As filed with the Securities and Exchange Commission on January 28, 2016

Registration No. 333-

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Inovio

Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

| Delaware |

|

33-0969592 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. employer

identification no.) |

|

|

|

| 660 W. Germantown Pike, Suite 100

Plymouth Meeting, Pennsylvania |

|

19462 |

| (Address of principal executive offices) |

|

(Zip code) |

2007 Omnibus Incentive Plan

(Full title of the plan)

J. Joseph Kim, Ph.D.

President and Chief Executive Officer

Inovio Pharmaceuticals, Inc.

660 W. Germantown Pike, Suite 100

Plymouth Meeting, Pennsylvania 19462

(267) 440-4200

(Name,

address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

John W.

Kauffman, Esq.

Duane Morris LLP

30 South 17th Street

Philadelphia, PA 19103

(215) 979-1227

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

|

|

|

|

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of securities

to be registered |

|

Amount

to be registered

(1)(2) |

|

Proposed

maximum

offering price

per share(3) |

|

Proposed

maximum aggregate

offering price(3) |

|

Amount of

registration fee(3) |

| Common Stock, $0.001 par value |

|

3,000,000 shares |

|

N/A |

|

$16,534,235.93 |

|

$1,665 |

| |

| |

| (1) |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional securities that may be offered or issued in connection

with any stock dividend, stock split, recapitalization or other similar transaction effected without receipt of consideration that increases the outstanding number of shares of Common Stock. |

| (2) |

Represents 3,000,000 additional shares of Common Stock authorized to be issued under the Registrant’s 2007 Omnibus Incentive Plan (the “2007 Plan”). The Registrant previously registered shares available

for issuance under the 2007 Plan on registration statements on Form S-8 filed with the Securities and Exchange Commission on May 14, 2007, May 9, 2008, August 26, 2009, May 18, 2010, May 20, 2011, May 18, 2012,

November 13, 2013 and May 28, 2014 (Registration Nos. 333-142938, 333-150769, 333-161559, 333-166906, 333-174353, 333-181532, 333-192318 and 333-196325, respectively). |

| (3) |

Pursuant to Rule 457(h), the maximum aggregate offering price was calculated by adding (i) with respect to 498,665 shares issuable upon exercise of outstanding stock options, the weighted average per share exercise

price of those options of $7.55 and (ii) with respect to the remaining 2,501,335 shares issuable under the plan, the price of $5.105 per share based on the average of the high and low sale prices for the Registrant’s Common Stock as

reported on the NASDAQ Stock Market on January 26, 2016. |

INTRODUCTORY NOTE

This Registration Statement relates solely to the registration of additional securities of the same class as other securities for which a

registration statement on this form relating to an employee benefit plan is effective. Pursuant to General Instruction E of Form S-8, this Registration Statement hereby incorporates by reference the contents of the registration statements on

Form S-8 the Registrant filed on May 14, 2007, May 9, 2008, August 26, 2009, May 18, 2010, May 20, 2011, May 18, 2012, November 13, 2013 and May 28, 2014 with respect to the

Registrant’s 2007 Omnibus Incentive Plan (Registration Nos. 333-142938, 333-150769, 333-161559, 333-166906, 333-174353, 333-181532, 333-192318 and 333-196325, respectively.)

Item 8. Exhibits.

|

|

|

| Exhibit

No. |

|

Description of Exhibit |

|

|

| 5.1 |

|

Opinion of Duane Morris LLP |

|

|

| 23.1 |

|

Consent of Independent Registered Public Accounting Firm |

|

|

| 23.2 |

|

Consent of Duane Morris LLP (included in Exhibit 5.1) |

|

|

| 24.1 |

|

Powers of Attorney (included in signature pages) |

II-1

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Plymouth Meeting, Pennsylvania on January 27, 2016.

|

|

|

| INOVIO PHARMACEUTICALS, INC. |

|

|

| By: |

|

/s/ J. Joseph Kim |

|

|

J. Joseph Kim |

|

|

President and Chief Executive Officer |

Know all men by these presents, that each person whose signature appears below constitutes and appoints

J. Joseph Kim and Peter Kies, and each or either of them, as such person’s true and lawful attorneys-in-fact and agents, with full power of substitution, for such person, and in such person’s name, place and stead, in any and all

capacities to sign any or all amendments or post-effective amendments to this Registration Statement, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting

unto said attorneys-in-fact and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as such person might or could do in

person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them or their substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, the registration statement has been signed by the following persons in the

capacities and on the dates indicated.

|

|

|

|

|

| Signature |

|

Title |

|

Date |

|

|

|

| /s/ Avtar Dhillon |

|

Chairman |

|

January 27, 2016 |

| Avtar Dhillon |

|

|

|

|

|

|

|

| /s/ J. Joseph Kim

J. Joseph Kim |

|

President, Chief Executive Officer and Director (principal executive officer) |

|

January 27, 2016 |

|

|

|

| /s/ Peter Kies

Peter Kies |

|

Chief Financial Officer (principal financial and principal accounting officer) |

|

January 27, 2016 |

|

|

|

| /s/ Simon X. Benito |

|

Director |

|

January 27, 2016 |

| Simon X. Benito |

|

|

|

|

|

|

|

| /s/ Angel Cabrera |

|

Director |

|

January 27, 2016 |

| Angel Cabrera |

|

|

|

|

II-2

|

|

|

|

|

| Signature |

|

Title |

|

Date |

|

|

|

| /s/ Morton Collins |

|

Director |

|

January 27, 2016 |

| Morton Collins |

|

|

|

|

|

|

|

| /s/ Adel A.F. Mahmoud |

|

Director |

|

January 27, 2016 |

| Adel A.F. Mahmoud |

|

|

|

|

|

|

|

| /s/ Nancy J. Wysenski |

|

Director |

|

January 27, 2016 |

| Nancy J. Wysenski |

|

|

|

|

II-3

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description of Exhibit |

|

|

| 5.1 |

|

Opinion of Duane Morris LLP |

|

|

| 23.1 |

|

Consent of Independent Registered Public Accounting Firm |

|

|

| 23.2 |

|

Consent of Duane Morris LLP (included in Exhibit 5.1) |

|

|

| 24.1 |

|

Powers of Attorney (included in signature pages) |

Exhibit 5.1

January 27, 2016

Board of Directors

Inovio Pharmaceuticals, Inc.

660 W. Germantown Pike, Suite 100

Plymouth Meeting, Pennsylvania

19462

| |

Re: |

Inovio Pharmaceuticals, Inc. (the “Corporation”) |

| |

|

Registration Statement on Form S-8 (the “Registration Statement”) |

|

|

|

|

|

|

|

2007 Omnibus Plan (the “2007 Plan”) |

|

|

Gentlemen:

We

have acted as special counsel to the Corporation in connection with the preparation and filing with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Securities Act”), of the Registration Statement

relating to the offer and sale by the Corporation of up to 3,000,000 shares (the “Shares”) of common stock, $0.001 par value, of the Corporation, which will be issuable under the 2007 Plan.

As counsel to the Corporation in connection with the Registration Statement, we have examined the proceedings taken by the Corporation in

connection with the adoption of the 2007 Plan and the authorization of the issuance of the Shares. For the purpose of the opinion rendered below, we have assumed that, in connection with the issuance of the Shares, the Corporation will receive

consideration in an amount not less than the aggregate par value of the Shares covered by each such issuance.

For purposes of rendering

this opinion, we have examined originals or copies (certified or otherwise identified to our satisfaction) of:

a. the 2007 Plan;

b. the Certificate of Incorporation of the Corporation, as amended, certified by the Secretary of State of the State of Delaware;

c. the Amended and Restated By-laws of the Corporation, certified by the Secretary of the

Corporation;

d. resolutions of the Board of Directors and stockholders, certified by the Secretary of the Corporation.

We have also examined such other certificates of public officials, such certificates of officers of the Corporation and such other records,

agreements, documents and instruments as we have deemed relevant and necessary as a basis for the opinions hereafter set forth.

In such

examination, we have assumed: (i) the genuineness of all signatures; (ii) the legal capacity of all natural persons; (iii) the authenticity of all documents submitted to us as originals; (iv) the conformity to original documents

of all documents submitted to us as certified, conformed or other copies and the authenticity of the originals of such documents; and (v) that all records and other information made available to us by the Corporation on which we have relied are

complete in all material respects. As to all questions of fact material to this opinion, we have relied solely upon the above-referenced certificates or comparable documents, have not performed or had performed any independent research of public

records and have assumed that certificates of or other comparable documents from public officials dated prior to the date hereof remain accurate as of the date hereof.

Based on the foregoing, we are of the opinion that the issuance of the Shares pursuant to the terms of the 2007 Plan against receipt by the

Corporation of the consideration for the Shares in accordance with the 2007 Plan will result in the Shares being legally issued, fully paid and non-assessable.

The foregoing opinion is limited to the laws of the State of Delaware, and we do not express any opinion herein concerning any other law.

The opinion expressed herein is rendered as of the date hereof and is based on existing law, which is subject to change. Where our opinion

expressed herein refers to events to occur at a future date, we have assumed that there will have been no changes in the relevant law or facts between the date hereof and such future date. We do not undertake to advise you of any changes in the

opinion expressed herein from matters that may hereafter arise or be brought to our attention or to revise or supplement such opinions should the present laws of any jurisdiction be changed by legislative action, judicial decision or otherwise.

Our opinion expressed herein is limited to the matters expressly stated herein and no opinion is implied or may be inferred beyond the matters

expressly stated.

We hereby consent to the use of this letter as an exhibit to the Registration Statement and to any and all references

to our firm in the Registration Statement. In giving this consent, we do not admit that we are “experts” within the meaning of Section 11 of the Securities Act or within the category of persons whose consent is required under

Section 7 of the Securities Act.

|

| Respectfully, |

|

| /s/ DUANE MORRIS LLP |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the 2007 Omnibus Incentive Plan of Inovio Pharmaceuticals,

Inc. of our reports dated March 13, 2015, with respect to the consolidated financial statements of Inovio Pharmaceuticals, Inc. and the effectiveness of internal control over financial reporting of Inovio Pharmaceuticals, Inc. included in its

Annual Report (Form 10-K) for the year ended December 31, 2014, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

San Diego, California

January 27, 2016

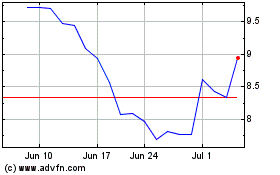

Inovio Pharmaceuticals (NASDAQ:INO)

Historical Stock Chart

From Mar 2024 to Apr 2024

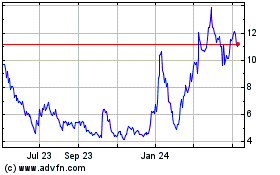

Inovio Pharmaceuticals (NASDAQ:INO)

Historical Stock Chart

From Apr 2023 to Apr 2024