Activists Make Peace With AIG

February 12 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 2/12/16)

By David Benoit and Leslie Scism

Billionaire investors Carl Icahn and John Paulson dropped their

public fight with American International Group Inc. on Thursday,

promising a year of peace in exchange for two board seats.

The pact ends a monthslong showdown between the two activist

shareholders and one of the largest insurance companies in the

world. Messrs. Icahn and Paulson urged the company to break up and

were publicly critical of AIG's structure and performance.

Their argument was that by dividing into smaller parts AIG could

escape onerous regulations imposed by federal policy makers in an

effort to head off systemic threats like the one AIG once posed

during the last financial crisis.

AIG and its Chief Executive Officer Peter Hancock resisted that

breakup call and argued the company was better off with its life

and property and casualty insurance units together, though Mr.

Hancock did unveil steps to shrink the conglomerate in coming

years.

The moves failed to persuade Mr. Icahn that the board was doing

as much as he thought could be done. Settlement talks between the

activists and AIG Chairman Douglas M. Steenland accelerated this

week and went straight through Thursday afternoon, people familiar

with the matter said, ahead of a weekend deadline for investors to

launch a proxy fight.

AIG in the end agreed to nominate Mr. Paulson and Samuel

Merksamer, one of Mr. Icahn's top lieutenants, to its board at the

company's 2016 annual meeting. In exchange, Messrs. Icahn and

Paulson agreed not to wage a proxy fight this year. That could have

put AIG's performance and management team under a harsh light,

something the company hasn't seen since the days when it took a

nearly $185 billion, since repaid, U.S. government bailout.

The settlement includes a standstill that would expire in

August, according to a securities filing, which would keep the

parties from publicly airing more concerns.

"We continue to believe that smaller and simpler is better and

look forward to working collaboratively with the board and

management to help catalyze a turnaround," Mr. Icahn said in a

statement. His aim, he said, is to get AIG to shed its federal

designation as a systemically important financial institution.

Referring to the new board members, Mr. Steenland said AIG looks

forward "to benefiting from their insights."

A representative for Mr. Paulson's Paulson & Co. hedge fund

said the firm had no comment.

The agreement came as AIG released fourth-quarter results. The

insurer posted a $1.84 billion loss on a previously announced

strengthening of claims reserves while increasing its common-stock

dividend and buyback program. AIG shares edged up 1.9% to $51.49

after hours.

Other insurance stocks fell sharply Thursday as worries mounted

about the pain of plunging oil prices and the possibility that low

interest rates won't go away as fast as expected. Prudential

Financial Inc. dropped 9.5%, to $58.

Rising rates are good for large insurers because they tend to

invest the premiums paid by individuals and businesses in

high-quality corporate bonds as a way of generating income until

claims come due.

The fear among insurance investors is that the Federal Reserve

won't follow through on its desire to gradually raise interest

rates this year because of concerns about global economic growth.

That means the pressure on insurers' investment income could remain

-- potentially for years.

In recent months, Mr. Icahn had suggested he would seek

directors who could replace AIG's CEO, Mr. Hancock.

Mr. Hancock committed on Jan. 26 to a wide-ranging set of

initiatives to improve financial results, including returning at

least $25 billion of capital to shareholders over the next two

years, as an alternative to the dramatic split envisioned by the

billionaire investors. He promised improvement in profit metrics

over the next two years, through more aggressive cost-cutting,

sales of some operations and exiting some business-insurance

segments. The company also announced a planned initial public

offering of up to 20% of its mortgage-insurance unit and the sale

of a financial-advisory business.

Mr. Hancock is "moving forward with a sense of urgency" to put

the strategy into place, and has spent a significant amount of time

meeting with shareholders over the past few months, one person

familiar with the matter said.

Last month, Mr. Hancock surprised investors with the

announcement of a plan to strengthen reserves.

The reserve strengthening and a $222 million pretax

restructuring charge created a fourth-quarter loss of $1.84

billion, or $1.50 a share, compared with net income of $655

million, or 46 cents a share, in the year-earlier quarter.

---

Joann S. Lublin contributed to this article.

(END) Dow Jones Newswires

February 12, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

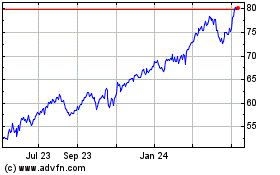

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

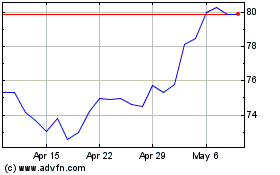

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024