UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 9, 2016

Astrotech Corporation

(Exact name of registrant as specified in its charter)

|

| | | | |

Washington | | 001-34426 | | 91-1273737 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

401 Congress Ave. Suite 1650 Austin, Texas | | 78701 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (512) 485-9530

|

|

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

¨ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

¨ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

¨ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

¨ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On February 9, 2016, Astrotech Corporation issued a press release announcing its results of operations for its second quarter ended December 31, 2015. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 Press release, dated February 9, 2016, issued by Astrotech Corporation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| Astrotech Corporation | |

| | | |

| By: | /s/ Thomas B. Pickens III | |

|

| | | |

| Name: | Thomas B. Pickens III |

| Title: | Chairman of the Board and Chief |

| | Executive Officer | |

Date: February 9, 2016

EXHIBIT INDEX

|

| | | | |

Exhibit No. | | Description | | Paper (P) or Electronic (E) |

| | | | |

99.1 | | Press release, dated February 9, 2016 issued by Astrotech Corporation. | | E |

ASTROTECH REPORTS SECOND QUARTER OF FISCAL YEAR 2016 FINANCIAL RESULTS

Austin, Texas - February 9, 2016 - Astrotech Corporation (NASDAQ: ASTC) reported its financial results for the second quarter of fiscal year 2016 as of December 31, 2015.

“During the second quarter of fiscal year 2016, our technologies garnered additional validation,” said Thomas B. Pickens III, Chairman and CEO of Astrotech Corporation. “1st Detect is meeting and exceeding milestones related to the next generation chemical detector (NGCD) program. The engineering team remains focused on satisfying application specific chemical detection objectives for customers and development partners.”

Astral Color ICE™ technology was selected by a worldwide technology leader in the media and entertainment sector to perform film restoration. “We are excited about the engagement and the market opportunity,” said Rajesh Mellacheruvu, COO of Astrotech Corporation. “As the demand for ultra-high definition, high-dynamic range 4K resolution format increases, we expect to expand Astral’s use among digital media and entertainment post-production houses and studios.”

Second Quarter Fiscal Year 2016 Financial Highlights

Revenue, costs of goods sold, SG&A, and R&D are expected to continue to fluctuate based on the timing of contract revenue and the continued transition from a research company to an operating company.

| |

• | Revenue was $927 thousand, reflecting 1st Detect’s income from research-based, fixed-price, government-related subcontracts of $685 thousand and from the manufacturing sales of space-grade handrails, a legacy business, of $242 thousand. |

| |

• | Gross profit was $295 thousand, or 32%, which reflects the benefit from the higher margin handrail sales. |

| |

• | Loss from continuing operations before income taxes was $2.6 million, compared to $3.0 million in the second quarter of fiscal year 2015. This decrease is the result of the aforementioned revenue. |

| |

• | Astrotech held $32.2 million in cash, investments, and an indemnity receivable at the quarter close. Management continues to expect to receive the full indemnity receivable of $6.1 million by the end of February 2016, and, as of February 8, was not aware of any claims against this receivable. |

| |

• | Astrotech Corporation had no debt at December 31, 2015. |

| |

• | The Board extended the share repurchase plan of up to $5 million of the Company’s outstanding common stock through December 31, 2016. |

Technology Highlights

| |

• | 1st Detect received three U.S. patents during the second quarter. The total at January 31, 2016 reached 14 U.S. and nine international issued and 10 U.S. and 16 international pending. |

| |

• | 1st Detect launched its new iONTRAC Process Chemical Analyzer at the Gulf Coast Conference where it contributed five technical programs in October. |

| |

• | Astral Images signed a contract with a worldwide technology leader in the media and entertainment sector to use Astral Color ICE™ as part of its workflow to restore film. |

| |

• | Astrogenetix continued its long-term efforts to use the unique power of microgravity to develop a novel vaccine and therapeutic products, and, in conjunction with NASA, continued the pursuit of an investigational new drug application with the Food and Drug Administration for Salmonella. |

About Astrotech Corporation

Astrotech Corporation (NASDAQ: ASTC) identifies and commercializes emerging disruptive technologies through its closely held subsidiaries. Management sources investment opportunities from various government laboratories, agencies, universities, and corporations, as well as through its own internal research. Sourced from Oak Ridge Laboratory’s chemical analyzer research, 1st Detect develops, manufactures, and sells chemical analyzers that streamline processes for industrial use in the airport security, food and beverage, semiconductor, pharmaceutical, research and environmental markets, and the military. Sourced from decades of image research from the laboratories of IBM and Kodak combined with classified satellite technology from government laboratories, Astral Images sells film to digital image enhancement, defect removal and color correction software, and post processing services providing economically feasible conversion of television and feature 35mm and 16mm films to the new 4K ultra-high definition (UHD), high-dynamic range (HDR) format necessary for the new generation of digital distribution. Sourced from NASA’s extensive microgravity research, Astrogenetix is applying a fast-track on-orbit discovery platform using the International Space Station to develop vaccines and other therapeutics. Demonstrating its entrepreneurial strategy, Astrotech management sold its state-of-the-art satellite servicing operations to Lockheed Martin in August 2014. Astrotech has operations throughout Texas and is headquartered in Austin. For information, please visit www.astrotechcorp.com.

This press release contains forward-looking statements that are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks, trends, and uncertainties that could cause actual results to be materially different from the forward-looking statement. These factors include, but are not limited to, whether we can successfully develop our proprietary technologies and whether the market will accept our products and services, as well as other risk factors and business considerations described in the Company’s Securities and Exchange Commission filings including the annual report on Form 10-K. Any forward-looking statements in this document should be evaluated in light of these important risk factors. The Company assumes no obligation to update these forward-looking statements.

Company Contact

Eric Stober

Chief Financial Officer

Astrotech Corporation

(512) 485-9530

Investor Relations Contact

Cathy Mattison and Kirsten Chapman

LHA

(415) 433-3777

ir@astrotechcorp.com

Tables follow

ASTROTECH CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statements of Operations and Comprehensive Income

(In thousands, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Six Months Ended

December 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Revenue | | $ | 927 |

| | $ | 4 |

| | $ | 927 |

| | $ | 324 |

|

Cost of revenue | | 632 |

| | 4 |

| | 632 |

| | 281 |

|

Gross profit | | 295 |

| | — |

| | 295 |

| | 43 |

|

Operating expenses: | | | | | | | | |

Selling, general and administrative | | 1,671 |

| | 2,012 |

| | 3,957 |

| | 3,972 |

|

Research and development | | 1,326 |

| | 984 |

| | 2,590 |

| | 1,676 |

|

Total operating expenses | | 2,997 |

| | 2,996 |

| | 6,547 |

| | 5,648 |

|

Loss from operations | | (2,702 | ) | | (2,996 | ) | | (6,252 | ) | | (5,605 | ) |

Interest and other expense, net | | 94 |

| | 24 |

| | 193 |

| | 36 |

|

Loss from continuing operations before income taxes | | (2,608 | ) | | (2,972 | ) | | (6,059 | ) | | (5,569 | ) |

Income tax benefit (expense) | | — |

| | 734 |

| | (2 | ) | | 2,059 |

|

Loss from continuing operations | | (2,608 | ) | | (2,238 | ) | | (6,061 | ) | | (3,510 | ) |

Discontinued operations | | | | | | | | |

Income from discontinued operations | | — |

| | — |

| | — |

| | 1,303 |

|

Income tax expense | | — |

| | (184 | ) | | — |

| | (2,562 | ) |

Gain on sale of discontinued operations | | — |

| | — |

| | — |

| | 25,630 |

|

(Loss) income from discontinued operations | | — |

| | (184 | ) | | — |

| | 24,371 |

|

Net (loss) income | | (2,608 | ) | | (2,422 | ) | | (6,061 | ) | | 20,861 |

|

Less: Net loss attributable to noncontrolling interest | | (82 | ) | | — |

| | (171 | ) | | — |

|

Net (loss) income attributable to Astrotech Corporation | | (2,526 | ) | | (2,422 | ) | | (5,890 | ) | | 20,861 |

|

Less: Deemed dividend to State of Texas | | — |

| | — |

| | — |

| | 531 |

|

Net (loss) income attributable to common stockholders | | $ | (2,526 | ) | | $ | (2,422 | ) | | $ | (5,890 | ) | | $ | 20,330 |

|

| | | | | | | | |

Amounts attributable to Astrotech Corporation: | | | | | | | | |

Loss from continuing operations, net of tax | | $ | (2,526 | ) | | $ | (2,238 | ) | | $ | (5,890 | ) | | $ | (3,510 | ) |

(Loss) income from discontinued operations, net of tax | | — |

| | (184 | ) | | — |

| | 24,371 |

|

Net (loss) income attributable to Astrotech Corporation | | $ | (2,526 | ) | | $ | (2,422 | ) | | $ | (5,890 | ) | | $ | 20,861 |

|

| | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | |

Basic and diluted | | 20,701 |

| | 19,637 |

| | 20,703 |

| | 19,593 |

|

| | | | | | | | |

Basic and diluted net (loss) income per common share: | | | | | | | | |

Net loss attributable to Astrotech Corporation from continuing operations | | $ | (0.12 | ) | | $ | (0.11 | ) | | $ | (0.28 | ) | | $ | (0.20 | ) |

Net (loss) income from discontinued operations | | — |

| | (0.01 | ) | | — |

| | 1.24 |

|

Net (loss) income attributable to Astrotech Corporation | | $ | (0.12 | ) | | $ | (0.12 | ) | | $ | (0.28 | ) | | $ | 1.04 |

|

| | | | | | | | |

Other comprehensive (loss) income, net of tax: | | | | | | | | |

Available-for-sale securities: | | | | | | | | |

Net unrealized loss, net of tax benefit of $40, $0, $73, and $0 | | $ | (74 | ) | | $ | — |

| | $ | (135 | ) | | $ | — |

|

Reclassification adjustment for realized losses included in net (loss) income, net of taxes of $2, $0, $5, and $0 | | 5 |

| | — |

| | 9 |

| | — |

|

Total comprehensive (loss) income | | $ | (2,595 | ) | | $ | (2,422 | ) | | $ | (6,016 | ) | | $ | 20,861 |

|

ASTROTECH CORPORATION AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In thousands, except share data)

(Unaudited)

|

| | | | | | | | |

| | December 31,

2015 | | June 30,

2015 |

| | | | |

Assets | | |

| | |

|

Current assets | | |

| | |

|

Cash and cash equivalents | | $ | 2,145 |

| | $ | 2,330 |

|

Short-term investments | | 18,192 |

| | 23,161 |

|

Accounts receivable, net of allowance | | 143 |

| | 198 |

|

Inventory | | 1,232 |

| | 509 |

|

Indemnity receivable | | 6,100 |

| | 6,100 |

|

Prepaid expenses and other current assets | | 475 |

| | 296 |

|

Total current assets | | 28,287 |

| | 32,594 |

|

Property and equipment, net | | 3,572 |

| | 3,108 |

|

Long-term investments | | 5,768 |

| | 8,516 |

|

Total assets | | $ | 37,627 |

| | $ | 44,218 |

|

| | | | |

Liabilities and stockholders’ equity | | |

| | |

|

Current liabilities | | |

| | |

|

Accounts payable | | $ | 409 |

| | $ | 398 |

|

Accrued liabilities and other | | 1,483 |

| | 1,801 |

|

Income tax payable | | — |

| | 190 |

|

Total current liabilities | | 1,892 |

| | 2,389 |

|

Other liabilities | | 130 |

| | 101 |

|

Total liabilities | | 2,022 |

| | 2,490 |

|

| | | | |

Commitments and contingencies | | | | |

| | | | |

Stockholders’ equity | | |

| | |

|

Preferred stock, no par value, convertible, 2,500,000 shares authorized; no shares issued and outstanding, at December 31, 2015 and June 30, 2015 | | — |

| | — |

|

Common stock, no par value, 75,000,000 shares authorized; 21,864,548 shares issued at December 31, 2015 and June 30, 2015, respectively; 20,700,673 and 20,743,973 shares outstanding at December 31, 2015 and June 30, 2015, respectively | | 189,185 |

| | 189,007 |

|

Treasury stock, 1,163,875 and 1,120,575 shares at cost at December 31, 2015 and June 30, 2015, respectively | | (2,789 | ) | | (2,672 | ) |

Additional paid-in capital | | 1,210 |

| | 1,139 |

|

Accumulated deficit | | (151,912 | ) | | (146,022 | ) |

Accumulated other comprehensive loss | | (217 | ) | | (23 | ) |

Equity attributable to stockholders of Astrotech Corporation | | 35,477 |

| | 41,429 |

|

Noncontrolling interest | | 128 |

| | 299 |

|

Total stockholders’ equity | | 35,605 |

| | 41,728 |

|

Total liabilities and stockholders’ equity | | $ | 37,627 |

| | $ | 44,218 |

|

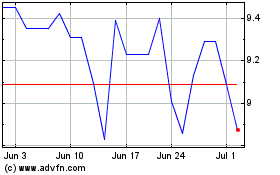

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Apr 2023 to Apr 2024