Current Report Filing (8-k)

February 22 2016 - 5:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

February 16, 2016

Date of report (Date of earliest event reported)

SurModics,

Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Minnesota |

|

0-23837 |

|

41-1356149 |

| (State

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 9924 West 74th Street

Eden Prairie, Minnesota |

|

55344 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(952) 500-7000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

On February 16, 2016, the Organization and Compensation Committee (the

“Committee”) of the Board of Directors of SurModics, Inc. (the “Company”) approved amendments to the form of restricted stock unit award agreement allowing for grants of such awards to the Company’s employees

under the Company’s 2009 Equity Incentive Plan. A copy of the form of agreement reflecting these amendments is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On February 17, 2016, the Company held its 2016 Annual Meeting of Shareholders. The final voting results of the proposals which were

described in more detail in the Company’s proxy statement filed with the Securities and Exchange Commission on January 8, 2016, are set forth below.

1. Election of Directors. Each of the individuals nominated by the Company’s Board of Directors to serve as Class II directors was duly elected by

the Company’s shareholders, and the final results of the votes cast are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For |

|

|

Withheld |

|

|

Broker Non-Votes |

|

| Ronald B. Kalich |

|

|

10,085,911 |

|

|

|

82,406 |

|

|

|

1,350,660 |

|

| Shawn T McCormick |

|

|

10,093,929 |

|

|

|

74,388 |

|

|

|

1,350,660 |

|

2. Set the Number of Directors. The Company’s shareholders approved the proposal to set the number of directors at

six (6) by the following vote:

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

Against |

|

|

Abstain |

|

|

Broker Non-Votes |

|

| 11,233,058 |

|

|

241,589 |

|

|

|

44,330 |

|

|

|

— |

|

3. Ratification of the Appointment of Deloitte & Touche LLP. The Company’s shareholders ratified the

appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal year 2016 by the following vote:

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

Against |

|

|

Abstain |

|

|

Broker Non-Votes |

|

| 11,311,881 |

|

|

199,365 |

|

|

|

7,731 |

|

|

|

— |

|

4. Advisory Vote on Executive Compensation. The Company’s shareholders approved the compensation of the

Company’s named executive officers, on an advisory basis, by the following vote:

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

Against |

|

|

Abstain |

|

|

Broker Non-Votes |

|

| 9,869,944 |

|

|

279,881 |

|

|

|

18,492 |

|

|

|

1,350,660 |

|

5. Amendment to the 2009 Equity Incentive Plan. The Company’s shareholders approved an amendment to

the Company’s 2009 Equity Incentive Plan by the following vote:

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

Against |

|

|

Abstain |

|

|

Broker Non-Votes |

|

| 8,182,907 |

|

|

1,966,547 |

|

|

|

18,863 |

|

|

|

1,350,660 |

|

6. Amendment to the 1999 Employee Stock Purchase Plan. The Company’s shareholders approved an amendment to the

Company’s 2009 Equity Incentive Plan by the following vote:

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

Against |

|

|

Abstain |

|

|

Broker Non-Votes |

|

| 10,090,824 |

|

|

12,639 |

|

|

|

64,854 |

|

|

|

1,350,660 |

|

Item 9.01 Financial Statements and Exhibits.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Form of Restricted Stock Unit Award Agreement (Employee) for the SurModics, Inc. 2009 Equity Incentive Plan. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

SURMODICS, INC. |

|

|

|

| Date: February 22, 2016 |

|

|

|

/s/ Bryan K. Phillips |

|

|

|

|

Bryan K. Phillips |

|

|

|

|

Sr. Vice President, General Counsel and Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Form of Restricted Stock Unit Award Agreement (Employee) for the SurModics, Inc. 2009 Equity Incentive Plan. |

Exhibit 10.1

SurModics, Inc.

2009 Equity Incentive Plan

Restricted Stock Unit Award Agreement

(Employee)

SurModics, Inc. (the “Company”), pursuant to Section 8 of its 2009 Equity Incentive Plan (the “Plan”), hereby grants an

award of Restricted Stock Units to you, the Participant named below. The terms and conditions of this restricted stock unit Award are set forth in this Restricted Stock Unit Award Agreement (the “Agreement”), consisting of this cover page

and the Terms and Conditions on the following pages, and in the Plan document which has been provided to you. To the extent any capitalized term used in this Agreement is not defined, it shall have the meaning assigned to it in the Plan as it

currently exists or as it is amended in the future.

|

|

|

| Name of Participant: |

|

|

| Number of Restricted Stock Units: |

|

Grant Date: |

|

| Vesting Schedule: |

|

|

| Vesting Date(s) |

|

Number of Unit(s) Which

Become Vested |

By signing below, you agree to all of the terms and conditions contained in this Agreement and in the Plan

document. You acknowledge that you have reviewed these documents and that they set forth the entire agreement between you and the Company regarding the grant to you of the number of Restricted Stock Units specified in the table above.

|

|

|

|

|

|

|

|

|

| PARTICIPANT: |

|

|

|

SURMODICS, INC |

|

|

|

|

| |

|

|

|

By |

|

|

|

|

|

|

|

|

|

|

Name: [Name of Authorized Officer] |

|

|

|

|

|

|

|

|

Title: [Title of Authorized Officer] |

SurModics, Inc.

2009 Equity Incentive Plan

Restricted Stock Unit Award Agreement

Terms and Conditions

| 1. |

Grant of Restricted Stock Units. The Company hereby grants to you, subject to the terms and conditions in this Agreement and the Plan, an Award of the number of Restricted Stock Units

(“Units”) specified on the cover page of this Agreement, each representing the right to receive one Share of the Company’s common stock. The Units granted to you will be credited to an account in your name maintained by the Company.

This account shall be unfunded and maintained for book-keeping purposes only, with the Units simply representing an unfunded and unsecured obligation of the Company. |

| 2. |

Restrictions on Units. Prior to settlement of the Units in accordance with Section 5, the Units may not be sold, assigned, transferred, exchanged or encumbered other than by will or the laws of

descent and distribution. Any attempted transfer in violation of this Section 2 shall be of no effect. The Units and your right to receive Shares in settlement of the Units under this Agreement shall be subject to forfeiture as

provided in Section 4 until satisfaction of the vesting conditions set forth in Section 3. |

| 3. |

Vesting of Units. If you remain a Service Provider to the Company or any of its Affiliates continuously from the Grant Date specified on the cover page of this Agreement, then the Units will vest in

accordance with the vesting schedule in the table at the beginning of this Agreement. |

| 4. |

Effect of Termination of Service. If, for any reason, you cease to be a Service Provider prior to the full vesting of the Award, this Award shall also terminate and all unvested Units shall be

forfeited by Participant. |

| 5. |

Settlement of Units. The Company shall cause to be issued and delivered to you, or to your designated beneficiary or estate in the event of your death, one Share in payment and settlement of each

vested Unit upon a termination of your Service to the Company and its Affiliates that constitutes a “separation from service” as such term is defined for purposes of Code Section 409A. Delivery of Shares in settlement of vested Units shall

be effected by an appropriate entry in the stock register maintained by the Company’s transfer agent with a notice of issuance provided to you, or by the electronic delivery of the Shares to a brokerage account you designate, and shall be

subject to compliance with all applicable legal requirements, including compliance with the requirements of applicable federal and state securities laws. |

| 7. |

No Stockholder Rights. The Units subject to this Award do not entitle you to any rights of a stockholder of the Company’s common stock. You will not have any of the rights of a stockholder

of the Company in connection with the grant of Units subject to this Agreement unless and until Shares are issued to you upon settlement of the Units as provided in Section 5. |

2

| 8. |

Changes in Capitalization. If an “equity restructuring” (as defined in Section 17 of the Plan) occurs that causes the per share value of the Shares to change, the Board shall make such equitable

adjustments to any Units subject to this Agreement as are contemplated by Section 17 of the Plan in order to avoid dilution or enlargement of your rights hereunder. The Board may make such equitable adjustments to any Units subject to this Agreement

as and to the extent provided in Section 17 of the Plan in connection with other changes in the Company’s capitalization contemplated by Section 17 of the Plan. |

| 9. |

Interpretation of This Agreement. All decisions and interpretations made by the Board or Committee with regard to any question arising hereunder or under the Plan shall be binding and conclusive upon

you and the Company. |

| 10. |

Governing Plan Document. The Award evidenced by this Agreement is granted pursuant to the Plan, the terms of which are hereby made a part of this Agreement. This Agreement shall in all respects

be interpreted in accordance with the terms of the Plan, and if any terms of this Agreement conflict with the terms of the Plan, the terms of the Plan shall control, except as the Plan may specifically provide otherwise. This Agreement and the

Plan constitute the entire agreement of the parties with respect to the Award and supersede all prior oral or written negotiations, commitments, representations and agreements with respect thereto. |

| 11. |

Discontinuance of Service. Neither this Agreement nor the Award evidenced by this Agreement shall confer on you any right with respect to continued Service with the Company or any of its Affiliates,

nor limit or interfere in any way with the right of the Company or any Affiliate to terminate such Service or otherwise deal with you without regard to the effect it may have upon you under this Agreement. |

| 12. |

Binding Effect. This Agreement will be binding in all respects on your heirs, representatives, successors and assigns, and on the successors and assigns of the Company. |

| 13. |

Choice of Law. This Agreement will be interpreted and enforced under the laws of the state of Minnesota (without regard to its conflicts or choice of law principles). |

By signing the cover page of this Agreement, you agree to all the terms and conditions described above and in the Plan document.

3

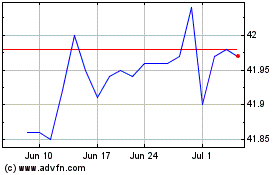

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

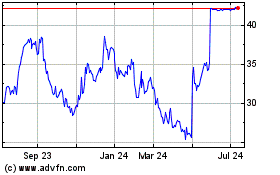

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Apr 2023 to Apr 2024