As filed with the Securities and Exchange Commission on February 4, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Benitec Biopharma Limited

(Exact name of registrant as specified in its charter)

|

|

|

| Australia

(State or other jurisdiction of

incorporation or organization) |

|

Not Applicable

(I.R.S. Employer

Identification No.) |

F6A/1-15 Barr Street

Balmain, NSW, 2041, Australia

(Address of principal executive offices)

Benitec

Officers’ and Employees’ Share Option Plan

(Full title of the plan)

Greg West

Interim Chief

Executive Officer and Chief Financial Officer

F6A/1-15 Barr Street

Balmain, NSW, 2041, Australia

Tel: +61 2 9555 6986

Fax: +612 9818 2238

(Name, address and telephone number, including area code, of agent for service)

With a copy to:

Andrew S. Reilly

Baker & McKenzie

50 Bridge Street, Level 27

Sydney, NSW 2000, Australia

Tel: +61 2 9225 0200

Fax: +61 2 9225 1595

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

x (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of Each Class of

Securities to be Registered |

|

Amount

to be Registered

(2) |

|

Proposed

Maximum Offering

Price Per Share (3) |

|

Proposed

Maximum Aggregate

Offering Price |

|

Amount of

Registration Fee |

| Ordinary Shares (1) |

|

18,000,000 |

|

$0.18 |

|

$3,240,000 |

|

$326.27 |

| |

| |

| (1) |

Ordinary shares, without par value (the “Ordinary Shares”), of Benitec Biopharma Limited (the “Registrant”) being registered hereby relate to the Benitec Officers’ and Employees’ Share

Option Plan (the “Plan”). These Ordinary Shares may be represented by the Registrant’s American Depositary Shares (“ADSs”), each of which represents twenty Ordinary Shares. ADSs, evidenced by American Depositary Receipts

(“ADRs”), each representing twenty Ordinary Shares of the Registrant, have been registered on a separate registration statement on Form F-6 filed with the Securities and Exchange Commission on May 20, 2014, as amended by

post-effective amendment no. 1 to the registration statement on Form F-6 filed with the Securities and Exchange Commission on July 21, 2015 (File 333-196105). |

| (2) |

Represents the maximum number of Ordinary Shares underlying the options that the Registrant expects to be issued pursuant to the Plan. The Plan does not include a limit on the number of options that may be issued

pursuant to the Plan. Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement covers an indeterminable number of additional securities as may be offered or issued as a result

of the anti-dilution provisions of the Plan. |

| (3) |

Estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and 457(h) under the Securities Act and based upon the average high and low sales prices per Ordinary Share as reported by

the Australian Securities Exchange on February 2, 2016 translated into U.S. dollars at an exchange rate of A$0.7077 to US$1.00 as published by the Australian Reserve Bank on February 2, 2016. |

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Not filed as part of this Registration Statement pursuant to the Note

to Part I of Form S-8. The document(s) containing the employee benefit plan information required by Item 1 of Form S-8 will be sent or given to participants as specified by Rule 428 under the Securities Act of 1933, as amended (the

“Securities Act”). In accordance with Rule 428 and the requirements of Part I of Form S-8, such documents are not being filed with the United States Securities and Exchange Commission (the

“Commission”) either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. Benitec Biopharma Limited (the “Registrant”) will maintain a file of such

documents in accordance with the provisions of Rule 428. Upon request, the Registrant will furnish to the Commission or its staff a copy of any or all of the documents included in such file.

| Item 2. |

Registrant Information and Employee Plan Annual Information |

Not filed as part of this

Registration Statement pursuant to the Note to Part I of Form S-8. The document(s) statement of availability of registrant information and any other information required by Item 2 of Form S-8 will be sent or given to participants as specified by Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”). In accordance with Rule 428 and the requirements of

Part I of Form S-8, such documents are not being filed with the United States Securities and Exchange Commission (the “Commission”) either as part of this Registration Statement or as

prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. Benitec Biopharma Limited (the “Registrant”) will maintain a file of such documents in accordance with the provisions of Rule 428. Upon request, the

Registrant will furnish to the Commission or its staff a copy of any or all of the documents included in such file.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. |

Incorporation of Documents by Reference. |

The following documents filed with or

furnished to the Commission by the Registrant pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated in this Registration Statement by reference and shall be deemed to be a part hereof:

| |

• |

|

The Registrant’s Annual Report on Form 20-F for the year ended June 30, 2015, as filed with the Commission on November 17, 2015; and |

| |

• |

|

The description of the Ordinary Shares as set forth in the Registrant’s Registration Statement on Form F-1 (Registration No. 333-205135), as amended, as filed with

the Commission on June 22, 2015, and any further amendment or report filed for the purposes of updating such description; and |

| |

• |

|

the Registrant’s Form 6-Ks furnished to the Commission on August 25, 2015, September 2, 2015, October 8, 2015, October 14,

2015, October 22, 2015, November 2, 2015 (both Form 6-Ks furnished on such date), December 7, 2015 and December 8, 2015. |

In addition to the foregoing, each document filed by the Registrant with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d)

of the Exchange Act and all reports on Form 6-K furnished by the Registrant subsequent to the date of this Registration Statement and prior to the filing of any post-effective amendment to this

Registration Statement which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part

hereof from the date of filing of such documents. Any statement contained herein, in any amendment hereto or in a document incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to

the extent that a statement contained herein or in any subsequently-filed amendment to this Registration Statement or in any document that also is incorporated by reference herein modifies or supersedes such statement. Any statement so modified or

superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

| Item 4. |

Description of Securities. |

Not applicable.

| Item 5. |

Interest of Named Experts and Counsel. |

Not applicable.

| Item 6. |

Indemnification of Directors and Officers. |

Australian law. Australian law

provides that a company or a related body corporate of the company may provide for indemnification of officers and directors, except to the extent of any of the following liabilities incurred as an officer or director of the company:

| |

• |

|

a liability owed to the company or a related body corporate of the company; |

| |

• |

|

a liability for a pecuniary penalty order made under section 1317G or a compensation order under section 961M, 1317H, 1317HA or 1317HB of the Australian Corporations Act 2001; |

| |

• |

|

a liability that is owed to someone other than the company or a related body corporate of the company and did not arise out of conduct in good faith; or |

| |

• |

|

legal costs incurred in defending an action for a liability incurred as an officer or director of the company if the costs are incurred: |

| |

• |

|

in defending or resisting proceedings in which the officer or director is found to have a liability for which they cannot be indemnified as set out above; |

| |

• |

|

in defending or resisting criminal proceedings in which the officer or director is found guilty; |

| |

• |

|

in defending or resisting proceedings brought by the Australian Securities & Investments Commission or a liquidator for a court order if the grounds for making the order are found by the court to have been

established (except costs incurred in responding to actions taken by the Australian Securities & Investments Commission or a liquidator as part of an investigation before commencing proceedings for a court order); or |

| |

• |

|

in connection with proceedings for relief to the officer or a director under the Corporations Act, in which the court denies the relief. |

Constitution. Our Constitution provides, except to the extent prohibited by the law and the Corporations Act, for the indemnification

of every person who is or has been an officer or a director of the company against liability (other than legal costs that are unreasonable) incurred by that person as an officer or director. This includes any liability incurred by that person in

their capacity as an officer or director of a subsidiary of the company where the company requested that person to accept that appointment.

Indemnification Agreements. Pursuant to Deeds of Access, Insurance and Indemnity, we have agreed to indemnify our directors and

officers against certain liabilities and expenses incurred by such persons in connection with claims made by reason of their being such a director or officer.

Commission Position. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors,

officers or persons controlling us pursuant to the foregoing provisions, we have been informed that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

| Item 7. |

Exemption from Registration Claimed. |

Not applicable.

The following documents are filed as a part of this Registration Statement or

incorporated by reference herein:

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 4.1 |

|

Constitution of Benitec Biopharma Limited (filed as Exhibit 3.1 to Benitec Biopharma Limited’s Registration Statement on Form F-1, as filed with the Commission on June 22, 2015 and incorporated by reference

herein). |

|

|

| 4.2 |

|

Benitec Officers’ and Employees’ Share Option Plan. |

|

|

| 5.1 |

|

Opinion of Baker & McKenzie regarding the validity of the Ordinary Shares. |

|

|

| 23.1 |

|

Consent of Baker & McKenzie (see Exhibit 5.1). |

|

|

| 23.2 |

|

Consent of Grant Thornton Audit Pty Ltd. |

|

|

| 24.1 |

|

Powers of Attorney (included in the signature page to this Registration Statement). |

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration

statement:

(i) to include any prospectus required by section 10(a)(3) of the Securities Act;

(ii) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the

most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of

securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of a prospectus filed

with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the

effective registration statement;

(iii) to include any material information with respect to the plan of

distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that the undertakings set forth in paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the

information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are

incorporated by reference in the registration statement.

(2) That, for the purpose of determining any liability under the

Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective

amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned registrant

hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each

filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in

the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the

registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the

securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against

public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Sydney, Australia, on this 4th day of February, 2016.

|

|

|

| Benitec Biopharma Limited |

|

|

| By: |

|

/s/ Greg West |

|

|

Name: Greg West |

|

|

Title: Interim Chief Executive Officer and

Chief Financial Officer |

POWER OF ATTORNEY

We, the undersigned officers and directors of Benitec Biopharma Limited hereby severally and individually constitute and appoint Greg West,

Peter Francis and John Chiplin, and each of them, the true and lawful attorneys and agents of each of us to execute in the name, place and stead of each of us (individually and in any capacity stated below) any and all amendments to this

Registration Statement on Form S-8, and all instruments necessary or advisable in connection therewith, and to file the same with the Securities and Exchange Commission, each of said attorneys and agents to have power to act with or without the

other and to have full power and authority to do and perform in the name and on behalf of each of the undersigned every act whatsoever necessary or advisable to be done in the premises as fully and to all intents and purposes as any of the

undersigned might or could do in person, and we hereby ratify and confirm our signatures as they may be signed by our said attorneys and agents and each of them to any and all such amendments and other instruments.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the

capacities and on the date indicated.

|

|

|

|

|

| Signature |

|

Title |

|

Date |

|

|

|

| /s/ Greg West

Name: Greg West |

|

Interim Chief Executive Officer and Chief Financial Officer (principal executive officer, principal financial officer and principal accounting officer) |

|

February 4, 2016 |

|

|

|

| /s/ Peter Francis

Name: Peter Francis |

|

Chairman of the Board of Directors |

|

February 4, 2016 |

|

|

|

| /s/ John Chiplin

Name: John Chiplin |

|

Director |

|

February 4, 2016 |

|

|

|

| /s/ Iain Ross

Name: Iain Ross |

|

Director |

|

February 4, 2016 |

|

|

|

| /s/ J. Kevin Buchi

Name: J. Kevin Buchi |

|

Director |

|

February 4, 2016 |

AUTHORIZED REPRESENTATIVE

Pursuant to the requirements to Section 6(a) of the Securities Act, the undersigned has signed this Registration Statement solely in the

capacity of the duly authorized representative of the Registrant in Sydney, Australia on February 4, 2016.

|

|

|

| Benitec Biopharma Limited |

|

|

| By: |

|

/s/ John Chiplin |

|

|

John Chiplin |

|

|

Director |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 4.1 |

|

Constitution of Benitec Biopharma Limited (filed as Exhibit 3.1 to Benitec Biopharma Limited’s Registration Statement on Form F-1, as filed with the Commission on June 22, 2015 and incorporated by reference

herein). |

|

|

| 4.2 |

|

Benitec Officers’ and Employees’ Share Option Plan. |

|

|

| 5.1 |

|

Opinion of Baker & McKenzie regarding the validity of the Ordinary Shares. |

|

|

| 23.1 |

|

Consent of Baker & McKenzie (see Exhibit 5.1). |

|

|

| 23.2 |

|

Consent of Grant Thornton Audit Pty Ltd. |

|

|

| 24.1 |

|

Powers of Attorney (included in the signature page to this Registration Statement). |

Exhibit 4.2

BENITEC OFFICERS’ AND EMPLOYEES’ SHARE OPTION PLAN

BENITEC BIOPHARMA LIMITED

ABN 64 068 943 662

BENITEC OFFICERS’ AND EMPLOYEES’ SHARE OPTION PLAN RULES

| 1 |

Definitions and Interpretation |

In these Rules, unless the context otherwise requires;

Board means the board of directors of the Company or a committee appointed by the board of directors;

Change in Control means a situation where a person obtains control (as defined in the Accounting Standards) over the Company on a

particular day and that person did not have control immediately prior to that day;

Company means Benitec Biopharma Ltd [ABN 64 086

943 662];

Eligible Employee means an employee (including any director, a part-time employee

and a consultant to the Company) of any Group Company who is declared by the Board to be an Eligible Employee for the purposes of these Rules;

Exchange means any securities exchange upon which the Company’s Shares are quoted;

Exercise Condition means one or more conditions which must be satisfied, or circumstances which must exist before the Options, or any of

them, vest and may be exercised, as determined by the Board and specified in the terms of issue;

Fair Value means a value for a

Share determined by the Board.

Grant Date in relation to an Option means the date from which the Board determines that an Option

takes effect;

Group Company means the Company, and its Subsidiaries;

Listing Rules means the official Listing Rules of the Exchange;

Market Value has the meaning given to that term in Division 13A of the Income Tax Assessment Act 1936;

Option means a right to acquire a Share, whether by subscription or by purchase;

Participant means a person who has been granted an Option under these Rules (whether or not that person continues to hold options at the

relevant time) and any transferee of Shares from a Participant;

Plan means this Benitec Directors’ and Employees’ Share

Option Plan as set out in these Rules, subject to any amendments or additions made under Rule 11;

Retirement means a termination of

an Eligible Employee’s employment with a Group Company by reason of attaining the age the Board from time to time accepts as the normal retirement age for the Eligible Employee, or because the Board forms the opinion that the Eligible Employee

is not able to perform the Eligible Employee’s duties as a result of illness or incapacity;

Share means a fully paid ordinary

share in the capital of the Company;

Subsidiary has the same meaning as in section 9 of the Corporations Act; and

Takeover Bid has the same meaning as in section 9 of the Corporations Act.

| |

(a) |

Words importing the singular include the plural and vice versa. |

- 2 -

| |

(b) |

Words importing a gender include any gender. |

| |

(c) |

Other parts of speech and grammatical forms of a word or phrase defined in these Rules have a corresponding meaning. |

| |

(d) |

Any reference in these Rules to any enactment or the Listing Rules includes a reference to that enactment or those Listing Rules as from time to time amended, consolidated, re-enacted or replaced and, in the case of an

enactment, all regulations and statutory instruments issued under it. |

| 2 |

Invitation to Participate |

The Board may from time to time, at its absolute discretion, issue written

invitations (in such form as the Board decides from time to time) to Eligible Employees to apply for up to a specified number of Options.

| |

2.2 |

Amount payable on grant |

Options will be granted for no consideration, unless the Board

determines otherwise.

| |

2.3 |

Information to be provided to employees |

The Board will, together with the invitation

referred to in Rule 2.1 advise each Eligible Employee of the following regarding the Options:

| |

(a) |

the method of calculation of the exercise price, failing the Board determining a specific value the exercise price of the Options will be Market Value on the Grant Date: |

| |

(b) |

the period or periods during which all or any of the Options may be exercised; |

| |

(c) |

the number of Shares over which Options may be granted; |

| |

(d) |

the dates and times when the Options expire; |

| |

(e) |

any Exercise Conditions applying to the Options; and |

| |

(f) |

the date and time by which the application for Options must be received by the Company. |

| |

2.4 |

Maximum number of Options that may be offered without a disclosure document |

Options may

not be offered under the Plan without the issue of a disclosure document in accordance with Chapter 6D of the Corporations Act, if the aggregate of:

| |

(a) |

the number of Options to be issued; |

| |

(b) |

the number of Shares which would be issued if all the current Options issued under any employee incentive scheme were exercised; |

| |

(c) |

the number of Shares which have been issued as a result of the exercise of Options issued under any employee incentive scheme, where the Options were issued during the preceding five years; and |

| |

(d) |

all other Shares issued pursuant to any employee incentive scheme during the preceding five years; |

but disregarding any offer made, Options or Shares issued by way of or as a result of:

| |

(e) |

an offer to a person situated at the time of receipt of the offer outside Australia; |

| |

(f) |

an offer that was an excluded offer or invitation within the meaning of the Corporations Act as it stood prior to the commencement of Schedule 1 of the Corporate Law Economic Reform Program Act 1999; |

| |

(g) |

an offer that did not need disclosure to investors because of section 708 of the Corporations Act; or |

| |

(h) |

an offer under a disclosure document, |

would exceed 5% of the then current number of Shares on

issue.

- 3 -

| 3 |

Application for Options |

| |

(a) |

Following receipt of an invitation, the Eligible Employee may apply for the Options specified in the invitation by sending to the person nominated by the Company an application (in the form attached to the invitation)

duly completed and signed (together with a cheque for any amount payable in respect of the grant of the Options). |

| |

(b) |

The application must be received by the Company within the period for acceptance specified in the invitation. |

| |

3.2 |

Number of Options applied for |

The Eligible Employee may apply for the number of Options

specified in the invitation or part thereof (but only in multiples of 1,000 Options).

An invitation is not transferable and an Eligible Employee may only

apply for the Options in his or her name and not on behalf of another person or entity unless that other another person or entity is controlled by or otherwise associated with the invitee, agrees to be bound by the Plan and terms of issue of the

Options as if it were an Eligible Employee (but on the basis that the occurrence of an event in respect of the invitee, such as but not only cessation of employment, will operate and bind the other person or entity as if the invitee were the

Eligible Employee and holder of the options), and is confirmed in writing at the Board’s unfettered discretion as being acceptable.

Once the Company has received and accepted a duly signed and completed

application for Options (together with any moneys payable in respect of the grant), the Company may:

| |

(a) |

grant Options to the Eligible Employee, with effect from the Grant Date; or |

| |

(b) |

procure their grant by a third party, |

upon the terms set out in the Plan and upon such

additional terms and Exercise Conditions as the Board determines.

| |

4.2 |

Advice to participants |

The Company must advise each Participant in writing that Options

have been granted to him or her.

An Option granted under the Plan is not capable of being

transferred or encumbered by the Participant, and will immediately lapse if it is transferred or encumbered, unless it is transferred or encumbered:

| |

(a) |

by force of law upon death to the Participant’s legal personal representative; |

| |

(b) |

upon bankruptcy to the Participant’s trustee in bankruptcy; or |

| |

(c) |

with the prior written approval of the Board. |

| |

6.1 |

Exercise preconditions |

| |

(a) |

The exercise of any Option granted under the Plan will be effected in the form and manner determined by the Board. |

| |

(b) |

Subject to these Rules, an Option may not be exercised unless the Exercise Conditions (if any) advised to the Participant by the Board pursuant to Rule 2.3 have been met. |

| |

(1) |

dies before an Option has been exercised and at that time the Participant was an employee of a Group Company; or |

- 4 -

| |

(2) |

ceases to be an employee of any Group Company by reason of Retirement, |

notwithstanding that

any Exercise Condition has not been met, at the Board’s discretion the Option may (and must, if at all) be exercised by the Participant or his or her personal representative (as the case may be) within a period determined by the Board or

otherwise within 6 months.

| |

(b) |

If, after any Exercise Condition has been met but before an Option has been exercised, a Participant: |

| |

(1) |

dies, and at that time the Participant was an employee of a Group Company; |

| |

(2) |

ceases to be an employee of any Group Company by reason of Retirement; or |

| |

(3) |

ceases to be an employee of any Group Company for any reason other than as set out in paragraphs (1) and (2) and the Board deems that this Rule applies, |

the Option may (and must, if at all) be exercised by the Participant or his or her personal representative (as the case may be) within a

period determined by the Board or otherwise within 12 months.

| |

(c) |

A Participant will not be treated for the purposes of paragraphs (a) and (b) as ceasing to be an employee of a Group Company until such time as the Participant is no longer an employee of any Group Company,

and a Participant who ceases to be such an employee by reason of approved leave of absence and who exercises his or her right to return to work under any applicable award, enterprise agreement, other agreement, statute or regulation before the

exercise of an Option will be treated for those purposes as not having ceased to be such an employee. |

Where:

| |

(a) |

a Participant ceases to be employed by a Group Company for a reason other than death or Retirement; and |

| |

(b) |

any Exercise Condition has not been met; |

all Options held by that Participant will lapse

unless the Board determines otherwise. Where the Board so determines the Option may be exercised to the extent permitted by the Board within the period of 3 months following the notification of the Board’s determination.

| |

6.4 |

Fraudulent and dishonest actions |

If in the opinion of the Board a Participant acts

fraudulently or dishonestly or is in breach of his or her obligations to any Group Company, then the Board may deem any unexercised Options held by the Participant to have lapsed.

| |

6.5 |

Maximum exercise period |

Notwithstanding any other provision of these Rules, an Option

granted over unissued Shares may be exercised within any period determined by the Board that is permitted by law, but not exceeding seven years from Grant Date.

Unless exercised, an Option will expire:

| |

(a) |

at 5.00 pm Melbourne, Victoria time on the last day permitted for its exercise; or |

| |

(b) |

if the exercise of an Option is subject to an Exercise Condition and the condition is not met, is not able to be met, or can no longer be met, at 5.00 pm Melbourne time on the day when the condition is not met, is not

able to be met or can no longer be met. |

Upon an Option expiring, the Company will repay to the Participant the

price paid for the issue of the Option (if any), but the Participant will have no further entitlement or claim against the Company in respect of the Option. For the avoidance of doubt, an undertaking by an Eligible Employee to accept the value of an

Option as a component of his or her remuneration package will not be regarded as a price paid for the issue of the Option.

- 5 -

| |

(a) |

Subject to paragraph (b), within 15 days after an Option has been exercised by a Participant or his or her personal representative, the grantor of the Option must issue to or procure the transfer to the Participant or

his or her personal representative (as the case may be) of the number of Shares in respect of which the Option has been exercised. |

| |

(b) |

All Shares allotted upon exercise of an Option will rank equally in all respects with the Shares of the same class for the time being on issue except as regards any rights attaching to such Shares by reference to a

record date prior to the date of their allotment. |

| |

(c) |

If Shares of the same class as those allotted upon exercise of an Option are listed on an Exchange the Company will apply for quotation of those Shares within any period prescribed by the Exchange. |

| 8 |

Takeover, Scheme of Arrangement and Winding-up |

| |

(a) |

If a Takeover Bid is made or a Change in Control occurs, the Board may (unless, in the opinion of the Board, an intention to make an equivalent offer to the Participants to acquire all or a substantial portion of their

Options is given) give written notice to each Participant of the Takeover Bid or Change in Control. |

| |

(b) |

If a Takeover Bid is made or Change in Control occurs after any Exercise Condition has been met, but before an Option has been exercised, the Options will then be exercisable within the period of 30 days from the date

of the notice, in addition to any other period during which the Options may be exercised. |

| |

(c) |

If a Takeover Bid is made or Change in Control occurs before any Exercise Condition has been met, the Board may determine that all or part of those Options will be exercisable within the period of 30 days from the date

of the notice, in addition to any other period during which the Options may be exercised. |

| |

(d) |

The Board may also, in its absolute discretion, permit the exercise of Options during such period as the Board determines where: |

| |

(1) |

a Court orders a meeting to be held in relation to a proposed compromise or arrangement for the purposes of or in connection with a scheme for the reconstruction of the Company or its amalgamation with any other company

or companies; |

| |

(2) |

any person becomes bound or entitled to acquire shares in the Company under: |

| |

(A) |

section 414 of the Corporations Act; or |

| |

(B) |

Chapter 6A of the Corporations Act; or |

| |

(3) |

the Company passes a resolution for voluntary winding up; or |

| |

(4) |

an order is made for the compulsory winding up of the Company. |

| |

(e) |

If a company (Acquiring Company) obtains control of the Company as a result of: |

| |

(1) |

a Takeover Bid or Change in Control; or |

| |

(2) |

a proposed scheme of arrangement between the Company and its Shareholders, |

and both the

Company and the Acquiring Company agree, a Participant may upon exercise of his or her Options elect to acquire and the Company may provide shares of the Acquiring Company or its parent in lieu of Shares, on substantially the same terms and subject

to substantially the same conditions as the Participant may exercise Options to acquire Shares, but with appropriate adjustments to the number and kind of shares subject to the Options, as well as to the exercise price.

- 6 -

| 9 |

Bonus Issues, Rights Issues, Reconstruction |

| |

9.1 |

Adjustment for Bonus Issue |

| |

(a) |

If Shares are issued pro rata to the Company’s shareholders by way of bonus issue (other than an issue in lieu of dividends or by way of dividend reinvestment), the Participant is entitled, upon exercise of the

Options, to receive in addition to the Shares in respect of which the Options are exercised and without the payment of any further consideration an allotment of as many additional Shares as would have been issued to a shareholder who, on the date

for determining entitlements under the bonus issue, held Shares equal in number to the Shares in respect of which the Options are exercised. |

| |

(b) |

Additional Shares to which the Participant becomes so entitled will as from the time Shares are issued pursuant to the bonus issue be regarded as Shares comprised in the relevant Options and in respect of which the

Options are exercised for the purposes of subsequent applications of Rule 9.1(a). |

| |

9.2 |

Adjustment for Rights Issue |

If Shares are offered pro rata for subscription by the

Company’s shareholders generally by way of a rights issue during the currency of and prior to exercise of any Options the exercise price of each Option will be adjusted, if the Company is listed on the Exchange, in the manner provided for in

the Listing Rules, and otherwise as the Board directs.

| |

9.3 |

Adjustment for reorganisation |

In the event of any reorganisation of the issued capital

of the Company, the number of Options to which each Participant is entitled or the exercise price of the Options or both as appropriate will be adjusted, if the Company is listed on the Exchange, in the manner provided for in the Listing Rules, and

otherwise as the Board directs.

| |

9.4 |

No other participation |

Subject to this Rule 9, during the currency of any Options and

prior to their exercise, Participants are not entitled to participate in any new issue of securities of the Company as a result of their holding Options.

| |

(a) |

This Rule only applies if the Company ceases to be listed on an Exchange. |

| |

(b) |

A Participant may not transfer any Share issued on exercise of an Option without the Board’s prior written approval, and where the Board approves the transfer of any Share, the transfer shall be subject to a

condition precedent that the transferee executes an appropriate Assumption Deed agreeing to be bound by the provisions of this Rule 10 as if they were the original Participant, such deed to be in a form approved by the Board. |

| |

(1) |

an Option becomes exercisable prior to Retirement, Separation or the Participant ceasing to be employed by a Group Company for another reason (each a “termination” for the purposes of this Rule); and

|

| |

(2) |

the Participant has exercised the Options and holds Shares on the date the termination takes effect, then the Board may, whether on the date the termination takes effect or at |

any time after the date the termination takes effect, require the Participant to sell the Shares into a capital raising or to an existing

Shareholder, or to another investor.

| |

(d) |

Any sale of Shares required in accordance with this Rule must be at Fair Value. |

| |

(e) |

Each Participant is deemed to have irrevocably appointed the Company as the Participant’s attorney and agent to do all things necessary to effect a sale in accordance with this Rule, including, but not limited to,

authorizing the Company to execute a share transfer in the name of the relevant shareholder as transferee for this purpose. |

- 7 -

Subject to Rule 11.2 and the Listing Rules, the Board may at any time by

resolution amend or add to (“amend”) all or any of the provisions of the Plan, or the terms or conditions of any Option granted under these Rules.

| |

11.2 |

Restrictions on amendments |

No amendment to these Rules, or the terms of any Option, may

be made which reduces the rights of Participants in respect of Options granted to them prior to the date of the amendment, other than an amendment introduced primarily:

| |

(a) |

for the purpose of complying with or conforming to present or future State or Commonwealth legislation governing or regulating the maintenance or operation of plans; |

| |

(b) |

to correct any manifest error or mistake; or |

| |

(c) |

to take into consideration possible adverse tax implications arising from, amongst others, adverse rulings from the Commissioner of Taxation, changes to tax legislation (including an official announcement by the

Commonwealth of Australia) changes in the interpretation of tax legislation by a court of competent jurisdiction. |

As soon as reasonably practicable making any amendment under Rule

11.1, the Board will give notice in writing of that amendment to any Option holder affected by the amendment.

| |

12.1 |

Terms of employment not affected |

The terms of employment of any Participant with a

Group Company are not affected by his or her applying for Options and these Rules will not form part of and are not incorporated into any contract of employment of any employee with a Group Company and no Participant will have any rights to

compensation or damages in consequence of the termination of his or her office or employment for any reason whatsoever in so far as those rights arise or may arise from his or her ceasing to have rights under these Rules as a result of such

termination.

| |

12.2 |

Board powers and administration |

| |

(a) |

These Rules will be administered by the Board which has power to: |

| |

(1) |

determine appropriate procedures for administration consistent with these Rules; and |

| |

(2) |

delegate to any one or more persons for such period and on such conditions as it may the exercise of any of its powers or discretions arising under these Rules. |

| |

(b) |

Except as otherwise expressly provided, the Board has absolute and unfettered discretion to act or refrain acting under or in with these Rules or any Options and in the exercise of any power or discretion under these

Rules. |

| |

(c) |

Notwithstanding any other provision, the Board may at any time waive in whole or in part any terms or conditions (including any Exercise Condition) in relation to any Options granted to any Participant.

|

| |

(d) |

In the event of any dispute or disagreement as to the interpretation, or as to any question or right arising from or related to these Rules or to any Options granted under them, the decision of the Board is final and

binding. |

| |

12.3 |

Non-residents of Australia |

When an Option is granted to a person who is not a resident

of Australia the provisions of these Rules apply subject to such alterations or additions as the Board determines having regard to any securities, exchange control or taxation laws or regulations or similar factors which may have application to the

Participant or to any Group Company in relation to the Option.

- 8 -

In particular, Options and Shares may not be offered or sold in the United States except in

transactions registered under the US Securities Act of 1933 or pursuant to an exemption from such registration as well as any applicable US state securities laws.

Any notice under these Rules may be given by personal delivery, by post or

facsimile, in the case of a company to its registered office, and in the case of an individual to the individual’s last known address, or, where a Participant is a director or employee of a Group Company, either to the Participant’s last

known address or to the address of the place of business at which the Participant performs the whole or substantially the whole of the duties of the Participant’s office or employment.

These Rules and any Options issued under them are governed by the laws of

Victoria and the Commonwealth of Australia.

| |

12.6 |

References to Listing Rules |

Except as otherwise provided, any provisions containing a

reference to the Listing Rules, or to a particular Listing Rule, will only apply once the Company is listed on an Exchange.

|

|

|

|

|

| Asia Pacific

Bangkok Beijing

Brisbane Hanoi

Ho Chi Minh City Hong Kong

Jakarta* Kuala Lumpur*

Manila* Melbourne

Seoul Shanghai

Singapore Sydney

Taipei Tokyo

Yangon

Europe, Middle East & Africa Abu Dhabi

Almaty Amsterdam

Antwerp Bahrain

Baku Barcelona

Berlin Brussels

Budapest Cairo

Casablanca Doha

Dubai Dusseldorf

Frankfurt/Main Geneva

Istanbul Johannesburg

Kyiv London

Luxembourg Madrid

Milan Moscow

Munich Paris

Prague Riyadh

Rome St. Petersburg

Stockholm Vienna

Warsaw Zurich

Latin America

Bogota Brasilia**

Buenos Aires Caracas

Guadalajara Juarez

Lima Mexico City

Monterrey Porto Alegre**

Rio de Janeiro** Santiago

Sao Paulo** Tijuana

Valencia

North America Chicago

Dallas Houston

Miami New York

Palo Alto San Francisco

Toronto Washington, DC

* Associated Firm

** In cooperation with |

|

|

|

Exhibit 5.1

Baker & McKenzie ABN 32 266 778 912

AMP Centre

Level 27 50 Bridge Street

Sydney NSW 2000 Australia

P.O. Box R126

Royal Exchange NSW 1223 Australia

Tel: +61 2 9225 0200 Fax: +61 2 9225 1595

DX: 218 SYDNEY www.bakermckenzie.com

|

| |

February 4, 2016

Benitec Biopharma Limited

F6A/1-15 Barr Street Balmain, NSW, 2041, Australia

Ladies and Gentleman:

We have acted as Australian counsel to Benitec Biopharma Limited (the

“Company”) in connection with the Company’s Registration Statement on Form S-8 (the “Registration Statement”) to be filed under the U.S. Securities Act of 1933 with the U.S. Securities and Exchange Commission (the

“Commission”) for the registration of 18,000,000 shares of the Company’s ordinary shares, no par value (the “Shares”), issuable pursuant to the Benitec Officers’ and Employees’ Share Option Plan (the

“Plan”). For the purposes of this opinion, we have examined and relied upon

copies of the Plan. We have also examined and relied on the constitution of the Company as previously certified to us by the Company Secretary of the Company, a copy of the resolutions of the board of directors of the Company dated 4 February

2016, a copy of resolutions of the shareholders of the Company dated 12 November 2015 approving the issue of options over the Shares, and a secretary’s certificate of the Company dated 4 February 2016, certifying the accuracy and

completeness of the abovementioned resolutions of the board of directors. In such

examination, we have assumed (a) the genuineness of all signatures; (b) the authenticity of all documents submitted to us as originals; (c) the conformity to original documents of all documents submitted to us as copies (certified or otherwise); (d)

the authenticity of the originals of such copies; (e) that all documents submitted to us are true and complete; (f) that resolutions of the directors of the Company that we have relied upon for the purposes of this letter opinion will not be varied

or revoked after the date of this letter and that the meetings of the directors of the Company at which the resolutions were considered were properly convened, all directors who attended and voted were entitled to do so, the resolutions were

properly passed, and the directors have performed their duties properly and all provisions relating to the declaration of directors’ interests or the power of interested directors were duly observed; (g) that any issue of Shares or options

under the Plan to a director of the company will be in accordance with the resolutions of shareholders of the Company referred to above; (h) the accuracy of any searches obtained from the Australian Securities and Investments Commission in relation

to the Company; (i) each natural person signing any document reviewed by us had the legal capacity to do so and to perform his or her obligations thereunder; and (j) each person signing in a representative capacity any document reviewed by us had

authority to sign in such capacity. |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Baker & McKenzie, an Australian partnership, is a

member of Baker & McKenzie International, a Swiss Verein. |

Based on the foregoing, and having regard to the legal considerations we deem relevant, we are of the opinion

that the Shares covered by the Registration Statement when allotted, issued, and delivered in accordance with the provisions of the Plan will be duly authorized, validly issued, fully paid and non-assessable (for the purpose of this opinion, the

term “non-assessable”, when used to describe the liability of a person as the registered holder of shares has no clear meaning under the laws of the Commonwealth of Australia, so we have assumed those words to mean that holders of such

Shares, having fully paid all amounts due on such Shares, are under no personal liability to contribute to the assets and liabilities of the Company in their capacities purely as holders of such Shares).

The opinions expressed above are limited to the laws of the Commonwealth of Australia and we do not express any opinion as to the effect of any other laws.

This opinion letter is limited to the matters stated herein; no opinion may be inferred beyond the matters expressly stated.

We hereby consent to the

filing of this opinion with the Commission as Exhibit 5.1 to the Registration Statement. In giving this consent, we do not hereby admit that we come within the category of persons whose consent is required under Section 7 of the U.S. Securities

Act or the rules and regulations of the Commission promulgated thereunder.

|

| Very truly yours, |

|

| /s/ Baker & McKenzie |

| Baker & McKenzie |

2

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have issued our reports dated November 16, 2015 and May 1, 2015 with respect to the consolidated financial statements of Benitec Biopharma

Limited included in the Annual Report on Form 20-F for the year ended June 30, 2015, which are incorporated by reference in this Registration Statement. We consent to the incorporation by reference of the aforementioned reports in this

Registration Statement.

|

|

|

| GRANT THORNTON AUDIT PTY LTD Chartered

Accountants |

|

| Sydney NSW Australia |

| 4 February 2016 |

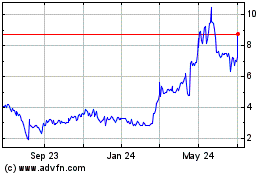

Benitec Biopharma (NASDAQ:BNTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

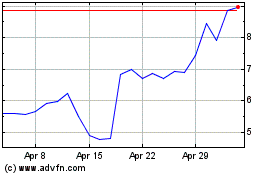

Benitec Biopharma (NASDAQ:BNTC)

Historical Stock Chart

From Apr 2023 to Apr 2024