Lightyear Capital to Offer Retention Deals to AIG Advisers

January 26 2016 - 7:16PM

Dow Jones News

By Veronica Dagher and Michael Wursthorn

Private-equity firm Lightyear Capital Group LLC plans to offer

retention deals to many of the more than 5,000 independent advisers

who work with AIG Advisor Group.

On Tuesday American International Group announced the sale of

AIG Advisor Group to Lightyear Capital and PSP Investments, the

Canadian pension investment manager. Terms of the deal weren't

disclosed.

Executives from Lightyear declined to share terms of the

retention deals. They will start their conversations with advisers

on Wednesday, the firm said.

The AIG unit's four brokerages--FSC Securities Corp., Royal

Alliance Associates, SagePoint Financial and Woodbury Financial

Services--provide customer-account custody and other services to

advisers who aren't employees but rather own their own

businesses.

Financial packages that encourage advisers to stay at a firm for

several years are typical at the largest brokerages, whose

financial advisers are employees. They are generally less common

and smaller at brokerages that service independent advisers,

industry recruiters say.

Advisers at those smaller firms "are evaluating their choices

constantly, " and a firm's resources are "what often keeps them in

their seats," said Danny Sarch, a financial-adviser recruiter for

Leitner Sarch Consultants in White Plains, N.Y.

Meanwhile, an executive named Tuesday to oversee the brokerage

unit being sold by AIG said she doesn't expect the transaction to

bring big changes to the advisers who work with the firm.

Advisers tend to brace for changes when a brokerage company is

sold or there is a management shake-up. But the AIG Advisor Group

sale won't have a big day-to-day impact on advisers, said Valerie

Brown, the incoming executive chairman. Under its new ownership,

the firm will invest in technology, add products and help advisers

better serve clients, Ms. Brown said.

Ms. Brown is a former chief executive officer of Cetera

Financial Group, another brokerage network.

Erica McGinnis will continue as chief executive officer of AIG

Advisor Group.

Lightyear has more experience in the wealth-management space

than most private-equity firms. Lightyear Chairman and Founder

Donald Marron had been chief executive of PaineWebber Group Inc., a

major brokerage that was acquired by UBS AG in 2000 for $10.8

billion. Leaning on Mr. Marron's expertise, Lightyear used some of

its capital in 2010 to buy three brokerages from ING Group NV to

form Cetera Financial Group. Lightyear sold Cetera to RCS Capital

Corp. in 2014.

Mr. Marron said that while his focus will be investing in the

existing AIG Advisor Group business, he would consider making more

acquisitions of brokerages in the future. "Every firm wants to

expand. It's a matter of timing," he said.

Write to Veronica Dagher at veronica.dagher@wsj.com and Michael

Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

January 26, 2016 19:01 ET (00:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

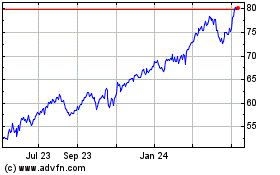

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

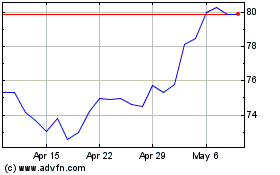

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024