UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 22, 2016

VAPOR CORP.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-36469 |

|

84-1070932 |

| (State or Other Jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

3001 Griffin Road

Dania Beach, Florida 33312

(Address of Principal Executive Office) (Zip

Code)

(888) 766-5351

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

x

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 3 Securities and Trading Market

Item 3.01. Notice of Delisting

or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On January 22, 2016, Vapor Corp. (the “Company”)

received a letter from the Listing Qualifications Staff (the “Staff”) of The NASDAQ Stock Market LLC (“Nasdaq”)

indicating that the Staff had determined to delist the Company’s securities based upon its concerns that the Company’s

continued listing on Nasdaq, particularly pursuant to a grace period within which to regain compliance with the $1.00 bid price

requirement set forth in Nasdaq Listing Rule 5450, is no longer in the public interest as that concept is described in Nasdaq Listing

Rule 5110 (the “Staff Determination”). Specifically, the Staff indicated that, given the potential for dilution of

the Company’s stockholders that may be caused by the cashless exercise provision of the Company’s Series A warrants,

the Staff believes that the grace period provided to the Company to regain compliance with the $1.00 bid price requirement is no

longer warranted.

As previously disclosed, on September 14, 2015,

the Staff notified the Company that, based upon its non-compliance with the minimum $1.00 bid price requirement for the prior 30

consecutive business days, the Company – in accordance with the Nasdaq Listing Rules – had been provided a grace period,

through March 14, 2016, to regain compliance with the minimum bid price requirement.

The Company plans to request a hearing before

the Nasdaq Listing Qualifications Panel (the “Panel”), which will stay any action arising from the Staff Determination

until the Panel renders a decision subsequent to the hearing. The Company will address the Staff’s concerns and request the

continued listing of its common stock at the hearing before the Panel. There can be no assurance, however, that the Panel will

grant the Company’s request for continued listing on Nasdaq.

Section 8 Other Events

Item 8.01. Other Events.

On January 26, 2016, the Company issued a press

release announcing its receipt of the notice from Nasdaq (described above). A copy of the press release is attached as Exhibit

99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

Exhibit

No. |

|

Exhibit |

| |

|

|

| 99. 1 |

|

Press release dated January 22, 2016. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VAPOR CORP. |

| |

|

|

| Date: January 26, 2016 |

By: |

/s/ Jeffrey Holman |

| |

Name: |

Jeffrey Holman |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

Investor Contacts:

Jeffrey Goldberger / Garth Russell

KCSA Strategic Communications

jgoldberger@kcsa.com / grussell@kcsa.com

(212)-896-1249 / (212)-896-1250

VAPOR

CORP. ANNOUNCES RECEIPT OF NASDAQ LISTING DETERMINATION; INTENDS TO REQUEST HEARING

DANIA BEACH, Fla., Jan.

26, 2016 — Vapor Corp. (NASDAQ: VPCO) (the “Company”), a leading U.S.-based distributor and retailer of vaporizers,

e-liquids, e-cigarettes and e-hookahs, today announced that it received notice that the Nasdaq Listing Qualifications Staff had

determined that the continued listing of Vapor’s common stock is no longer in the public interest as that concept is described

in Nasdaq Listing Rule 5110. The Staff indicated that, given the potential for dilution of Vapor’s shareholders that may

be caused by the cashless exercise provision of Vapor’s Series A warrants, the Staff believes that the grace period provided

to Vapor to regain compliance with the $1.00 bid price requirement is no longer warranted.

Vapor plans to request

a hearing before the Nasdaq Listing Qualifications Panel (the “Panel”), which will stay any action arising from the

Staff’s determination at least pending the issuance of a decision by the Panel subsequent to the hearing and the ultimate

conclusion of the hearing process. Vapor will address the Staff’s concerns and request the continued listing of its common

stock at the hearing before the Panel. There can be no assurance, however, that the Panel will grant Vapor’s request for

the continued listing of its common stock on Nasdaq.

About

Vapor Corp.

Vapor

Corp., a Nasdaq company, is a U.S. based distributor and retailer of vaporizers, e-liquids and electronic cigarettes. It recently

acquired the retail store chain “The Vape Store” as part of a merger with Vaporin, Inc. The Company’s innovative

technology enables users to inhale nicotine vapor without smoke, tar, ash or carbon monoxide. Vapor Corp. has a streamlined supply

chain, marketing strategies and wide distribution capabilities to deliver its products. The Company’s brands include VaporX®,

Krave®, Hookah Stix® and Vaporin™ and are distributed to retail stores throughout the U.S. and Canada. The Company

sells direct to consumer via e-commerce and Company-owned brick-and-mortar retail locations operating under “The Vape Store”

brand.

Safe

Harbor Statement

Safe

Harbor Statements under the Private Securities Litigation Reform Act of 1995: The Material contained in this press release may

include statements that are not historical facts and are considered “forward-looking” statements within the meaning

of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect Vapor Corp.’s current views

about future events, financial performances, and project development. These “forward-looking” statements are identified

by the use of terms and phrases such as “will,” “believe,” “expect,” “plan,” “anticipate,”

and similar expressions identifying forward-looking statements. Investors should not rely on forward-looking statements because

they are subject to a variety of risks, uncertainties, and other factors that could cause actual results to differ materially from

Vapor’s expectations. These risk factors include, but are not limited to, the risks and uncertainties identified by Vapor

Corp. under the headings “Risk Factors” in its latest Annual Report on Form 10-K. These factors are elaborated upon

and other factors may be disclosed from time to time in Vapor Corp.’s filings with the Securities and Exchange Commission.

Vapor Corp. expressly does not undertake any duty to update forward-looking statements.

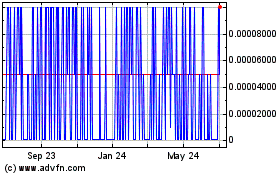

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

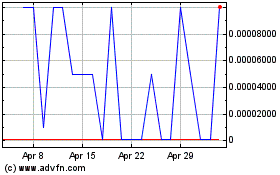

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Apr 2023 to Apr 2024