Fannie Mae and Freddie Mac Agree to Terms on Resolving Mortgage Disputes

February 02 2016 - 4:50PM

Dow Jones News

Fannie Mae and Freddie Mac on Tuesday said they have come to

terms with lenders on how to resolve mortgage disputes, capping an

effort that regulators hope will make loans cheaper and easier to

get for risky borrowers.

The announcement marks the end of a four-year push by Fannie,

Freddie and their regulator, the Federal Housing Finance Agency, to

ease mortgage companies' fears of being slapped with penalties for

faulty loans, in a bid to encourage them to pick up lending to more

risky borrowers.

FHFA Director Mel Watt in a statement said the changes "will

increase clarity for lenders and will ultimately increase access to

mortgages for creditworthy borrowers."

Under the new rules announced Tuesday, lenders will have the

ability to appeal a mortgage-related penalty to an independent

arbiter, a step meant to speed up the resolution of disagreements

between regulators and lenders.

Fannie and Freddie don't make mortgages. They buy them from

lenders, wrap the loans into securities and provide guarantees to

make investors whole if the loans default.

When Fannie and Freddie determine a lender has made mistakes on

a mortgage or that it doesn't meet their requirements, the

companies have sometimes forced lenders to buy the loans back.

As billions in loans defaulted during the financial crisis,

Fannie and Freddie said many of the mortgages didn't meet their

requirements. That, combined with major lawsuits and federal

settlements, prompted some lenders to pull back from making some

mortgages to borrowers eligible for federal backing but who are

more prone to default.

Even with the changes to the dispute process, however, some

mortgage experts doubt that borrowers will see greatly expanded

mortgage access. Fannie and Freddie will back loans to borrowers

with a credit score of as low as 620, on a scale of 300 to 850.

Before the changes were implemented, some large banks hit with

the hardest penalties set higher credit score cutoffs or other

requirements that excluded riskier borrowers. Rather than limit

mortgage access, that instead shifted more business to smaller

nonbank lenders that didn't experience severe penalties after the

mortgage crisis, said Mark Calabria, director of financial

regulation studies for the Cato Institute, a libertarian think

tank.

Although it remains difficult for less-creditworthy borrowers to

get a mortgage, without the FHFA's effort, lenders might have

pulled back from the mortgage market even further, said Michael

Calhoun, president of the Center for Responsible Lending, which

advocates for broader loan access. Fannie and Freddie "need to do a

lot more, but it does remove what was a huge impediment and stops

further contraction," Mr. Calhoun said.

Some lenders have said that Fannie's and Freddie's changes have

led them to feel more comfortable lending to riskier borrowers.

Bill Emerson, CEO of Quicken Loans Inc., said the nonbank lender

now will make any loan that Fannie and Freddie will accept. Mr.

Emerson said Quicken never had severe restrictions on mortgages

backed by the companies but that could have changed without the

FHFA's moves of the last couple of years.

Franklin Codel, head of home lending for Wells Fargo & Co.,

said in an email that the change "brings greater certainty and

strengthens the home lending system."

The process of allaying lenders' concerns on penalties and

broadening mortgage access began in 2012 but has ramped up since

Mr. Watt took the helm of the FHFA in 2014.

In 2013, the agency said lenders wouldn't face buybacks as long

as the borrower didn't miss a payment for three years except in

cases of fraud, and later said that borrowers could miss up to two,

nonconsecutive payments.

In 2014, the agency reached an agreement with lenders on what

would constitute fraud. Last year, the FHFA defined the severity

and associated costs for various mistakes, opening the possibility

for lenders to receive a less onerous penalty for smaller

problems.

Now, under Tuesday's agreement, Fannie, Freddie and lenders will

go to an independent arbiter in cases where they still disagree on

whether a mortgage had a mistake. That takes some power away from

Fannie and Freddie, which previously were the final deciders unless

a lender tried to take the companies to court.

Write to Joe Light at joe.light@wsj.com

(END) Dow Jones Newswires

February 02, 2016 16:35 ET (21:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

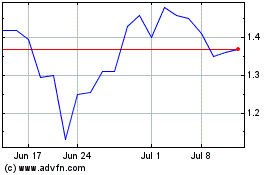

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

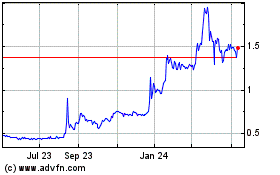

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Apr 2023 to Apr 2024