UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): January 27, 2016

| |

|

PLASTIC2OIL,

Inc.

|

|

|

| |

|

(Exact

name of registrant as specified in its charter)

|

|

|

| Nevada |

|

000-52444 |

|

90-0822950 |

| (State

or other jurisdiction |

|

(Commission |

|

(I.R.S.

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| |

|

|

|

|

20

Iroquois Street

Niagara Falls, NY |

|

|

|

14303 |

| (Address

of principal executive offices) |

|

|

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (716) 278-0015

N/A

Former

name or former address, if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| [ ] |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| [ ] |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section

1 – Registrant’s Business and Operations

Item

1.01 Entry into a Material Definitive Agreement.

On

February 11, 2016, Plastic2Oil, Inc., a Nevada corporation (the “Company”), issued a promissory note in favor of Richard

Heddle, the Company’s President, Chief Executive Officer and Chairman of the Company’s board of directors, to memorialize

various advances, not to exceed $200,000 in total, which are expected to be made by Mr. Heddle to the Company from February 11,

2016 until March 31, 2016. The promissory note bears interest at the rate of 12% per annum. All principal and interest on the

promissory note is due and payable in full by the Company on demand. The repayment of promissory note will be secured by assets

of the Company. It is anticipated that the proceeds of these advances will be used for working capital purposes. The foregoing

summary of the promissory note does not purport to be complete and is qualified in its entirety by reference to the actual promissory

note, a copy of which is attached to this Report as Exhibit 10.1.

Item

1.02 Termination of a Material Definitive Agreement.

Termination

of Recycling Center Lease

On

January 15, 2016, the Company entered into a Surrender of Lease agreement which terminated its lease, dated December 1, 2010,

between Avondale Store Limited Properties and JBI, (Canada) Inc. relating to the Company’s premises located at 1786 Allanport

Road, Thorold, Canada. The effective date of the termination was October 31, 2015. The premises was the site of the Company’s

Regional Recycling Center, which was part of a business line that was discontinued by the Company in 2013. The Company anticipates

the termination will save approximately $1,161,360 in lease payments over the original life of the lease which had a term ending

on December 1, 2030. The Company will remain liable for unpaid rent of approximately $49,180, covering the period from May 2016

to October 2016. The foregoing summary of the Surrender of Lease does not purport to be complete and is qualified in its entirety

by reference to the actual Surrender of Lease, a copy of which is attached to this Report as Exhibit 10.2.

Expiration

of EcoNavigation Agreements

As

previously reported, the Company Plastic2Oil, Inc. (the “Company”) entered into four related agreements with EcoNavigation,

LLC (“EcoNavigation”) in connection with the supply of plastic-to-oil, or P2O, processors by the Company to EcoNavigation.

As of January 27, 2016, such agreements expired and were not renewed by the parties, however, the parties continue to pursue joint

opportunities for the sale of processors to third parties.

Section

2 - Financial Information

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

disclosure contained in Item 1.01 of this Report is incorporated herein by reference.

Section

9 - Financial Statements and Exhibits

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits. The exhibits required by this item are listed on the Exhibit Index hereto.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

| |

Plastic2Oil,

Inc. |

| |

|

|

| February

18, 2016 |

By: |

/s/ Rahoul Banerjea |

| |

Name:

|

Rahoul

Banerjea |

| |

Title:

|

Chief

Financial Officer |

EXHIBIT

INDEX

| Exhibit No. |

|

Description |

| |

|

|

| 10.1 |

|

Demand

Note. |

| |

|

|

| 10.2 |

|

Surrender

of Lease. |

DEMAND

GRID NOTE

Dated:

As of February 11, 2016

1.

PROMISE TO PAY. For value received, PLASTIC2OIL, INC., a corporation organized under the laws of the State of Nevada,

with an address of 20 Iroquois Street, Niagara Falls, NY 14303 (the “Borrower”) promises to pay to the order

of RICHARD HEDDLE, having an address of 721 Miles Road, Hannon Ontario, Canada, LOR1PO (the “Lender”)

or as otherwise specified by the Lender or any transferee of this Demand Grid Note (the “Note”), in lawful money of

the United States and immediately available funds, ON DEMAND:

| (a) |

the

aggregate outstanding principal amounts of all advances made from time to time under this Note (the “Outstanding

Principal Amount”); |

| |

|

| (b) |

interest,

calculated on the basis of a 365-day year or a 366-day year, as the case may be, on the Outstanding Principal Amount from

and including the date hereof to but not including the date the Outstanding Principal Amount is paid in full at a rate per

year that shall on each day be equal to the lesser of (i) the highest rate permitted by applicable law or (ii) 12% per annum;

and |

| |

|

| (c) |

the

reasonable fees and disbursements of counsel incurred at any time by the Lender in endeavoring to collect any amount payable

under this Note or preserve or exercise any right or remedy of the Lender pursuant to this Note. |

2. INTEREST

RATE FOLLOWING DEMAND. If the Borrower fails to pay any amount under this Note following demand for payment, interest shall

thereafter accrue on the Outstanding Principal Sum at a rate equal to 15% per annum.

3. AVAILABILITY

OF ADVANCES. The advances under this Note shall be made in the sole and absolute discretion of the Lender, except Lender commits

to make advances totaling $200,000 during the period from the date of this Note until March 31, 2016; provided such commitment

shall terminate if the Borrower commences or there is commenced against the Borrower any bankruptcy or insolvency proceeding.

No refusal by the Lender to make any advance shall affect the Borrower’s obligation to repay the principal amount of each

advance, the Borrower’s obligation to pay interest on the outstanding principal amount of each advance that has been or

is thereafter made or any other obligation of the Borrower to the Lender under this Note or otherwise.

4. SCHEDULE

OF ADVANCES. The Lender may set forth on the schedule attached to and made a part of this Note or on any similar schedule

or loan account (including, but not limited to, any similar schedule or loan account maintained in computerized records) annotations

evidencing (a) the date and principal amount of each advance, (b) the date and amount of each payment applied to the Outstanding

Principal Amount and (c) the Outstanding Principal Amount after each advance and each such payment. Each such annotation shall,

in the absence of manifest error, be conclusive and binding upon the Borrower. No failure by the Lender to make and no error by

the Lender in making any annotation on such attached schedule or any such similar schedule or loan account shall affect the Borrower’s

obligation to repay the principal amount of each advance, the Borrower’s obligation to pay interest on the outstanding principal

amount of each advance or any other obligation of the Borrower to the Lender under this Note or otherwise.

5. REPAYMENTS

BEFORE DEMAND. The Borrower shall have the option before any demand has been made by the Lender under this Note of paying

the Outstanding Principal Amount in whole or in part without any premium or penalty.

6. AMOUNTS

IMMEDIATELY DUE; WAIVERS. The Outstanding Principal Amount and all interest and other amounts payable pursuant to this Note

and remaining unpaid shall, without any notice, demand, presentment or protest of any kind (each of which is knowingly, voluntarily,

intentionally and irrevocably waived by the Borrower), automatically become immediately due if the Borrower commences or there

is commenced against the Borrower any bankruptcy or insolvency proceeding. To the maximum extent permitted under applicable law,

the Borrower knowingly, voluntarily, intentionally and irrevocably waives (a) any notice, demand, presentment or protest of any

kind in connection with this Note and (b) ANY RIGHT TO A TRIAL BY JURY IN CONNECTION WITH ANY MATTER RELATING TO THIS NOTE.

7. GOVERNING

LAW; CONSENT TO JURISDICTION. This Note shall be governed by and construed, interpreted and enforced in accordance with the

law of the State of New York without regard to the law of any other jurisdiction. THE BORROWER CONSENTS IN EACH ACTION OR OTHER

LEGAL PROCEEDING COMMENCED BY THE LENDER ARISING OUT OF OR RELATED TO THIS NOTE TO THE NONEXCLUSIVE JURISDICTION OF ANY STATE

OR FEDERAL COURT LOCATED IN THE STATE OF NEW YORK; WAIVES PERSONAL SERVICE OF PROCESS; AND AGREES THAT SERVICE OF PROCESS MAY

BE EFFECTED BY THE LENDER BY REGISTERED MAIL TO THE BORROWER AT THE ADDRESS SET FORTH BELOW OR IN ANY MANNER ALLOWED BY THE STATE

OF NEW YORK OR THE FEDERAL LAWS OF THE UNITED STATES. THE BORROWER WAIVES ANY OBJECTION TO THE LAYING OF VENUE OF ANY SUCH ACTION

OR OTHER LEGAL PROCEEDING.

8. MISCELLANEOUS.

This Note, together with any related loan and security agreements and guaranties, contains the entire agreement between the

Lender and Borrower with respect to the Note, and supersedes every course of dealing, other conduct, oral agreement and representation

previously made by the Lender. All rights and remedies of the Lender under applicable law and this Note or amendment of any provision

of this Note are cumulative and not exclusive. No single, partial or delayed exercise by the Lender of any right or remedy shall

preclude the subsequent exercise by the Lender at any time of any right or remedy of the Lender without notice. No waiver or amendment

of any provision of this Note shall be effective unless made specifically in writing by the Lender. No course of dealing or other

conduct, no oral agreement or representation made by the Lender, and no usage of trade, shall operate as a waiver of any right

or remedy of the Lender. No waiver of any right or remedy of the Lender shall be effective unless made specifically in writing

by the Lender. Borrower agrees that in any legal proceeding, a copy of this Note kept in the Lender’s course of business

may be admitted into evidence as an original. This Note is a binding obligation enforceable against Borrower and its successors

and assigns and shall inure to the benefit of the Lender and its successors and assigns. If a court deems any provision of this

Note invalid, the remainder of the Note shall remain in effect. Section headings are for convenience only. Singular number includes

plural and neuter gender includes masculine and feminine as appropriate.

9.

NOTICES. Any demand or notice hereunder or under any applicable law pertaining hereto shall be in writing and duly given

if delivered to Borrower (at its address in the Lender’s records) or to the Lender (at the address on page one). Such notice

or demand shall be deemed sufficiently given for all purposes when delivered (i) by personal delivery and shall be deemed effective

when delivered, or (ii) by mail or courier and shall be deemed effective three (3) business days after deposit in an official

depository maintained by the United States Post Office for the collection of mail or one (1) business day after delivery to a

nationally recognized overnight courier service (e.g., Federal Express).

| |

PLASTIC2OIL,

INC. |

| |

|

|

| |

By: |

/s/

Rahoul S. Banerjea |

| |

Name:

|

Rahoul

S. Banerjea |

| |

Title: |

Chief

Financial Officer |

SCHEDULE

OF ADVANCES AND PAYMENTS

| Date

Advanced |

|

Principal

Amount Advanced |

|

Date

Paid |

|

Amount

Paid |

|

Outstanding

Principal Amount |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

SURRENDER

OF LEASE

THIS

SURRENDER OF LEASE made as of the 15th day of January, 2016.

BETWEEN:

AVONDALE

STORE LIMITED

Herein

called the “Landlord”

-

and -

JBI (CANADA)

INC.

Herein

called the “Tenant”

PREMISES

WITNESS

that in consideration of the rents, covenants and agreements hereafter reserved, the parties hereto mutually agree each with

each other, as follows:

WHEREAS:

| |

1. |

By

a lease (the “Lease”) dated the 1st day of December, 2010 between the Landlord, the Tenant,

the Landlord leased to the Tenant those premises known as 1786 Allanport Road, Thorold, Ontario (the “Premises”); |

| |

|

|

| |

2. |

Tenant

has vacated the Premises and Landlord has accepted the delivery of vacant possession but specifically continues to hold the

Tenant responsible for Rent in arrears up to and including October 31,2015, pursuant to the terms of the Lease; |

NOW

THEREFORE in consideration of the sum of ONE DOLLAR ($1.00) paid by the Landlord to the Tenant:

| 1. |

Tenant

hereby surrenders the Premises to the Landlord. |

| |

|

| 2. |

Landlord

hereby accepts the above surrender provided however that the Tenant acknowledges and agrees that it currently owes arrears

of Rent to the Landlord up to October 31,2015 and the Landlord shall not release the Tenant from such financial obligations

under the Lease until the Tenant has made payment in full of any and all monies owed under the Lease by the Tenant to the

Landlord. |

[Signature

page immediately follows]

IN

WITNESS WHEREOF the parties have hereunto set their hands and seals as of the day and year first-above mentioned.

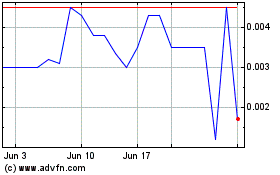

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

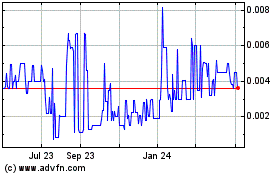

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From Apr 2023 to Apr 2024