Filed pursuant to Rule 433

Registration No. 333-192302

|

|

|

|

|

| 2

|

|

CitiFirst Offerings

Brochure | February 2016

|

|

|

Table of Contents

For all offerings documented herein (other than the Market-Linked Certificates of Deposit):

|

|

|

|

|

|

|

|

|

|

|

Investment Products

|

|

Not FDIC Insured

|

|

May Lose Value

|

|

No Bank

Guarantee |

|

|

|

|

|

| |

|

CitiFirst Offerings Brochure | February 2016

|

|

3

|

Introduction to CitiFirst Investments

CitiFirst is the brand name for Citi’s offering of investments including notes and deposits. Tailored to meet the needs of a range of

investors, CitiFirst investments are divided into three categories based on the amount of principal due at maturity:

|

|

|

|

|

|

|

|

|

|

| CitiFirst Protection

Full principal amount due at maturity |

|

CitiFirst Performance

Payment due at maturity may be less than the principal

amount |

|

CitiFirst Opportunity

Payment due at maturity may be zero |

|

|

|

| Investments provide for the full principal amount to be due at maturity, subject to the credit risk of the issuer, and are for investors who place a priority on the

preservation of principal while looking for a way to potentially outperform cash or traditional fixed income investments |

|

Investments provide for a payment due at maturity, subject to the credit risk of the issuer, that may be less than the principal amount and in some cases may be zero, and

are for investors who are seeking the potential for current income and/or growth, in addition to partial or contingent downside protection |

|

Investments provide for a payment at maturity, subject to the credit risk of the issuer, that may be zero and are for investors who are willing to take full market risk in

return for either leveraged principal appreciation at a predetermined rate or access to a unique underlying strategy |

The structured investments discussed herein are not suitable for all investors. Prospective investors should

evaluate their financial objectives and tolerance for risk prior to investing in any structured investment. The SEC registered securities described herein are not bank deposits but are senior, unsecured debt obligations of Citi. All returns and any

principal amount due at maturity are subject to the applicable issuer credit risk, with the exception of the Market-Linked Certificates of Deposit which have FDIC insurance, subject to applicable limitations. Structured investments are not

conventional debt securities. They are complex in nature and the specific terms and conditions will vary for each offering.

CitiFirst

operates across all asset classes meaning that underlying assets include equities, commodities, currencies, interest rates and alternative investments. When depicting a specific product, the relevant underlying asset will be shown as a symbol on the

cube:

|

|

|

|

|

| For instance, if a CitiFirst Performance investment were based upon a single stock, which belongs to an equity asset class, its symbol would be shown as

follows: |

|

|

|

|

Classification of investments into categories is not intended to guarantee particular results or performance. Though

the potential returns on structured investments are based upon the performance of the relevant underlying asset or index, investing in a structured investment is not equivalent to investing directly in the underlying asset or index.

|

|

|

|

|

| 4

|

|

CitiFirst Offerings

Brochure | February 2016

|

|

|

|

|

|

Market-Linked Notes Based on

a Basket of Three Underliers |

|

|

Indicative Terms*

|

|

|

|

|

| Issuer: |

|

Citigroup Inc. |

|

|

| Basket: |

|

Basket Component |

|

Weighting Initial Component Value* Multiplier** |

|

|

|

|

|

Dow Jones Industrial

AverageTM (ticker symbol:

“INDU”) |

|

33.34% |

|

|

Nikkei 225 Index (ticker symbol: “NKY”) |

|

33.33% |

|

|

Shares of the iShares® Core

U.S. Aggregate Bond ETF (ticker symbol: “AGG”) |

|

33.33% |

|

|

|

|

* The initial component value for each basket component will be the closing level or

closing price, as applicable, of that basket component on the pricing date |

|

|

|

|

** The multiplier for each basket component will be determined as follows: (initial basket level x

weighting) / initial component value. |

| Stated principal amount: |

|

$1,000 per note |

| Pricing date: |

|

February , 2016 (expected to be February 24, 2016) |

| Issue date: |

|

February , 2016 (three business days after the pricing

date) |

| Valuation dates: |

|

The day of each February, May, August, November (expected to be the

24th day of each February, May, August,

November) during the term of the notes, beginning May 2016, each subject to postponement if such date is not a scheduled trading day or if certain market disruption events occur with respect to a basket component |

| Maturity date: |

|

August , 2021 (expected to be August 27, 2021) |

| Coupon payment dates: |

|

The day of each February and August (expected to be the 27th day of each February and August), beginning on August

, 2016 (expected to be August 27, 2016) and ending on the maturity date, provided that if any such day is not a business day, the applicable coupon payment will be made on the next succeeding business day and no interest will

accrue as a result of delayed payment |

| Coupon: |

|

On each semi-annual coupon payment date, the notes will pay a coupon at a rate of 0.25% per annum |

| Payment at maturity: |

|

For each note, the $ 1,000 stated principal amount per note

plus the note return amount, which will be either zero or positive, plus the coupon payment due at maturity |

| |

|

| Note return amount: |

|

¡ If the average basket return percentage is greater than zero: |

|

|

|

|

$ 1,000 x average basket return percentage x upside participation rate |

|

|

|

|

¡ If the average basket return percentage is less than or equal to zero: |

|

|

|

|

$ 0 |

| Average basket return percentage: |

|

The arithmetic average of the interim basket return percentages, as measured on each of the valuation

dates |

| Interim basket return percentage: |

|

On each valuation date: (ending basket level – initial basket level) / initial basket

level |

For questions, please call your

Financial Advisor

* The information listed above is not intended to be a complete description of all of the terms,

risks and benefits of a particular investment. All maturities are approximate. All terms in brackets are indicative only and will be set on the applicable pricing date. All returns and any principal amount due at maturity are subject to the

applicable issuer’s credit risk, with the exception of the Market-Linked Certificates of Deposit which have FDIC insurance, subject to applicable limitations. Please refer to the relevant investment’s offering documents and related

material(s) for additional information.

|

|

|

|

|

| |

|

CitiFirst Offerings Brochure | February 2016

|

|

5

|

|

|

|

| Initial basket level: |

|

100 |

| Ending basket level: |

|

The closing level of the basket on the relevant valuation date. The closing level of the basket on any valuation date is equal to the

sum of the products of each basket component’s closing level or closing price, as applicable, on that date and its multiplier |

| Upside participation rate: |

|

100.00% to 120.00%. The actual upside participation rate will be determined on the pricing date. |

| CUSIP: |

|

17298C6Y9 |

| Listing: |

|

The notes will not be listed on any securities exchange and, accordingly, may have limited or no liquidity. You should not invest in

the notes unless you are willing to hold them to maturity. |

Investor Profile

|

|

|

|

|

|

|

|

|

| Investor Seeks: |

|

|

|

Investor Can Accept: |

| ¡ |

|

A medium-term equity index-linked investment |

|

|

|

¡ |

|

A holding period of approximately 5.5 years |

|

|

|

|

|

| ¡ |

|

Full principal amount due at maturity |

|

|

|

¡ |

|

The structured investments discussed herein are not suitable for all investors. Prospective investors should evaluate their financial objectives and

tolerance for risk prior to investing in any structured investment |

A complete description of the risks associated with this investment is outlined in the

“Summary Risk Factors” section of the applicable preliminary pricing supplement.

For questions, please call your Financial Advisor

* The information listed above is not intended to be a complete description of all of the terms, risks and benefits of a particular

investment. All maturities are approximate. All terms in brackets are indicative only and will be set on the applicable pricing date. All returns and any principal amount due at maturity are subject to the applicable issuer’s credit risk, with

the exception of the Market-Linked Certificates of Deposit which have FDIC insurance, subject to applicable limitations. Please refer to the relevant investment’s offering documents and related material(s) for additional information.

|

|

|

|

|

| 6

|

|

CitiFirst Offerings

Brochure | February 2016

|

|

|

|

|

|

| Enhanced Barrier Digital Plus Securities Based on the S&P 500® Index |

|

|

Indicative Terms*

|

|

|

| Issuer: |

|

Citigroup Inc. |

| Underlying index: |

|

The S&P 500® Index (ticker symbol: “SPX”) |

| Stated principal amount: |

|

$1,000 per security |

| Pricing date: |

|

February , 2016 (expected to be February 25, 2016) |

| Issue date: |

|

February , 2016 (three business days after the pricing date) |

| Valuation date: |

|

February , 2021 (expected to be February 25, 2021), subject to postponement if

such date is not a scheduled trading day or if certain market disruption events occur |

| Maturity date: |

|

March , 2021 (expected to be March 2, 2021) |

| Payment at maturity: |

|

For each $1,000 stated principal amount security you hold at maturity: |

|

|

|

|

¡ If the final index level is greater than or equal to the barrier level: |

|

|

|

|

$1,000 + the greater of (i) the fixed return amount and (ii) $1,000 x the index percent increase |

|

|

|

|

¡ If the final index level is less than

the barrier level: |

|

|

|

|

$1,000 x the index performance factor |

|

|

| |

|

If the final index level is less than the barrier level, your payment at maturity will be less, and possibly significantly less,

than $800.00 per security. You should not invest in the securities unless you are willing and able to bear the risk of losing a significant portion of your investment. |

| Initial index level: |

|

, the closing level of the underlying index on the

pricing date |

| Final index level: |

|

The closing level of the underlying index on the valuation date |

| Fixed return amount: |

|

$220.00 to $250.00 per security (22.00% to 25.00% of the stated principal amount), to be determined on

the pricing date. You will receive the fixed return amount only if the final index level is greater than or equal to the barrier level. |

| Index performance factor: |

|

The final index level divided by

the initial index level |

| Index percent increase: |

|

The final index level minus

the initial index level, divided by the

initial index level |

| Barrier level: |

|

, 80.00% of the initial index level |

| Listing: |

|

The securities will not be listed on any securities exchange and, accordingly, may have limited or no

liquidity. You should not invest in the securities unless you are willing to hold them to maturity. |

| CUSIP: |

|

17298C7B8 |

For questions, please call your

Financial Advisor

* The information listed above is not intended to be a complete description of all of the terms,

risks and benefits of a particular investment. All maturities are approximate. All terms in brackets are indicative only and will be set on the applicable pricing date. All returns and any principal amount due at maturity are subject to the

applicable issuer’s credit risk, with the exception of the Market-Linked Certificates of Deposit which have FDIC insurance, subject to applicable limitations. Please refer to the relevant investment’s offering documents and related

material(s) for additional information.

|

|

|

|

|

| |

|

CitiFirst Offerings Brochure | February 2016

|

|

7

|

Investor Profile

|

|

|

|

|

|

|

|

|

| Investor Seeks: |

|

|

|

Investor Can Accept: |

|

¡ |

|

A medium-term equity index-linked investment |

|

|

|

¡ |

|

A holding period of approximately 5 years |

|

|

|

|

|

|

¡ |

|

A risk-adjusted equity complement |

|

|

|

¡ |

|

The possibility of losing a significant portion of the principal amount invested |

|

|

|

|

|

|

|

|

|

|

|

¡ |

|

The structured investments discussed herein are not suitable for all investors. Prospective investors should evaluate their financial objectives and

tolerance for risk prior to investing in any structured investment |

A complete description of the risks associated with this investment is outlined in the

“Summary Risk Factors” section of the applicable preliminary pricing supplement.

For questions, please call your Financial Advisor

* The

information listed above is not intended to be a complete description of all of the terms, risks and benefits of a particular investment. All maturities are approximate. All terms in brackets are indicative only and will be set on the applicable

pricing date. All returns and any principal amount due at maturity are subject to the applicable issuer’s credit risk, with the exception of the Market-Linked Certificates of Deposit which have FDIC insurance, subject to applicable limitations.

Please refer to the relevant investment’s offering documents and related material(s) for additional information.

|

|

|

|

|

| 8

|

|

CitiFirst Offerings

Brochure | February 2016

|

|

|

|

|

|

| Buffer Securities Based on the Dow Jones Industrial AverageTM |

|

|

Indicative Terms*

|

|

|

| Issuer: |

|

Citigroup Inc. |

| Underlying index: |

|

Dow Jones Industrial AverageTM (ticker symbol: “INDU”) |

| Stated principal amount: |

|

$1,000 per security |

| Pricing date: |

|

February , 2016 (expected to be February 25, 2016) |

| Issue date: |

|

February , 2016 (three business days after the pricing date) |

| Valuation date: |

|

February , 2021 (expected to be February 25, 2021), subject to postponement if such date is not a scheduled

trading day or if certain market disruption events occur |

| Maturity date: |

|

March , 2021 (expected to be March 1, 2021) |

| Payment at maturity: |

|

For each $1,000 stated principal amount security you hold at maturity: |

|

|

|

|

¡ If the final index level is greater

than the initial index level: |

|

|

|

|

$1,000 + the leveraged return amount |

|

|

|

|

¡ If the final index level is equal to or less than the initial index level by an amount equal to or less than the

buffer amount: |

|

|

|

|

$1,000 |

|

|

|

|

¡ If the final index level is less than

the initial index level by an amount greater than the buffer amount: |

|

|

|

|

($1,000 x the index performance factor) + $150.00 |

|

|

| |

|

If the underlying index depreciates from the initial index level to the final index level by more than the buffer amount, your

payment at maturity will be less, and possibly significantly less, than the $1,000 stated principal amount per security. You should not invest in the securities unless you are willing and able to bear the risk of losing a significant portion of your

investment. |

| Initial index level: |

|

, the closing level of the underlying index on the pricing date |

| Final index level: |

|

The closing level of the underlying index on the valuation date |

| Index performance factor: |

|

The final index level divided by the initial index level |

| Index percent increase: |

|

The final index level minus the initial index level, divided by the initial index

level |

| Upside amount: |

|

$1,000 x the index percent increase x the leverage factor |

| Upside participation rate: |

|

110.00% to 120.00%. The actual upside participation rate will be determined on the pricing date. |

| Buffer amount: |

|

15.00% |

| Listing: |

|

The securities will not be listed on any securities exchange and, accordingly, may have limited or no liquidity. You should not

invest in the securities unless you are willing to hold them to maturity. |

| CUSIP: |

|

17298C7H5 |

For questions, please call your Financial Advisor

* The

information listed above is not intended to be a complete description of all of the terms, risks and benefits of a particular investment. All maturities are approximate. All terms in brackets are indicative only and will be set on the applicable

pricing date. All returns and any principal amount due at maturity are subject to the applicable issuer’s credit risk, with the exception of the Market-Linked Certificates of Deposit which have FDIC insurance, subject to applicable limitations.

Please refer to the relevant investment’s offering documents and related material(s) for additional information.

|

|

|

|

|

| |

|

CitiFirst Offerings Brochure | February 2016 |

|

9

|

Investor Profile

|

|

|

|

|

|

|

|

|

| Investor Seeks: |

|

|

|

Investor Can Accept: |

|

¡ |

|

A medium-term equity index-linked investment |

|

|

|

¡ |

|

A holding period of approximately 5 years |

|

|

|

|

|

|

¡ |

|

A risk-adjusted equity complement |

|

|

|

¡ |

|

The possibility of losing a significant portion of the principal amount invested |

|

|

|

|

|

|

|

|

|

|

|

¡ |

|

The structured investments discussed herein are not suitable for all investors. Prospective investors should evaluate their financial objectives and

tolerance for risk prior to investing in any structured investment |

A complete description of the risks associated with this investment is outlined in the

“Summary Risk Factors” section of the applicable preliminary pricing supplement.

For questions, please call your Financial Advisor

* The

information listed above is not intended to be a complete description of all of the terms, risks and benefits of a particular investment. All maturities are approximate. All terms in brackets are indicative only and will be set on the applicable

pricing date. All returns and any principal amount due at maturity are subject to the applicable issuer’s credit risk, with the exception of the Market-Linked Certificates of Deposit which have FDIC insurance, subject to applicable limitations.

Please refer to the relevant investment’s offering documents and related material(s) for additional information.

|

|

|

|

|

| 10

|

|

CitiFirst Offerings

Brochure | February 2016

|

|

|

|

|

|

| Barrier Digital Plus Securities Based on iShares® Russell

2000 ETF |

|

|

Indicative Terms*

|

|

|

| Issuer: |

|

Citigroup Inc. |

| Underlying index: |

|

Shares of the iShares® Russell 2000 ETF (NYSE Arca symbol: “IWM”) (the “underlying share issuer” or “ETF”) |

| Stated principal amount: |

|

$1,000 per security |

| Pricing date: |

|

February , 2016 (expected to be February 24, 2016) |

| Issue date: |

|

February , 2016 (three business days after the pricing date) |

| Valuation date: |

|

August , 2019 (expected to be August 26, 2019), subject to postponement if such date is not a scheduled

trading day or if certain market disruption events occur |

| Maturity date: |

|

August , 2019 (expected to be August 29, 2019) |

| Payment at maturity: |

|

For each $1,000 stated principal amount security you hold at maturity: |

|

|

|

|

¡ If the final share price is greater than or equal to the initial share price: |

|

|

|

|

$1,000 + the greater of (i) the fixed return amount and (ii) $1,000 x the share percent increase |

|

|

|

|

¡ If the final share price is less than

the initial share price but greater than or equal to the barrier price: |

|

|

|

|

$1,000 |

|

|

|

|

¡ If the final share price is less than

the barrier price: |

|

|

|

|

$1,000 x the share performance factor |

|

|

| |

|

If the final share price is less than the barrier price, your payment at maturity will be less, and possibly significantly less,

than $800.00 per security. You should not invest in the securities unless you are willing and able to bear the risk of losing a significant portion of your investment. |

| Initial share price: |

|

, the closing price of the underlying shares on the pricing date |

| Final share price: |

|

The closing price of the underlying shares on the valuation date |

| Fixed return amount: |

|

$200.00 to $250.00 per security (20.00% to 25.00% of the stated principal amount), to be determined on the pricing date. You will

receive the fixed return amount only if the final share price is greater than or equal to the initial share price. |

| Share performance factor: |

|

The final share price divided by the initial share price |

| Share percent increase: |

|

The final share price minus the initial share price, divided by the initial share

price |

| Barrier price: |

|

, 80.00% of the initial share price |

| Listing: |

|

The securities will not be listed on any securities exchange and, accordingly, may have limited or no liquidity. You should not

invest in the securities unless you are willing to hold them to maturity. |

| CUSIP: |

|

17298C7E2 |

For questions, please call your Financial Advisor

* The

information listed above is not intended to be a complete description of all of the terms, risks and benefits of a particular investment. All maturities are approximate. All terms in brackets are indicative only and will be set on the applicable

pricing date. All returns and any principal amount due at maturity are subject to the applicable issuer’s credit risk, with the exception of the Market-Linked Certificates of Deposit which have FDIC insurance, subject to applicable limitations.

Please refer to the relevant investment’s offering documents and related material(s) for additional information.

|

|

|

|

|

| |

|

CitiFirst Offerings Brochure | February 2016

|

|

11

|

Investor Profile

|

|

|

|

|

|

|

|

|

| Investor Seeks: |

|

|

|

Investor Can Accept: |

|

¡ |

|

A medium-term equity index-linked investment |

|

|

|

¡ |

|

A holding period of approximately 3.5 years |

|

|

|

|

|

|

¡ |

|

A risk-adjusted equity complement |

|

|

|

¡ |

|

The possibility of losing a significant portion of the principal amount invested |

|

|

|

|

|

|

|

|

|

|

|

¡ |

|

The structured investments discussed herein are not suitable for all investors. Prospective investors should evaluate their financial objectives and tolerance for risk

prior to investing in any structured investment |

A complete description of the risks associated with this investment is outlined in the

“Summary Risk Factors” section of the applicable preliminary pricing supplement.

For questions, please call your Financial Advisor

* The

information listed above is not intended to be a complete description of all of the terms, risks and benefits of a particular investment. All maturities are approximate. All terms in brackets are indicative only and will be set on the applicable

pricing date. All returns and any principal amount due at maturity are subject to the applicable issuer’s credit risk, with the exception of the Market-Linked Certificates of Deposit which have FDIC insurance, subject to applicable limitations.

Please refer to the relevant investment’s offering documents and related material(s) for additional information.

|

|

|

|

|

| 12

|

|

CitiFirst Offerings

Brochure | February 2016

|

|

|

|

|

|

| Autocallable Contingent Coupon Equity Linked Securities Based on the Common Stock of Apple Inc. |

|

|

Indicative Terms*

|

|

|

| Issuer: |

|

Citigroup Inc. |

| Underlying shares: |

|

Shares of common stock of Apple Inc. (NASDAQ symbol: “AAPL”) (the “underlying share

issuer”) |

| Stated principal amount: |

|

$1,000 per security |

| Pricing date: |

|

February , 2016 (expected to be February 24, 2016) |

| Issue date: |

|

February , 2016 (three business days after the pricing date) |

| Valuation dates: |

|

The day of each February, May, August and November (expected to be the 24th day of each February, May, August and November,

beginning in May , 2016 and ending on February , 2018 (the “final valuation date”, which is expected to be February 26, 2018), each subject to postponement if such date is not a

scheduled trading day or if certain market disruption events occur |

| Maturity date: |

|

Unless earlier redeemed, March , 2018 (expected to be March 1, 2018) |

| Contingent coupon payment dates: |

|

For each valuation date, the fifth business day after such valuation date, except that the contingent coupon payment date for the

final valuation date will be the maturity date |

| Contingent coupon: |

|

On each quarterly contingent coupon payment date, unless previously redeemed, the securities will pay a contingent coupon equal to

2.00% to 2.25% (approximately 8.00% to 9.00% per annum) (to be determined on the pricing date) of the stated principal amount of the securities if and only if the closing price of the underlying shares on the related valuation date is greater than

or equal to the coupon barrier price. If the closing price of the underlying shares on any quarterly valuation date is less than the coupon barrier price, you will not receive any

contingent coupon payment on the related contingent coupon payment date. |

| Automatic early redemption: |

|

If, on any quarterly valuation date beginning February , 2017 (expected to be February 24, 2017)

and prior to the final valuation date, the closing price of the underlying shares is greater than or equal to the initial share price, each security you then hold will be automatically redeemed on the related contingent coupon payment date for an

amount in cash equal to $1,000 plus the related contingent coupon payment. |

| Payment at maturity: |

|

If the securities are not automatically redeemed prior to maturity, you will be entitled to receive at maturity, for each security you then hold: |

|

|

|

|

¡ If the final share price is greater than or equal to the final barrier price: |

|

|

|

|

$1,000 plus the contingent coupon payment due at maturity |

|

|

|

|

¡ If the final share price is less than

the final barrier price: |

|

|

|

|

a fixed number of underlying shares equal to the equity ratio (or, if we exercise our cash election right, the cash value of those shares

based on the closing price of the underlying shares on the final valuation date) |

|

|

| |

|

If the final share price is less than the final barrier price, you will receive underlying shares (or, in our sole discretion,

cash) worth less than 80.00% of the stated principal amount of your securities, and possibly nothing, at maturity, and you will not receive any contingent coupon payment at maturity. |

For questions, please call your

Financial Advisor

* The information listed above is not intended to be a complete description of all of the terms,

risks and benefits of a particular investment. All maturities are approximate. All terms in brackets are indicative only and will be set on the applicable pricing date. All returns and any principal amount due at maturity are subject to the

applicable issuer’s credit risk, with the exception of the Market-Linked Certificates of Deposit which have FDIC insurance, subject to applicable limitations. Please refer to the relevant investment’s offering documents and related

material(s) for additional information.

|

|

|

|

|

| |

|

CitiFirst Offerings Brochure | February 2016

|

|

13

|

|

|

|

| Initial share price: |

|

$ , the closing level of the underlying shares on the

pricing date |

| Final share price: |

|

The closing level of the underlying index on the valuation date |

| Coupon barrier price: |

|

$ ,80.00% of the initial share price |

| Final barrier price: |

|

$ ,80.00% of the initial share price |

| Equity ratio: |

|

, the stated principal amount divided by the initial share price, subject to anti-dilution adjustments for certain corporate events |

| Listing: |

|

The securities will not be listed on any securities exchange and, accordingly, may have limited or no liquidity. You should not

invest in the securities unless you are willing to hold them to maturity. |

| CUSIP: |

|

17298C7L6 |

Investor Profile

|

|

|

|

|

|

|

|

|

| Investor Seeks: |

|

|

|

Investor Can Accept: |

| ¡ |

|

A medium-term equity-linked investment |

|

|

|

¡ |

|

A holding period of approximately 2 years |

|

|

|

|

|

| ¡ |

|

A risk-adjusted equity complement |

|

|

|

¡ |

|

The possibility of losing a significant portion of the principal amount invested |

|

|

|

|

|

|

|

|

|

|

|

¡ |

|

The structured investments discussed herein are not suitable for all investors. Prospective investors should evaluate their financial objectives and tolerance for risk

prior to investing in any structured investment |

A complete description of the risks associated with this investment is outlined in the

“Summary Risk Factors” section of the applicable preliminary pricing supplement.

For questions, please call your Financial Advisor

* The information listed above is not intended to be a complete description of all of the terms, risks and benefits of a particular investment. All maturities are approximate. All terms in brackets

are indicative only and will be set on the applicable pricing date. All returns and any principal amount due at maturity are subject to the applicable issuer’s credit risk, with the exception of the Market-Linked Certificates of Deposit which

have FDIC insurance, subject to applicable limitations. Please refer to the relevant investment’s offering documents and related material(s) for additional information.

|

|

|

|

|

| 14

|

|

CitiFirst Offerings

Brochure | February 2016

|

|

|

|

|

|

| Autocallable Contingent Coupon Equity Linked Securities Based on the Class A Common Stock

of Alphabet, Inc. |

|

|

Indicative Terms*

|

|

|

| Issuer: |

|

Citigroup Inc. |

| Underlying shares: |

|

Shares of Class A common stock of Alphabet, Inc. (NASDAQ symbol: “GOOGL”) (the

“underlying share issuer”) |

| Stated principal amount: |

|

$1,000 per security |

| Pricing date: |

|

February , 2016 (expected to be February 24, 2016) |

| Issue date: |

|

February , 2016 (three business days after the pricing date) |

| Valuation dates: |

|

The day of each February and August (expected to be the 24th day of each February 24, 2017 and August), beginning in

August 2016 and ending on February , 2018 (the ““final valuation date”,” which is expected to be February 26, 2018), each subject to postponement if such date is not a scheduled trading day or if certain

market disruption events occur |

| Maturity date: |

|

Unless earlier redeemed, March , 2018 (expected to be March 1, 2018) |

| Contingent coupon payment dates: |

|

For each valuation date, the fifth business day after such valuation date, except that the contingent coupon payment date for the

final valuation date will be the maturity date |

| Contingent coupon: |

|

On each semi-annual contingent coupon payment date, unless previously redeemed, the securities will pay a contingent coupon equal to

3.50% to 4.00% (approximately 7.00% to 8.00% per annum) (to be determined on the pricing date) of the stated principal amount of the securities if and only if the closing price of the underlying shares on the related valuation date is greater than

or equal to the coupon barrier price. If the closing price of the underlying shares on any semi-annual valuation date is less than the coupon barrier price, you will not receive any

contingent coupon payment on the related contingent coupon payment date. |

| Automatic early redemption: |

|

If, on any semi-annual valuation date beginning February , 2017 (expected to be February 24, 2017)

and prior to the final valuation date, the closing price of the underlying shares is greater than or equal to the initial share price, each security you then hold will be automatically redeemed on the related contingent coupon payment date for an

amount in cash equal to $1,000 plus the related contingent coupon payment. |

| Payment at maturity: |

|

If the securities are not automatically redeemed prior to maturity, you will be entitled to receive at maturity, for each security you then hold: |

|

|

|

|

¡ If the final share price is greater than or equal to the final barrier price: |

|

|

|

|

$1,000 plus the contingent coupon payment due at maturity |

|

|

|

|

¡ If the final share price is less than

the final barrier price: |

|

|

|

|

a fixed number of underlying shares equal to the equity ratio (or, if we exercise our cash election right, the cash value of those shares

based on the closing price of the underlying shares on the final valuation date) |

|

|

| |

|

If the final share price is less than the final barrier price, you will receive underlying shares (or, in our sole discretion,

cash) worth less than 80.00% of the stated principal amount of your securities, and possibly nothing, at maturity, and you will not receive any contingent coupon payment at maturity. |

For questions, please call your

Financial Advisor

* The information listed above is not intended to be a complete description of all of the terms,

risks and benefits of a particular investment. All maturities are approximate. All terms in brackets are indicative only and will be set on the applicable pricing date. All returns and any principal amount due at maturity are subject to the

applicable issuer’s credit risk, with the exception of the Market-Linked Certificates of Deposit which have FDIC insurance, subject to applicable limitations. Please refer to the relevant investment’s offering documents and related

material(s) for additional information.

|

|

|

|

|

| |

|

CitiFirst Offerings Brochure | February 2016

|

|

15

|

|

|

|

| Initial share price: |

|

$ , the closing level of the underlying shares on the

pricing date |

| Final share price: |

|

The closing level of the underlying index on the valuation date |

| Coupon barrier price: |

|

$ ,80.00% of the initial share price |

| Final barrier price: |

|

$ ,80.00% of the initial share price |

| Equity ratio: |

|

, the stated principal amount divided by the initial share price, subject to anti-dilution adjustments for certain corporate events |

| Listing: |

|

The securities will not be listed on any securities exchange and, accordingly, may have limited or no

liquidity. You should not invest in the securities unless you are willing to hold them to maturity. |

| CUSIP: |

|

17298C7M4 |

Investor Profile

|

|

|

|

|

|

|

|

|

| Investor Seeks: |

|

|

|

Investor Can Accept: |

| ¡ |

|

A medium-term equity-linked investment |

|

|

|

¡ |

|

A holding period of approximately 2 years |

|

|

|

|

|

| ¡ |

|

A risk-adjusted equity complement |

|

|

|

¡ |

|

The possibility of losing a significant portion of the principal amount invested |

|

|

|

|

|

|

|

|

|

|

|

¡ |

|

The structured investments discussed herein are not suitable for all investors. Prospective investors should evaluate their financial objectives and tolerance for risk

prior to investing in any structured investment |

A complete description of the risks associated with this investment is outlined in the

“Summary Risk Factors” section of the applicable preliminary pricing supplement.

For questions, please call your Financial Advisor

* The information listed above is not intended to be a complete description of all of the terms, risks and benefits of a particular investment. All maturities are approximate. All terms in brackets

are indicative only and will be set on the applicable pricing date. All returns and any principal amount due at maturity are subject to the applicable issuer’s credit risk, with the exception of the Market-Linked Certificates of Deposit which

have FDIC insurance, subject to applicable limitations. Please refer to the relevant investment’s offering documents and related material(s) for additional information.

|

|

|

|

|

| 16

|

|

CitiFirst Offerings Brochure |

February

2016 |

|

|

General Overview of Investments

|

|

|

|

|

|

|

| Investments |

|

Maturity |

|

Risk Profile* |

|

Return* |

| Contingent Absolute Return MLDs/Notes |

|

1-2 Years |

|

Full principal

amount due at

maturity |

|

If the underlying never crosses either an upside or downside threshold, the return on the investment equals the absolute value of

the return of the underlying. Otherwise, the return equals zero |

| Contingent Upside Participation MLDs/Notes |

|

1-5 Years |

|

Full principal

amount due at

maturity |

|

If the underlying crosses an upside threshold, the return on the investment equals an interest payment paid at maturity. Otherwise,

the return equals the greater of the return of the underlying and zero |

| Minimum Coupon

Notes |

|

3-5 Years |

|

Full principal

amount due at

maturity |

|

If the underlying ever crosses an upside threshold during a coupon period, the return for the coupon period equals the minimum

coupon. Otherwise, the return for a coupon period equals the greater of the return of the underlying during the coupon period and the minimum coupon |

| Market-Linked Notes/ Deposits & Safety First Trust Certificates |

|

3-7 Years |

|

Full principal

amount due at

maturity |

|

The return on the investment equals the greater of the return of the underlying multiplied by a participation rate and zero; the maximum return is capped |

|

|

|

|

|

|

|

| Investments |

|

Maturity |

|

Risk Profile* |

|

Return* |

| ELKS® |

|

6-13 Months |

|

Payment at

maturity may be

less than the

principal amount |

|

A fixed coupon is paid regardless of the performance of the underlying. If the underlying never crosses a downside threshold, the

return on the investment equals the coupons paid. Otherwise, the return equals the sum of the coupons paid and the return of the underlying at maturity |

| Buffer Notes |

|

1-5 Years |

|

Payment at

maturity may be

less than the

principal amount |

|

If the return of the underlying is positive at maturity, the return on the investment equals the lesser of (a) the return of the

underlying multiplied by a participation rate and (b) the maximum return on the notes. If the return of the underlying is either zero or negative by an amount lesser than the buffer amount, the investor receives the stated principal amount.

Otherwise, the return on the investment equals the return of the underlying plus the buffer amount |

| CoBas/PACERSSM |

|

1-5 Years |

|

Payment at

maturity may be

less than the

principal amount |

|

If the underlying is equal to or greater than a threshold (such as its initial value) on any call date, the note is called and the

return on the investment equals a fixed premium. If the note has not been called, at maturity, if the underlying has crossed a downside threshold, the return on the investment equals the return of the underlying, which will be negative. Otherwise,

the return equals zero |

| LASERSSM |

|

1-5 Years |

|

Payment at

maturity may be

less than the

principal amount |

|

If the return of the underlying is positive at maturity, the return on the investment equals the return of the underlying multiplied by a participation rate (some versions

are subject to a maximum return on the notes). If the return of the underlying is negative and the underlying has crossed a downside threshold, the return on the investment equals the return of the underlying, which will be negative. Otherwise, the

return equals zero |

|

|

|

|

|

|

|

| Investments |

|

Maturity |

|

Risk Profile* |

|

Return* |

| Upturn Notes |

|

1-2 Years |

|

Payment at

maturity may be

zero |

|

If the underlying is above its initial level at maturity, the return on the investment equals the lesser of the return of the

underlying multiplied by a participation rate and the maximum return on the notes. Otherwise, the return equals the return of the underlying |

| Fixed Upside Return Notes |

|

1-2 Years |

|

Payment at

maturity may be

zero |

|

If the underlying is equal to or above its initial level at maturity, the return on the investment equals a predetermined fixed

amount. Otherwise, the return equals the return of the underlying |

| Strategic Market Access Notes |

|

3-4 Years |

|

Payment at

maturity may be

zero |

|

The return on the investment equals the return of a unique index created by Citi |

*All returns and any principal

amount due at maturity are subject to the applicable issuer’s credit risk, with the exception of Market-Linked Certificates of Deposit which has FDIC insurance, subject to applicable limitations. This is not a complete list of CitiFirst structures. The descriptions above are not intended to completely describe how an investment works or to detail all of the terms, risks and benefits of a

particular investment. The return profiles can change. Please refer to the offering documents and related material(s) of a particular investment for a comprehensive description of the structure, terms, risks and benefits related to that investment.

|

|

|

|

|

| |

|

CitiFirst Offerings Brochure | February 2016

|

|

17

|

Important Information for the Monthly Offerings

Investment Information

The investments set forth in

the previous pages are intended for general indication only of the CitiFirst Investments offerings. The issuer reserves the right to terminate any offering prior to its pricing date or to close ticketing early on any offering.

SEC Registered (Public) Offerings

Each issuer has separately

filed a registration statement (including a prospectus) with the Securities and Exchange Commission (the “SEC”) for the SEC registered offerings by that issuer to which this communication relates. Before you invest in any of the registered

offerings identified in this Offerings Brochure, you should read the prospectus in the applicable registration statement and the other documents the issuer have filed with the SEC for more complete information about that issuer and offerings. You

may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov.

For Registered Offerings Issued

by: Citigroup Inc.

Issuer’s Registration Statement Number: 333-192302

Issuer’s CIK on the SEC Website: 0000831001

Alternatively, you can request a prospectus and any other documents

related to the offerings, either in hard copy or electronic form, by calling toll-free 1-877-858-5407 or by calling your Financial Advisor.

The SEC registered securities described herein are not bank deposits but are senior, unsecured debt obligations of the issuer. The SEC registered securities are not insured or guaranteed by the

Federal Deposit Insurance Corporation (“FDIC”) or any other governmental agency or instrumentality.

Market-Linked Certificates of Deposit

The Market-Linked Deposits

(“MLDs”) are not SEC registered offerings and are not required to be so registered. For indicative terms and conditions on any MLD, please contact your Financial Advisor or call the toll-free number 1-800-831-9146.

|

|

|

|

|

| 18

|

|

CitiFirst Offerings

Brochure | February 2016

|

|

|

Overview of Key Benefits

and Risks of CitiFirst Investments

Benefits

| ¡ |

Investors can access investments linked to a variety of underlying assets or indices, such as domestic and foreign indices, exchange-traded

funds, commodities, foreign-exchange, interest rates, equities, or a combination thereof. |

| ¡ |

Structured investments can offer unique risk/ return profiles to match investment objectives, such as the amount of principal due at maturity,

periodic income, and enhanced returns. |

Risks

| ¡ |

The risks below are not intended to be an exhaustive list of the risks associated with a particular CitiFirst Structured Investment offering.

Before you invest in any CitiFirst Structured Investment, you should thoroughly review the particular investment’s offering document(s) and related material(s) for a comprehensive description of the risks and considerations associated with the

particular investment. |

| |

¡ |

The terms of certain investments provide that the full principal amount is due at maturity, subject to the issuer credit risk. However, if an

investor sells or redeems such investment prior to maturity, the investor may receive an amount less than his/her original investment. |

| |

¡ |

The terms of certain investments provide that the payment due at maturity could be significantly less than the full principal amount and, for

certain investments, could be zero. In these cases, an investor may receive an amount significantly less than his/ her original investment and may receive nothing at maturity of the investment. |

| ¡ |

Appreciation May Be Limited – Depending on the investment, an investor’s appreciation may be limited by a maximum amount payable or by

the extent to which the return reflects the performance of the underlying asset or index. |

| ¡ |

Issuer Credit Risk – All payments on CitiFirst Structured Investments are dependent on the applicable issuer’s ability to pay all

amounts due on these investments, including

|

| |

any principal due at maturity, and therefore investors are subject to the credit risk of the applicable issuer. |

| ¡ |

Secondary Market – There may be little or no secondary market for a particular investment. If the applicable offering document(s) so

specifies, the issuer may apply to list an investment on a securities exchange, but it is not possible to predict whether any investment will meet the listing requirements of that particular exchange, or if listed, whether any secondary market will

exist. |

| ¡ |

Resale Value of a CitiFirst Structured Investment May be Lower than Your Initial Investment – Due to, among other things, the changes in the

price of and dividend yield on the underlying asset, interest rates, the earnings performance of the issuer of the underlying asset, and the applicable issuer of the CitiFirst Structured Investment’s perceived creditworthiness, the investment

may trade, if at all, at prices below its initial issue price and an investor could receive substantially less than the amount of his/her original investment upon any resale of the investment. |

| ¡ |

Volatility of the Underlying Asset or Index – Depending on the investment, the amount you receive at maturity could depend on the price or

value of the underlying asset or index during the term of the trade as well as where the price or value of the underlying asset or index is at maturity; thus, the volatility of the underlying asset or index, which is the term used to describe the

size and frequency of market fluctuations in the price or value of the underlying asset or index, may result in an investor receiving an amount less than he/she would otherwise receive. |

| ¡ |

Potential for Lower Comparable Yield – The effective yield on any investment may be less than that which would be payable on a conventional

fixed-rate debt security of the same issuer with comparable maturity. |

| ¡ |

Affiliate Research Reports and Commentary – Affiliates of the particular issuer may publish research reports or otherwise express opinions

or provide recommendations from time to time regarding the underlying asset or index which may influence the price or value of the underlying asset or index and, therefore, the value of the investment. Further, any research, opinion or

recommendation expressed within such research reports may not be consistent with purchasing, holding or selling the investment.

|

| ¡ |

The United States Federal Income Tax Consequences of Structured Investments are Uncertain – No statutory, judicial or administrative

authority directly addresses the characterization of structured investments for U.S. federal income tax purposes. The tax treatment of a structured investment may be very different than that of its underlying asset. As a result, significant aspects

of the U.S. federal income tax consequences and treatment of an investment are not certain. The offering document(s) for each structured investment contains tax conclusions and discussions about the expected U.S. federal income tax consequences and

treatment of the related structured investment. However, no ruling is being requested from the Internal Revenue Service with respect to any structured investment and no assurance can be given that the Internal Revenue Service will agree with the tax

conclusions and treatment expressed within the offering document(s) of a particular structured investment. Citigroup Inc., its affiliates, and employees do not provide tax or legal advice. Investors should consult with their own professional

advisor(s) on such matters before investing in any structured investment. |

| ¡ |

Fees and Conflicts – The issuer of a structured investment and its affiliates may play a variety of roles in connection with the investment,

including acting as calculation agent and hedging the issuer’s obligations under the investment. In performing these duties, the economic interests of the affiliates of the issuer may be adverse to the interests of the investor.

|

|

|

|

|

|

| |

|

CitiFirst Offerings Brochure | February 2016

|

|

19

|

Additional Considerations

Please note that the information contained in this brochure is current as of the date indicated and

is not intended to be a complete description of the terms, risks and benefits associated with any particular structured investment. Therefore, all of the information set forth herein is qualified in its entirety by the more detailed information

provided in the offering documents(s) and related material for the respective structured investment.

The structured investments

discussed within this brochure are not suitable for all investors. Prospective investors should evaluate their financial objectives and tolerance for risk prior to investing in any structured investment.

Tax Disclosure

Citigroup

Inc., its affiliates and employees do not provide tax or legal advice. To the extent that this brochure or any offering document(s) concerns tax matters, it is not intended to be used and cannot be used by a taxpayer for the purpose of avoiding

penalties that may be imposed by law. Any such taxpayer should seek advice based on the taxpayer‘s particular circumstances from an independent tax advisor.

ERISA and IRA Purchase Considerations

Employee benefit plans subject to ERISA,

entities the assets of which are deemed to constitute the assets of such plans, governmental or other plans subject to laws substantially similar to ERISA and retirement accounts (including Keogh, SEP and SIMPLE plans, individual retirement accounts

and individual retirement annuities) are permitted to purchase structured investments as long as either (A) (1) no Citi affiliate or employee is a fiduciary to such plan or retirement account that has or exercises any discretionary

authority or control with respect to the assets of such plan or retirement account used to purchase the structured investments or renders investment advice with respect to those assets, and (2) such plan or retirement account is paying no more

than adequate consideration for the structured investments, or (B) its acquisition and holding of the structured investment is not prohibited by any such provisions or laws or is exempt from any such prohibition.

However, individual retirement accounts, individual retirement annuities and Keogh plans, as well as employee benefit plans that permit

participants to direct the investment of their accounts, will not be permitted to purchase or hold the structured investments if the account, plan or annuity is for the benefit of an employee of Citi or a family member and the employee receives

any compensation (such as, for example, an addition to bonus) based on the purchase of structured investments by the account, plan or annuity. You should refer to the section “ERISA Matters” in the applicable offering document(s) for more information.

Distribution Limitations and Considerations

This document may not be distributed in any jurisdiction where it is unlawful to do so. The investments described in this document may not be marketed, or sold or be available for offer or sale in

any jurisdiction outside of the U.S., unless permitted under applicable law and in accordance with the offering documents and related materials. In particular:

WARNING TO INVESTORS IN HONG KONG ONLY: The contents of this document have not been reviewed by any regulatory authority in Hong Kong. Investors are advised to exercise caution in relation to the

offer. If Investors are in any doubt about any of the contents of this document, they should obtain independent professional advice.

This offer is not being made in Hong Kong, by means of any document, other than (1) to persons whose ordinary business it is to buy or sell

shares or debentures (whether as principal or agent); (2) to “professional investors” within the meaning of the Securities and Futures Ordinance (Cap. 571) of Hong Kong (the “SFO”) and any rules made under the SFO; or

(3) in other circumstances which do not result in the document being a “prospectus” as defined in the Companies Ordinance (Cap. 32) of Hong Kong (the “CO”) or which do not constitute an offer to the public within the meaning

of the CO.

There is no advertisement, invitation or document relating to structured investments, which is directed at, or the contents

of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the laws of Hong Kong) other than with respect to structured investments which are or are intended to be disposed of only to persons outside

Hong Kong or only to the persons or in the circumstances described in the preceding paragraph.

WARNING TO INVESTORS IN SINGAPORE ONLY:

This document has not been registered as a prospectus with the Monetary Authority of Singapore under the Securities and Futures Act, Chapter 289 of the Singapore Statutes (the Securities and Futures Act). Accordingly, neither this document nor any

other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the structured investments may be circulated or

distributed, nor may the structured investments be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to the public or any

member of the public in Singapore other than in circumstances where the registration of a prospectus is not required and thus only (1) to an institutional investor or other person falling within section 274 of the Securities and Futures Act,

(2) to a relevant person (as defined in section 275 of the Securities and Futures Act) or to any person pursuant to section 275(1A) of the Securities and Futures Act and in accordance with the conditions specified in section 275 of that Act, or

(3) pursuant to, and in accordance with the conditions of, any other applicable provision of the Securities and Futures Act. No person receiving a copy of this document may treat the same as constituting any invitation to him/her, unless in the

relevant territory such an invitation could be lawfully made to him/her without compliance with any registration or other legal requirements or where such registration or other legal requirements have been complied with. Each of the following

relevant persons specified in Section 275 of the Securities and Futures Act who has subscribed for or purchased structured investments, namely a person who is:

(a) a corporation (which is not an accredited investor) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is

an accredited investor, or

(b) a trust (other than a trust the trustee of which is an accredited investor) whose sole purpose is to

hold investments and of which each beneficiary is an individual who is an accredited investor, should note that securities of that corporation or the beneficiaries’ rights and interest in that trust may not be transferred for 6 months after

that corporation or that trust has acquired the structured investments under Section 275 of the Securities and Futures Act pursuant to an offer made in reliance on an exemption under Section 275 of the Securities and Futures Act unless:

(i) the transfer is made only to institutional investors, or relevant persons as defined in Section 275(2) of that Act, or arises

from an offer referred to in Section 275(1A) of that Act (in the case of a corporation) or in accordance with Section 276(4)(i)(B) of that Act (in the case of a trust);

(ii) no consideration is or will be given for the transfer; or

(iii) the transfer is

by operation of law.

To discuss CitiFirst investment ideas and strategies,

Financial Advisors, Private Bankers and other distribution partners may call our sales team. Private Investors should call their financial advisor or private banker.

Client service number for Financial Advisors and Distribution Partners in the Americas:

+1 (212) 723-7288

For more information, please go to www.citifirst.com

|

|

|

|

|

|

|

|

|

“Standard & Poor’s,” “S&P 500®,” and “S&P®” are trademarks of The McGraw-Hill Companies, Inc. and have

been licensed for use by Citigroup Inc. Dow Jones Industrial AverageTM is a service mark of Dow Jones & Company, Inc. (“Dow Jones”) and has been

licensed for use by Citigroup Funding Inc. The Notes described herein are not sponsored, endorsed, sold or promoted by Dow Jones and Dow Jones makes no warranties and bears no liability with respect to the Notes.

Citi Personal Wealth

Management is a business of Citigroup Inc., which offers investment products through Citigroup Inc., member SIPC. Citibank, N.A. is an affiliated company under control of Citigroup Inc.

©2016 Citigroup Inc. Citi and Citi with Arc Design are registered service marks of Citigroup Inc. or its affiliates |

|

|

|

|

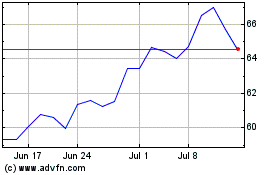

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024