By Ellie Ismailidou and Victor Reklaitis, MarketWatch

Sprint surges 18% after strong earnings; energy sector

bounces

U.S. stocks marched sharply higher Tuesday, as energy stocks

soared amid a rally in oil prices.

Big earnings-driven gains in market bellwethers like Sprint

Corp., Procter & Gamble Co., and 3M Co. added steam to the

rally as Wall Street sought to find its footing after what has so

far been an awful start to 2016.

The S&P 500 gained 25 points, or 1.4%, to 1,902, with all 10

major sectors showing gains. The Dow Jones Industrial Average

flirted with a 300-point gain before pulling back. It was last up

266 points, or 1.7%, at 16,152, still more than reversing Monday's

losses.

Shares of 3M (MMM) up 4.2%, led blue-chip advancers, after the

industrial-goods company beat fourth-quarter earnings expectations

(http://www.marketwatch.com/story/3m-beats-fourth-quarter-earning-expectations-2016-01-26).

The Nasdaq Composite reversed early losses to trade up 51

points, or 1.1%, at 4,569.

The energy sector led gains for the S&P as it surged 3.3% on

the day. But it has still tumbled 8.3% since the beginning of the

year. Among individual stocks, Chesapeake Energy Corp (CHK) leapt

6.8%, and Dover Corp. (DOV) climbed up 5.8%.

The energy sector also buoyed the Dow industrials, with Chevron

Corp. (CVX), up 3.8%, posting the benchmark's second-best

performance.

Oil is "the main driver of risk assets nowadays," Hans

Mikkelsen, Bank of America's credit strategist said in a note.

However, "before fear turns to greed there is an intermediate stage

of short covering," he added.

Oil futures

(http://www.marketwatch.com/story/crude-prices-slide-below-30-with-traders-gloomy-about-oversupply-2016-01-26)

erased early losses and jumped 5.8% to above $32 a barrel. Both

stocks and oil prices had skidded Monday. The S&P 500 closed

1.6% lower

(http://www.marketwatch.com/story/us-stock-futures-knocked-lower-by-slide-in-oil-prices-2016-01-25),

while the Dow lost 1.3%, or 208 points.

Also read: What oil prices really say about the stock market's

future

(http://www.marketwatch.com/story/what-oil-prices-really-say-about-the-stock-markets-future-2016-01-26)

Analysts also speculated that part of Tuesday's rally was due to

reallocation of funds from bonds to equities.

(https://twitter.com/MarkNewtonCMT/status/691976910843154432)

The fact that the equity markets "recently dislocated, and in

some cases unjustifiably so, has created opportunities," said Ryan

Larson, head of equity trading at RBC Global Asset Management,

fueling market chatter that "money is moving back into

equities."

Some analysts warned that stock-market bulls are in a tough

spot, and stocks could make big swings between gains and

losses.

"A lot of technical damage has been done over the last few

weeks, and the bulls have their work cut out for them," said Colin

Cieszynski, chief market strategist at CMC Markets, in a note late

Monday. "Because of this, we may continue to see significant

intraday swings in both directions, creating opportunities for

short-term trading."

Read:S&P will end this year at 2,000, not 2,200, J.P.

Morgan's strategist says

(http://www.marketwatch.com/story/sp-will-end-this-year-at-2000-not-2200-jp-morgans-strategist-says-2016-01-26)

Fresh data emphasized the housing market's strength. The

S&P/Case-Shiller home price index showed that U.S. home prices

accelerate at their fastest pace in 16 months during November

(http://www.marketwatch.com/story/home-prices-accelerate-to-fastest-pace-in-16-months-in-november-spcase-shiller-2016-01-26).

The Federal Housing Finance Agency said house-price gains pushed

past their 2007 peaks

(http://www.marketwatch.com/story/house-price-gains-push-past-2007-peaks-fhfa-says-2016-01-26).

Read more: Why the stock market has established a low--but not

the low

(http://www.marketwatch.com/story/the-stock-market-has-established-a-low-but-not-the-low-these-chart-watchers-say-2016-01-25)

Other markets: U.S. markets shrugged off a plunge in China's

Shanghai Composite Index , which finished down 6.4%

(http://www.marketwatch.com/story/asian-stocks-slide-again-on-oil-weakness-2016-01-25)

and ended below 2,800 for the first time since December 2014.

European stocks

(http://www.marketwatch.com/story/european-stocks-under-pressure-as-oil-sells-off-again-2016-01-26)

ended higher, also lifted by oil, while gold futures

(http://www.marketwatch.com/story/gold-rallies-as-oil-china-jitters-fuel-safe-haven-flight-2016-01-26)

rose. The dollar rose against its main rivals.

(http://www.marketwatch.com/story/dollar-weakens-as-investors-hit-the-sidelines-ahead-of-fed-boj-meetings-2016-01-26)

Stocks to watch: Sprint Corp.'s stock (S) soared 18.5% after the

telecommunications company reported narrower-than-expected fiscal

third-quarter loss

(http://www.marketwatch.com/story/sprints-stock-rockets-after-narrower-than-expected-loss-upbeat-outlook-2016-01-26).

Shares in Procter & Gamble Co. (PG) rose 2.5% after the

consumer-goods company adjusted quarterly profit beat Wall Street's

forecasts

(http://www.marketwatch.com/story/procter-gamble-sales-bouyed-by-higher-prices-2016-01-26).

Johnson & Johnson (JNJ) and Coach Inc. (COH) both posted

profit that topped estimates, but revenue that fell short. Coach

shares jumped 11% to lead the S&P 500, while J&J was up

3.9%.

DuPont Co.'s (DD) shares rose 1.7% after revenue missed

expectations

(http://www.marketwatch.com/story/duponts-quarterly-revenue-misses-wall-streets-expectations-2016-01-26).

Shares of American International Group Inc. (AIG) added 1.3%

after the insurance company said it would sell its broker-dealer

network

(http://www.marketwatch.com/story/aig-to-sell-broker-dealer-network-ipo-part-of-mortgage-insurance-unit-2016-01-26),

conduct a partial spinoff of its mortgage-insurance unit and more

aggressively cut costs.

Apple Inc. (AAPL) and AT&T Inc. (T) are among the companies

slated to report quarterly results after the market's close.

Read more: Apple earnings optimism may be 'detached from

reality'

(http://www.marketwatch.com/story/apple-earnings-optimism-may-be-detached-from-reality-2016-01-21)

Economic news:A reading on consumer confidence topped

expectations

(http://www.marketwatch.com/story/consumer-confidence-rises-in-january-as-market-volatility-shrugged-off-2016-01-26),

rising to 98.1 in January from 96.3 in the previous month, despite

the turmoil on Wall Street.

The Federal Reserve began a two-day meeting, with a statement

due Wednesday afternoon. The meeting is seen by many as a nonevent,

but other analysts have warned that slight shifts in Fed statements

often have big impact

(http://www.marketwatch.com/story/slight-shifts-in-fed-statements-often-have-big-impact-analyst-says-2016-01-25).

(http://www.marketwatch.com/story/why-ubs-says-housing-may-surprise-to-the-upside-2016-01-25)--Sara

Sjolin contributed to this article.

(END) Dow Jones Newswires

January 26, 2016 13:40 ET (18:40 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

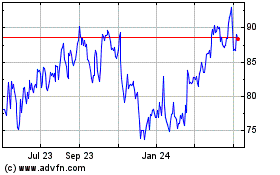

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

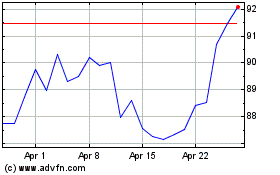

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024