Fannie Mae Sees 'Unspectacular' Economic Growth

February 17 2016 - 10:40AM

Dow Jones News

Fannie Mae said economic growth could remain "unspectacular"

this year despite a healthier labor market, according to a new

report from the mortgage-finance company.

As a result of the lackluster growth and weak inflation, Fannie

Mae said it now expects the Federal Reserve to raise interest rates

just twice this year instead of three times. That comes despite

tightening in the labor market, which is expected to boost wages

and drive higher consumer spending.

Also weighing on the U.S. economy this year are a strong U.S.

dollar and struggling economies abroad, which Fannie said have hurt

manufacturing and exports.

The comments came as Fannie's economic and strategic research

group released its February outlook for the economy and housing

market.

Fannie expects improvement in the housing market, as home price

increases help lift underwater mortgages. Low mortgage rates and

easier borrowing are also expected to drive growth in the housing

market, while single-family home production is expected to pick up

this year.

Fannie and peer Freddie Mac don't make mortgages. They buy them

from lenders, wrap the loans into securities and provide guarantees

to make investors whole if the loans default.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

February 17, 2016 10:25 ET (15:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

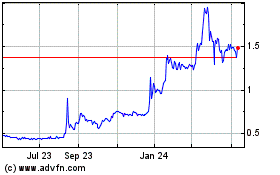

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

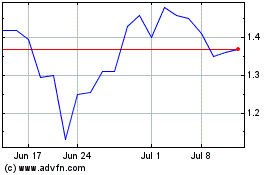

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Apr 2023 to Apr 2024