Caterpillar Expects Sales To Keep Falling

January 29 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 1/29/16)

By Bob Tita

Caterpillar Inc. warned its revenue this year could sink to a

six-year low on falling demand but held out hope for better

earnings as the heavy equipment maker swung to a fourth-quarter

loss on restructuring expenses.

The mining and construction equipment supplier said depressed

prices for iron ore, copper and other commodities, cheaper oil and

weakness in developing countries are weighing on sales of its

bulldozers, excavators, mining trucks and engines.

The Peoria, Ill.-based company now expects 2016 revenue of about

$42 billion, more than a third below the company's $65.9 billion

four years ago. The projected 10% decline is twice what it had

forecast for the year in October and would leave revenue at below

what it had before its acquisition of mining equipment company

Bucyrus International Inc. in 2011.

Caterpillar forecast 2016 earnings of $4 a share, excluding

additional restructuring costs and including the benefit of lower

pension costs, up from $3.50 a share in adjusted earnings in 2015.

Analysts were expecting $3.48 a share excluding charges. Its

pension costs this year are expected to fall on a change in

accounting practices, a move that provided most of the higher

per-share profit in the company's forecast.

The better-than-expected profit view helped lift the company's

shares. Caterpillar gained 4.7% to $61.08 a share on Thursday.

The Bucyrus acquisition -- the largest in the 90-year-old

company's history -- represented a doubling down on global demand

for minerals. At the same time, Caterpillar aggressively added

plants in overseas markets to capture surging demand for

construction machinery. But both bets struggled as commodity prices

fell and emerging economies contracted.

Caterpillar Chief Executive Doug Oberhelman said he's not

expecting a recovery in commodity or oil prices in 2016 or much

economic expansion in developing countries, such as Brazil and

Russia.

"I would expect bumps in the road all through the year," he said

on a conference call with analysts. "We're really going into [2016]

with eyes wide open."

Profit for 2015 dropped 43% from a year earlier to $2.1 billion

on revenue down 15%, to $47 billion.

Fourth-quarter revenue tumbled 23% below the same period a year

earlier to $11.03 billion as equipment and engine sales declined in

all of the company's geographic markets.

Analysts had forecast $11.4 billion in revenue. Restructuring

costs pushed Caterpillar to a loss of $87 million, or 15 cents a

share, for the quarter compared with a prior-year profit of $757

million, or $1.23 a share. Excluding 89-cents-a-share in

restructuring costs, the company reported earnings of 74 cents a

share, topping analysts' forecast of 69 cents a share.

Caterpillar, which is already planning to cut 10,000 jobs in the

coming years, said it would book $400 million in charges for

restructuring operations in 2016 to lower expenses after spending

$908 million on restructuring in 2015.

(END) Dow Jones Newswires

January 29, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

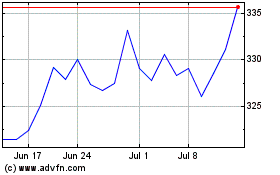

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

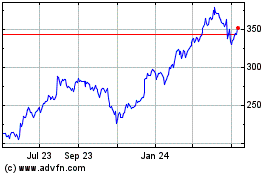

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024