As filed with the Securities and Exchange Commission on February 25, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 25, 2016

B&G Foods, Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware |

|

001-32316 |

|

13-3918742 |

|

(State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of Incorporation) |

|

File Number) |

|

Identification No.) |

|

Four Gatehall Drive, Parsippany, New Jersey |

|

07054 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (973) 401-6500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

Item 7.01. Regulation FD Disclosure.

On February 25, 2016, B&G Foods, Inc. issued a press release announcing its financial results for the fourth quarter and fiscal year ended January 2, 2016. The information contained in the press release, which is attached to this report as Exhibit 99.1, is incorporated by reference herein and is furnished pursuant to Item 2.02, “Results of Operations and Financial Condition” and Item 7.01, “Regulation FD Disclosure.”

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

99.1 |

|

Press Release dated February 25, 2016, furnished pursuant to Item 2.02 and Item 7.01 |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

B&G FOODS, INC. |

|

|

|

|

|

|

|

Dated: February 25, 2016 |

By: |

/s/ Thomas P. Crimmins |

|

|

|

Thomas P. Crimmins |

|

|

|

Executive Vice President of Finance and Chief Financial Officer |

3

Exhibit 99.1

B&G Foods Reports Financial Results for Fourth Quarter and Full Year 2015

— Delivers strong growth in net sales, adjusted EBITDA* and adjusted diluted EPS* for the quarter and full year —

Parsippany, N.J., February 25, 2016—B&G Foods, Inc. (NYSE: BGS) today announced financial results for the fourth quarter and full year 2015.

Highlights (vs. prior year quarter and prior full year where applicable):

· Completed the acquisition of the iconic Green Giant® brand on November 2, 2015 — transition and integration is on track

· Net sales increased 43.8% to $342.3 million for the quarter and 14.0% to $966.4 million for the year

· Comparable base business net sales* were relatively flat for the quarter and for the year

· Net income decreased 4.3% to $11.0 million for the quarter and increased 68.7% to $69.1 million for the year

· Adjusted net income* increased 17.9% to $25.0 million for the quarter and 12.5% to $86.8 million for the year

· Diluted earnings per share decreased 9.5% to $0.19 for the quarter and increased 60.5% to $1.22 for the year

· Adjusted diluted earnings per share* increased 10.3% to $0.43 for the quarter and 6.3% to $1.53 for the year

· Adjusted EBITDA* increased 29.2% to $67.4 million for the quarter and 12.2% to $217.8 million for the year

· Guidance for full year fiscal 2016:

- Net sales of $1.38 billion to $1.42 billion

- Adjusted EBITDA of $294.0 million to $304.0 million

- Adjusted diluted earnings per share of $1.98 to $2.09

“2015 was a year characterized by a return to our long history of solid, disciplined financial performance, the continuation of our long-standing acquisition preference for center of the store shelf-stable brands with our acquisition of Mama Mary’s, and of course our transformational acquisition of the Green Giant brand. We are excited to enter the frozen food category and by the other possibilities that an iconic brand like Green Giant provides us, and we are truly inspired to reinvigorate Green Giant for today’s consumer through innovation and enhanced marketing. Overall, I am extremely proud of what we accomplished in 2015 and look forward to another rewarding year in 2016 for our customers, our consumers and our shareholders,” said Robert C. Cantwell, President and Chief Executive Officer of B&G Foods.

* Please see “About Non-GAAP Financial Measures and Items Affecting Comparability” below for the definition of the non-GAAP financial measures “adjusted net income,” “adjusted diluted earnings per share,” “base business net sales,” “comparable base business net sales,” “EBITDA,” and “adjusted EBITDA,” as well as information concerning certain items affecting comparability and reconciliations of the non-GAAP terms to the most comparable GAAP financial measures.

Financial Results for the Fourth Quarter of 2015

Net sales for the fourth quarter of 2015 increased $104.3 million, or 43.8%, to $342.3 million from $238.0 million for the fourth quarter of 2014. Net sales of Green Giant (which includes the Le Sueur brand), acquired on November 2, 2015, and net sales of Mama Mary’s, acquired on July 10, 2015, contributed $106.2 million and $9.9 million, respectively, to the Company’s net sales for the quarter.

The fourth quarter of 2015 contained 13 weeks and the fourth quarter of 2014 contained 14 weeks, which negatively impacted the fourth quarter of 2015 on a comparative basis. The Company estimates that the additional week in the fourth quarter of 2014 contributed approximately $15.0 million of incremental net sales in the fourth quarter of 2014. Customer refunds related to the Ortega and Las Palmas recall negatively impacted fourth quarter of 2014 net sales by $4.1 million.

Comparable base business net sales for the fourth quarter of 2015 decreased $0.6 million, or 0.3%, to $225.3 from $225.9 for the fourth quarter of 2014. The $0.6 million decrease was attributable to a decrease in unit volume of $1.7 million, or 0.7%, offset by an increase in net pricing of $1.1 million, or 0.5%.

Gross profit for the fourth quarter of 2015 increased $31.6 million, or 55.3%, to $88.6 million from $57.0 million for the fourth quarter of 2014. Gross profit expressed as a percentage of net sales increased to 25.9% in the fourth quarter of 2015 from 24.0% in the fourth quarter of 2014. The 1.9 percentage point increase resulted primarily from the negative impact that the fourth quarter of 2014 product recall and write-off of certain raw material and finished goods inventory used in the production of Rickland Orchards products had on gross profit percentage in the fourth quarter of 2014. The increase in fiscal 2015 gross profit percentage was also attributable to price increases and lower delivery costs as a percentage of net sales, partially offset by $6.1 million of non-cash amortization of the step-up of inventory acquired in the Green Giant acquisition.

Selling, general and administrative expenses increased $12.6 million, or 52.6%, to $36.6 million for the fourth quarter of 2015 (which includes $5.7 million of incremental operating expenses related to Green Giant) from $24.0 million for the fourth quarter of 2014. This increase was primarily due to increases in general and administrative expenses of $4.8 million (primarily consisting of increases in accruals for performance-based compensation), selling expenses of $3.3 million (including an increase of $1.6 million for salesperson compensation and a $1.5 million increase in brokerage expenses), acquisition-related expenses of $2.0 million, warehousing expenses of $1.3 million (primarily consisting of $1.5 million of distribution restructuring expenses) and consumer marketing of $1.2 million. Expressed as a percentage of net sales, selling, general and administrative expenses increased 0.6 percentage points to 10.7% for the fourth quarter of 2015 from 10.1% for the fourth quarter of 2014.

Net interest expense for the fourth quarter of 2015 increased $5.2 million, or 43.3%, to $17.3 million from $12.1 million in the fourth quarter of 2014. The increase was primarily attributable to additional borrowings used to fund the Green Giant acquisition.

The Company’s reported net income under U.S. generally accepted accounting principles (GAAP) was $11.0 million, or $0.19 per diluted share, for the fourth quarter of 2015, as compared to reported net income of $11.5 million, or $0.21 per diluted share, for the fourth quarter of 2014. The Company’s adjusted net income for the fourth quarter of 2015, which excludes an acquisition-related adjustment to deferred taxes, and the after-tax impact of the amortization of acquisition-related inventory step-up, other acquisition-related expenses and distribution restructuring expenses was $25.0 million, or $0.43 per adjusted diluted share. The Company’s adjusted net income for the fourth quarter of 2014, which excludes the after tax impact of the Rickland Orchards loss on disposal of inventory, the loss on product recall, and acquisition-related expenses, was $21.2 million, or $0.39 per adjusted diluted share.

2

For the fourth quarter of 2015, adjusted EBITDA (which excludes the impact of the amortization of acquisition-related inventory step-up, the impact of the loss on product recall, other acquisition-related expenses and the related loss on disposal of inventory, and distribution restructuring expenses), increased 29.2% to $67.4 million from $52.1 million for the fourth quarter of 2014.

Financial Results for the Full Year 2015

Net sales for fiscal 2015 increased $118.4 million, or 14.0%, to $966.4 million from $848.0 million for fiscal 2014. Net sales of Green Giant, acquired on November 2, 2015, contributed $106.2 million to the overall increase, and net sales of Mama Mary’s, acquired on July 10, 2015, contributed $18.4 million. Additional months of ownership of Specialty Brands, which was acquired on April 23, 2014, contributed $23.1 million to fiscal 2015 net sales.

Fiscal 2015 contained 52 weeks and fiscal 2014 contained 53 weeks, which negatively impacted fiscal 2015 on a comparative basis. The Company estimates that the additional week in the fourth quarter of 2014 contributed approximately $15.0 million of incremental net sales in 2014. Net sales for fiscal 2015 were also negatively impacted by the Rickland Orchards brand, whose net sales decreased by $17.2 million compared to fiscal 2014, a continuation of the weakness that caused the Company to impair the brand’s trademark and customer relationship assets in 2014. Customer refunds related to the Ortega and Las Palmas recall negatively impacted fiscal 2015 net sales by $1.2 million and fiscal 2014 net sales by $4.1 million.

Comparable base business net sales for fiscal 2015 increased $0.2 million, or less than 0.1%, to $815.9 million from $815.7 million for fiscal 2014. The $0.2 million increase was attributable to an increase in net pricing of $12.3 million, or 1.5%, offset by a decrease in unit volume of $12.1 million, or 1.5%.

Gross profit for fiscal 2015 increased $41.8 million, or 16.9%, to $289.6 million from $247.8 million for fiscal 2014. Gross profit expressed as a percentage of net sales increased to 30.0% in fiscal 2015 from 29.2% in fiscal 2014. The 0.8 percentage point increase resulted primarily from price increases, partially offset by $6.1 million of non-cash amortization of the step-up of inventory acquired in the Green Giant acquisition. The increase in fiscal 2015 gross profit percentage was also attributable to the negative impact that the fourth quarter of 2014 product recall and write-off of certain raw material and finished goods inventory used in the production of Rickland Orchards products had on gross profit percentage in fiscal 2014.

Selling, general and administrative expenses increased $12.9 million, or 13.9%, to $105.9 million for fiscal 2015 (which includes $5.7 million of incremental operating expenses related to Green Giant) from $93.0 million for fiscal 2014. The increase was primarily due to increases in general and administrative expenses of $7.7 million (primarily consisting of increases in accruals for performance-based compensation), warehousing expenses of $4.5 million (primarily consisting of $2.7 million of distribution restructuring expenses), selling expenses of $4.2 million (including an increase of $3.4 million for salesperson compensation, partially offset by a decrease in brokerage expenses of $0.3 million), partially offset by decreases in consumer marketing of $2.3 million (primarily related to a reduction in demo spending) and acquisition-related expenses of $1.2 million. Expressed as a percentage of net sales, selling, general and administrative expenses remained flat at 11.0% for fiscal 2015.

Net interest expense for fiscal 2015 increased $4.5 million, or 9.8%, to $51.1 million from $46.6 million in fiscal 2014. The increase was primarily attributable to additional borrowings used to fund the Green Giant acquisition.

The Company’s reported net income under GAAP was $69.1 million, or $1.22 per diluted share, for fiscal 2015, as compared to $41.0 million, or $0.76 per diluted share, for fiscal 2014. The Company’s adjusted net income for fiscal 2015, which excludes the acquisition-related adjustment to deferred taxes, and the after-tax impact of the amortization of acquisition-related inventory step-up, other acquisition-related

3

expenses, distribution restructuring expenses and the loss on product recall was $86.8 million, or $1.53 per adjusted diluted share. The Company’s adjusted net income for fiscal 2014, which excludes the after-tax impact of the loss on product recall, loss on extinguishment of debt, acquisition-related expenses, the non-cash impairment charges to Rickland Orchards intangible assets and the related loss on disposal of inventory, and a non-cash gain relating to the Rickland Orchards earn-out, was $77.1 million, or $1.44 per adjusted diluted share.

For fiscal 2015, adjusted EBITDA, which excludes the impact of the amortization of acquisition-related inventory step-up, the impact of the loss on product recall, other acquisition-related expenses, the non-cash impairment charges to Rickland Orchards intangible assets and the related loss on disposal of inventory, the non-cash gain relating to an earn-out and distribution restructuring expenses, increased 12.2% to $217.8 million from $194.1 million for fiscal 2014.

2016 Guidance

For full year 2016, net sales is expected to be approximately $1.38 billion to $1.42 billion, adjusted EBITDA is expected to be approximately $294.0 million to $304.0 million and adjusted diluted earnings per share is expected to be $1.98 to $2.09.

Conference Call

B&G Foods will hold a conference call at 4:30 p.m. ET today, February 25, 2016. The call will be webcast live from B&G Foods’ website at www.bgfoods.com under “Investor Relations—Company Overview.” The call can also be accessed live over the phone by dialing (888) 599-4883 for U.S. callers or (913) 312-0978 for international callers.

A replay of the call will be available two hours after the call and can be accessed by dialing (877) 870-5176 or (858) 384-5517 for international callers; the password is 891363. The replay will be available from February 25, 2016 through March 10, 2016. Investors may also access a web-based replay of the call at the Investor Relations section of B&G Foods’ website, www.bgfoods.com.

About Non-GAAP Financial Measures and Items Affecting Comparability

“Adjusted net income,” “adjusted diluted earnings per share,” “base business net sales” (net sales without the impact of acquisitions until the acquisitions are included in both comparable periods), “comparable base business net sales” (base business net sales, excluding the impact of the extra reporting week in fiscal 2014 and the fourth quarter of 2014, the negative impact of the product recall and the Rickland Orchards shortfall), “EBITDA” (net income before net interest expense, income taxes, depreciation and amortization and loss on extinguishment of debt); and “adjusted EBITDA” (EBITDA as adjusted for cash and non-cash acquisition-related expenses, gains and losses (which may include third party fees and expenses, integration, restructuring and consolidation expenses and amortization of acquisition-related inventory step-up); intangible asset impairment charges and related asset write-offs; gains or losses related to changes in the fair value of contingent liabilities from earn-outs; loss on product recalls, including customer refunds, selling, general and administrative expenses and the impact on cost of sales; and distribution restructuring expenses) are “non-GAAP financial measures.” A non-GAAP financial measure is a numerical measure of financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in B&G Foods’ consolidated balance sheets and related consolidated statements of operations, comprehensive income, changes in stockholders’ equity and cash flows. Non-GAAP financial measures should not be considered in isolation or as a substitute for the most directly comparable GAAP measures. The Company’s non-GAAP financial measures may be different from non-GAAP financial measures used by other companies.

The Company uses “adjusted net income,” “adjusted diluted earnings per share,” “base business net sales” and “comparable base business net sales,” which are calculated as reported net income, reported diluted earnings per share and reported net sales adjusted for certain items that affect comparability. These non-

4

GAAP financial measures reflect adjustments to reported net income, diluted earnings per share and net sales to eliminate the items identified above. This information is provided in order to allow investors to make meaningful comparisons of the Company’s operating performance between periods and to view the Company’s business from the same perspective as the Company’s management. Because the Company cannot predict the timing and amount of these items, management does not consider these items when evaluating the Company’s performance or when making decisions regarding allocation of resources.

Additional information regarding EBITDA and adjusted EBITDA, and a reconciliation of EBITDA and adjusted EBITDA to net income and to net cash provided by operating activities is included below for the fourth quarter and full year of fiscal 2015 and 2014, along with the components of EBITDA and adjusted EBITDA. Also included below are reconciliations of the non-GAAP terms adjusted net income, adjusted diluted earnings per share, base business net sales and comparable base business net sales to the most directly comparable measure calculated and presented in accordance with GAAP in the Company’s consolidated balance sheets and related consolidated statements of operations, comprehensive income, changes in stockholders’ equity and cash flows.

About B&G Foods, Inc.

B&G Foods and its subsidiaries manufacture, sell and distribute a diversified portfolio of high-quality, branded shelf-stable and frozen foods across the United States, Canada and Puerto Rico. Based in Parsippany, New Jersey, B&G Foods’ products are marketed under many recognized brands, including Ac’cent, B&G, B&M, Baker’s Joy, Bear Creek Country Kitchens, Brer Rabbit, Canoleo, Cary’s, Cream of Rice, Cream of Wheat, Devonsheer, Don Pepino, Emeril’s, Grandma’s Molasses, Green Giant, JJ Flats, Joan of Arc, Las Palmas, Le Sueur, MacDonald’s, Mama Mary’s, Maple Grove Farms, Molly McButter, Mrs. Dash, New York Flatbreads, New York Style, Old London, Original Tings, Ortega, Pirate’s Booty, Polaner, Red Devil, Regina, Rickland Orchards, Sa-són, Sclafani, Smart Puffs, Spring Tree, Sugar Twin, Trappey’s, TrueNorth, Underwood, Vermont Maid and Wright’s. B&G Foods also sells and distributes Static Guard, a household product brand.

Forward-Looking Statements

Statements in this press release that are not statements of historical or current fact constitute “forward-looking statements.” The forward-looking statements contained in this press release include, without limitation, statements related to B&G Foods’ net sales, adjusted EBITDA and adjusted diluted earnings per share, and overall expectations for fiscal 2016. Such forward-looking statements involve known and unknown risks, uncertainties and other unknown factors that could cause the actual results of B&G Foods to be materially different from the historical results or from any future results expressed or implied by such forward-looking statements. In addition to statements that explicitly describe such risks and uncertainties readers are urged to consider statements labeled with the terms “believes,” “belief,” “expects,” “projects,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in B&G Foods’ filings with the Securities and Exchange Commission, including under Item 1A, “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and in its subsequent reports on Forms 10-Q and 8-K. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made. B&G Foods undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

5

Contacts:

|

|

|

Investor Relations: |

Media Relations: |

|

ICR, Inc. |

ICR, Inc. |

|

Dara Dierks |

Matt Lindberg |

|

866-211-8151 |

203-682-8214 |

6

B&G Foods, Inc. and Subsidiaries

Consolidated Balance Sheets

(In thousands, except share and per share data)

(Unaudited)

|

|

|

January 2, 2016 |

|

January 3, 2015 |

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,246 |

|

$ |

1,490 |

|

|

Trade accounts receivable, net |

|

69,712 |

|

55,925 |

|

|

Inventories |

|

312,880 |

|

106,557 |

|

|

Prepaid expenses and other current assets |

|

67,517 |

|

14,830 |

|

|

Income tax receivable |

|

2,514 |

|

14,442 |

|

|

Deferred income taxes |

|

5,292 |

|

3,275 |

|

|

Total current assets |

|

463,161 |

|

196,519 |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

163,642 |

|

116,197 |

|

|

Goodwill |

|

473,145 |

|

370,424 |

|

|

Other intangibles, net |

|

1,442,340 |

|

947,895 |

|

|

Other assets |

|

29,427 |

|

18,318 |

|

|

Total assets |

|

$ |

2,571,715 |

|

$ |

1,649,353 |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Trade accounts payable |

|

$ |

49,593 |

|

$ |

38,052 |

|

|

Accrued expenses |

|

31,233 |

|

17,644 |

|

|

Current portion of long-term debt |

|

33,750 |

|

18,750 |

|

|

Dividends payable |

|

20,292 |

|

18,246 |

|

|

Total current liabilities |

|

134,868 |

|

92,692 |

|

|

|

|

|

|

|

|

|

Long-term debt |

|

1,725,866 |

|

1,007,107 |

|

|

Other liabilities |

|

3,212 |

|

7,352 |

|

|

Deferred income taxes |

|

250,084 |

|

204,207 |

|

|

Total liabilities |

|

2,114,030 |

|

1,311,358 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.01 par value per share. Authorized 1,000,000 shares; no shares issued or outstanding |

|

— |

|

— |

|

|

Common stock, $0.01 par value per share. Authorized 125,000,000 shares; 57,976,744 and 53,663,697 shares issued and outstanding as of January 2, 2016 and January 3, 2015, respectively |

|

580 |

|

537 |

|

|

Additional paid-in capital |

|

162,568 |

|

110,349 |

|

|

Accumulated other comprehensive loss |

|

(12,696 |

) |

(11,034 |

) |

|

Retained earnings |

|

307,233 |

|

238,143 |

|

|

Total stockholders’ equity |

|

457,685 |

|

337,995 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

2,571,715 |

|

$ |

1,649,353 |

|

7

B&G Foods, Inc. and Subsidiaries

Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited)

|

|

|

Fourth Quarter Ended |

|

Fiscal Year Ended |

|

|

|

|

January 2,

2016 |

|

January 3,

2015 |

|

January 2,

2016 |

|

January 3,

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

342,291 |

|

$ |

237,990 |

|

$ |

966,358 |

|

$ |

848,017 |

|

|

Cost of goods sold |

|

253,728 |

|

180,977 |

|

676,794 |

|

600,246 |

|

|

Gross profit |

|

88,563 |

|

57,013 |

|

289,564 |

|

247,771 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

36,587 |

|

23,968 |

|

105,939 |

|

93,033 |

|

|

Amortization expense |

|

3,183 |

|

2,706 |

|

11,255 |

|

12,692 |

|

|

Impairment of intangible assets |

|

— |

|

— |

|

— |

|

34,154 |

|

|

Gain on change in fair value of contingent consideration |

|

— |

|

— |

|

— |

|

(8,206 |

) |

|

Operating income |

|

48,793 |

|

30,339 |

|

172,370 |

|

116,098 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expenses: |

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

17,258 |

|

12,041 |

|

51,131 |

|

46,573 |

|

|

Loss on extinguishment of debt |

|

— |

|

— |

|

— |

|

5,748 |

|

|

Income before income tax expense |

|

31,535 |

|

18,298 |

|

121,239 |

|

63,777 |

|

|

Income tax expense |

|

20,575 |

|

6,844 |

|

52,149 |

|

22,821 |

|

|

Net income |

|

$ |

10,960 |

|

$ |

11,454 |

|

$ |

69,090 |

|

$ |

40,956 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

57,977 |

|

53,665 |

|

56,585 |

|

53,658 |

|

|

Diluted |

|

58,084 |

|

53,797 |

|

56,656 |

|

53,747 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted earnings per share |

|

$ |

0.19 |

|

$ |

0.21 |

|

$ |

1.22 |

|

$ |

0.76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per share |

|

$ |

0.35 |

|

$ |

0.34 |

|

$ |

1.38 |

|

$ |

1.36 |

|

8

B&G Foods, Inc. and Subsidiaries

Reconciliation of EBITDA and Adjusted EBITDA to Net Income and to Net Cash Provided by Operating Activities

(In thousands)

(Unaudited)

|

|

|

Fourth Quarter Ended |

|

Fiscal Year Ended |

|

|

|

|

January 2,

2016 |

|

January 3,

2015 |

|

January 2,

2016 |

|

January 3,

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

10,960 |

|

$ |

11,454 |

|

$ |

69,090 |

|

$ |

40,956 |

|

|

Income tax expense |

|

20,575 |

|

6,844 |

|

52,149 |

|

22,821 |

|

|

Interest expense, net |

|

17,258 |

|

12,041 |

|

51,131 |

|

46,573 |

|

|

Depreciation and amortization |

|

8,141 |

|

6,651 |

|

28,653 |

|

27,434 |

|

|

Loss on extinguishment of debt |

|

— |

|

— |

|

— |

|

5,748 |

|

|

EBITDA(1) |

|

56,934 |

|

36,990 |

|

201,023 |

|

143,532 |

|

|

Acquisition-related expenses |

|

2,817 |

|

791 |

|

6,118 |

|

7,315 |

|

|

Amortization of acquisition-related inventory step-up |

|

6,127 |

|

— |

|

6,127 |

|

— |

|

|

Impairment of intangible assets |

|

— |

|

— |

|

— |

|

34,154 |

|

|

Loss on disposal of inventory |

|

— |

|

1,557 |

|

— |

|

4,535 |

|

|

Loss on product recall, net of insurance recoveries |

|

— |

|

12,798 |

|

1,868 |

|

12,798 |

|

|

Distribution restructuring expenses |

|

1,493 |

|

— |

|

2,665 |

|

— |

|

|

Gain on change in fair value of contingent consideration |

|

— |

|

— |

|

— |

|

(8,206 |

) |

|

Adjusted EBITDA(1) |

|

67,371 |

|

52,136 |

|

217,801 |

|

194,128 |

|

|

Income tax expense |

|

(20,575 |

) |

(6,844 |

) |

(52,149 |

) |

(22,821 |

) |

|

Interest expense, net |

|

(17,258 |

) |

(12,041 |

) |

(51,131 |

) |

(46,573 |

) |

|

Acquisition-related expenses |

|

(2,817 |

) |

(791 |

) |

(6,118 |

) |

(7,315 |

) |

|

Amortization of acquisition-related inventory step-up |

|

(6,127 |

) |

— |

|

(6,127 |

) |

— |

|

|

Loss on product recall, net of insurance recoveries |

|

— |

|

(12,798 |

) |

(1,868 |

) |

(12,798 |

) |

|

Distribution restructuring expenses |

|

(1,493 |

) |

— |

|

(2,665 |

) |

— |

|

|

Distribution restructuring fixed asset write-off |

|

(107 |

) |

— |

|

(107 |

) |

— |

|

|

Deferred income taxes |

|

15,514 |

|

8,772 |

|

29,152 |

|

13,855 |

|

|

Amortization of deferred financing costs and bond discount |

|

1,269 |

|

883 |

|

3,900 |

|

3,790 |

|

|

Share-based compensation expense |

|

2,113 |

|

107 |

|

5,817 |

|

2,235 |

|

|

Excess tax benefits from share-based compensation |

|

(21 |

) |

— |

|

(539 |

) |

(2,356 |

) |

|

Acquisition-related contingent consideration expense, including interest accretion |

|

— |

|

— |

|

— |

|

432 |

|

|

Changes in assets and liabilities, net of effects of business combinations |

|

3,913 |

|

9,013 |

|

(7,487 |

) |

(23,451 |

) |

|

Net cash provided by operating activities |

|

$ |

41,782 |

|

$ |

38,437 |

|

$ |

128,479 |

|

$ |

99,126 |

|

(1) EBITDA and adjusted EBITDA are non-GAAP financial measures used by management to measure operating performance. A non-GAAP financial measure is defined as a numerical measure of our financial performance that excludes or includes amounts so as to be different from the most directly comparable measure calculated and presented in accordance with GAAP in our consolidated balance sheets and related consolidated statements of operations, comprehensive income, changes in stockholders’ equity and cash flows. We define EBITDA as net income before net interest expense, income taxes, depreciation and amortization and loss on extinguishment of debt. We define adjusted EBITDA as EBITDA adjusted for cash and non-cash acquisition-related expenses, gains and losses (which may include third party fees and expenses, integration, restructuring and consolidation expenses and amortization of acquired inventory fair value step-up); intangible asset impairment charges and related asset write-offs; gains or losses related to changes in the fair value of contingent liabilities from earn-outs; loss on product recalls, including customer refunds, selling, general and administrative expenses and the impact on cost of sales; and distribution restructuring expenses. Management believes that it is useful to eliminate net interest expense, income taxes, depreciation and amortization, loss on extinguishment of debt, acquisition-related

9

expenses, gains and losses, non-cash intangible asset impairment charges and related asset write-offs, gains or losses related to changes in the fair value of contingent liabilities from earn-outs, loss on product recalls and distribution restructuring expenses because it allows management to focus on what it deems to be a more reliable indicator of ongoing operating performance and our ability to generate cash flow from operations. We use EBITDA and adjusted EBITDA in our business operations to, among other things, evaluate our operating performance, develop budgets and measure our performance against those budgets, determine employee bonuses and evaluate our cash flows in terms of cash needs. We also present EBITDA and adjusted EBITDA because we believe they are useful indicators of our historical debt capacity and ability to service debt and because covenants in our credit agreement and our senior notes indenture contain ratios based on these measures. As a result, internal management reports used during monthly operating reviews feature the EBITDA and adjusted EBITDA metrics. However, management uses these metrics in conjunction with traditional GAAP operating performance and liquidity measures as part of its overall assessment of company performance and liquidity and therefore does not place undue reliance on these measures as its only measures of operating performance and liquidity.

EBITDA and adjusted EBITDA are not recognized terms under GAAP and do not purport to be an alternative to operating income or net income or any other GAAP measure as an indicator of operating performance. EBITDA and adjusted EBITDA are not complete net cash flow measures because EBITDA and adjusted EBITDA are measures of liquidity that do not include reductions for cash payments for an entity’s obligation to service its debt, fund its working capital, capital expenditures and acquisitions and pay its income taxes and dividends. Rather, EBITDA and adjusted EBITDA are two potential indicators of an entity’s ability to fund these cash requirements. EBITDA and adjusted EBITDA are not complete measures of an entity’s profitability because they do not include costs and expenses for depreciation and amortization, interest and related expenses, loss on extinguishment of debt, acquisition-related expenses, gains and losses and income taxes, intangible asset impairment charges and related asset write-offs, gains or losses related to changes in the fair value of contingent liabilities from earn-outs, loss on product recalls and distribution restructuring expenses. Because not all companies use identical calculations, this presentation of EBITDA and adjusted EBITDA may not be comparable to other similarly titled measures of other companies. However, EBITDA and adjusted EBITDA can still be useful in evaluating our performance against our peer companies because management believes these measures provide users with valuable insight into key components of GAAP amounts.

10

B&G Foods, Inc. and Subsidiaries

Items Affecting Comparability — Reconciliation of Adjusted Information to GAAP Information

(In thousands, except per share data)

(Unaudited)

|

|

|

Fourth Quarter Ended |

|

Fiscal Year Ended |

|

|

|

|

January 2,

2016 |

|

January 3,

2015 |

|

January 2,

2016 |

|

January 3,

2015 |

|

|

Reported net income |

|

$ |

10,960 |

|

$ |

11,454 |

|

$ |

69,090 |

|

$ |

40,956 |

|

|

Acquisition-related adjustment to deferred taxes(1) |

|

7,451 |

|

— |

|

7,166 |

|

— |

|

|

Loss on extinguishment of debt, net of tax(2) |

|

— |

|

— |

|

— |

|

3,690 |

|

|

Acquisition-related expenses, net of tax |

|

1,769 |

|

508 |

|

3,842 |

|

4,696 |

|

|

Distribution restructuring expenses, net of tax(3) |

|

938 |

|

— |

|

1,674 |

|

— |

|

|

Acquisition-related inventory step-up, net of tax(4) |

|

3,848 |

|

— |

|

3,848 |

|

— |

|

|

Impairment of intangible assets, net of tax(5) |

|

— |

|

— |

|

— |

|

21,927 |

|

|

Loss on disposal of inventory, net of tax(5) |

|

— |

|

1,000 |

|

— |

|

2,911 |

|

|

Loss on product recall, net of insurance recoveries and tax(6) |

|

— |

|

8,216 |

|

1,173 |

|

8,216 |

|

|

Gain on contingent consideration, net of tax(5) |

|

— |

|

— |

|

— |

|

(5,268 |

) |

|

Adjusted net income |

|

$ |

24,966 |

|

$ |

21,178 |

|

$ |

86,793 |

|

$ |

77,128 |

|

|

Adjusted diluted earnings per share (7) |

|

$ |

0.43 |

|

$ |

0.39 |

|

$ |

1.53 |

|

$ |

1.44 |

|

(1) Acquisition-related adjustment to deferred taxes for the fourth quarter and full year 2015 relate to a true-up of deferred taxes for state apportionment as a result of the Green Giant and Mama Mary’s acquisitions.

(2) Loss on extinguishment of debt for full year 2014 includes costs relating to the termination of our prior credit agreement, which included the repayment of $121.9 million aggregate principal amount of tranche A term loans and $215.0 million aggregate principal amount of revolving loans, and the write-off of deferred debt financing costs and unamortized discount of $5.4 million and $0.3 million, respectively.

(3) Distribution restructuring expenses for the fourth quarter and full year of 2015 includes expenses relating to our transitioning of the operations of our three primary distribution centers to a third party logistics provider. We expect this transition and the incurrence of related distribution restructuring expenses to be completed during the first half of 2016.

(4) Acquisition-related inventory step-up for the fourth quarter and full year 2015 relates to the purchase accounting adjustments made to the finished goods inventory acquired in the Green Giant acquisition.

(5) On October 7, 2013, we completed the Rickland Orchards acquisition for a base purchase price of $57.5 million, of which $37.4 million was paid in cash and approximately $20.1 million was paid in shares of B&G Foods’ common stock. The purchase agreement also provided that the purchase price could be increased by contingent earn-out consideration of up to $15.0 million in the aggregate based upon the achievement of revenue growth targets during fiscal 2014, 2015 and 2016 meant to achieve operating results in excess of base purchase price acquisition model assumptions.

As of the date of acquisition we estimated the original fair value of the contingent consideration to be approximately $7.6 million. During the remainder of fiscal 2013 and the first two quarters of 2014, we recorded interest accretion expense on the contingent consideration liability of $0.2 million and $0.4 million, respectively. At June 28, 2014, we remeasured the fair value of the contingent consideration using actual operating results through June 28, 2014 and revised forecasted operating results for Rickland Orchards for the remainder of fiscal 2014, 2015 and 2016. As a result of lower than expected net sales results for Rickland Orchards, and the unlikelihood of Rickland Orchards achieving the revenue growth targets, the fair value of the contingent consideration was reduced to zero, resulting in a non-cash gain of $8.2 million that is included in gain on change in fair value of contingent consideration in the consolidated statements of operations for fiscal 2014.

11

Based on the results of an interim impairment analysis performed at September 27, 2014, we recorded non-cash impairment charges to amortizable trademarks and customer relationship intangibles of Rickland Orchards of $26.9 million and $7.3 million, respectively, which are recorded in Impairment of Intangible Assets in the consolidated statement of operations for fiscal 2014. As of January 2, 2016, the remaining balances of the Rickland Orchards amortizable trademark and customer relationship intangibles were $4.7 million and $1.0 million, respectively. If operating results for the Rickland Orchards brand continue to deteriorate at rates in excess of our current projections, we may be required to record an additional non-cash charge for the impairment of long-lived intangibles relating to Rickland Orchards, and these non-cash charges would be material.

In connection with the impairment of the Rickland Orchards intangibles, we also recorded a charge to cost of goods sold of approximately $1.5 million and $4.5 million during the fourth quarter and full year 2014, respectively, relating to the write-off of certain raw material and finished goods inventory used in the production of Rickland Orchards products.

(6) On November 14, 2014, we announced a voluntary recall for certain Ortega and Las Palmas products after learning that one or more of the spice ingredients purchased from a third party supplier contained peanuts and almonds, allergens that are not declared on the products’ ingredient statements. A significant majority of the costs of this recall were incurred in the fourth quarter of 2014. The cost impact of this recall during fiscal 2015, was $1.9 million, of which $1.2 million was recorded as a decrease in net sales related to customer refunds; $0.5 million was recorded as an increase in cost of goods sold primarily related to costs associated with product retrieval, destruction charges and customer fees; and $0.2 million was recorded as an increase in selling, general, and administrative expenses related to administrative costs. The cost impact of this recall during fiscal 2014 (not including lost sales during the period of time production and distribution of the affected products were suspended, net of expected insurance recoveries of $5.0 million (which were subsequently recovered in fiscal 2015)) was $12.8 million, of which $4.1 million was recorded as a decrease in net sales related to customer refunds; $8.2 million was recorded as an increase in cost of goods sold primarily related to costs associated with product retrieval, destruction charges, customer fees and inventory write-offs; and $0.5 million was recorded as an increase in selling, general, and administrative expenses related to administrative costs.

(7) For the fourth quarter and full year 2014, 418,158 shares of common stock issuable upon the exercise of stock options have not been included in the calculation of diluted weighted average shares outstanding because the effect would be antidilutive.

12

B&G Foods, Inc. and Subsidiaries

Items Affecting Comparability — Reconciliation of Base Business Net Sales and

Comparable Base Business Net Sales to Reported Net Sales

(In thousands)

(Unaudited)

|

|

|

Fourth Quarter Ended |

|

Fiscal Year Ended |

|

|

|

|

January 2,

2016 |

|

January 3,

2015 |

|

January 2,

2016 |

|

January 3,

2015 |

|

|

Reported net sales |

|

$ |

342,291 |

|

$ |

237,990 |

|

$ |

966,358 |

|

$ |

848,017 |

|

|

Net sales from acquisitions(1) |

|

(116,039 |

) |

— |

|

(147,584 |

) |

— |

|

|

Base business net sales(2) |

|

226,252 |

|

237,990 |

|

818,774 |

|

848,017 |

|

|

Extra reporting week |

|

— |

|

(15,000 |

) |

— |

|

(15,000 |

) |

|

Net sales of Rickland Orchards |

|

(934 |

) |

(1,093 |

) |

(4,106 |

) |

(21,343 |

) |

|

Customer refunds related to recall, net of insurance recoveries |

|

— |

|

4,063 |

|

1,225 |

|

4,063 |

|

|

Comparable base business net sales(3) |

|

$ |

225,318 |

|

$ |

225,960 |

|

$ |

815,893 |

|

$ |

815,737 |

|

(1) Reflects net sales for Green Giant, Mama Mary’s and Specialty Brands for the portion of the fourth quarter and full year 2015 for which there is no comparable period of net sales during the same period in 2014. Green Giant was acquired on November 2, 2015, Mama Mary’s was acquired on July 10, 2015 and Specialty Brands was acquired on April 23, 2014.

(2) Base business net sales is a non-GAAP financial measure used by management to measure operating performance. We define base business net sales as our net sales excluding the impact of acquisitions until the net sales from such acquisitions are included in both comparable periods. The portion of current period net sales attributable to recent acquisitions for which there is no corresponding period in the comparable period of the prior year is excluded. For each acquisition, the excluded period starts at the beginning of the most recent fiscal period being compared and ends on the first anniversary of the acquisition date. Management has included this financial measure because it provides useful and comparable trend information regarding the results of our business without the effect of the timing of acquisitions.

(3) Comparable base business net sales is a non-GAAP financial measure used by management to measure operating performance. We define comparable base business net sales as our base business net sales, excluding the impact of the extra reporting week in the fourth quarter of 2014, the Rickland Orchards shortfall and customer refunds relating to the Ortega and Las Palmas recall, described in more detail below:

· The Company’s fourth quarter of 2015 contained 13 weeks and the fourth quarter of 2014 contained 14 weeks. Fiscal 2015 contained 52 weeks and fiscal 2014 contained 53 weeks.

· Net sales were negatively impacted by the Rickland Orchards shortfall in fiscal 2015 (primarily during the first three quarters) and in fiscal 2014, a continuation of the weakness that caused our company to impair the brand’s trademark and customer relationship intangible assets in fiscal 2014. Net sales of Rickland Orchards are excluded from comparable base business net sales.

· On November 14, 2014, we announced a voluntary recall for certain Ortega and Las Palmas products after learning that one or more of the spice ingredients purchased from a third party supplier contained peanuts and almonds, allergens that are not declared on the products’ ingredient statements. Fiscal 2015 and fiscal 2014 net sales were negatively impacted by customer refunds related to the recall. Ortega and Las Palmas combined net sales in fiscal 2015 and fiscal 2014 were $182.6 million and $169.5 million. Ortega and Las Palmas combined net sales the fourth quarter of 2015 and 2014 were $45.6 million and $39.5 million, respectively.

13

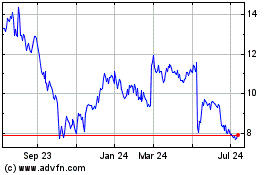

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

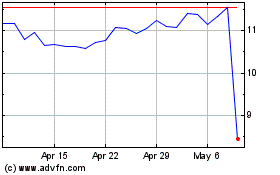

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Apr 2023 to Apr 2024