UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

January 29, 2016

CV SCIENCES,

INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation) |

333-173215

(Commission File Number) |

80-0944970

(I.R.S. Employer Identification No.) |

2688 South Rainbow Boulevard, Suite B

Las Vegas, Nevada 89146

(Address of principal executive offices,

Zip Code)

(866) 290-2157

(Registrant’s telephone number, including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

[_] Written communications pursuant to

Rule 425 under the Securities Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a-12)

[_] Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry

into a Material Definitive Agreement

The information provided below in “Item

2.03 – Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of Registrant”

and “Item 3.02 – Unregistered Sales of Equity Securities” of this Current Report on Form 8-K is incorporated

by reference into this Item 1.01.

Item 2.03 Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of Registrant

On January 29, 2016, CV Sciences, Inc.

(the “Company”) issued a Promissory Note (the “Note”) to Wiltshire, LLC (the “Lender”) in the

principal amount of Eight Hundred Fifty Thousand Dollars ($850,000) in consideration of a loan provided to the Company by the Lender.

Under the terms of the Note, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K, the Lender delivered to

the Company Five Hundred Thousand Dollars ($500,000) on January 29, 2016, and shall deliver the sum of Three Hundred Five Thousand

Dollars ($305,000) no later than February 2, 2015, for an aggregate amount of Eight Hundred Five Thousand Dollars ($805,000) (the

“Purchase Price”). The principal amount of the Note reflects the Purchase Price, plus $15,000 in legal fees paid to

the Lender, plus an “Original Issue Discount” of $30,000.

The Note bears interest at twelve percent

(12%) per annum, calculated and payable monthly, not in advance. The Company is obligated to make monthly interest-only payments

in the amount of Eight Thousand Five Hundred Dollars ($8,500), due on the first (1st) day of each month commencing March

1, 2016. All principal and accrued and unpaid interest is due under the Note on February 1, 2018. The Company has the right to

prepay the Note without penalty or premium, provided that if a prepayment of principal is made before July 1, 2016, the Lender

is entitled to a prepayment interest guarantee equal to six (6) months’ interest payments on the Note. If the Company does

not pay the full amount of each monthly payment within thirty (30) days of the date it is due, the Company would be in default

under the Note and, at such time, the Lender may in its discretion accelerate the Note and demand repayment of all principal and

interest outstanding.

Item 3.02 Unregistered

Sales of Equity Securities

The information provided above in “Item

2.03 – Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of Registrant”

of this Current Report on Form 8-K is incorporated by reference into this Item 3.02.

Pursuant to the terms of the Note, and

in consideration for the loan evidenced by the Note, the Company on January 29, 2016 issued to the Lender a common stock purchase

warrant providing the Lender with the right to purchase up to 2,000,000 shares of the Company’s common stock (the “Warrant”).

The Warrant is exercisable, subject to certain limitations described below, subsequent to July 1, 2017 and before the date that

is five (5) years from the date of issuance at an exercise price of $0.20 per share, subject to adjustment upon the occurrence

of certain events such as stock splits and dividends. At no time may the Lender exercise the Warrant for the greater of (A) one

percent (1%) of the outstanding common stock of the Company, and (B) the average weekly trading volume, excluding any public offerings

of the Company, during four (4) calendar weeks prior to the exercise of the Warrant. A copy of the Warrant is filed as Exhibit

2.2 to this Current Report on Form 8-K.

The issuance of the Warrant is exempt from

registration under the Securities Act of 1933, as amended (the “Act”), in reliance on exemptions from the registration

requirements of the Act in transactions not involved in a public offering pursuant to Rule 506(b) of Regulation D, as promulgated

by the Securities and Exchange Commission under the Act.

Item 7.01 Regulation

FD Disclosure

On February 2, 2016, the Company issued

a press release (the “Press Release”) announcing that the Company prepaid obligations under certain Convertible Promissory

Notes originally issued by the Company to Redwood Management, LLC. A copy of the Press Release is attached hereto as Exhibit 99.1

and incorporated herein by reference.

The information set forth under this Item

7.01, including Exhibit 99.1, is being furnished and, as a result, such information shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of such Section, nor shall such information be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and

Exhibits.

| 2.1 | Promissory Note, dated January 29, 2016 |

| 2.2 | Common Stock Purchase Warrant, dated January 29, 2016 |

| 99.1 | Press Release of CV Sciences, Inc., dated February 2, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date: February 2, 2016

CANNAVEST CORP.

By: /s/ Michael Mona, Jr.

Michael Mona, Jr.

President and

CEO

Exhibit 2.1

PROMISSORY NOTE

| $850,000 |

|

|

January 29, 2016 |

| |

|

|

San Diego, CA |

| |

|

|

|

FOR VALUE RECEIVED,

CV SCIENCES, INC., a Delaware limited liability company (“Borrower”), promises to pay to WILTSHIRE, LLC, whose

address is 4690 West Evans Avenue, Denver, Colorado 80219 (“Lender”), or its registered assigns, in lawful money

of the United States of America, the principal sum of Eight Hundred Fifty Thousand Dollars ($850,000) (the “Amount”),

or such lesser amount as shall equal the outstanding principal amount hereof, together with interest from the date of this Note

on the unpaid principal balance at a rate equal to twelve percent (12%) per annum, calculated and payable monthly, not in advance.

The purchase price

for this Promissory Note (this “Note”) is $805,000 (the “Purchase Price”). The Amount shall

be funded by the delivery to Borrower of Five Hundred Thousand Dollars ($500,000) on or before January 29, 2016, with the remaining

Three Hundred Five Thousand Dollars ($305,000) funded by Lender no later than February 2, 2016. The Amount is comprised of the

Purchase Price, Fifteen Thousand Dollars ($15,000) to cover Lender’s legal expenses incurred, and an original issue discount

(“OID”) of $30,000.

The following is a

statement of the rights of Lender and the conditions to which this Note is subject, and to which Lender, by the acceptance of this

Note, agrees:

1.

Repayment. Interest due shall accrue as of the date of closing with monthly interest-only payments in the amount

of Eight Thousand Five Hundred Dollars ($8,500) due each month on the 1st day of each month commencing March 1, 2016

with interest-only payments based on a 360 day year and a 30 day month. Payments must be received by the 10th of the

month of each month or a late fee of $850 will be assessed.

2.

Maturity; Prepayment. The entire principal sum and all interest accrued thereon shall be due on February 1, 2018.

This Note may be prepaid at any time; however, if a prepayment of principal is made before July 1, 2016, Lender requires a prepayment

interest guarantee equal to six (6) months’ interest payments on this Note.

3.

Warrants. In consideration for the loan provided for in this Note, Borrower shall issue to Lender a common stock

purchase warrant for 2,000,000 shares of Borrower’s common stock, with a five-year exercise period and an exercise price

equal to $0.20 per share.

4.

Events of Default. If Borrower does not pay the full amount of each monthly payment within 30 days of the date it

is due, Borrower will be in default. If any payment due under this Note is not paid prior to its default date, as defined in this

section, the entire outstanding principal balance, and all accrued interest thereon, shall at once become due and payable at the

option of Lender. Lender may exercise this option to accelerate during any default by Borrower regardless of any prior forbearance

by Lender. In the event of any breach or other default, Lender reserves the right to increase the interest rate by five percent

(5%) above the interest rate in effect at the time of breach or default; however, if Lender does not elect to increase the interest

rate subsequent to a breach or default, this Note shall continue to bear interest at the rate set forth herein. All sums extended

to Borrower, or to others on behalf of Borrower, by Lender shall earn interest at the Note rate in effect, and as determined, under

the terms of the Note. Should any interest not be paid when due, it shall bear like interest as the principal.

5.

Assignment. The rights and obligations of Borrower and Lender shall be binding upon and benefit the successors, assigns,

heirs, administrators and transferees of the parties. All payments required to be made hereunder shall be made by Borrower without

any rights of setoff or counterclaim.

6.

Amendment. This Note may be amended or modified only upon the written consent of Borrower and Lender. Any amendment

effected in accordance with this Section 6 shall be binding upon Lender and Borrower and each of their respective successors

and assigns.

7.

Failure or Indulgence Not Waiver. No failure or delay on the part of Lender in the exercise of any power, right or

privilege hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any such power, right or privilege

preclude other or further exercise thereof or of any other right, power or privilege. All rights and remedies existing hereunder

are cumulative to, and not exclusive of, any rights or remedies otherwise available.

8.

Severability. In the event that any provision of this Note is invalid or unenforceable under any applicable statute

or rule of law, then such provision shall be deemed inoperative to the extent that it may conflict herewith and shall be deemed

modified to conform with such statute or rule of law. Any such provision which may prove invalid or unenforceable under any law

shall not affect the validity or enforceability of any other provision of this Note.

9.

Governing Law. This Note and all actions arising out of or in connection with this Note shall be governed by and

construed in accordance with the laws of the State of California, without regard to the conflicts of law provisions of the State

of California or of any other state.

Borrower has caused this Note to be issued as of the date first

written above.

CV SCIENCES, INC.,

a Delaware limited liability

company

By: /s/ Michael Mona,

Jr.

Name: Michael Mona, Jr.

Its:

President and CEO

Exhibit 2.2

NEITHER THIS WARRANT

NOR THE SHARES OF COMMON STOCK ISSUABLE UPON ITS EXERCISE HAS BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE

“ACT”), OR ANY APPLICABLE STATE SECURITIES LAWS, AND MAY NOT BE OFFERED, SOLD OR TRANSFERRED OR OTHERWISE DISPOSED

OF UNLESS (I) PURSUANT TO REGISTRATION UNDER THE ACT OR (II) IN COMPLIANCE WITH AN EXEMPTION THEREFROM AND ACCOMPANIED, IF

REQUESTED BY THE COMPANY, WITH AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY TO THE EFFECT THAT SUCH TRANSFER IS

BEING MADE IN COMPLIANCE WITH AN EXEMPTION THEREFROM (UNLESS SUCH TRANSFER IS TO AN AFFILIATE OF THE HOLDER).

CV SCIENCES, INC.

WARRANT TO PURCHASE

COMMON STOCK

FOR

VALUE RECEIVED, CV Sciences, Inc., a Delaware corporation (the “Company”), hereby grants to Wiltshire, LLC (“Holder”),

the right to purchase 2,000,000 shares of the Company’s Common Stock (“Shares”). The exercise price

per Share (the “Purchase Price”) of the warrants granted hereby shall equal $0.20 per Share. The Purchase Price

and the number of Shares purchasable hereunder are subject to adjustment as provided in Section 3 of this Warrant. This Warrant

may be exercised at any time and from time to time (the “Exercise Period”) subsequent to July 1, 2017 but prior

to the five (5) year anniversary of the date hereof (the “Expiration Date”). This Warrant shall expire and be

of no further force or effect at the earlier of the time when it has been exercised or 5:00 p.m., New York time, on the Expiration

Date.

1. Exercise

of Warrant.

a. This

Warrant may be exercised at any time and from time to time by the Holder during the Exercise Period, subject to the following limitations:

during any ninety (90) day period, the Holder may only exercise this Warrant for the greater of the following:

i. One

percent (1%) of the outstanding common stock of the Company; and

ii. The

average weekly trading volume, excluding any public offerings of the Company, during four (4) calendar weeks prior to the exercise

of this Warrant, as reported (A) on national securities exchanges or an automated quotation system of a registered securities association,

or (B) under an effective transaction reporting plan/national market system plan.

b. The

Holder shall exercise this Warrant by surrendering this Warrant, together with a Notice of Exercise in the form appearing at the

end hereof properly completed and duly executed by the Holder or on behalf of the Holder by the Holder’s duly authorized

representative, to the Company at its principal executive office (or at the office of the agency maintained for such purpose).

The Warrants may be exercised at any time prior to expiration by providing ten (10) day notice to the Company.

c. In

the event of an exercise of this Warrant, certificates for the Shares purchased pursuant to such exercise shall be delivered to

the Holder within ten (10) days of receipt of such notice and, unless this Warrant has been fully exercised or has expired,

a new Warrant representing the portion of the Shares, if any, with respect to which this Warrant shall not then have been exercised

shall also be issued to the Holder within such ten day period. Upon receipt by the Company of this Warrant and such Notice of Exercise,

together with the applicable aggregate Purchase Price, the Holder shall be deemed to be the holder of record of the Shares purchased

pursuant to such exercise, notwithstanding that certificates representing such Shares shall not then be actually delivered to the

Holder or that such Shares are not then set forth on the stock transfer book of the Company.

2. Net

Exercise. In lieu of cash exercising this Warrant, the Holder may elect to receive shares equal to the value of this Warrant

(or the portion thereof being canceled) by surrender of this Warrant to the Company together with notice of such election, in which

event the Company shall issue to the Holder hereof a number of Shares computed using the following formula:

Where:

X -- The number of Shares to be issued to the

Holder.

Y -- The number of Shares purchasable under

this Warrant.

A -- The fair market value of one Share.

B -- The Purchase Price (as adjusted to the

date of such calculations).

For purposes of this Section

2, the fair market value of a Share shall mean the average of the closing bid and asked prices of Shares quoted in the over-the-counter

market in which the Shares are traded or the closing price quoted on any exchange on which the Shares are listed, whichever is

applicable, as published in the Western Edition of The Wall Street Journal for the ten (10) trading days prior to the date of determination

of fair market value (or such shorter period of time during which such stock was traded over-the-counter or on such exchange).

If the Shares are not traded on the over-the-counter market or on an exchange, the fair market value shall be the price per Share

that the Company could obtain from a willing buyer for Shares sold by the Company from authorized but unissued Shares, as such

prices shall be determined in good faith by the Company’s Board of Directors.

3. Adjustments.

a. Stock

Dividends - Split Ups. If, after the date hereof, the number of outstanding shares of Common Stock is increased

by a stock dividend payable in shares of Common Stock, or by a split up of shares of Common Stock, or other similar event, then,

on the effective date of such stock dividend, split up or similar event, the number of shares of Common Stock issuable on exercise

of each Warrant shall be increased in proportion to such increase in outstanding shares of Common Stock. No fractional shares will

be issued.

b. Aggregation

of Shares. If after the date hereof, the number of outstanding shares of Common Stock is decreased by a consolidation,

combination, reverse stock split or reclassification of shares of Common Stock or other similar event, then, on the effective date

of such consolidation, combination, reverse stock split, reclassification or similar event, the number of shares of Common Stock

issuable on exercise of each Warrant shall be decreased in proportion to such decrease in outstanding shares of Common Stock. No

fractional shares shall be issued.

c. Adjustments

in Exercise Price. Whenever the number of shares of Common Stock purchasable upon the exercise of the Warrants is

adjusted as described above, the Purchase Price shall be adjusted (to the nearest cent) by multiplying such Purchase Price immediately

prior to such adjustment by a fraction (x) the numerator of which shall be the number of shares of Common Stock purchasable upon

the exercise of the Warrants immediately prior to such adjustment, and (y) the denominator of which shall be the number of shares

of Common Stock so purchasable immediately thereafter.

d. Replacement

of Securities upon Reorganization, etc. In case of any reclassification or reorganization of the outstanding shares

of Common Stock (other than a change covered by adjustments described above or that solely affects the par value of such shares

of Common Stock), or in the case of any merger or consolidation of the Company with or into another corporation (other than a consolidation

or merger in which the Company is the continuing corporation and that does not result in any reclassification or reorganization

of the outstanding shares of Common Stock), or in the case of any sale or conveyance to another corporation or entity of the assets

or other property of the Company as an entirety or substantially as an entirety in connection with which the Company is dissolved,

the Holder shall thereafter have the right to purchase and receive, upon the basis and upon the terms and conditions specified

in the Warrants and in lieu of the shares of Common Stock of the Company immediately theretofore purchasable and receivable upon

the exercise of the rights represented thereby, the kind and amount of shares of stock or other securities or property (including

cash) receivable upon such reclassification, reorganization, merger or consolidation, or upon a dissolution following any such

sale or transfer, that the Holder would have received if such Holder had exercised his, her or its Warrant(s) immediately prior

to such event; and if any reclassification also results in a change in shares of Common Stock covered by stock dividends, stock

splits or an aggregation of shares, then such adjustment shall be made as described above. The provisions relating to

the adjustments in exercise price shall similarly apply to successive reclassifications, reorganizations, mergers or consolidations,

sales or other transfers.

e. Notices

of Changes in Warrant. Upon every adjustment of the Purchase Price or the number of shares issuable upon exercise

of a Warrant, the Company shall give written notice thereof to the Holder, which notice shall state the Purchase Price resulting

from such adjustment and the increase or decrease, if any, in the number of shares purchasable at such price upon the exercise

of a Warrant, setting forth in reasonable detail the method of calculation and the facts upon which such calculation is based. Upon

the occurrence of any event specified above, then, in any such event, the Company shall give written notice to each Holder, at

the last address set forth for such holder in the warrant register, of the record date or the effective date of the event. Failure

to give such notice, or any defect therein, shall not affect the legality or validity of such event.

4. Covenants.

a. No

Impairment. The Company will not, by amendment of its charter as in effect on the date hereof or through any reorganization,

recapitalization, transfer of all or a substantial portion of its assets, consolidation, merger, dissolution, issue or sale of

securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed

or performed under this Warrant by the Company, but will at all times in good faith assist in carrying out all the provisions of

this Warrant and in taking all such action as may be necessary or appropriate in order to protect the rights of the Holder of the

Warrant against impairment. Without limiting the generality of the foregoing, the Company will (a) not increase the par value

of any shares of Common Stock obtainable upon the exercise of this Warrant and (b) take all such actions as may be necessary

or appropriate in order that the Company may validly and legally issue fully paid and non-assessable shares of Common Stock upon

the exercise of this Warrant.

b. Reservation

of Shares. So long as the Warrant shall remain outstanding, the Company shall at all times reserve and keep available, free

from preemptive rights, out of its authorized capital stock, for the purpose of issuance upon exercise of the Warrant, the full

number of shares of Common Stock then issuable upon exercise of the Warrant. If the Common Stock shall be listed on any national

stock exchange, the Company at its expense shall include in its listing application all of the shares of Common Stock issuable

upon exercise of the Warrant at any time, including as a result of adjustments in the outstanding Common Stock or otherwise.

c.

Validity of Shares. All shares of Common Stock issuable upon exercise of this Warrant will be duly and validly issued,

fully paid and non-assessable and will be free of restrictions on transfer, other than restrictions on transfer under applicable

state and federal securities laws, and will be free from all taxes, liens and charges in respect of the issue thereof (other than

taxes in respect of any transfer occurring contemporaneously or otherwise specified herein). The Company shall take all such actions

as may be necessary to ensure that all such shares of Common Stock may be so issued without violation of any applicable law or

governmental regulation or any requirements of any domestic stock exchange upon which shares of Common Stock may be listed (except

for official notice of issuance which shall be immediately delivered by the Company upon each such issuance).

d. Notice

of Certain Events. If at any time, (1) the Company shall declare any dividend or distribution payable to the holders of

its Common Stock, (2) the Company shall offer for subscription pro rata to the holders of Common Stock any additional shares

of capital stock of any class or any other rights, (3) there shall be any recapitalization of the Company or consolidation

or merger of the Company with, or sale of all or substantially all of its assets to, another corporation or business organization,

or, if sooner, promptly following any agreement to do any of the foregoing, or (4) there shall be a voluntary or involuntary

dissolution, liquidation or winding up of the Company, then, in any one or more of such cases, the Company shall give the registered

Holder of this Warrant ten days’ prior written notice (or such other time period set forth in the Company’s Articles

of Incorporation).

5. Legend.

Each certificate for Shares issued upon the exercise of the Warrant, each certificate issued upon the direct or indirect transfer

of any Shares and each Warrant issued upon direct or indirect transfer or in substitution for any Warrant shall be stamped or otherwise

imprinted with legends in substantially the form set forth on the face of this Warrant.

6. Ownership

of Warrants. The Company may treat the person in whose name any Warrant is registered on the register kept at the principal

executive office of the Company (or at the office of the agency maintained for such purpose) as the owner and holder thereof for

all purposes, notwithstanding any notice to the contrary. Subject to the preceding sentence, a Warrant, if properly assigned, may

be exercised by a new holder without a new warrant first having been issued.

7. Replacement

of Warrants. Upon receipt of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation

of any Warrant and, in the case of any such mutilation, upon surrender of such Warrant for cancellation at the principal executive

office of the Company (or at the office of the agency maintained for such purpose), the Company at its expense will execute and

deliver, in lieu thereof, a new Warrant of like tenor and dated the date hereof.

8. Remedies.

In the event of a breach by the Company of any of its obligations under this Warrant, the Holder, in addition to being entitled

to exercise all rights granted by law, including recovery of damages, will be entitled to specific performance of its rights under

this Warrant. The Company agrees that monetary damages would not provide adequate compensation for any losses incurred by reason

of its breach of any of the provisions of this Warrant.

9. No

Liabilities or Rights as a Stockholder. Nothing contained in this Warrant shall be construed as imposing any liabilities

on the Holder as a stockholder of the Company, whether such liabilities are asserted by the Company or by creditors of the Company.

Until the exercise of this Warrant, the Holder shall not have nor exercise any rights by virtue hereof as a stockholder of the

Company. Notwithstanding the foregoing, in the event (a) the Company effects a split of the Common Stock by means of a stock

dividend and the Purchase Price of and the number of Shares are adjusted as of the date of the distribution of the dividend (rather

than as of the record date for such dividend), and (b) the Holder exercises this Warrant between the record date and the distribution

date for such stock dividend, the Holder shall be entitled to receive, on the distribution date, the stock dividend with respect

to the shares of Common Stock acquired upon such exercise, notwithstanding the fact that such shares were not outstanding as of

the close of business on the record date for such stock dividend.

10. Permits

and Taxes. The Company shall, at its own expense, apply for and obtain any and all permits, approvals, authorizations,

licenses and orders that may be necessary for the Company lawfully to issue the Shares on exercise of this Warrant. On exercise

of this Warrant, the Company shall pay any and all issuance taxes that may be payable in respect of any issuance or delivery of

the Shares. The Company shall not, however, be required to pay, and Holder shall pay, any tax that may be payable in respect of

any transfer involved in the issuance and delivery of the Shares in a name other than that of Holder, and no such issuance and

delivery shall be made unless and until the person requesting such issuance shall have paid to the Company the amount of any such

tax or shall have established to the Company’s reasonable satisfaction that such tax has been paid.

12. Acquisition

for Own Account. The Holder is acquiring this Warrant with its own funds, for its own account, not as a nominee or agent.

The Holder is purchasing or will purchase this Warrant for investment for an indefinite period and not with a view to any sale

or distribution thereof, by public or private sale or other disposition.

13. Section

Headings. The section headings in this Warrant are for convenience of reference only and shall not constitute a part hereof.

14. Amendments

or Waivers. This Warrant and any term hereof may be changed, waived, discharged or terminated only by an instrument in

writing signed by the party against which enforcement of such change, waiver, discharge or termination is sought.

15. Counterparts.

This Warrant may be executed in two or more counterparts, each of which will be deemed an original but all of which together will

constitute one and the same instrument.

16. Severability.

The provisions of this Warrant will be deemed severable and the invalidity or unenforceability of any provision hereof will not

affect the validity or enforceability of the other provisions hereof; provided that if any provision of this Warrant, as applied

to any party or to any circumstance, is adjudged by a court or other governmental body not to be enforceable in accordance with

its terms, the parties agree that the court or governmental body making such determination will have the power to modify the provision

in a manner consistent with its objectives such that it is enforceable, and/or to delete specific words or phrases, and in its

reduced form, such provision will then be enforceable and will be enforced.

17. Successors

and Assigns. This Warrant shall be binding upon and inure to the benefit of the Holder and its assigns, and shall be binding

upon any entity succeeding to the Company by consolidation, merger or acquisition of all or substantially all of the Company’s

assets. The Company may not assign this Warrant or any rights or obligations hereunder without the prior written consent of the

Holder. Holder may assign this Warrant without the Company’s prior written consent.

18. Transfer.

Subject to the restrictions on transfer set forth on the face of this Warrant, this Warrant and all rights hereunder may be transferred,

in whole or in part, upon surrender of this Warrant with a properly executed assignment at the principal executive office of the

Company.

19. Governing

Law. This Warrant and the performance of the transactions and obligations of the parties hereunder shall be construed and

enforced in accordance with and governed by the laws, other than the conflict of laws rules, of the State of Delaware.

| |

|

|

|

|

|

|

| Dated: January 29, 2016 |

|

|

|

CV SCIENCES, INC. |

| |

|

|

|

| |

|

|

|

By: |

|

/s/ Michael Mona, Jr. |

| |

|

|

|

Name: |

|

Michael Mona, Jr. |

| |

|

|

|

Title: |

|

President and CEO |

| |

|

|

|

Agreed and Accepted:

WILTSHIRE, LLC |

| |

|

| By: |

|

/s/ Nicholas Filardo |

| Name: |

|

Nicholas Filardo |

| Title: |

|

Managing Partner |

Address: 4690 West Evans Avenue

Denver, Colorado 80219

NOTICE OF EXERCISE

(To be completed and

signed only on

an exercise of the

Warrant.)

TO: CV Sciences, Inc.

RE: [Specify Holder’s Warrant] (the

“Warrant”)

| 1. | | The undersigned hereby elects to purchase _________ shares of ____________ pursuant

to the terms of the attached Warrant. |

| 2. | | Method of Exercise (Please initial the applicable blank): |

| ___ | | The undersigned elects to exercise the attached Warrant by means of a cash payment,

and tenders herewith payment in full for the purchase price of the shares being purchased, together with all applicable transfer

taxes, if any. |

| ___ | | The undersigned elects to exercise the attached Warrant by means of the net exercise

provisions of Section 2 of the Warrant. |

| 3. | | The undersigned hereby requests that the certificates for the Shares issuable upon

this exercise of the Warrant be issued in the name(s) and delivered to the address(es) as follows: |

Dated:

| |

| |

| |

| Signature of Holder |

| |

| |

|

Print Name of Holder

(name must conform in all respects to name of Holder as specified

in the face of the Warrant)

|

Exhibit 99.1

CV

Sciences, Inc. Prepays Investors and Avoids Dilution

LAS VEGAS,

NV, February 2, 2016 /PRNewswire/ -- CV Sciences, Inc. (OTCBB: CANV) today

announced it has prepaid investors holding a series of its Convertible Promissory Notes in advance of conversion, thereby avoiding

dilution to its stockholders. Under the terms of certain Convertible Promissory Notes issued by CV Sciences to its investors, the

company could, on 10 days’ advance notice, prepay the debt obligations together with a 30% premium. The company prepaid a

total of $535,081 in principal and interest under the notes, and $160,524 in prepayment premium.

“By

prepaying this debt, not only have we retired outstanding convertible debt obligations, but we have avoided having this debt converted

at steeply discounted prices,” stated Michael Mona, Jr., President and CEO of CV Sciences, Inc. “This prepayment benefits

our shareholders by limiting further downward pressure on our stock created by the discounted conversions in a market for our stock

already impacted by short positions in advance of conversions,” continued Mr. Mona.

By prepaying

this debt, the company avoided issuing up to 9,000,000 shares of its common stock on conversion of the debt. After the prepayment

of this debt, CV Sciences continues to have obligations to its investors on its fourth, and final tranche of Convertible Promissory

Notes in the amount of $255,000, as of February 2, 2016. The company issued this debt on September 16, 2015. The company is engaged

in efforts to secure further bridge financing to prepay the fourth, and final tranche of Convertible Promissory Notes.

The company

secured funds to effectuate the prepayments by an unsecured, non-convertible promissory note issued to Wiltshire, LLC in the principal

amount of $850,000. As more specifically set forth in the Current Report on Form 8-K filed by CV Sciences, Inc. on February 2,

2016, the promissory note bears interest at 12% per annum. The note matures in 24 months and provides for installment payments

of $8,500 per month.

About CannaVest Corp.

CannaVest

Corp. (OTCBB:CANV), located in Las Vegas, Nevada, focuses on drug development activities

on products containing the hemp plant extract cannabidiol (CBD) as the active pharmaceutical ingredient, and also is engaged in

the sale of CBD, and the development, marketing and sale of end consumer products containing CBD, which is refined into its own

PlusCBD Oil™ brand. Additional information is available from OTCMarkets.com or by visiting http://www.CannaVest.com.

FORWARD-LOOKING DISCLAIMER

This

press release may contain certain forward-looking statements and information, as defined within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and is subject to the Safe

Harbor created by those sections. This material contains statements about expected future events and/or financial results that

are forward-looking in nature and subject to risks and uncertainties. Such forward-looking statements by definition involve risks,

uncertainties and other factors, which may cause the actual results, performance or achievements of CannaVest Corp. to be materially

different from the statements made herein.

LEGAL DISCLOSURE

CannaVest

Corp. does not sell or distribute any products that are in violation of the United States Controlled Substances Act (US.CSA). The

company does grow, sell and distribute hemp-based products and are involved with the federally legal distribution of medical marijuana-based

products within certain international markets.

Corporate Contact:

CannaVest Corp.

2688 S. Rainbow Blvd., Ste.

B

Las Vegas, NV 89146

Office: 866-290-2157

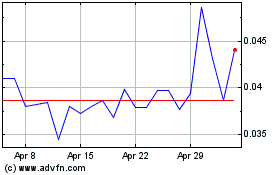

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Apr 2023 to Apr 2024