UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 26, 2016 (January 20, 2016)

National CineMedia, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-33296 |

|

20-5665602 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

file number) |

|

(IRS employer

identification no.) |

National CineMedia, LLC

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

333-176056 |

|

20-2632505 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

file number) |

|

(IRS employer

identification no.) |

9110 E. Nichols Ave., Suite 200

Centennial, Colorado 80112-3405

(Address of principal executive offices, including zip code)

(303) 792-3600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 210.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

Compensation for Chairman of the Board

On January 20, 2016, the Board of Directors of National CineMedia, Inc. (the “Company”) appointed Scott N. Schneider,

currently Chairman of the Company’s Board of Directors, as the Non-employee Executive Chairman of the Board of Directors of the Company. The term of his appointment (the “Chairmanship Term”) is from January 4, 2016 through the

earliest of (1) December 31, 2016, (2) the death of Mr. Schneider or (3) the removal of Mr. Schneider from the Board of Directors of the Company.

In connection with Mr. Schneider’s new position, the Company, National CineMedia, LLC and Mr. Schneider entered into a Director

Service Agreement, dated January 22, 2016, with a term ending at the end of the Chairmanship Term. Under the terms of the Director Service Agreement, the Company will pay Mr. Schneider $675,000 for his services, $405,000 of which is

payable in cash. The remainder of the compensation is a grant of restricted stock units (“RSU”) of 17,988 shares of Company stock ($270,000 divided by $15.01, the closing price of the Company’s common stock on January 20, 2016).

This RSU award vests in full on January 20, 2017. This compensation to Mr. Schneider is in lieu of other Board of Director and Board Committee compensation otherwise payable in 2016.

The Company’s Compensation Committee also awarded Mr. Schneider a one-time payment in consideration for extraordinary services

during 2015 undertaken in his role as the Company’s lead director, including for work in connection with the succession of the Company’s past chief executive officer to the Company’s new chief executive officer on January 1,

2016. This one-time payment was $1,000,000, $600,000 of which is payable in cash. The remaining portion was a fully-vested RSU award of 26,648 shares of Company stock ($400,000 divided by $15.01, the closing price of the Company’s common stock

on January 20, 2016).

A copy of the Director Service Agreement is included as Exhibit 10.1.

2016 Restricted Stock Awards to Executive Officers

The Compensation Committee of the Board of Directors of the Company granted performance-based and time-based restricted stock awards to each of

the Company’s executive officers effective January 20, 2016, as described in greater detail below.

The following table shows

the target number of Performance-Based Restricted Stock and Time-Based Restricted Stock for each executive officer:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name and Position |

|

Number of

Target

Shares of

Performance

- Based

Restricted

Stock (1) |

|

|

Number of

Shares of

Time -

Based

Restricted

Stock |

|

|

Total

Number of

Shares of

Restricted

Stock |

|

| Andrew J. England

Chief Executive Officer & Director |

|

|

74,950 |

|

|

|

24,983 |

|

|

|

99,933 |

|

| Clifford E. Marks

President of Sales & Marketing |

|

|

92,503 |

|

|

|

61,669 |

|

|

|

154,172 |

|

| Alfonso P. Rosabal, Jr.

EVP, Chief Operations Officer & Chief Technology Officer |

|

|

32,778 |

|

|

|

21,852 |

|

|

|

54,630 |

|

| Ralph E. Hardy

Executive Vice President & General Counsel |

|

|

21,279 |

|

|

|

14,186 |

|

|

|

35,465 |

|

| David J. Oddo

Senior Vice President, Finance & Interim Co-Chief Financial Officer |

|

|

4,582 |

|

|

|

13,745 |

|

|

|

18,327 |

|

| Jeffrey T. Cabot

Senior Vice President, Controller & Interim Co-Chief Financial Officer |

|

|

5,126 |

|

|

|

15,379 |

|

|

|

20,505 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Executive Officers as a Group |

|

|

231,218 |

|

|

|

151,814 |

|

|

|

383,032 |

|

| (1) |

Reflects the target number of shares that will vest if actual cumulative Free Cash Flow equals 100% of the three-year cumulative Free Cash Flow target. The performance-based restricted stock awards are scheduled to vest

based on the scale shown below. The Compensation Committee may apply other pre-determined adjustments to the definition of Free Cash Flow under the plan The performance-based restricted shares are scheduled to vest on the 60th day following the last day of the three-year measurement period (the “Vesting Date”) and include the right to receive regular and special cash dividends accrued over the vesting period, if

and when the underlying shares vest. Below is a summary of how the number of vested shares of restricted stock will be determined based on the level of achievement of actual cumulative Free Cash Flow. |

1

|

|

|

| Free Cash Flow - % of Target |

|

Award Vesting % of Target Shares |

| <80% |

|

None |

| 80% |

|

25% |

| 95% |

|

90% |

| 100% |

|

100% |

| ³110% |

|

150% |

If actual cumulative Free Cash Flow is between 80% and 110% of the target, the award will be determined by

interpolation according to the scale above.

The time-based restricted shares are scheduled to vest 33.33% on the first, second and third

anniversaries of the grant date, subject to continuous service. The time-based restricted shares include the right to receive regular and special cash dividends, if and when the underlying shares vest.

Upon vesting of the restricted stock described above, National CineMedia, LLC (“NCM LLC”) will issue common membership units to the

Company equal to the number of shares of the Company’s common stock represented by such restricted stock.

2016 Base Salaries for Executive

Officers

The Compensation Committee approved the following 2016 base salaries effective January 20, 2016.

Mr. England’s base salary is $750,000 as of January 1, 2016 per the terms of his previously disclosed employment agreement.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2016 Base

Salary |

|

|

2015 Base

Salary |

|

|

Percentage

Increase |

|

| Name and Position |

|

(in thousands) |

|

|

|

|

| Clifford E. Marks

President of Sales & Marketing |

|

$ |

842 |

|

|

$ |

825 |

|

|

|

2 |

% |

| Alfonso P. Rosabal, Jr.

EVP, Chief Operations Officer & Chief Technology Officer |

|

$ |

410 |

|

|

$ |

341 |

|

|

|

20 |

% (1) |

| Ralph E. Hardy

Executive Vice President & General Counsel |

|

$ |

304 |

|

|

$ |

298 |

|

|

|

2 |

% |

| David J. Oddo

Senior Vice President, Finance & Interim Co-Chief Financial Officer |

|

$ |

183 |

|

|

$ |

180 |

|

|

|

2 |

% |

| Jeffrey T. Cabot

Senior Vice President, Controller & Interim Co-Chief Financial Officer |

|

$ |

205 |

|

|

$ |

201 |

|

|

|

2 |

% |

| (1) |

Mr. Rosabal received a 2% increase in total direct compensation (salary, bonus and restricted stock), with a shift in pay mix from restricted stock to salary to better align his compensation with the compensation

of other executives at our peer companies. Specifically, Mr. Rosabal received a 20% increase in salary and a 10% reduction in restricted stock grant value. |

2

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Director Service Agreement dated January 22, 2016, among National CineMedia, Inc., National CineMedia, LLC and Scott Schneider. |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each of NCM, Inc. and NCM LLC has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

NATIONAL CINEMEDIA, INC. |

|

|

|

|

| Dated: January 26, 2016 |

|

|

|

By: |

|

/s/ Ralph E. Hardy |

|

|

|

|

|

|

Ralph E. Hardy |

|

|

|

|

|

|

Executive Vice President, General Counsel and Secretary |

|

|

|

|

|

|

|

NATIONAL CINEMEDIA, LLC |

|

|

|

|

|

|

|

|

By: |

|

National CineMedia, Inc., its manager |

|

|

|

|

| Dated: January 26, 2016 |

|

|

|

By: |

|

/s/ Ralph E. Hardy |

|

|

|

|

|

|

Ralph E. Hardy |

|

|

|

|

|

|

Executive Vice President, General Counsel and Secretary |

4

Exhibit Index

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Director Service Agreement dated January 22, 2016, among National CineMedia, Inc., National CineMedia, LLC and Scott Schneider. |

5

Exhibit 10.1

DIRECTOR SERVICE AGREEMENT

THIS DIRECTOR SERVICE AGREEMENT (this “Agreement”) is made this 22, day of January 2016, by and among National

CineMedia, Inc. (“NCM Inc.” or the “Company”) and National CineMedia, LLC (“NCM LLC”) and Scott Schneider (the “Director”).

WHEREAS, each of the Company and NCM LLC desires to retain the services of the Director as the Non-Employee Executive Chairman of Board

of Directors of the Company for the benefit of the Company, NCM LLC and their respective equityholders; and

WHEREAS, the Director

desires to serve as the Non-Employee Executive Chairman of the Board of Directors of the Company;

NOW, THEREFORE, in consideration

of the foregoing recitations, the mutual promises hereinafter set forth and other good and valuable consideration, the receipt and sufficiency of which are acknowledged hereby, the parties hereto, intending legally to be bound, hereby covenant and

agree as follows:

SECTION 1. DUTIES. During the Chairmanship Term (as hereinafter defined), the Director will fulfill his

fiduciary duties, make commercially reasonable efforts to attend all prescheduled Board meetings, serve on appropriate committees as reasonably requested and agreed upon by the Board, make himself available to the Company or NCM LLC at mutually

convenient times and places and perform such duties, services and responsibilities, and have the authority commensurate to his position as Non-Employee Executive Chairman of the Board, including serving as a liaison between the Board, on the one

hand, and the Chief Executive Officer and management, on the other hand. For the avoidance of doubt, the Director will not serve in a policy-making function.

SECTION 2. TERM. The “Chairmanship Term,” as used in this Agreement, shall mean the period of time commencing on

January 4, 2016 and terminating on the earliest of (i) December 31, 2016, (ii) the death of the Director or (iii) the removal of the Director from the Board.

SECTION 3. COMPENSATION.

| |

a. |

Fees. In consideration for the services (described in Section 1 hereto) to be provided by Director during the Chairmanship Term,

the Company shall pay to the Director an amount equal to $675,000 (“Chairman Fee”); provided, however, that if, prior to the expiration of the Chairmanship Term, the Director voluntarily resigns from his position as Non-Employee

Executive Chairman of the Board of the Directors of the Company, the aggregate amount payable by the Company to the Director pursuant to this Section 3(a) shall be only that portion of the Chairman Fee earned as of the Director’s

|

| |

resignation date. A portion of the Director Fee ($405,000) will be paid in a single cash payment, promptly, but in any event not later than the Company pays Board/Committee cash retainers for

2016 to certain other Board members. The Company anticipates that the payment will occur on or before January 31, 2016. The remainder of the Chairman Fee will be comprised of that number of shares of NCM time-based restricted stock (to vest 12

months after the grant date) equal to (a) $270,000 divided by (b) the closing price of one share of NCM common stock on January 20, 2016; provided, however, that no fractional shares shall be issued. |

| |

b. |

Expense Reimbursement. During the Chairmanship Term, the Company shall reimburse Director for all reasonable business expenses actually paid or incurred by Director in the course of, pursuant to and

in furtherance of providing the services hereunder, and such reimbursement of expenses shall be made no later than thirty (30) days following such submission of supporting documentation. |

SECTION 4. TERMINATION. Notwithstanding anything to the contrary contained in this Agreement, this Agreement shall terminate on

the earlier of the following to occur:

(i) the expiration of the Chairmanship Term; or

(ii) upon the payment by the Company of all amounts due to the Director (including the earned portion of the Chairman Fee) in the event of the

Director’s voluntary resignation from his position as Non-Employee Executive Chairman of the Board of the Directors of the Company.

SECTION 5. MISCELLANEOUS.

| |

a. |

Entire Agreement; Amendment. This Agreement constitutes the entire agreement between the parties hereto with respect to the subject matter hereof and supersede all prior agreements, understandings,

negotiations and discussions, both written and oral, among the parties hereto. This Agreement may not be amended or modified in any way except by a written instrument executed by each of the parties hereto. |

| |

b. |

Notice. All notices under this Agreement shall be in writing and shall be given by personal delivery, or by registered or certified United States mail, postage prepaid, return receipt requested, to the

address set forth below |

|

|

|

|

|

| If to the Director: |

|

|

|

Scott Schneider |

|

|

|

|

1 Parley Lane |

|

|

|

|

Ridgefield, CT 06877 |

|

|

|

| If to the Company: |

|

|

|

National CineMedia, Inc. |

|

|

|

|

9110 East Nichols Avenue, Suite 200 |

|

|

|

|

Centennial, CO 80112 |

|

|

|

|

Attention: Ralph E. Hardy, General Counsel |

|

|

|

| If to the NCM LLC: |

|

|

|

National CineMedia, LLC |

|

|

|

|

9110 East Nichols Avenue, Suite 200 |

|

|

|

|

Centennial, CO 80112 |

|

|

|

|

Attention: Ralph E. Hardy, General Counsel |

or to such other person or persons or to such other address or addresses as Director and the Board or the

Company or their respective successors or assigns may hereafter furnish to the other by notice similarly given. Notices, if personally delivered, shall be deemed to have been received on the date of delivery, and if given by registered or certified

mail, shall be deemed to have been received on the fifth business day after mailing.

| |

c. |

Governing Law. The rights and obligations of the Parties hereunder shall be construed and enforced in accordance with, and shall be governed by, the laws of the State of Colorado, without regard to

principles of conflict of laws. |

| |

d. |

Assignment: Successors and Assigns. No Party hereto may make any direct or indirect assignment or subcontracting of this Agreement or any interest herein, by operation of laws or otherwise, without the

prior written consent of the other Parties hereto. This Agreement shall inure to the benefit of and be binding upon the Parties hereto and their respective heirs, personal representatives, executors, legal representatives, successors and permitted

assigns. |

| |

e. |

Severability. The invalidity of any one or more of the words, phrases, sentences, clauses, sections or subsections contained in this Agreement shall not affect the enforceability of the remaining portions

of this Agreement or any part thereof, all of which are inserted conditionally on their being valid in law, and, in the event that any one or more of the words, phrases, sentences, clauses, sections or subsections contained in this Agreement shall

be declared invalid by a court of competent jurisdiction, then this Agreement shall be construed as if such invalid word or words, phrase or phrases, sentence or sentences, clause or clauses, section or sections, or subsection or subsections had not

been inserted. |

| |

f. |

Section Headings. The section or other headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of any or all of the provisions of

this Agreement. |

| |

g. |

Counterparts; Facsimile. This Agreement may be executed in multiple counterparts, any one of which need not contain the signatures of more than one party, but all such counterparts taken together shall

constitute one and the same instrument. Any signature page delivered by facsimile or PDF signature shall be binding to the same extent as an original signature page with regard to any agreement subject to the terms hereof or any amendment thereto.

|

IN WITNESS WHEREOF, the undersigned have executed this Agreement as of the date first above written.

|

|

|

|

|

| Dated:1/22/2016 |

|

/s/ Scott Schneider |

|

|

Scott Schneider (Director) |

|

|

|

|

National CineMedia, Inc. |

|

|

| Dated:1/22/2016 |

|

/s/ Ralph E. Hardy |

|

|

By: |

|

Ralph E. Hardy |

|

|

|

|

Executive Vice President and General

Counsel |

|

|

|

|

National CineMedia, LLC |

|

|

|

|

|

By: |

|

National CineMedia, Inc., |

|

|

|

|

Its Manager |

|

|

| Dated:1/22/2016 |

|

/s/ Ralph E. Hardy |

|

|

By: |

|

Ralph E. Hardy |

|

|

|

|

Executive Vice President and General

Counsel |

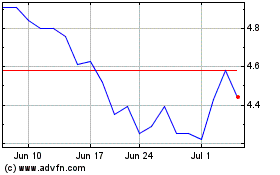

National CineMedia (NASDAQ:NCMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

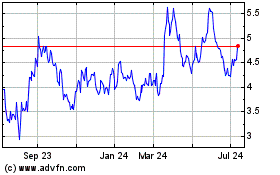

National CineMedia (NASDAQ:NCMI)

Historical Stock Chart

From Apr 2023 to Apr 2024