such Holder converted such Series A-1 Preferred Stock immediately prior to the applicable event. The adjustments shall be described in a statement provided to the Holders of the portion of assets or evidences of indebtedness so distributed or such subscription rights applicable to one share of Common Stock. Such adjustment shall be made whenever any such distribution is made and shall become effective immediately after the record date mentioned above.

f)

Calculations. All calculations under this Section shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be. The number of shares of Common Stock outstanding at any given time shall not include shares owned or held by or for the account of the Corporation, and the description of any such shares of Common Stock shall be considered on issue or sale of Common Stock. For purposes of this Section 7, the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall be the sum of the number of shares of Common Stock (excluding treasury shares, if any) issued and outstanding.

g)

Notice to Holders; Adjustment to Conversion Price. Whenever the Conversion Price is adjusted pursuant to any of this Section, the Corporation shall promptly mail to each Holder a notice setting forth the Conversion Price after such adjustment and setting forth a brief statement of the facts requiring such adjustment.

Section 8.

Conversion Restrictions.

a)

Notwithstanding anything to the contrary set forth in this Certificate of Designation, at no time may a Holder of shares of Series A-1 Preferred Stock convert shares of the Series A-1 Preferred Stock if the number of shares of Common Stock to be issued pursuant to such conversion would exceed, when aggregated with all other shares of Common Stock owned by such Holder and its affiliates at such time, the number of shares of Common Stock which would result in such Holder and its affiliates beneficially owning (as determined in accordance with Section 13(d) of the Exchange Act, and the rules thereunder) in excess of 4.99% of all of the Common Stock outstanding at such time; provided, however, that upon a Holder providing the Corporation with sixty-one (61) days notice (pursuant to Section 9(b) hereof) (the "Waiver Notice") that such Holder would like to waive this Section 8(a) with regard to any or all shares of Common Stock issuable upon conversion of Series A-1 Preferred Stock, this Section 8(a) shall be of no force or effect with regard to those shares of Series A-1 Preferred Stock referenced in the Waiver Notice.

b)

Notwithstanding anything to the contrary set forth in this Certificate of Designation, at no time may a Holder of shares of Series A-1 Preferred Stock convert shares of the Series A-1 Preferred Stock if the number of shares of Common Stock to be issued pursuant to such conversion would exceed, when aggregated with all other

shares of Common Stock owned by such Holder and its affiliates at such time, would result in such Holder and its affiliates beneficially owning (as determined in accordance with Section 13(d) of the Exchange Act, and the rules thereunder) in excess of 9.99% of the Common Stock outstanding at such time; provided, however, that upon a Holder providing the Corporation with a Waiver Notice that such Holder would like to waive this Section 8(b) with regard to any or all shares of Common Stock issuable upon conversion of Series A-1 Preferred Stock, this Section 8(b) shall be of no force or effect with regard to those shares of Series A-1 Preferred Stock referenced in the Waiver Notice.

Section 9.

Miscellaneous.

a)

Notices. Any and all notices or other communications or deliveries to be provided by the Holders hereunder, including, without limitation, any Notice of Conversion, shall be in writing and delivered personally, by facsimile, by electronic mail (email) or sent by a nationally recognized overnight courier service, addressed to the Corporation. Any and all notices or other communications or deliveries to be provided by the Corporation hereunder shall be in writing and delivered personally, by facsimile, electronic mail (email), or sent by a nationally recognized overnight courier service addressed to each Holder at the facsimile telephone number, electronic mail (email) address or address of such Holder appearing on the books of the Corporation, or if no such facsimile telephone number, electronic mail (email) address, or address appears, at the principal place of business of the Holder. Any notice or other communication or deliveries hereunder shall be deemed given and effective on the earliest of (i) the date of transmission, if such notice or communication is delivered via facsimile at the facsimile telephone number specified, or electronic mail (email) at the electronic mail (email) address specified in this Section prior to 5:30 p.m. (New York City time), (ii) the date after the date of transmission, if such notice or communication is delivered via facsimile at the facsimile telephone number specified or electronic mail (email) at the electronic mail (email) address specified in this Section later than 5:30 p.m. (New York City time) on any date and earlier than 11:59 p.m. (New York City time) on such date, (iii) the second Business Day following the date of mailing, if sent by nationally recognized overnight courier service, or (iv) upon actual receipt by the party to whom such notice is required to be given

b)

Lost or Mutilated Series A-1 Preferred Stock Certificate. If a Holder’s Series A-1 Preferred Stock certificate shall be mutilated, lost, stolen or destroyed, the Corporation shall execute and deliver, in exchange and substitution for and upon cancellation of a mutilated certificate, or in lieu of or in substitution for a lost, stolen or destroyed certificate, a new certificate for the shares of Series A-1 Preferred Stock so mutilated, lost, stolen or destroyed but only upon receipt of evidence of such loss, theft or destruction of such certificate, and of the ownership hereof, and indemnity, if requested, all reasonably satisfactory to the Corporation.

c)

Transfer and Assignment. The rights of each Holder hereunder shall be automatically assignable by each Holder to any Person (other than a known competitor of the Corporation) of all or a portion of the Series A-1 Preferred Stock if: (i) the Holder agrees in writing with the transferee or assignee to assign such rights, and a copy of such agreement is furnished to the Corporation within a reasonable time after such assignment, (ii) the Corporation is, within a reasonable time after such transfer or assignment, furnished with written notice of (a) the name and address of such transferee or assignee, and (b) the number of shares of Preferred Stock with respect to which are being transferred or assigned, and (iii) following such transfer or assignment the further disposition of such Series A-1 Preferred Stock is restricted under the Securities Act and applicable state securities laws. The rights to transfer and assign the Series A-1 Preferred Stock shall apply to the Holders (and to subsequent) successors and assigns.

d)

Waiver. Any waiver by the Corporation or the Holder of a breach of any provision of this Certificate of Designation shall not operate as or be construed to be a waiver of any other breach of such provision or of any breach of any other provision of this Certificate of Designation. The failure of the Corporation or the Holder to insist upon strict adherence to any term of this Certificate of Designation on one or more occasions shall not be considered a waiver or deprive that party of the right thereafter to insist upon strict adherence to that term or any other term of this Certificate of Designation. Any waiver must be in writing.

e)

Severability. If any provision of this Certificate of Designation is invalid, illegal or unenforceable, the balance of this Certificate of Designation shall remain in effect, and if any provision is inapplicable to any person or circumstance, it shall nevertheless remain applicable to all other persons and circumstances. If it shall be

found that any interest or other amount deemed interest due hereunder violates applicable laws governing usury, the applicable rate of interest due hereunder shall automatically be lowered to equal the maximum permitted rate of interest.

f)

Next Business Day. Whenever any payment or other obligation hereunder shall be due on a day other than a Business Day, such payment shall be made on the next succeeding Business Day.

g)

Headings. The headings contained herein are for convenience only, do not constitute a part of this Certificate of Designation and shall not be deemed to limit or affect any of the provisions hereof.

IN WITNESS WHEREOF, the undersigned has executed and subscribed this Certificate and does affirm the foregoing as true this 22nd day of February, 2016.

EVOLUTIONARY GENOMICS, INC.

| |

By:

| /s/ Steve B. Warnecke

|

Name:

| Steve B. Warnecke

|

Title:

| Chairman, President and Chief Executive Officer

|

| |

ANNEX A

NOTICE OF CONVERSION

(TO BE EXECUTED BY THE REGISTERED HOLDER IN ORDER TO CONVERT SHARES OF SERIES A-1 PREFERRED STOCK)

The undersigned hereby elects to convert the number of shares of Series A-1 Convertible Preferred Stock indicated below, into shares of common stock (the "Common Stock"), of Evolutionary Genomics, Inc., a Nevada corporation (the "Corporation"), according to the conditions hereof, as of the date written below. If shares are to be issued in the name of a person other than undersigned, the undersigned will pay all transfer taxes payable with respect thereto and is delivering herewith such certificates and opinions as reasonably requested by the Corporation in accordance therewith. No fee will be charged to the Holder for any conversion, except for such transfer taxes, if any.

Conversion calculations:

Date to Effect Conversion:

Number of shares of Series A-1 Preferred Stock owned prior to Conversion:

Number of shares of Series A-1 Preferred Stock to be Converted:

Number of shares of Common Stock to be Issued:

[HOLDER]

EXHIBIT 10.1

THE SECURITIES OFFERED INVOLVE A HIGH DEGREE OF RISK AND MAY RESULT IN THE LOSS OF YOUR ENTIRE INVESTMENT. ANY PERSON CONSIDERING THE PURCHASE OF THESE SECURITIES SHOULD CONSULT WITH HIS, HER OR ITS LEGAL, TAX AND FINANCIAL ADVISORS PRIOR TO MAKING AN INVESTMENT IN SECURITIES. THE SECURITIES SHOULD ONLY BE PURCHASED BY PERSONS WHO CAN AFFORD TO LOSE ALL OF THEIR INVESTMENT.

SUBSCRIPTION AGREEMENT

This Subscription Agreement (the “Agreement”), dated as of ______________, 2016 (the “Agreement”), is entered into by and between the undersigned subscriber, (the “Subscriber”) and Evolutionary Genomics, Inc., a Nevada corporation (the “Company”).

WHEREAS, the Company is conducting a “best efforts” offering (the “Offering”) up to $3,150,000 (the “Offering Amount”) of Series A-1 Preferred Stock (the “Series A-1 Preferred Stock”);

WHEREAS, Subscriber desires to purchase the Securities for the Purchase Price (as defined below), and the Company desires to sell the Series A-1 Preferred Stock to the Subscriber for the Purchase Price.

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained, Subscriber and the Company agree as follows:

1.

Purchase and Sale of the Securities.

(a)

The Company hereby agrees to issue and to sell to Subscriber, and Subscriber hereby agrees to purchase from the Company, the Series A-1 Preferred Stock as indicated above.

(b)

Upon execution of this Agreement, Subscriber will deliver payment equal to the aggregate purchase price set forth on the signature page hereof in an amount required to purchase and pay for the Series A-1 Preferred Stock subscribed for hereunder (the “Purchase Price”), which amount has been paid in U.S. Dollars by wire transfer or check, subject to collection, to the order of “Evolutionary Genomics, Inc.” The Purchase Price is the principal amount of the Series A-1 Preferred Stock, provided, however, the minimum amount of investment in the Series A-1 Preferred Stock by each Subscriber shall be in the principal amount of $100,000, although the Company, in its sole discretion, may accept subscriptions for less.

(c)

The subscription amounts paid by the Subscriber to the Company will be deposited in the Company’s operating account. A closing shall take place on such date and time specified by the Company. At the closing, the Company shall issue the Series A-1 Preferred Stock to the Subscriber. The offering period will terminate upon the earlier to occur of (i) the date the Offering Amount is sold or (ii) March 15, 2016; provided, however, that such offering period may be extended without notice to investors for an additional 30 day period.

(d)

The Series A-1 Preferred Stock shall have the designations, preferences and relative, participating, optional or other rights, and the qualifications, limitations or restrictions thereof set forth in the Certificate of Designations, Rights, and Preferences of the Series A-1 Preferred Stock which is attached hereto as Exhibit A.

2.

Representations and Warranties of Subscriber. Subscriber represents and warrants to the Company as follows:

(a)

Subscriber is an “accredited investor” as defined by Rule 501 under the Act and Subscriber is capable of evaluating the merits and risks of Subscriber’s investment in the Securities and has the ability and capacity to protect Subscriber’s interests.

(b)

Subscriber understands that the Series A-1 Preferred Stock has not been registered and will not be registered under the Act. Subscriber understands that the sale of Series A-1 Preferred Stock to Subscriber will not be required to be registered under the Act on the ground that the issuance thereof is exempt under Section 4(a)(2) of the Act as a transaction by an issuer not involving any public offering and that, in the view of the United States Securities and Exchange Commission (the “SEC”), the statutory basis for the exception claimed would not be present if any of the representations and warranties of Subscriber contained in this Subscription Agreement are untrue or, notwithstanding the Subscriber’s representations and warranties, the Subscriber currently has in mind acquiring the Series A-1 Preferred Stock for resale upon the occurrence or non-occurrence of some predetermined event.

(c)

Subscriber acknowledges and understands that the Series A-1 Preferred Stock is being purchased for investment purposes and not with a view to distribution or resale, nor with the intention of selling, transferring or otherwise disposing of all or any part thereof for any particular price, or at any particular time, or upon the happening of any particular event or circumstances, except selling, transferring, or disposing the Series A-1 Preferred Stock made in full compliance with all applicable provisions of the Act, the rules and regulations promulgated by the SEC thereunder, and applicable state securities laws; and that an investment in the Securities is not a liquid investment.

(d)

Subscriber acknowledges that the Series A-1 Preferred Stock must be held indefinitely unless subsequently registered under the Act or unless an exemption from such registration is available. Subscriber is aware of the provisions of Rule 144 promulgated under the Act which permit limited resale of a security subject to the satisfaction of certain conditions, including, among other things, the existence of a public market for the security and the availability of certain current public information about the Company. In the event that the Company determines to register the Securities under the Act, Subscriber agrees to cooperate with the Company as reasonably requested by the Company in connection with the preparation and filing of a registration statement, unless such Subscriber notifies the Company in writing of Subscriber’s election to exclude all of Subscriber’s Series A-1 Preferred Stock from the registration statement. Upon effectiveness of the registration statement, Subscriber further agrees that it will comply with the prospectus delivery requirements of the Act as applicable to it in connection with sales of their Series A-1 Preferred Stock pursuant to such registration statement.

(e)

Subscriber acknowledges that Subscriber has had the opportunity to ask questions of, and receive answers from the Company or any person acting on its behalf concerning the Company and its business and to obtain any additional information, to the extent possessed by the Company (or to the extent it could have been acquired by the Company without unreasonable effort or expense) necessary to verify the accuracy of the information received by Subscriber. In connection therewith, Subscriber acknowledges that Subscriber has had the opportunity to discuss the Company’s business, management and financial affairs with the Company’s management or any person acting on its behalf. Subscriber has received and reviewed the Subscription Booklet, and all the information, both written and oral, that it desires. Without limiting the generality of the foregoing, Subscriber has been furnished with or has had the opportunity to acquire, and to review, all information, both written and oral, that it desires with respect to the Company’s business, management, financial affairs and prospects. In determining whether to make this investment, Subscriber has relied solely on Subscriber’s own knowledge and understanding

2

of the Company and its business based upon Subscriber’s own due diligence investigations and the information furnished pursuant to this paragraph. Subscriber understands that no person has been authorized to give any information or to make any representations which were not furnished pursuant to this paragraph and Subscriber has not relied on any other representations or information.

(f)

Subscriber has all requisite legal and other power and authority to execute and deliver this Subscription Agreement and to carry out and perform Subscriber’s obligations under the terms of this Subscription Agreement. This Subscription Agreement constitutes a valid and legally binding obligation of Subscriber, enforceable in accordance with its terms, and subject to laws of general application relating to bankruptcy, insolvency and the relief of debtors and rules of law governing specific performance, injunctive relief or other general principals of equity, whether such enforcement is considered in a proceeding in equity or law.

(g)

Subscriber has carefully considered and has discussed with Subscriber’s professional legal, tax, accounting and financial advisors, to the extent Subscriber has deemed necessary, the suitability of this investment and the transactions contemplated by this Subscription Agreement for Subscriber’s particular federal, state, local and foreign tax and financial situation and has determined that this investment and the transactions contemplated by this Subscription Agreement are a suitable investment for Subscriber. Subscriber relies solely on such advisors and not on any statements or representations of the Company or any of its agents. Subscriber understands that Subscriber (and not the Company) shall be responsible for Subscriber’s own tax liability that may arise as a result of this investment or the transactions contemplated by this Subscription Agreement.

(h)

This Subscription Agreement does not contain any untrue statement of a material fact concerning Subscriber.

(i)

There are no actions, suits, proceedings or investigations pending against Subscriber or Subscriber’s properties before any court or governmental agency (nor, to Subscriber’s knowledge, is there any threat thereof) which would impair in any way Subscriber’s ability to enter into and fully perform Subscriber’s commitments and obligations under this Subscription Agreement or the transactions contemplated hereby.

(j)

The execution, delivery and performance of and compliance with this Subscription Agreement, and the issuance of the Series A-1 Preferred Stock will not result in any material violation of, or conflict with, or constitute a material default under, any of Subscriber’s articles of incorporation or bylaws, if applicable, or any of Subscriber’s material agreements nor result in the creation of any mortgage, pledge, lien, encumbrance or charge against any of the assets or properties of Subscriber or the Series A-1 Preferred Stock.

(k)

Subscriber acknowledges that the Series A-1 Preferred Stock is speculative and involve a high degree of risk and that Subscriber can bear the economic risk of the purchase of the Series A-1 Preferred Stock, including a total loss of its investment.

(l)

Subscriber fully understands that the proceeds from this Offering will be used for general working capital of the Company and research costs.

(m)

Subscriber recognizes that no federal, state or foreign agency has recommended or endorsed the purchase of the Securities.

3

(n)

Subscriber is aware that the shares of Series A-1 Preferred Stock is and will be, when issued, “restricted securities” as that term is defined in Rule 144 of the general rules and regulations under the Act.

(o)

Subscriber understands that any and all certificates representing shares of Series A-1 Preferred Stock and any and all securities issued in replacement thereof or in exchange therefor shall bear the following legend or one substantially similar thereto, which Subscriber has read and understands:

“THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933 (THE “ACT”) AND ARE “RESTRICTED SECURITIES” AS THAT TERM IS DEFINED IN RULE 144 UNDER THE ACT. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD OR OTHERWISE TRANSFERRED EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT OR PURSUANT TO AN EXEMPTION FROM REGISTRATION UNDER THE ACT, THE AVAILABILITY OF WHICH IS TO BE ESTABLISHED TO THE REASONABLE SATISFACTION OF THE ISSUER.”

(p)

In addition, the certificates representing shares of Series A-1 Preferred Stock, and any and all securities issued in replacement thereof or in exchange therefor, shall bear such legend as may be required by the securities laws of the jurisdiction in which Subscriber resides.

(q)

Because of the restrictions imposed on resale, Subscriber understands that the Company shall have the right to note stop-transfer instructions in its stock transfer records, and Subscriber has been informed of the Company’s intention to do so. Any sales, transfers, or any other dispositions of the Series A-1 Preferred Stock by Subscriber, if any, will be in compliance with the Act.

(r)

Subscriber acknowledges that Subscriber has such knowledge and experience in financial and business matters that it is capable of evaluating the merits and risks of an investment in the Series A-1 Preferred Stock and of making an informed investment decision.

(s)

Subscriber represents that (i) Subscriber is able to bear the economic risks of an investment in the Series A-1 Preferred Stock and to afford the complete loss of the investment; and (ii) (A) Subscriber could be reasonably assumed to have the capacity to protect its own interests in connection with this subscription; or (B) Subscriber has a pre-existing personal or business relationship with either the Company or any affiliate thereof of such duration and nature as would enable a reasonably prudent purchaser to be aware of the character, business acumen and general business and financial circumstances of the Company or such affiliate and is otherwise personally qualified to evaluate and assess the risks, nature and other aspects of this subscription.

(t)

Subscriber understands that the Company shall have the unconditional right to accept or reject this subscription, in whole or in part, for any reason or without a specific reason, in the sole and absolute discretion of the Company (even after receipt and clearance of Subscriber’s funds). This Subscription Agreement is not binding upon the Company until accepted by an authorized officer of the Company. In the event that the subscription is rejected, then Subscriber’s subscription funds will be returned without interest thereon or deduction therefrom.

(u)

Subscriber has not been furnished with any oral representation or oral information in connection with the Offering of the Securities that is not in this Subscription Booklet.

4

(v)

No representations or warranties have been made to Subscriber by the Company, or any officer, employee, agent, affiliate or subsidiary of the Company, other than the representations of the Company contained herein, and in subscribing for the Series A-1 Preferred Stock, Subscriber is not relying upon any representations other than those contained in this Subscription Agreement.

(w)

Subscriber represents and warrants, to the best of its knowledge, unless previously disclosed to the Company or its counsel, that no finder, broker, agent, financial advisor or other intermediary, nor any purchaser representative or any broker-dealer acting as a broker, is entitled to any compensation in connection with the transactions contemplated by this Subscription Agreement.

(x)

Subscriber represents and warrants that he, she or it is not an affiliate of the Company.

(y)

Subscriber understands that there is no minimum amount which must be raised before the Company holds an initial closing of this Offering.

3.

Representations, Warranties and Covenants of the Company. The Company represents, warrants and covenants to Subscriber as follows:

(a)

The Company is duly organized and validly existing as a corporation in good standing under the laws of Nevada.

(b)

The Company has all such corporate power and authority to enter into, deliver and perform this Subscription Agreement.

(c)

All necessary corporate action has been duly and validly taken by the Company to authorize the execution, delivery and performance of this Subscription Agreement by the Company, and the issuance and sale of the Series A-1 Preferred Stock to be sold by the Company pursuant to this Subscription Agreement. This Subscription Agreement has been duly and validly authorized, executed and delivered by the Company and constitutes the legal, valid and binding obligation of the Company enforceable against the Company in accordance with its terms, except as the enforceability thereof may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and by general equitable principles.

4.

Indemnification. Subscriber agrees to indemnify and hold harmless the Company, its shareholders, officers, directors, employees, promissory noteholders (if applicable) and affiliates, and any person acting on behalf of the Company, from and against any and all damage, loss, liability, cost and expense (including reasonable attorneys’ fees and court costs) which any of them may incur by reason of the failure by Subscriber to fulfill any of the terms and conditions of this Subscription Agreement, or by reason of any breach of the representations and warranties made by Subscriber herein, or in any other document provided by Subscriber to the Company. All representations, warranties and covenants of each of Subscriber and the Company contained herein shall survive the acceptance of this subscription.

5.

Miscellaneous.

(a)

Subscriber agrees not to transfer or assign this Subscription Agreement or any of Subscriber’s interest herein and further agrees that the transfer or assignment of the Series A-1 Preferred Stock acquired pursuant hereto shall be made only in accordance with all applicable laws.

(b)

Subscriber agrees that Subscriber cannot cancel, terminate, or revoke this Subscription Agreement or any agreement of Subscriber made hereunder, and this Subscription Agreement shall

5

survive the death or legal disability of Subscriber and shall be binding upon Subscriber’s heirs, executors, administrators, successors, and permitted assigns.

(c)

Subscriber has read and has accurately completed this entire Subscription Agreement.

(d)

This Subscription Agreement constitutes the entire agreement among the parties hereto with respect to the subject matter hereof and may be amended only by a written execution by all parties.

(e)

Subscriber acknowledges that it has been advised to consult with its own attorney regarding this subscription and Subscriber has done so to the extent that Subscriber deems appropriate.

(f)

Any notice or other document required or permitted to be given or delivered to Subscriber shall be in writing and sent (i) by fax if the sender on the same day sends a confirming copy of such notice by a recognized overnight delivery service (charges prepaid), or (b) by registered or certified mail with return receipt requested (postage prepaid) or (c) by a recognized overnight delivery service (with charges prepaid).

If to the Company, at:

Evolutionary Genomics, Inc.

1026 Anaconda Drive,

Castle Rock, Colorado 80108

Attention: Steve B. Warnecke

or such other address as it shall have specified to Subscriber in writing.

(g)

Failure of the Company to exercise any right or remedy under this Subscription Agreement or any other agreement between the Company and Subscriber, or otherwise, or delay by the Company in exercising such right or remedy, will not operate as a waiver thereof. No waiver by the Company will be effective unless and until it is in writing and signed by the Company.

(h)

This Subscription Agreement shall be enforced, governed and construed in all respects in accordance with the laws of the State of New York, as such laws are applied by the New York courts to agreements entered into and to be performed in New York by and between residents of New York, and shall be binding upon Subscriber, Subscriber’s heirs, estate, legal representatives, successors and assigns and shall inure to the benefit of the Company, its successors and assigns.

(i)

If any provision of this Subscription Agreement is held to be invalid or unenforceable under any applicable statute or rule of law, then such provision shall be deemed modified to conform with such statute or rule of law. Any provision hereof that may prove invalid or unenforceable under any law shall not affect the validity or enforceability of any other provisions hereof.

(j)

The parties understand and agree that money damages would not be a sufficient remedy for any breach of the Subscription Agreement by the Company or Subscriber and that the party against which such breach is committed shall be entitled to equitable relief, including injunction and specific performance, as a remedy for any such breach. Such remedies shall not be deemed to be the exclusive remedies for a breach by either party of the Subscription Agreement but shall be in addition to all other remedies available at law or equity to the party against which such breach is committed.

(k)

All pronouns and any variations thereof used herein shall be deemed to refer to the masculine, feminine, singular or plural, as identity of the person or persons may require.

6

(l)

This Subscription Agreement may be executed in counterparts and by facsimile, each of which shall be deemed an original, but all of which shall constitute one and the same instrument.

[Remainder of Page Intentionally Left Blank]

7

IN WITNESS WHEREOF, the parties have executed this Subscription Agreement as of the day and year first written above.

|

$__________________________

|

Aggregate Purchase Price

|

Manner in which Title is to be held (Please Check One):

| | | | | |

1.

| ___

| Individual

| 7.

| ___

| Trust/Estate/Pension or Profit Sharing Plan

Date Opened:______________

|

| | | | | |

2.

| ___

| Joint Tenants with Right of Survivorship

| 8.

| ___

| As a Custodian for

________________________________

Under the Uniform Gift to Minors Act of the State of

________________________________

|

| | | | | |

3.

| ___

| Community Property

| 9.

| ___

| Married with Separate Property

|

| | | | | |

4.

| ___

| Tenants in Common

| 10.

| ___

| Keogh

|

| | | | | |

5.

| ___

| Corporation/Partnership/ Limited Liability Company

| 11.

| ___

| Tenants by the Entirety

|

| | | | | |

6.

| ___

| IRA

| 12.

| ___

| Foundation described in Section 501(c)(3) of the Internal Revenue Code of 1986, as amended.

|

IF MORE THAN ONE SUBSCRIBER, EACH SUBSCRIBER MUST SIGN:

·

INDIVIDUAL SUBSCRIBERS MUST COMPLETE PAGE 9

·

SUBSCRIBERS WHICH ARE ENTITIES MUST COMPLETE PAGE 10

8

EXECUTION BY NATURAL PERSONS

| | | |

_____________________________________________________________________________

Exact Name in Which Title is to be Held

|

__________________________________

Name (Please Print)

| | __________________________________

Name of Additional Subscriber

|

__________________________________

Residence: Number and Street

| | __________________________________

Address of Additional Subscriber

|

__________________________________

City, State and Zip Code

| | __________________________________

City, State and Zip Code

|

__________________________________

Social Security Number

| | __________________________________

Social Security Number

|

__________________________________

Telephone Number

| | __________________________________

Telephone Number

|

__________________________________

Fax Number (if available)

| | __________________________________

Fax Number (if available)

|

__________________________________

E-Mail (if available)

| | __________________________________

E-Mail (if available)

|

__________________________________

(Signature)

| | __________________________________

(Signature of Additional Subscriber)

|

| | |

*If Subscriber is a Registered Representative with a FINRA member firm, have the following acknowledgement signed by the appropriate party:

| |

The undersigned FINRA member firm acknowledges receipt of the notice

required by Rule 3050 of the FINRA

Conduct Rules

| |

|

__________________________________

Name of FINRA Firm

| ACCEPTED this ____ day of __________ 2016, on behalf of Evolutionary Genomics, Inc.

|

By: __________________________________

Name:

Title:

|

By: __________________________________

Name: Steve B. Warnecke

Title: CEO

|

9

EXECUTION BY SUBSCRIBER WHICH IS AN ENTITY

(Corporation, Partnership, Trust, Etc.)

| |

____________________________________________________________________________

Name of Entity (Please Print)

|

Date of Incorporation or Organization:

|

State of Principal Office:

|

Federal Taxpayer Identification Number: _________________________________________________

____________________________________________

Office Address

____________________________________________

City, State and Zip Code

____________________________________________

Telephone Number

____________________________________________

Fax Number (if available)

____________________________________________

E-Mail (if available)

|

[seal]

Attest: __________________________________

(If Entity is a Corporation)

| By: __________________________________

Name:

Title:

|

| |

*If Subscriber is a Registered Representative with a FINRA member firm, have the following acknowledgement signed by the appropriate party:

| |

The undersigned FINRA member firm acknowledges receipt of the notice

required by Rule 3050 of the FINRA

Conduct Rules

| |

|

_____________________________________

Name of FINRA Firm

| ACCEPTED this ____ day of __________ 2016, on behalf of Evolutionary Genomics, Inc.

|

By: __________________________________

Name:

Title:

|

By: __________________________________

Name: Steve B. Warnecke

Title: CEO

|

10

Exhibit A

Certificate of Designations, Rights and Preferences of Series A-1 Preferred Stock

[See attached]

11

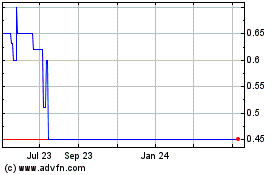

Evolutionary Genomics In... (CE) (USOTC:FNAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Evolutionary Genomics In... (CE) (USOTC:FNAM)

Historical Stock Chart

From Apr 2023 to Apr 2024