By Ellie Ismailidou and Sara Sjolin, MarketWatch

Facebook, Under Armour leap on strong earnings

U.S. stocks rallied in early trade, as a surge in oil prices

drove strong gains in the energy sector and overshadowed a

weaker-than-expected reading on the economy.

The S&P 500 rose 6 points, or 0.3%, at 1,888, briefly

hitting the psychologically important level of 1,900. The Dow Jones

Industrial Average was up 19 points, or 0.1%, at 15,964, after an

early gain of 120 points. The Nasdaq Composite rose 27 points, or

0.6%, at 4,494.

Crude oil futures leapt more than 5%, hitting $34.82, following

unconfirmed reports that Russia and the Organization of the

Petroleum Exporting Countries may cut output.

Join video chat: How to know when oil has hit bottom? Live video

chat with experts

(http://www.marketwatch.com/story/how-to-know-when-oil-has-hit-bottom-live-video-chat-with-experts-2016-01-27)

The news gave a boost to energy companies' stocks, with the

energy sector leading the S&P 500 after the open, up 2.7%.

Energy names were the top performers in the Dow industrials, led by

Chevron Corp. (CVX), up 3.9% Caterpillar Inc. (CAT), which makes

equipment fpr the oil and gas industry, was up 3.2%. The company on

Thursday reported fourth-quarter earnings that beat expectations,

but its sales fell short

(http://www.marketwatch.com/story/caterpillar-shares-rise-on-fourth-quarter-earnings-beat-2016-01-28).

Among other big moves in individual stocks, a 13% jump for

Facebook Inc. (FB) on the back of a well-received earnings report

(http://www.marketwatch.com/story/facebook-shares-surge-as-quarterly-profit-tops-1-billion-2016-01-27)

helped lift the Nasdaq. And shares of Under Armour Inc. (UA) jumped

12% after the athletic apparel company beat fourth-quarter profit

and revenue expectations

(http://www.marketwatch.com/story/under-armours-stock-soars-after-results-beat-expectations-upbeat-outlook-2016-01-28).

Read:It's 'impossible to deny Facebook's momentum'

(http://www.marketwatch.com/story/its-impossible-to-deny-facebooks-momentum-analyst-2016-01-28)

The oil rally outweighed a steeper-than-expected slide in orders

for durable goods that could mean the economy shrank in fourth

quarter. Orders for long-lasting goods slid 5.1% in December

(http://www.marketwatch.com/story/durable-goods-orders-slide-51-in-december-2016-01-28),

well below the 1.5% forecasted decline. That data come a day after

the Federal Reserve recognized a slowdown in the global

economy.

U.S. stocks throughout January have moved mostly in lockstep

with swings in oil as the ultralow prices were feared to trigger

defaults in the energy sector, freeze credit lines and destroy

wealth in emerging markets, such as Russia, Saudi Arabia and

Brazil.

"There's two key factors driving markets at the moment, the Fed

and oil," said Craig Erlam, senior market analyst at Oanda, in

emailed comments.

"As we've seen a lot this year already, oil can be quite

volatile and should we see it take a turn for the worse, I would

expect U.S. indexes won't be far behind," he said.

On Wednesday, U.S. stocks diverted from oil's direction and

ended lower after the latest Federal Reserve decision

(http://www.marketwatch.com/story/us-stocks-set-to-open-lower-as-investors-wait-for-fed-rate-call-2016-01-27).

The central bank, in its Wednesday policy statement, left the

door open for an interest-rate increase in March, but still hinted

that it isn't likely to tighten policy again so soon in the mist of

global economic turmoil. Investors lowered their bets of a March

rate rise after the meeting, with the CME Group federal-fund

futures

(http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html)indicating

a 25% likelihood of a March hike on Thursday, down from 34% ahead

of the Fed's statement on Wednesday.

Economic data:Pending home sales eked out a small gain in

December

(http://www.marketwatch.com/story/pending-home-sales-inch-up-01-in-december-2016-01-28),

signaling moderate homebuying activity ahead, but falling short of

economists' expectations. The labor market, however, continues to

do fairly well. Initial jobless claims fell last week

(http://www.marketwatch.com/story/us-jobless-claims-fall-16000-to-278000-2016-01-28)

after touching a seven-month high earlier in January.

Movers and shakers: eBay Inc. (EBAY) tumbled 12.2% after the

online marketplace late Wednesday reported a drop in sales

(http://www.marketwatch.com/story/ebay-reports-another-drop-in-revenue-2016-01-27-164853749).

Apple Inc. (AAPL) advanced 0.1%, rebounding slightly from a 6.6%

slump on Wednesday that came after the quarterly earnings report

showed slower iPhone sales growth

(http://www.marketwatch.com/story/iphone-sales-slip-as-apples-growth-boom-ends-2016-01-26).

Alibaba Group Holding Ltd. (BABA) reversed premarket gains and

tumbling 2% after the open, after the China-based e-commerce giant

reported fiscal third-quarter profit and sales that rose above

expectations

(http://www.marketwatch.com/story/alibabas-stock-surges-after-profit-sales-beat-2016-01-28).

(http://www.marketwatch.com/story/caterpillar-shares-rise-on-fourth-quarter-earnings-beat-2016-01-28)Time

Warner Cable Inc. (TWC) was up 0.7% after the company reported

sales and profit ahead of expectations.

Drugmaker Eli Lilly & Co. (LLY) was down 2.5% after the

drugmaker reported adjusted earnings that met Wall Street's

forecast

(http://www.marketwatch.com/story/eli-lilly-meets-earnings-forecasts-sticks-to-2016-guidelines-2016-01-28),

though revenue fell slightly short.

Ford Motor Co. (F) shares reversed premarket gains, tumbling

3.1% after the car maker swung to a profit

(http://www.marketwatch.com/story/ford-swings-to-profit-on-strength-in-namerica-2016-01-28)

in the fourth quarter.

After the closing bell, Amazon.com Inc. (AMZN), Visa Inc. (V)

and Microsoft Corp. (MSFT) are expected to report earnings.

Other markets: Chinese stocks closed at the lowest level in over

a year, as investors digested the Fed statement. Other Asian

markets closed mixed

(http://www.marketwatch.com/story/asian-stocks-unsettled-as-markets-ponder-fed-statement-2016-01-27).

Markets in Europe

(http://www.marketwatch.com/story/european-stocks-fall-as-earnings-fed-weigh-2016-01-28)

were covered in a sea of red, with several heavyweight companies

adding pressure after announcing results.

Gold inched higher, while the dollar dropped against most other

currencies.

(http://www.marketwatch.com/story/dollar-could-head-towards-116-if-bank-of-japan-does-nothing-friday-2016-01-28)

(END) Dow Jones Newswires

January 28, 2016 11:30 ET (16:30 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

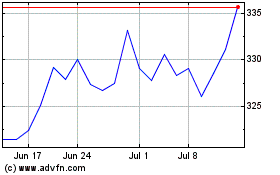

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

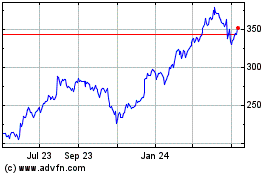

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024