Company Beats Q4 2015 Revenue, Gross

Margin and EPS Guidance

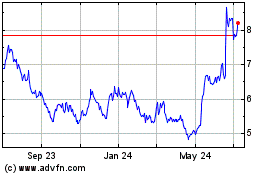

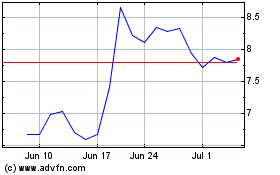

Himax Technologies, Inc. (Nasdaq:HIMX) (“Himax” or “Company”), a

leading supplier and fabless manufacturer of display drivers and

other semiconductor products, announced its financial results for

the fourth quarter and full year ended December 31, 2015.

SUMMARY FINANCIALS

|

Fourth Quarter 2015 Results

Compared to Fourth

Quarter 2014 Results (USD in

millions) (unaudited) |

| |

Q4 2015 |

Q4 2014 |

CHANGE |

| Net Revenues |

$178.0 million |

$227.2 million |

|

-21.7 |

% |

| Gross Profit |

$40.7 million |

$56.0 million |

|

-27.3 |

% |

| Gross Margin |

|

22.9 |

% |

|

24.7 |

% |

|

-1.8 |

% |

| GAAP Net Income

Attributable to Shareholders |

$6.1 million |

$15.6 million |

|

-60.8 |

% |

| Non-GAAP Net Income

Attributable to Shareholders |

$6.5 million (1) |

$16.1 million (2) |

|

-59.7 |

% |

| GAAP EPS (Per Diluted ADS,

USD) |

$ |

0.036 |

|

$ |

0.091 |

|

|

-60.8 |

% |

| Non-GAAP EPS (Per Diluted

ADS, USD) |

$0.038 (1) |

$0.094 (2) |

|

-59.8 |

% |

(1) Non-GAAP Net income attributable to common

shareholders and EPS excludes $0.2 million share-based compensation

expenses, net of tax and $0.2 million non-cash acquisition related

charge, net of tax.(2) Non-GAAP Net income attributable to common

shareholders and EPS excludes $0.4 million of share-based

compensation expenses, net of tax and $0.1 million non-cash

acquisition related charges, net of tax.

|

Fourth Quarter 2015 Results Compared to

Third Quarter 2015 Results (USD in

millions) (unaudited) |

| |

Q4 2015 |

Q3 2015 |

CHANGE |

| Net

Revenue |

$178.0 million |

$165.6 million |

|

+7.5 |

% |

| Gross

Profit |

$40.7 million |

$36.1 million |

|

+12.9 |

% |

| Gross

Margin |

|

22.9 |

% |

|

21.8 |

% |

|

+1.1 |

% |

| GAAP Net

Income (Loss) Attributable to Shareholders |

$6.1

million |

$(2.3) million |

|

+362.9 |

% |

| Non-GAAP Net

Income Attributable to Shareholders |

$6.5 million (1) |

$1.7 million (2) |

|

+286.4 |

% |

| GAAP EPS (Per

Diluted ADS, USD) |

$ |

0.036 |

|

$ |

(0.014 |

) |

|

+362.3 |

% |

| Non-GAAP EPS

(Per Diluted ADS, USD) |

$0.038 (1) |

$0.010 (2) |

|

+285.6 |

% |

(1) Non-GAAP Net income attributable to common

shareholders and EPS excludes $0.2 million share-based compensation

expenses, net of tax and $0.2 million non-cash acquisition related

charge, net of tax.(2) Non-GAAP Net income attributable to common

shareholders and EPS excludes $3.9 million of share-based

compensation expenses, net of tax and $0.1 million non-cash

acquisition related charge, net of tax.

"Our 2015 fourth quarter results beat our

guidance as preannounced on January 7. Our 2015 fourth quarter

revenue was $178.0 million, representing 7.5% sequential increase.

It is in line with our preannouncement and outperformed the

original guidance of flat to 5% up quarter-over-quarter. Gross

margin for the quarter was 22.9%, also beating the original

guidance of ‘flat to slightly up’ sequentially. Fourth quarter GAAP

earnings per diluted ADS came in at 3.6 cents, reaching the high

end of our preannounced GAAP EPS range of 3.3 to 3.8 cents and beat

our initially guided 1.0 to 3.0 cents. The strong result came from

all three product categories,” began Mr. Jordan Wu, President and

Chief Executive Officer of Himax. “Notably, we saw increased market

share of our large panel driver ICs, new addition of a major

smartphone customer for small and medium-sized driver ICs and

shipments of AR/VR related products. 2015 was a difficult year with

different challenges every quarter. Despite hints of a continued

market softness and tougher competition in mobile devices and TV,

we were able to exit the year of 2015 with decent sequential

growth. We believe such strength will continue into 2016. During

2015, our increased large panel driver IC market share in China has

helped us solidify the foundation of our core business, and has

brought in a strong flow sales and new opportunities as our Chinese

customers continue to expand their panel capacities while Chinese

TV makers are sourcing more panels locally. Equally important,

following quite a few quarters of sales decline in small and

medium-sized driver ICs, we finally saw smartphone order

rebounds coming from the industry’s restocking and new model

launches in the last quarter, especially from our leading brand

customers. Two of the key achievements of our smartphone driver IC

business are the completion of our qualification by a primary

Korean customer for our OLED driver IC design and the successful

launch of our TDDI (Touch and Display Driver Integration) products

in 2015. Both products were actively sought after by mobile device

makers, module houses, and panel makers. Lastly, some of the

world’s largest and most impactful technology companies have

continued to work closely with us on their AR/VR devices using our

LCOS, WLO and/or driver IC solutions. Some of them have announced

the launch of their products in 2016. We are seeing strong momentum

across all our major product lines and feel excited about the

growth prospect of 2016, despite the uncertain economic

environment.”

Fourth Quarter 2015 Revenue Breakdown by Product Line

(USD in millions) (unaudited)

| |

Q4

2015 |

% |

Q4

2014 |

% |

%

Change |

| Display drivers for large-sized panels |

$ |

62.1 |

|

|

34.9 |

% |

$ |

65.5 |

|

|

28.8 |

% |

|

-5.2 |

% |

| Display drivers for small/medium-sized

panels |

$ |

81.9 |

|

|

46.0 |

% |

$ |

114.8 |

|

|

50.5 |

% |

|

-28.7 |

% |

| Non-driver products |

$ |

34.0 |

|

|

19.1 |

% |

$ |

46.9 |

|

|

20.7 |

% |

|

-27.4 |

% |

| Total |

$ |

178.0 |

|

|

100.0 |

% |

$ |

227.2 |

|

|

100.0 |

% |

|

-21.7 |

% |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

Q4

2015 |

% |

Q3

2015 |

% |

%

Change |

| Display drivers for large-sized panels |

$ |

62.1 |

|

|

34.9 |

% |

$ |

50.5 |

|

|

30.5 |

% |

|

+22.9 |

% |

| Display drivers for small/medium-sized

panels |

$ |

81.9 |

|

|

46.0 |

% |

$ |

84.3 |

|

|

50.9 |

% |

|

-2.9 |

% |

| Non-driver products |

$ |

34.0 |

|

|

19.1 |

% |

$ |

30.8 |

|

|

18.6 |

% |

|

+10.5 |

% |

| Total |

$ |

178.0 |

|

|

100.0 |

% |

$ |

165.6 |

|

|

100.0 |

% |

|

+7.5 |

% |

| |

|

|

|

|

|

Himax’s fourth quarter revenue of $178.0 million

represented a 7.5% sequential increase from the previous quarter

and a 21.7% decrease from the same period last year. Overall, sales

came in better than guided across all three product lines during

the quarter. Notably, the Company saw increased market share of its

large panel driver ICs, new addition of a major smartphone customer

for small and medium-sized driver ICs, and shipments of AR/VR

related products.

Revenue from large panel display drivers was

$62.1 million, up 22.9% sequentially, and down 5.2% from a year

ago. Large panel driver ICs accounted for 34.9% of Himax’s total

revenues for the fourth quarter, compared to 30.5% in the last

quarter and 28.8% a year ago. NB demand remained weak, yet the

Company’s driver IC business for TVs and monitors grew more than

20% sequentially while, according to the market research firm IHS,

worldwide TV and monitor panel shipments decreased 2% during the

same period. This bright spot, as Himax has repeatedly emphasized,

came from its long-standing leading market share in China’s

fast-expanding panel manufacturing base. If looking only at China,

the Company’s driver IC revenue grew close to 40% sequentially for

each of NB, monitor and TV applications in the fourth quarter of

2015. Overall large panel driver IC for Chinese panel customers

grew 16.9% year-over-year. Himax’s leading market share, coupled

with rapid capacity ramping of Chinese panel customers and more

in-sourcing from their local set maker customers, have led to this

favorable result. It is especially worth highlighting that Himax’s

engineering collaboration and design-in activities with Chinese

panel customers remain robust despite the soft market

sentiment.

Revenue for small and medium-sized drivers came

in at $81.9 million, down 2.9% sequentially and down 28.7% from the

same period last year. Driver ICs for small and medium-sized

applications accounted for 46.0% of total sales for the fourth

quarter, as compared to 50.9% in the previous quarter and 50.5% a

year ago. The main reason behind the weak performance was the loss

of business from the Company’s primary Korean end customer as they

replaced the use of LCD displays, for which Himax was a major IC

vendor, by AMOLED for their smartphone products, thereby creating a

gap in the Company’s small and medium-sized business. While with a

much reduced volume, Himax remained a major IC partner to this

Korean customer for their LCD displays and is working on AMOLED

projects with them. Business from Chinese smartphone makers grew

significantly over the last quarter due to their new model launches

and inventory replenishing, as well as the addition of a Chinese

new top-tier customer for one of their high-volume models. Compared

to the same quarter last year, revenues for Chinese smartphones

stayed around flat. For automotive applications, Himax continued to

see solid momentum, growing high teens from the third quarter and

around 3% year-over-year. The Company’s revenues for tablet segment

grew around 9% sequentially, a result of strong shipments to

certain international brand customers. The tablet sector registered

a year-over-year decline of around 17%, a reflection of the overall

weakness of the tablet market.

Revenues from non-driver businesses were $34.0

million, up 10.5% sequentially and down 27.4% from the same period

last year. Non-driver products accounted for 19.1% of total

revenues, as compared to 18.6% in the previous quarter and 20.7% a

year ago. CMOS image sensor business was the main factor behind the

year-over-year decline. Himax’s CMOS Image sensor business suffered

because the Company didn’t ramp its 8MP and 13MP sensors as planned

due to the lack of Phase Detection Auto Focus (PDAF), a new but

nowadays-required feature for high end smartphone. Himax remained

one of the market share leaders in notebook sector. The sequential

growth of its non-driver segment was mainly contributed by AR/VR

related businesses. Himax’s LCOS and WLO revenues started to show

growth as it started to make shipments to certain leading customers

in September. Development fees from AR/VR project engagements with

both current and new customers also worked in its favor. Among the

non-driver products, power management ICs also delivered impressive

growth sequentially.

GAAP gross margin for the fourth quarter was

22.9%, a 110 basis points increase from 21.8% in the previous

quarter and down 180 basis points from 24.7% in the same period

last year. The gross margin beat the Company’s initial guidance

mainly due to a more favorable product mix, including more high-end

smartphone and tablet driver IC shipments and higher development

fee incomes from LCOS and WLO businesses. Such increased

development activities will eventually lead to mass production of

these products, which will enhance the Company’s gross margin even

further in the long run. Gross margin expansion was also a

testament to Himax’s costs-down measures. Gross margin improvement

remains one of the Company’s business focuses.

Fourth quarter GAAP operating expenses were

$32.1 million, down 16.6% from the previous quarter and down 3.8%

from a year ago. The sequential decrease was primarily the result

of the difference in RSU charges. In accordance with the Company’s

protocol, Himax grants annual RSUs to its staff at the end of

September each year, which, given all other items equal, leads to

higher third quarter GAAP operating expenses compared to the other

quarters of the year. The fourth quarter RSU expense was only $0.3

million while it was $4.5 million in the third quarter. Excluding

the RSU expense, operating expenses decreased 6.5% from last

quarter and down 3.3% year-over-year. The sequential decrease was

the result of streamlining core business R&D activities and

other expense control measures.

GAAP operating income for the fourth quarter of

2015 was $8.6 million or 4.8% of sales, up 449.9% sequentially and

down 62.0% year-over-year. The sequential profit increase was from

higher revenue, enhanced gross margin, and lower operating expenses

including less RSU expenses. The year-over-year decline was, on the

contrary, a result of lower revenue and gross margin, but offset by

lowered operating expenses.

Reported GAAP net income for the fourth quarter

was $6.1 million, or 3.6 cents per diluted ADS, compared to GAAP

net loss of $2.3 million, or 1.4 cents per diluted ADS, in the

previous quarter and GAAP net income of $15.6 million, or 9.1 cents

per diluted ADS, for the same period last year. GAAP EPS exceeded

the Company’s 1.0 to 3.0 cents guided range.

In the Company’s last earnings call, it

estimated $3.1 million of additional income tax charges caused by

the NTD depreciation based on the exchange rate of 32.66 on

November 12th, the date of the EPS guidance. As it turned out, from

November 12th to the year end, the NTD further depreciated to 32.83

against the USD, resulting in an additional $0.5 million, or 0.3

cents per diluted ADS, of income tax charges. If the NTD/USD rate

had stayed at 32.66, Himax’s EPS would have been 3.9 cents,

outperforming its original guidance even more. The exchange rate

has very little effect on the Company’s margins and operating

results as Himax maintains vast majority of its cash, conducts its

entire buy and sell activities, and keep its books all in US

dollars. The only major impact it has is on the effective income

tax. This is because the Company pays literally all its taxes in

Taiwan where tax authorities determine Himax’s tax based on NT

dollar dominated ROC GAAP accounting. In general, as NT dollar

depreciates against US dollar, the Company is worse off in its US

GAAP effective tax rate and vice versa. Himax chooses to maintain

natural hedge in its operational activities as it believes this

minimizes the overall exchange rate impact over time.

The sequential profit increase was a result of

higher revenue and gross margin, together with lower operating

expenses. The year-over-year profit decline was due to decline in

revenue and gross margin but lower operating expenses helped offset

some of the bottom line decline.

Fourth quarter non-GAAP net income, which

excludes share-based compensation and acquisition-related charges,

was $6.5 million, or 3.8 cents per diluted ADS, compared to $1.7

million last quarter and $16.1 million the same period last

year.

Full Year 2015 Financial Results

|

FY 2015 Results Compared

to FY 2014 Results (USD

in millions) (unaudited) |

| |

FY 2015 |

FY 2014 |

CHANGE |

| Net Revenues |

$691.8 million |

$840.5 million |

|

-17.7 |

% |

| Gross Profit |

$163.1 million |

$205.9 million |

|

-20.8 |

% |

| Gross Margin |

|

23.6 |

% |

|

24.5 |

% |

|

-0.9 |

% |

| GAAP Net Income

Attributable to Shareholders |

$25.2 million |

$66.6 million |

|

-62.2 |

% |

| Non-GAAP Net Income

Attributable to Shareholders |

$30.6 million (1) |

$76.0 million (2) |

|

-59.7 |

% |

| GAAP EPS (Per Diluted ADS,

USD) |

$ |

0.146 |

|

$ |

0.387 |

|

|

-62.2 |

% |

| Non-GAAP EPS (Per Diluted

ADS, USD) |

$0.178 (1) |

$0.442 (2) |

|

-59.7 |

% |

(1) Non-GAAP Net income attributable to common

shareholders and EPS excludes $4.9 million share-based compensation

expenses, net of tax and $0.5 million non-cash acquisition related

charge, net of tax.(2) Non-GAAP Net income attributable to common

shareholders and EPS excludes $8.8 million of share-based

compensation expenses, net of tax and $0.6 million non-cash

acquisition related charges, net of tax.

| FY

2015 Revenue Breakdown by Product Line (USD in millions)

(unaudited) |

| |

|

|

|

|

|

| |

FY 2015 |

% |

FY 2014 |

% |

% Change |

| Display drivers for

large-sized panels |

$ |

224.4 |

|

|

32.4 |

% |

$ |

226.1 |

|

|

26.9 |

% |

|

-0.7 |

% |

| Display drivers for

small/medium-sized panels |

$ |

336.0 |

|

|

48.6 |

% |

$ |

446.0 |

|

|

53.1 |

% |

|

-24.7 |

% |

| Non-driver products |

$ |

131.4 |

|

|

19.0 |

% |

$ |

168.4 |

|

|

20.0 |

% |

|

-22.0 |

% |

|

Total |

$ |

691.8 |

|

|

100.0 |

% |

$ |

840.5 |

|

|

100.0 |

% |

|

-17.7 |

% |

Revenues totaled $691.8 million in 2015,

representing a 17.7% decrease over 2014. Revenues from large panel

display drivers declined 0.7% year-over-year, representing 32.4% of

total revenues, as compared to 26.9% in 2014. Notably, TV

application grew over 20% year-over-year, the highest growth since

2011. Such strength was originated from the Company’s focus in

China starting 2012 as it bets on China’s long term prospect and

sought to diversify customer base. Himax believes that panel

capacity expansion in China is a tailwind ride uniquely for the

Company, and its large panel driver IC sales and market share will

further improve as it moves into 2016 as a result.

Small and medium-sized driver sales declined

24.7% year-over-year, representing 48.6% of total revenues, as

compared to 53.1% in 2014. Himax’s key Korean end-customer’s

decision to substantially increase the portion of AMOLED panels in

their smartphone portfolio was the main reason that caused the

Company’s smartphone drivers to decline. The Company’s driver sales

for small and medium size panels were also hit by the weak

smartphone sales in China where smartphone vendors, lacking new

government stimulus, turned conservative while trying new sales

channels such as e-commerce and direct sales points to replace the

previous approach of selling through telecom operators. Worse yet,

exports were also weakened by the relatively strong RMB over the

full year. However, the Chinese smartphone market started to

rebound in the fourth quarter. Smartphone aside, Himax’s driver IC

sales into the tablet market also declined significantly

year-over-year while those for automotive applications grew double

digit. The Company would like to reiterate that despite the fast

changes in the smartphone makers’ competition landscape, it remains

the leading supplier of small and medium-sized driver IC for panel

makers and module houses across Taiwan, Korea, China and Japan. Now

that Himax’s smartphone end customers have recaptured the market

with refreshed marketing strategies, new model launches and better

grasp of internet sales channels, and with its latest addition of a

major brand customer, the Company is well-positioned to grow again

in 2016.

Non-driver products declined 22.0%

year-over-year, representing 19.0% of total sales, as compared to

20.0% a year ago. As explained earlier, CMOS image sensors’ decline

was the main reason behind the poor performance. LCOS, WLO and

timing controllers actually grew strongly last year. Himax launched

eDP 1.4 timing controller, targeting high end monitors, NBs and

tablets, and have received positive feedbacks and strong customer

adoption as the Company was the first to launch such timing

controller capable of supporting resolutions of up to 4K for

medium-sized panels.

The Company indicated before that its LCOS and

WLO business hit inflection in September 2015 with pilot production

shipment made to a major customer. The increasing shipments of its

LCOS and WLO products to some industry heavyweights in the fourth

quarter 2015 and the additional design engagements with current and

new customers are evidence that Himax is uniquely positioned as the

provider of choice for microdisplay and related optics to enable AR

applications. Separately, Himax has officially broken into the VR

space with major design-wins taking place toward the end of 2015.

The Company’s expertise in customized display solutions in OLED

driver IC, timing controller, and power management ICs have led to

ASIC developments that will go into the next generation panels of

several VR devices. With multiple AR/VR players announcing their

product launches in 2016, Himax stands to benefit from these new

businesses.

Himax’s touch panel controller sales remained

flat year-over-year in 2015. The introduction and mass shipment of

on-cell and pure in-cell products have led to fast customer

additions in its touch business in 2015. The Company continues to

believe that TDDI will start to take off starting 2H16.

Gross margin in 2015 was 23.6%, a 90 basis-point

decline from 24.5% in 2014. The margin decline was mainly the

result of pricing pressures passed on to driver IC vendors from

cost sensitive panel makers. Pressure on gross margin was partially

offset by higher development incomes from LCOS and WLO products and

higher sales of driver ICs for high end smartphones in the fourth

quarter.

GAAP operating expenses were $132.5 million,

down $0.7 million or 0.5% compared to last year. As repeatedly

indicated, the Company only intended to increase its expenses in

LCOS and WLO sectors, where it is seeing a lot of growth

opportunities. GAAP operating income of $30.7 million

represented a 57.8% decrease versus 2014.

GAAP net income for the year was $25.2 million,

or 14.6 cents per diluted ADS, down from $66.6 million, or 38.7

cents per diluted ADS, for the same period last year. The exchange

rate impact on income tax was $3.6 million for 2015 as NTD

depreciated to 32.83 against USD at end of 2015 from 31.65 at the

beginning of the year.

Non-GAAP net income for 2015 was $30.6 million,

or 17.8 cents per diluted ADS, down from $76.0 million, or 44.2

cents per diluted ADS, for 2014. The decrease in non-GAAP net

income was mainly the result of lower revenue in this year.

Balance Sheet and Cash Flow

Himax had $148.3 million of cash, cash

equivalents, and marketable securities at the end of December 2015,

compared to $187.8 million at the same time last year and $126.0

million a quarter ago. On top of the above cash position,

restricted cash was $180.4 million at the end of the quarter. The

restricted cash is mainly used to guarantee the company’s short

term loan for the same amount. Himax continues to maintain a very

strong balance sheet, and remains a debt-free company.

Inventories as of December 31, 2015 were $171.4

million, up from $166.1 million a year ago and down from $177.7

million a quarter ago. Himax was able to further lower inventory

levels sequentially because of demand rebound. The higher inventory

year-over-year was the result of the Company’s measures to counter

the relatively low customer demand visibility in a volatile market.

Accounts receivable at the end of December 2015 were $177.2 million

as compared to $219.4 million a year ago and $168.0 million last

quarter. DSO was 93 days at the end of December, 2015, little

changed from 95 days a year ago and 89 days at end of the last

quarter.

Net cash inflow from operating activities for

the fourth quarter was $25.9 million as compared to an inflow of

$38.7 million for the fourth quarter of 2014 and an inflow of $14.1

million for the third quarter of 2015. Cumulative cash inflow from

operations in 2015 was $22.5 million as compared to $93.7 million

in 2014. The decrease in cash flow is mainly due to lower net

profit and higher working capital.

Capital expenditures were $3.6 million in the

fourth quarter of 2015 versus $2.4 million a year ago and $2.6

million last quarter. The capital expenditure in the fourth quarter

consisted mainly of the manufacturing toolings of CMOS image sensor

products and facility updates and capacity expansion for LCOS and

WLO product lines. Total capital expenditures for the year were

$10.0 million versus $10.9 million a year ago.

In July 2015, Himax paid an annual dividend of

30 cents per ADS, equal to 77.5% of 2014 GAAP earnings per diluted

ADS. The Company remains committed to paying annual dividends, the

amount of which is based primarily on its prior year’s

profitability. The high payout ratio in 2015 is an illustration of

the Company’s confidence in its future profitability.

Share Buyback Update

As of December 31, 2015, Himax had 171.9 million

ADS outstanding, unchanged from last quarter. On a fully diluted

basis, the total ADS outstanding are 172.3 million.

2016 Investor Outreach and

Conferences

Ms. Jackie Chang, CFO, Ms. Nadiya Chen and Ms.

Penny Lin, internal IR Managers, and Mr. John Mattio, Himax’s

US-Based IR, will maintain corporate access for shareholders and

attend future investor conferences in the U.S. If you are

interested in speaking with the management, please contact Himax’s

US or Taiwan-based investor relations contact at the numbers

below.

Business Updates

The Company is mindful that 2016 will likely be

a year of macro uncertainty, marked by currency fluctuations and

the risk of China’s slowdown. However, looking ahead into the new

year, we believe our businesses will be resilient to macro

headwinds for reasons set out below. Himax’s large panel driver ICs

for TV application will grow from higher 4K TV penetration and the

added capacities from China. In terms of small and medium sized

driver ICs, those for automotive applications, where Himax has a

leading market share, will continue to show strong growth as more

panels are going into vehicles. For smartphone applications, the

Company believes that the adoption of 4G network should rise in

China which will stimulate demand in 2016. Himax also believes in

technology integration such as TDDI in smartphones. Revenue

contribution from TDDI will likely take place in the second half of

2016. Non-driver products wise, 2016 will be the year for Himax to

see a bigger revenue percentage generated by LCOS and WLO product

lines as shipments to its major customers start to take off. Himax

will also tap into new territories such as IoT and machine vision

with its latest CIS and WLO product offerings as stated in the

Company’s recent press releases. Overall, 2016 will be a year of

growth for both top and bottom line.

Following a strong fourth quarter, large panel

driver ICs should continue to grow around 10% sequentially and

high-teens year over year, with China and 4K TV still the major

growth engines. Himax expects its 4K TV to double in the first

quarter sequentially and close to triple over the same period last

year.

The Company is experiencing accelerating demand

from panel manufacturers seeking IC vendors who can provide driver

IC, timing controller, Gamma OP, and PMIC as a total solution.

Meanwhile, timing controller is getting more technologically

advanced, with high end models integrating sophisticated functions

such as MEMC. This positions Himax very well in the high end 4K TV

market. As the industry migrates to 8K TVs, which is already

starting to take place in product development, Himax’s business and

technology strength and integrated product solutions will be a

significant differentiator against the competition.

The other segments in Himax’ driver business is

ICs used in small and medium-sized panels for applications

including smartphones, tablets and automotives. First quarter sales

for smartphones are likely to remain flat, despite few working days

around Chinese New Year, as Himax’s end customers, including a

newly added first-tier player, are launching new models and

replenishing inventories ahead of the holidays. Furthermore, Himax

is seeing accelerating FHD shipments and design-wins in its

pipeline, a testament to the trend that FHD is quickly becoming the

new mainstream display resolution for smartphones, replacing HD720.

Himax is also pleased to report that its shipment of AMOLED driver

IC to key Korean customer will start later this quarter,

reaffirming its technology leadership. As it is collaborating with

multiple customers both in Korea and China on AMOLED product

development, Himax believes AMOLED driver ICs will be one of the

critical future growth engines of its small panel driver IC

business, especially with quite a few new AMOLED fabs being built

in China where Himax has the most comprehensive customer

coverage.

Among driver ICs used in small and medium-sized

panels, the best-performing category has been automotives in recent

years. The Company anticipates Q1 shipment to be slightly higher

than the previous quarter, growing double digit year-over-year.

Himax expects the growth to stay robust throughout the year. With

numerous top automobile brands having been its indirect end

customers, it is well positioned to take advantage of the growing

market in 2016 and beyond.

For driver ICs used in tablets, demands remain

weak and will decline double digit in the first quarter, resulting

in a declining small and medium-sized driver IC segment in the

first quarter of around mid single digit sequentially.

For the past few years, Himax’s non-driver

business segment has been its most exciting growth segment and a

differentiator for the Company. New product development continues

to evolve and gain traction, and Himax remains positive on the

long-term growth prospect of its non-driver businesses.

The Company expects mid single digit sequential

growth in non-driver products for the first quarter. Looking ahead,

many of Himax’s non-driver products, including its CMOS image

sensor, timing controller, touch panel controller, power management

IC, ASIC service, wafer level optics and LCOS microdisplay, are set

to grow significantly in 2016 and the years ahead.

For touch panel controller product line, the

Company exited 2015 with sales flat year-over-year as the industry

shifted to on-cell and pure in-cell TDDI. Himax expects on-cell to

become the mainstream touch technology in 2016. It has also

launched force touch products, a new feature to the touch panel,

and already secured design-wins from leading smartphone makers for

their 2016 models. Himax’s on-cell sales will significantly

accelerate starting late first quarter with shipments to Chinese

and Japanese smartphone makers. Furthermore, Himax is one of the

pioneers in offering TDDI solutions for the state-of-art in-cell

panels, which have started small volume production in 2015. The

Company is in partnerships with essentially all of the panel

manufacturers in pure in-cell touch for joint technological

development and believes there is a strong market for Himax going

forward. The Company expects to see its contribution starting

2H16.

Moving on to Himax’s most exciting AR/VR related

businesses, the CES Show last month showcased the fast-growing,

multi-billion dollar AR/VR sector under development. Participants

included leading multinationals in the gaming, search, mobile,

social media, military and consumer industries. Having invested in

the technologies for over 15 years, Himax is uniquely positioned as

the provider of choice for microdisplay and related optics to

enable AR.

As some of Himax’s major customers have already

announced product launches, revenues from LCOS and WLO are expected

to double sequentially in the first quarter off a small base,

marking the beginning of mass production for some of its leading AR

device customers. While most customers don’t expect big volume for

their early generation products, the Company has been working with

many of them for future generation devices. Himax is also seeing

constant additions of new customers using its LCOS and/or WLO for a

variety of new applications. We currently have more than 30

customers using the Company’s LCOS and/or WLO for their AR devices

and optical engine designs, with the vast majority of them in the

U.S.. When adopted, the Company’s LCOS and WLO typically represent

two of the parts with the highest value in an AR product’s

bill-of-materials. As for VR applications, as mentioned in the

press release in January, Himax has had new driver IC design-wins

with two top-notch VR players in the next generation OLED panels

for their VR devices.

In addition, in a recent press release, Himax

introduced WLO laser diode collimator with integrated Diffractive

Optical Element (“DOE”). The Company believes this is the most

effective solution for 3D sensing and detection. Himax’s technology

can reduce the size of the incumbent laser projector module by a

factor of 9, actually making it smaller than conventional camera

modules. This breakthrough allows the solution to be easily

integrated into next-generation smartphones, tablets, automobiles,

AR/VR devices, IoT devices, and consumer electronics accessories to

enable new applications in the consumer, medical, and industrial

marketplaces.

To be paired with the laser projector module

mentioned above, Himax is also developing a Near Infrared (NIR)

sensor to provide customers with a total solution. Additionally, in

January, Himax announced an ultra-low-power QVGA CMOS image sensor,

which, the Company believes is by far the lowest power CIS in the

industry with similar resolution, while offering outstanding sensor

performance and high level of feature integration. This sensor can

be in a constant state of operation, enabling “always on”,

contextually aware, computer vision capabilities such as feature

extraction, proximity sensing, gesture recognition, object tracking

and pattern identification. Likewise, it can be applied in new

applications across smartphones, tablets, AR/VR devices, IoT and

artificial intelligence. This series of smart sensors will open a

new business territory for Himax’s CIS products.

In terms of the Company’s 8MP and 13MP CMOS

image sensors with PDAF feature, the Company is catching up fast.

Himax believes it will be one of the few players capable of

providing PDAF-equipped CMOS image sensors in the very near

future.

First Quarter 2016

Guidance

The Company is providing the following financial

guidance for the first quarter of 2016:

| Net Revenue: |

|

|

To be down 1%

to up 4% as compared to the fourth quarter of 2015 |

| Gross Margin: |

|

|

To be around

25% as opposed to 22.9% reported in the fourth quarter of 2015 |

| GAAP

EPS: |

|

|

5.5 to 7.5

cents per diluted ADS, as compared to 3.6 cents reported in the

fourth quarter of 2015 |

In providing the above earnings guidance, we have assumed a 20%

income tax rate, calculated based on exchange rate of NTD 33.45

against the USD, which is also the exchange rate as of beginning of

February 2016.

HIMAX TECHNOLOGIES FOURTH QUARTER

2015 EARNINGS CONFERENCE

CALL

|

DATE: |

|

|

Thursday, February 4th, 2016 |

|

TIME: |

|

|

U.S. 8:00 a.m.

EST |

| |

|

|

Taiwan 9:00 p.m. |

|

DIAL IN: |

|

|

U.S. +1 (866) 444-9147 |

| |

|

|

INTERNATIONAL +1 (678) 509-7569 |

|

CONFERENCE ID |

|

|

25019205 |

|

WEBCAST: |

|

|

http://edge.media-server.com/m/p/xd9h5jr4 |

A replay of the call will be available beginning two hours after

the call through 11:59 p.m. US EST on February 11, 2016 (12:59 p.m.

Taiwan time, February 12, 2016) on www.himax.com.tw and by

telephone at +1 (855) 859-2056 (US Domestic) or +1 (404) 537-3406

(International). The conference ID number is 25019205. This call is

being webcast by Nasdaq and can be accessed by clicking on this

link or Himax’s website, where the webcast can be accessed through

February 4, 2017.

About Himax Technologies,

Inc.

Himax Technologies, Inc. (HIMX) is a fabless

semiconductor solution provider dedicated to display imaging

processing technologies. Himax is a worldwide market leader in

display driver ICs and timing controllers used in TVs, laptops,

monitors, mobile phones, tablets, digital cameras, car navigation,

and many other consumer electronics devices. Additionally, Himax

designs and provides controllers for touch sensor displays, LCOS

micro-displays used in palm-size projectors and head-mounted

displays, LED driver ICs, power management ICs, scaler products for

monitors and projectors, tailor-made video processing IC solutions

and silicon IPs. The company also offers digital camera solutions,

including CMOS image sensors and wafer level optics, which are used

in a wide variety of applications such as mobile phone, tablet,

laptop, TV, PC camera, automobile, security and medical devices.

Founded in 2001 and headquartered in Tainan, Taiwan, Himax

currently employs around 1,900 people from three Taiwan-based

offices in Tainan, Hsinchu and Taipei and country offices in China,

Korea, Japan and the US. Himax has 2,764 patents granted and 566

patents pending approval worldwide as of December 31, 2015. Himax

has retained its position as the leading display imaging processing

semiconductor solution provider to consumer electronics brands

worldwide. http://www.himax.com.tw

Forward Looking Statements

Factors that could cause actual events or

results to differ materially include, but not limited to, General

business and economic conditions and the state of the semiconductor

industry; market acceptance and competitiveness of the driver and

non-driver products developed by the Company; demand for end-use

applications products; reliance on a small group of principal

customers; the uncertainty of continued success in technological

innovations; our ability to develop and protect our intellectual

property; pricing pressures including declines in average selling

prices; changes in customer order patterns; changes in estimated

full-year effective tax rate; shortages in supply of key

components; changes in environmental laws and regulations; exchange

rate fluctuations; regulatory approvals for further investments in

our subsidiaries; our ability to collect accounts receivable and

manage inventory and other risks described from time to time in the

Company's SEC filings, including those risks identified in the

section entitled "Risk Factors" in its Form 20-F for the year ended

December 31, 2014 filed with the SEC, as may be amended.

– FINANCIAL TABLES –

| Himax Technologies, Inc. |

| Unaudited Condensed Consolidated Statements of

Income |

| (These interim financials do not fully comply with US

GAAP because they omit all interim disclosure required by US

GAAP) |

| (Amounts in Thousands of U.S. Dollars, Except

Share and Per Share Data) |

| |

|

|

Three Months Ended December

31, |

|

Three Months Ended September

30, |

|

|

|

2015 |

|

|

|

2014 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

Revenues |

$ |

177,977 |

|

|

$ |

227,179 |

|

|

$ |

165,582 |

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

| Cost of revenues |

|

137,243 |

|

|

|

171,140 |

|

|

|

129,510 |

|

| Research and development |

|

22,575 |

|

|

|

22,788 |

|

|

|

27,907 |

|

| General and administrative |

|

4,544 |

|

|

|

4,901 |

|

|

|

5,158 |

|

| Sales and marketing |

|

5,004 |

|

|

|

5,714 |

|

|

|

5,468 |

|

| Total costs and

expenses |

|

169,366 |

|

|

|

204,543 |

|

|

|

168,043 |

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

8,611 |

|

|

|

22,636 |

|

|

|

(2,461 |

) |

|

|

|

|

|

|

|

|

Non operating income: |

|

|

|

|

|

|

Interest income |

|

188 |

|

|

|

225 |

|

|

|

116 |

|

| Gains

(losses) on sale of securities, net |

|

159 |

|

|

|

(26 |

) |

|

|

32 |

|

|

Equity in income (losses) of equity method investees |

|

262 |

|

|

|

(24 |

) |

|

|

(119 |

) |

|

Valuation gain on financial instruments |

|

- |

|

|

|

1,255 |

|

|

|

- |

|

|

Impairment loss on investments |

|

- |

|

|

|

(309 |

) |

|

|

- |

|

|

Foreign currency exchange gains (losses), net |

|

(28 |

) |

|

|

759 |

|

|

|

680 |

|

|

Interest expense |

|

(141 |

) |

|

|

(149 |

) |

|

|

(152 |

) |

| Other

income (losses), net |

|

(77 |

) |

|

|

18 |

|

|

|

125 |

|

|

|

|

363 |

|

|

|

1,749 |

|

|

|

682 |

|

|

Earnings (loss) before

income taxes |

|

8,974 |

|

|

|

24,385 |

|

|

|

(1,779 |

) |

| Income tax expense |

|

3,759 |

|

|

|

9,247 |

|

|

|

1,151 |

|

|

Net income (loss) |

|

5,215 |

|

|

|

15,138 |

|

|

|

(2,930 |

) |

| Net loss

attributable to noncontrolling interests |

|

915 |

|

|

|

487 |

|

|

|

598 |

|

|

Net income (loss)

attributable to Himax stockholders |

$ |

6,130 |

|

|

$ |

15,625 |

|

|

$ |

(2,332 |

) |

|

|

|

|

|

|

|

| Basic earnings

(loss) per ADS attributable to Himax

stockholders |

$ |

0.036 |

|

|

$ |

0.091 |

|

|

$ |

(0.014 |

) |

| Diluted

earnings (loss) per ADS

attributable to Himax stockholders |

$ |

0.036 |

|

|

$ |

0.091 |

|

|

$ |

(0.014 |

) |

|

|

|

|

|

|

|

|

Basic Weighted Average Outstanding ADS |

|

172,303 |

|

|

|

171,608 |

|

|

|

171,615 |

|

|

Diluted Weighted Average Outstanding

ADS |

|

172,303 |

|

|

|

172,161 |

|

|

|

171,936 |

|

| Himax Technologies, Inc. |

| Unaudited Condensed Consolidated Statements of

Income |

| (Amounts in Thousands of U.S. Dollars, Except

Share and Per Share Data) |

| |

|

|

|

Twelve Months Ended

December

31, |

|

|

|

|

|

2015 |

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

Revenues |

|

|

$ |

691,789 |

|

|

$ |

840,542 |

|

|

|

|

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

| Cost of revenues |

|

|

|

528,651 |

|

|

|

634,660 |

|

| Research and development |

|

|

|

94,422 |

|

|

|

91,839 |

|

| General and administrative |

|

|

|

18,470 |

|

|

|

20,192 |

|

| Sales and marketing |

|

|

|

19,574 |

|

|

|

21,126 |

|

| Total costs and

expenses |

|

|

|

661,117 |

|

|

|

767,817 |

|

|

|

|

|

|

|

|

| Operating

income |

|

|

|

30,672 |

|

|

|

72,725 |

|

|

|

|

|

|

|

|

| Non

operating income: |

|

|

|

|

|

| Interest income |

|

|

|

710 |

|

|

|

728 |

|

| Gains on sale of

securities, net |

|

|

|

1,993 |

|

|

|

10,471 |

|

| Valuation gain on

financial instruments |

|

|

|

- |

|

|

|

1,255 |

|

| Impairment loss on

investments |

|

|

|

- |

|

|

|

(309 |

) |

| Equity in losses of equity

method investees |

|

|

|

(77 |

) |

|

|

(80 |

) |

| Foreign currency exchange

gains (losses), net |

|

|

|

(43 |

) |

|

|

1,077 |

|

| Interest expense |

|

|

|

(514 |

) |

|

|

(518 |

) |

| Other income, net |

|

|

|

126 |

|

|

|

145 |

|

| |

|

|

|

2,195 |

|

|

|

12,769 |

|

| Earnings

before income taxes |

|

|

|

32,867 |

|

|

|

85,494 |

|

| Income tax expense |

|

|

|

11,405 |

|

|

|

21,591 |

|

| Net

income |

|

|

|

21,462 |

|

|

|

63,903 |

|

| Net loss

attributable to noncontrolling interests |

|

|

|

3,733 |

|

|

|

2,695 |

|

| Net

income attributable to Himax

stockholders |

|

|

$ |

25,195 |

|

|

$ |

66,598 |

|

|

|

|

|

|

|

|

| Basic earnings per

ADS attributable to Himax stockholders |

|

|

$ |

0.147 |

|

|

$ |

0.389 |

|

| Diluted earnings

per ADS attributable to Himax stockholders |

|

|

$ |

0.146 |

|

|

$ |

0.387 |

|

|

|

|

|

|

|

|

|

Basic Weighted Average Outstanding ADS |

|

|

|

171,785 |

|

|

|

171,095 |

|

|

Diluted Weighted Average Outstanding

ADS |

|

|

|

172,066 |

|

|

|

171,999 |

|

| Himax Technologies,

Inc.Unaudited Supplemental Financial

Information(Amounts in Thousands of U.S.

Dollars) |

| |

|

|

|

|

| The amount of

share-based compensation included in applicable

statements of income categories is

summarized as follows: |

|

Three MonthsEnded December

31, |

|

Three MonthsEnded September 30, |

| |

|

|

2015 |

|

|

|

2014 |

|

|

|

2015 |

|

| Share-based

compensation |

|

|

|

|

|

|

| Cost of revenues |

|

$ |

27 |

|

|

$ |

6 |

|

|

$ |

70 |

|

| Research and development |

|

|

160 |

|

|

|

312 |

|

|

|

3,505 |

|

| General and administrative |

|

|

70 |

|

|

|

132 |

|

|

|

530 |

|

| Sales and marketing |

|

|

20 |

|

|

|

84 |

|

|

|

823 |

|

| Income tax benefit |

|

|

(47 |

) |

|

|

(127 |

) |

|

|

(1,040 |

) |

| Total |

|

$ |

230 |

|

|

$ |

407 |

|

|

$ |

3,888 |

|

| |

|

|

|

|

|

|

| The amount

of acquisition-related charges

included in applicable statements of

income categories is summarized as

follows: |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Acquisition-related

charges |

|

|

|

|

|

|

| Research and development |

|

$ |

237 |

|

|

$ |

194 |

|

|

$ |

220 |

|

| Income tax benefit |

|

|

(98 |

) |

|

|

|

|

(83 |

) |

|

|

(94 |

) |

| Total |

|

$ |

139 |

|

|

$ |

111 |

|

|

$ |

126 |

|

| Himax Technologies,

Inc.Unaudited Supplemental Financial

Information(Amounts in Thousands of U.S.

Dollars) |

| |

|

|

| The amount of

share-based compensation included in applicable

statements of income categories is

summarized as follows: |

|

Twelve Months Ended

December

31, |

| |

|

|

2015 |

|

|

|

2014 |

|

| Share-based

compensation |

|

|

|

|

| Cost of revenues |

|

$ |

110 |

|

|

$ |

121 |

|

| Research and development |

|

|

4,289 |

|

|

|

7,610 |

|

| General and administrative |

|

|

865 |

|

|

|

1,688 |

|

| Sales and marketing |

|

|

1,010 |

|

|

|

1,847 |

|

| Income tax benefit |

|

|

(1,342 |

) |

|

|

(2,437 |

) |

| Total |

|

$ |

4,932 |

|

|

$ |

8,829 |

|

| |

|

|

|

|

| The amount

of acquisition-related charges

included in applicable statements of

income categories is summarized as

follows: |

|

|

|

|

| |

|

|

|

|

| Acquisition-related

charges |

|

|

|

|

| Research and development |

|

$ |

845 |

|

|

$ |

850 |

|

| Sales and marketing |

|

|

- |

|

|

|

|

|

96 |

|

| Income tax benefit |

|

|

(358 |

) |

|

|

|

|

(374 |

) |

| Total |

|

$ |

487 |

|

|

$ |

572 |

|

| Himax Technologies, Inc. |

| GAAP Unaudited Condensed

Consolidated Balance Sheets |

| (Amounts in Thousands of U.S. Dollars,

Except Share and Per Share

Data) |

| |

|

December

31, 2015 |

|

September

30, 2015 |

|

December

31, 2014 |

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

129,829 |

|

|

$ |

106,387 |

|

|

$ |

185,466 |

|

| Restricted cash and marketable

securities |

|

|

180,442 |

|

|

|

180,442 |

|

|

|

130,179 |

|

| Investments in marketable

securities available-for-sale |

|

|

18,511 |

|

|

|

19,625 |

|

|

|

2,377 |

|

| Accounts receivable, less allowance

for doubtful accounts, sales returns and discounts |

|

|

177,198 |

|

|

|

167,975 |

|

|

|

219,368 |

|

| Inventories |

|

|

171,374 |

|

|

|

177,694 |

|

|

|

166,105 |

|

| Deferred income taxes |

|

|

3,306 |

|

|

|

4,216 |

|

|

|

7,740 |

|

| Prepaid expenses and other current

assets |

|

|

17,175 |

|

|

|

23,520 |

|

|

|

18,341 |

|

| Total current

assets |

|

|

697,835 |

|

|

|

679,859 |

|

|

|

729,576 |

|

|

Investment in non-marketable

equity securities |

|

|

11,211 |

|

|

|

11,211 |

|

|

|

11,211 |

|

| Equity method

investments |

|

|

3,648 |

|

|

|

3,392 |

|

|

|

102 |

|

|

Property, plant and

equipment, net |

|

|

54,461 |

|

|

|

55,700 |

|

|

|

57,271 |

|

| Deferred income

taxes |

|

|

871 |

|

|

|

1,492 |

|

|

|

477 |

|

|

Goodwill |

|

|

28,138 |

|

|

|

28,138 |

|

|

|

28,138 |

|

| Other

intangible assets, net |

|

|

4,161 |

|

|

|

3,668 |

|

|

|

4,281 |

|

| Other

assets |

|

|

2,012 |

|

|

|

2,142 |

|

|

|

1,938 |

|

|

|

|

|

104,502 |

|

|

|

105,743 |

|

|

|

103,418 |

|

| Total assets |

|

$ |

802,337 |

|

|

$ |

785,602 |

|

|

$ |

832,994 |

|

|

Liabilities, Redeemable

noncontrolling interest and

Equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

| Short-term debt |

|

$ |

180,000 |

|

|

$ |

180,000 |

|

|

$ |

130,000 |

|

| Accounts payable |

|

|

124,423 |

|

|

|

111,996 |

|

|

|

179,328 |

|

| Income taxes payable |

|

|

12,139 |

|

|

|

13,517 |

|

|

|

19,050 |

|

| Deferred income taxes |

|

|

138 |

|

|

|

34 |

|

|

|

35 |

|

| Other accrued expenses and other

current liabilities |

|

|

36,030 |

|

|

|

35,781 |

|

|

|

26,992 |

|

| Total current

liabilities |

|

|

352,730 |

|

|

|

341,328 |

|

|

|

355,405 |

|

| Other

liabilities |

|

|

4,610 |

|

|

|

4,407 |

|

|

|

5,636 |

|

| Total

liabilities |

|

|

357,340 |

|

|

|

345,735 |

|

|

|

361,041 |

|

| Redeemable

noncontrolling interest |

|

|

3,656 |

|

|

|

3,656 |

|

|

|

3,656 |

|

|

Equity |

|

|

|

|

|

|

| Himax

stockholders’ equity: |

|

|

|

|

|

|

| Ordinary shares, US$0.3

par value, 1,000,000,000 shares authorized; 356,699,482 shares

issued and 343,815,424 shares, 343,815,424 shares and 342,425,144

shares outstanding at December 31, 2015, September 30, 2015 and

December 31, 2014, respectively |

|

107,010 |

|

|

|

107,010 |

|

|

|

107,010 |

|

| Additional paid-in capital |

|

|

105,355 |

|

|

|

|

|

107,238 |

|

|

|

107,808 |

|

| Treasury shares, at cost,

12,884,058 shares, 12,884,058 shares and 14,274,338 shares at

December 31, 2015, September 30, 2015 and December 31, 2014,

respectively |

|

|

(9,157 |

) |

|

|

|

|

(9,157 |

) |

|

|

(10,144 |

) |

| Accumulated other comprehensive

loss |

|

|

(1,879 |

) |

|

|

|

|

(723 |

) |

|

|

(316 |

) |

| Unappropriated retained

earnings |

|

|

237,375 |

|

|

|

233,082 |

|

|

|

268,266 |

|

| Himax

stockholders’ equity |

|

|

438,704 |

|

|

|

437,450 |

|

|

|

472,624 |

|

| Noncontrolling

interests |

|

|

2,637 |

|

|

|

(1,239 |

) |

|

|

(4,327 |

) |

| Total

equity |

|

|

441,341 |

|

|

|

436,211 |

|

|

|

468,297 |

|

| Total

liabilities, redeemable

noncontrolling interest and

equity |

|

$ |

802,337 |

|

|

$ |

785,602 |

|

|

$ |

832,994 |

|

| Himax Technologies, Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts in

Thousands of

U.S.

Dollars) |

|

|

|

Three Months Ended

December

31, |

|

Three Months Ended

September

30, |

|

|

|

|

2015 |

|

|

|

2014 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

| Net income (loss) |

|

$ |

5,215 |

|

|

$ |

15,138 |

|

|

$ |

(2,930 |

) |

| Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

|

| Depreciation and amortization |

|

|

3,407 |

|

|

|

3,903 |

|

|

|

3,425 |

|

| Bad debt expense |

|

|

310 |

|

|

|

554 |

|

|

|

--- |

|

| Share-based compensation

expenses |

|

|

277 |

|

|

|

534 |

|

|

|

472 |

|

| Gain on disposals of property and

equipment |

|

--- |

|

|

(2 |

) |

|

|

(2 |

) |

| Losses (gains) on disposals of

marketable securities, net |

|

|

(159 |

) |

|

|

26 |

|

|

|

(32 |

) |

| Impairment loss on investment |

|

--- |

|

|

309 |

|

|

|

--- |

|

| Equity in losses (gains) of equity

method investees |

|

|

(262 |

) |

|

|

24 |

|

|

|

119 |

|

| Valuation gain on financial

liabilities |

|

--- |

|

|

(1,255 |

) |

|

|

--- |

|

| Deferred income tax expense

(benefit) |

|

|

1,665 |

|

|

|

2,710 |

|

|

|

(85 |

) |

| Inventories write downs |

|

|

2,445 |

|

|

|

2,892 |

|

|

|

2,078 |

|

| Changes in operating

assets and liabilities: |

|

|

|

|

|

|

| Accounts receivable |

|

|

(9,583 |

) |

|

|

(1,149 |

) |

|

|

14,181 |

|

| Inventories |

|

|

3,875 |

|

|

|

(11,858 |

) |

|

|

9,800 |

|

| Prepaid expenses and other current

assets |

|

|

8,977 |

|

|

|

573 |

|

|

|

(5,533 |

) |

| Accounts payable |

|

|

12,427 |

|

|

|

23,375 |

|

|

|

(13,775 |

) |

| Income taxes payable |

|

|

(749 |

) |

|

|

3,092 |

|

|

|

(425 |

) |

| Other accrued expenses and other

current liabilities |

|

|

(1,594 |

) |

|

|

(184 |

) |

|

|

6,850 |

|

| Other liabilities |

|

|

(385 |

) |

|

|

(2 |

) |

|

|

--- |

|

| Net cash

provided by operating

activities |

|

|

25,866 |

|

|

|

38,680 |

|

|

|

14,143 |

|

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

| Purchases of property, plant and

equipment |

|

|

(3,567 |

) |

|

|

(2,383 |

) |

|

|

(2,554 |

) |

| Proceeds from disposal of property

and equipment |

|

--- |

|

--- |

|

|

2 |

|

| Purchases of available-for-sale

marketable securities |

|

|

(16,498 |

) |

|

|

(6,252 |

) |

|

|

(33,328 |

) |

| Proceeds from disposals of

available-for-sale marketable securities |

|

|

17,520 |

|

|

|

6,851 |

|

|

|

16,757 |

|

| Proceeds from capital reduction of

investments |

|

--- |

|

|

1,168 |

|

|

|

--- |

|

| Proceeds from (repayments of)

refundable deposits, net |

|

|

13 |

|

|

|

|

|

(31 |

) |

|

|

(204 |

) |

| Releases (pledges) of restricted

marketable securities |

|

--- |

|

|

2,887 |

|

|

|

(131 |

) |

| Cash increase resulting from change

in consolidated entity |

|

|

341 |

|

|

--- |

|

|

--- |

|

| Net cash

provided by (used in)

investing activities |

|

|

(2,191 |

) |

|

|

|

|

2,240 |

|

|

|

(19,458 |

) |

| Himax Technologies, Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts in

Thousands of

U.S.

Dollars) |

|

|

|

Three Months Ended December

31, |

|

Three Months Ended September

30, |

|

|

|

|

2015 |

|

|

|

2014 |

|

|

|

2015 |

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

| Payments of cash dividends |

|

--- |

|

--- |

|

|

(51,364 |

) |

| Excess tax benefits from

share-based compensation |

|

--- |

|

--- |

|

|

771 |

|

| Proceeds from disposals of

subsidiary shares to noncontrolling interests by Himax Imaging,

Inc. |

|

|

4 |

|

|

|

18 |

|

|

|

8 |

|

| Purchases of subsidiary shares from

noncontrolling interests |

|

|

(145 |

) |

|

|

(46 |

) |

|

|

(305 |

) |

| Releases (pledges) of restricted

cash, cash equivalents and marketable securities (for borrowing of

short-term debt) |

|

--- |

|

|

7,500 |

|

|

|

(50,000 |

) |

| Proceeds from issuance of new

shares by subsidiaries |

|

--- |

|

--- |

|

|

1,466 |

|

| Proceeds from short-term debt |

|

|

92,303 |

|

|

|

136,000 |

|

|

|

130,000 |

|

| Repayments of short-term debt |

|

|

(92,303 |

) |

|

|

(143,500 |

) |

|

|

|

|

(80,000 |

) |

| Net cash

used in financing activities |

|

|

(141 |

) |

|

|

(28 |

) |

|

|

(49,424 |

) |

| Effect

of foreign currency exchange rate

changes on cash and cash equivalents |

|

|

(92 |

) |

|

|

(3 |

) |

|

|

(130 |

) |

| Net

increase

(decrease) in

cash and cash equivalents |

|

|

23,442 |

|

|

|

40,889 |

|

|

|

(54,869 |

) |

| Cash and cash

equivalents at beginning of period |

|

|

106,387 |

|

|

|

144,577 |

|

|

|

161,256 |

|

| Cash and cash

equivalents at end of period |

|

$ |

129,829 |

|

|

$ |

185,466 |

|

|

$ |

106,387 |

|

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

|

|

| Cash paid during the period

for: |

|

|

|

|

|

|

| Interest expense |

|

$ |

79 |

|

|

$ |

223 |

|

|

$ |

215 |

|

| Income taxes |

|

$ |

350 |

|

|

$ |

84 |

|

|

$ |

2,479 |

|

| |

|

|

|

|

|

|

| Supplemental

disclosures of investing activities affecting both

cash and non-cash items: |

|

|

|

|

|

|

| Purchases of property, plant and

equipment |

|

$ |

1,948 |

|

|

$ |

2,645 |

|

|

$ |

4,708 |

|

| Decrease (increase) in payable for

purchases of equipment and asset retirement obligations |

|

|

1,619 |

|

|

|

(262 |

) |

|

|

|

|

(2,154 |

) |

| Cash paid |

|

$ |

3,567 |

|

|

$ |

2,383 |

|

|

$ |

2,554 |

|

| Himax Technologies, Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts in

Thousands of

U.S.

Dollars) |

|

|

|

|

|

Twelve Months Ended

December

31, |

|

|

|

|

|

|

2015 |

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

| Net income |

|

|

|

$ |

21,462 |

|

|

$ |

63,903 |

|

| Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

|

| Depreciation and amortization |

|

|

|

|

14,164 |

|

|

|

14,592 |

|

| Bad debt expense |

|

|

|

|

310 |

|

|

|

554 |

|

| Share-based compensation

expenses |

|

|

|

|

1,818 |

|

|

|

1,929 |

|

| Gain on disposals of property and

equipment |

|

|

|

|

(2 |

) |

|

|

(2 |

) |

| Gain on disposal of investment

securities, net |

|

|

|

|

(1,770 |

) |

|

|

(10,502 |

) |

| Losses (gains) on disposal of

marketable securities, net |

|

|

|

|

(223 |

) |

|

|

31 |

|

| Impairment loss on investment |

|

|

|

--- |

|

|

309 |

|

| Equity in losses of equity method

investees |

|

|

|

|

77 |

|

|

|

80 |

|

| Valuation gain on financial

liabilities |

|

|

|

--- |

|

|

(1,255 |

) |

| Deferred income tax expense |

|

|

|

|

4,148 |

|

|

|

3,816 |

|

| Inventories write downs |

|

|

|

|

9,785 |

|

|

|

8,198 |

|

| Changes in operating

assets and liabilities: |

|

|

|

|

|

|

| Accounts receivable |

|

|

|

|

41,656 |

|

|

|

(19,211 |

) |

| Inventories |

|

|

|

|

(15,054 |

) |

|

|

3,096 |

|

| Prepaid expenses and other current

assets |

|

|

|

|

2,067 |

|

|

|

1,053 |

|

| Accounts payable |

|

|

|

|

(54,905 |

) |

|

|

28,038 |

|

| Income taxes payable |

|

|

|

|

(6,475 |

) |

|

|

2,357 |

|

| Other accrued expenses and other

current liabilities |

|

|

|

|

5,987 |

|

|

|

(3,262 |

) |

| Other liabilities |

|

|

|

|

(516 |

) |

|

|

(5 |

) |

| Net cash

provided by operating

activities |

|

|

|

|

22,529 |

|

|

|