MetLife CEO Warned Federal Regulators in 2014 of Possible Breakup, Court Filing Shows

January 27 2016 - 5:51PM

Dow Jones News

By Leslie Scism

MetLife Inc. Chief Executive Steven Kandarian warned federal

regulators 15 months ago that the big life insurer could split up

if subjected to stricter U.S. oversight, according to new court

documents filed Wednesday.

"Frankly, what we have under consideration is a breakup of

MetLife," Mr. Kandarian said at a closed-door hearing of the

Financial Stability Oversight Council on Nov. 3, 2014.

The CEO's comments, which haven't previously been reported, came

about six weeks before the panel of U.S. regulators concluded

MetLife posed significant risks to the financial system and

warranted tougher oversight. It was the fourth nonbank financial

firm to be designated as a "systemically important" firm after

rival insurers American International Group Inc. and Prudential

Financial Inc., and General Electric Co.'s finance arm.

MetLife is now challenging that designation in federal court,

saying it doesn't pose risks to the financial system and that the

government used flawed metrics in reaching its decision. On

Wednesday it filed a transcript of the 2014 hearing with some

portions unredacted.

Mr. Kandarian said at the hearing he raised the prospect of a

breakup because "I don't want people to say later on, 'Geez, we had

no idea that you were thinking of this,' " according to the

transcript.

Earlier this month, MetLife said it would divest a large part of

its U.S. life-insurance business, both for strategic reasons and to

ease some of the capital burden it anticipates facing as a

systemically important firm. The Federal Reserve has yet to develop

rules for MetLife and two other insurers designated as systemically

important.

At the 2014 hearing Mr. Kandarian identified greater capital

requirements as a primary concern, saying that an investment bank

had been hired to analyze the potential impact.

"If the capital rules are extremely harsh from our perspective

and makes us uncompetitive in certain lines of business, then we

will have to exit those businesses in some form," he said,

according to the transcript. "And that is what is being studied:

How would you do that? How would you exit those businesses?"

At the time, MetLife was concerned the Fed would use rules

tailored for the banking industry, as the Fed hadn't historically

regulated insurance companies. MetLife's fear was that such

bank-centric rules could result in unusually steep capital amounts

for MetLife.

Since then, the Fed has indicated it would adjust rules for the

insurance industry. But MetLife has said the insurer would still

operate at a disadvantage as compared with smaller rivals.

Write to Leslie Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

January 27, 2016 17:36 ET (22:36 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

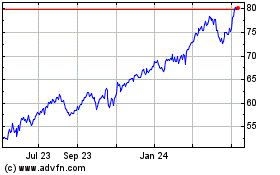

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

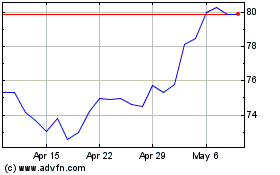

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024