Halliburton Posts Loss Amid North American Weakness -- 2nd Update

January 25 2016 - 2:51PM

Dow Jones News

By Anne Steele

Halliburton Co. laid off another 4,000 workers at the end of

last year as it lost money in the fourth quarter on its oil-field

drilling and services businesses, the company said Monday.

The company, a bellwether for the energy industry, was hurt by

asset write-downs and severance costs, as well as drastically lower

revenue from its North American division, Halliburton executives

told investors and analysts on a conference call to discuss

financial results.

Halliburton, the second-largest oil-field services firm behind

Schlumberger Ltd., is hunkering down for another tough year as oil

prices hover around $30 a barrel and its customers continue to

slash their budgets to deal with the downturn in energy

markets.

Exploration and production companies that pump oil and natural

gas are projected to cut their spending for the second year in a

row, said Halliburton Chief Executive Dave Lesar. That trend marks

the first time since the 1980s that energy producers have dialed

back their operations by such a large extent.

"Once the market has visibility of the trough, the recovery will

come into view," Mr. Lesar said, but adding that "2016 is simply

going to be a tough slog through the mud."

Worries about slowing oil demand in China and additional crude

supplies coming online from Iran have weighed heavily on the price

of oil so far this year.

In North America, which is Halliburton's largest region, sales

skidded 54% lower in the fourth quarter compared with the prior

year's period, to $2.16 billion. Customers in the U.S. and Canada

continued to curtail activity and ask for lower prices from

Halliburton and other suppliers, the company said.

Even so, analysts said Halliburton's margins held up better than

they had expected, particularly in North America, as the company

aggressively cut its costs. Halliburton reported operating profit

margins in North America of 1.9% in the fourth quarter. That is

down from 19.4% in the prior year's period but an improvement over

the third quarter of 2015.

"Halliburton delivered a considerably better-than-expected

operational result, with margins markedly outpacing our

expectations while revenues aligned with our estimate," said Bill

Herbert, an analyst at Simmons & Co. International, in a note

to clients.

The layoffs at the end of 2015 bring to 22,000 the number of

jobs cut since the 2014 peak, representing a 25% reduction.

The oil-field services giant is in the process of acquiring

Baker Hughes Inc., the third-largest energy company in this space,

in a $35 billion deal. But the merger has been delayed by antitrust

concerns from the U.S. Justice Department and other competition

authorities around the world.

Mr. Lesar told investors and analysts Monday that the deal is

still compelling even though it is taking longer than expected to

complete. The company remains committed to seeing it through, and

Halliburton has presented the Justice Department with a plan to

sell more businesses to satisfy concerns, he added.

The company reported a loss of $28 million, or 3 cents a share,

in the fourth quarter, compared with a year-earlier profit of $901

million, or $1.06 a share. Baker Hughes-related acquisition costs

of $79 million, or 9 cents a share, were recorded. Excluding

special items, per-share earnings from continuing operations were

31 cents, or flat from a year earlier.

Total revenue for Halliburton slumped 42% to $5.08 billion.

Analysts polled by Thomson Reuters were expecting adjusted

earnings of 24 cents on revenue of $5.11 billion.

Shares of Halliburton, which are down 26% over the past 12

months, were down 2% at $29.60 shortly after 2 p.m. EST.

Last week, Schlumberger reported a fourth-quarter loss as

revenue fell 39%. Schlumberger said it laid off an additional

10,000 workers, and hopes that will be the end of the personnel

cuts.

Baker Hughes is set to report its financial results on

Thursday.

Anne Steele contributed to this article.

Write to Alison Sider at alison.sider@wsj.com

(END) Dow Jones Newswires

January 25, 2016 14:36 ET (19:36 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

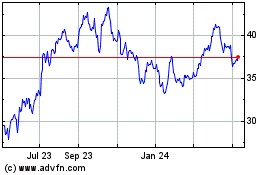

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

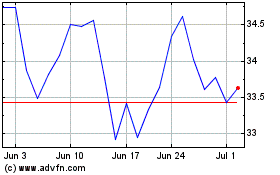

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024