UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 17, 2016

VOPIA,

INC.

(Exact

name of Company as specified in its charter)

| Nevada |

|

333-188119 |

|

39-2079422 |

| (State

of Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification No.) |

1700

Montgomery Street, Suite 101

San

Francisco, CA |

|

94111 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Company’s

telephone number, including area code: 415-835-9463

| |

(Former

Name or Former Address, if Changed Since Last Report) |

|

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following

provisions (see General Instruction A.2. below):

| o |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 1 – REGISTRANT’S

BUSINESS AND OPERATIONS

Item 1.01 Entry into a

Material Definitive Agreement

On February 18, 2016, Vopia,

Inc. (the “Company”) entered into an Agreement of Purchase and Sale (the “Purchase Agreement”)

with Saqoia Corp., a Delaware corporation (“Saqoia”) pursuant to which the Company will acquire Saqoia’s

big data and search technology business. Specifically, the Company will acquire from Saqoia: (i) the rights to its database of

140 million company data; (ii) priority software to crawl and organize company information in real time; (iii) 51% ownership in

Fastbase Inc. and Masterseek Corp., both Nevada corporations; and (iv) goodwill of the business

In consideration for the foregoing,

the Company agreed to issue to Saqoia 300,000,000 shares of its common stock. A closing under the Purchase Agreement is to occur

on March 25, 2016 after the satisfaction or waiver of all conditions to closing.

The Purchase Agreement contains

customary representations and warranties of Saqoia relating to its businesses. The representations and warranties in the Purchase

Agreement survive the closing date.

The Purchase Agreement contains

customary conditions which must be satisfied prior to closing. In addition to such customary conditions, as a condition to the

Company’s obligation to close, the certain conditions related to third party financing for the Company must be satisfied.

Either party may terminate the Purchase Agreement if the conditions to closing have not been satisfied on or before May 25, 2016.

The foregoing description

of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of

the Purchase Agreement, which is filed with the Securities and Exchange Commission as Exhibit 10.1 to this Current Report on Form

8-K.

SECTION 8 - OTHER EVENTS

Item 8.01 Other Events

On February 17, 2016, the

Company issued a press release in connection with the announcement of the Purchase Agreement, which is attached hereto as Exhibit

99.1 and is incorporated herein by reference.

SECTION 9 - FINANCIAL STATEMENTS

AND EXHIBITS

Item 9.01 Financial

Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

VOPIA,

INC. |

|

| |

|

|

|

| Date: February

25, 2016 |

By:

|

/s/

Jorgen Frederiksen |

|

| |

|

Jorgen

Frederiksen |

|

| |

|

Chief Executive Officer |

|

| |

|

|

|

Intent of Purchase

and sale of business

This Agreement of Purchase and Sale (the “Agreement”)

is made in two original copies, effective

February 18, 2016.

| BETWEEN: | Saqoia Corp. (the "Vendor"), an individual having is principal place of living located in Delaware. |

| AND: | Vopia Inc. (the "Purchaser"), CUSIP number: 929030203 a corporation organized and existing under the laws of the

Nevada, USA with its head office located at:

1700 Montgomery Street, Suite 101

San Francisco, CA 94111 |

| 1.1 | The Purchaser agrees to buy and the Vendor agrees to sell to the Purchaser

as a going concern all the undertaking and assets owned by the Vendor in connection with the big data and search texhnology business

carried on as Saqoia Corp. at (the "business") including, without limiting the generality of the foregoing: |

| a) | The rights to database of 140 million company data. |

| b) | Priority Software to crawl and organize company information from website

in real-timec. |

| c) | The full right to the websites: Golta.com, Surb.com, Linkdio.com, BusinessGlobe.com

|

| d) | 51% ownership of Fastbase Inc. and Masterseek Corp. incorporated in

Nevada, United States. |

| e) | Goodwill of the business together with the exclusive right to the Purchaser

to represent itself as carrying on business in succession to the Vendor and to use the business style of the business and variations

in the business to be carried on by the Purchaser (the "goodwill"). |

| 1.2 | No assets are excluded from the purchase and sale. |

| 2.1 | The purchase price payable for the company and assets agreed to be

bought and sold is payable with 300 million (300,000,000) new issue shares in Vopia Inc, CUSIP number: 929030203 |

| 2.2 | The purchase price for the stock in trade shall be established by an

inventory taken and valued after close of business on the day before the day of closing. The Vendor shall produce evidence satisfactory

to the Purchaser of the direct cost to the Vendor of items included in stock in trade. The Purchaser may exclude from the purchase

and sale any items which the Purchaser reasonably considers unsaleable by reason of defect in quality or in respect of which the

Purchaser is not reasonably satisfied as to proof of direct cost. |

| 2.3 | The purchase price for the parts and supplies shall be established

by an inventory taken and valued after close of business on the day before the day of closing. The Vendor shall produce evidence

satisfactory to the Purchaser of the direct cost to the Vendor of items included in the parts and supplies. The Purchaser may exclude

from the purchase and sale any items which the Purchaser reasonably considers unusable or in respect of which the Purchaser is

not reasonably satisfied as to proof of direct cost. |

| 3.1 | The Vendor acknowledges receiving shares from the Purchaser on execution

of this agreement to be held as a deposit by the Vendor on account of the purchase price of the undertaking and assets agreed to

be bought and sold and as security for the Purchaser's due performance of this agreement. |

| 3.2 | The balance of the purchase price for the undertaking and assets agreed

to be bought and sold shall be paid, subject to adjustments, by certified check on closing. |

| 3.3 | The balance of the purchase price due on closing shall be specially

adjusted for all prepaid and assumed operating expenses of the business including but not limited to rent and utilities. |

| 4. | CONDITIONS, REPRESENTATIONS AND WARRANTIES |

| 4.1 | In addition to anything else in this agreement, the following are conditions

of completing this agreement in favor of the Purchaser: |

| a) | that the Purchaser obtain financing on terms satisfactory to it to

complete the purchase; |

| b) | that the carrying on of the business at its present location is not

prohibited by land use restrictions; |

| c) | that the lessor of the lease consents to its assignment to the Purchaser; |

| d) | that the Purchaser obtain all the permits and licenses required for

it to carry on the business; |

| e) | that the Vendor supply or deliver on closing all of the closing documents; |

| f) | that the premises shall be in the same condition, reasonable wear and

tear expected, on the date of passing as they are currently in; |

| g) | that the execution of this agreement has been duly authorized by Seller’s

board of directors. |

| 4.2 | The following representations and warranties are made and given by

the Vendor to the Purchaser and expressly survive the closing of this agreement. The representations are true as of the date of

this agreement and will be true as of the date of closing when they shall continue as warranties according to their terms. At the

option of the Purchaser, the representations and warranties may be treated as conditions of the closing of this agreement in favor

of the Purchaser. However, the closing of this agreement shall not operate as a waiver or otherwise result in a merger to deprive

the Purchaser of the right to sue the Vendor for breach of warranty in respect of any matter warranted, whether or not ascertained

by the Purchaser prior to closing: |

| a) | the Vendor is a resident of Delaware, United States within the meaning

of the Income Tax Act of United States. |

| b) | the Vendor owns and has the right to sell the items listed in Schedule

A; |

| c) | the assets agreed to be bought and sold are sold free and clear of

all liens, encumbrances and charges; |

| d) | the equipment is in good operating condition; |

| e) | until the closing date of this agreement, Vendor shall not, without

the written consent of Purchaser, dispose of or encumber any of the assets or property to be sold hereunder, with the exception

of any transactions occurring in the ordinary course of Vendor’s business. The undertaking and assets agreed to be bought

and sold will not be adversely affected in any material respect in any way, and Vendor will not do anything before or after closing

to prejudice the goodwill; |

| f) | the financial statements for the business produced by the Vendor and

appended as Schedule B are fair and accurate, and prepared in accordance with generally accepted accounting principles. |

| g) | the lease is in good standing and the Vendor has fulfilled all of its

obligations under the lease; |

| h) | the Vendor has made full and fair disclosure in all material respects

of any matter that could reasonably be expected to affect the Purchaser's decision to purchase the undertaking and assets agreed

to be ought and sold on the terms set out this agreement; |

| i) | the Vendor will execute such assignments, consents, clearances or assurances

after closing, prepared at the Purchaser's expense, as the Purchaser considers necessary or desirable to assure the Purchaser of

the proper and effective completion of this agreement. |

| j) | Vendor agrees to disclose to Purchaser not later than [NUMBER] days

after the closing date, all trade secrets, customer lists, and technical information held or controlled by Vendor and relating

to the business sold hereunder. |

| 5.1 | The risk of loss or damage to the undertaking and assets agreed to

be bought and sold remains with the Vendor until closing. |

| 5.2 | In the event of loss or damage to the tangible assets agreed to be

bought and sold prior to closing, at the option of the Purchaser, the replacement cost of the assets lost or damaged or any of

them may be deducted from the total purchase price otherwise payable by the Purchaser under this agreement and the corresponding

lost or damaged assets shall be excluded from the purchase and sale. |

| | This agreement shall be completed and the Vendor agrees to comply with any applicable laws governing the sale in bulk of the

stock in trade or of any of the other assets pursuant to this agreement. |

| | Vendor shall deliver to the Purchaser, in registrable form where applicable, the following closing documents (the "closing

documents"), prepared or obtained at the Vendor's expense, on or before closing: |

| a) | duplicate, properly executed Bills of Sale of the equipment, stock

in trade and parts and supplies together with evidence satisfactory to the Purchaser that the sale complies with any laws governing

the sale in bulk of the stock in trade or of the sale of any of the other assets pursuant to this agreement; |

| b) | a statutory declaration that the Vendor is a resident of United States

within the meaning of the Income Tax Act of United States as of the date of closing; |

| c) | all records and financial data, including but not limited to any lists

of customers and suppliers, relevant to the continuation of the business by the Purchaser; |

| d) | a duly executed notice in proper form revoking any registration of

the style of the business under any business name registration law; |

| e) | an executed assignment of the lease to the Purchaser endorsed with

the lessor's consent to the assignment; |

| f) | such other assignments, consents, clearances or assurances as the Purchaser

reasonably considers necessary or desirable to assure the Purchaser of the proper and effective completion of this agreement. |

| | The purchase and sale in this agreement shall close on March 25, 2016. |

| 9.1 | In this agreement, the singular includes the plural and the masculine

includes the feminine and neuter and vice versa unless the context otherwise requires. |

| 9.2 | The capitalized headings in this agreement are only for convenience

of reference and do not form part of or affect the interpretation of this agreement. |

| 9.3 | If any provision or part of any provision in this agreement is void

for any reason, it shall be severed without affecting the validity of the balance of the agreement. |

| 9.4 | Time is of the essence of this agreement. |

| 9.5 | There are no representations, warranties, conditions, terms or collateral

contracts affecting the transaction contemplated in this agreement except as set out in this agreement. |

| 9.6 | This agreement binds and benefits the parties and their respective

heirs, executors, administrators, personal representatives, successors and assigns. |

| 9.7 | This agreement is governed by the laws of the State/Province of Delaware,

United States. |

| | This agreement executed on behalf of the Purchaser constitutes an offer

to purchase which can only be accepted by the Vendor by return of at least one originally accepted copy of agreement to the Purchaser

on or before February 25, 2016 failing which the offer becomes null and void. If this offer becomes null and void or is validly

revoked before acceptance or this agreement is not completed by the Purchaser for any valid reason, any deposit tendered with it

on behalf of the Purchaser shall be returned without penalty or interest. |

Signed and Delivered by:

| VENDOR | |

PURCHASER |

| Saqoia Corp. | |

Vopia Inc. |

| | |

|

| | |

|

| Authorized Signature: | |

Authorized Signature: |

| | |

|

| /s/ Rasmus Refer | |

/s/ Jorgen Fredericksen |

| Rasmus Refer, President | |

Jorgen Frederiksen, Director |

| Saqoia Corp. | |

Vopia Inc. |

Vopia Inc. Acquires Big Data Company Saqoia Corp.

NEW YORK, Feb. 17, 2016 (GLOBE NEWSWIRE)

-- Today, Vopia Inc. (OTC:VOPA) have announced it has signed a purchase agreement to acquire proprietary software and all of the

online portals owned by the big data company Saqoia Corp. Terms of the deal remain undisclosed, and payment will be made by issuing

new shares in Vopia Inc. listed as OTCBB. The closing date is set to 25 March 2016. The financials of the deal have

not yet been announced.

Vopia Inc. has already experienced

vast success with their software, obtaining listings for over 40 million companies globally, with continued accomplishment and

success already visible, it has firmly cemented its place alongside the best in the business information services sector.

As a global leader in business data

and search technologies, Vopia Inc., will prepare to seek admission to the Nasdaq Capital Market with a listing in December 2016.

They are planning to expand further by making further acquisitions within the online lead generation space. They are embarking

on an exciting journey, with a clear vision which is to be the largest global providers of global business data.

The activities of Saqoia

Corp. include specialized software to analyze web data, a number of online portals and search engines including Masterseek.com,

Surb.com, Golta.com

along with the dynamic and exciting new start-up called fastbase.com

that focuses on global lead generation. The acquisition expands Vopia Inc. to a big player in big data, lead generation and search

technologies.

In addition to the new business mapping

app, during the spring, Vopia Inc. will be launching a new global business network dedicated exclusively to business owners, executives

and business leaders. This will be a key launch for the company, creating an exciting and much-needed alternative to LinkedIn

where anyone can create a profile free of charge.

This highly lucrative

acquisition of Saqoia will give Vopia Inc. direct access to over 850 million additional business contacts, along with providing

a good platform on which to build new business networks. Additionally, the company have launched a new global B2B marketplace

which will take its stakes in the billion-dollar marketplace. It is best described, how alibaba.com

sits heavy on the Chinese market, Vopia Inc. will focus these efforts in new marketplaces across Europe, South America and the

USA.

ABOUT VOPIA INC.

Vopia Inc. (OTC:VOPA), is a powerful search technology software and online platform that collects, merges and validates the best

information from all across the web. The new Vopia innovative Business Mapping App allows customers to find what they are searching

for with a business directory that pinpoints the positions of over 40 Million businesses globally. Utilizing the information provided

by the support of our online community, we add millions of daily updates to mapped locations to provide detailed, accurate, and

up-to-date maps.

CONTACT

Vopia Inc.

415 835-9463

investor@vopia.com

www.vopia.com

Source: Vopia Inc.

© 2016 GlobeNewswire, Inc.

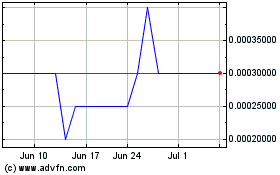

Drone Guarder (PK) (USOTC:DRNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

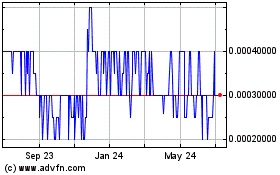

Drone Guarder (PK) (USOTC:DRNG)

Historical Stock Chart

From Apr 2023 to Apr 2024