UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

o Registration Statement Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934

OR

x Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended: September 30, 2015

OR

o Transition Report Pursuant to Section 13 or 15(d) of the Securities and Exchange Act of 1934

OR

o Shell Company Report Pursuant to Section 13 or 15(d) of the Securities and Exchange Act of 1934

Date of event requiring this shell company report

For the transition period from __________to __________

Commission File Number: 000-30813

UMeWorld, Limited |

(Exact name of Registrant as specified in its charter) |

N/A

(Translation of Registrant's name into English)

British Virgin Islands |

(Jurisdiction of incorporation or organization) |

31/F, Tower One, Times Square, 1 Matheson Street, Causeway Bay, Hong Kong, China |

(Address of principal executive offices) |

|

Michael Lee, (86) 020-8923 7947, info@umeworld.com |

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of Each Class | | Name of Exchange on Which Registered |

Common Stock ($0.0001 par value) | | None |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

| SEC 1852 (01-12) | Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

Securities registered or to be registered pursuant to Section 15(d) of the Act.

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

As of September 30, 2015 there were 89,036,000 shares outstanding of the issuer's Common Stock.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

If the report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Security Exchange Act of 1934. YES ¨ NO x

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Security Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Security Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definitions of "accelerated filer" and "large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one).

Large accelerated filer | ¨ | Accelerated filer | ¨ | Non-accelerated filer | x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ | International Financial Reporting Standards as issued ¨ | Other ¨ |

| by the International Accounting Standards Board | |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 o Item 18 x

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes o No o

FORM 20-F

For the Year Ended September 30, 2015

INDEX

PRELIMINARY NOTES

PART I | | | | |

| | | | | |

Item 1. | Identity of Directors, Senior Management and Advisers | | | 6 | |

Item 2. | Offer Statistics and Expected Timetable | | | 6 | |

Item 3. | Key Information | | | 6 | |

| | Selected Financial Data | | | 6 | |

| | Currency Exchange Rate | | | 6 | |

| | Capitalization and Indebtedness | | | 6 | |

| | Risk Factors | | 6 | |

Item 4. | Information of the Company | | | 10 | |

| | History and Development of the Company | | | 10 | |

| | Business Overview | | 10 | |

| | Organization Structure | | 11 | |

| | Property, Plants and Equipment | | | 12 | |

| | Unresolved Staff Comments | | | 12 | |

Item 5. | Operating and Financial Review and Prospects | | 13 | |

Item 6. | Directors, Senior Management and Employees | | 15 | |

Item 7. | Major Shareholders and Related Party Transactions | | | 19 | |

Item 8. | Financial Information | | 20 | |

Item 9. | The Offer and Listings | | 20 | |

Item 10. | Additional Information | | | 21 | |

| | Share Capital | | | 21 | |

| | Memorandum and Articles of Association | | | 22 | |

| | Material Contracts | | | 22 | |

| | Exchange Controls | | | 22 | |

| | Taxation | | | 23 | |

| | Dividend and Paying Agents | | | 24 | |

| | Statement by Experts | | | 24 | |

| | Documents on Display | | | 24 | |

Item 11. | Quantitative and Qualitative Disclosure About Market Risk | | | 25 | |

| | Foreign Currency Exchange Rate Sensitivity | | | 25 | |

| | Interest Rate Sensitivity | | | 25 | |

Item 12. | Description of Securities Other Than Equity Securities | | | 25 | |

PART II | | | | |

| | | | | |

Item 13. | Default, Dividend Arrearages and Delinquencies | | | 26 | |

Item 14. | Material Modifications to the Rights of Securities Holders and Use of Proceeds | | | 26 | |

Item 15. | Controls and Procedures | | 26 | |

Item 16A. | Audit Committee Financial Experts | | | 28 | |

Item 16B. | Code of Ethics | | | 28 | |

Item 16C. | Principal Accountant Fees and Services | | 28 | |

Item 16D. | Exemptions from the Listing Standards for Audit Committee | | | 28 | |

Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | | | 28 | |

PART III | | | | |

| | | | | |

Item 17. | Reserved | | | 29 | |

Item 18. | Financial Statements | | | 29 | |

Item 19. | Exhibits | | | 30 | |

| | Exhibit Index | | | 30 | |

SIGNATURES | | | | 31 | |

Pursuant to General Instruction E(b) of Form 20-F, this annual report includes the information specified in Parts I, II and III.

Pursuant to General Instruction E(c) of Form 20-F, the registrant has elected to provide the financial statements and related information specified in Item 18 in lieu of Item 17.

INTRODUCTION

Unless otherwise indicated and except where the context otherwise requires, references in this annual report on Form 20-F to:

| · | "we," "us," "our company", "the company" or "our" refers to UMeWorld Limited, its predecessor entities and subsidiaries; |

| · | "China" or "PRC" refers to People's Republic of China, and for the purpose of this annual report, excludes Taiwan, Hong Kong and Macau; |

| · | "shares" or "common shares" refers to our common shares, par value US$0.0001 per share; |

| · | "RMB" or "Renminbi" refers to the legal currency of China, "HK$" refers to the legal currency of Hong Kong and "$," "dollars," "US$" or "U.S. dollars" refers to the legal currency of the United States. |

| · | "U.S. GAAP" refers to generally accepted accounting principles in the United States; and |

| · | "PRC GAAP" refers to generally accepted accounting principles in the People's Republic of China. |

Our common shares are quoted on OTC Market under the symbol "UMEWF"

FORWARD-LOOKING INFORMAITON

This annual report on Form 20-F contains forward-looking statements that are based on our current expectations, assumptions, estimates and projections about us and our industry. All statements other than statements of historical fact in this annual report are forward-looking statements. In some cases, these forward-looking statements can be identified by words and phrases such as "may," "should," "intend," "predict," "potential," "continue," "will," "expect," "anticipate," "estimate," "plan," "believe," "is /are likely to" or the negative form of these words and phrases or other comparable expressions. The forward-looking statements included in this annual report relate to, among others:

| · | our goals and strategies; |

| · | our future prospects and market acceptance of our technologies, products and services; |

| · | our future business development and results of operations; |

| · | projected revenues, profits, earnings and other estimated financial information; |

| · | our plans to expand and enhance our products and services; |

| · | competition in the online video, computer-based testing and educational services markets; and |

| · | Chinese laws, regulations and policies, including those applicable to the education industry, Internet content providers, Internet content and foreign exchange. |

These forward-looking statements involve various risks, assumptions and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may turn out to be incorrect. Our actual results could be materially different from our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in Item 3 of this annual report, "Key information - Risk Factors" and elsewhere in this annual report.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

| A. | Selected Financial Data |

| |

| Not applicable |

| B. | Currency Exchange Rate |

| |

| Not applicable. |

| C. | Capitalization and Indebtedness |

| |

| Not applicable. |

We provide the following cautionary discussion of risks, uncertainties and possible inaccurate assumptions relevant to our business and our products. These are factors that we think could cause our actual results to differ materially from expected results. Other factors besides those listed here could also adversely affect us.

The Chinese market for our services is still emerging and evolving rapidly, there may not be a market for our products or services. If market acceptance of our services declines or fails to grow, our revenue growth may slow or we may experience a decrease in revenues.

As the Chinese market for our services is still emerging, our success will depend to a large extent on our ability to convince our clients that our technologies and services are valuable and that it is more cost-effective for them to utilize our services than for them to develop similar services in-house.

| · | We must address the following concerns, among others, with our clients as they decide to implement our online assessment and educational services and to use our technologies and services: |

| · | concern over the commitment of time, personnel and funding necessary to implement our online assessment services; |

| · | ability of clients to develop their own online assessment and educational services; |

| · | possible perceived security and academic integrity risks associated with online assessment and educational services; and |

| · | reluctance of the academic community to adopt online assessment and educational services. |

As the markets for our online assessment and education services are relatively new for us, we cannot assure you that we will succeed in adapting to client needs in these markets. It may be difficult for us to accurately predict demand for the service offerings we develop. Furthermore, the PRC government may enact unforeseen regulations and policies that could limit our ability to provide certain services, such as prohibitions on foreign-invested entities engaging in certain businesses. Additional risks that we face in this market include the following:

| · | we may underestimate the amount of capital, personnel and other resources required to carry out our marketing and distribution plans, which may affect the success of our product launch; |

| · | if we are unsuccessful in the relevant new market, it may negatively affect our reputation and the status of our brand in our other markets; and |

| · | we may fail to develop sufficient payment collection, technical support and other administrative capabilities necessary to successfully develop and manage our service offerings on an increasingly large scale. |

If our new service offerings are ultimately unsuccessful or do not grow as rapidly as we expect, our net revenues and profitability will be adversely affected.

Reductions in public funding available to our clients that are governmental agencies could adversely impact demand by these agencies and institutions for our products and services.

We expect to derive a significant portion of our revenues from service fees from Chinese governmental agencies. Demand and ability to pay for our products and services by these agencies are affected by government budgetary cycles, funding availability and government policies. Funding reductions, reallocations or delays could adversely impact demand for our products and services by our clients or reduce the fees these clients are willing to pay for our products and services

A significant portion of our revenues are dependent on market acceptance of our online assessment platform and other cloud -based testing technologies, and if we are unable to anticipate and meet our clients' technological needs and challenges from new technologies and industry standards, our products and services may lose market acceptance or become obsolete, and our margins and results of operations may be adversely affected.

Our advanced technologies for the creation and delivery of online tests and assessment, including our UMFun platform, are a key factor in growing and maintaining our relationships with educational institution clients and educational program content providers. Our future success depends on our ability to upgrade our systems, develop new technologies and anticipate and meet the technical needs of our clients on a regular basis. The emergence in the market of new test creation and delivery technologies or substitute products and services could reduce the competitiveness or result in the obsolescence of our current technologies and services. Moreover, if other companies develop similar technologies offering functionality comparable to that of our technologies, pricing pressure may increase and our margins and results of operations may be adversely affected. Additionally, industry standards such as standard interfaces and data exchange protocols may be developed for testing technologies, and if these industry standards are incompatible with our technologies, demand for our technologies, products and services may decline significantly. To the extent we are unable to maintain our market leadership position in key testing technologies or anticipate and respond to technological developments and changes in industry standards in a timely and cost-effective manner, our products and services may lose market acceptance or become obsolete.

Technical errors or failures in relation to cloud-based tests delivered through our delivery platform could result in negative publicity, loss of clients, liability claims and costly and disruptive litigation.

Due to the complexity of the technologies we have developed and use to create and deliver cloud-based tests for our clients, there is a risk that technical errors or failures may occur in relation to these services. These may include errors, failures or bugs in our self-developed software applications and test security technologies, breakdowns or failures of our servers and computer networks, and connectivity failures between our networks. While we have not experienced major problems to date due to errors, breakdowns, failures, bugs or defects, we cannot assure you that we will not experience such problems in the future. If such a problem were to occur, it could disrupt or compromise the integrity of the test taking process or of test content and results, which could lead to negative publicity and loss of clients and may subject us to liability claims. Although we have established a formal crisis management system to respond to technical problems, it has never been tested in a real crisis situation. Any litigation or negative publicity resulting from an error or failure, with or without merit, could result in substantial costs and divert management's attention and resources from our business and operations.

If we fail to maintain a strong brand identity, our business may not grow and our financial results may be adversely impacted.

We believe that maintaining and enhancing the value of the "UMFun" brand is important to attracting clients. Our success in maintaining brand awareness will depend on our ability to consistently provide high quality, value-adding, user-friendly and secure products and services. To establish a significant recognition of our "UMFun" brand among schools, teachers, students and parents, we may need to spend significant resources on advertising. As we have limited experience with advertising and other activities required to establish a widely recognized brand, we cannot assure you that we will effectively allocate our resources for these activities or succeed in maintaining and broadening our brand recognition and appeal. If we fail to maintain a strong brand identity, our business may not grow and our financial results may be adversely impacted.

We have significant historical losses and may continue to incur losses in the future.

We have incurred annual operating losses since our inception. As a result, at September 30, 2015 we had an accumulated loss of approximately $27,119,410. Our revenues for the years ended September 30, 2015, September 30, 2014 and September 30, 2013 were $0, $0 and $760,329 respectively. Our revenues have not been sufficient to sustain our operations. Revenues for 2013 consisted of royalty revenues, gain from disposal of fixed assets, and interest income, and in 2012 revenues consisted of royalty revenues, gain from disposal of fixed assets, forgo of salary from Chief Executive Officer, legal settlement, and interest income. In order to achieve profitability our revenue streams will have to increase and there is no assurance that revenues can increase to such a level. We may never be profitable. Our ability to achieve profitability is affected by various factors, including:

- | growth of the online video industry and the online advertising market; |

- | the transition from long-form professional content to short-form user-generated content, or UGC; |

- | the continued growth and maintenance of our user base; |

- | our efforts to sell and market our products through licensees, distributors and other partners; |

- | our ability to establish corporate partnerships and licensing arrangements; |

- | the time and costs involved in obtaining regulatory approvals; |

- | our ability to control our costs and expenses; and |

- | the continued ability to source investments from our investors. |

Many of these factors are beyond our control. We may continue to incur net losses in the future due to our continued investments in content, bandwidth and technology. If we cannot successfully offset our increased costs with an increase in net revenues, our gross margin, financial condition and results of operations could be materially and adversely affected. We may also continue to incur net losses in the future due to changes in the macroeconomic and regulatory environment, competitive dynamics and our inability to respond to these changes in a timely and effective manner.

Our disclosure controls & procedures and internal control over financial reporting were ineffective

Section 404 of the Sarbanes-Oxley Act of 2002 requires companies to conduct a comprehensive evaluation of their disclosure controls & procedures and internal control over financial reporting. At the end of each fiscal year, we must perform an evaluation of our disclosure controls & procedures and internal control over financial reporting, include in our annual report the results of the evaluation, and have our external auditors publicly attest to such evaluation. If material weaknesses were found in our disclosure controls & procedures and internal controls in the future, if we fail to complete future evaluations on time, or if our external auditors cannot attest to our future evaluations, we could fail to meet our regulatory reporting requirements and be subject to regulatory scrutiny and a loss of public confidence in our disclosure and internal controls, which could have an adverse effect on our stock price.In connection with management's assessment of the Company's disclosure controls & procedures and internal control over financial reporting, we identified the following material weakness in our disclosure controls & procedures and internal control over financial reporting as of September 30, 2015:

Segregation of Duties: We did not maintain adequate segregation of duties related to job responsibilities for initiating, authorizing, and recording of certain transactions. Due to this material weakness, there is a risk that a material misstatement in the financial statements would not be prevented or detected on a timely basis.

We are subject to currency fluctuations, which may affect our results

The majority of our expenses and some of our debt are in Chinese Yuan, Canadian dollars and U.S. dollars, while our revenues are primarily Chinese Yuan. We also incur expenses in Hong Kong dollars related to our Hong Kong subsidiaries. The fluctuation of the Canadian dollar, Hong Kong dollar and U.S. dollar vis-a-vis the Chinese Yuan could materially impact our operating results and financial position.

We will require additional financing to sustain our operations, and our ability to secure additional financing is uncertain.

We may be unable to raise on acceptable terms, if at all, the substantial capital resources necessary to conduct our operations. If we are unable to raise the required capital, we may be forced to curtail business development activities and, ultimately, cease operations. At September 30, 2015, we had working capital deficiency of $572,934 as compared to working capital deficiency of $40,775 as at September 30, 2014 and to a working capital of $593,601 as at September 30, 2013. The independent auditors' report for the year ended September 30, 2012 includes an explanatory paragraph stating that our recurring losses from operations and working capital levels raise substantial doubt about our ability to continue as a going concern.

We may be unable to retain key employees or recruit additional qualified personnel.

Because of the specialized scientific nature of our business, we are highly dependent upon qualified scientific, technical, and managerial and marketing personnel. There is competition for qualified personnel in our business. Therefore, we may not be able to attract and retain the qualified personnel necessary for the development of our business. The loss of the services of existing personnel, as well as the failure to recruit additional key scientific, technical, and managerial personnel in a timely manner would harm our research and development programs and our business.

The market price of our Common Stock is volatile.

The market price of our Common Stock has been, and we expect it to continue to be, highly unstable. Factors, including our announcement of technological improvements or announcements by other companies, regulatory matters, research and development activities, new or existing products or procedures, signing or termination of licensing agreements, concerns about our financial condition, operating results, litigation, government regulation, developments or disputes relating to agreements, patents or proprietary rights, and public concern over the safety of activities or products have had a significant impact on the market price of our stock. We expect such factors to continue to impact our market price for the foreseeable future.

Our Common Stock is classified as a "penny stock" under SEC rules which may make it more difficult for our stockholders to resell our Common Stock.

Our Common Stock is traded on the OTC Market. As a result, the holders of our Common Stock may find it more difficult to obtain accurate quotations concerning the market value of the stock. Stockholders also may experience greater difficulties in attempting to sell the stock than if it was listed on a stock exchange or quoted on the Nasdaq National Market or the Nasdaq Small-Cap Market. Because our Common Stock is not traded on a stock exchange or on Nasdaq, and the market price of the Common Stock is less than $5.00 per share, the Common Stock is classified as a "penny stock." Rule 15g-9 of the Securities Exchange Act of 1934 imposes additional sales practice requirements on broker-dealers that recommend the purchase or sale of penny stocks to persons other than those who qualify as an "established customer" or an "accredited investor." This includes the requirement that a broker-dealer must make a determination that investments in penny stocks are suitable for the customer and must make special disclosures to the customer concerning the risks of penny stocks. Application of the penny stock rules to our Common Stock could adversely affect the market liquidity of the shares, which in turn may affect the ability of holders of our Common Stock to resell the stock. We have a significant number of options and warrants outstanding that could be exercised in the future. Subsequent resales of these and other shares could cause the Company's stock price to decline. This could also make it more difficult to raise funds at acceptable levels, via future securities offerings.

Lack of Independent Directors

We cannot guarantee that our Board of Directors will have a majority of independent directors in the future. In the absence of a majority of independent directors, our executive officers, which are also principal stockholders and directors, could establish policies and enter into transactions without independent review and approval thereof. This could present the potential for a conflict of interest between the Company and its stockholders generally and the controlling officers, stockholders or directors.

Ownership of our Common Stock by Current Officers and Directors

The present officers and directors own approximately 5.98% of the outstanding shares of Common Stock, and are therefore no longer in a position to elect all of our Directors and otherwise control the Company. As of September 30, 2015, Vago International Limited controlled by Yee Chu beneficially owned approximately 62.90% of our outstanding capital stock. Chu therefore has significant influence over management and affairs and over all matters requiring stockholder approval, including the election of directors and significant corporate transactions, such as a merger or other sale of our company or our assets, for the foreseeable future. This concentrated control limits or severely restricts our stockholders' ability to influence corporate matters and, as a result, we may take actions that our stockholders do not view as beneficial. As a result, the market price of our common stock could be adversely affected.

ITEM 4. INFORMATION OF THE COMPANY

| A. | History and Development of the Company |

Introduction and History

UMeWorld (the "Company") was incorporated in August 8, 1997 in Delaware under its prior name AlphaRx Inc. The Company was re-domiciled to BVI and continued as a BVI registered company in January 7, 2013. On March 8, 2013, AlphaRx Inc. changed its name to UMeWorld Limited.

AlphaRx was a specialty pharmaceutical company dedicated to developing therapies to treat and manage pain. Prior to November, 2011, the business of the Company was focused on reformulating FDA approved and marketed drugs using its proprietary site-specific nano drug delivery technology. From 2000 until June 2011, substantial efforts and resources were devoted to understanding our nano drug delivery technology and establishing a product development pipeline that incorporated this technology with selected molecules. On November 4, 2011, the Company ceased all operations on its drug development business and adopted a new corporate development strategy that changed the business operation of the Company to digital media and digital education with an intense focus on China. On August 30, 2012, the Company acquired all of the issued and outstanding shares of UMeLook Holdings Limited ("UMeLook"), a digital media startup with an intense focus on China. The acquisition of UMeLook was completed as a share exchange through the issuance of 70,000,000 common shares of AlphaRx Inc. to the shareholders of UMeLook at a deemed price of $0.30 per share in exchange for all of the issued and outstanding shares in the capital of UMeLook. There were no changes of control of our officers and Board of Directors as a result of the Transaction.

UMeWorld is an internet technology company with a focus on the K-12 education market in China. UMFun, the Company's K-12 flagship product, is a cloud-based, patent-pending, adaptive learning and assessment platform that can intelligently analyze and adapt to a student's performance and personalizes the delivery of proprietary educational items in accordance with the student's learning needs. UMFun's off-school version is made available to Chinese K-12 students through China Mobile, the world's largest mobile service provider by network scale and subscriber base, serving over 801,000,000 customers.

UMFun is currently available to China Mobile's subscription-based "AND! Education" platform in the Shanxi, Guangxi, Guizhou and Guangdong provinces, servicing over 16,000,000 paid subscribers. Established in 2003, China Mobile's "AND! Education" K-12 subscription-based communication plat-form is the largest of its' kind in the world, used primarily by teachers, students, parents and schools through the provinces that China Mobile services. Currently, this platform has over 90,000,000 paid subscribers system-wide and generates over US$2.1 billion in sales annually.

The kindergarten-to-grade-12 (K-12) educational system in China is the largest in the world, comprising approximately 200 million students. UMeWorld is on track to becoming a leading educational service provider in China.

Our objective is to become the leading kindergarten to grade 12 education services platform, content provider and social networking system in China's education sector. We intend to provide a range of services to government education authorities, schools, teachers, students and their parents. We have developed the UMFun Formative Assessment Item Bank, one of the most robust and comprehensive item banks available, is a repository of high-quality, standards-based item designed for us on district and classroom formative assessments to monitor and track student progress toward mastering standards. Using our item bank educators can:

| · | Evaluate student skills for placement early in the year |

| · | Measure student progress toward provincial standards |

| · | Provide targeted testing to identify students having difficulty with specific concepts |

| · | Give students valuable test experience in preparation for provincial and national tests |

| · | Assess student readiness for end-of-course or national tests |

Our formative item bank consists of nearly 1,000,000 high-quality multiple choice and constructed response items aligned to provincial standards. The items in the bank cover the core subject areas of Chinese Language Arts, English Language and Mathematics.

| C. | Organizational Structure |

We are a holding company, and we conduct our business primarily through our subsidiaries and PRC-affiliated entity incorporated in China. The following diagram illustrates our corporate structure as of September 30, 2015.

We have been, and expect to continue to be, dependent on our PRC subsidiaries and PRC-affiliated entity to conduct our core businesses in China. Through one of our subsidiaries, we have entered into a series of contractual arrangements with our PRC-affiliated entity and its shareholders that are intended to provide us with the control over, and the economic benefits enjoyed by, our PRC-affiliated entity. Pursuant to the terms of these contractual arrangements:

| · | we effectively control our PRC-affiliated entity and its respective subsidiaries; |

| · | substantially all of the economic benefits of our PRC-affiliated entity are transferred to us; and |

| · | our PRC subsidiaries or their respective designees have an exclusive option to purchase all or substantially all of the equity interests in our PRC-affiliated entity, to the extent permitted under PRC law. |

We believe the structure for operating our business in China (including our corporate structure and our contractual arrangements with our consolidated affiliated entities) complies with all applicable PRC laws, rules and regulations, and does not violate, breach, contravene or otherwise conflict with any applicable PRC laws, rules or regulations.

However, there are uncertainties regarding the interpretation and application of the relevant PRC laws, rules and regulations. Accordingly, there can be no assurance that the PRC regulatory authorities will not take a view that is contrary to our opinion. If a PRC government authority determines that our corporate structure, the contractual arrangements or the reorganization to establish our current corporate structure violates any applicable PRC laws, rules or regulations, the contractual arrangements will become invalid or unenforceable, and we could be subject to severe penalties and required to obtain additional governmental approvals from the PRC regulatory authorities.

The following table sets out the details of our subsidiaries as of the date of this annual report:

Subsidiaries | | Jurisdiction | | Ownership

Interest | |

UMeLook Holdings Limited | | British Virgin Islands | | | 100 | % |

UMeZone Holdings Limited | | British Virgin Islands | | | 100 | % |

UMeLook Limited | | Hong Kong | | | 100 | % |

UMeZone Adaptive Learning Limited | | Hong Kong | | | 100 | % |

UMeLook (Guangzhou) Information Technology Co. Ltd. | | China | | | 100 | % |

Guangzhou YouYiXue Information Technology Co. Ltd. | | China | | | 100 | % |

Affiliated Entity Consolidated in our Financial Statements | | Jurisdiction | | | | |

Guangzhou XinYiXun Network Technology Co. Ltd. | | China | | | 100 | % |

UMeWorld is headquartered in Causeway Bay, Hong Kong, where it leases its executive offices from which the Company is managed. A lease was executed with the landlord through October 30, 2016 and the monthly rent payment is $3,440.

Our principal executive offices are currently located at 31/F, Tower One, Times Square, Causeway Bay, Hong Kong. We can be contacted by email at info@UMeWorld.com.

ITEM 4A. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

Overview of Results of Operations

The following tables summarize the results of operations for the years ended September 30, 2015 and 2014 and the quarterly results of operations for the past two years:

| | 2015 | | | 2014 | |

| Year Ended September 30 | | $ | | | $ | |

Net Sales | | | 0 | | | | 0 | |

Net Loss | | | (1,373,292 | ) | | | (3,870,962 | ) |

Net Loss Per Share | | | (0.0154 | ) | | | (0.0435 | ) |

Three Months Ended | | Sep 30, 2015 $ | | | Jun 30, 2015 $ | | | Mar 31, 2015 $ | | | Dec 31, 2014 $ | | | Sep 30, 2014 $ | | | Jun 30, 2014 $ | | | Mar 31, 2014 $ | | | Dec 31, 2013 $ | |

Net Sales | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

Net Income (Loss) | | | (389,011 | ) | | | (474,750 | ) | | | (296,594 | ) | | | (212,937 | ) | | | (369,110 | ) | | | (2,933,595 | ) | | | (336,871 | ) | | | (232,386 | ) |

Net Income (Loss) per Share (1) | | | (0.0043 | ) | | | (0.0054 | ) | | | (0.0033 | ) | | | (0.0024 | ) | | | (0.0041 | ) | | | (0.0329 | ) | | | (0.0038 | ) | | | (0.0026 | ) |

NOTE (1) Net Loss per share on a quarterly basis does not equal net Loss per share for the annual periods due to rounding.

RESULTS OF OPERATIONS

Year ended September 30, 2015 as compared to year ended September 30, 2014

Revenues

Revenues totaled $0 for the year ended September 30, 2015 as compared to $0 generated for the year ended September 30, 2014.

General and Administrative Expenses

General and administrative expenses were $765,691 for the year ended September 30, 2015 as compared to $1,076,086 incurred for the same period a year ago, a decrease of $310,395 or about 28.84%. The decrease is due to the termination of Umelook.com video business operation.

Stock based compensation was $485,912 for the year ended September 30, 2015 as compared to $2,692,960 in 2014, a decrease of $2,207,084 or 82%. There are no further amounts remaining to be amortized related to warrants or options as at September 30, 2015. We anticipate issuance of additional options and warrants in the future, which may result in stock based compensation expense and warrant amortization expense.

General and administrative salary and consulting fees totaled $550,798 for the year ended September 30, 2015 as compared to $552,179 incurred for the same period a year ago, a decrease of $1,381 or about 0.25%, due mainly to lower headcount-related expenses.

We incurred $15,382 in investor relations expenses for the year ended September 30, 2015 as compared to $75,560 incurred in the same period a year ago, a decrease of $60,178 or about 79.6%.

We realized a foreign exchange gain of $160,312 for the year ended September 30, 2015 as compared to a foreign exchange loss of $77,783 generated during the same period a year ago, an increase of $238,095 between years.

We incurred travel expenses of $45,093 for the year ended September 30, 2015 as compared to $81,014 incurred during the same period a year ago, a decrease of $35,921 or about 44.34%.

Goodwill Impairment

We recorded no non-cash or goodwill impairment charge for the fiscal year ended September 30, 2015 and 2014.

Depreciation Expense

Depreciation expense totaled $4,793 for the year ended September 30, 2015 as compared to $4,804 incurred for the same period a year ago, a decrease of $11 or about 0.23%.

Interest Expense

We incurred $119,102 in net interest expense during 2015 as a result of our borrowings and the issuance of promissory notes yielding interest ranging from 10% - 12% per annum. This compares to $96,670 incurred during 2014 an increase of $22,432 or about 23.20%. We will continue to seek funding in the form of Promissory Notes, which will result in ongoing interest expense until more permanent equity financing or other forms of funding are sourced.

Loss from Continuing Operations and Net Loss

As a result of the above revenues and expenses, we incurred a loss from continuing operations of $1,370,750 for the year ended September 30, 2015 as compared to $3,872,371 incurred loss for the same period a year ago, a decrease of $2,501,621 or about 64.60%. Revenues decreased by $0 and expenses decreased by $2,517,454 in the year ended September 30, 2015 as compared to the previous year.

Cumulative Translation Adjustment and Comprehensive Loss

The cumulative translation adjustment ("CTA") stems from unrealized foreign exchange gains and losses resulting from translation of foreign currency subsidiaries into U.S. dollars. Although the CTA is reflected in the statement of operations, it is reflected after the net loss and flows into stockholders' equity/ (deficiency) directly. The CTA was a $2,118 loss for the year ended September 30, 2015 as compared to a loss of $1,174 for the year ended September 30, 2014. Netting the CTA against the Net Loss for the year results in comprehensive loss of $1,372,868 for the year ended September 30, 2015 as compared to a comprehensive loss of $3,871,197 incurred for the year ended September 30, 2014.

Liquidity And Capital Resources

At September 30, 2015, we had working capital deficiency of approximately $601,434 as compared to a working capital deficiency of $40,775 as at September 30, 2014. Since inception, we have financed operations primarily from the issuance of Common Stock. We expect to continue Common Stock issuances and issuance of promissory notes to fund our ongoing activities.

We currently do not have sufficient resources to carry out our entire business strategy. Therefore, we will need to raise additional capital to fund our operations sometime in the future. We cannot be certain that any financing will be available when needed. Any additional equity financings will be dilutive to our existing stockholders, and debt financing, if available, may involve restrictive covenants on our business and also the issuance of warrants or conversion features which may further dilute our existing stockholders.

We expect to continue to spend capital on:

1. | development, sales and marketing activities related to UMFun, our digital education platform; and |

2. | expansion into the English language training & test prep business. |

The inability to raise capital would have a material adverse effect on the Company.

Off Balance Sheet Arrangements

We do not have any off balance sheet arrangements that are material and which, in our opinion, could become material in the future.

Contractual Obligations and Commitments

Excluding accounts payable and accrued liabilities, the Company is committed to the following contractual obligations and commitments.

| | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | 2016 | |

Operating Lease Obligations | | $ | 2,572 | | | $ | 10,288 | | | $ | 9,818 | | | $ | 4,534 | | | | 28,900 | |

Notes Payable (1) | | | 995,912 | | | | 941,616 | | | | 1,328,516 | | | | 1,556,318 | | | | 1,613,766 | |

Total | | $ | 998,484 | | | $ | 951,904 | | | $ | 1,338,334 | | | $ | 1,560,852 | | | | 1,642,666 | |

_____________

(1) These notes are unsecured and include accrued interest accruing at rates ranging from 8% -12% per annum.

Certain Factors that may Affect Future Results

Certain of the information contained in this document constitutes "forward-looking statements", including but not limited to those with respect to the future revenues, our development strategy, involve known and unknown risks, uncertainties, and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the risks and uncertainties associated with a drug delivery company including a history of net losses, unproven technology, lack of manufacturing experience, current and potential competitors with significant technical and marketing resources, need for future capital and dependence on collaborative partners and on key personnel. Additionally, we are subject to the risks and uncertainties associated with all drug delivery companies, including compliance with government regulations and the possibility of patent infringement litigation, as well as those factors disclosed in our documents filed from time to time with the United States Securities and Exchange Commission.

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

| A. | Directors and Senior Management |

The following table sets forth the names and ages of our current directors and executive officers, their principal offices and positions and the date each such person became a director or executive officer. Executive officers are elected annually by our Board of Directors. Each executive officer holds his office until he resigns, is removed by the Board or his successor is elected and qualified. Directors are elected annually by our stockholders at the annual meeting. Each director holds his office until his successor is elected and qualified or his earlier resignation or removal.

The following persons are the directors and executive officers of our company:

Name | | Age | | Position | | Term |

Michael M. Lee | | 52 | | Chairman of the Board of Directors, Chief Executive Officer | | Since 8/8/1997 |

Sandro Persia | | 44 | | Secretary/Treasurer | | Since 8/8/1997 |

Dr. David Milroy | | 63 | | Director | | Since 4/15/2003 |

Dr. Ford Moore | | 63 | | Director | | Since 4/15/2003 |

Michael M. Lee: Mr. Lee is a founder of the Company. Mr. Lee has over 15 years of business experience in the areas of high tech development, marketing and corporate finance. Mr. Lee holds a B.Sc. in Applied Mathematics from the University of Western Ontario. Mr. Lee founded the company in August 1997.

Sandro Persia: Mr. Persia joined Logic Tech Corp. in 1989 as Marketing Manager and promoted to Vice President in 1996. Mr. Persia has extensive business experience in high tech marketing and sales. Mr. Persia holds a diploma in business administration from Seneca College based in Toronto.

David Milroy, D.D.S. M.R.C.D. (C): Dr. Milroy is a Certified Oral & Maxillofacial Surgeon and has been in private practice in Richmond Hill, Woodbridge, and Port Hope, Ontario for the past twenty years. He graduated from the University of Toronto, Faculty of Dentistry with a Doctor of Dental Surgery degree in 1976 and a Residency in Oral & Maxillofacial Surgery at the University of Toronto, Toronto General and Toronto Doctor's Hospitals in 1982.

Ford Moore, D.D.S. F.R.C.D. (C): Dr. Moore is a certified Oral & Maxillofacial Surgeon, is engaged in a full-time private practice in Newmarket, Ontario that he established in 1981. Dr. Moore graduated from the University of Toronto with a Doctor of Dental Surgery degree in 1976, and completed a hospital Residency in Oral Surgery and Anesthesia at Toronto General Hospital, Toronto Doctor's Hospital and the University of Toronto in 1980.

All directors will hold office until the next annual stockholder's meeting and until their successors have been elected or qualified or until their death, resignation, retirement, removal, or disqualification. Vacancies on the board will be filled by a majority vote of the remaining directors. Officers of the Company serve at the discretion of the board of directors.

| B. | Compensation of Directors and Executive Officers |

Our directors did not receive any compensation for the year ended September 30, 2015 or 2014. Directors are reimbursed for direct out-of-pocket expenses for attendance at meetings of the Board of Directors and for expenses incurred for and on behalf of the Company.

Summary of Executive Compensation

The table below summarizes the compensation received by the Company's Chief Executive Officer for the fiscal years ended September 30, 2015, 2014 and 2013 and any other executive officer of the Company who received compensation in excess of $40,000 for services rendered during any of those years ("named executive officers").

NAME AND PRINCIPAL POSITION | | YEAR | | SALARY ($) | | | BONUS ($) | | | LONG TERM COMPENSATION SECURITIES UNDERLYING OPTION (#) | |

Michael M. Lee | | 2015 | | | 120,000 | | | | 0 | | | | 0 | |

President & C.E.O. | | 2014 | | | 120,000 | | | | 0 | | | | 4,000,000 | |

| | | 2013 | | | 19,305 | | | | 0 | | | | 0 | |

Summary of Stock Plans

2013 Share Incentive Plan

Our board of directors adopted the 2013 Share Incentive Plan, or the 2013 Plan, which became effective in July 2013. A total of 17,000,000 common shares of our company are reserved for issuance under the 2013 Plan. A general description of the terms of the 2013 Plan is set forth below:

Plan Administration. Our board of directors or one or more committees appointed by our board acts as of the administrator of the 2013 Plan.

Award Document. Awards granted under the 2013 Plan are evidenced by an award document that sets forth the terms and conditions applicable to each of these awards, as determined by the administrator in its sole discretion.

Termination of the 2013 Plan. Without further action by our board of directors, the 2013 Plan will terminate in July 2023. Our board of directors may amend, suspend or terminate the 2013 Plan at any time, provided, however, that our board of directors must first seek the approval of the participants of the 2013 Plan if such amendment, suspension or termination would materially adversely affect the rights of participants with respect to any of their existing awards.

Granted Options. As of September 30, 2015, we had granted options to purchase an aggregate of 14,750,000 ordinary shares to our directors, officers and employees, all granted options are outstanding. Among these options:

| · | Options to purchase 2,000,000 ordinary shares have an exercise price of $0.20 per share and are subject to a two-year vesting schedule, with 50% vesting on July 22, 2015 and 2016, respectively; |

| · | Options to purchase 12,750,000 ordinary shares have an exercise price of $0.15 per share and are subject to a four-year vesting schedule, with 25% vesting on July 22, 2015, 2016, 2017 and 2018, respectively. |

Duties of Directors

Under British Virgin Islands Law, our directors have a statutory duty of loyalty to act honestly in good faith with a view to our best interests. Our directors also have a duty to exercise the care, diligence and skills that a reasonably prudent person would exercise in comparable circumstances. In fulfilling their duty of care to us, our directors must ensure compliance with our amended and restated memorandum and articles of association. A shareholder has the right to seek damages if a duty owed by our directors is breached.

The functions and powers of our board of directors include, among others:

| · | convening shareholders' annual general meetings and reporting its work to shareholders at such meetings; |

| · | issuing authorized but unissued shares; |

| · | declaring dividends and distributions; |

| · | exercising the borrowing powers of our company and mortgaging the property of our company; |

| · | approving the transfer of shares of our company, including the registering of such shares in our share register; and |

| · | exercising any other powers conferred by the shareholders' meetings or under our amended and restated memorandum and articles of association. |

Board of Directors Committees

We were not able to attract an independent director with financial experience to sit on our board. Based on the size of the organization, however, effective controls over financial reporting and internal financial controls can still be effectively maintained without an audit committee. The board of directors has not yet established a compensation committee.

Audit Committee

Although its By-laws provide for the appointment of one, the Company is not yet required to have an Audit Committee as a result of the fact that our common stock is not considered a "listed security" as defined in Rule 10A-3 of the Exchange Act. There are currently no audit committee members that meet the criteria of "Financial Expert", however the company is actively working to appoint a "Financial Expert" in the current year.

Terms of Directors and Officers

Our officers are elected by and serve at the discretion of the board of directors. Our directors are not subject to a term of office and hold office until such time as they resign or are removed from office by ordinary resolution or the unanimous written resolution of all shareholders. A director will be removed from office automatically if, among other things, the director (1) becomes bankrupt or makes any arrangement or composition with his creditors; or (2) dies or is found by our company to be or becomes of unsound mind.

We have 35 full time employees. None of our staff is represented by a collective bargaining agreement, nor have we experienced any work stoppage. We believe that our relations with our staff are good.

The following table sets forth information with respect to ownership of the Company's securities by its officers and directors and by any person (including any "group") who is the beneficial owner of more than 5% of the Company's Common Stock. The total number of shares authorized is 250,000,000 shares of Common Stock, each of which has a par value of $0.0001. As of September 30, 2015 there were 89,036,000 shares of Common Stock issued and outstanding.

| | | Shares Beneficially Owned | |

Name | | Number | | | Percentage | |

Directors & Executive Officers | | | | | | |

Michael Lee | | | 3,876,774 | | | | 4.35 | % |

Ford Moore | | | 911,636 | | | | 1.02 | % |

David Milroy | | | 700,000 | | | | 0.79 | % |

Sandro Persia | | | 3,600 | | | | 0.004 | % |

All Directors and Executive Officers as a group | | | 5,492,010 | | | | 6.17 | % |

| | | | | | | | | |

5% or More Beneficial Owner | | | | | | | | |

Vago International Limited(1) | | | 56,000,000 | | | | 62.90 | % |

Yan Zeng | | | 5,5000,000 | | | | 6.18 | % |

| | | | | | | | | |

___________

(1) Vago International Limited is owned by Yee W. Chu

ITEM 7. MAJOR SHARHEOLDERS AND RELATED PARTY TRANSACTION

Please refer to Item 6E. "Share Ownership."

| B. | Related Party Transactions |

Contractual Arrangements with Respect to Our Consolidated Affiliated Entities

We conduct our operations in China principally through contractual arrangements with our PRC subsidiary, our consolidated affiliated entity in China, and their respective shareholders. See Item 4.C. "Organizational Structure."

Loans from our CEO & directors

Mr. Lee, CEO and directors loaned us $111,915 during the year ended September 30, 2015. Interest accrued on all loans outstanding to Mr. Lee totaled $67,154 as of September 30, 2015.

Except as disclosed above, during the past two years, there have been no other material transactions, series of similar transactions or currently proposed transactions, to which the Company was or is to be a party, and in which any director or executive officer, or any security holder who is known to the Company to own of record or beneficially more than five percent of the Company's Common Stock, or any member of the immediate family of any of the foregoing persons, had a material interest.

ITEM 8. FINANCIAL INFORMATION

| A. | Consolidated Statements and Other Financial Information |

See Item 18 "Financial Statements."

Dividend Policy

Since the incorporation of our company, we have not declared or paid any dividends on our common shares. We have no present plan to declare or pay any dividends on our common shares in the foreseeable future. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business.

We are a holding company incorporated in the British Virgin Islands. Although we have not received any to date, we may in the future rely on dividends from our subsidiaries in the PRC. Current PRC regulations permit our subsidiaries to pay dividends to us only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, our subsidiaries in the PRC are required to set aside a certain amount of their accumulated after-tax profits each year, if any, to fund certain statutory reserves. These reserves may not be distributed as cash dividends. Further, if our subsidiaries in the PRC incur debt on their own behalf, the instruments governing the debt may restrict their ability to pay dividends or make other payments to us.

Under the previous PRC tax law, dividend payments to foreign investors made by FIEs, such as our PRC subsidiaries, were exempt from PRC withholding tax. Pursuant to the EIT Law that became effective on January 1, 2008, as well as the related implementation rules and other recently issued regulations, dividends payable by an FIE to its foreign investors are subject to a 10% withholding tax (unless the foreign investor's jurisdiction of incorporation has a tax treaty with China that provides for a different withholding arrangement). Distributions made from pre-January 1, 2008 retained earnings will not be subject to the withholding tax.

Our board of directors has complete discretion as to whether to distribute dividends, subject to the approval of our shareholders. Even if our board of directors decides to pay dividends, the form, frequency and amount will depend upon our future operations and earnings, capital requirements and surplus, our general financial condition, contractual restrictions and other factors that the board of directors may deem relevant. Cash dividends on our common shares, if any, will be paid in U.S. dollars.

Legal Proceedings

We are currently not a party to, and we are not aware of any threat of, any legal, arbitral or administrative proceedings, which, in the opinion of our management, is likely to have a material and adverse effect on our business, financial condition or results of operations. We may from time to time become a party to various legal, arbitral or administrative proceedings arising in the ordinary course of our business.

Except as disclosed elsewhere in this annual report, we have not experienced any significant changes since the date of our audited consolidated financial statements included in this annual report.

ITEM 9. THE OFFER AND LISTINGS

| A. | Offering and Listing Details |

| |

| See "-C. Markets" |

| B. | Plan of Distribution |

| |

| Not applicable. |

Our Common Stock is traded over-the-counter and its quotations are carried by the OTC Market Group.

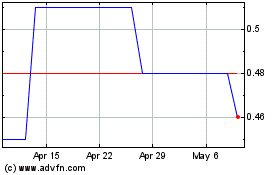

The following table sets forth the range of high and low bid quotations for our Common Stock for the periods indicated from sources we deem reliable.

| | | | | High $ | | | Low $ | |

Fourth Quarter | | (Ended September 30, 2015) | | | 0.49 | | | | 0.30 | |

Third Quarter | | (Ended June 30, 2015) | | | 0.45 | | | | 0.27 | |

Second Quarter | | (Ended March 31, 2015) | | | 0.32 | | | | 0.24 | |

First Quarter | | (Ended December 31, 2014) | | | 0.28 | | | | 0.18 | |

Fourth Quarter | | (Ended September 30, 2014) | | | 0.28 | | | | 0.17 | |

Third Quarter | | (Ended June 30, 2014) | | | 0.46 | | | | 0.18 | |

Second Quarter | | (Ended March 31, 2014) | | | 0.38 | | | | 0.20 | |

First Quarter | | (Ended December 31, 2013) | | | 0.45 | | | | 0.10 | |

The foregoing quotations reflect inter-dealer prices without retail mark-up, markdown or commissions and may not necessarily represent actual transactions. Records of our stock transfer agent indicate that as of September 30, 2015 there were approximately 62 record holders of our Common Stock. This does not include an indeterminate number of stockholders who may hold their shares in "street name" or in nominee form.

| D. | Selling Shareholders |

| |

| Not applicable. |

| |

| E. | Dilution |

| |

| Not applicable. |

| |

| F. | Expenses of the Issue |

| |

| Not applicable. |

ITEM 10. ADDITIONAL INFORMATION

| A. | Share Capital |

| |

| Not applicable. |

| B. | Memorandum and Articles of Association |

We are a British Virgin Islands company and our affairs are governed by our memorandum and articles of association, the Companies Law of the British Virgin Islands, or the Companies Law, and the common law of the British Virgin Islands.

We have not entered into any material contracts other than in the ordinary course of business and other than those described in "Item 4. Information on the Company" or elsewhere in this annual report.

Regulation of Foreign Exchange

China's government imposes restrictions on the convertibility of the Renminbi and on the collection and use of foreign currency by Chinese entities. Under current regulations, the Renminbi is convertible for current account transactions, which include dividend distributions, interest payments, and the import and export of goods and services. Conversion of Renminbi into foreign currency and foreign currency into Renminbi for capital account transactions, such as direct investment, portfolio investment and loans, however, is still generally subject to the prior approval of the PRC State Administration of Foreign Exchange, or SAFE.

Under current Chinese regulations, Foreign-Invested Enterprises such as our Chinese subsidiaries are required to apply to SAFE for a Foreign Exchange Registration Certificate for Foreign-Invested Enterprise. With such a foreign exchange registration certificate (which is subject to review and renewal by SAFE on an annual basis), a foreign-invested enterprise may open foreign exchange bank accounts at banks authorized to conduct foreign exchange business by SAFE and may buy, sell and remit foreign exchange through such banks, subject to documentation and approval requirements. Foreign-invested enterprises are required to open and maintain separate foreign exchange accounts for capital account transactions and current account transactions. In addition, there are restrictions on the amount of foreign currency that foreign-invested enterprises may retain in such accounts.

The value of the Renminbi against the U.S. dollar and other currencies is affected by, among other things, changes in China's political and economic conditions and China's foreign exchange policies. The People's Bank of China regularly intervenes in the foreign exchange market to limit fluctuations in Renminbi exchange rates and achieve policy goals.

Dividend Distributions

We have adopted a holding company structure, and our holding companies may rely on dividends and other distributions on equity paid by our current and future Chinese subsidiaries for their cash requirements, including the funds necessary to service any debt we may incur or financing we may need for operations other than through our Chinese subsidiaries. Chinese legal restrictions permit payments of dividends by our Chinese subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with Chinese accounting standards and regulations. Our Chinese subsidiaries are also required under Chinese laws and regulations to allocate at least 10% of their after-tax profits determined in accordance with PRC GAAP to statutory reserves until such reserves reach 50% of the company's registered capital. Allocations to these statutory reserves and funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends.

British Virgin Islands Taxation

In the BVI there are no taxes on profits, income or dividends, nor is there any capital gains tax, estate duty or death duty. Profits can be accumulated and it is not obligatory for a company to pay dividends. Stamp duty is not chargeable in respect of the incorporation, registration or licensing of an exempted company, nor, subject to certain minor exceptions, on their transactions.

People's Republic of China Taxation

On March 16, 2007, the National People's Congress, the PRC legislature, enacted the Enterprise Income Tax Law, or the New EIT Law which became effective on January 1, 2008, and on December 6, 2007, the State Council promulgated the Implementation Rules to the Enterprise Income Tax Law, or the Implementation Rules,which also became effective on January 1, 2008. Under the New EIT Law and its Implementation Rules, foreign-invested enterprises and domestic companies are subject to a uniform enterprise income tax rate of 25%, unless otherwise specified.

In addition, dividends payable to foreign investors by PRC resident enterprises are subject to a PRC withholding tax at the rate of 10% unless the foreign investor's jurisdiction of incorporation has a tax treaty with the PRC that provides for a preferential withholding arrangement. Pursuant to the Double Taxation Arrangement (Hong Kong), which became effective on December 8, 2006, the withholding tax may be lowered to 5% if the PRC enterprise is at least 25% directly held by a Hong Kong enterprise. According to Circular 601, non-resident enterprises that cannot provide valid supporting documents as to "beneficial ownership" may not be approved to enjoy tax treaty benefits, and the term "beneficial owners" refers to individuals, companies or other organizations normally engaged in substantive operations. These rules also expressly exclude a "conduit company," or a company established for the purposes of avoiding or reducing tax obligations or transferring or accumulating profits and not engaged in substantive operations, such as manufacturing, sales or management, from being deemed a beneficial owner. As a result, dividends from our PRC subsidiaries paid to us through our Hong Kong subsidiaries may be subject to a reduced withholding tax rate of 5% if our Hong Kong subsidiaries are determined to be Hong Kong tax residents and beneficial owners under the Double Taxation Arrangement (Hong Kong).

Under the New EIT Law, enterprises organized under the laws of jurisdictions outside China with their "de facto management bodies" located within China may be considered PRC resident enterprises and therefore subject to PRC enterprise income tax at the rate of 25%on their worldwide income. The Implementation Rules define the term "de facto management body" as the management body that exercises substantial and overall control and management over the business, personnel, accounts and properties of an enterprise. Circular 82 sets out certain specific criteria for determining the location of the "de facto management bodies" of an enterprise registered outside of the PRC and funded by Chinese enterprises as controlling investors, or a Chinese Controlled Enterprise. Under Circular 82, a Chinese Controlled Enterprise shall be considered a resident enterprise if all of the following applies:

| 1) | the Chinese Controlled Enterprise's major management department and personnel who are responsible for carrying out daily operations are located in the PRC; |

| | |

| 2) | the department or the personnel who have the right to decide or approve the Chinese Controlled Enterprise's financial and human resource matters are located in the PRC; |

| | |

| 3) | the major assets, account book, company seal and meeting minutes of the Chinese Controlled Enterprise are located or stored in the PRC; and |

| | |

| 4) | the directors or management personnel holding no less than 50% voting rights of the Chinese Controlled Enterprise habitually reside in the PRC. |

Since the Company is not controlled by a PRC enterprise or a PRC enterprise group, it remains unclear whether the standards set out in the SAT Circular 82 will apply or be cited for reference when considering whether the "de facto management bodies" of the Company and its overseas subsidiaries are in the PRC or not. Furthermore, we do not believe that any of our offshore entities meet all of the conditions detailed above, as the key assets and records for these entities, including the resolutions of their respective board of directors and the resolutions of their respective shareholders, are located and maintained outside of the PRC. While we do not currently consider our company or any of our overseas subsidiaries to be a PRC resident enterprise, there is a risk that the PRC tax authorities may deem our company or any of our overseas subsidiaries as a PRC resident enterprise since a substantial majority of the members of our management team as well as the management team of some of our offshore holding companies are located in China. If the PRC tax authorities determine that our British Virgin Islands holding company is a "resident enterprise" for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. For example, a 10% withholding tax may be imposed on dividends we pay to our non-PRC enterprise shareholders and, with respect to gains derived by our non-PRCenterprise shareholders, from transferring our shares. It is unclear whether, if we are considered a PRC resident enterprise, holders of our shares would be able to claim the benefit of income tax treaties or agreements entered into between China and other countries or areas.

Pursuant to the New EIT Law, if a non-resident enterprise derives China-sourced income, such as dividends or capital gains, that income is subject to EIT, in the form of a withholding tax. The SAT issued the Interim Measures for Administration of Withholding EIT for Non-Resident Enterprise, effective from January 1, 2009. According to the measures, the entity or individual with the legal or contractual obligation to remit income to the non-resident enterprise is deemed as a withholding agent. The withholding agent must withhold the EIT at the time the relevant payment is made or due to be made and pay the tax within seven days from the date of withholding. Noncompliance with the prescribed procedures by a PRC withholding agent and failure of the non-resident enterprise to pay the applicable EIT must be rectified within a designated period and could result in a fine.

| F. | Dividends and Paying Agents |

We have never declared any cash dividends and do not anticipate paying such dividends in the near future. We anticipate all earnings, if any, over the next twelve (12) to twenty - four (24) months will be retained for working capital purposes. Any future determination to pay cash dividends will be at the discretion of the Board of Directors and will be dependent upon our results of operations, financial conditions, contractual restrictions, and other factors deemed relevant by the Board of Directors. We are under no contractual restrictions in declaring or paying dividends to our common stockholders.

The future sale of presently outstanding "unregistered" and "restricted" Common Stock of the Company by present members of management and persons who own more than five percent of the outstanding voting securities of the Company may have an adverse effect on the public market for our Common Stock.

Not Applicable

We are subject to the periodic reporting and other informational requirements of the Exchange Act. Under the Exchange Act, we are required to file reports and other information with the SEC. Specifically, we are required to file annually a Form 20-F within four months after the end of each fiscal year. Copies of reports and other information, when so filed, may be inspected without charge and may be obtained at prescribed rates at the public reference facilities maintained by the SEC at Judiciary Plaza, 100 F Street, N.E., Washington, D.C. 20549, and at the regional office of the SEC located at Citicorp Center, 500 West Madison Street, Suite 1400, Chicago, Illinois 60661. The public may obtain information regarding the Washington, D.C. Public Reference Room by calling the Commission at 1-800-SEC-0330. The SEC also maintains a web site at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding registrants that make electronic filings with the SEC using its EDGAR system. As a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content of quarterly reports and proxy statements, and officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act.

| I. | Subsidiary Information |

For a listing of our subsidiaries, see "Item 4. Information on the Company - C. Organizational Structure."

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We have not entered into market risk sensitive instruments for any purposes.

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

| A. | Debt Securities |

| |

| Not applicable. |

| |

| B. | Warrants and Rights |

| |

| Not applicable. |

| |

| C. | Other Securities |

| |

| Not applicable. |

PART II

ITEM 13. DEFAULT, DIVIDEND ARREARAGES AND DELINQUENCIES

None.

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITIES HOLDERS AND USE OF PROCEEDS

None.

ITEM 15. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, we have evaluated the effectiveness of the design and operation of our "disclosure controls and procedures," as such term is defined in Rules 13a-15e promulgated under the Exchange Act as of this report. Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer have concluded that our disclosure controls and procedures were ineffective as of the end of the period covered by this report to provide reasonable assurance that material information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms.

Management is aware that there is a lack of segregation of certain duties at the Company due to the small number of employees with responsibility for general administrative and financial matters. This constitutes a deficiency in financial reporting. However, at this time, management has decided that considering the employees involved and the control procedures in place, the risks associated with such lack of segregation of duties are insignificant and the potential benefits of adding additional employees to clearly segregate duties do not justify the additional expenses associated with such increases. Management will periodically reevaluate this situation. If the volume of business increases and sufficient capital is secured, it is the Company's intention to further increase staffing to mitigate the current lack of segregation of duties within the general, administrative and financial functions.

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f), and for the assessment of the effectiveness of internal control over financial reporting. As defined by the Securities and Exchange Commission, internal control over financial reporting is a process designed by, or under the supervision of, our principal executive officer and principal financial officer and effected by our Board, management, and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the consolidated financial statements in accordance with U.S. generally accepted accounting principles.

Our internal control over financial reporting is supported by policies and procedures that: (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect our transactions and dispositions of our assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of the consolidated financial statements in accordance with U.S. generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of our management and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the consolidated financial statements.

Management's Annual Report on Internal Control over Financial Reporting

Management assessed our internal control over financial reporting as of September 30, 2015, the end of our fiscal year. Management based its assessment on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Management's assessment included an evaluation of the design of our internal control over financial reporting and testing of the operational effectiveness of those controls.

Based on this assessment, management has concluded that as of September 30, 2015, our internal control over financial reporting was ineffective to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. generally accepted accounting principles.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Our report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit us to provide only Management's report in this Form 20-F.