Meredith Corp. Left at the Altar Again

January 27 2016 - 11:30AM

Dow Jones News

For the second time in three years, Meredith Corp. is left

without a dance partner.

Meredith on Wednesday agreed to let Media General Inc. abandon

its $2.4 billion merger agreement, capping a five-month drama that

hit turbulence as soon as Nexstar Broadcasting Group Inc. publicly

made a bid for Media General in late September. For Meredith, the

deal with Media General would have created a larger, more

competitive business—bolstering its local television stations

across the U.S. and reducing its exposure to the magazine business.

Instead, Nexstar will walk away with Media General.

It isn't the first time Meredith shareholders have been left

empty-handed. In early 2013, Meredith was involved in extensive

talks to create a new company by combining most of Time Warner

Inc.'s magazine group with Meredith's magazine portfolio that

includes titles like Family Circle and Better Homes and Gardens.

However, that deal eventually unraveled, and Time Warner instead

decided to spin off Time Inc. into a separate, publicly traded

company.

This time, Meredith is walking away with a $60 million breakup

fee—not the heftier payment they were said to be pushing for in

order to agree to let Media General terminate their deal, but a

cash consolation nonetheless. Meredith also gained the right to

negotiate for the purchase of some Media General assets. The

question is what will the more-than-century-old company do now?

With its shares down 25% in the last year, Meredith could use

the cash windfall to buy back more stock and increase its dividend

that pays out $1.83 a share annually, according to a person

familiar with the company's thinking. As of Wednesday morning,

Meredith shares were up 2.1% to $39.72, giving the company a market

value of about $1.8 billion.

"We entered into this potential transaction opportunistically

and from a position of strength as a very successful stand-alone

company," said Stephen Lacy, Meredith's chief executive, via email.

"While we worked hard to close the merger, we worked just as hard

over the last year—and last several years for that matter—to create

a strong Meredith Corporation."

From an operational standpoint, Meredith is left with its 17

local TV stations that reach 11% of U.S. households and a portfolio

of magazines such as Parents and Eating Well. It is one of the few

U.S. media companies that have chosen to keep its TV and publishing

assets under one roof.

Media conglomerates including Time Warner, Tribune, News Corp.

(owner of The Wall Street Journal), Washington Post Co. and Scripps

separated off print assets in recent years that had become less

profitable as readers and advertisers migrated online. Even Gannett

Co. last year spun off its publishing business and renamed its

broadcasting and digital-media business Tegna Inc.

Meredith, on the other hand, has maintained an interest in

publishing, even adding titles like Shape and Martha Stewart

brands.

The fact that Meredith hadn't separated its broadcast and print

properties was clearly an issue in the deal with Media General,

which had sold off its newspapers in 2012, according to Carl Salas,

an analyst at Moody's Investors Service.

"One of the concerns was that Media General had earlier exited

the publishing business, and with the Meredith deal they would be

bringing it back," Mr. Salas said.

In fact, Nexstar CEO Perry Sook made that same point during his

efforts to break up the Meredith-Media General deal. In a September

letter to Media General, he said the proposed combination with

Meredith "exposes Media General once again to the publishing

business" and creates a company with an earnings mix "with

significant exposure toward publishing."

Peter Kreisky, a media consultant, said that Meredith will now

be under greater pressure to find a new path forward.

"They need greater scale. The question is should they be

acquired or acquire more companies," said Mr. Kreisky. "There is

little real fit between print and local television stations.

Perhaps spinning out the television group would generate additional

value."

A successful deal with Media General would have boosted

Meredith's broadcasting footprint to 88 local TV stations reaching

39% of U.S. households. For broadcasters like Meredith, scale

increasingly matters when negotiating for the lucrative

retransmission fees that cable companies pay to carry their

signals.

"Meredith has got some great top 20 stations, but what they need

to do is find some new partnerships and create scale," said Mr.

Salas of Moody's. "Larger broadcasters with bigger footprints will

be better positioned in the future."

Write to Jeffrey A. Trachtenberg at

jeffrey.trachtenberg@wsj.com

(END) Dow Jones Newswires

January 27, 2016 11:15 ET (16:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

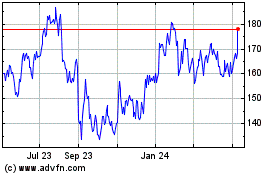

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Mar 2024 to Apr 2024

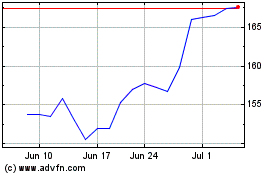

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Apr 2023 to Apr 2024