UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 9, 2016 (February 8, 2016) Owens & Minor, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Virginia | | 1-9810 | | 54-1701843 |

(State or other jurisdiction of incorporation | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

| | |

9120 Lockwood Blvd., Mechanicsville, Virginia | | 23116 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (804) 723-7000

Not applicable

(former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02. | Results of Operations and Financial Condition. |

On February 8, 2016, Owens & Minor, Inc. (the “Company”) issued a press release regarding its financial results for the fourth quarter and year ended December 31, 2015. The Company is furnishing the press release attached hereto as Exhibit 99.1 pursuant to Item 2.02 of Form 8-K. In accordance with General Instruction B.2 of Form 8-K, the information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

(c)Exhibits.

|

| | |

| | |

99.1 | | Press Release issued by the Company on February 8, 2016 (furnished pursuant to Item 2.02). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | | | | | | | |

| | | | | | | | |

| | | | | | OWENS & MINOR, INC. |

| | | |

Date: February 9, 2016 | | | | By: | | /s/ Grace R. den Hartog |

| | | | | | Name: | | Grace R. den Hartog |

| | | | | | Title: | | Senior Vice President, General Counsel and Corporate Secretary |

Exhibit Index

|

| | |

| | |

Exhibit No. | | Description |

| |

99.1 | | Press Release issued by the Company on February 8, 2016 (furnished pursuant to Item 2.02). |

Exhibit 99.1

FOR IMMEDIATE RELEASE

February 8, 2016

Owens & Minor Reports 4th Quarter & Full-Year 2015

Financial Results

| |

• | Company achieved record annual adjusted earnings of $2.00 per share for 2015 |

| |

• | Consolidated annual revenues increased 3.5% to $9.77 billion |

| |

• | International segment operating earnings improved $10.6 million compared to 2014 |

RICHMOND, VA…Owens & Minor, Inc. (NYSE-OMI) today reported financial results for the year ended December 31, 2015, including consolidated revenues of $9.77 billion, which improved 3.5% over the prior year. Net income for 2015 was $103.4 million, or $1.65 per diluted share. Adjusted net income (non-GAAP) was $125.3 million, or $2.00 per diluted share, the strongest earnings result ever reported by the company. The increase of $0.24 in adjusted earnings per diluted share resulted from continued progress in repositioning the International segment, improving performance from the two 2014 acquisitions, benefits derived from the global sourcing strategy, and early progress associated with implementation of the company’s transformation agenda. A reconciliation of reported results to adjusted (non-GAAP) measures is included below.

Consolidated operating earnings for 2015 were $200.4 million, or 2.05% of revenues, representing an improvement of $40.8 million when compared to last year’s operating earnings. Adjusted consolidated operating earnings (non-GAAP) for the full year improved 12.2% to $227.3 million, or 2.33% of revenues.

“I am pleased with the performance of our teams in the U.S., Europe, and Asia, who worked in concert to close out 2015 on a strong note by achieving solid revenue and record earnings results,” said P. Cody Phipps, president & chief executive officer of Owens & Minor. “We are making solid progress on our transformation agenda, which contributed to our positive results for 2015. Looking ahead, we have a clear path, a newly energized leadership team, and specific plans for creating efficiencies throughout our global business platform. Our focus remains on demonstrating consistent earnings growth, while we reposition the company for long term success.”

Fourth Quarter 2015 Results

For the fourth quarter of 2015, consolidated net revenues were $2.49 billion, representing a slight decline when compared to revenues in the fourth quarter of 2014. Quarterly revenue results reflected the previously discussed exit of certain healthcare customers in the Domestic and International segments. Quarterly net income was $32.1 million, or $0.51 per diluted share. Adjusted net income (non-GAAP) for the quarter was $35.1 million, or $0.56 per diluted share.

Consolidated operating earnings for the fourth quarter of 2015 increased $17.2 million to $58.0 million, when compared to the same period last year. Adjusted consolidated operating earnings (non-GAAP) for the fourth quarter of 2015 were $63.1 million, an improvement of $4.1 million over last year. The quarterly improvements were derived from the same factors highlighted in the annual results.

Asset Management

The balance of cash and cash equivalents was $161 million at December 31, 2015. For the year, the company reported $270 million of cash provided by operating activities, compared to cash used for operating activities of $3.8 million in the prior year. The increase in operating cash flow was driven primarily by improved net income and the recovery from the temporarily unfavorable timing of vendor payments in 2014. Asset management metrics, as of the end of the year, included consolidated days sales outstanding (DSO) of 21.0, compared to DSO of 22.1 days last year; as well as consolidated inventory turns of 9.4 compared to 10.1 for 2014.

Segment Results

For the full year of 2015, Domestic segment revenue increased 4.5% to $9.36 billion, when compared to the prior year. Domestic segment revenues for the fourth quarter of 2015 were $2.38 billion, representing an increase of 1.3% when compared to last

year’s fourth quarter. Revenue growth in the Domestic segment resulted primarily from larger healthcare provider customers and new business, which offset declines from smaller customer accounts. Another positive contributor to Domestic segment revenue growth was the Medical Action acquisition, which accounted for 1.5% of the annual revenue increase.

For the full year, Domestic segment operating earnings increased $14.1 million to $223.4 million, representing 2.39% of segment revenues. For the fourth quarter of 2015, Domestic segment operating earnings were $62.5 million, an increase of $5.0 million, when compared to the same period of 2014. The improvement in annual and quarterly Domestic segment operating earnings resulted primarily from revenue growth, benefits from manufacturer product price changes, contributions from Medical Action, expense control initiatives, and lower fuel costs.

For the International segment, full-year revenues decreased 14.6% to $417 million, while quarterly revenues decreased 25.6% to $103 million. On a constant currency basis, excluding the effect of the transition of a U.K. customer from a buy-sell to a fee-for-service arrangement and the first full year of contributions from the ArcRoyal acquisition, International segment revenues declined approximately 3.5% for the year. For the year, the International segment reported operating earnings of $3.9 million, which improved $10.6 million from the prior year. The company attributed the gains to measures taken throughout the year to streamline and reposition the business, improve operational efficiency, and reduce expenses. For the fourth quarter of 2015, the International segment had operating earnings of $0.6 million.

“Our International team worked throughout the year to achieve operational and financial improvements, leading to a $10.6 million increase in International segment operating earnings for the year,” said Richard A. Meier, executive vice president & chief financial officer and president-International of Owens & Minor. “At the same time, the team repositioned and stabilized the business, finding ways to serve our clients with greater efficiency. In the coming year, we look forward to focusing on developing new avenues for growth.”

2016 Outlook

The company reiterated its financial guidance for 2016, consistent with the guidance originally provided at its December 2015 Investor Day.

For 2016, the company is targeting adjusted earnings per diluted share in a range of $2.00 to $2.05.

Upcoming Investor Relations Events

Owens & Minor will participate in the following investor conference in the first quarter of 2016; a webcast of the presentation will be available on www.owens-minor.com.

| |

• | Barclays Capital 2016 Global Healthcare Conference; March 15-17, Miami |

Investors Conference Call & Supplemental Material

Conference Call: Company executives will host a conference call, which will also be webcast, to discuss the results on the following morning, Tuesday, February 9, 2016, at 8:30 a.m. EST. The access code for this event is #27559950. The dial-in number for the live conference call is 866-393-1604; the international dial-in number is 224-357-2191; and a replay of the call will be available for one week by calling 855-859-2056. A webcast of the event and a corresponding slide presentation will be available on www.owens-minor.com under the Investor Relations section.

Owens & Minor uses its Web site, www.owens-minor.com, as a channel of distribution for material company information, including news releases, investor presentations and financial information. This information is routinely posted and accessible under the Investor Relations section.

Included with the press release financial tables are reconciliations of the differences between the non-GAAP financial measures presented in this news release and their most directly comparable GAAP financial measures.

Safe Harbor Statement

Except for historical information, the matters discussed in this press release may constitute forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those projected. These risk factors are discussed in reports filed by the company with the Securities & Exchange Commission. All of this information is available at www.owens-minor.com. The company assumes no obligation, and expressly disclaims any such obligation, to update or alter information, whether as a result of new information, future events, or otherwise.

Owens & Minor, Inc. (NYSE: OMI) is a leading healthcare services company dedicated to Connecting the World of Medical Products to the Point of CareTM by providing vital supply chain services to healthcare providers and manufacturers of healthcare products. Owens & Minor provides logistics services across the spectrum of medical products from disposable medical supplies to devices and implants. With logistics platforms strategically located in the United States and Europe, Owens & Minor serves markets where three quarters of global healthcare spending occurs. Owens & Minor’s customers span the healthcare market from independent hospitals to large integrated healthcare networks, as well as group purchasing organizations, healthcare products manufacturers, and the federal government. A FORTUNE 500 company, Owens & Minor is headquartered in Richmond, Virginia, and has annualized revenues exceeding $9 billion. For more information about Owens & Minor, visit the company website at owens-minor.com.

CONTACTS:

Truitt Allcott, Director, Investor & Media Relations, 804-723-7555, truitt.allcott@owens-minor.com

Chuck Graves, Director, Finance & Investor Relations, 804-723-7556, chuck.graves@owens-minor.com

SOURCE: Owens & Minor

Owens & Minor, Inc.

Consolidated Statements of Income (unaudited)

(in thousands, except per share data)

|

| | | | | | | | |

| | Three Months Ended December 31, |

| | 2015 | | 2014 |

Net revenue | | $ | 2,487,914 |

| | $ | 2,491,817 |

|

Cost of goods sold | | 2,175,632 |

| | 2,177,802 |

|

Gross margin | | 312,282 |

| | 314,015 |

|

Selling, general and administrative expenses | | 236,426 |

| | 244,152 |

|

Acquisition-related and exit and realignment charges | | 6,647 |

| | 17,988 |

|

Depreciation and amortization | | 13,745 |

| | 15,528 |

|

Other operating expense (income), net | | (2,489 | ) | | (4,426 | ) |

Operating earnings | | 57,953 |

| | 40,773 |

|

Interest expense, net | | 6,845 |

| | 7,270 |

|

Income before income taxes | | 51,108 |

| | 33,503 |

|

Income tax provision | | 19,040 |

| | 19,516 |

|

Net income | | $ | 32,068 |

| | $ | 13,987 |

|

| | | | |

Net income per common share: | | | | |

Basic | | $ | 0.51 |

| | $ | 0.22 |

|

Diluted | | $ | 0.51 |

| | $ | 0.22 |

|

| | | | |

| | | | |

| | Twelve Months Ended December 31, |

| | 2015 | | 2014 |

Net revenue | | $ | 9,772,946 |

| | $ | 9,440,182 |

|

Cost of goods sold | | 8,558,373 |

| | 8,270,216 |

|

Gross margin | | 1,214,573 |

| | 1,169,966 |

|

Selling, general and administrative expenses | | 933,596 |

| | 926,977 |

|

Acquisition-related and exit and realignment charges | | 28,404 |

| | 42,801 |

|

Depreciation and amortization | | 60,187 |

| | 57,125 |

|

Other operating expense (income), net | | (7,973 | ) | | (16,473 | ) |

Operating earnings | | 200,359 |

| | 159,536 |

|

Loss on early retirement of debt | | — |

| | 14,890 |

|

Interest expense, net | | 27,149 |

| | 18,163 |

|

Income before income taxes | | 173,210 |

| | 126,483 |

|

Income tax provision | | 69,801 |

| | 59,980 |

|

Net income | | $ | 103,409 |

| | $ | 66,503 |

|

| | | | |

Net income per common share: | | | | |

Basic | | $ | 1.65 |

| | $ | 1.06 |

|

Diluted | | $ | 1.65 |

| | $ | 1.06 |

|

Owens & Minor, Inc.

Condensed Consolidated Balance Sheets (unaudited)

(in thousands)

|

| | | | | | | | |

| | December 31, | | December 31, |

| | 2015 | | 2014 |

| | | | |

Assets | | | | |

Current assets | | | | |

Cash and cash equivalents | | $ | 161,020 |

| | $ | 56,772 |

|

Accounts and notes receivable, net | | 587,935 |

| | 626,192 |

|

Merchandise inventories | | 940,775 |

| | 872,457 |

|

Other current assets | | 284,970 |

| | 314,479 |

|

Total current assets | | 1,974,700 |

| | 1,869,900 |

|

Property and equipment, net | | 208,930 |

| | 232,979 |

|

Goodwill, net | | 419,619 |

| | 423,276 |

|

Intangible assets, net | | 95,250 |

| | 108,593 |

|

Other assets, net | | 79,341 |

| | 100,658 |

|

Total assets | | $ | 2,777,840 |

| | $ | 2,735,406 |

|

Liabilities and equity | | | | |

Current liabilities | | | | |

Accounts payable | | $ | 700,116 |

| | $ | 608,846 |

|

Accrued payroll and related liabilities | | 45,907 |

| | 31,507 |

|

Other current liabilities | | 317,566 |

| | 326,223 |

|

Total current liabilities | | 1,063,589 |

| | 966,576 |

|

Long-term debt, excluding current portion | | 572,559 |

| | 608,551 |

|

Deferred income taxes | | 86,326 |

| | 101,880 |

|

Other liabilities | | 62,776 |

| | 67,561 |

|

Total liabilities | | 1,785,250 |

| | 1,744,568 |

|

Total equity | | 992,590 |

| | 990,838 |

|

Total liabilities and equity | | $ | 2,777,840 |

| | $ | 2,735,406 |

|

Owens & Minor, Inc.

Consolidated Statements of Cash Flows (unaudited)

(in thousands)

) |

| | | | | | | | |

| Twelve Months Ended December 31, |

| | 2015 | | 2014 |

| | | | |

Operating activities: | | | | |

Net income | | $ | 103,409 |

| | $ | 66,503 |

|

Adjustments to reconcile net income to cash provided by operating activities: | | | | |

Depreciation and amortization | | 65,982 |

| | 63,407 |

|

Share-based compensation expense | | 11,306 |

| | 8,207 |

|

Deferred income tax expense (benefit) | | (6,101 | ) | | (3,385 | ) |

Provision for losses on accounts and notes receivable | | (24 | ) | | 448 |

|

Loss on early retirement of debt | | — |

| | 14,890 |

|

Changes in operating assets and liabilities: | | | | |

Accounts and notes receivable | | 18,333 |

| | (17,803 | ) |

Merchandise inventories | | (69,727 | ) | | (57,329 | ) |

Accounts payable | | 103,518 |

| | (52,148 | ) |

Net change in other assets and liabilities | | 40,670 |

| | (25,828 | ) |

Other, net | | 2,231 |

| | (723 | ) |

Cash (used for) provided by operating activities | | 269,597 |

| | (3,761 | ) |

| | | | |

Investing activities: | | | | |

Acquisitions, net of cash acquired | | — |

| | (248,536 | ) |

Additions to computer software and intangible assets | | (16,085 | ) | | (22,384 | ) |

Additions to property and equipment | | (20,531 | ) | | (48,424 | ) |

Proceeds from the sale of investment | | — |

| | 1,937 |

|

Proceeds from the sale of property and equipment | | 143 |

| | 156 |

|

Cash used for investing activities | | (36,473 | ) | | (317,251 | ) |

| | | | |

Financing activities: | | | | |

Proceeds from issuance of debt | | — |

| | 547,693 |

|

Proceeds from (repayment of) revolving credit facility | | (33,700 | ) | | 33,700 |

|

Repayment of debt | | — |

| | (217,352 | ) |

Cash dividends paid | | (63,651 | ) | | (63,104 | ) |

Repurchases of common stock | | (20,000 | ) | | (9,934 | ) |

Financing costs paid | | — |

| | (5,391 | ) |

Proceeds from exercise of stock options | | — |

| | 1,180 |

|

Excess tax benefits related to share-based compensation | | 646 |

| | 582 |

|

Purchase of noncontrolling interest | | — |

| | (1,500 | ) |

Other, net | | (7,528 | ) | | (7,314 | ) |

Cash provided by (used for) financing activities | | (124,233 | ) | | 278,560 |

|

| | | | |

Effect of exchange rate changes on cash and cash equivalents | | (4,643 | ) | | (2,681 | ) |

| | | | |

Net increase (decrease) in cash and cash equivalents | | 104,248 |

| | (45,133 | ) |

Cash and cash equivalents at beginning of period | | 56,772 |

| | 101,905 |

|

Cash and cash equivalents at end of period | | $ | 161,020 |

| | $ | 56,772 |

|

Owens & Minor, Inc.

Financial Statistics and GAAP/Non-GAAP Reconciliations (unaudited)

(in thousands, except per share data)

|

| | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended |

(in thousands, except ratios and per share data) | | 12/31/2015 | | 9/30/2015 | | 6/30/2015 | | 3/31/2015 | | 12/31/2014 |

| | | | | | | | | | |

Consolidated operating results: | | | | | | | | | | |

Domestic | | $ | 2,384,836 |

| | $ | 2,368,008 |

| | $ | 2,317,661 |

| | $ | 2,285,635 |

| | $ | 2,353,321 |

|

International | | 103,078 |

| | 103,661 |

| | 104,506 |

| | 105,561 |

| | 138,496 |

|

Net revenue | | $ | 2,487,914 |

| | $ | 2,471,669 |

| | $ | 2,422,167 |

| | $ | 2,391,196 |

| | $ | 2,491,817 |

|

| | | | | | | | | | |

Gross margin | | $ | 312,282 |

| | $ | 306,354 |

| | $ | 298,337 |

| | $ | 297,601 |

| | $ | 314,015 |

|

Gross margin as a percent of revenue | | 12.55 | % | | 12.39 | % | | 12.32 | % | | 12.45 | % | | 12.60 | % |

| | | | | | | | | | |

SG&A expenses | | $ | 236,426 |

| | $ | 231,847 |

| | $ | 231,498 |

| | $ | 233,825 |

| | $ | 244,152 |

|

SG&A expenses as a percent of revenue | | 9.50 | % | | 9.38 | % |

| 9.56 | % |

| 9.78 | % |

| 9.80 | % |

| | | | | | | | | | |

Operating earnings, as reported (GAAP) | | $ | 57,953 |

| | $ | 53,572 |

| | $ | 47,860 |

| | $ | 40,975 |

| | $ | 40,773 |

|

Acquisition-related charges (1) | | 4,048 |

| | 1,335 |

| | 1,786 |

| | 2,605 |

| | 7,394 |

|

Exit and realignment charges (2) | | 2,599 |

| | 4,799 |

| | 3,921 |

| | 7,311 |

| | 10,594 |

|

Fair value adjustments related to purchase accounting (3) | | — |

| | — |

| | — |

| | — |

| | (3,706 | ) |

Other (4) | | (1,500 | ) | | — |

| | — |

| | — |

| | 3,907 |

|

Operating earnings, adjusted (Non-GAAP) | | $ | 63,100 |

| | $ | 59,706 |

| | $ | 53,567 |

| | $ | 50,891 |

| | $ | 58,962 |

|

Operating earnings as a percent of revenue, adjusted (Non-GAAP) | | 2.54 | % | | 2.42 | % | | 2.21 | % | | 2.13 | % | | 2.37 | % |

| | | | | | | | | | |

Net income, as reported (GAAP) | | $ | 32,068 |

| | $ | 28,176 |

| | $ | 24,226 |

| | $ | 18,940 |

| | $ | 13,987 |

|

Acquisition-related charges, after-tax (1) | | 4,125 |

| | 1,099 |

| | 1,349 |

| | 2,257 |

| | 6,211 |

|

Exit and realignment charges, after-tax (2) | | 436 |

| | 4,280 |

| | 3,520 |

| | 6,335 |

| | 11,477 |

|

Fair value adjustments related to purchase accounting, after-tax (3) | | — |

| | — |

| | — |

| | — |

| | (4,703 | ) |

Other, after-tax (4) | | (1,500 | ) | | — |

| | — |

| | — |

| | 3,907 |

|

Net income, adjusted (Non-GAAP) | | $ | 35,129 |

| | $ | 33,555 |

| | $ | 29,095 |

| | $ | 27,532 |

| | $ | 30,879 |

|

| | | | | | | | | | |

Net income per diluted common share, as reported (GAAP) | | $ | 0.51 |

| | $ | 0.45 |

| | $ | 0.39 |

| | $ | 0.30 |

| | $ | 0.22 |

|

Acquisition-related charges, after-tax (1) | | 0.07 |

| | 0.02 |

| | 0.02 |

| | 0.03 |

| | 0.10 |

|

Exit and realignment charges, after-tax (2) | | — |

| | 0.07 |

| | 0.05 |

| | 0.11 |

| | 0.18 |

|

Fair value adjustments related to purchase accounting, after-tax (3) | | — |

| | — |

| | — |

| | — |

| | (0.07 | ) |

Other, after-tax (4) | | (0.02 | ) | | — |

| | — |

| | — |

| | 0.06 |

|

Net income per diluted common share, adjusted (Non-GAAP) | | $ | 0.56 |

| | $ | 0.54 |

| | $ | 0.46 |

| | $ | 0.44 |

| | $ | 0.49 |

|

| | | | | | | | | | |

Financing: | | | | | | | | | | |

Cash and cash equivalents | | $ | 161,020 |

| | $ | 125,245 |

| | $ | 200,969 |

| | $ | 159,056 |

| | $ | 56,772 |

|

Total interest-bearing debt | | $ | 577,585 |

| | $ | 578,512 |

| | $ | 579,415 |

| | $ | 579,505 |

| | $ | 613,809 |

|

| | | | | | | | | | |

Stock information: | | | | | | | | | | |

Cash dividends per common share | | $ | 0.2525 |

| | $ | 0.2525 |

| | $ | 0.2525 |

| | $ | 0.2525 |

| | $ | 0.25 |

|

Stock price at quarter-end | | $ | 35.98 |

| | $ | 31.94 |

| | $ | 34.00 |

| | $ | 33.84 |

| | $ | 35.11 |

|

Owens & Minor, Inc.

Financial Statistics and GAAP/Non-GAAP Reconciliations (unaudited)

The following items have been excluded in our non-GAAP financial measures:

(1) Acquisition-related charges in 2015 consist primarily of costs to continue the integration of Medical Action and ArcRoyal which were acquired in the fourth quarter of 2014 including certain severance and contractual payments to the former owner and costs to transition information technology and other administrative functions. Charges incurred in 2014 related primarily to costs to complete the transactions, and costs to begin the integration of the acquired operations (including certain severance and contractual payments) as well as certain costs in Movianto to resolve issues and claims with the former owner.

(2) Exit and realignment charges in 2015 and 2014 were associated with optimizing our operations and include the consolidation of distribution and logistics centers and closure of offsite warehouses in the United States and Europe, as well as other costs associated with our strategic organizational realignment which include certain professional fees and costs to streamline administrative functions and processes in Europe.

(3) The fourth quarter of 2014 included a gain of $6.7 million (pretax) recorded in other operating income, net from a fair value adjustment to contingent consideration related to the Movianto acquisition purchase price, offset by the incremental charge to cost of goods sold of $3.0 million (pretax) from purchase accounting impacts related to the sale of acquired inventory that was written up to fair value in connection with the 2014 acquisitions.

(4) The fourth quarter of 2015 included a partial recovery of $1.5 million related to a contract settlement in the United Kingdom for which $3.9 million was expensed in 2014. Both the 2015 recovery and the 2014 settlement expense were recorded in other operating income, net.

These charges have been tax effected in the preceding table by determining the income tax rate depending on the amount of charges incurred in different tax jurisdictions and the deductibility of those charges for income tax purposes.

Use of Non-GAAP Measures

This earnings release contains financial measures that are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP"). In general, the measures exclude items and charges that (i) management does not believe reflect Owens & Minor, Inc.'s (the "Company") core business and relate more to strategic, multi-year corporate activities; or (ii) relate to activities or actions that may have occurred over multiple or in prior periods without predictable trends. Management uses these non-GAAP financial measures internally to evaluate the Company's performance, evaluate the balance sheet, engage in financial and operational planning and determine incentive compensation. Management provides these non-GAAP financial measures to investors as supplemental metrics to assist readers in assessing the effects of items and events on its financial and operating results and in comparing the Company's performance to that of its competitors. However, the non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial statements set forth above should be carefully evaluated.

Owens & Minor, Inc.

Summary Segment Information (unaudited)

(in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| | | % of | | | | % of | | | | % of | | | | % of |

| | | consolidated | | | | consolidated | | | | consolidated | | | | consolidated |

| Amount | | net revenue | | Amount | | net revenue | | Amount | | net revenue | | Amount | | net revenue |

Net revenue: | | | | | | | | | | | | | | | |

Domestic | $ | 2,384,836 |

| | 95.86 | % | | $ | 2,353,321 |

| | 94.44 | % | | $ | 9,356,140 |

| | 95.74 | % | | $ | 8,951,852 |

| | 94.83 | % |

International | 103,078 |

| | 4.14 | % | | 138,496 |

| | 5.56 | % | | 416,806 |

| | 4.26 | % | | 488,330 |

| | 5.17 | % |

Consolidated net revenue | $ | 2,487,914 |

| | 100.00 | % | | $ | 2,491,817 |

| | 100.00 | % | | $ | 9,772,946 |

| | 100.00 | % | | $ | 9,440,182 |

| | 100.00 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | % of segment | | | | % of segment | | | | % of segment | | | | % of segment |

Operating earnings (loss): | | | net revenue | | | | net revenue | | | | net revenue | | | | net revenue |

Domestic | $ | 62,459 |

| | 2.62 | % | | $ | 57,428 |

| | 2.44 | % | | $ | 223,364 |

| | 2.39 | % | | $ | 209,277 |

| | 2.34 | % |

International | 641 |

| | 0.62 | % | | 1,534 |

| | 1.11 | % | | 3,899 |

| | 0.94 | % | | (6,739 | ) | | (1.38 | )% |

Acquisition-related and exit and realignment charges (1) | (6,647 | ) | | N/A |

| | (17,988 | ) | | N/A |

| | (28,404 | ) | | N/A |

| | (42,801 | ) | | N/A |

|

Fair value adjustments related to purchase accounting | — |

| | N/A |

| | 3,706 |

| | N/A |

| | — |

| | N/A |

| | 3,706 |

| | N/A |

|

Other | 1,500 |

| | N/A |

| | (3,907 | ) | | N/A |

| | 1,500 |

| | N/A |

| | (3,907 | ) | | N/A |

|

Consolidated operating earnings | $ | 57,953 |

| | 2.33 | % | | $ | 40,773 |

| | 1.64 | % | | $ | 200,359 |

| | 2.05 | % | | $ | 159,536 |

| | 1.69 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Depreciation and amortization: | | | | | | | | | | | | | | |

Domestic | $ | 9,143 |

| | | | $ | 10,420 |

| | | | $ | 40,582 |

| | | | $ | 37,193 |

| | |

International | 4,967 |

| | | | 5,406 |

| | | | 20,926 |

| | | | 20,230 |

| | |

Consolidated depreciation and amortization | $ | 14,110 |

| | | | $ | 15,826 |

| | | | $ | 61,508 |

| | | | $ | 57,423 |

| | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Capital expenditures: (2) | | | | | | | | | | | | | | | |

Domestic | $ | 4,286 |

| | | | $ | 12,419 |

| | | | $ | 18,458 |

| | | | $ | 52,529 |

| | |

International | 133 |

| | | | 4,232 |

| | | | 18,158 |

| | | | 18,279 |

| | |

Consolidated capital expenditures | $ | 4,419 |

| | | | $ | 16,651 |

| | | | $ | 36,616 |

| | | | $ | 70,808 |

| | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| December 31, 2015 | | | | December 31, 2014 | | | | | | | | | | |

Total assets: | | | | | | | | | | | | | | | |

Domestic | $ | 2,155,236 |

| | | | $ | 2,139,972 |

| | | | | | | | | | |

International | 461,584 |

| | | | 538,662 |

| | | | | | | | | | |

Segment assets | 2,616,820 |

| | | | 2,678,634 |

| | | | | | | | | | |

Cash and cash equivalents | 161,020 |

| | | | 56,772 |

| | | | | | | | | | |

Consolidated total assets | $ | 2,777,840 |

| | | | $ | 2,735,406 |

| | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1) The years ended December 31, 2015 and 2014 include $4.5 million and $6.0 million, respectively and the three months ended December 31, 2014 includes $3.3 million of accelerated amortization related to an information system that has been replaced. |

(2) Represents additions to property and equipment and additions to computer software and separately acquired intangible assets. |

Owens & Minor, Inc.

Net Income Per Common Share (unaudited)

(in thousands, except per share data)

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Numerator: | | | | | | | |

Net income | $ | 32,068 |

| | $ | 13,987 |

| | $ | 103,409 |

| | $ | 66,503 |

|

Less: income allocated to unvested restricted shares | (307 | ) | | (141 | ) | | (925 | ) | | (597 | ) |

Net income attributable to common shareholders - basic | 31,761 |

| | 13,846 |

| | 102,484 |

| | 65,906 |

|

Add: undistributed income attributable to unvested restricted shares -basic | 107 |

| | — |

| | 235 |

| | 18 |

|

Less: undistributed income attributable to unvested restricted shares -diluted | (107 | ) | | — |

| | (235 | ) | | (18 | ) |

Net income attributable to common shareholders - diluted | $ | 31,761 |

| | $ | 13,846 |

| | $ | 102,484 |

| | $ | 65,906 |

|

| | | | | | | |

Denominator: | | | | | | | |

Weighted average shares outstanding — basic | 61,771 |

| | 62,193 |

| | 62,116 |

| | 62,220 |

|

Dilutive shares - stock options | — |

| | 4 |

| | 1 |

| | 6 |

|

Weighted average shares outstanding — diluted | 61,771 |

| | 62,197 |

| | 62,117 |

| | 62,226 |

|

| | | | | | | |

| | | | | | | |

Net income per share attributable to common shareholders: | | | | | | | |

Basic | $ | 0.51 |

| | $ | 0.22 |

| | $ | 1.65 |

| | $ | 1.06 |

|

Diluted | $ | 0.51 |

| | $ | 0.22 |

| | $ | 1.65 |

| | $ | 1.06 |

|

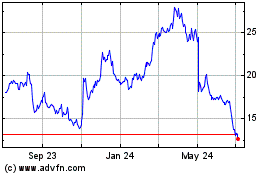

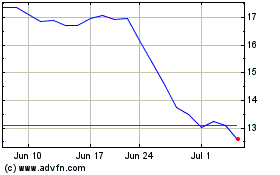

Owens and Minor (NYSE:OMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Owens and Minor (NYSE:OMI)

Historical Stock Chart

From Apr 2023 to Apr 2024