UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 5, 2016

BROADWIND ENERGY, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-34278

|

|

88-0409160

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

3240 South Central Avenue, Cicero, Illinois 60804

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (708) 780-4800

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

On February 2, 2016, the Board of Directors of Broadwind Energy, Inc. (the “Company”) unanimously approved, and on February 5, 2016, the Company entered into, a First Amendment to Section 382 Rights Agreement (the “Amendment”), which amends the Section 382 Rights Agreement, dated as of February 12, 2013 (the “Rights Agreement”), between the Company and Wells Fargo, National Association (“Wells Fargo”), as rights agent. Wells Fargo also serves as to the Company’s transfer agent.

The Amendment (i) decreases the purchase price for each one-thousandth of a share of the Company’s Series A Junior Participating Preferred Stock, par value $0.001 per share, from $14.00 to $9.81 and (ii) extends the Final Expiration Date (as defined in the Rights Agreement) from February 22, 2016 to February 22, 2019. In addition, the Amendment provides that the Rights (as defined in the Rights Agreement) will no longer be exercisable if the Company’s stockholders do not approve the Amendment at the Company’s 2016 Annual Meeting of Stockholders.

The Amendment was not adopted as a result of, or in response to, any effort to acquire control of the Company. The Amendment has been adopted in order to preserve for the Company’s stockholders the long-term value of the Company’s net operating loss carry-forwards for United States federal income tax purposes and other tax benefits.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the Amendment, which is filed as Exhibit 4.1 hereto and is incorporated herein by reference. The Rights Agreement and a description of its material terms were filed with the Securities and Exchange Commission in a Current Report on Form 8-K on February 13, 2013.

On February 5, 2016, the Company issued a press release regarding the matters described above. The press release is incorporated herein by reference and is attached hereto as Exhibit 99.1.

Item 3.03. Material Modification to Rights of Security Holders.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated into this Item 3.03 by reference.

Item 9.01. Financial Statements and Exhibits.

|

(d)

|

Exhibits

|

|

|

|

|

|

|

|

EXHIBIT

NUMBER

|

DESCRIPTION

|

|

4.1

99.1

|

First Amendment to Section 382 Rights Agreement, dated as of February 5, 2016, between Broadwind Energy, Inc. and Wells Fargo, National Association, as rights agent

Press Release dated February 5, 2016

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BROADWIND ENERGY, INC.

|

|

|

|

|

|

February 8, 2016

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

|

|

|

|

Stephanie K. Kushner

|

|

|

|

Interim President and Chief Executive Officer

|

|

|

|

and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

EXHIBIT

NUMBER

|

|

DESCRIPTION

|

|

4.1

99.1

|

|

First Amendment to Section 382 Rights Agreement, dated as of February 5, 2016, between Broadwind Energy, Inc. and Wells Fargo, National Association, as rights agent

Press Release dated February 5, 2016

|

Exhibit 4.1

FIRST AMENDMENT TO SECTION 382 RIGHTS AGREEMENT

THIS FIRST AMENDMENT TO SECTION 382 RIGHTS AGREEMENT (this “Amendment”) is made and entered into as of February 5, 2016, by and between Broadwind Energy, Inc., a Delaware corporation (the “Company”), and Wells Fargo, National Association, as rights agent (the “Rights Agent”).

WHEREAS, the Company and the Rights Agent entered into a Section 382 Rights Agreement dated as of February 12, 2013 (the “Agreement”);

WHEREAS, Section 27 of the Agreement provides, among other things, that, prior to the Stock Acquisition Date (as defined in the Agreement) the Company and the Rights Agent may from time to time supplement or amend the Agreement in any respect without the approval of any holders of Rights (as defined in the Agreement);

WHEREAS, no Stock Acquisition Date has occurred on or prior to the date hereof;

WHEREAS, the Board of Directors of the Company (the “Board”) has determined it is in the best interests of the Company and its stockholders to amend the Agreement as set forth herein; and

WHEREAS, the Board has authorized and approved this Amendment;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company hereby agrees to amend the Agreement as follows and directs the Rights Agent to execute this Amendment:

1. Section 7 of the Agreement is hereby amended as follows:

(a)Clause (a)(i) shall be removed and replaced with the following:

(i) the Close of Business on February 22, 2019 (the “Final Expiration Date”),

(b)Clause (a)(vi) shall be removed and replaced with the following:

(vi) the Close of Business on the first Business Day following the date on which the Inspector of Election for the Company’s 2016 Annual Meeting of Stockholders certifies that the vote on the amendment to this Agreement dated as of February 5, 2016 at such meeting (with the required vote for such approval to be described in the Company’s proxy statement relating to such Annual Meeting) reflects that stockholder approval of such amendment has not been received (the earliest of (i), (ii), (iii), (iv), (v) and (vi) being herein referred to as the “Expiration Date”).

(c)Clause (b) shall be removed and replaced with the following:

The Purchase Price for each one one-thousandth of a share of Preferred Stock pursuant to the exercise of a Right shall initially be $9.81, and shall be subject to adjustment from time to time as provided in Section 11 and shall be payable in accordance with paragraph (c) below.

2.Exhibit B to the Agreement is hereby amended as follows:

(a) The reference to “FEBRUARY 22, 2016” on page B-1 shall be removed and replaced with “FEBRUARY 22, 2019.”

(b) The first sentence on page B-2 shall be removed and replaced with the following:

This certifies that _______________, or registered assigns, is the registered owner of the number of Rights set forth above, each of which entitles the owner thereof, subject to the terms, provisions and conditions of the Section 382 Rights Agreement, dated as of February 12, 2013 (as amended from time to time, the “Rights Agreement”), between Broadwind Energy, Inc., a Delaware corporation (the “Company”), and Wells Fargo, National Association (the “Rights Agent”), to purchase from the Company at any time prior to the Expiration Date (as defined in the Rights Agreement) at the office or offices of the Rights Agent designated for such purpose, or its successors as Rights Agent, one one-thousandth of a fully paid, nonassessable share of Series A Junior Participating Preferred Stock, par value $0.001 per share (the “Preferred Stock”), of the Company, at a purchase price of $_____ per one one-thousandth of a share (the “Purchase Price”), upon presentation and surrender of this Rights Certificate with the Form of Election to Purchase and related Certificate duly executed.

3.Exhibit C to the Agreement is hereby amended as follows:

(a)The second sentence of Exhibit C shall be removed and replaced with the following:

Each right entitles its holder, under the circumstances described below, to purchase from us one one-thousandth of a share of our Series A Junior Participating Preferred Stock at an exercise price of $9.81 per right, subject to adjustment.

(b) The first bullet point in the eleventh paragraph of Exhibit C shall be removed and replaced with the following:

•the close of business on February 22, 2019;

(c) The last bullet point in the eleventh paragraph of Exhibit C shall be removed and replaced with the following:

•the close of business on the first business day following the date on which the Inspector of Election for Broadwind’s 2016 Annual Meeting of Stockholders certifies that the

vote on the amendment, dated as of February 5, 2016, to the Section 382 Rights Agreement at such meeting reflects that stockholder approval has not been received.

(d)The thirteenth paragraph of Exhibit C shall be removed and replaced with the following:

For example, at an exercise price of $9.81 per right, each right not owned by an acquiring person (or by certain related parties) following a flip-in event would entitle its holder to purchase $19.62 worth of common stock (or other consideration, as noted above) for $9.81. Assuming that the common stock had a per share value of $2.45 at that time, the holder of each valid right would be entitled to purchase eight shares of common stock for $9.81.

4. This Amendment is effective as of the date first set forth above.

5. Capitalized terms used but not defined herein shall have the respective meanings ascribed to such terms in the Agreement.

6.This Amendment may be executed in any number of counterparts; each such counterpart shall for all purposes be deemed to be an original; and all such counterparts shall together constitute but one and the same instrument. A signature to this Amendment executed and/or transmitted electronically shall have the same authority, effect and enforceability as an original signature.

7.Except as modified hereby, the Agreement is reaffirmed in all respects, and all references therein to “the Agreement” shall mean the Agreement, as modified hereby.

* * * * *

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the date first written above.

Attest:BROADWIND ENERGY, INC.

By: /s/ David W. Fell By: /s/ Stephanie K. Kushner

David W. Fell Stephanie K. Kushner

Secretary Interim President & Chief Executive Officer

Attest:WELLS FARGO, NATIONAL ASSOCIATION

By: /s/ Martin J. KnappBy: /s/ Andrea Severson

Name: Martin J. Knapp Name: Andrea Severson

Title: Vice President Title: AVP – Client Services

Exhibit 99.1

Broadwind Energy Approves Extension of Section 382 Rights Plan

Cicero, Ill., February 5, 2016 — Broadwind Energy, Inc. (NASDAQ: BWEN) announced today that its Board of Directors has approved an amendment to the Company’s Section 382 Rights Plan (the “Rights Plan”) designed to preserve Broadwind’s substantial tax assets associated with net operating loss carryforwards (“NOLs”) under Section 382 of the Internal Revenue Code (“Section 382”). The amendment extends the Rights Plan through February 22, 2019.

Broadwind interim CEO Stephanie Kushner stated, “The Rights Plan was designed to serve the interests of all shareholders by helping to protect Broadwind’s valuable tax assets of approximately $200 million that can be used to offset future taxable income.”

Pursuant to U.S. federal income tax rules, Broadwind’s use of certain tax assets could be substantially limited if the Company experiences an “ownership change” (as defined in Section 382). In general, an ownership change occurs if the ownership of Broadwind’s stock by “5 percent shareholders” increases by more than 50 percent over the lowest percentage owned by such shareholders at any time during the prior three years on a rolling basis. Broadwind intends to submit the amendment to the Rights Plan for shareholder ratification at its 2016 Annual Meeting of Stockholders.

In connection with the original implementation of the Rights Plan, the Board declared a non-taxable dividend of one preferred share purchase right (a “Right”) for each outstanding share of Broadwind common stock to the Company’s shareholders of record as of the close of business on February 22, 2013. Under the Rights Plan, any person or group that acquires beneficial ownership of 4.9% or more of the Company’s common stock without Board approval would be subject to significant dilution in the ownership interest of that person or group. Shareholders who owned 4.9% or more of the outstanding shares of Broadwind common stock as of the effective date of the Rights Plan will not trigger the Rights unless they acquire additional shares.

The Rights will expire on the earliest of (i) the close of business on February 22, 2019 (unless that date is advanced or extended by the Board), (ii) the time at which the Rights are redeemed or exchanged under the Rights Plan, (iii) the repeal of Section 382 or any successor statute and the Board’s determination that the Rights Plan is no longer necessary for the preservation of the Company’s NOLs, (iv) the beginning of a taxable year of the Company to which the Board determines that no NOLs may be carried forward, or (v) the failure to obtain shareholder ratification of the amendment to the Rights Plan at Broadwind’s 2016 Annual Meeting of Stockholders.

Additional information regarding the amendment to the Rights Plan will be contained in a Form 8-K and in an amendment to Registration Statement on Form 8-A that Broadwind is filing with the Securities and Exchange Commission.

About Broadwind Energy, Inc.

Broadwind Energy (NASDAQ: BWEN) applies decades of deep industrial expertise to innovate integrated solutions for customers in the energy and infrastructure markets. From gears and gearing systems for wind, oil and gas and mining applications, to wind towers and industrial weldments, we have solutions for the energy needs of the future. With facilities throughout the central U.S., Broadwind Energy's talented team is committed to helping customers maximize performance of their investments—quicker, easier and smarter. Find out more at www.bwen.com

Forward-Looking Statements

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve risks, uncertainties and assumptions, such as statements regarding our third-quarter outlook, as well as assumptions made by, and information currently available to, our management. Forward-looking statements include any statement that does not directly relate to a current or historical fact. We have tried to identify forward-looking statements by using words such as “anticipate,” “believe,” “expect,” “intend,” “will,” “should,” “may,” “plan” and similar expressions, but these words are not the exclusive means of identifying forward-looking statements. These statements are based on current expectations, and we undertake no obligation to update these statements to reflect events or circumstances occurring after this release. Such statements are subject to various risks and uncertainties that could cause actual results to vary materially from those stated. Such risks and uncertainties include, but are not limited to: expectations regarding our business, end-markets, relationships with customers and our ability to diversify our customer base; the impact of competition and economic volatility on the industries in which we compete, including, but not limited to, the oil and gas and mining markets; our ability to realize revenue from customer orders and backlog; the impact of regulation on our end-markets, including the wind energy industry in particular; the sufficiency of our liquidity and working capital and our plans to evaluate alternative sources of funding if necessary; our ability to preserve and utilize our tax net operating loss carry-forwards; our plans to continue to grow our business through organic growth; our plans with respect to the use of proceeds from financing activities and our ability to operate our business efficiently, manage capital expenditures and costs effectively, and generate cash flow; and other risks and uncertainties described in our filings with the Securities and Exchange Commission, including those contained in Part I, Item 1A “Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2014.

BWEN INVESTOR CONTACT: Joni Konstantelos, 708.780.4819 joni.konstantelos@bwen.com

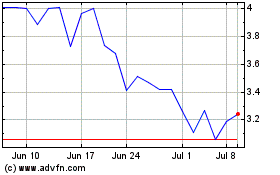

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

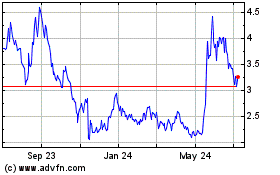

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Apr 2023 to Apr 2024