(FROM THE WALL STREET JOURNAL 2/19/16)

By Ryan Dezember and Corrie Driebusch

Oil prices remain at depressed levels, but investors in new

shares issued by energy companies are acting like they have

detected a bottom.

North American oil-and-gas producers have sold more than $5

billion of new shares so far this year, including three deals on

Wednesday. They have found a receptive market despite last year's

poor stock performance for energy company stock offerings.

Demand for these follow-on offerings, in which already-listed

companies sell new shares, has been strong. Devon Energy Corp., one

of the largest U.S. energy producers, boosted the size of its

Wednesday evening offering by 25%, to more than $1.2 billion, to

meet investor interest.

Investors have been lining up to grab shares of beaten-down

exploration-and-production companies, betting that oil prices won't

go much lower and that these shares are coming cheap.

Jodie Gunzberg, global head of Commodities and Real Assets at

S&P Dow Jones Indices, a unit of McGraw Hill Financial Inc.,

said investors have been looking at other signals that the worst of

the price declines are over, such as energy stocks starting to

outperform energy bonds.

"That has only happened around oil bottoms," she said.

Many energy companies are issuing new stock to reduce debt and

shore up their balance sheets as a cushion against energy prices

remaining unprofitably low for an extended period. Companies that

are in solid shape now could come under financial pressure if their

earnings and reserves of oil and gas decline.

Those energy companies that have sold shares this year or at the

end of 2015 may have been generally more opportunistic sellers.

"When capital markets are open you take it," said David Tameron,

an analyst with Wells Fargo Securities.

These companies' ability to raise cash from investors has helped

insulate them from the pressures of low prices, which would

otherwise force them out of business or at least curtail production

more than they have already. The decision in late 2014 by the

Organization of the Petroleum Exporting Countries not to reduce

output was expected to force weaker rivals out of the market.

Buying shares from these energy producers carries risk, even if

oil prices don't fall much lower. Such companies last year raised

$18 billion selling shares during a record year for energy-share

offerings.

But the stock purchases didn't turn out well for many investors,

who misjudged the extent of the oil slump and its impact on the

companies. Those shares have collectively lost $7.2 billion of

their offering prices, through Thursday. Of 58 energy offerings

last year, only seven traded at or above their offer price,

according to a Wall Street Journal analysis of Dealogic data.

U.S.-traded crude has slumped 50% since June.

Oil prices have been hovering around $30 a barrel, meaning few

new wells are profitable and putting many companies in a bind. Some

of the smaller producers could end up filing for bankruptcy

protection if oil prices remain at these levels for a period of

time.

The offerings also hurt current investors in these stocks,

diluting their stakes in the company, sometimes significantly. Some

of these offerings have increased the number of shares outstanding

by up to 20%. Devon's offering will boost the Oklahoma City

company's share count by at least 15%.

These most recent offerings came as oil prices surged briefly

this week on news that major producers Saudi Arabia and Russia are

coordinating an effort to cap production, sparking hope that the

global glut of crude oil could wane.

But in a sign of how sensitive the market is to any bad news,

oil-inventory reports on Thursday showing another increase in U.S.

stockpiles raised concerns again about the surplus of crude. On

Thursday, U.S. crude closed up 11 cents, or 0.4%, to $30.77 a

barrel, on the New York Mercantile Exchange.

That volatility didn't prevent energy producers from raising

money this week. Energen Corp., which drills in western Texas, and

Raging River Exploration Inc., a Canadian company, also increased

the amount of stock they sold from what they had originally

proposed on Wednesday.

Each of those companies' stocks on Thursday traded above the

offering prices, as have shares of five of the other six companies

that sold shares this year.

The early returns on 2016's deals have helped stoke investor

interest, said Bill Costello, an energy analyst at investment

manager Westwood Holdings Group. "Anybody who has played them has

made money," said Mr. Costello.

The situation has similarities to last year, when the follow-on

market was just heating up. Through this point last year, about

$2.9 billion had been raised through stock offerings, yet activity

picked up at the end of February as investors bet on a rebound in

crude prices.

(END) Dow Jones Newswires

February 19, 2016 02:48 ET (07:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

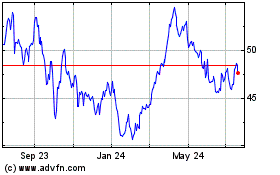

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

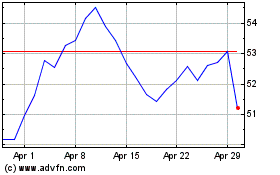

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Apr 2023 to Apr 2024