UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 17, 2016

VAPOR

CORP.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-36469 |

|

84-1070932 |

| (State or Other Jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

3001 Griffin Road

Dania Beach, Florida 33312

(Address of Principal

Executive Office) (Zip Code)

(888) 766-5351

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

On February 17, 2016, the Company issued a press release announcing

that certain holders (each, a “Holder”) of the Company’s Series A Warrants (the “Series A Warrants”)

have entered into standstill agreements with the Company (each, a “Standstill Agreement”), pursuant to which, among

other things, each Holder agreed not to exercise their Series A Warrants pursuant to the “cashless exercise” provisions

of the Series A Warrants prior to April 15, 2016, in whole or in part, which period may be extended in certain circumstances. These

circumstances include the Company being delayed beyond April 15, 2016 in meeting the requirements for listing or quotation on the

OTCQX or the OTCQB. The Standstill Agreements may be amended by Holders owning a majority of the issued and outstanding Series

A Warrants executing the Standstill Agreements. The Company is seeking to obtain Standstill Agreements from all of the holders

of Series A Warrants.

In addition, the Company has announced that it no longer meets the

“Equity Conditions” required to issue Company common stock to fulfill a cashless exercise pursuant to Section 1(d)

of its Series A Warrants. A copy of the press release is included as Exhibit 99.1 to this Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number |

|

Description |

| |

|

| 99.1 |

|

|

Press release dated February 17, 2016 |

| |

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VAPOR CORP. |

| |

|

|

| Date: February 17, 2016 |

By: |

/s/ Jeffrey E. Holman |

| |

|

Jeffrey E. Holman |

| |

|

Chief Executive Officer |

EXHIBIT INDEX

| Exhibit Number |

|

Description |

| |

|

| 99.1 |

|

|

Press release dated February 17, 2016 |

| |

|

|

|

Exhibit 99.1

Investor Contacts:

Gina Hicks

Chief Financial Officer

Phone: 888-482-7671

ghicks@vpco.com

VAPOR

CORP. ENTERS INTO STANDSTILL AGREEMENTS WITH HOLDERS OF ITS SERIES A WARRANTS

DANIA

BEACH, Fla., Feb. 17, 2016 — Vapor Corp. (OTC

PINKSHEETS: VPCO.PK) (the "Company"),

a leading U.S.-based distributor and retailer of vaporizers, e-liquids, e-cigarettes and e-hookahs, announced today that certain

holders (each, a “Holder”) of the Company’s Series A Warrants (the “Series A Warrants”) have entered

into standstill agreements with the Company (each, a “Standstill Agreement”), pursuant to which, among other things,

each Holder agreed not to exercise their Series A Warrants pursuant to the “cashless exercise” provisions of the Series

A Warrants prior to April 15, 2016, in whole or in part, which period may be extended in certain circumstances. These circumstances

include the Company being delayed beyond April 15, 2016 in meeting the requirements for listing or quotation on the OTCQX or the

OTCQB. The Standstill Agreements may be amended by Holders owning a majority of the issued and outstanding Series A Warrants executing

the Standstill Agreements. The Company is seeking to obtain Standstill Agreements from all of the holders of Series A Warrants.

In

addition, the Company has disclosed it no longer meets the “Equity Conditions” required to issue Company common stock

to fulfill a cashless exercise pursuant to Section 1(d) of its Series A Warrants. The Company, therefore, can no longer elect to

issue Company common stock in lieu of delivering of a cash payment upon an exercise pursuant to Section 1(d) of the Series A Warrants.

The Company is seeking to meet the requirements for quotation on the OTCQX or the OTCQB to comply with the Equity Conditions of

the Series A Warrants, including through the implementation of the 1:70 reverse stock split previously approved by the Company’s

stockholders.

About

Vapor Corp.

Vapor

Corp. is a U.S. based distributor and retailer of vaporizers, e-liquids and electronic cigarettes. It recently acquired the retail

store chain “The Vape Store” as part of a merger with Vaporin, Inc. The Company’s innovative technology enables

users to inhale nicotine vapor without smoke, tar, ash or carbon monoxide. Vapor Corp. has a streamlined supply chain, marketing

strategies and wide distribution capabilities to deliver its products. The Company’s brands include VaporX®, Krave®,

Hookah Stix® and Vaporin™ and are distributed to retail stores throughout the U.S. and Canada. The Company sells direct

to consumer via e-commerce and Company-owned brick-and-mortar retail locations operating under “The Vape Store” brand.

Safe

Harbor Statement

Safe

Harbor Statements under the Private Securities Litigation Reform Act of 1995: The Material contained in this press release may

include statements that are not historical facts and are considered “forward-looking” statements within the meaning

of the Private Securities Litigation Reform Act of

3001

Griffin Road | Ft. Lauderdale, FL 33312 | Phone: 1.888.766.5351 | Fax:

1.888.882.7095

www.vapor-corp.com

1995.

These forward-looking statements reflect Vapor Corp.’s current views about future events, financial performances, and project

development. These “forward-looking” statements are identified by the use of terms and phrases such as “will,”

“believe,” “expect,” “plan,” “anticipate,” and similar expressions identifying

forward-looking statements. Investors should not rely on forward-looking statements because they are subject to a variety of risks,

uncertainties, and other factors that could cause actual results to differ materially from Vapor’s expectations. These risk

factors include, but are not limited to, the risks and uncertainties identified by Vapor Corp. under the headings “Risk Factors”

in its latest Annual Report on Form 10-K. These factors are elaborated upon and other factors may be disclosed from time to time

in Vapor Corp.’s filings with the Securities and Exchange Commission. Vapor Corp. expressly does not undertake any duty to

update forward-looking statements.

SOURCE Vapor Corp.

3001

Griffin Road | Ft. Lauderdale, FL 33312 | Phone: 1.888.766.5351 | Fax:

1.888.882.7095

www.vapor-corp.com

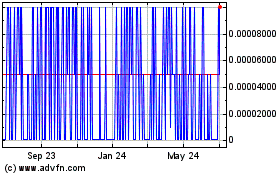

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

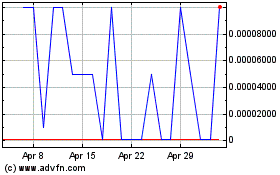

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Apr 2023 to Apr 2024