UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 Or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2016

Growblox Sciences, Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware

(State or other Jurisdiction of

Incorporation or organization)

|

000-55462

(Commission File Number)

|

59-3733133

(IRS Employer I.D. No.)

|

6450 Cameron Street #110A

Las Vegas, Nevada 89118

Phone: (844) 843-2569

(Address, including zip code, and telephone number, including area code, of

registrant’s principal executive offices)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule l 4a- l 2 under the Exchange Act ( 17 CFR 240. l 4a- l 2)

☐ Pre-commencement communications pursuant to Rule l 4d-2(b) under the Exchange Act (17 CFR 240. l 4d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240. l 3e-4(c))

ITEM 1.01 Material Definitive Agreement.

On February 8, 2016, Growblox Sciences, Inc. (the “Company”) entered into an Amended and Restated 6% Senior Secured Convertible Promissory Note (the “Amended Note”) in the face amount of $2,750,000.00. Under the terms of the Amended Note, the Company is the borrower and Pacific Leaf Ventures, LP (“Pacific Leaf”), is the lender. The Amended Note amends and restates an earlier note dated June 8, 2015, pursuant to which Pacific Leaf advanced to the Company an aggregate of $1,781,872.40 in various increments from June 9, 2015 to January 25, 2016. All of the advances remain outstanding. Accordingly, under the Amended Note, Pacific Leaf can make to the Company new advances in the total additional amount of approximately $1,000,000.00. Each new advance will be made at the request of the Company and in the discretion of Pacific Leaf.

Interest accrues on the outstanding principal amount at the rate of 6% per annum and is paid quarterly. All outstanding principal, or any portion thereof, together with any unpaid interest can be converted at any time at the option of Pacific Leaf into common shares of the Company at the conversion price of $.25 per share, subject to adjustment in the event of certain corporate actions. The maturity date by which all principal and interest shall be paid is May 26, 2020.

The Amended Note was issued pursuant to a Note Purchase Agreement originally entered into between the Company and Pacific Leaf on May 12, 2015, and amended on February 8, 2016, the date of the Amended Note. The Amended Note is secured by a Security Agreement covering certain collateral owned by the Company and/or its wholly owned subsidiary GB Sciences Nevada LLC, a Nevada limited liability company (“GB Sciences”).

Also on February 8, 2016, the Company entered into an Amended and Restated Royalty Agreement wherein Pacific Leaf is entitled to a royalty during a ten year royalty period of between 9.1% and 18.2%, depending on certain contingencies, on the gross sales revenues of GB Sciences. GB Sciences holds a provisional certificate issued by the Division of Public & Behavioral Health of the Nevada Department of Health and Human Services to cultivate medical cannabis at 3550 W. Teco Avenue, Las Vegas, Nevada. The royalty is in exchange for a license from Pacific Leaf to the Company and GB Sciences of certain cannabis growing technologies.

ITEM 9.01 Financial Statements and Exhibits.

|

Exhibit No.

|

Exhibit Description

|

| |

|

|

10.1

|

Amended and Restated 6% Senior Secured Convertible Promissory Note

|

|

10.2

|

Amended and Restated Royalty Agreement

|

|

10.3

|

Omnibus Amendment and Waiver

|

SIGNATURE PAGE

Pursuant to the requirement of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Growblox Sciences, Inc.

|

|

| |

|

|

|

|

|

Dated: February 12, 2016

|

|

By:

|

/s/ John Poss

|

|

| |

|

|

John Poss

|

|

| |

|

|

Chief Financial Officer

|

|

THIS NOTE AND THE UNDERLYING SECURITIES HAVE BEEN ACQUIRED FOR INVESTMENT PURPOSES ONLY AND MAY NOT BE TRANSFERRED UNTIL (i) A REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”) SHALL HAVE BECOME EFFECTIVE WITH RESPECT THERETO OR (ii) RECEIPT BY THE COMPANY OF AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY TO THE EFFECT THAT REGISTRATION UNDER THE ACT IS NOT REQUIRED IN CONNECTION WITH SUCH PROPOSED TRANSFER NOR IS IN VIOLATION OF ANY APPLICABLE STATE SECURITIES LAWS. THIS LEGEND SHALL BE ENDORSED UPON ANY NOTE ISSUED IN EXCHANGE FOR THIS NOTE.

GROWBLOX SCIENCES, INC.

Amended and Restated

6% Senior Secured Convertible Promissory Note

$2,750,000.00 As of June 8, 2015 (the “Original Issue Date”)

FOR VALUE RECEIVED, GROWBLOX SCIENCES, INC., a Delaware corporation (the “Company”) with its principal executive office at 6450 Cameron Blvd., Suite 110A, Las Vegas, Nevada 89118, promises to pay to the order of PACIFIC LEAF VENTURES, LP (the “Payee” or the “Holder of this Note”) or registered assigns, the principal amount of Two Million Seven Hundred Fifty Thousand Dollars ($2,750,000) Dollars, or such lesser amount as shall equal the aggregate unpaid principal amount of the loans made from time to time by Payee to the Company hereunder (the “Principal Amount”), together with interest on such Principal Amount, on May 26, 2020 (the “Maturity Date”). Interest on this Amended and Restated Senior Secured Convertible Promissory Note (this “Note”) shall accrue on the Principal Amount outstanding from time to time at a rate per annum computed in accordance with Section 2 hereof.

This Note amends and restates in its entirety, and is issued in substitution of and exchange for, but not in payment of, that certain 6% Senior Secured Convertible Promissory Note, dated June 8, 2015, in the principal amount of $1,750,000.00, made by the Company in favor of the Payee. As of the date of this Note, the Payee has provided aggregate loans to the Company in the amount of $1,781,872.40, as set forth on Schedule A attached hereto.

The amount of each loan made by Payee to the Company under this Note, the date each such loan is made, and the amount of payment or prepayment made by the Company on account of such loans shall be endorsed by Payee on its books, and, prior to any transfer of this Note, endorsed by Payee on Schedule A attached hereto or any continuation thereof. Any failure by Payee to so endorse shall in no way mitigate or discharge the obligation of the Company to repay any loan actually made.

Interest shall accrue on the Principal Amount outstanding from time to time and shall be payable (i) quarterly in arrears commencing on July 1, 2015 and on the first day of each calendar quarter thereafter, (ii) upon maturity (whether at the Maturity Date, by acceleration or otherwise) and (iii) at any time after maturity until paid in full (after as well as before judgment), on demand. All computations of interest hereunder shall be made based on the actual number of days elapsed in a year of 365 days (including the first day but excluding the last day during which any such Principal Amount is outstanding). All payments by the Company hereunder shall be applied first to pay any interest which is due, but unpaid, and then to reduce the Principal Amount.

Each payment by the Company pursuant to this Note shall be made without set-off or counterclaim and in immediately available funds. The Company (i) waives presentment, demand, protest or notice of any kind in connection with this Note and (ii) agrees to pay to the Holder of this Note, on demand, all costs and expenses (including reasonable and documented legal fees and expenses) incurred in connection with the enforcement and collection of this Note.

This Note has been issued to Payee pursuant to a Note Purchase Agreement (as amended from time to time, the “Note Purchase Agreement”) originally entered into between the Company and the Payee on May 12, 2015 and amended on February __, 2016, and is secured by a Security Agreement (as amended from time to time, the “Security Agreement”) among the Company ,GB Sciences Nevada LLC (“GBS Nevada”) and Payee, covering certain collateral (the “Collateral”), all as more particularly described and provided therein, and is entitled to the benefits thereof. The Security Agreement and any and all other documents executed and delivered by the Company or GBS Nevada to Payee under which Payee is granted liens on assets of the Company or GBS Nevada in connection with the transactions contemplated by the Note Purchase Agreement are collectively referred to as the “Security Documents.”

Unless otherwise defined in this Note, capitalized terms used herein shall have the meanings set forth in the Note Purchase Agreement.

1. Principal Repayment

A. Optional Prepayment. At any time from and after the Issue Date, the Company may prepay this Note, without premium or penalty, in whole or in part, with accrued interest to the date of such prepayment on the amount prepaid, subject to Section 1B below.

B. Notice of Prepayment. Before the Company shall be permitted to prepay this Note pursuant to 1A hereof, the Company shall provide thirty (30) days prior notice to the Payee of its intent to make such prepayment, which notice shall state the date and amount of such prepayment (the “Prepayment Date”). The Payee shall have the option at any time prior to the Prepayment Date to elect to convert this Note pursuant to Section 5 below.

2. Computation of Interest.

A. Base Interest Rate. Subject to Sections 2B and 2C below, the outstanding Principal Amount shall bear interest at the rate of six (6%) percent per annum.

B. Penalty Interest. Upon the occurrence and during the continuance of an Event of Default (as defined below), the rate of interest applicable to the unpaid Principal Amount shall be increased to ten (10%) percent per annum.

C. Maximum Rate. In the event that it is determined that, under the laws relating to usury applicable to the Company or the indebtedness evidenced by this Note (“Applicable Usury Laws”), the interest charges and fees payable by the Company in connection herewith or in connection with any other document or instrument executed and delivered in connection herewith cause the effective interest rate applicable to the indebtedness evidenced by this Note to exceed the maximum rate allowed by law (the “Maximum Rate”), then such interest shall be recalculated for the period in question and any excess over the Maximum Rate paid with respect to such period shall be credited, without further agreement or notice, to the Principal Amount outstanding hereunder to reduce said balance by such amount with the same force and effect as though the Company had specifically designated such extra sums to be so applied to principal and the Payee had agreed to accept such extra payment(s) as a premium-free prepayment. All such deemed prepayments shall be applied to the principal balance payable at maturity. In no event shall any agreed-to or actual exaction as consideration for this Note exceed the limits imposed or provided by Applicable Usury Laws in the jurisdiction in which the Company is resident applicable to the use or detention of money or to forbearance in seeking its collection in the jurisdiction in which the Company is resident.

3. Covenants of Company.

A. Affirmative Covenants. The Company covenants and agrees that, so long as this Note shall be outstanding, unless it has otherwise obtained the prior written consent of the Payee, it will perform the obligations set forth in this Section 3A:

(i) Taxes and Levies. The Company (and each of its subsidiaries) will promptly pay and discharge all taxes, assessments, and governmental charges or levies imposed upon the Company or upon its income and profits, or upon any of its property, before the same shall become delinquent, as well as all claims for labor, materials and supplies which, if unpaid, might become a lien or charge upon such properties or any part thereof; provided, however, that the Company shall not be required to pay and discharge any such tax, assessment, charge, levy or claim so long as the validity thereof shall be contested in good faith by appropriate proceedings and the Company shall set aside on its books adequate reserves in accordance with generally accepted accounting principles with respect to any such tax, assessment, charge, levy or claim so contested;

(ii) Maintenance of Existence. The Company (and each of its subsidiaries) will do or cause to be done all things reasonably necessary to preserve and keep in full force and effect its corporate existence, rights and franchises and comply with all laws applicable to the Company, except where the failure to comply would not have a material adverse effect on the Company;

(iii) Maintenance of Property. The Company (and each of its subsidiaries) will at all times reasonably maintain, preserve, protect and keep its property used or useful in the conduct of its business in good repair, working order and condition (ordinary wear and tear excepted), and from time to time make all needful and proper repairs, renewals, replacements and improvements thereto as shall be reasonably required in the conduct of its business;

(iv) Maintenance of MME Certificates. The Company will cause GBS Nevada to hold a duly issued provisional certificate or successor certificate from the Division of Public & Behavioral Health of the Nevada Department of Health and Human Services to operate an establishment to cultivate medical cannabis at 3550 W. Teco Avenue, Las Vegas, Nevada (the “Teco Facility”) until the Teco Facility becomes operational, and the Company will thereafter cause GBS Nevada to operate the Teco Facility in accordance with all Nevada Legal Requirements (including, without limitation, by obtaining and maintaining all required certificates, permits and licenses from all applicable state and local governmental authorities required for operating the Teco Facility to cultivate medical cannabis);

(v) Insurance. The Company (and each of its subsidiaries) will, to the extent necessary for the operation of its business, keep adequately insured by financially sound reputable insurers, all property of a character usually insured by similar corporations and carry such other insurance as is usually carried by similar corporations;

(vi) Books and Records. The Company (and each of its subsidiaries) will at all times keep true and correct books, records and accounts reflecting all of its business affairs and transactions in accordance with GAAP. Such books and records shall be open at reasonable times and upon reasonable notice to the inspection of the Payee or its agents;

(vii) Notice of Certain Events. The Company (and each of its subsidiaries) will give prompt written notice (with a description in reasonable detail) to the Payee of the occurrence of any Event of Default or any event which, with the giving of notice or the lapse of time, would constitute an Event of Default;

(viii) Management of GBS Nevada. The Company shall obtain the prior written consent of the Payee to the appointment of all persons serving as a managers and/or chief executive officer of GBS Nevada, or otherwise principally responsible for oversight of the operations of the Teco Facility; and

(ix) Compliance with Laws. The Company will comply, and cause each Subsidiary, including, without limitation, GBS Nevada, to comply, in all material respects with all applicable laws, ordinances, rules, regulations, and requirements of governmental authorities (including, without limitation, Nevada Legal Requirements).

B. Negative Covenants. The Company covenants and agrees that, so long as this Note shall be outstanding, unless it has otherwise obtained the prior written consent of the Payee, it will perform the obligations set forth in this Section 3B:

(i) Liquidation, Dissolution. The Company will not (and will not permit any of its subsidiaries to) liquidate or dissolve, consolidate with, or merge into or with, any other corporation or other entity, except that any wholly-owned subsidiary may merge with another wholly-owned subsidiary or with the Company (so long as the Company is the surviving corporation and no Event of Default shall occur as a result thereof); provided, however, such prior written consent shall not be required in connection with the consummation of any merger or change of control transaction which results in prepayment of the Note pursuant to the terms of this Note;

(ii) Sales of Assets. The Company will not (nor permit any of its subsidiaries with respect to their assets and properties), other than in the ordinary course of business, sell, transfer, lease or otherwise dispose of, or grant options, warrants or other rights with respect to, all or a substantial part of its properties or assets material to the Company’s business to any person or entity; provided, however, such prior written consent shall not be required in connection with licenses or other rights granted by the Company to a strategic partner, licensee or distributor as approved by the Board of Directors of the Company (the “Board of Directors”);

(iii) Redemptions. The Company will not redeem or repurchase any outstanding equity and/or debt securities of the Company (or its subsidiaries), except for (a) repurchases of outstanding warrants prior to May 15, 2015 for nominal consideration, or (b) repurchases of unvested or restricted shares of Common Stock, at cost, from employees, consultants or members of the Board of Directors pursuant to repurchase options of the Company (1) currently outstanding or (2) hereafter entered into pursuant to a stock option plan or restricted stock plan approved by the Company’s Board of Directors;

(iv) Indebtedness. Company will hereafter not create, incur, assume or suffer to exist, contingently or otherwise, any indebtedness which is not expressly subordinate in all respects to this Note, provided, that this covenant shall not apply to (A) capitalized leases, purchase money indebtedness (secured solely by Liens on the equipment or assets leased or purchased), (B) accounts payable, or (C) other accrued expenses incurred by the Company in the ordinary course of business;

(v) Negative Pledge. Other than with respect to this Note, the Company will not (nor will it permit its subsidiaries to) hereafter create, incur, assume or suffer to exist any mortgage, pledge, hypothecation, assignment, security interest, encumbrance, lien (statutory or other), preference, priority or other security agreement or preferential arrangement of any kind or nature whatsoever (including any conditional sale or other title retention agreement and any financing lease) (each, a “Lien”) upon any of its property, revenues or assets, whether now owned or hereafter acquired, except any of the following (collectively, “Permitted Liens”):

(a) Liens granted to secure indebtedness incurred (i) to finance the acquisition (whether by purchase or capitalized lease) of tangible assets or (ii) under equipment leases or purchase money indebtedness, but in each case, only on the assets acquired with the proceeds of such indebtedness;

(b) Liens for taxes, assessments or other governmental charges or levies not at the time delinquent or thereafter payable without penalty or being contested in good faith by appropriate proceedings and for which adequate reserves in accordance with GAAP shall have been set aside on its books;

(c) Liens of carriers, warehousemen, mechanics, materialmen and landlords incurred in the ordinary course of business for sums not overdue or being contested in good faith by appropriate proceedings and for which adequate reserves in accordance with GAAP shall have been set aside on its books;

(d) Liens incurred in the ordinary course of business in connection with workers’ compensation, unemployment insurance or other forms of governmental insurance or benefits, or to secure performance of tenders, statutory obligations, leases and contracts (other than for borrowed money) entered into in the ordinary course of business or to secure obligations on surety or appeal bonds; and

(e) judgment Liens in existence less than 30 days after notice of the entry thereof is forwarded to the Company or with respect to which execution has been stayed.

(vi) Transactions with Affiliates. The Company will not (and will not permit any of its subsidiaries to) enter into any transaction after the Issue Date, including, without limitation, the purchase, sale, lease or exchange of property, real or personal, the purchase or sale of any security, the borrowing or lending of any money, or the rendering of any service, with any person or entity affiliated with the Company or any of its subsidiaries (including officers, directors and shareholders owning five (5%) percent or more of the Company’s outstanding capital stock), except in the ordinary course of and pursuant to the reasonable requirements of its business and upon fair and reasonable terms not less favorable than would be obtained in a comparable arms-length transaction with any other person or entity not affiliated with the Company as determined by the Board of Directors in good faith.

(vii) Dividends. The Company will not declare or pay any cash dividends or distributions on its outstanding capital stock.

(viii) GBS Nevada. The Company shall not allow any reduction of its membership interest or distribution rights in GBS Nevada.

4. Events of Default.

If any of the following events shall occur for any reason whatsoever (and whether such occurrence shall be voluntary or involuntary or come about or be effected by operation by law or otherwise) (each, an “Event of Default”):

(i) Non-Payment of Obligations. The Company shall default in the payment of the principal of this Note as and when the same shall become due and payable (whether by acceleration or otherwise) or shall fail to pay accrued interest on this Note within five (5) business days of when the same shall become due and payable (whether by acceleration or otherwise);

(ii) Non-Performance of Affirmative Covenants. The Company shall default in the due observance or performance of any covenant set forth in Section 3A, which default shall continue uncured for ten (10) days;

(iii) Non-Performance of Negative Covenants. The Company shall default in the due observance or performance of any covenant set forth in Section 3B, and, if capable of cure, such default shall not have been cured within ten (10) days;

(iv) Bankruptcy, Insolvency, Etc. The Company (or any of its subsidiaries) shall:

(a) in any legal document admit in writing its inability to pay its debts as they become due;

(b) apply for, consent to, or acquiesce in, the appointment of a trustee, receiver, sequestrator or other custodian for the Company or any of its property, or make a general assignment for the benefit of creditors;

(c) in the absence of such application, consent or acquiesce in, permit or suffer to exist the appointment of a trustee, receiver, sequestrator or other custodian for the Company or for any part of its property;

(d) permit or suffer to exist the commencement of any bankruptcy, reorganization, debt arrangement or other case or proceeding under any bankruptcy or insolvency law, or any dissolution, winding up or liquidation proceeding, in respect of the Company, and, if such case or proceeding is not commenced by the Company or converted to a voluntary case, such case or proceeding shall be consented to or acquiesced in by the Company or shall result in the entry of an order for relief; or

(e) take any corporate or other action authorizing, or in furtherance of, any of the foregoing;

(v) Teco Facility. GBS Nevada shall fail to hold any required provisional or permanent certificate (as applicable) under State or local law for the operation of the Teco Facility as an establishment to cultivate medical cannabis, or the Teco Facility shall fail to become fully operational as a medical cannabis cultivation facility by July 30, 2016;

(vi) Cross-Default. The Company shall default in the payment when due, after the expiration of any applicable grace period, of any amount payable under any other obligation of the Company for money borrowed in excess of $100,000;

(vii) Cross-Acceleration. Any other indebtedness for borrowed money of the Company (or any of its subsidiaries) in an aggregate principal amount exceeding $100,000 shall be duly declared to be or shall become due and payable prior to the stated maturity thereof or shall not be paid as and when the same becomes due and payable including any applicable grace period;

(viii) Other Breaches, Defaults. The Company or any of its subsidiaries (including, without limitation, GBS Nevada) shall default or be in breach of any term or provision of this Note, any other Transaction Document, the Amended and Restated Royalty Agreement, dated as of February 8, 2016, between the Company and the Payee, or the Omnibus Amendment and Waiver, dated as of February 8, 2016, between the Company, GBS Nevada and the Payee, in each case, in any material respect, for a period of ten (10) days, or any material representation or warranty made by the Company to the Payee in any Transaction Document shall be materially false or misleading; or

(ix) Security Documents. The Security Documents shall cease to create a valid and perfected Lien in and to any material Collateral;

then, and in any such event, the Payee shall, by notice to the Company, take or cause to be taken any or all of the following actions, without prejudice to the rights of Payee to enforce its claims against the Company: (1) declare the principal of and any accrued interest and all other amounts payable under this Note to be due and payable, whereupon the same shall become, forthwith due and payable without presentment, demand, protest or other notice of any kind, all of which are hereby waived by the Company, (2) proceed to enforce or cause to be enforced any remedies provided under the Security Agreement, and (3) exercise any other remedies available at law or in equity, either by suit in equity or by action at law, or both, whether for specific performance of any covenant or other agreement contained in this Note; provided, that upon the occurrence of any Event of Default referred to in Section 4(v) then (without prejudice to the rights and remedies specified in clause (3) above) automatically, without notice, demand or any other act by any Holder, the principal of and any accrued interest and all other amounts payable under this Note shall become immediately due and payable without presentment, demand, protest or other notice of any kind, all of which are hereby expressly waived by the Company, anything contained in this Note to the contrary notwithstanding. No remedy conferred in this Note upon any Holder is intended to be exclusive of any other remedy, and each and every such remedy shall be cumulative and shall be in addition to every other remedy conferred herein or now or hereinafter existing at law or in equity or by statute or otherwise.

5. Conversion of Note.

A. Optional Conversion. The Holder of this Note shall have the option, at any time and from time to time, prior to the date on which the Company makes payment in full of the Principal Amount of this Note in accordance herewith, all accrued interest thereon and all other amounts due and payable thereunder to convert all or any portion of the outstanding Principal Amount of this Note plus all accrued and unpaid interest thereon (such Principal Amount and accrued and unpaid interest to be so converted the “Conversion Amount”) into shares of common stock, par value $.0001 per share (“Common Stock”), of the Company at an initial conversion price per share equal to $0.25 per share (the “Conversion Price”), subject to adjustment as provided in subsection 5F below. The shares of Common Stock issuable upon conversion of this Note at the Conversion Price are referred to herein as the “Conversion Shares.”

B. Conversion Limitation. Notwithstanding anything contained herein to the contrary, the Holder shall not be entitled to convert pursuant to the terms of this Note an amount that would be convertible into that number of Conversion Shares which would exceed the difference between the number of shares of Common Stock beneficially owned by such Holder and 4.99% of the outstanding shares of Common Stock of the Company. For the purposes of the immediately preceding sentence, beneficial ownership shall be determined in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended, and Regulation 13d-3 thereunder. The Holder may void the Conversion Share limitation described in this Section 5B upon 65 days prior notice to the Company or without any notice requirement upon an Event of Default.

C. Mechanics of Conversion.

(i) Before the Holder of this Note shall be entitled to convert this Note into shares of Common Stock pursuant to Section 5A, such holder shall give written notice to the Company in the form attached hereto as Annex A (“Conversion Notice”), at its principal corporate office, by email, facsimile or otherwise, of the election to convert the same and shall state therein the Conversion Amount and the name or names in which the certificate or certificates for shares of Common Stock are to be issued. On or before the third (3rd) business day following the date of receipt of a Conversion Notice, the Company shall (A) if legends are not required to be placed on certificates of Common Stock pursuant to the then existing provisions of Rule 144 of the Securities Act of 1933 (“Rule 144”) and provided that the Company’s transfer agent is participating in the Depository Trust Company's (“DTC”) Fast Automated Securities Transfer Program, credit such aggregate number of shares of Common Stock to which the Holder shall be entitled to the Holder’s or its designee’s balance account with DTC, or (B) if the Company’s transfer agent is not participating in the DTC Fast Automated Securities Transfer Program, issue and deliver to the address as specified in the Conversion Notice, a certificate, registered in the name of the Holder or its designee, for the number of shares of Common Stock to which the Holder shall be entitled which certificates shall not bear any restrictive legends unless required pursuant the Rule 144.

(ii) All Common Stock which may be issued upon conversion of the Note will, upon issuance, be duly issued, fully paid and non-assessable and free from all taxes, liens, and charges with respect to the issuance thereof.

D. Authorized Shares. At all times the Company shall have authorized and shall have reserved a sufficient number of shares of Common Stock to provide for the conversion of the Principal Amount outstanding under this Note at the then effective Conversion Price. Without limiting the generality of the foregoing, if, at any time, the Conversion Price is decreased, the number of shares of Common Stock authorized and reserved for issuance upon the conversion of this Note shall be proportionately increased.

E. Failure to Timely Deliver Shares. If within five (5) business days after the Company’s receipt of the facsimile or email copy of a Conversion Notice, the Company shall fail to issue and deliver to the Holder the number of shares of Common Stock to which the Holder is entitled upon such Holder's conversion of this Note (a “Conversion Failure”), the Company shall pay to the Holder $3,000 per day until the Company issues and delivers a certificate to the Holder for the number of shares of Common Stock to which the Holder is entitled upon such Holder’s conversion of any portion of the Principal Amount of this Note. If the Company fails to deliver shares in accordance with the timeframe stated in this Section, resulting in a Conversion Failure, the Holder, at any time prior to selling all of those shares, may rescind any portion, in whole or in part, of that particular Conversion Notice attributable to the unsold shares.

F. Anti-Dilution Provisions. The Conversion Price in effect at any time and the number and kind of securities issuable upon the conversion of this Note shall be subject to adjustment from time to time upon the happening of certain events as follows:

(i) In case the Company shall hereafter (i) declare a dividend or make a distribution on its outstanding shares of Common Stock in shares of Common Stock, (ii) subdivide or reclassify its outstanding shares of Common Stock into a greater number of shares, or (iii) combine or reclassify its outstanding shares of Common Stock into a smaller number of shares, the Conversion Price in effect at the time of the record date for such dividend or distribution or of the effective date of such subdivision, combination or reclassification shall be adjusted so that it shall equal the price determined by multiplying the Conversion Price by a fraction, the denominator of which shall be the number of shares of Common Stock outstanding after giving effect to such action, and the numerator of which shall be the number of shares of Common Stock outstanding immediately prior to such action. Such adjustment shall be made successively whenever any event listed above shall occur.

(ii) Whenever the Conversion Price is adjusted pursuant to Subsection (i) above, the number of Conversion Shares issuable upon conversion of this Note shall simultaneously be adjusted by multiplying the number of Conversion Shares initially issuable upon conversion of this Note by the Conversion Price in effect on the date hereof and dividing the product so obtained by the Conversion Price, as adjusted.

(iii) In case of any reorganization, reclassification or change of the Common Stock (including any such reorganization, reclassification or change in connection with a consolidation or merger in which the Company is the continuing entity), or any consolidation of the Company with, or merger of the Company with or into, any other entity (other than a consolidation or merger in which the Company is the continuing entity), or of any sale of the properties and assets of the Company as, or substantially as, an entirety to any other person or entity, this Note shall thereafter be convertible into the kind and amount of stock or other securities or property receivable upon such reorganization, reclassification, change, consolidation, merger or sale by a Holder of the number of shares of Common Stock into which this Note would have been converted prior to such transaction. The provisions of this subsection (iii) shall similarly apply to successive reorganizations, reclassifications, changes, consolidations, mergers or sales immediately prior to such reorganization, reclassification, change, consolidation, merger or sale.

6. Amendments and Waivers.

A. The provisions of this Note may from time to time be amended, modified or supplemented, if such amendment, modification or supplement is in writing and consented to by the Company and the Payee.

B. No failure or delay on the part of the Payee in exercising any power or right under this Note shall operate as a waiver thereof, nor shall any single or partial exercise of any such power or right preclude any other or further exercise thereof or the exercise of any other power or right. No notice to or demand on the Company in any case shall entitle it to any notice or demand in similar or other circumstances. No waiver or approval by the Payee shall, except as may be otherwise stated in such waiver or approval, be applicable to subsequent transactions. No waiver or approval hereunder shall require any similar or dissimilar waiver or approval thereafter to be granted hereunder.

C. To the extent that the Company makes a payment or payments to the Payee, and such payment or payments or any part thereof are subsequently for any reason invalidated, set aside and/or required to be repaid by the Payee to a trustee, receiver or any other party under any bankruptcy law, state or federal law, common law or equitable cause, then to the extent of such recovery, the obligation or part thereof originally intended to be satisfied, and all rights and remedies therefor, shall be revived and continued in full force and effect as if such payment had not been made by the Payee or such enforcement or setoff had not occurred.

7. Miscellaneous.

A. Parties in Interest. All covenants, agreements and undertakings in this Note binding upon the Company or the Payee shall bind and inure to the benefit of its successors and permitted assigns of the Company and the Payee, respectively, whether so express or not.

B. Governing Law. This Note shall be governed by and construed in accordance with the laws of the State of New York without regard to the conflicts of laws principles thereof. Sections 5-1401 and 5-1402 of the General Obligations Law of the State of New York shall apply to this Note, and the Company hereby waives any right to stay or dismiss on the basis of forum non conveniens any action or proceeding brought before the courts of the State of New York sitting in New York County or of the United States of America for the Southern District of New York, and hereby submits to the jurisdiction of such courts.

C. Waiver of Jury Trial. THE PAYEE AND THE COMPANY HEREBY KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVE ANY RIGHTS THEY MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION BASED HEREON, OR ARISING OUT OF, UNDER, OR IN CONNECTION WITH THIS NOTE OR ANY OTHER DOCUMENT OR INSTRUMENT EXECUTED AND DELIVERED IN CONNECTION HEREWITH OR ANY COURSE OF CONDUCT, COURSE OF DEALING, STATEMENTS (WHETHER VERBAL OR WRITTEN) OR ACTIONS OF THE PAYEE OR THE COMPANY. THIS PROVISION IS A MATERIAL INDUCEMENT FOR THE PAYEE’S PURCHASING THIS NOTE.

[Signature Page Follows]

IN WITNESS WHEREOF, this Note has been executed and delivered on February 8, 2016, as of the Original Issue Date, by a duly authorized representative of the Company.

GROWBLOX SCIENCES, INC.

By: /s/ John Poss

Name: John Poss

Title: President

SCHEDULE A

LOANS

|

Date Loan Made

|

Amount of Loan

|

Amount Paid

|

Unpaid Principal Amount

|

Notation

Made By

|

|

June 9, 2015

|

$100,000.00

|

--

|

$100,000.00

|

|

|

July 1, 2015

|

$200,000.00

|

--

|

$300,000.00

|

|

|

July 22, 2015

|

$200,000.00

|

--

|

$500,000.00

|

|

|

July 30, 2015

|

$200,000.00

|

--

|

$700,000.00

|

|

|

August 17, 2015

|

$100,000.00

|

--

|

$800,000.00

|

|

|

August 27, 2015

|

$200,000.00

|

--

|

$1,000,000.00

|

|

|

September 17, 2015

|

$200,000.00

|

--

|

$1,200,000.00

|

|

|

October 5, 2015

|

$200,000.00

|

--

|

$1,400,000.00

|

|

|

October 22, 2015

|

$100,000.00

|

--

|

$1,500,000.00

|

|

|

November 4, 2015

|

$100,000.00

|

--

|

$1,600,000.00

|

|

|

November 16, 2015

|

$50,000.00

|

--

|

$1,650,000.00

|

|

|

December 7, 2015

|

$31,844.00

|

--

|

$1,681,844.00

|

|

|

December 10, 2015

|

$3,184.40

|

--

|

$1,685,028.40

|

|

|

December 22, 2015

|

$33,000.00

|

--

|

$1,718,028.40

|

|

|

December 29, 2015

|

$31,844.00

|

--

|

$1,749,872.40

|

|

|

January 3, 2016

|

$7,000.00

|

--

|

$1,756,872.40

|

|

|

January 25, 2016

|

$25,000.00

|

--

|

$1,781,872.40

|

|

| |

|

|

|

|

ANNEX A

CONVERSION NOTICE

The undersigned hereby elects to convert principal and/or interest under the Amended and Restated 6% Senior Secured Convertible Promissory Note, originally issued as of June 8, 2015 (the “Note”) of Growblox Sciences, Inc., a Delaware corporation (the “Company”), into shares of common stock (the “Common Stock”), of the Company according to the conditions hereof and the Note, as of the date written below. If shares of Common Stock are to be issued in the name of a person other than the undersigned, the undersigned will pay all transfer taxes payable with respect thereto and is delivering herewith such certificates and opinions as reasonably requested by the Company in accordance therewith. No fee will be charged to the holder for any conversion, except for such transfer taxes, if any.

By the delivery of this Notice of Conversion the undersigned represents and warrants to the Company that its ownership of the Common Stock does not exceed the amounts specified under Section 5B of the Note, as determined in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended.

Conversion calculations:

Date to Effect Conversion:

Principal Amount of Note to be Converted:

Amount of Interest of Note to be Converted:

Number of shares of Common Stock to be issued:

Signature:

Name:

Address for Delivery of Common Stock Certificates:

Or

DWAC Instructions:

Broker No:

Account No:

AMENDED AND RESTATED ROYALTY AGREEMENT

This Amended and Restated Royalty Agreement (this “Agreement”), dated and effective as of February 8, 2016 (the “Effective Date”), by and between GrowBlox Sciences, Inc. a Delaware corporation (“GBS Delaware”), GB Sciences Nevada LLC, a Nevada limited liability company (“GBS Nevada”), and Pacific Leaf Ventures, LP, a California limited partnership (“PACIFIC LEAF”), amends and restates in its entirety that certain Royalty Agreement dated May 12, 2015, by and between GBS Delaware and PACIFIC LEAF (the “Original Royalty Agreement”).

RECITALS

A. GBS Delaware is the sole member of GBS Nevada. GBS Nevada holds a provisional certificate issued by the Division of Public & Behavioral Health of the Nevada Department of Health and Human Services to operate an establishment to cultivate medical cannabis at 3550 W. Teco Avenue, Las Vegas, Nevada (the “Teco Facility”).

B. GBS Nevada is also a party to that certain Binding Letter of Separation (the “Letter Agreement”), dated as of August 17, 2015, between GBS Nevada and GBS Nevada Partners LLC (“GBS Partners”), which provides for GBS Nevada and GBS Partners to enter into a Consignment and Delivery Agreement (the “CDA”, and together with the Letter Agreement, the “GBS Partners Agreements”). Pursuant to the GBS Partners Agreements, GBS Nevada is entitled to (i) 20% of the shelf space at the dispensaries operated by GBS Partners for consignment sales of GBS Nevada’s medical cannabis products, and (ii) 10% of the profits and distributions of GBS Partners’ dispensary operations (the “Profits Interest”).

C. PACIFIC LEAF has developed certain proprietary know-how and other intellectual property for the cultivation of cannabis and the extraction of oils and other constituents from cannabis (the “Intellectual Property”), and has provided GBS Nevada and GBS Delaware with financial support, advice and services (collectively, the “Support”), including, without limitation, pursuant to that certain Amended and Restated 6% Senior Secured Convertible Promissory Note, dated as of the date hereof, made by GBS Delaware in favor of PACIFIC LEAF, in the principal amount of $2,750,000 (the “Note”).

D. Pursuant to the Original Royalty Agreement, PACIFIC LEAF has provided the Intellectual Property to GBS Delaware for the use of GBS Nevada in its operations in the State of Nevada.

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing recitals, the mutual promises and covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

ARTICLE I

LICENSE AND ROYALTY

1.1 Transfer and Use of Intellectual Property. GBS Nevada shall have the right to use the Intellectual Property in perpetuity in its operations within the State of Nevada. In addition, any other entity owned, controlled, or otherwise affiliated with GBS Delaware (collectively, the “Affiliates”) shall have the right to use the Intellectual Property within the State of Nevada. Any other use or transfer of the Intellectual Property by GBS Delaware, GBS Nevada, or the Affiliates shall require the explicit written authorization of PACIFIC LEAF following additional negotiations, agreements, and consideration. Any and all costs of equipment, related installation expenses, and operational expenses related to the implementation and use of the Intellectual Property by GBS Nevada and Affiliates shall be the sole responsibility of GBS Delaware, GBS Nevada, and the Affiliates, provided however that the hiring of all control personnel in connection with the installation, cultivation or extraction operations of GBS Nevada shall require the approval of PACIFIC LEAF, which approval shall not be unreasonably withheld or delayed.

1.2 Royalty Payments. In consideration of the transfer by PACIFIC LEAF of the Intellectual Property pursuant to the Section 1.1, and the Support provided by PACIFIC LEAF to GBS Nevada and GBS Delaware, during the period (the “Royalty Period”) commencing on the Effective Date and ending ten (10) years after the date the first royalty payment in excess of twenty-five thousand dollars ($25,000) is made to PACIFIC LEAF pursuant to this Agreement (the “First Royalty Payment Date”), GBS Nevada shall pay to PACIFIC LEAF within forty-five (45) days after the end of each calendar quarter an amount equal to the Royalty Rate (defined below) multiplied by the gross sales revenues of GBS Nevada and its subsidiaries from all sources during the preceding fiscal quarters, including, without limitation (i) from the sale of cannabis produced at the Teco Facility, (ii) from the sale of its cannabis at dispensaries operated by GBS Partners, and (iii) received by it in respect of the Profits Interest issued to under the GBS Partners Agreements. The Royalty Rate at any time shall be equal to the sum of (i) 9.1%, and (ii) 9.1% multiplied by a fraction, the numerator of which shall be equal to the maximum amount by which the aggregate advances by PACIFIC LEAF to GBS Delaware at any one time outstanding under the Note prior the date of the applicable royalty payment exceeded $1,750,000, and the denominator of which shall be equal to $1,000,000; provided, however, that following the later of (i) the seventh anniversary of the First Royalty Payment Date, and (ii) the date that all amounts outstanding under the Note have been repaid in full, the Royalty Rate shall be reduced by 50%.

1.3 SEC Filing. Concurrently with or prior to each royalty payment made under Section 1.2 above, GBS Delaware shall file with the Securities and Exchange Commission a Quarterly Report on Form 10-Q, an Annual Report on Form 10-K or Current Report on Form 8-K, which shall report the revenues of GBS Nevada for the applicable quarter resulting in such royalty payment.

1.4 No Transfer or Encumbrance. Until the termination of the Royalty Period, without PACIFIC LEAF’s prior written consent (i) GB Delaware shall not sell, transfer, assign or encumber its ownership interest in GBS Nevada, and (ii) GBS Nevada shall not sell, transfer, assign or encumber the Teco Facility or any of its rights under the GB Partners Agreements.

1.5 Good Faith and Fair Dealing. GBS Delaware and GBS Nevada further agree that the royalty payments provided by this Agreement shall be paid in good faith and with fair dealing and that GBS Delaware and GBS Nevada will not enter into any arrangement to modify pricing or transfer sales or revenue that would have the effect of depriving PACIFIC LEAF of the full payment of royalties due under this Agreement.

1.6 Late Charges. On any royalty payment due under this Agreement not paid within fifteen (15) days of the date due, GBS Nevada shall pay to PACIFIC LEAF (i) a late fee in the amount of 2% of the total past due amount and (ii) interest on the amount due until paid at the rate of 1.5% per month or the highest rate allowed by law, whichever is less.

1.7 Insurance. Until the termination of the Royalty Period, GBS Nevada shall at all times maintain a commercial general liability insurance policy with limits of at least Two Million Dollars ($2,000,000) per occurrence and per claim issued by a company admitted to write liability insurance in the State of Nevada and rated at least A or better by AM Best or Standard & Poor’s Ratings Services.

1.8 Guaranty. GBS Delaware hereby unconditionally and irrevocably guarantees to PACIFIC LEAF (i) the punctual payment when due of all debts, obligations and liabilities of GBS Nevada to PACIFIC LEAF pursuant to this Agreement, and (ii) the due and prompt performance of all other covenants, agreements, obligations and liabilities of GBS Nevada under this Agreement.

ARTICLE II

INFORMATION; AUDITS; DISPUTES

2.1 Information. GBS Delaware and GBS Nevada shall keep accurate records of date, type, and weight of all cultivated material produced by GBS Nevada, all revenues generated by GBS Nevada, including, without limitation, under the GBS Partner Agreements, and any other information or data relevant to the calculation of the royalty payments provided herein, including but not limited to settlement sheets, receipts, invoices or other information regarding transactions between GBS Nevada and third parties. In addition, PACIFIC LEAF shall have the right to physically inspect all facilities of GBS Nevada at any time during regular business hours.

2.2 Audits. PACIFIC LEAF shall have the right to audit the books and records of GBS Delaware and GBS Nevada related to the calculation of the royalty payments provided herein. The audit may be performed once during any calendar quarter by any person or persons designated by PACIFIC LEAF during regular business hours and in a manner that does not materially interfere with the operations of GBS Delaware and GBS Nevada.

2.3 Disputes. Any controversy or claim, whether based on contract, tort, statute or other legal or equitable theory (including, but not limited to, any claim of fraud, misrepresentation or fraudulent inducement or any question of validity or effect of this Agreement, including this clause) arising out of or related to this Agreement (including amendments or extensions), or the breach or termination of this Agreement, shall be settled by arbitration proceedings held within the State of Nevada in accordance with the then current Rules of the American Arbitration Association for Commercial Arbitration.

ARTICLE IV

GENERAL

3.1 Confidentiality. GBS Delaware and GBS Nevada agree to keep confidential all information provided to them by PACIFIC LEAF under this Agreement and not to disclose any such information to any third party without the prior written consent of PACIFIC LEAF.

3.2 Amendment and Waiver. This Agreement may only be amended by an instrument in writing signed by the parties hereto. Except for waivers specifically provided for in this Agreement, rights under this Agreement may not be waived except by an instrument in writing signed by the party to be charged with the waiver. The failure of a party to insist on the strict performance of any provision of this Agreement or to exercise any right, power or remedy upon a breach of this Agreement will not constitute a waiver of any provision of this Agreement or limit such party’s rights thereafter to enforce any provision or exercise any right.

3.3 Severability. If at any time any covenant or provision contained in this Agreement is deemed to be invalid or unenforceable, such covenant or provision shall be considered divisible and shall be deemed immediately amended and reformed to include only such portion of such covenant or provision that is valid and enforceable. Such covenant or provision, as so amended and reformed, shall be valid and binding as though the invalid or unenforceable portion had not been included in this Agreement.

3.4. Entire Agreement. This Agreement constitutes the entire agreement between the parties hereto and supersedes any prior understandings, agreements, or representations by or between the parties, written or oral, to the extent they relate in any way to the subject matter hereof.

3.5 Headings. The subject headings of the Articles, Sections, and Subsections of this Agreement and the Exhibits to this Agreement are included for purposes of convenience only, and shall not affect the construction or interpretation of any of their provisions.

3.6 Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Nevada without giving effect to any choice or conflicts of law provision or rule (whether of the State of Nevada or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of Nevada.

3.7 Rules of Construction. Each party represents that it has been represented by counsel during the negotiation, preparation, and execution of this Agreement. Each such party therefore waives the application of any law or rule of construction providing that ambiguities in an agreement or other document shall be construed against the drafter of the agreement or document.

3.8 Attorneys’ Fees. Except as otherwise specified herein, in the event of a dispute under this Agreement, the prevailing Party shall be entitled to payment of its reasonable attorneys’ fees and costs in arbitrating or litigating the dispute.

3.9 No Joint Venture, Partnership, or Agency. This Agreement shall not be construed to create, expressly or by implication, a joint venture, partnership, or agency relationship between the parties.

3.10 Parties in Interest. This Agreement shall inure to the benefit of and be binding upon the successors and assigns of the parties.

3.11 Counterparts. This Agreement may be executed in multiple counterparts, and all such counterparts taken together shall constitute the same document.

[Signature Page Follows]

Executed as of this __ day of February, 2016.

GROWBLOX SCIENCES, INC. PACIFIC LEAF VENTURES, LP

By /s/ John Poss By /s/ Signature

Name: John Poss Name:

Title: President Title: Manager

GB SCIENCES NEVADA LLC

By /s/ John Poss

Name: John Poss

Title: President

OMNIBUS AMENDMENT AND WAIVER

THIS OMNIBUS AMENDMENT AND WAIVER (this “Amendment”) is entered into as of February 8, 2016 (the “Amendment Date”), between Growblox Sciences, Inc., a Delaware corporation (the “Company”), GB Sciences Nevada LLC, a Nevada limited liability company (“GBS Nevada”) and Pacific Leaf Ventures, LP (the “Investor”).

R E C I T A L S

A. The Company and the Investor are parties to that certain Note Purchase Agreement dated as of May 12, 2015 and made effective June 8, 2015 (as amended from time to time, the “Purchase Agreement”), and a related 6% Senior Secured Convertible Promissory Note and, with GBS Nevada, a Security Agreement (respectively, the “Note” and “Security Agreement”). Unless otherwise indicated herein, all capitalized terms used herein have the respective meanings set forth in the Purchase Agreement.

B. The Company, GBS Nevada and the Investor desire to amend the Purchase Agreement, the Note and the Security Agreement as set forth in this Amendment.

NOW, THEREFORE, in consideration of these premises and other valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto agree, as follows:

1. Amended and Restated Note. Concurrent with the execution of this Amendment, the Company shall deliver to the Investor an Amended and Restated 6% Senior Secured Convertible Promissory Note (the “Amended Note”), in the form attached hereto as Exhibit A, duly executed by the Company, which Amended Note will amend and restate the outstanding Note, and will be issued in substitution of and exchange for the original Note. From and after the date this Amendment becomes effective, the Amended Note will be deemed to be the “Note” referred to in the Purchase Agreement and the Security Agreement for all purposes therein.

|

2.

|

Amendment to Purchase Agreement.

|

|

(a)

|

Section 1.4 of the Purchase Agreement is hereby amended and restated in its entirety to read as follows:

|

“Subsequent Advances Under the Note. From time to time as requested by the Company and agreed to by the Investor in its sole and absolute discretion, the Investor may make additional advances to the Company under the Note (“Advances”) in an amount up to an additional $2,650,000 in the aggregate. All such Advances made at any additional closing (each an “Additional Closing” and each of the Initial Closing and Additional Closing, as applicable, being referred to herein as a “Closing”), shall be made on the terms and conditions set forth in this Agreement, and the representations and warranties of the Company set forth in Section 2 hereof shall speak as of the Closing Date for the Additional Closing. Notwithstanding any other provision of this Agreement to the contrary, the Investor shall have no obligation to make an Advance at any Additional Closing even if the conditions to closing set forth in Section 4 as of the Closing Date of such Additional Closing have been satisfied, unless the Investor in its sole and absolute discretion determines to make such Advance.

|

(b)

|

Section 1.5 of the Purchase Agreement is hereby amended and restated in its entirety to read as follows:

|

|

(c)

|

“Use of Proceeds. The proceeds of the Initial Advance and all other Advances under the Note shall be used solely for (i) the acquisition and installation of equipment and other hard assets dedicated to the cultivation of cannabis by GB Sciences Nevada LLC, a Nevada limited liability company and subsidiary of the Company (“GBS Nevada”), at a grow facility located at 3550 W. Teco Avenue, Las Vegas, Nevada (the “Teco Facility”), in an amount and manner that complies in all respects with all legal requirements of the State of Nevada, including, without limitation, by obtaining and/or complying with, all applicable licenses, permits and approvals of all governmental authorities in the State of Nevada (collectively, “Nevada Legal Requirements”); (ii) the acquisition and installation at the Teco Facility of equipment and other hard assets dedicated to the extraction of oils and other constituents present in cannabis in an amount and manner complying in all respects with Nevada Legal Requirements; and (iii) such other tenant improvements at the Teco Facility, approved of in writing by the Investor, as may be reasonably necessary to improve the output and profitability of the cannabis cultivation and extraction operations of GBS Nevada at the Teco Facility.”

|

|

(d)

|

Section 1.6, Exhibit C and Schedule 1.4 of the Purchase Agreement are hereby deleted.

|

3. Amendment to Security Agreement.

|

(a)

|

Section 1 of the Security Agreement is hereby amended and restated in its entirety to read as follows:

|

“Each Grantor hereby grants to Secured Party, a security interest in and so pledges and assigns to the Secured Party, all of its right, title and interest in, to and under, the following properties, assets and rights of such Grantor, wherever located, whether now owned or hereafter acquired or arising, and all proceeds and products thereof (all of the same being hereinafter called the “Collateral”): (i) all goods (as defined in the Uniform Commercial Code) including inventory, equipment and fixtures, of GBS Nevada, (ii) Borrower’s membership interest in GBS Nevada (the “Membership Interest”), together with the right to receive all cash and other distributions from GBS Nevada with respect to such membership interest, (iii) all rights of GBS Nevada under (x) that certain Binding Letter of Separation, dated as of August 17, 2015 between, GBS Nevada and GBS Nevada Partners LLC, and (y) the Consignment and Delivery Agreement referred to therein, and (iv) the proceeds and products, whether tangible or intangible, of any of the foregoing, including proceeds of insurance covering any or all of the foregoing, or other tangible or intangible property resulting from the sale, exchange, collection or other disposition of any of the foregoing, or any portion thereof or interest therein, and the proceeds thereof. The security interest in the Collateral shall secure the payment in full of all obligations (the “Secured Obligations”) of Grantors to Secured Party under the Note, the Purchase Agreement, this Agreement and that certain Amended and Restated Royalty Agreement, dated as of February __, 2016, between the Company and the Investor, as amended from time to time. By their execution of this Agreement, each Grantor authorizes Secured Party at any time and from time to time to file in any Uniform Commercial Code jurisdiction any initial financing statements and amendments thereto that (a) indicate the Collateral, and (b) contain any other information required by part 5 of Article 9 of the Uniform Commercial Code for the sufficiency or filing office acceptance of any financing statement or amendment, including whether the applicable Grantor is an organization, the type of organization and any organization identification number issued to such Grantor. Each Grantor agrees to furnish any such information to the Secured Party promptly upon request.”

|

(b)

|

Section 9 of the Security Agreement is hereby amended by adding the following to the end thereof:

|

“In the event of the transfer of the Membership Interest to the Secured Party or any other person (the “Transferee”) following an Event of Default and the exercise by the Secured Party of its rights hereunder, Borrower and GBS Nevada shall cooperate with the Transferee, and take all action reasonably requested by it, to effect the transfer to the Transferee or its designee of all State and local licenses and permits held by GBS Nevada with respect to the cultivation of medical cannabis.”

4. Waiver and Consent. The Company and the Investor each waive any default by the other of their respective obligations under Sections 1.4 and 1.5 of the Purchase Agreement occurring prior to the date hereof.

5. Reaffirmation of Loan Documents. Except as amended and modified hereby, all of the terms and provisions of the Purchase Agreement and the other Transaction Documents shall remain in full force and effect and are hereby in all respects ratified and confirmed by the Company. The Company hereby agrees that except as expressly provided in this Amendment, the amendments and modifications herein contained shall in no manner affect or impair the liabilities, duties and obligations of the Company under the Purchase Agreement or the other Transaction Documents.

6. Representations and Warranties. As a material inducement for the Investor to enter into this Amendment, the Company hereby represents and warrants to the Investor that after giving effect to this Amendment: (a) all representations and warranties in the Purchase Agreement and the other Transaction Documents are true and correct in all material respects, as though made on the date hereof, except to the extent that (i) any of them speak to a different specific date or may have otherwise been made inaccurate by the mere passage of time; or (ii) the facts or circumstances on which any of them were based have been changed by transactions or events not prohibited by the Transaction Documents; (b) no Event of Default under the Note will exist after giving effect to this Amendment; and (c) this Amendment has been duly authorized and approved by all necessary organizational action and requires the consent of no other person, and is binding and enforceable against the Company in accordance with its terms. The Company further represents and warrants to the Investor as of the date of this Amendment that (i) GBS Nevada holds a duly issued provisional certificate (the “Certificate”) from the Division of Public & Behavioral Health of the Nevada Department of Health and Human Services to operate an establishment to cultivate medical cannabis at 3550 W. Teco Avenue, Las Vegas, Nevada, (ii) such Certificate is in good standing, (iii) GBS Nevada is in compliance with all applicable legal requirements for the issuance and maintenance of the Certificate, and (iv) neither the Company nor GBS Nevada has received any notice that such Certificate may be revoked nor is any of them aware of any grounds for such revocation.

7. GBS Nevada Purchase Option. Until the payment in full of the Amended Note, the Investor or its designee shall have the option (the “Option”) to purchase up to a 20% membership interest in GBS Nevada from GBS Nevada for a purchase price equal to $100,000 for each 2% of membership interest purchased (i.e., $1,000,000 if the Option is exercised in full), provided that the Option may not be exercised for less than a 1% membership interest in GBS Nevada. Investor or its designee (the “Purchaser”) shall give written notice (the “Exercise Notice”) to the Company of its intention to exercise the Option no less than 15 days prior to the date designated by the Purchaser in the Exercise Notice for the closing of its purchase of the membership interest in GBS Nevada. The Exercise Notice shall also specify the percentage membership interest of GBS Nevada to be purchased pursuant to the Option. The Company and GBS Nevada shall thereafter take all reasonable actions necessary or requested by the Purchaser to cause the Purchaser to be admitted as a member of GBS Nevada in accordance with the terms of this Section 7 and the Exercise Notice. The proceeds of the purchase price paid by the Purchaser upon exercise of the Option shall be used by GBS Nevada for the operation, development and/or expansion of the Teco Facility. The Option under this Section 7 may be exercised by one or more Purchasers at one or more times, subject to the 20% membership interest limitation set forth above.

|

8.

|

Conditions Precedent. Notwithstanding any contrary provision, this Amendment shall be effective on the first business day upon which all of the following conditions precedent have been satisfied:

|

|

(a)

|

Investor shall have received duly executed counterparts of this Amendment executed by the Company and GBS Nevada;

|

|

(b)

|

Investor shall have received the Amended Note in the principal amount of $2,750,000 duly executed by the Company and payable to the order of Investor; and

|

|

(c)

|

Investor shall have received a duly executed counterpart to that certain Amended and Restated Royalty Agreement, dated as of February __, 2016, in form and substance satisfactory to Investor.

|

9. Miscellaneous.

|

(a)

|

All of the terms and provisions of this Amendment shall bind and inure to the benefit of the parties hereto and their respective successors and assigns.

|

|

(b)

|

This Amendment may be executed in counterparts and by different parties hereto in separate counterparts each of which when so executed and delivered shall be deemed an original, but all such counterparts together shall constitute but one and the same instrument; signature pages may be detached from multiple separate counterparts and attached to a single counterpart so that all signature pages are physically attached to the same document. Delivery of photocopies of the signature pages to this Amendment by facsimile or electronic mail shall be effective as delivery of manually executed counterparts of this Amendment.

|

|

(c)

|

The headings, captions and arrangements used in this Amendment are, unless specified otherwise, for convenience only and shall not be deemed to limit, amplify or modify the terms of this Amendment, nor affect the meaning thereof.

|

|

(d)

|

Any provision of this Amendment held to be invalid, illegal or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability without affecting the validity, legality and enforceability of the remaining provisions hereof; and the invalidity of a particular provision in a particular jurisdiction shall not invalidate such provision in any other jurisdiction.

|

|

(e)

|

This Amendment shall be construed in accordance with and governed by the laws of the State of Delaware.

|

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have executed this Amendment as of the date first set forth above.

GROWBLOX SCIENCES, INC.

By: /s/ John Poss

Name: John Poss

Title: President

GB SCIENCES NEVADA LLC

By: /s/ John Poss

Name: John Poss

Title: President

PACIFIC LEAF VENTURES, LP

By: /s/ Signature

Name:

Title: Manager

Signature Page to Omnibus Amendment and Waiver

Exhibit A

AMENDED AND RESTATED NOTE

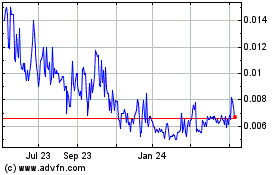

GB Sciences (PK) (USOTC:GBLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

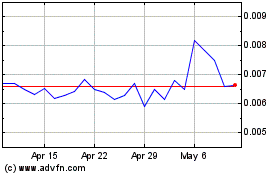

GB Sciences (PK) (USOTC:GBLX)

Historical Stock Chart

From Apr 2023 to Apr 2024