Caterpillar Sees Further Revenue Weakness -- 2nd Update

January 28 2016 - 3:27PM

Dow Jones News

By Bob Tita

Caterpillar Inc. warned Thursday that its sales for 2016 could

sink to a six-year low as the company swung to a fourth-quarter

loss from expenses to shrink operations as it deals with falling

demand.

The maker of mining and construction equipment said depressed

prices for mined commodities, lower oil prices and weak economic

conditions in developing countries are weighing on sales of its

bulldozers, excavators, giant dump trucks and engines.

The Peoria, Ill.-based company now expects 2016 revenue to fall

by about 10% from 2015 to about $42 billion, which would be the

lowest level since 2010 and more than one-third below the company's

peak of $65.9 billion in 2012. Caterpillar in October had forecast

a 5% decrease in sales this year. The revised outlook would drop

Caterpillar's revenue to a level not seen since the company

acquired mining equipment company Bucyrus International Inc. in

2011 for $8.8 billion

The Bucyrus acquisition--the largest in the 90-year-old

company's history--represented a double-down bet by Caterpillar on

the global mining industry and sustained high demand for iron ore,

copper, coal and other commodities. At the same time, Caterpillar

aggressively added plants in overseas markets to capture surging

demand for machinery for infrastructure construction. But the

growth strategy stalled as the company encountered falling

commodity prices and contracting economies throughout the

world.

Caterpillar's 2015 profit dropped 43% from 2014 to $2.1 billion,

or $3.50 a share. Revenue slipped 15% to $47 billion.

Caterpillar Chairman and Chief Executive Doug Oberhelman said

he's not expecting a recovery in commodity or oil prices in 2016 or

much economic expansion in developing countries, such as Brazil and

Russia.

"I would expect bumps in the road throughout the year," he said

on a conference call with analysts. "We're really going into [2016]

with eyes wide open."

Fourth-quarter revenue came in lower than expected and was 23%

below the same period a year earlier, as equipment and engine sales

declined in all of the company's geographic markets. Caterpillar,

which is already planning to cut 10,000 jobs in the coming years,

said it would book $400 million in charges for restructuring

operations in 2016 to lower expenses after spending $908 million on

restructuring in 2015.

Restructuring expenses wiped out the company's fourth-quarter

profit. But excluding the restructuring costs, earnings per share

topped expectations, which helped propel Caterpillar's stock to a

4.6% gain to $61 a share.

Caterpillar expects sales of mining equipment this year to fall

15% to 20% from 2015. Fourth-quarter sales of resource industry

equipment dropped 23% from a year earlier to $1.8 billion. The

business recorded a $105 million loss during the quarter after

earning $25 million a year earlier.

Mike DeWalt, a Caterpillar vice president, described the global

mining industry as "very a tough business" with "very few orders"

for equipment.

"Many of our customers are in challenged financial conditions,"

he said.

Meanwhile, falling oil prices are choking demand for

Caterpillar's engines, which are used to generate power at oil

drilling sites. The company expects sales from its energy and

transportation unit to sink 10% to 15% in 2016. Fourth-quarter

sales for the unit plunged 29% to $4.4 billion, while profit

declined 37% to $712 million.

The company predicts that construction equipment sales will

decline 5% to 10% this year, following an 18% decline in fourth

quarter to $3.6 billion. Profit from the business dropped 39% to

$220 million.

Kwame Webb, an analyst for research firm Morningstar Inc., said

he considers the construction outlook overly optimistic, especially

after equipment rental giant United Rentals Inc. warned Wednesday

that its 2016 revenue could decline for the first time since 2010.

The rental industry accounts for about half the construction

machinery used in the U.S.

"The market is just awash in too much equipment," Mr. Webb

said.

Caterpillar forecast earnings of $4 a share for 2016, excluding

the restructuring costs. Analysts were expecting $3.48 a share in

adjusted earnings. But lower pension costs caused by change in

accounting practices provide nearly all the higher per-share profit

in the company's forecast.

For the fourth quarter ended Dec. 31, Caterpillar swung to a

loss of $87 million, or 15 cents a share, compared with a

prior-year profit of $757 million, or $1.23 a share.

Excluding restructuring costs, which totaled about 89 cents a

share, the company reported earnings of 74 cents a share, topping

analysts' forecast of 69 cents a share. Total revenue, which

includes Caterpillar's finance unit, tumbled 23% to $11.03 billion.

Analysts had forecast $11.4 billion in revenue.

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

January 28, 2016 15:12 ET (20:12 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

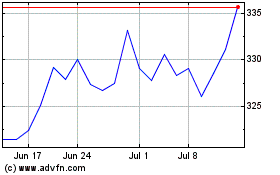

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

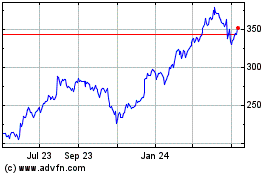

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024