AIG To Offer Stock In Mortgage Unit

January 25 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 1/25/16)

By Leslie Scism

American International Group Inc. plans to offer shares of its

mortgage-insurance unit to the public while retaining a large

majority position, according to people familiar with the matter,

heeding many investors' calls for more asset dispositions but not

following activists' game plan for an immediate breakup of the

insurance conglomerate.

Separately, AIG is finalizing a deal to sell its network of

broker-dealers, people familiar with the matter said.

The transactions are part of a broader effort to slim down that

began when the insurernearly collapsed into bankruptcy proceedings

in 2008 and received one of the biggest bailouts of the financial

crisis, since fully repaid.

Recently, AIG has come under increasing pressure to take more

drastic steps to improve results. Activist Carl Icahn and fellow

billionaire investor John Paulson have called for the company to

soon break into three parts, as part of a plan to get out from

under federal regulation as a "systemically important financial

institution."

AIG Chief Executive Peter Hancock has said that while

heunderstands many investors' desire for urgent action to boost the

company's overall financial results, an immediate breakup isn't in

shareholders' best interests.

Analysts expect the mortgage-insurance unit, one of AIG'smost

profitable businesses,to probably be valued at or above $3.5

billion. The broker-dealer sale would total hundreds of millions of

dollars, analysts say.AIG has a market value of about $70

billion.

While AIG has been aggressively buying back its shares with the

cash it is generating from operations and asset sales, its

profitability lags behind big rivals like Travelers Cos. and Chubb

Ltd., the newly merged ACE Ltd. and Chubb Corp.

Mr. Hancock is set to update investors on the company's strategy

in a session Tuesday morning, and the two transactions are expected

to be discussed. They are likely to be part of a menu of items --

including potentially steeper cost cuts -- to show Mr. Hancock is

moving decisively to improve the company's profit margins.

If these two transactions are "a sign of more divestitures to

come, this could be an important first step in the right

direction," Josh Stirling, a stock analyst at Sanford C. Bernstein

& Co., said Saturday.

By maintaining a majority stake in the mortgage-insurance unit,

AIG could continue to book a substantial portion of its earnings

and take advantage of certain deferred tax assets that Mr. Hancock

maintains would be wasted if the company were immediately split

into three parts, analysts said.

AIG's primary focus is property-casualty insurance sold to

businesses globally, and life insurance and retirement services

sold mostly in the U.S. Before the crisis, it was a leading seller

of life insurance in Asia, among many other far-flung

operations.

Private-equity firm Lightyear Capital is a buyer in the

broker-dealer sale, according to the people familiar with the

matter. It wasn't clear if other buyers are involved.

A Lightyear Capital spokesman declined to comment.

AIG's broker-dealer network is known as AIG Advisor Group, with

more than 5,000 financial advisers. They work through four

different firms: SagePoint Financial, FSC Securities Corp.,

Woodbury Financial and Royal Alliance.

An AIG spokesman said Friday that the company "continues to take

steps to narrow its focus, improve its financial performance and

return capital to shareholders," and that it will disclose more on

Tuesday.

(END) Dow Jones Newswires

January 25, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

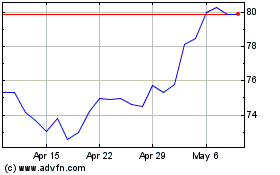

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

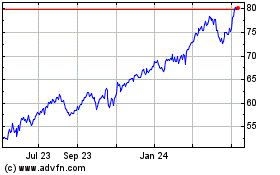

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024