Four of 2016’s Ten Risk Hot Spots in Middle East, IHS Says

January 25 2016 - 3:30AM

Business Wire

Europe’s Schengen rules are likely to be revised; Climate ripe

for return to piracy in Gulf of Aden

IHS Inc. (NYSE:IHS), the leading global source of critical

information and insight, today announced findings from the annual

top risk environments report.

The report, produced by IHS Country Risk, explores 10 of the

major risk environments of 2016, with their likely impact and key

indicators for change.

“Four of the 10 risk hot spots for 2016 are in the Middle East,”

said Keerti Rajan, head of political risk analysis at IHS Country

Risk. “The new cold war between Saudi Arabia and Iran, the rising

threat from the Islamic State, the potential for more protests in

Egypt and contract risks in Iran are all risks for businesses

operating in the region.”

Short summaries of the major risk environments of 2016

follow.

Iran:

In addition to a sustained risk of the US unilaterally imposing

non-nuclear-related sanctions (for instance, terrorism-related),

divergence among Iran’s political factions on the scope and pace of

FDI presents high risk of contracts becoming politicised and

consequently subject to review and renegotiation.

The Gulf:

The emergence of Islamic State in Saudi Arabia and a revived

terrorist campaign there poses risks of the country being used as a

launching pad to expand the group’s activities and recruitment

elsewhere in the region, especially in Kuwait and Bahrain.

Syria, Iraq:

The proxy conflicts in Iraq, Yemen and Syria are drawing Russia,

Iran, Turkey and Saudi Arabia into more direct and overt

involvement, raising the risk of limited direct confrontations

between these sponsors. With the Saudi air force bombing the

Iranian-backed Houthi movement in Yemen, Iran sending IRGC combat

units into Iraq and Syria to fight against Turkish and Saudi

militia proxies, and Russia bombing Saudi and Turkish Sunni

insurgent proxies in Syria, the proxy war in the Middle East is

significantly expanding.

Egypt:

Egypt’s military-backed government is consolidating its own

power and suppressing political opposition, but ongoing failures to

meet security and economic challenges would heighten the risk of

protests re-emerging. At the same time, Egypt’s jihadist insurgency

poses risks to economic recovery.

Somalia:

The onshore and maritime security environment that has

contributed to a reduction in Somali-based piracy since 2012 is

changing, with indicators of an increasing risk of piracy in 2016.

The pirates that thrived in Somalia between 2005 and 2012 were

reliant on the support of regional political leaders who were

willing to provide safe havens for hijacked ships to be stored

during lengthy ransom negotiations. The two conditions that led

regional politicians to provide that support, namely a lack of

alternative economic opportunities and a threat to their control of

their territory, are currently being recreated in the Galmudug

region of central Somalia.

About 60 percent of commercial shipping travelling through this

historic piracy zone no longer carry privately contracted armed

security personnel (PCASP) on-board due to the costs involved and

perception that piracy is not a significant risk. This means that

Somali pirates, who still have the technical capabilities,

manpower, weaponry and financing networks to organise deep-water

hijacks, may soon regain the secure ship-storage locations required

to resume operations.

Argentina:

Newly elected president Mauricio Macri faces significant

challenges through the first half of 2016, despite expectations of

a swift improvement in the business operating environment.

Europe:

The record-high influx of refugees continues to place the EU

under significant strain, with protests, inter-EU political

disputes and a revision of Schengen likely in 2016. A heightened

risk of terrorist attacks will add to Europe’s challenging outlook.

Disruption to ground, rail, and marine cargo in the EU and its

neighbouring countries as a direct result of the refugee crisis is

likely to continue in 2016, causing delays to cargo and disruption

to supply chains.

Nigeria:

Nigerian president Muhammadu Buhari faces a daunting series of

security and economic challenges in 2016 to match some of the high

expectations of him since assuming office in May 2015. Despite

President Buhari giving his new security chiefs until December 2015

to finish off Boko Haram, the Islamist militant group has continued

to stage regular suicide bombing attacks aimed at causing mass

casualties, and the faction, led by Abubakar Shekau, is likely to

receive increased support from the Islamic State. The collapse in

the oil price means Buhari has greatly reduced resources at his

disposal as he attempts to boost fading GDP growth

Myanmar:

The landslide victory by opposition pro-democracy leader Aung

San Suu Kyi’s National League for Democracy (NLD) in the November

2015 election has placed Myanmar on an unchartered path towards

democratic rule, but political stability depends on Suu Kyi’s

ability to negotiate her party’s co-existence with the military and

the outgoing Union Solidarity and Development Party (USDP).

Russia:

As public grievances about the government’s inability to

maintain public services mount, Russia’s elites will strive to

scapegoat prominent policymakers, leading to changes in key

influencers and contract reviews and corruption investigations in

construction, real estate, and transport among the provinces.

About IHS (www.ihs.com)

IHS (NYSE:IHS) is the leading source of insight, analytics and

expertise in critical areas that shape today’s business landscape.

Businesses and governments in more than 140 countries around the

globe rely on the comprehensive content, expert independent

analysis and flexible delivery methods of IHS to make high-impact

decisions and develop strategies with speed and confidence. IHS has

been in business since 1959 and became a publicly traded company on

the New York Stock Exchange in 2005. Headquartered in Englewood,

Colorado, USA, IHS is committed to sustainable, profitable growth

and employs approximately 8,600 people in 32 countries around the

world.

IHS is a registered trademark of IHS Inc. All other company and

product names may be trademarks of their respective owners. © 2016

IHS Inc. All rights reserved.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160125005399/en/

IHS Inc.Amanda Russo, +44 208 276 4727+44 781 460

3420amanda.russo@ihs.comPress Team, +1 303 305

8021press@ihs.com

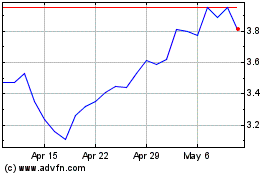

IHS (NYSE:IHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

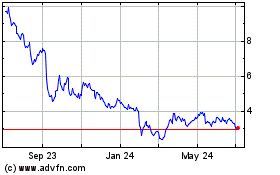

IHS (NYSE:IHS)

Historical Stock Chart

From Apr 2023 to Apr 2024