Steel Dynamics Loss Widens

January 25 2016 - 8:00PM

Dow Jones News

Steel Dynamics Inc. on Monday reported a wider fourth-quarter

loss as it booked $435 million in charges largely tied to its

beleaguered metals-recycling operations.

The Fort Wayne, Ind., company had warned last month the

recycling segment, which accounts for roughly 40% of annual

revenue, would go into the red.

Shares, largely flat in late trading, closed Monday at $15.96,

down 6% over the past 12 months and just above a 52-week-low set

last week.

Over all, the steelmaker and metals recycler reported a loss of

$253.2 million, or $1.04 a share, compared with a year-earlier loss

of $45 million, or 19 cents a share. Excluding impairment charges

and other items, Steel Dynamics reported a profit of nine cents a

share, compared with 40 cents a year earlier.

The company had projected profit of three cents to seven cents a

share.

Revenue, meanwhile, fell 37% to $1.59 billion.

Analysts surveyed by Thomson Reuters had projected seven cents a

share on $1.7 billion in revenue.

Gross margin narrowed to 9.1% from 11.6% a year earlier.

Oversupply—exacerbated by an economic slowdown in China, the

world's largest steel producer and user—has battered the sector,

driving down steel prices and forcing steelmakers to idle mills and

lay off workers.

The benchmark hot-rolled coil price in the U.S. is down about

32% over the past 12 months to $400 a ton.

The average steel product selling price fell to $614 a ton, from

$806 a ton a year earlier and $665 during the previous quarter, the

company said. Meanwhile, the average ferrous scrap cost per ton

melted fell to $205, from $346 a year earlier and $252 in the

preceding quarter.

The steel production utilization rate declined to 73%, compared

with 84% in the year-earlier period and 82% in the previous

quarter.

Founded in 1993 as a "minimill" to make steel from scrap metal,

Steel Dynamics has expanded into one of the largest carbon steel

producers in the U.S. But like its industry peers, Steel Dynamics

has been battered by sharply lower prices brought on by a global

supply glut as less-expensive imports, helped by the stronger U.S.

dollar, flood the market.

As a result, unfair trade complaints have proliferated, both in

the U.S. and abroad. Last month, India imposed an antidumping tax

on some steel imports, including cold-rolled stainless steel

products from the U.S.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

January 25, 2016 19:45 ET (00:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

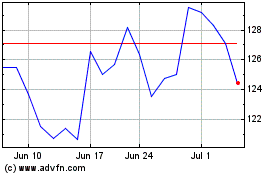

Steel Dynamics (NASDAQ:STLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

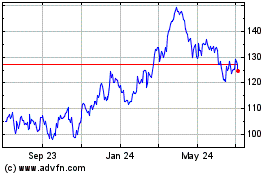

Steel Dynamics (NASDAQ:STLD)

Historical Stock Chart

From Apr 2023 to Apr 2024