UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December

31, 2015

or

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 000-54323

RedHawk

Holdings Corp.

(Exact name of registrant as specified in

its charter)

| Nevada |

|

20-3866475 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(IRS Employer

Identification No.) |

| 219 Chemin Metairie Road |

|

|

| Youngsville, Louisiana |

|

70592 |

| (Address of principal executive offices) |

|

(Zip Code) |

(337) 269-5933

(Registrant’s telephone number, including

area code)

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act.

| Large accelerated filer |

o |

|

Accelerated filer |

o |

| |

|

|

|

|

| Non-accelerated filer |

o |

(Do not check if a smaller reporting company) |

Smaller reporting company |

x |

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

On February 8, 2016, 365,094,082 shares of common stock, par

value 0.001 per share, were outstanding.

REDHAWK HOLDINGS CORP.

Form

10-Q

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

Item 1. UNAUDITED

Consolidated Financial Statements.

REDHAWK HOLDINGS CORP.

Consolidated Balance Sheets

(unaudited)

| | |

December 31, | | |

June 30, | |

| | |

2015 | | |

2015 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 16,933 | | |

$ | 900 | |

| Marketable securities, at market value | |

| 1,846,687 | | |

| - | |

| Accounts receivable | |

| 4,860 | | |

| 610 | |

| Inventory, at cost | |

| 9,756 | | |

| 9,756 | |

| Prepaid expenses | |

| 59,227 | | |

| - | |

| | |

| | | |

| | |

| Total Current Assets | |

| 1,937,463 | | |

| 11,266 | |

| | |

| | | |

| | |

| Property and Improvements: | |

| | | |

| | |

| Land | |

| 110,000 | | |

| - | |

| Building and improvements | |

| 670,000 | | |

| - | |

| | |

| 780,000 | | |

| - | |

| Less, accumulated depreciation | |

| (2,812 | ) | |

| - | |

| | |

| | | |

| | |

| Total Property and Improvements | |

| 777,188 | | |

| - | |

| | |

| | | |

| | |

| Other Assets: | |

| | | |

| | |

| Investment in real estate limited partnership | |

| 625,000 | | |

| - | |

| Intangible assets, net of amortization of $120,412 and $86,080, respectively | |

| 205,019 | | |

| 234,351 | |

| | |

| | | |

| | |

| Total Other Assets | |

| 830,019 | | |

| 234,351 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 3,544,670 | | |

$ | 245,617 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 162,801 | | |

$ | 87,980 | |

| Current maturities of long-term debt | |

| 8,206 | | |

| - | |

| Line of credit | |

| 1,080,000 | | |

| - | |

| Due to related party | |

| - | | |

| 28,635 | |

| Loans payable | |

| - | | |

| 156,697 | |

| Insurance notes payable | |

| 16,425 | | |

| - | |

| | |

| | | |

| | |

| Total Current Liabilities | |

| 1,267,432 | | |

| 273,312 | |

| | |

| | | |

| | |

| Long-Term Debt: | |

| | | |

| | |

| Real estate note payable, net of current maturities | |

| 255,540 | | |

| - | |

| Convertible notes payable | |

| 5,000 | | |

| - | |

| | |

| | | |

| | |

| Total Long-Term Debt | |

| 260,540 | | |

| - | |

| | |

| | | |

| | |

| Total Liabilities | |

| 1,527,972 | | |

| 273,312 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders' Equity (Deficit): | |

| | | |

| | |

| Preferred Stock, stated value of $1,000 per share, 5,000 authorized shares and 2,140 shares issued and outstanding: | |

| | | |

| | |

| 5% Series A, 2,000 shares designated, 1,240 issued and outstanding | |

| 1,240,000 | | |

| - | |

| 5% Series B, 1,000 shares designated, 1,000 issued and outstanding | |

| 1,000,000 | | |

| - | |

| Common Stock, par value of $0.001 per share, 450,000,000 authorized shares and 365,094,082 issued and outstanding at December 31, 2015 and 360,094,082 issued and outstanding at June 30, 2015 | |

| 365,094 | | |

| 360,094 | |

| Additional paid-in capital | |

| 875,283 | | |

| 927,826 | |

| Accumulated comprehensive loss | |

| (11,607 | ) | |

| - | |

| Accumulated deficit | |

| (1,452,072 | ) | |

| (1,315,615 | ) |

| | |

| | | |

| | |

| Total Stockholders' Equity (Deficit) | |

| 2,016,698 | | |

| (27,695 | ) |

| | |

| | | |

| | |

| Total Liabilities and Stockholders' Equity | |

$ | 3,544,670 | | |

$ | 245,617 | |

The accompanying notes are an integral part

of these financial statements

REDHAWK HOLDINGS CORP.

Consolidated Statements of

Operations

(unaudited)

| | |

Three Months Ended December 31, | | |

Six Months Ended December 31, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 5,200 | | |

$ | 225 | | |

$ | 9,950 | | |

$ | 225 | |

| | |

| | | |

| | | |

| | | |

| | |

| Costs and Expenses: | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| 1,374 | | |

| - | | |

| 1,374 | | |

| - | |

| Professional fees | |

| 137,176 | | |

| 24,800 | | |

| 198,326 | | |

| 24,800 | |

| Management fees | |

| 14,000 | | |

| (37,351 | ) | |

| 35,500 | | |

| 5,149 | |

| Depreciation | |

| 2,812 | | |

| - | | |

| 2,812 | | |

| - | |

| Amortization of intangibles | |

| 17,166 | | |

| 57,220 | | |

| 34,332 | | |

| 57,220 | |

| General and administrative | |

| 15,155 | | |

| 12,221 | | |

| 28,493 | | |

| 16,336 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Costs and Expenses | |

| 187,683 | | |

| 56,890 | | |

| 300,837 | | |

| 103,505 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss from Continuing Operations | |

| (182,483 | ) | |

| (56,665 | ) | |

| (290,887 | ) | |

| (103,280 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense): | |

| | | |

| | | |

| | | |

| | |

| Expiration of indebtedness | |

| 156,697 | | |

| - | | |

| 156,697 | | |

| - | |

| Dividend income | |

| 2,770 | | |

| - | | |

| 2,770 | | |

| - | |

| Interest expense | |

| (3,693 | ) | |

| - | | |

| (3,693 | ) | |

| - | |

| | |

| 155,774 | | |

| - | | |

| 155,774 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss from Continuing Operations | |

| (26,709 | ) | |

| (56,665 | ) | |

| (135,113 | ) | |

| (103,280 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Discontinued Operations: | |

| | | |

| | | |

| | | |

| | |

| Income from discontinued operations | |

| - | | |

| - | | |

| - | | |

| 444 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income on Discontinued Operations | |

| - | | |

| - | | |

| - | | |

| 444 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| (26,709 | ) | |

| (56,665 | ) | |

| (135,113 | ) | |

| (102,836 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | |

| Unrecognized loss on marketable securities | |

| (11,607 | ) | |

| - | | |

| (11,607 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss and Comprehensive Loss | |

| (38,316 | ) | |

| (56,665 | ) | |

| (146,720 | ) | |

| (102,836 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Preferred Stock Dividends | |

| (1,344 | ) | |

| - | | |

| (1,344 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss and Comprehensive Loss Available for Common Stockholders | |

$ | (39,660 | ) | |

$ | (56,665 | ) | |

$ | (148,064 | ) | |

$ | (102,836 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss Per Share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| Diluted | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 364,278,865 | | |

| 353,937,290 | | |

| 362,186,473 | | |

| 349,562,727 | |

| Diluted | |

| 364,278,865 | | |

| 353,937,290 | | |

| 362,186,473 | | |

| 349,562,727 | |

The accompanying notes are an integral

part of these financial statements

REDHAWK HOLDINGS CORP.

CONSOLIDATED STATEMENTS OF

STOCKHOLDERS' EQUITY (DEFICIT)

For the Six

Months ended December 31, 2015

(unaudited)

| | |

| | |

| | |

| | |

| | |

UNRECOGNIZED | | |

| | |

| |

| | |

SERIES A | | |

SERIES B | | |

| | |

ADDITIONAL | | |

LOSS ON | | |

| | |

| |

| | |

PREFERRED

STOCK | | |

PREFERRED

STOCK | | |

COMMON

STOCK | | |

PAID-IN | | |

MARKETABLE | | |

ACCUMULATED | | |

| |

| | |

SHARES | | |

AMOUNT | | |

SHARES | | |

AMOUNT | | |

SHARES | | |

AMOUNT | | |

CAPITAL | | |

SECURITIES | | |

DEFICIT | | |

TOTAL | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| BALANCE, JUNE 30, 2015 | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 360,094,082 | | |

$ | 360,094 | | |

$ | 927,826 | | |

$ | - | | |

$ | (1,315,615 | ) | |

$ | (27,695 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Contributed management servcies | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 10,000 | | |

| - | | |

| - | | |

| 10,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (108,404 | ) | |

| (108,404 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE, SEPTEMBER 30, 2015 | |

| - | | |

| - | | |

| - | | |

| - | | |

| 360,094,082 | | |

| 360,094 | | |

| 937,826 | | |

| - | | |

| (1,424,019 | ) | |

| (126,099 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sale of unregistered securities | |

| - | | |

| - | | |

| - | | |

| - | | |

| 5,000,000 | | |

| 5,000 | | |

| 45,000 | | |

| - | | |

| - | | |

| 50,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Acquisitions: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Commercial real estate | |

| 215 | | |

| 215,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 215,000 | |

| Investment in real estate partnership | |

| 625 | | |

| 625,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 625,000 | |

| Corporate office | |

| 300 | | |

| 300,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 300,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Working capital contribution | |

| - | | |

| - | | |

| 1,000 | | |

| 1,000,000 | | |

| - | | |

| - | | |

| (117,543 | ) | |

| - | | |

| - | | |

| 882,457 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Conversion of shareholder line of credit | |

| 100 | | |

| 100,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 100,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Contributed management servcies | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 10,000 | | |

| - | | |

| - | | |

| 10,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Preferred stock dividends declared | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,344 | ) | |

| (1,344 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unrecognized loss on marketable securities | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (11,607 | ) | |

| - | | |

| (11,607 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (26,709 | ) | |

| (26,709 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE, DECEMBER 31, 2015 | |

| 1,240 | | |

$ | 1,240,000 | | |

| 1,000 | | |

$ | 1,000,000 | | |

| 365,094,082 | | |

$ | 365,094 | | |

$ | 875,283 | | |

$ | (11,607 | ) | |

$ | (1,452,072 | ) | |

$ | 2,016,698 | |

The accompanying notes are an integral part

of these financial statements

REDHAWK HOLDINGS CORP.

Consolidated Statements of

Cash Flows

(unaudited)

| | |

Six Months Ended December 31, | |

| | |

2015 | | |

2014 | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss from continuing operations | |

$ | (135,113 | ) | |

$ | (103,280 | ) |

| Adjustments to reconcile net loss to net cash used in continuing operations: | |

| | | |

| | |

| Amortization of intangibles | |

| 34,332 | | |

| 57,220 | |

| Depreciation | |

| 2,812 | | |

| - | |

| Contributed management services | |

| 20,000 | | |

| - | |

| Expiration of indebtedness | |

| (156,697 | ) | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (4,250 | ) | |

| (225 | ) |

| Inventory | |

| - | | |

| (10,080 | ) |

| Prepaid expense and deposits | |

| (59,227 | ) | |

| - | |

| Accounts payable and accrued liabilities | |

| 73,475 | | |

| 15,026 | |

| Due to related party | |

| (28,635 | ) | |

| (8,601 | ) |

| | |

| | | |

| | |

| Net Cash Used in Operating Activities | |

| (253,303 | ) | |

| (49,940 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Acquisition of intangible assets | |

| (5,000 | ) | |

| - | |

| | |

| | | |

| | |

| Net Cash Used in Investing Activities | |

| (5,000 | ) | |

| - | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Proceeds from issuance of common stock | |

| 50,000 | | |

| 49,900 | |

| Proceeds from related party line of credit | |

| 100,000 | | |

| - | |

| Proceeds from the issuance of the Series B Preferred Stock | |

| 4,165 | | |

| - | |

| Proceeds from bank line of credit | |

| 100,000 | | |

| - | |

| Proceeds from insurance note payable | |

| 30,048 | | |

| - | |

| Principal payments on insurance note payable | |

| (13,623 | ) | |

| - | |

| Principal payments on long-term debt | |

| (1,254 | ) | |

| - | |

| Proceeds from issuance of debentures | |

| 5,000 | | |

| - | |

| | |

| | | |

| | |

| Net Cash Provided by Financing Activities | |

| 274,336 | | |

| 49,900 | |

| | |

| | | |

| | |

| NET CASH PROVIDED BY DISCONTINUED OPERATIONS | |

| - | | |

| 444 | |

| | |

| | | |

| | |

| Increase in cash | |

| 16,033 | | |

| 404 | |

| | |

| | | |

| | |

| Cash, Beginning of Period | |

| 900 | | |

| 7,203 | |

| | |

| | | |

| | |

| Cash, End of Period | |

$ | 16,933 | | |

$ | 7,607 | |

| | |

| | | |

| | |

| Non-Cash Investing and Financing Activities: | |

| | | |

| | |

| Land and building acquired in exchange for Series A Preferred Stock and assumption of debt | |

$ | 780,000 | | |

$ | - | |

| Exchange of marketable securities and assumption of line of credit for

Series B Preferred Stock | |

$ | 1,858,294 | | |

$ | - | |

| Partnership investment acquired in exchange for Series A Preferred Stock | |

$ | 625,000 | | |

$ | - | |

| Related party line of credit converted into Series A Preferred Stock | |

$ | 100,000 | | |

$ | - | |

| Preferred stock dividends declared but unpaid | |

$ | 1,344 | | |

$ | - | |

| | |

| | | |

| | |

| Supplemental Disclosures: | |

| | | |

| | |

| Interest paid | |

$ | 3,693 | | |

$ | - | |

| Income tax paid | |

$ | - | | |

$ | - | |

The accompanying notes are an integral part

of these financial statements

REDHAWK HOLDINGS CORP.

Notes to the Unaudited Consolidated Financial

Statements

December 31, 2015

| 1. | NATURE OF OPERATIONS AND CONTINUANCE OF BUSINESS |

RedHawk Holdings Corp. (“we”

or the “Company”) (formerly Independence Energy Corp.) was incorporated in the State of Nevada on November 30, 2005

under the name “Oliver Creek Resources Inc.” At inception, we were organized to acquire, explore and develop

natural resource properties in the United States. Effective August 12, 2008, we changed our name from “Oliver

Creek Resources Inc.” to “Independence Energy Corp.” and opened for trading with the Over-the Counter Bulletin

Board under the symbol “IDNG.” Effective October 13, 2015, by vote of a majority of the Company’s stockholders,

the Company’s name was changed from “Independence Energy Corp.” to “RedHawk Holdings Corp.”

On March 31, 2014, the Company acquired

the exclusive right to distribute certain medical products and changed the focus of its operations to include medical products

distribution. Since then, we have expanded our operations to include specialized financial services, pharmaceutical sales and commercial

real estate leasing and investment. We may explore other lines of business in the future including, but not limited to, oilfield

services and equipment leasing.

In June 2014, the Company decided to discontinue

its oil and gas exploration and production operations.

Going Concern

These financial statements have been prepared

on a going concern basis, which implies that the Company will be able to continue as a going concern without further financing.

Currently, the Company must continue to realize its assets to discharge its liabilities in the normal course of business. The Company

has generated minimal revenues to date and has never paid any dividends and is unlikely to pay dividends or generate significant

earnings in the immediate or foreseeable future.

As of December 31, 2015, the Company had

a working capital of $670,031 but an accumulated deficit of $1,452,072. The continuation of the Company as a going concern is dependent

upon the continued financial support from its stockholders, the ability to raise equity or debt financing, and the attainment of

profitable operations from the Company’s businesses. These factors raise substantial doubt regarding the Company’s

ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification

of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as

a going concern.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation

The unaudited interim condensed financial

statements of the Company as of December 31, 2015 and for the three and six month periods ended December 31, 2015 and 2014 included

herein have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”)

for interim financial information and pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”).

The year-end condensed balance sheet dated as of June 30, 2015 is also unaudited and is presented here as a basis for comparison

and reflective of our transition period balance sheet for our new year end which was changed on June 15, 2015. The Company’s

fiscal year-end was January 31 but has been changed to June 30 by vote of a majority of the Company’s board of directors.

Although the financial statements and related information included herein have been prepared without audit, and certain information

and note disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted,

the Company believes that the note disclosures are adequate to make the information presented not misleading. These unaudited

condensed financial statements should be read in conjunction with the Company’s audited consolidated financial statements

and the notes thereto included in the Company’s Annual Report on Form 10-K as of January 31, 2015. In the opinion of

our management, the unaudited interim financial statements included herein reflect all adjustments, consisting of normal recurring

adjustments, considered necessary for a fair presentation of the Company’s financial position, results of operations, and

cash flows for the periods presented. The results of operations for interim periods are not necessarily indicative of the results

expected for the full year or any future period.

Principles of Consolidation

The consolidated financial statements include

the accounts of the Company and its subsidiaries in which we have a greater than 50% ownership. All material intercompany accounts

have been eliminated upon consolidation. Certain prior year amounts are sometimes reclassified to be consistent with the current

year financial statement presentation.

Use of Estimates

The financial statements and related notes

are prepared in conformity with GAAP which requires our management to make estimates and assumptions that affect the reported amounts

of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported

amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related

to valuation and impairment of long-lived assets, asset retirement obligations, fair value of share-based payments, and deferred

income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience

and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making

judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent

from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s

estimates. To the extent there are material differences between the estimates and the actual results, future results of operations

will be affected.

Revenue Recognition

We derive revenue from several types of

activities – medical product sales, commercial real estate leasing and financial services. Our medical product sales include

the marketing and distribution of certain professional and consumer grade digital non-contact thermometers. Our real estate leasing

revenues are from certain commercial properties under long-term lease. The financial service revenue is from brokerage services

earned in connection with debt placement services.

Cash and Cash Equivalents

We consider highly liquid investments with

an original maturity of 90 days or less to be cash equivalents.

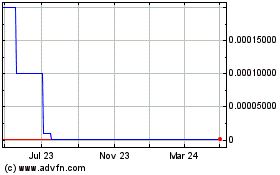

Marketable Securities

We determine the appropriate classification

of our marketable securities at the time of purchase and reassess the appropriateness of the classification at each reporting date.

At December 31, 2015, all marketable securities held by the Company have been classified as available-for-sale and, as a result,

are stated at fair value with unrealized gains and losses included as a component of accumulated comprehensive income or loss.

Realized gains and losses on the sale of securities are determined on a specific identification basis. Interest and dividend income

is recorded when it is earned and deemed realizable by the Company. At December 31, 2015, the cost of the marketable securities

on hand, which consisted entirely of widely recognized publically-traded securities, was $1,858,294. Gross unrealized losses on

the fair market value of the marketable securities was $11,607 as of December 31, 2015 (see Note 8).

Accounts Receivable

Accounts receivables are amounts due from

customers of our medical products division and our financial services division. The amount is reported at the billed amount, net

of any expected allowance for bad debts.

Inventory

Inventory consist of purchased thermometers held for resale

and are stated at the lower of cost or market utilizing the first-in, first-out method.

Property and Improvements

Property and improvements are stated at cost. We provide for

depreciation expense on a straight line basis over each asset’s useful life depreciated to their estimated salvage value.

Buildings are depreciated over a useful life of 20 years. Building improvements are depreciated over a useful life of 5 to 10 years.

Oil and Gas Property Costs

During the year ended January 31, 2015, the Company decided

to discontinue its oil and gas business and the relevant assets have been impaired. In June 2015, the Company assigned its working

interest in the Quinlan wells to the operator of those wells in exchange for the cancellation of all amounts due to the operator,

including any future liabilities related to the Quinlan wells

Income Taxes

Potential benefits of income tax losses

are not recognized in the accounts until realization is more likely than not. The Company has adopted Accounting Standard Codification

(“ASC”) 740, Income Taxes, as of its inception. Pursuant to ASC 740, the Company is required to compute tax

asset benefits for net operating losses carried forward. The potential benefits of net operating losses have not been recognized

in these financial statements because the Company cannot be assured it is more likely than not it will utilize the net operating

losses carried forward in future years. The Company recognizes interest and penalties related to uncertain tax positions in income

tax expense in the period they are incurred. The Company does not believe that it has any uncertain tax positions. The Company

has not filed any corporate tax returns since its inception.

Basic and Diluted Net Loss Per Share

The Company computes net loss per share

in accordance with ASC 260, Earnings Per Share, which requires presentation of both basic and diluted earnings per share

(EPS) on the face of the income statement. Basic EPS is computed by dividing net loss available to common shareholders (numerator)

by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive

potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the

if-converted method. In computing Diluted EPS, the average stock price for the period is used in determining the number of shares

assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their

effect is anti-dilutive. As of December 31, 2015 and 2014, the Company had 7,452,959 potentially dilutive shares from our warrants

issued in connection with the November 2014 private equity sale. There were 333,333 shares issuable upon conversion of the debentures

but have been excluded from earnings per share calculations because these shares are anti-dilutive. At December 31, 2015, there

were potentially 82,666,666 shares issuable upon the conversion of the Series A Preferred Stock. In addition, there were potentially

100,000,000 shares issuable upon the conversion of the Series B preferred stock.

Comprehensive

Loss

ASC 220, Comprehensive Income, establishes

standards for the reporting and display of comprehensive loss and its components in the financial statements. During the three

and six month periods ended December 31, 2015, the Company had $11,607 of comprehensive losses resulting from the unrecognized losses

on marketable securities. During the three and six month periods ended December 31, 2014, the Company had no items that represented

comprehensive income (loss) and, therefore, did not include a schedule of comprehensive income (loss) in the financial statements.

Financial Instruments

Pursuant to ASC 820, Fair Value Measurements

and Disclosures, an entity is required to maximize the use of observable inputs and minimize the use of unobservable inputs

when measuring fair value. ASC 820 establishes a fair value hierarchy based on the level of independent, objective evidence surrounding

the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon

the lowest level of input that is significant to the fair value measurement. ASC 820 prioritizes the inputs into the following

three levels that may be used to measure fair value:

Level 1. Level

1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2. Level

2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability

such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in

markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant

inputs are observable or can be derived principally from, or corroborated by, observable market data.

Level 3. Level

3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to

the measurement of the fair value of the assets or liabilities.

The Company has marketable securities with

a fair market value of $1,846,687 at December 31, 2015, which are all publicly traded securities with quoted prices in active markets.

These are fair values using Level 1 assumptions.

The Company’s financial instruments

consist principally of cash, accounts payable and accrued liabilities, and amounts due to related parties. Pursuant to ASC 820

and ASC 825, the fair value of our cash is determined based on “Level 1” inputs, which consist of quoted prices in

active markets for identical assets.

We believe that the recorded values of

all of our other financial instruments approximate their current fair values because of their nature and respective maturity dates

or durations.

Recent Accounting Pronouncements

Development Stage

The Company has limited operations and

is considered to be in the development stage. During the year ended January 31, 2015, the Company elected to early adopt Accounting

Standards Update (“ASU”) No. 2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting

Requirements. The adoption of this ASU allows the Company to remove the inception to date information and all references to

development stage.

Revenue Recognition

In May 2014, the Financial Accounting Standards

Board (the “FASB”) issued new guidance intended to change the criteria for recognition of revenue. The new guidance

establishes a single revenue recognition model for all contracts with customers, eliminates industry specific requirements and

expands disclosure requirements. The core principle of the guidance is that an entity should recognize revenue to depict the transfer

of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled

in exchange for those goods or services. To achieve this core principle, an entity should apply the following five steps: (1) identify

contracts with customers, (2) identify the performance obligations in the contracts, (3) determine the transaction price, (4) allocate

the transaction price to the performance obligation in the contract, and (5) recognize revenue as the entity satisfies performance

obligations. The amendments are effective for annual reporting periods beginning after December 15, 2017, including interim periods

within that reporting period. Early application is permitted for annual reporting periods beginning after December 15, 2016, including

interim periods within that reporting period. We are currently evaluating what impact the adoption of this guidance would have

on our financial position, results of operations, cash flows and disclosures.

Going Concern

In August 2014, the FASB issued guidance

on disclosures of uncertainties about an entity’s ability to continue as a going concern. The guidance requires management’s

evaluation of whether there are conditions or events that raise substantial doubt about the entity’s ability to continue

as a going concern within one year after the date that the financial statements are issued. This assessment must be made in connection

with preparing financial statements for each annual and interim reporting period. Management’s evaluation should be based

on the relevant conditions and events that are known and reasonably knowable at the date the financial statements are issued. If

conditions or events raise substantial doubt about the entity’s ability to continue as a going concern, but this doubt is

alleviated by management’s plans, the entity should disclose information that enables the reader to understand what the conditions

or events are, management’s evaluation of those conditions or events and management’s plans that alleviate that substantial

doubt. If conditions or events raise substantial doubt and the substantial doubt is not alleviated, the entity must disclose this

in the footnotes. The entity must also disclose information that enables the reader to understand what the conditions or events

are, management’s evaluation of those conditions or events and management’s plans that are intended to alleviate that

substantial doubt. The amendments are effective for annual periods and interim periods within those annual periods beginning after

December 15, 2016. We do not expect that adoption will have a material impact on our financial position, results of operations,

cash flows or disclosures.

Debt Issuance Costs

In April 2015, the FASB issued new guidance

which requires debt issuance costs to be presented in the balance sheet as a direct deduction from the carrying value of the associated

debt liability, consistent with the presentation of a debt discount. The new guidance does not affect the recognition and measurement

of debt issuance costs. Therefore, the amortization of such costs will continue to be calculated using the interest method and

be reported as interest expense. The new guidance does not specifically address, and therefore does not affect, the balance sheet

presentation of debt issuance costs for revolving debt arrangements. The new guidance is effective for financial statements issued

in fiscal years beginning after December 15, 2015, and will be applied on a retrospective basis. Early adoption is permitted

for financial statements that have not been previously issued. To date our debt issuance cost has not been significant, however,

as the Company continues to raise capital to execute its growth strategy, the use of debt in the future may have issuance costs

to be accounted for under this guidance.

New Accounting Pronouncements

The Company does not believe that there

are any other new accounting pronouncements that have been issued that might have a material impact on its consolidated financial

statements.

Properties and Improvements

On November 13, 2015, we acquired certain

commercial rental property, consisting of $75,000 of land and $405,000 of buildings and improvements, from a related party that

is an entity controlled by a stockholder and officer of the Company, for $480,000. The purchase price was paid by the Company

through the assumption of $265,000 of long-term bank indebtedness (see Note 7) plus the issuance of 215 shares of the Company’s

newly designated Series A Preferred Stock (see Note 8). The purchase price of the property was determined by independent third-party

appraisers commissioned by the financial institution providing the long-term financing for the acquisition, which included the

cost of specific security improvements requested by the lessee.

On December 31, 2015, we acquired certain

commercial real estate from a related party, that is an entity controlled by a shareholder and officer of the Company, to be used

as our corporate office, for $300,000 consisting of $35,000 of land and $265,000 of buildings and improvements. The purchase price

was paid by the Company with the issuance of 300 shares of the Company’s Series A Preferred Stock. The purchase price of

the property was determined by independent third-party appraisal.

Oil and Gas Properties

Effective June 1, 2015, we assigned 100%

of our interest in the Quinlan wells to the operator of those wells in exchange for the cancellation of all current and future

liabilities on the Quinlan wells.

Tower Hotel Fund 2013, LLC

On December 31, 2015, RedHawk Land

& Hospitality, LLC acquired from Beechwood Properties, LLC 280,000 Class A Units (approximately a 2.0%

membership interest) of fully paid, non-assessable units of limited liability company interest in Tower Hotel Fund 2013, LLC,

a real estate development limited liability company formed in the state of Hawaii for acquisition, restoration and

development of the Naniloa Hilo Resort in Hilo, Hawaii. The $625,000 purchase price was paid by the issuance of 625 shares of

the Company’s Series A Preferred Stock. The purchase price was determined by an independent third-party

valuation. Beechwood Properties, LLC is a real estate limited liability Company owned and controlled by G. Darcy Klug, a

stockholder and Chief Financial Officer of the Company.

Intangible Assets

On March 31, 2014, the Company entered

into an asset purchase agreement (the “Agreement”) with American Medical Distributors, LLC (“AMD”) pursuant

to which the Company acquired a five-year license commencing on November 27, 2013 for the exclusive territorial distribution

rights to the Thermofinder non-contact thermometer from AMD in exchange for the issuance of 152,172,287 shares of the Company’s

common stock with a fair value of $320,431 based on the fair value of such shares on the date of issuance. As a part of this asset

acquisition and share issuance, the Company also received a payment of $60,000. The intangible asset is being amortized over the

remaining life of the license agreement. Amortization expense is expected to be approximately $68,664 per year for years 2016,

2017 and 2018 and approximately $57,219 in year 2019.

On December 31, 2015, we acquired certain

tangible and intangible high-quality medical device assets, including the Disintegrator™ Insulin Needle Destruction Unit

(“NDD”) and the Carotid Artery Non-Contact Thermometer. The purchase price was paid by the issuance of 60,000,000 restricted

shares of our common stock, which are subject to vesting based upon the completion by the seller of certain performance milestones

including, but not limited to, successful completion of NDD upgrades, submission for worldwide patents for the NDD, completion

of the first NDD production model, approval by the Company of the initial NDD production run, attaining certain NDD unit sales

and profitability milestones, and receipt of final worldwide patents for the NDD. At December 31, 2015, none of the restricted

shares had vested.

| 5. | LOAN AND INSURANCE NOTE PAYABLE |

We finance a portion of our insurance

premiums. At December 31, 2015, the outstanding balance due on our premium finance agreement was $16,425. The note matures on

May 14, 2016 with interest accruing at 6.5% per annum.

In December 2011, the Company received

a loan in the amount of $156,697 from an unrelated third party. The loan was non-interest bearing, unsecured and due on demand.

On December 11, 2015, the time frame to collect the loan by the third party had expired. Therefore, the loan was written off and

recorded within other income/expense as expiration of indebtedness.

Effective November 12, 2015,

the Company entered into a $100,000 Commercial Note Line of Credit (“Line of Credit”) with a stockholder and

officer of the Company to evidence prior indebtedness and provide for future borrowings. The advances are used to fund our

operations.

The Line of Credit accrues interest at

5% per annum and matures on October 31, 2016. At maturity, or in connection with a pre-payment, subject to the conditions set

forth in the Line of Credit, the stockholder has the right to convert the amount outstanding (or the amount of the prepayment)

into the Company’s Series A Preferred Stock at the par value of $1,000 per share.

At December 31, 2015, the principal

balance plus accrued interest totaled $100,000. At that date, the stockholder elected to convert the outstanding principal

and interest balance into 100 shares of our Series A Preferred Stock.

| 7. | LONG-TERM DEBT, DEBENTURES AND LINE OF CREDIT |

On November 13, 2015, we acquired

certain commercial real estate from a related party that is an entity controlled by a stockholder and officer of the

Company for $480,000 consisting of $75,000 of land costs and $405,000 of buildings and improvements (see Note 3). The

purchase price was paid by through the assumption by the Company of $265,000 of long-term bank indebtedness

(“Note”) plus the issuance of 215 shares of the Company’s newly designated Series A Preferred Stock.

The purchase price also included the cost of specific security improvements requested by the lessee.

The Note is dated November 13, 2015 and

has a principal amount of $265,000. Monthly payments under the Note are $1,962 including interest accruing at a rate of 5.95% per

annum. The Note matures in June 2021 and is secured by the commercial real estate, guarantees by the Company and its real estate

subsidiary and the personal guarantee of a stockholder who is also an officer of the Company.

We have authorized the issuance of up to

$10 million in principal amount of convertible promissory notes (the “Convertible Notes”). The Convertible Notes are

secured by the membership interests in Tower Fund 2013, LLC, a Hawaii limited liability company (see Note 4). The Convertible Notes

mature on the fifth anniversary of the date of issuance and are convertible into shares of our common stock at a price of $0.015

per share. Interest accrues at a rate of 5% per annum and is payable quarterly. Beginning 180 days after issuance of the Convertible

Notes, the Company has the option to issue a notice of its intent to redeem, for cash, an amount equal to the sum of (a) 120% of

the then outstanding principal balance, (b) accrued but unpaid interest and (c) all liquidated damages and other amounts due in

respect of the Convertible Notes. The Company may only issue the notice of its intent to redeem the Convertible Notes if the trading

average of the Company’s common stock equals or exceeds 300% of the conversion price during each of the five business days

immediately preceding the date of the notice of intent to redeem. The holder of the Convertible Notes has the right to convert

all or any portion of the Convertible Notes at the conversion price at any time prior to redemption. At December 31, 2015, there

were $5,000 of convertible debentures outstanding.

Our line of credit with a bank totals

$1,130,000 of which $1,080,000 is outstanding as of December 31, 2015 (See Note 8). The line of credit matures on September

4, 2016 and is secured by marketable securities, a corporate guarantee and the guarantee of a stockholder who is also an

officer of the Company. Interest accrues at the rate of one-month LIBOR plus 3% and is paid monthly. The interest rate at

December 31, 2015 was 3.5%.

Effective on October 13, 2015, we amended

and restated our articles of incorporation as previously adopted by a majority vote of our stockholders. The amended and restated

articles of incorporation, among other things, changed our name to RedHawk Holdings Corp., authorized 5,000 shares of Preferred

Stock, and increased the number of authorized shares of common stock from 375,000,000 to 450,000,000.

Common Stock

On October 15, 2015, we entered into a securities purchase agreement

with an accredited investor for the sale of 5,000,000 shares of our common stock in exchange for $50,000.

Preferred Stock

Pursuant to a certificate of designation

filed with the Secretary of State of the State of Nevada, effective November 12, 2015, 2,000 shares of our authorized Preferred

Stock have been designated as Series A 5% Convertible Preferred Stock, with a $1,000 stated value (“Series A Preferred Stock”).

The holders of the Series A Preferred Stock are entitled to receive cumulative dividends at a rate of 5% per annum, payable quarterly

in cash, or at the Company’s option, such dividends shall be accreted to, and increase, the stated value of the issued Series

A Preferred Stock (“PIK”). Holders of the Series A Preferred Stock are entitled to votes on all matters submitted to

stockholders at a rate of ten votes for each share of common stock into which the Series A Preferred Stock may be converted. After

six months from issuance, each share of Series A Preferred Stock is convertible, at the option of the holder, into the number of

shares of common stock equal to the quotient of the stated value, as adjusted for PIK dividends, by $0.015, as adjusted for stock

splits and dividends.

On November 13, 2015, we issued 215 shares

of our Series A Preferred Stock in connection with the acquisition of certain commercial real estate from a related party which

is an entity controlled by a stockholder and officer of the Company. On December 31, 2015, in exchange for 300 shares of our Series

A Preferred Stock, we acquired from a related party, which is an entity controlled by a stockholder and officer of the Company,

certain real estate to be used as our corporate offices (see Note 3).

On December 31, 2015, we issued 625 shares

of Series A Preferred Stock to acquire certain limited partnership membership interest in a real estate development located in

Hawaii (see Note 4).

On December 31, 2015, a stockholder and

officer of the Company, converted $100,000 of the outstanding principal and interest balance due to the stockholder in exchange

for 100 shares of the Company’s Series A Preferred Stock (see Note 7).

Pursuant to a certificate of designation

filed with the Secretary of State of the State of Nevada, effective December 29, 2015, 1,000 shares of our authorized Preferred

Stock have been designated as Series B 5% Convertible Preferred Stock, with a $1,000 stated value (“Series B Preferred Stock”).

The holders of the Series B Preferred Stock are entitled to receive cumulative dividends at a rate of 5% per annum, payable quarterly

in cash, or at the Company’s option, such dividends shall be accreted to, and increase, the stated value of the issued Series

B Preferred Stock (“PIK”). Holders of the Series B Preferred Stock are entitled to votes on all matters submitted to

stockholders at a rate of ten votes for each share of common stock into which the Series B Preferred Stock may be converted. After

six months from issuance, each share of Series B Preferred Stock is convertible, at the option of the holder, into the number of

shares of common stock equal to the quotient of the stated value, as adjusted for PIK dividends, by $0.01, as adjusted for stock

splits and dividends.

On December 31, 2015, we received, from

a stockholder and officer of the Company, $1,862,458 of cash and marketable securities, net of a $980,000 line of credit balance,

in exchange for 1,000 shares of our Series B Preferred Stock.

| 9. | DISCONTINUED OPERATIONS |

On June 23, 2014, the Company impaired

its remaining oil and natural gas properties and changed its focus to medical products distribution and other businesses. The Company’s

oil and gas properties have been classified as held for sale and are reflected at the estimated fair value expected to be realized

by the Company. As a result of the Company’s impairment of its oil and gas properties and change in direction for the Company’s

business, all expenses related to the oil and natural gas operations have been classified as discontinued operations.

The results of discontinued operations

are summarized as follows:

| | |

For the Six Months

Ended December 31, | |

| | |

2015 | | |

2014 | |

| | |

| | |

| |

| Operating Income | |

$ | - | | |

$ | 444 | |

| | |

| | | |

| | |

| Net Income from Discontinued Operations | |

$ | - | | |

$ | 444 | |

As of January 31, 2015, the Company has

$986,035 of net operating losses carried forward to offset taxable income in future years which expire commencing in fiscal 2026

and run through 2035. Since January 31, 2015, the Company has increased those available net operating losses to offset

future taxable income by $64,031 through the periods ended December 31, 2015. The income tax benefit differs from the amount computed

by applying the U.S. federal income tax rate of 34% due to a valuation allowance established for the fair value of the tax benefit

generated which is discussed in more detail below to net loss before income taxes. At December 31, 2015, the Company had no uncertain

tax positions.

The Company accounts for interest and penalties

relating to uncertain tax provisions in the current period statement of income, as necessary. The Company has never filed a tax

return. In order to utilize the available net operating loss carryforwards, the Company will need to prepare and file all tax returns

since its inception. The Company’s tax years from inception are subject to examination.

Due to the uncertainty surrounding the

realization of the deferred tax assets in future years, our management has determined that it is more likely than not that the

deferred tax assets will not be realized in future periods. Accordingly, the Company has recorded a valuation allowance against

its net deferred tax assets. As of December 31, 2015, the cumulative net operating loss carried forward is $1,050,066 or a net

tax asset of $357,022, which has been fully allowed for and increased by $14,139 due to the tax loss generated during the six month

period ended December 31, 2015.

Effective February 1, 2016, Thomas J. Concannon

was appointed Executive Vice President and Chief Operating Officer and a Director. Upon joining the Company, Mr. Concannon agreed

to invest $250,000 into the Company in exchange for 250 shares of the Company’s Series B Preferred Stock.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Management’s Discussion and

Analysis of Financial Condition and Results of Operations contains forward-looking statements. Forward-looking statements are all

statements other than statements of historical facts. The words “may,” “can,” “will” “should,”

“plans,” “believes,” “estimates,” “expects,” “projects,” “targets,”

“intends,” “potential,” “proposed,” and any similar expressions are intended to identify those

assertions as forward-looking statements. Investors are cautioned that forward-looking statements are predictions and are inherently

uncertain. Actual performance and results may differ materially from that projected or suggested herein due to certain risks and

uncertainties. In evaluating forward-looking statements, you should consider the various factors which may cause actual results

to differ materially from any forward-looking statements, including the risks below and those listed in the “Risk Factors”

section of our latest 10-K report:

| |

· |

Changes in the effects of the significant level of competition that exists in the medical device distribution industry, or our inability to attract customers for other reasons. |

| |

· |

The unexpected cost of regulation applicable to our industry, and the possibility of future additional regulation. |

| |

|

|

| |

· |

Our lack of insurance coverage in the event we incur an unexpected liability. |

| |

|

|

| |

· |

Our lack of a proven operating history and the possibility of future losses that are greater than we currently anticipate. |

| |

|

|

| |

· |

The possibility that we may not be able to generate revenues or access other financing sources necessary to operate our business. |

| |

|

|

| |

· |

Our inability to attract necessary personnel to run and market our business. |

| |

|

|

| |

· |

The volatility of our stock price. |

| |

|

|

| |

· |

Changes in the market prices for our products, or our failure to perform or renew the distribution agreement for our products. |

| |

|

|

| |

· |

Our failure to execute our growth strategy or enter into other lines of business that we may identify as potentially profitable for our company. |

| |

|

|

| |

· |

Changes in economic and business conditions. |

| |

|

|

| |

· |

Changes in accounting policies and practices we may voluntarily adopt or that we may be required to adopt under generally accepted accounting principles in the United States. |

Although we believe that the exceptions

reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance

or achievements. New risks and uncertainties arise over time, and it is not possible for us to predict the occurrence of those

matters or the manner in which they may affect us. Except as required by law, we are not obligated to, and do not intend to, update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Therefore, you should

not rely on these forward-looking statements as of any date subsequent to the date of this Quarterly Report on Form 10-Q.

Overview

RedHawk Holdings Corp.

was incorporated in the State of Nevada on November 30, 2005 under the name “Oliver Creek Resources, Inc. At its

inception, we were an exploration stage company engaged in the acquisition, exploration and development of natural resources.

We discontinued our oil and gas operations in 2014 and changed our business focus, Currently, through subsidiaries, we

are engaged in medical product sales, commercial real estate leasing and financial services. Our medical product sales

include the marketing and distribution of certain professional and consumer grade digital non-contact thermometers. Our real

estate leasing revenues are generated from certain commercial properties under long-term lease. We also hold limited

liability company interest in certain commercial restoration projects in Hawaii. Our financial service revenue is from

brokerage services earned in connection with debt placement services.

Working Capital

| | |

September 30, | | |

June 30, | |

| | |

2015 | | |

2015 | |

| Current Assets | |

$ | 1,937,463 | | |

$ | 11,266 | |

| Current Liabilities | |

$ | 1,267,432 | | |

$ | 273,312 | |

| Working Capital (Deficit) | |

$ | 670,031 | | |

$ | (262,046 | ) |

RESULTS OF OPERATIONS

Operating Revenues

For the period from November 30, 2005 (date

of inception) to December 31, 2015, our Company has earned only minimal operating revenues. During the quarter ended December 31,

2015, we commenced operations in our financial services and commercial real estate leasing business units. On December 31, 2015,

our medical products business unit completed the acquisition of certain specialized tangible and intangible medical devices.

Operating Expenses and Loss from

Continuing Operations

For the three months ended December 31,

2015, we incurred a $(26,709) loss from continuing operations or $nil per share compared with a loss from continuing operations

of $(56,665) or $nil per share for the three months ended December 31, 2014.

Costs and expenses for the three months

ended December 31, 2015 were $187,683 compared with $56,890 for the three months ended December 31, 2014. The increase of $130,793

was principally due to a $112,376 increase in professional fees and a $51,351 increase in management fees. These increases were

partially offset by a $40,054 reduction in amortization expense. Amortization expense relates to the intangible asset acquired

from AMD. The higher professional fees resulted primarily from higher legal costs associated with the various transactional costs

and related regulatory filings completed during the three months ended December 31, 2015. The decrease in management fees resulted

primarily from the resignation and dismissal of certain of our prior executives who were not replaced.

For the six months ended December 31, 2015,

we incurred a $(135,113) loss from continuing operations or $nil per share compared with a loss from continuing operations of $(103,280)

or $nil per share for the six months ended December 31, 2014. After $444 of income from discontinued operations, the Company reported

a net loss of $(102,836) for the six month period ended December 31, 2014.

Costs and expenses for the six

months ended December 31, 2015 were $300,837 compared with $103,505 for the six months ended December 31, 2014. The increase

of $197,332 was principally due to a $173,526 increase in professional fees and a $30,351 increase in management fees.

These increases were partially offset by a $22,888 reduction in amortization expense related to the intangible asset acquired

from AMD. The higher professional fees resulted primarily from higher legal costs associated with various transactional costs

and regulatory filing. The higher management fees were related principally to the non-cash charge of approximately $20,000

of contributed management services by our executive officers. The prior year management fees were partially offset due

to resignation and dismissal of certain of our prior executives who were not replaced.

During the three and six months ended December

31, 2015, we recognized a one-time benefit totaling $156,697 which resulted from the expiration of certain indebtedness obligations.

Liquidity and Capital Resources

As of December 31, 2015, we had cash and

cash equivalents of $16,933 compared with $900 at June 30, 2015. Additionally, at December 31, 2015, we had $1,846,687 of marketable

securities. During the six months ended December 31, 2015, we focused on recapitalizing our balance sheet and reducing cash outlays

for operating costs, including management and consulting fees. These reductions were offset by higher professional fees associated

with transactional costs and regulatory filings. We also concentrated on the completion of certain acquisition which we believe

will provide us with revenue opportunities in the future.

We had total assets at December 31, 2015

of $3,544,670 compared with $245,617 at June 30, 2015. The increase in overall assets was principally due to the December 31, 2015

contribution of cash and marketable securities by a stockholder and officer of the Company.

At December 31, 2015, we had total liabilities

of $1,527,972 compared with $273,312 at June 30, 2015. The increase in total liabilities was principally due to the outstanding

balance of $1,080,000 from the line of credit assumed from a stockholder and officer of the Company, the purchase of certain commercial

real estate including the assumption of $265,000 in bank indebtedness, all of which was partially offset with the expiration of

$156,697 of indebtedness obligations. Subsequent to December 31, 2015, we sold approximately $250,000 of our marketable securities

and reduced the outstanding balance on the line of credit.

Cash Flows

| | |

Six months ended

December 31, | |

| | |

2015 | | |

2014 | |

| Cash Flows used in Operating Activities | |

$ | (253,303 | ) | |

$ | (49,940 | ) |

| Cash Flows used in Investing Activities | |

$ | (5,000 | ) | |

$ | - | |

| Cash provided by Financing Activities | |

$ | 274,336 | | |

$ | 49,900 | |

| Net Increase in Cash During Period | |

$ | 16,033 | | |

$ | 404 | |

Cash Flow from Operating Activities

During the six months ended

December 31, 2015, cash of $253,303 was used in operating activities compared with $49,940 used during the same six month

period ended December 31, 2014. Change to our operating activities are sporatic and result from the early stage of

implementation of our business strategies that are supported by capital raising activities. For the 2015 six month period, a

$73,475 increase in accounts payable, a $20,000 non-cash compensation expense, and a $34,332 non-cash intangible amortization

charge partially offset the $135,113 net loss for the period, increases of $4,250 and $59,227 in accounts receivable and

prepaid expenses, respectively, a $28,635 decrease in amounts due to a related party who is an entity controlled by a

stockholder and officer of the Company and a $156,697 gain from the expiration of certain indebtedness.

The decrease in cash used for operating

activities during the six month period ended December 31, 2014, was attributed a a net loss of $103,280 which was partially offset

by a $57,220 non-cash intangible amortization charge. Significant reduction in day-to-day general and administrative expenses for

our Company which was partially offset by our payables and amounts due to a related party.

Cash Flow from Investing Activities

During the six month period ended

December 31, 2015, we acquired for $5,000 certain intellectual properties in connection with specific medical device

technology including, but not limited to, trademarks, tradenames, clinical trial data, designs, drawings and tooling.

Cash Flows from Financing Activities

During the six month period ended December

31, 2015, we received $50,000 from the issuance and sale of our common stock. This compares to $49,900 received during the same

six month period ended December 31, 2014.

During the six month period ended

December 31, 2015, we received $100,000 from a line of credit with a related party, who is an entity controlled by a stockholder

and officer of the Company, $100,000 from a bank line of credit, $5,000 from the sale of our convertible debentures, $4,165 from

the issuance of our Series B Preferred Stock and $30,048 from an insurance note payable. These proceeds were offset by $13,623

and $1,254 of principal note payments on our insurance note payable and on the long-term debt, respectively.

Non-Cash Investing and Financing

Activities

During the six month period ended

December 31, 2015, we completed several non-cash investing and financing transactions with an entity that is controlled by a

stockholder and an officer of the Company: (i) in exchange for 215 shares of our Series A Preferred Stock and the assumption

of $265,000 of bank indebtedness, we acquired certain commercial real estate for $480,000; (ii) in exchange for 300 shares of

our Series A Preferred Stock, we acquired for $300,000 certain commercial real estate to be used as our corporate offices;

(iii) we acquired 280,000 Class A Units (approximately 2% membership interest) in a real estate development limited

liability company formed for the restoration and development of certain commercial property in Hawaii in exchange for 625

shares of our Series A Preferred Stock; (iv) in exchange for 1,000 shares of our Series B Preferred Stock, we

received approximately $1,862,458 million of cash and marketable securities, net of a $980,000 line of credit balance; and

(v) we issued 100 shares of our Series A Preferred Stock upon the conversion of a $100,000 outstanding balance on our line of

credit.

Going Concern

We have not attained profitable operations

and are dependent upon obtaining financing to pursue any extensive acquisitions and activities. For these reasons, our Independent

Registered Public Accounting Firm stated in their report on our audited financial statements as of January 31, 2015 that they have

substantial doubt that we will be able to continue as a going concern without further financing.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet

arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial

condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material

to stockholders.

Future Financings

We will continue to rely on financial support

from our stockholders and our ability to raise equity capital or debt financing in order to continue to fund our business operations.

Issuances of additional shares and debt instruments convertible into shares of our stock will result in dilution to existing stockholders.

There is no assurance that we will achieve any additional sales of the equity securities or arrange for debt or other financing

to fund our operations and other activities.

Use of Estimates and Critical Accounting

Policies

Our financial statements and accompanying

notes have been prepared in accordance with GAAP applied on a consistent basis. The preparation of financial statements in conformity

with GAAP requires our management to make estimates and assumptions that affect the reported amounts of assets and liabilities,

the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues

and expenses during the reporting periods.

We regularly evaluate the accounting policies

and estimates that we use to prepare our financial statements. A complete summary of these policies is included in the notes to

our financial statements. In general, our management’s estimates are based on historical experience, information from third

party professionals, and various other assumptions that are believed to be reasonable under the facts and circumstances. Actual

results could differ from those estimates made by management.

Recently Issued Accounting Pronouncements

We have implemented all new accounting

pronouncements that are in effect and applicable to us. These pronouncements did not have any material impact on the financial

statements unless otherwise disclosed, and we do not believe that there are any other new accounting pronouncements that have been

issued that might have a material impact on our financial position or results of operations.

ITEM 3. QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

As a smaller

reporting company, we are not required to provide the information under this item.

ITEM 4. CONTROLS

AND PROCEDURES.

Management’s Report on Disclosure

Controls and Procedures

The Company maintains disclosure controls

and procedures that are designed to ensure that information required to be disclosed in the Company’s reports filed under

the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified

in the SEC’s rules and forms, and that such information is accumulated and communicated to our management, including our

Chief Executive Officer and Chief Financial Officer to allow for timely decisions regarding required disclosure.

As of the end of the quarter covered

by this Quarterly Report on Form 10-Q, we carried out an evaluation of the effectiveness of the design and operation of the

Company’s disclosure controls and procedures. Based on the foregoing, our Chief Executive Officer and Chief Financial

Officer concluded, in light of material weaknesses in our internal controls, that the Company’s disclosure controls and

procedures were not effective as of the end of the period covered by this Quarterly Report on Form 10-Q. The Company has a

limited number of employees and, as such, all cash receipts and disbursements are controlled by the Company’s Chief

Executive Officer and the Chief Financial Officer. Therefore, segregation of duties surrounding certain processes are not

adequately maintained. To overcome this material weakness, the Company uses third party accounting experts to assist in the

maintenance of the accounting records and the preparation of the Company’s financial statements to ensure compliance

with accounting and reporting rules and regulations of the SEC. Until

then, the Company believes the use of third party accounting experts will adequately resolve any material

weaknesses currently present.

Changes in Internal Control Over

Financial Reporting

During the period covered by this Quarterly

Report on Form 10-Q, there were no changes in the Company’s internal control over financial reporting that materially affected,

or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

PART II - OTHER INFORMATION

ITEM 1. LEGAL

PROCEEDINGS.

Other than as described below,

we know of no material, existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material

proceeding or pending litigation. Other than as described below, there are no proceedings in which our director, officer or

any affiliates, or any registered or beneficial stockholder, is a party adverse to us or has a material interest adverse to

our interest.

On August 5, 2015, the Company made application

with the Financial Industry Regulatory Authority (“FINRA”) for permission to change the Company’s name and our