Current Report Filing (8-k)

February 11 2016 - 7:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 10, 2016

INNOVATIVE SOLUTIONS AND SUPPORT, INC.

(Exact name of registrant as specified in its charter)

|

Pennsylvania |

|

0-31157 |

|

23-2507402 |

|

(State or other jurisdiction of

Incorporation) |

|

(Commission File

Number) |

|

(I.R.S. Employer

Identification No.) |

720 Pennsylvania Drive

Exton, Pennsylvania 19341

(Address of principal executive offices) (Zip Code)

(610) 646-9800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On February 10, 2016, Innovative Solutions and Support, Inc. (the “Company”) issued a press release announcing its financial results for its fiscal first quarter ended December 31, 2015. A copy of that press release and the attached financial schedules are attached as Exhibit 99.1 to this report and incorporated herein by reference.

The information in this report (including Exhibit 99.1) is being furnished pursuant to Item 2.02 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release, dated February 10, 2016, announcing financial results for the fiscal first quarter ended December 31, 2015 |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

INNOVATIVE SOLUTIONS AND SUPPORT, INC. |

|

|

|

|

|

|

|

Date: February 11, 2016 |

By: |

/s/ Relland M. Winand |

|

|

|

Relland M. Winand |

|

|

|

Chief Financial Officer |

3

Exhibit 99.1

Contact:

Innovative Solutions & Support, Inc.

Relland Winand

Chief Financial Officer

610-646-0350

rwinand@innovative-ss.com

Innovative Solutions & Support, Inc. Announces First Quarter Fiscal 2016 Financial Results

Exton, PA. — February 10, 2016 — Innovative Solutions & Support, Inc. (“IS&S” or the “Company”) (ISSC) today announced its financial results for the first quarter of fiscal 2016 ended December 31, 2015.

For the first quarter of fiscal 2016, the Company reported sales of $6.6 million, compared to first quarter fiscal 2015 sales of $6.7 million. Gross profit for the first quarter of 2016 was up 20% from a year ago to $3.3 million, or 50.4% of revenues reflecting an increased mix of product revenue. The Company reported a first quarter fiscal 2016 net loss of $215,000, or ($0.01) per share, compared to net income of $594,000, or $0.03 per share, in the first quarter of fiscal 2015, with the loss in the current quarter primarily attributable to an increase in legal expense and a one-time marketing expense, partially off-set by reduced compensation expense. In addition, first quarter fiscal 2015 earnings benefited from a tax benefit due to the retroactive reinstatement of the R&D tax credit effective January 1, 2014.

Geoffrey Hedrick, Chairman and Chief Executive Officer of IS&S, said, “Revenues in the first quarter doubled compared to the fourth quarter of fiscal 2015, reflecting further progress in our transition to greater production revenue. In addition, our gross margins increased to our historical product levels of over 50% in the current quarter compared to just 41% a year ago in the same quarter as we grew our production revenues, on both an absolute basis and as a proportion of our

total revenue. We also booked over $12 million of new orders in the quarter, the best quarter of new business in over a year. Although the bottom line was impacted, as anticipated, by an increase in legal expenses and internally funded research and development costs, from an operational perspective, we believe we are building momentum as well as strengthening our overall financial position. The challenges presented by new and expanding regulatory and competitive demands are pressuring aircraft owners and operators to seek new technology that can provide cost-effective and easily implemented solutions. Innovative Solutions & Support’s legacy has been built on our ability to respond to these market opportunities. With a robust portfolio of products providing the widest range of applications the Company has ever offered, we believe we have a strong foundation to capitalize on a growing market.”

New orders in the first quarter of fiscal 2016 were $12.3 million. Backlog was $13.3 million at December 31, 2015, up from $7.6 million at September 30, 2105. Backlog excludes potential future sole-source production orders from products in development under the Company’s engineering development contracts, including the Pilatus PC-24 and the KC-46A, which the Company expects to remain in production for a decade following completion of their respective development phases. The Company expects that these contracts will add to production sales already in backlog.

At December 31, 2015, the Company had $16.3 million of cash on hand, essentially unchanged from September 30, 2015.

Shahram Askarpour, President of IS&S, added, “Our focus on leveraging our growing portfolio of existing products has led to new production programs that we expect to quickly lead to revenues and generate attractive margins. Innovative Solutions and Support has a long history of developing innovative new products, and the increased investment in internally-funded research and development over recent months has enabled us to introduce a number of new products, the most recent of which is our patent pending auto-throttle. In addition, our aggressive marketing efforts have enabled us to penetrate potentially lucrative new geographic markets where we previously had a minimal presence, including Europe, the Middle East, and Asia, markets which are becoming important components of our growth strategy. In the near term, our goal is to

sustain the momentum we have created, to diversify across both markets and geographies, and to continue to provide the market with price-for-performance solutions available to build our franchise and grow the business.”

Conference Call

The Company will be hosting a conference call February 11, 2016 at 10:00 a.m. ET to discuss these results and its business outlook. Please use the following dial in number to register your name and company affiliation for the conference call: 877-883-0383 and enter the PIN Number 3195580. The call will also be carried live on the Investor Relations page of the Company web site at www.innovative-ss.com.

About Innovative Solutions & Support, Inc.

Headquartered in Exton, Pa., Innovative Solutions & Support, Inc. (www.innovative-ss.com) is a systems integrator that designs and manufactures flight guidance and cockpit display systems for Original Equipment Manufacturers (OEMs) and retrofit applications. The company supplies integrated Flight Management Systems (FMS) and advanced GPS receivers for precision low carbon footprint navigation.

Certain matters contained herein that are not descriptions of historical facts are “forward-looking” (as such term is defined in the Private Securities Litigation Reform Act of 1995). Because such statements include risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause results to differ materially from those expressed or implied by such forward-looking statements include, but are not limited to, those discussed in filings made by the Company with the Securities and Exchange Commission. Many of the factors that will determine the Company’s future results are beyond the ability of management to control or predict. Readers should not place undue reliance on forward-looking statements, which reflect management’s views only as of the date hereof. The Company undertakes no obligation to revise or update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Innovative Solutions and Support, Inc.

Consolidated Balance Sheets

|

|

|

December 31, |

|

September 30, |

|

|

|

|

2015 |

|

2015 |

|

|

|

|

(unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

16,273,491 |

|

$ |

16,282,039 |

|

|

Accounts receivable |

|

5,346,678 |

|

2,394,695 |

|

|

Unbilled receivables, net |

|

2,686,324 |

|

3,920,209 |

|

|

Inventories |

|

4,523,910 |

|

4,597,316 |

|

|

Deferred income taxes |

|

933,499 |

|

933,499 |

|

|

Prepaid expenses and other current assets |

|

928,344 |

|

1,221,717 |

|

|

|

|

|

|

|

|

|

Total current assets |

|

30,692,246 |

|

29,349,475 |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

7,047,627 |

|

7,095,330 |

|

|

Other assets |

|

168,948 |

|

168,948 |

|

|

Total assets |

|

$ |

37,908,821 |

|

$ |

36,613,753 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

2,570,818 |

|

$ |

1,435,981 |

|

|

Accrued expenses |

|

2,907,006 |

|

2,568,531 |

|

|

Deferred revenue |

|

738,443 |

|

756,745 |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

6,216,267 |

|

4,761,257 |

|

|

|

|

|

|

|

|

|

Deferred income taxes |

|

507,184 |

|

507,184 |

|

|

Other liabilities |

|

2,826 |

|

2,826 |

|

|

Total liabilities |

|

6,726,277 |

|

5,271,267 |

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

Shareholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, 10,000,000 shares authorized, $.001 par value, of which 200,000 shares are authorized as Class A Convertible stock. No shares issued and outstanding at December 31, 2015 and September 30, 2015 |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

Common stock, $.001 par value: 75,000,000 shares authorized, 18,756,089 issued at December 31, 2015 and September 30, 2015, respectively |

|

18,756 |

|

18,756 |

|

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

51,204,218 |

|

51,148,722 |

|

|

Retained earnings |

|

603,330 |

|

818,768 |

|

|

Treasury stock, at cost, 1,846,451 shares at December 31, 2015 and September 30, 2015, respectively |

|

(20,643,760 |

) |

(20,643,760 |

) |

|

|

|

|

|

|

|

|

Total shareholders’ equity |

|

31,182,544 |

|

31,342,486 |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity |

|

$ |

37,908,821 |

|

$ |

36,613,753 |

|

Innovative Solutions and Support, Inc.

Consolidated Statements of Operations

(unaudited)

|

|

|

Three months ended |

|

|

|

|

December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

6,583,578 |

|

$ |

6,724,255 |

|

|

|

|

|

|

|

|

|

Cost of sales |

|

3,267,767 |

|

3,962,450 |

|

|

|

|

|

|

|

|

|

Gross profit |

|

3,315,811 |

|

2,761,805 |

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

931,600 |

|

654,999 |

|

|

Selling, general and administrative |

|

2,692,944 |

|

1,940,491 |

|

|

Total operating expenses |

|

3,624,544 |

|

2,595,490 |

|

|

|

|

|

|

|

|

|

Operating (loss) income |

|

(308,733 |

) |

166,315 |

|

|

|

|

|

|

|

|

|

Interest income |

|

7,025 |

|

5,885 |

|

|

Other income |

|

32,410 |

|

10,822 |

|

|

(Loss) income before income taxes |

|

(269,298 |

) |

183,022 |

|

|

|

|

|

|

|

|

|

Income tax benefit |

|

(53,860 |

) |

(410,720 |

) |

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(215,438 |

) |

$ |

593,742 |

|

|

|

|

|

|

|

|

|

Net (loss) income per common share: |

|

|

|

|

|

|

Basic |

|

$ |

(0.01 |

) |

$ |

0.04 |

|

|

Diluted |

|

$ |

(0.01 |

) |

$ |

0.03 |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

Basic |

|

16,909,638 |

|

16,955,726 |

|

|

Diluted |

|

16,909,638 |

|

17,040,681 |

|

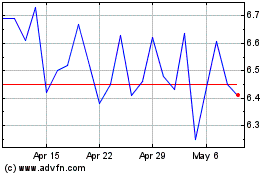

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

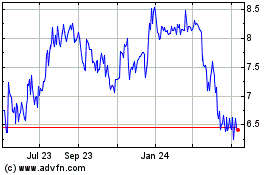

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Apr 2023 to Apr 2024