All holders of Common Stock of record at the close of business on January 21, 2016, will be entitled to vote at the meeting or any adjournments or postponements. As of January 21, 2016, there were 16,566,956 shares of Class A Common Stock, par value $0.01666 (“Common Stock”), outstanding, entitled to vote and owned by approximately 6,900 shareholders. A list of record shareholders entitled to vote at the meeting will be available for examination at least 10 days prior to the meeting at the Company’s offices during ordinary business hours and at the meeting.

The Amended Certificate of Incorporation of the Company provides for one vote for each share of Common Stock outstanding. At the meeting, each record holder of Common Stock will be entitled to cast one vote per share of Common Stock held on the record date. Votes may be cast by shareholders either in person or by proxy.

The presence, in person or by proxy, of a majority of the outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum for the transaction of business at the meeting. Abstentions and broker “non-votes” are counted as present and entitled to vote for the purpose of determining a quorum. Broker “non-votes” are shares held by brokers or nominees over which the broker or nominee lacks discretionary power to vote (such as for the election of directors) and for which the broker or nominee has not received specific voting instructions from the beneficial owner. For purposes of determining the outcome of any matter as to which the broker or nominee has indicated on the proxy card that it does not have discretionary authority to vote, those shares will be treated as not present and not entitled to vote with respect to that particular matter, even though those shares will be considered present and entitled to vote for purposes of determining a quorum and may be entitled to vote on other matters.

Under the rules of the New York Stock Exchange, brokers or their nominees do not have the discretionary power to vote shares on most matters. At the meeting, they may only vote shares if they receive specific voting instructions from the beneficial owner. In very limited circumstances, brokers generally do have discretion to vote on matters deemed to be routine such as ratification of the appointment of our auditor. If your shares are held by a broker or other nominee and if you do not provide such specific voting instructions, your shares cannot be voted for the election of directors or any Proposal other than ratification of the appointment of our independent registered public accounting firm.

The Board has adopted a majority vote standard for the election of directors in uncontested director elections. Accordingly, at the meeting, each nominee will be elected if the holders of a majority of shares of Common Stock present at the meeting and entitled to vote for the election of directors cast their votes “FOR” the nominee.

The two nominees for director at the meeting are currently directors of the Company. If any incumbent nominee for director fails to receive the required affirmative vote of the holders of a majority of the votes entitled to be cast for that director, under Oklahoma law and the Company’s Bylaws, the incumbent will remain in office until his successor is elected and qualified or until his earlier death, resignation, retirement or removal. If any incumbent for director receives a greater number of votes “WITHHELD” from his election than votes “FOR”, he must promptly submit his offer of resignation from the Board for consideration by the Corporate Governance and Nominating Committee of the Board. The Corporate Governance and Nominating Committee will consider all relevant facts and circumstances and recommend to the Board the action to be taken

with respect to such offer of resignation. The Board will act on the offered resignation, taking into account such recommendation, and publicly disclose its decision regarding the offered resignation within 90 days from the date of the annual meeting. The director who offered his resignation will not participate in any proceedings with respect to his offered resignation. If the Board accepts a director’s offered resignation, the Corporate Governance and Nominating Committee will recommend to the Board whether to fill such vacancy or reduce the size of the Board. The Company’s Corporate Governance Guidelines and Bylaws can be viewed at the Company’s website: www.panhandleoilandgas.com.

Proposals No. 2 and No. 3 will be approved if the holders of a majority of shares of Common Stock present at the meeting and entitled to vote on each such Proposal vote “FOR” the Proposal.

The Company knows of no arrangements which would result in a change in control of the Company at any future date.

The Company knows of no other matters to come before the meeting. The Company did not receive any shareholder proposals. If any other matters properly come before the meeting, the proxies solicited hereby will be voted on such matters as the Board may recommend, except proxies which are marked to deny discretionary authority.

A proxy card is enclosed for your signature. Please return it immediately, marked, dated and signed. If your shares are held in “street name”, please provide voting instructions on the form you receive from your broker or other nominee.

|

Proposal No. 1

Election of Two Directors for Three Year Terms Ending 2019 |

The present directors of the Company and their current Board Committee memberships are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Positions/Offices Presently

|

Served As

|

Present

|

|

Name

|

Age

|

Held with the Company

|

Director Since

|

Term Ends

|

|

Michael C. Coffman

|

62

|

Director, President and Chief

|

2006

|

2017

|

|

|

|

Executive Officer

|

|

|

|

Lee M. Canaan (1)(3)

|

59

|

Director

|

2015

|

2018

|

|

Robert O. Lorenz (1)(2)

|

69

|

Lead Independent Director

|

2003

|

2016

|

|

Robert A. Reece (1)(3)

|

71

|

Director

|

1986

|

2017

|

|

Robert E. Robotti (2)(3)

|

62

|

Director

|

2004

|

2016

|

|

Darryl G. Smette (1)(2)

|

68

|

Director

|

2010

|

2017

|

|

H. Grant Swartzwelder (2)(3)

|

52

|

Director

|

2002

|

2018

|

|

|

|

|

|

|

|

(1) Member of the Audit Committee.

|

|

(2) Member of the Compensation Committee.

|

|

(3) Member of the Corporate Governance and Nominating Committee.

|

Our Bylaws state the Board shall be comprised of not less than five members with the exact number determined by resolution of the Board. The Board has set the current size of the Board at seven members. The Board is divided into three classes. Under the classified Board, at each annual shareholders’ meeting, the term of one class expires. Directors in each class ordinarily serve three year terms, or until the director’s retirement or until his or her successor is elected and qualified.

The Board believes it is in the Company's best interest to continue to have a classified board structure with three year terms for its directors due to the uniqueness of Company assets, strategies and the minimal amount of shares outstanding. Panhandle's ownership of perpetual fee mineral acres leads the Company to employ business strategies that are more long-term results oriented as compared to more traditional oil and gas exploration and production companies. This requires the Company's directors to have a long-term outlook and understanding rather than being focused on short term results. This long-term results oriented focus has served the Company well, with demonstrated operating and financial results that have created value for our shareholders. Maintaining a consistent focus by a long-term oriented board is imperative and maintaining longer service for our board of directors is important in order to effectively execute the overall strategy of Panhandle.

Nominees for the vacancies for the three year terms ending in 2019 are Robert O. Lorenz and Robert E. Robotti, both nominees are currently directors.

These two nominees were recommended by the Corporate Governance and Nominating Committee and approved by the Board. The Board has no reason to believe that either nominee will be unable to serve as a director. However, if either nominee should be unable for any reason to accept nomination or election, it is the intention of the persons named in the enclosed proxy to vote those proxies for the election of such other person or persons as the Board may recommend.

|

Nominees for Election to the Board of Directors for Three Year Terms Ending in 2019 |

Robert O. Lorenz is a former audit partner of Arthur Andersen LLP. He served as the managing partner of the Oklahoma City office beginning in 1994 and as the managing partner of the Oklahoma practice beginning in 2000. He retired from Arthur Andersen in 2002. Since 2005, Mr. Lorenz has been a director of OGE Energy Corp. (regulated electric utility and natural gas transportation), and was a director of Infinity Inc. (oil and gas exploration and development) from 2004 to 2009. He was elected to the Board in 2003.

Mr. Lorenz’s qualifications to serve on the Board include over 30 years in public accounting, his expertise in the areas of finance and accounting, and his broad experience as a director of public companies engaged in the energy business.

Robert E. Robotti, since 1983, has been the president of Robotti & Company, LLC (a registered broker-dealer), president of Robotti & Company Advisors, LLC (a registered investment advisor), or their predecessors, and, since 1980, has been the managing member of Ravenswood Investment Company, LLC, which serves as the general partner of three investment partnerships, all located in New York City. Since 2007, Mr. Robotti has served as a portfolio manager and managing member of Robotti Global Fund, LLC, a global equity fund. Mr. Robotti holds an MBA degree and is a member of the New York Society of Security Analysts. He was elected to the Board in 2004.

Mr. Robotti’s qualifications to serve on the Board include his extensive experience in the investment business as the owner of a registered broker-dealer and a registered investment advisor, as the manager of several investment partnerships and as a portfolio manager of a global equity fund.

The Board of Directors Recommends Shareholders

Vote “FOR”

The Election of Robert O. Lorenz and Robert E. Robotti

as Directors

|

Directors Whose Terms Continue Beyond the 2016 Annual Meeting and Who are Not Subject to Election this Year |

Directors Whose Terms End in 2017

Michael C. Coffman has worked in public accounting and as a financial officer with companies involved in the oil and gas industry since 1975. He joined the Company in 1990 as its treasurer. From 1995 to 2006, he served as vice-president and chief financial officer. From 2006 to August 2007, he served as co-president and chief financial officer. Since August 2007, he has served as president and chief executive officer. He was elected to the Board in 2006. Since January 1, 2013, Mr. Coffman has been a director of the Oklahoma City branch of the Federal Reserve Bank of Kansas City. He served as a director of Equal Energy Ltd. (oil and gas exploration and production) from May 2013 until its sale in 2014.

Mr. Coffman’s qualifications to serve on the Board include his 39 years in the oil and gas exploration and production industry and his skills and experience in financial, accounting and acquisition matters.

Robert A. Reece is an attorney and since 1980 has been of counsel with the law firm of Crowe & Dunlevy, Oklahoma City, and active in the management of his family’s investments, including significant oil and gas holdings. He has been a director of NBC Bank of Oklahoma City (a state chartered bank) since 1982. He holds an MBA degree. Mr. Reece was elected to the Board in 1986.

Mr. Reece’s qualifications to serve on the Board include extensive experience in the legal, oil and gas and private equity investment fields. Mr. Reece has managed significant investments for his family for over 35 years.

Darryl G. Smette joined Devon Energy Corporation (oil and gas exploration, production and transportation) in 1986 and currently serves as Executive Vice President of Marketing, Midstream and Supply Chain. Mr. Smette is a member of Devon’s Capital Budget Committee and the senior management Executive Committee and as such is charged with developing and executing Devon’s corporate strategy. Mr. Smette is also responsible for marketing, midstream operations and procurement and logistics of goods and services. Prior to joining Devon, Mr. Smette worked in the oil and gas industry for 16 years. Mr. Smette holds an MBA degree. He was elected to the Board in August 2010.

Mr. Smette’s qualifications to serve on the Board are his extensive operational experience in the oil and gas industry, including, exploration, production, distribution and marketing, and in developing and executing corporate business strategies for a large independent oil and gas company.

Directors Whose Terms End in 2018

Lee M. Canaan is the founder and portfolio manager of Braeburn Capital Partners, LLC, Bloomfield Hills, Michigan, (a private investment management firm). Ms. Canaan founded the firm in 2003. She has previously served as a director of Noble International Inc. (automotive supplies) from 2000 to 2004, Oakmont Acquisition Corporation (a special purpose acquisition corporation) from 2005 to 2007 and Equal Energy Ltd (oil and gas exploration and production) from 2013 until its sale in 2014. She has been a director of Rock Creek Pharmaceuticals, Inc. (a drug development company) since 2014. She holds a bachelor’s degree in Geological Sciences, a master’s degree in Geophysics, and an MBA degree. She is also a Chartered Financial Analyst. She was elected to the Board in 2015.

Ms. Canaan’s qualifications to serve on the board include her corporate finance and merger and acquisition experience, her scientific background in geology and geophysics, her oil and gas exploration knowledge of most North American basins and her experience serving as a director of several public companies.

H. Grant Swartzwelder is president of PetroGrowth Advisors and PG Energy Holdings, LP, Irving, Texas (investment banking and venture capital), both of which he founded in 1998. Since 1998, he has founded and managed several private companies engaged in various aspects of the oil and gas service business. Prior to 1998, he was vice president of Principal Financial Securities, Inc.,

Dallas, Texas (an investment-banking firm). He holds a Bachelor of Science degree in Petroleum Engineering and an MBA degree. He was elected to the Board in 2002.

Mr. Swartzwelder’s qualifications to serve on the Board include his investment banking and venture capital experience, his founding and management of several oil and gas service businesses and his background in petroleum engineering.

|

Stock Ownership of Directors, Nominees and Executive Officers |

The following table sets forth information with respect to the outstanding shares of Common Stock owned beneficially as of December 31, 2015, by each director, nominee for director and executive officers, individually and as a group.

|

|

|

|

|

|

|

|

|

|

|

|

Amount of Shares

|

Percent of

|

|

Name of Beneficial Owner

|

Beneficially Owned(3)(4)

|

Common Stock

|

|

|

|

|

|

|

Paul F. Blanchard, Jr. (2)(6)

|

194,990

|

|

1.2%

|

|

Lee M. Canaan (1)(5)

|

4,949

|

|

*

|

|

Michael C. Coffman (1)(2)(6)

|

305,174

|

|

1.8%

|

|

Robert O. Lorenz (1)(3)(5)

|

13,572

|

|

*

|

|

Lonnie J. Lowry (2)(6)

|

19,111

|

|

*

|

|

Robert A. Reece (1)(5)

|

43,155

|

|

*

|

|

Robert E. Robotti (1)(5)

|

805,842

|

|

4.8%

|

|

Darryl G. Smette (1)(5)

|

8,873

|

|

*

|

|

H. Grant Swartzwelder (1)(3)(5)

|

14,716

|

|

*

|

|

Robb P. Winfield (2)(6)

|

21,381

|

|

*

|

|

|

|

|

|

|

All directors and executive

|

|

|

|

officers as a group (10 persons)

|

1,431,763

|

|

8.5%

|

*Less than 1% owned

(1)Director

(2)Executive Officer

(3)The number of shares shown includes shares that are individually or jointly owned, as well as shares over which the individual has either sole or shared investment or voting authority.

(4)The number of shares shown does not include future share amounts recorded to each outside director’s account under the Directors’ Deferred Compensation Plan. These future share amounts represent shares to be issued in the future and have no investment or voting authority. See “Compensation of Directors” - footnote (2) of table entitled “Outside Directors Compensation For Fiscal 2015”, on page 11.

(5)The number of shares includes vested and unvested shares of restricted stock granted to outside directors under the Company’s Amended 2010 Restricted Stock Plan.

(6)The number of shares shown for Messrs. Coffman, Blanchard, Lowry and Winfield include unvested shares of restricted stock awarded under the Company’s Amended 2010 Restricted Stock Plan and their shares in the Company’s ESOP Plan, in each case over which they exercise voting authority.

|

Lead Independent Director |

Effective November 1, 2008, the Board named Robert O. Lorenz as Lead Independent Director and eliminated the position of Chairman of the Board. The Lead Independent Director determines the agenda and presides at all Board meetings and all executive sessions of outside

directors. The Board adopted a “Charter of Lead Independent Director” which can be viewed at the Company’s website: www.panhandleoilandgas.com.

Our Board annually determines the independence of each director and nominees for election as a director based on a review of the information provided by the directors, nominees and executive officers. The Board makes these determinations under the NYSE Listed Company Manual’s independence standards, applicable SEC rules and our Corporate Governance Guidelines which can be viewed at the Company’s website: www.panhandleoilandgas.com.. As a result of this evaluation, the Board affirmatively determined by resolution that all current directors named above are independent, except Michael C. Coffman, Chief Executive Officer, who does not serve on any Board committee.

|

Meetings and Committees of the Board of Directors |

During the fiscal year ended September 30, 2015 (“fiscal 2015”), the Board held five meetings. At each meeting, a quorum of directors was present. The outside directors hold executive sessions at each Board meeting without management present. The Company expects all of its directors to attend each annual shareholders meeting. All directors except Mr. Coffman (due to illness) attended the 2015 annual shareholders meeting.

During fiscal 2015, each director attended at least 75% of the meetings of the Board and each of the Board committees on which he or she served.

Each year, the Board and each of its committees conducts a formal evaluation of its performance. These evaluations address, among other matters, the qualifications and performance of individual directors, overall Board or committee dynamics, the quality of information received from management, the appropriateness of matters reviewed, and the quality of Board or committee deliberations. The results of these evaluations are discussed with the Chair of the relevant committees, the lead independent director, or the full Board in executive session, as appropriate.

The independent members of the Board are elected to various committees. The Board presently has three standing committees: Audit, Compensation, and Corporate Governance and Nominating. Each committee operates under a charter that has been approved by the Board, and the Chair of each committee reports to the Board on actions taken at each committee meeting.

The Audit Committee is comprised of Robert O. Lorenz, chair, Lee M. Canaan, Robert A. Reece and Darryl G. Smette. Duke R. Ligon served on the Audit Committee until his retirement from the Board in March 2015. For information regarding the functions performed by the Audit Committee, its membership and the number of meetings held during fiscal 2015, see “Report of the Audit Committee” on page 14 below. The Board has determined that each member of the Audit Committee meets all applicable independence and financial literacy requirements of the Securities and Exchange Commission and of the New York Stock Exchange. Robert O. Lorenz has been determined by the Board to meet the “audit committee financial expert” requirements of the Securities and Exchange Commission. The Audit Committee Charter, which was most recently amended in December 2014, can be viewed at the Company’s website: www.panhandleoilandgas.com.

The Compensation Committee is comprised of Darryl G. Smette, chair, Robert O. Lorenz, Robert E. Robotti and H. Grant Swartzwelder. Each member meets applicable independence requirements, including the enhanced independence standards of the NYSE, and qualifies as an “outside director” under Section 162(m) of the Internal Revenue Code and as a “Non-Employee Director” under SEC Rule 16b-3. The Committee met five times during fiscal 2015. The Committee reviews officer performance and recommends to the Board compensation amounts for executive officers and directors. See “Compensation Discussion and Analysis” on page 19 below. The Compensation Committee also oversees the administration of the Panhandle Oil and Gas Inc. Employee Stock Ownership and 401(k) Plan and Trust Agreement (the “ESOP Plan”). The Compensation Committee Charter (which was most recently amended in December 2014) can be viewed at the Company’s website: www.panhandleoilandgas.com.

The Corporate Governance and Nominating Committee is comprised of Lee M. Canaan, chair, Robert A. Reece, Robert E. Robotti and H. Grant Swartzwelder. Duke R. Ligon served on the Corporate Governance and Nominating Committee until his retirement from the Board in March 2015. The Committee met three times during fiscal 2015. Functions of the Corporate Governance and Nominating Committee include: search for, identify and screen individuals qualified to become members of the Board; recommend to the Board when new members should be added to the Board; recommend to the Board individuals to fill vacant Board positions; and recommend to the Board nominees for election as directors at the annual shareholders meeting; and recommend the committee structure of the Board and the directors who will serve as members and chairs of each committee. If a vacancy on the Board exists that will not be filled by an incumbent director, the Committee identifies prospective nominees primarily through business and industry contacts. At a minimum, in its assessment of potential Board candidates, the Corporate Governance and Nominating Committee will review each candidate’s character, wisdom, acumen, business skills and experience, understanding of and involvement in the oil and gas industry, and ability to devote the time and effort necessary to fulfill his or her responsibilities. It is the policy of the Company to seek the most qualified candidates for Board membership without regard to race, gender, national origin, religion or disability. The Corporate Governance and Nominating Committee will consider nominees proposed by shareholders of the Company if the requirements set forth in the Company’s Bylaws are satisfied. For more information, see “Shareholder Proposals” below. Those nominations must include sufficient biographical information so that the Committee can appropriately assess the proposed nominee’s background and qualifications. To propose a prospective nominee for the Committee’s consideration, shareholders must submit the proposal in writing to Panhandle Oil and Gas Inc., Attention: Secretary, 5400 N. Grand Boulevard, Suite 300, Oklahoma City, OK 73112-5688. Any such submission must be accompanied by the written consent of the proposed nominee to being named as a nominee and to serve as a director, if elected. The Committee is responsible for overall corporate governance issues and compliance. The Committee reviews periodically the corporate governance policies and principles of the Company and oversees and evaluates compliance with the Company’s Code of Ethics and Business Practices. This Code and the Corporate Governance and Nominating Committee Charter (which was most recently amended in December 2015) can be viewed at the Company’s website: www.panhandleoilandgas.com.

|

Board Role in Risk Oversight |

Management is responsible for day-to-day risk assessment and mitigation activities. The Board is responsible for risk oversight, focusing on the Company’s overall risk management strategy, its degree of tolerance for risk and the steps management is taking to manage the Company’s risk. This process is designed to provide to the Board timely visibility about the identification, assessment and management of critical risks. The Audit Committee assists the Board by annually reviewing and discussing with management this process and its functionality. The areas of critical risk include information technology, strategic, operational, compliance, environmental and financial risks. The Board, or the Audit Committee, receives this information through updates from the appropriate members of management to enable it to understand and monitor the Company’s risk management process. Information brought to the attention of the Audit Committee is then shared as appropriate with the Board.

|

Compensation of Directors |

The following outlines the compensation for the Company’s non-employee directors for their services in all capacities in fiscal 2015.

The table below contains information with respect to fiscal 2015 compensation of non-employee directors who served in such capacity at any time during fiscal 2015. The fiscal 2015 compensation of Michael C. Coffman, Chief Executive Officer, is disclosed below in the caption “Executive Compensation – Summary Compensation Table”. Currently, the Company’s Deferred Compensation Plan for Non-Employee Directors (the “Directors’ Deferred Compensation Plan”) and the Company’s Amended 2010 Restricted Stock Plan (“Restricted Stock Plan”) serve as the only equity incentive plans for its non-employee directors.

Annually, non-employee directors may elect to be included in the Directors’ Deferred Compensation Plan. The Directors’ Deferred Compensation Plan provides that each outside director may individually elect to be credited with future unissued shares of Company Common Stock rather than cash for all or a portion of the annual retainers, Board meeting fees and committee meeting fees, and may elect to receive shares, if and when issued, over annual time periods up to ten years. These unissued shares are recorded to each director’s deferred compensation account at the closing market price of the shares (i) on the dates of the Board and committee meetings, and (ii) on the payment dates of the annual retainers. Dividends are credited to each deferred account on the record date of each declared dividend. Only on a director’s retirement, resignation, termination, death, or a change-in-control of the Company will the shares recorded for such director under the Directors’ Deferred Compensation Plan be issued to the director. In the case of a change-in-control of the Company, all shares in the deferred accounts will be issued in a single lump sum to the appropriate directors at the closing of such change-in-control. The promise to issue such shares in the future is an unsecured obligation of the Company. All but two non-employee directors participated in the Directors’ Deferred Compensation Plan in fiscal 2015.

For fiscal 2015, outside directors received annual retainers of $37,500, $1,500 for attending each Board meeting, $1,000 for attending each committee meeting and out-of-pocket travel expenses for attending all meetings. Any director who traveled over 50 miles to attend a Board or committee meeting received an additional $500 for each meeting. During fiscal 2015, the Lead Independent Director and the chairs of the Audit, Compensation and Corporate Governance and

Nominating Committees received additional annual retainers of $15,000, $10,000, $6,000, and $5,000, respectively. The annual retainers were paid in equal installments on December 31, 2014, and March 31, June 30 and September 30, 2015. This retainer and fee structure was guided by a study conducted by Longnecker & Associates, Houston, Texas (“Longnecker”), an independent compensation consultant, retained by the Compensation Committee to review the Company’s Board compensation levels.

For fiscal 2016, outside directors’ compensation will remain the same as fiscal 2015: annual retainers of $37,500, $1,500 for attending each Board meeting, $1,000 for attending each committee meeting and out-of-pocket travel expenses for attending all meetings. Any director who travels over 50 miles to attend a Board or committee meeting receives an additional $500 for each meeting. In addition, the Lead Independent Director and the chairs of the Audit, Compensation and Corporate Governance and Nominating Committees will receive additional annual retainers of $15,000, $10,000, $6,000 and $5,000, respectively. These annual retainers are to be paid in equal installments on December 31, 2015, March 31, June 30 and September 30, 2016.

Any director who participates in a board meeting or committee meeting by conference telephone or other communications equipment receives only one-half of the fee paid for attendance in person at these meetings.

Longnecker for several years recommended that Panhandle directors add an equity-based component to their compensation. To address Longnecker's recommendation, an amendment to the Restricted Stock Plan was approved by the shareholders at the 2014 annual meeting, providing that all independent directors are eligible to participate in the Plan. The initial grant of restricted stock to each director was valued at $35,000, vesting throughout calendar 2014 and was effective May 29, 2014. On March 4, 2015, each director was granted restricted stock valued at $35,000, vesting quarterly throughout calendar 2015. At its December 9, 2015, meeting, the Board approved restricted stock awards with a grant date of December 31, 2015, to each director in the amount of $35,000 which will vest quarterly throughout calendar 2016.

Outside Directors Compensation For Fiscal 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Fees Paid in Cash or Deferred(1)(2)

|

|

All Other Compensation(3)(4)

|

|

Total

|

|

Lee M. Canaan

|

$33,056

|

|

$35,000

|

|

$68,056

|

|

Duke R. Ligon (5)

|

$19,125

|

|

$2,198

|

|

$21,323

|

|

Robert O. Lorenz

|

$79,000

|

|

$43,716

|

|

$122,716

|

|

Robert A. Reece

|

$51,000

|

|

$49,227

|

|

$100,227

|

|

Robert E. Robotti

|

$53,750

|

|

$40,783

|

|

$94,533

|

|

Darryl G. Smette

|

$60,000

|

|

$37,286

|

|

$97,286

|

|

H. Grant Swartzwelder

|

$58,500

|

|

$42,768

|

|

$101,268

|

(1)All but two directors deferred 100% of their retainers and fees under the Directors’ Deferred Compensation Plan.

(2)At the end of fiscal 2015, the following future share amounts had been recorded to each director’s account under the Directors’ Deferred Compensation Plan: Ligon– 2,806; Lorenz– 57,204; Reece– 90,922; Robotti– 37,931; Smette– 14,365; and Swartzwelder– 50,484.

(3)Includes dividends accrued under the Directors’ Deferred Compensation Plan. Under the Plan, dividends paid on the Common Stock are recorded to each Director’s account under the Plan on the record date of the dividend in the

form of unissued shares. The amount recorded is based on the number of future unissued shares in each Director’s account and the closing market price of the Company Stock on each dividend record date. These future share amounts have no voting authority and the Directors have no investment authority with respect thereto.

(4)Includes $35,000 for each outside director, with the exception of Mr. Ligon, as a result of restricted stock awards in March 2015. In accordance with applicable accounting standards, this amount represents the grant date fair value of the award on the award date.

(5)Retired from the Board in March 2015.

Share Ownership Guidelines for Directors

The Bylaws of the Company require outside directors to own shares of the Company’s Common Stock in order to be a Board member. To further align the interests of the Directors with the Company’s shareholders, each Director is expected to own that number of shares at the end of their third year of Board service which equals, on a cost basis, the aggregate amount of the three prior years’ Directors’ annual Board retainers and meeting fees for the five regularly scheduled Board meetings held each year during such three year period. Future unissued shares that have been recorded to the directors’ accounts under the Directors’ Deferred Compensation Plan may be used to satisfy this share ownership requirement.

|

Related Person Transactions |

The Company has entered into indemnification agreements with each of its directors and executive officers.

Except as detailed below, none of the organizations described above in the business experiences of the Company’s directors, nominees for election to the Board and officers are parents, subsidiaries or affiliates of the Company, or do business with the Company. The Company for many years, in the ordinary course of its business, has participated on industry terms through its mineral acreage ownership in the drilling and completion of oil and gas wells in which Devon Energy Corporation serves as the operator. Darryl G. Smette is an Executive Vice President of Devon.

None of the non-employee directors have ever been an officer or employee of the Company.

We review all transactions and relationships in which the Company and any of our directors, nominees for director, executive officers or any of their immediate family members may be participants, so as to determine whether any of these individuals have a direct or indirect material interest in any such transaction. We have developed and implemented processes and controls to obtain information from the directors and executive officers about related person transactions, and for then determining, based on the facts and circumstances, whether a related person has a direct or indirect material interest in any such transaction. Transactions that are determined to be directly or indirectly material to a related person are disclosed in our proxy statement as required by SEC rules.

Pursuant to these processes, all directors and executive officers annually complete, sign and submit a directors’ and officers’ questionnaire that is designed to identify related persons and any transactions and both actual and potential conflicts of interest. We also make appropriate inquiries as to the nature and extent of business that the Company may conduct with other companies for whom any of our directors or executive officers also serve as directors or executive officers. Under

the Company’s Code of Ethics & Business Practices, if an actual or potential conflict of interest affects an executive officer or a director, he or she is to immediately disclose all the relevant facts and circumstances to the Company’s President or the Corporate Governance and Nominating Committee, as appropriate. If the Corporate Governance and Nominating Committee determines that there is a conflict, it will refer the matter to the Board, which will review the matter to make a final determination as to whether a conflict exists; and, if so, how the conflict should be resolved. In addition, the Audit Committee reviews all reports and disclosures of actual and potential related person transactions.

|

Compensation Committee Interlocks and Insider Participation |

The functions and members of the Compensation Committee are set forth above under “Proposal No. 1 – Meetings and Committees of the Board of Directors.” All Committee members are independent under the enhanced independence standards of the NYSE for compensation committee members of NYSE listed companies.

The Board has adopted a Code of Ethics & Business Practices applicable to all directors, officers and employees of the Company. Each director, officer and employee annually submits a signed statement that he or she is in compliance with the Company’s Code of Ethics & Business Practices. In addition, the Board has adopted a Code of Ethics for Senior Financial Officers. The Company’s Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer are required to sign this Code and will be held to the standards outlined in the Code. Copies of both Codes are available at the Company’s website: www.panhandleoilandgas.com.

|

Communications with the Board of Directors |

The Company provides a process for shareholders and other interested parties to send communications to its Board. Shareholders or other interested parties who wish to contact the Lead Independent Director, the outside directors as a group, or any of its individual members may do so by writing: Board of Directors, Panhandle Oil and Gas Inc., 5400 N. Grand Boulevard, Suite 300, Oklahoma City, OK 73112-5688. Correspondence directed to any individual Board member is referred, unopened, to that member. Correspondence not directed to a particular Board member is referred, unopened, to the Lead Independent Director.

|

Proposal No. 2

Ratification of Selection of Independent Registered Public Accounting Firm |

The Audit Committee has directed the Company to submit the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal 2016 for ratification by the shareholders at the meeting. Neither the Company’s Bylaws nor other governing documents or law require shareholder ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm. However, the Audit Committee is submitting the selection of Ernst & Young LLP to the shareholders for ratification as a matter of good corporate practice. If the shareholders fail to ratify the selection, the Audit Committee will reconsider whether

or not to retain that firm. Even if the selection is ratified, the Audit Committee may, in its discretion, direct the appointment of a different independent registered public accounting firm at any time during fiscal 2016 if it determines that such a change would be in the best interests of the Company and its shareholders.

A representative of Ernst & Young LLP is expected to attend the meeting and will have the opportunity to make a statement if he or she so desires, and will be available to respond to appropriate questions of shareholders.

The Audit Committee has selected Ernst & Young LLP to conduct quarterly reviews for the first three fiscal quarters of fiscal 2016.

|

Report of the Audit Committee |

The Audit Committee is currently comprised of four independent directors: Robert O. Lorenz, chair, Lee M. Canaan, Robert A. Reece, and Darryl G. Smette. Four meetings of the Committee were held during fiscal 2015. The Board has determined that all committee members are independent and financially literate as defined by NYSE listing standards and SEC regulations and that Mr. Lorenz is an “audit committee financial expert” as defined by applicable SEC regulations. For purposes of complying with NYSE rules, the Board has determined that none of the Committee members currently serve on the audit committees of more than three public companies.

The Audit Committee Charter was last amended in December 2014. A copy of the amended Charter can be viewed at the Company’s website: www.panhandleoilandgas.com.

The Audit Committee’s primary responsibility is to oversee the Company’s financial reporting process on behalf of the Board and report the results of its activities to the Board. Management has the primary responsibility for the financial statements and the reporting process, including internal control over financial reporting.

Disclosure Controls and Procedures. Management has established and maintains a system of disclosure controls and procedures designed to provide reasonable assurance that information required to be disclosed by the Company in the reports filed or submitted under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and includes controls and procedures designed to provide reasonable assurance that information required to be disclosed by the Company in those reports is accumulated and communicated to management, including the Chief Executive Officer and the Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. As of September 30, 2015, management conducted an evaluation of disclosure controls and procedures. Based on this evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures are effective to provide reasonable assurance that the information required to be disclosed in the reports filed or submitted under the Securities and Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. The Audit Committee discussed with management and Ernst & Young LLP, the Company’s independent registered public accounting firm (“independent accountants”), the quality and adequacy of the Company’s disclosure controls and procedures.

Internal Controls. Management has also established and maintains a system of internal controls over financial reporting as defined in Rule 13a-15(f) of the Securities Exchange Act of 1934. These internal controls are designed to provide reasonable assurance that the reported financial information is presented fairly, that disclosures are adequate and that the judgments inherent in the preparation of financial statements are reasonable. Management conducted an evaluation of the effectiveness of the Company’s internal control over financial reporting based on the framework set forth in Internal Control – Integrated Framework (as updated in 2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on management’s evaluation under the framework in Internal Control – Integrated Framework, management concluded that the Company’s internal control over financial reporting was effective as of September 30, 2015, as discussed in more detail in Management’s Report on Internal Control Over Financial Reporting, which was included in our Annual Report on Form 10-K for the year ended September 30, 2015, filed with the SEC on December 10, 2015. The effectiveness of the Company’s internal control over financial reporting as of September 30, 2015, has been audited by Ernst & Young LLP, as stated in its attestation report, which was included in our Annual Report on Form 10-K for the year ended September 30, 2015. The Audit Committee reviewed and discussed with management and Ernst & Young LLP the Company’s system of internal control over financial reporting in compliance with Section 404 of the Sarbanes-Oxley Act of 2002.

Discussions with Management and Independent Accountants. In fulfilling its responsibilities, the Committee reviewed with management the audited financial statements included in the Company’s Annual Report on Form 10-K for fiscal 2015, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. The Audit Committee also reviewed the audited financial statements with Ernst & Young LLP, which is responsible for expressing an opinion on the conformity of those financial statements with the standards of the Public Company Accounting Oversight Board and its judgment as to the quality, not just the acceptability, of the Company’s accounting principles. The Audit Committee discussed with the independent accountants such matters required under the standards of the Public Company Accounting Oversight Board and the SEC. In addition, the Audit Committee discussed with the independent accountants its independence from management and the Company, including matters in the written disclosures and letter received from the independent accountants as required by Public Company Accounting Oversight Board Rule 3526 (Communications with Audit Committee Concerning Independence). The Audit Committee met with the independent accountants, with and without management present, to discuss the overall scope and plans for their audit, the results of their examinations, their evaluations of the Company’s internal control over financial reporting and the overall quality of the Company’s financial reporting.

The Audit Committee also met with the independent accountants and management after the end of each of the first three 2015 fiscal quarters. At these meetings, the independent accountants’ review of quarterly results was presented and discussed and discussions were also held with management concerning these results.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board (and the Board approved) that the audited financial statements be included in our Annual Report on Form 10-K for fiscal 2015 for filing with the Securities and Exchange Commission (which was filed on December 10, 2015).

|

|

|

Audit Committee

|

|

Robert O. Lorenz – Chair

|

|

Lee M. Canaan

|

|

Robert A. Reece

|

|

Darryl G. Smette

|

|

|

|

Independent Accountants’ Fees and Services |

The following sets forth fees billed for audit and other services provided by Ernst & Young LLP for the fiscal years ended September 30, 2015, and September 30, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

Fee Category

|

Fiscal 2015 Fees

|

Fiscal 2014 Fees

|

|

Audit Fees (1)

|

$

|

374,600

|

$

|

394,000 (2)

|

|

Audit-Related Fees

|

$

|

---

|

$

|

---

|

|

Tax Fees

|

$

|

---

|

$

|

---

|

|

All Other Fees

|

$

|

---

|

$

|

---

|

(1)Includes fees for audit of annual financial statements, reviews of the related quarterly financial statements and internal control audits required by Section 404 of the Sarbanes-Oxley Act.

(2)Includes fees of $33,000 for the audit of revenue and expenses on properties acquired in June 2014.

All services rendered by Ernst & Young LLP were permissible under applicable laws and regulations and were pre-approved by the Audit Committee. The Audit Committee’s pre-approval policy is set forth in the Audit Committee Charter which can be viewed at the Company’s website: www.panhandleoilandgas.com.

To ratify the selection of Ernst & Young LLP, a majority of the votes entitled to be cast on Proposal No. 2 must vote “FOR” ratification. Abstentions will have the effect of a vote “AGAINST” ratification.

The Board of Directors Recommends Shareholders

Vote “FOR”

Ratification of Selection of Independent

Registered Public Accounting Firm

|

Proposal No. 3

Advisory Vote on Executive Compensation |

The Securities Exchange Act of 1934 requires that we include in our proxy statements a non-binding vote on our executive compensation (commonly referred to as “Say-On-Pay”). At the 2014 Annual Shareholders meeting, the Board recommended, and the shareholders approved, that the Say-on-Pay vote should occur every year. Accordingly, we include a non-binding vote on our executive compensation as described in this proxy statement.

The first vote was taken in 2011 and 94% of the shares voted were cast in support of the Company’s executive compensation program. In 2014, 96% of the shares voted were cast in support of the program and, in 2015, 97% of the shares voted were cast in support of the program. We encourage shareholders to review the discussion on executive compensation contained in this Proxy Statement, the Compensation Discussion and Analysis section below on pages 19 to 28 and the Executive Compensation section on pages 28 to 35. The Company’s consistent value creation over time is attributable to a rigorously applied management process implemented over the years by successive teams of talented and committed executives. The Company’s executive compensation underpins and reinforces this process and the performance it generates. We believe our compensation program strikes the appropriate balance between utilizing fair and responsible pay practices and effectively incentivizing our executives to dedicate themselves fully to value creation for our shareholders.

The Board strongly endorses the Company’s executive compensation program and recommends that the shareholders vote in favor of the following resolution:

RESOLVED, that the shareholders approve on an advisory basis the compensation of the Company’s named executive officers as described in the Company’s Proxy Statement for the 2016 Annual Meeting of Shareholders under “Compensation Discussion and Analysis” and “Executive Compensation” and the other related tabular and narrative disclosures contained in this Proxy Statement.

Because the vote is advisory, it will not be binding upon the Board or the Compensation Committee and neither the Board nor the Compensation Committee will be required to take any action as a result of the outcome of the vote on this Proposal. The Compensation Committee will carefully consider the outcome of the vote when considering future executive compensation arrangements.

To approve the foregoing resolution, a majority of the votes entitled to be cast on Proposal No. 3 must vote “FOR” approval. Abstentions will have the effect of a vote “AGAINST” approval.

The Board of Directors Recommends a Vote

“FOR”

Approval of the Company’s Executive Compensation

|

Executive Compensation Overview |

For fiscal 2015, Panhandle's executive compensation program was generally unchanged from fiscal 2014. The program is designed to reward the Company's leadership team for operating and financial results for the year and for adding to and building per share value for our shareholders, measured on both yearly and long-term horizons. We believe our current program's performance metrics are the correct measures to align shareholder interests and executive interests to Company performance over the short-, medium- and long-term horizons. Because of the unique assets and operating strategies of the Company, we believe it is imperative that its management team be engaged in and manage the Company based on a longer-term horizon than the typical oil and gas exploration and production company. Accordingly, our compensation programs and performance metric measurements are structured to achieve that purpose.

|

Summary of Current Compensation Program |

|

·

| |

Yearly base salaries of our executives are based on Company and individual results, overall responsibilities of each officer, expertise required in execution of the position and comparable peer company ranges, |

|

·

| |

Yearly cash bonus payments are based on achievement of Company operational performance metrics and subjective job responsibility performance goals of each officer, |

|

·

| |

Yearly Long-Term Incentive (LTI) restricted equity based compensation is used to motivate achievement of long-range goals of the Company and to reward individual achievement performance over longer-term horizons, and |

|

·

| |

Yearly LTI ultimate realization is based on employment longevity (25%) and growth in the per share market price (75%) of the Common Stock over the vesting period of the restricted stock grants. |

|

Financial and Operating Performance – Fiscal 2015 |

The financial and operating results outlined below provide additional perspective on Panhandle's fiscal 2015 performance:

|

·

| |

Net income of $9,321,341, $0.56 per share, decreased 63% from 2014; |

|

·

| |

Production of oil, natural gas and natural gas liquids (NGL) decreased 3% to 13.7 billion cubic feet equivalent (Bcfe); |

|

·

| |

Generated cash from operating activities of $45.6 million in fiscal 2015, well in excess of fiscal 2015 capital expenditures; |

|

·

| |

Continued to maintain a strong balance sheet. |

|

Information About Our Executive Officers |

The current executive officers of the Company are listed below. All officers hold office at the discretion of the Board and may be removed from office, with or without cause, at any time by the Board.

|

|

|

|

|

|

|

|

|

|

|

|

|

Positions and Offices

|

Officer

|

|

Name (1)

|

Age

|

Presently Held With the Company

|

Since

|

|

|

|

|

|

|

Michael C. Coffman(2)

|

62

|

President and Chief Executive Officer

|

1990

|

|

Paul F. Blanchard, Jr.

|

55

|

Senior Vice President and Chief Operating Officer

|

2009

|

|

Lonnie J. Lowry

|

63

|

Vice President, Chief Financial Officer and Secretary

|

2006

|

|

Robb P. Winfield

|

41

|

Controller and Chief Accounting Officer

|

2009

|

(1)During two of the past three years, Ben Spriestersbach was listed as an executive officer but he retired in October 2014.

(2)Biographical information for Mr. Coffman is set forth above in “Election of Directors – Directors Whose Terms End in 2017.”

Paul F. Blanchard, Jr. was sole proprietor of a consulting petroleum engineering firm from 2007 to 2008, and served from 1997 to 2007 as Vice President, Mid-Continent Business Unit of Range Resources Corporation (oil and gas exploration and production). He joined the Company as Vice President and Chief Operating Officer in January 2009. In March 2010, he was elected Senior Vice President and Chief Operating Officer. Mr. Blanchard holds a Bachelor of Science Degree in Petroleum Engineering.

Lonnie J. Lowry served as Vice President, Controller and Secretary from March 2006 until August 2007 when he was elected Vice President, Chief Financial Officer and Secretary. From 2001 to 2006, he served as Controller of the Company. He had been Controller of Wood Oil Company, Tulsa, Oklahoma (oil and gas exploration and production) for 15 years prior to its acquisition by Panhandle in 2001.

Robb P. Winfield served as Controller from February 2008 to March 2009 when he was elected Controller and Chief Accounting Officer. Mr. Winfield was employed by Chesapeake Energy Corporation (independent oil and gas company) from 2004 to 2008 as Revenue Coordinator and Supervisor and was employed by Ernst & Young LLP as an auditor from 1999 to 2004.

|

Compensation Discussion and Analysis |

|

Compensation Committee and Role of the Board of Directors in Fiscal 2015 |

The Compensation Committee is composed entirely of independent directors as defined by NYSE listing standards and SEC rules and has the responsibility for establishing, implementing and monitoring all facets of the compensation of the Company’s executive officers. In particular, the Committee’s role is to recommend to the Board for final approval, the compensation, benefit plans and policies, and, in addition, to review, approve and recommend to the Board annually all compensation decisions relating to the Chief Executive Officer and the other executive officers of the Company. The Committee reviews the executive compensation program, recommends compensation levels, performance metrics, and recommends executive bonus distributions and restricted stock awards. The Committee met five times during fiscal 2015. The Committee operates in accordance with its Charter which sets forth its powers and responsibilities. A copy of the Charter of the Compensation Committee, which was most recently amended in December 2014, can be viewed at the Company’s website: www.panhandleoilandgas.com.

|

Compensation Philosophy and Objectives |

The objectives of the Company’s compensation program are to:

|

·

| |

Attract, retain and incentivize key executives which are necessary to continue execution of the Company’s unique business strategies, including the ownership, management and use of mineral acreage in an oil and gas exploration and production company; |

|

·

| |

Motivate and reward individual and Company performance and contributions; and |

|

·

| |

Align the interests of our executives with those of our shareholders. |

The principal elements of the executive compensation program are (i) yearly salary, (ii) annual cash bonus, (iii) restricted stock awards and (iv) contributions to the ESOP Plan. Awards of

restricted stock pursuant to the Company’s Amended 2010 Restricted Stock Plan are an integral part of the Company’s compensation program as a retention and long-term incentive form of compensation. The executive compensation program is used to meet the Company’s compensation objectives as follows:

|

·

| |

Attract and retain key executives, reward the officers who contribute to the Company’s success, and motivate the officers to develop and execute short-term, medium-term and long-term business strategies as well as meet annual goals approved by the Board; |

|

·

| |

Align the interests of our executives with those of the Company’s shareholders. In fiscal 2015, the Company used awards of restricted stock and allocations of Company stock to the ESOP Plan to align the financial interests of the executives with those of our shareholders and to provide a longer-term incentive form of compensation; |

|

·

| |

Motivate and reward individual performance and contributions. The Company’s evaluation of the individual performance of each executive officer affects most aspects of the executive’s compensation. Market data, individual performance and level of responsibility are considered in determining an executive’s annual salary and are important factors in deciding discretionary cash bonuses; |

|

·

| |

Financial and operating performances of the Company and the market price performance of the Company’s Common Stock are also key factors in determining compensation; and |

|

·

| |

Awards of shares under the Amended 2010 Restricted Stock Plan made in December of 2013, 2014 and 2015 contain different vesting provisions relating to continuous length of service to the Company and market price performance of the Company’s Common Stock. These provisions further align the structure of management compensation to Company performance and the enhancement of shareholder value. |

|

Role of the Compensation Consultant |

In an effort to align our executives’ compensation competitively with the market, the Compensation Committee engaged an outside, independent compensation consultant, Longnecker & Associates, Houston, Texas, to review levels and incentive components of the executives’ compensation for fiscal 2015. The primary role of Longnecker was to help identify peer companies and to provide the Compensation Committee with market data and information regarding compensation trends in our industry, base salaries, the design of our incentive programs and executive and director compensation levels. Management does not direct or oversee the retention or activities of Longnecker with respect to the Company’s executive compensation program. The Compensation Committee has sole authority to retain and terminate independent compensation consultants and to determine the terms of their retention. Longnecker takes direction from the Compensation Committee, as appropriate, reports directly to the committee and does not provide any other services to Panhandle.

|

Role of Executive Officers |

In fiscal 2015, the Compensation Committee and the Board, after receiving input from Longnecker, made all compensation decisions for the executive officers. The Compensation

Committee and the Board reviewed the performance of the Chief Executive Officer, and afterwards, set his compensation. Mr. Coffman was not present during these discussions. The Chief Executive Officer made compensation recommendations to the Compensation Committee with respect to the other executive officers. Messrs. Blanchard, Lowry and Winfield were not present during these discussions. The Chief Executive Officer did not participate in the Compensation Committee or Board deliberations about executive compensation. The Board made the final decisions on compensation of our executive officers.

|

Base Salaries and Annual Cash Bonuses |

In December of each year, base salaries of the executive officers are set for the next calendar year and bonuses are determined based on the preceding fiscal year’s (year-end September 30) operational and financial performance. Base salaries and annual cash bonuses for executive officers are based on the individual’s responsibilities and experience, taking into account, among other factors, the individual’s initiative, contribution to the Company’s overall performance, handling of special projects or events during the year and yearly financial and operating results of the Company. Base salaries for executive officers are reviewed and compared to similar positions in the Company’s industry. The Compensation Committee, with the assistance of Longnecker, selected the following group of “peer companies” for comparison purposes in determining compensation for fiscal 2015.

|

|

|

|

Antero Resources Corp.

|

PetroQuest Energy, Inc.

|

|

Cabot Oil & Gas Corporation

|

Quicksilver Resources Inc.

|

|

CONSOL Energy Inc.

|

Rice Energy Inc.

|

|

Encana Corporation

|

Southwestern Energy Company

|

|

EQT Corporation

|

Talisman Energy, Inc.

|

|

EXCO Resources, Inc.

|

Ultra Petroleum Corp.

|

|

National Fuel Gas Company

|

WPX Energy, Inc.

|

Since the Company is not the same size and does not have the same complexity of drilling and field operations as most of the peer companies, the Compensation Committee uses the peer group comparison as a tool while considering many other factors.

Base Salaries. The base salaries of our executive officers are reviewed annually by the Compensation Committee and future salary adjustments, if any, are recommended to the Board for final approval. The Compensation Committee and the Board consider various factors, including:

|

·

| |

overall responsibilities of the executive officers; |

|

·

| |

scope, level of experience and expertise required to successfully execute the executive officer’s position with the Company; |

|

·

| |

demonstrated individual performance of the executive officer; and |

|

·

| |

recommendation of the Chief Executive Officer with respect to other executive officers. |

Salaries for the executive officers in fiscal 2015 are set forth below in the “Executive Compensation - Summary Compensation Table” on page 29 and were determined by the Board based on the considerations described above. Based on the above factors and considerations, in December 2015, the Board established the annual base salary for the Chief Executive Officer at

$327,000 for calendar 2016. Calendar 2016 base salaries established for the other executive officers were: Paul F. Blanchard - $297,000; Lonnie J. Lowry - $190,000; and Robb P. Winfield - $164,500. For calendar 2016 there were no changes made to base salaries of Messrs. Coffman, Blanchard and Lowry from 2015 amounts.

Annual Cash Bonuses. Annual cash bonuses are determined by the weighting of objective performance metrics and subjective performance goals applicable to each executive officer. During an annual Company goal-setting process, the Compensation Committee and the Board approve Company objective performance metrics as well as more subjective performance goals that focus on the manner in which the Company’s oil and gas business is managed. These performance metrics are used in determining annual cash bonuses.

For fiscal years 2015 and 2014, the objective performance metrics addressed earnings per share, reserve replacement percentage, Mmcfe production, finding cost per Mcfe and total General and Administrative (G&A) expense were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2015

|

|

Fiscal 2014

|

|

Metric Category

|

Minimum(1)

|

Target(1)

|

Weighting

|

|

Minimum(1)

|

Target(1)

|

Weighting

|

|

Earnings per share (1)(3)

|

$0.80

|

$1.25

|

7%

|

|

$1.50

|

$1.90

|

7%

|

|

Reserve replacement percentage (1)

|

140%

|

170%

|

29%

|

|

140%

|

170%

|

29%

|

|

Mmcfe production (1)

|

14,380

|

15,508

|

7%

|

|

13,221

|

13,870

|

7%

|

|

|

Maximum(2)

|

Target(2)

|

Weighting

|

|

Maximum(2)

|

Target(2)

|

Weighting

|

|

Finding cost per Mcfe (2)(4)

|

$1.50

|

$1.17

|

50%

|

|

$1.45

|

$1.05

|

50%

|

|

Total G&A expense (2)

|

$7.5 mil

|

$7.25 mil

|

7%

|

|

$7.3 mil

|

$7.1 mil

|

7%

|

(1)If the Target is achieved in any metric category utilizing a Minimum measurement, 100% credit is earned. If the Minimum is achieved for any of these metric categories and the Target is not achieved, 50% credit is earned, with the remaining 50% based on the proportion achieved between the Minimum and the applicable Target. If the Minimum is not achieved in a metric category, no credit is earned.

(2)If the Maximum is exceeded for either of these two metric categories, no credit is received for the affected metric category. If the Target is met for these metric categories, 100% credit is earned. If the amount achieved is below the Maximum for either of these metric categories and the Target is not achieved, 50% credit is earned, with the remaining 50% based on the proportion achieved between the Maximum and the applicable Target.

(3)Earnings per share is net of the tax effected net change during the fiscal year in receivables and payables related to derivative contracts.

(4)Finding cost per Mcfe is defined by the Compensation Committee as costs of all fiscal year exploration and development costs (excluding any costs for property acquisitions) divided by the change in proved developed reserves (excluding any changes in proved developed reserves related to property acquisitions). Standard SEC pricing is used to calculate these reserves; however, instead of utilizing the SEC standard conversion factor of six Mcf to one barrel of oil or NGL, the conversion factor is based on the ratio of the oil price or NGL price to the natural gas price.

The Compensation Committee believes that combining the performance metric categories of growing reserves, increasing Mcfe production, minimizing finding cost per Mcfe and managing G&A (overhead) expense are the important measurements necessary for increasing shareholder value and to grow our oil and gas exploration and production business. The target metric of minimizing finding cost per Mcfe is intended to discourage drilling marginal or unprofitable wells only to achieve increased production and reserves. These metrics have been adopted by the Compensation Committee to focus management on drilling wells that are economically viable and

generate a reasonable rate of return for the Company. The earnings per share metric has the effect of discouraging excessive risk taking. The Compensation Committee does not believe that these performance metrics reward executives for taking risks beyond those risks inherent in the oil and gas exploration and production business.

The Compensation Committee has the discretion to modify the effect of any of the objective performance metrics if unforeseen or uncontrollable conditions result in any of these metrics not being relevant to the Company’s results for the year.

The subjective performance goals are tailored to fit the job description of each executive officer by weighting each major area of responsibility. Within each major area, a breakdown is made of more detailed areas of responsibility. An evaluation of the Chief Executive Officer is performed annually by the Compensation Committee. The Chief Executive Officer performed the evaluation of each of the other executive officers. In these evaluations, performances are evaluated on each of the detailed areas of responsibility.

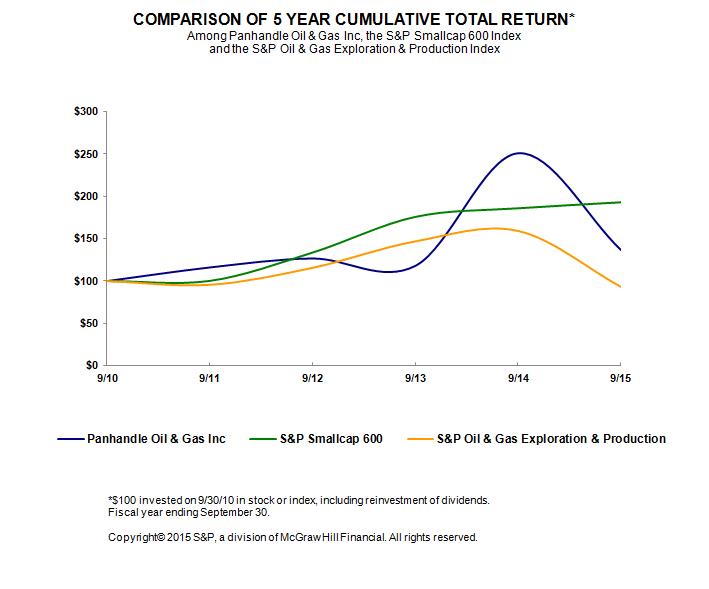

The Committee reviewed the performance of the Chief Executive Officer and Chief Operating Officer in meeting the objective performance metrics and their subjective performance goals for fiscal 2015. In addition, the Committee noted that the Company’s share price had outperformed the S&P Oil and Gas Exploration and Production Index for the last five fiscal years while underperforming the S&P Small Cap 600 Index. The Company’s share price decreased 46% during fiscal 2015.

The graph below matches Panhandle Oil and Gas Inc.'s cumulative 5-Year total shareholder return on Common Stock with the cumulative total returns of the S&P Smallcap 600 index and the S&P Oil & Gas Exploration & Production index. The graph tracks the performance of a $100 investment in our Common Stock and in each index (with the reinvestment of all dividends) from September 30, 2010, to September 30, 2015.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9/10

|

9/11

|

9/12

|

9/13

|

9/14

|

9/15

|

|

|

|

|

|

|

|

|

|

Panhandle Oil and Gas Inc.

|

100.00

|

116.05

|

126.63

|

117.93

|

250.84

|

136.83

|

|

S&P Smallcap 600

|

100.00

|

100.21

|

133.63

|

175.74

|

185.83

|

192.92

|

|

S&P Oil & Gas Exploration & Production

|

100.00

|

95.58

|

115.61

|

146.86

|

159.15

|

93.17

|

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

The Compensation Committee believes that the cash bonus element of compensation for Mr. Coffman, Chief Executive Officer, and Mr. Blanchard, Chief Operating Officer, should principally reflect their success in achieving the above outlined objective performance metrics. Their bonus calculation is based on a weighting of 70% for meeting the objective performance metrics and 30% for meeting their subjective performance goals.

Cash bonuses are paid in the first fiscal quarter (December) of each fiscal year based on the preceding fiscal year’s metric results. Thus, bonuses awarded in fiscal 2015 (paid in December 2014) were based on the following fiscal 2014 objective performance metric results.

|

|

|

|

|

|

|

|

|

|

|

|

|

Metric Category

|

|

Actual Results

|

|

Target

|

|

Earnings per share

|

|

$1.44

|

|

$1.90

|

|

Reserve replacement percentage

|

|

485%

|

|

170%

|

|

Mmcfe production

|

|

14,098

|

|

13,870

|

|

Finding cost per Mcfe

|

|

$1.08

|

|

$1.05

|

|

Total G&A expense

|

|

$7.4 mil

|

|

$7.1 mil

|

The maximum targeted annual cash bonus that could have been paid in December 2014 to the Chief Executive Officer (based on fiscal 2014 results) was 100% of his $310,000 base salary. The maximum targeted annual cash bonus that could have been paid in December 2014 to the Chief Operating Officer (based on fiscal 2014 results) was 75% of his $286,500 base salary. See “Executive Compensation – Summary Compensation Table”, footnotes (4) and (6), page 29, for the dollar amount of their cash bonuses for fiscal years 2015, 2014 and 2013.

The other executive officers’ annual bonuses were targeted at 30% of base salaries and were based 80% on meeting subjective performance goals and 20% on meeting Company objective performance metrics.

Cash bonus payments made to all executive officers during the first fiscal quarter of 2015 (December 2014) are set forth below in the “Summary Compensation Table” under “Executive Compensation” on page 29.

|

Long-Term Equity-Based Restricted Stock Compensation |

Our executive officers are eligible to receive stock-based awards under our Amended 2010 Restricted Stock Plan (“Restricted Stock Plan”). The objectives of the Restricted Stock Plan are to attract and retain key employees, to motivate them to achieve long-range goals and to reward individual performance. Because executives’ compensation from stock-based awards is heavily weighted to our stock price performance, the Compensation Committee believes stock-based awards create a strong incentive to improve long-term financial performance and increase shareholder value.

Vesting provisions contained in the stock restriction agreements for restricted stock awards are used by the Compensation Committee as another method to tie executive compensation both to continuing service by the executive to the Company and to the growth in shareholder value, as measured by the market price of the Company’s shares. Under various circumstances, the restricted stock awards may vest totally, partially or not at all.

A portion (usually 25%) of these restricted stock awards vest if the executive officers remain employees of the Company for the vesting period (known as “non-performance shares”). These time vested stock awards are forfeited if the officer does not remain continuously employed for the vesting period (typically three years). The other portion (usually 75%) of these restricted stock awards vest based on the market price performance of the Company’s Common Stock at the completion of three years of service (known as “performance shares”). The Compensation Committee believes a three-year vesting schedule for restricted stock awards enhances the retention value of these awards and positions the Company competitively from a market perspective. For a description of the stock-based awards for executive officers under the Restricted Stock Plan, see the table entitled “Outstanding Restricted Stock Awards” on page 34.