UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

| ¨ | Preliminary Information Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

x | Definitive Information Statement |

NOVUS ROBOTICS INC.

(Name of Registrant As Specified in Charter)

Payment of Filing Fee (Check the appropriate box)

¨ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

¨ | Fee paid previously with preliminary materials |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOVUS ROBOTICS INC.

7669 Kimbal Street

Mississauga, Ontario

Canada L5S 1A7

Dear Shareholders:

We are writing to advise you that our Board of Directors and shareholders holding a majority of our outstanding voting capital stock have approved a reverse stock split of one for three hundred (1:300) of the shares of common stock of the Company (the "Reverse Stock Split").

These actions were approved by written consent on October 26, 2015 by our Board of Directors and a majority of holders of our voting capital stock, in accordance with Nevada Revised Statutes. Our directors and majority of the shareholders of our outstanding capital stock, as of the record date of October 26, 2015, have approved the Reverse Stock Split.

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

No action is required by you. Pursuant to Rule 14(c)-2 under the Securities Exchange Act of 1934, as amended, the proposals will not be adopted until a date at least ten (10) days after the date of this Information Statement has been mailed to our shareholders. This Information Statement is first mailed to you on or about December 28, 2015.

| For the Board of Directors | |

| | | |

| By: | /s/ Bernardino Paolucci | |

| Name: | Bernardino Paolucci | |

| Title: | President/Chief Executive Officer | |

NOVUS ROBOTICS INC.

7669 Kimbal Street

Mississauga, Ontario

Canada L5S 1A7

INFORMATION STATEMENT REGARDING

ACTION TO BE TAKEN BY WRITTEN CONSENT OF

MAJORITY SHAREHOLDERS

IN LIEU OF A SPECIAL MEETING

PURSUANT TO SECTION 14(C) OF THE

SECURITIES EXCHANGE ACT OF 1934

WE ARE NOT ASKING YOU FOR A PROXY,

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

GENERAL

This Information Statement is being furnished to all holders of the common stock of Novus Robotics, Inc., a Nevada corporation (the "Company") as of October 26, 2015 in connection with the action taken by written consent of holders of a majority of the outstanding voting power of the Company to authorize the Reverse Stock Split.

"We," "us," "our," the "Registrant" and the "Company" refers to Novus Robotics, Inc., a Nevada corporation.

SUMMARY OF CORPORATE ACTIONS

INFORMATION STATEMENT

This Information Statement is furnished to the stockholders of Novus Robotics, Inc., a Nevada corporation (the "Company"), in connection with our prior receipt of approval by written consents, in lieu of a special meeting, of the holders of a majority of our outstanding voting power authorizing the board of directors of the Company to effectuate a reverse stock split of one for three hundred (1:300) of the Company's common stock (the "Reverse Stock Split").

On October 26, 2015, the Company obtained the approval of the Reverse Stock Split by written consent of the stockholders that are the record owners of 65,564,000 shares of common stock, which represents an aggregate of approximately 58.54% of the voting power as of October 26, 2015. The names of the shareholders of record who hold in the aggregate a majority of our total issued and outstanding common stock and who signed the written consent of stockholders are: (i) Bernardino Paolucci holding of record 51,404,000 shares of common stock (45.83%); and (ii) Drasko Karanovic holding of record 14,160,000 shares of common stock (12.71%).

The Reverse Stock Split cannot be effectuated until ten (10) days after the mailing of this Information Statement and after the filing of certain documentation with FINRA.

The date on which this Information Statement will be sent to stockholders will be on or about December 28, 2015 and is being furnished to all holders of the common stock of the Company on record as of October 26, 2015.

The Board of Directors and persons owning a majority of the outstanding voting securities of the Company have unanimously adopted, ratified and approved the proposed actions by the Company's board of directors. No other votes are required or necessary.

The Quarterly Report on Form 10-Q for the quarters ended September 30, 2015, June 30, 2015, March 31, 2015 and the Annual Report on Form 10-K for fiscal year ended December 31, 2014 and the Quarterly Reports on Form 10-Q for the quarters ended September 30, 2014, June 30, 2014 and March 31, 2014 filed by the Company during the past two years with the Securities and Exchange Commission may be viewed on the Securities and Exchange Commission's web site at www.sec.gov in the Edgar Archives. The Company is presently current in the filing of all reports required to be filed by it.

Only one Information Statement is being delivered to multiple shareholders sharing an address, unless we have received contrary instructions from one or more of the shareholders. We will undertake to deliver promptly upon written or oral request a separate copy of the information statement to a stockholder at a shared address to which a single copy of the information statement was delivered. You may make a written or oral request by sending a written notification to our principal executive offices stating your name, your shared address, and the address to which we should direct the additional copy of the information statement or by calling our principal executive offices at 714.462.4880. If multiple shareholders sharing an address have received one copy of this information statement and would prefer us to mail each stockholder a separate copy of future mailings, you may send notification to or call our principal executive offices. Additionally, if current shareholders with a shared address received multiple copies of this information statement and would prefer us to mail one copy of future mailings to shareholders at the shared address, notification of that request may also be made by mail or telephone call to our principal executive offices.

VOTE REQUIRED

Pursuant to the Company's Bylaws and the Nevada Revised Statutes, a vote by the holders of at least a majority of the Company's outstanding votes is required to approve and effect the Reverse Stock Split. The Company's certificate of incorporation does not authorize cumulative voting. As of the record date, the Company had 111,370,000 voting shares of common stock issued and outstanding. The consenting stockholders of the shares of common stock are entitled to 65,564,000 votes, which represents approximately 58.54% of the voting rights associated with the Company's shares of common stock. The consenting stockholders voted in favor of the Reverse Stock Split described herein in a unanimous written consent dated October 26, 2015.

PROPOSAL I

GRANT AUTHORITY TO THE BOARD OF DIRECTORS

TO CONDUCT UP TO A ONE FOR FIVE HUNDRED SHARE

REVERSE STOCK SPLIT OF THE COMPANY'S COMMON STOCK.

On October 26, 2015, our Board of Directors and majority shareholders, believing it to be in the best interests of the Company and its shareholders, approved the Reverse Stock Split upon receipt of all necessary regulatory approvals and the passage of all necessary waiting periods. The Reverse Split would reduce the number of outstanding shares of our common stock but have no effect on the number of authorized shares of common stock.

The Board of Directors has determined that it is in the Company's best interests to effect the Reverse Split and has considered certain factors including, but not limited to, the following:

| (i) | current trading price of the Company's shares of common stock on the OTC QB market and potential to increase the marketability and liquidity of the Company's common stock; |

| |

| (ii) | possible reluctance of brokerage firms and institutional investors to recommend lower-priced stocks to their clients or to hold in their own portfolios; |

| |

| (iii) | desire to meet future requirements of per-share price and net tangible assets and shareholders' equity relating to admission for trading on other markets; |

| |

| (iv) | posturing the Company and its structure in favorable position in order to effectively negotiate with potential acquisition candidates; and |

| |

| (v) | provide the management of the Company with additional flexibility to issue shares to facilitate future stock acquisitions and financing for the Company. |

For the above reasons, the board believes that the Reverse Split is in the best interest of the Company and its shareholders. There can be no assurance, however, that the Reverse Split will have the desired benefits.

The Reverse Split would provide for the combination of the presently issued and outstanding shares of common stock into a smaller number of shares of identical common stock, and the Reverse Split would affect all common stockholders uniformly. This process, that is known as a reverse split, would take 300 shares of the presently issued and outstanding common stock on the effective date of the amendment to the articles of incorporation that would carry out the Reverse Split and convert those shares into one share of the post-reverse stock split common stock. The conversion rate of all securities convertible into common stock, including any of the shares of preferred stock, would be proportionately adjusted.

The Board of Directors has indicated that fractional shares will not be issued. Instead, the Company will issue one full share of the post-reverse stock split common stock to any shareholder who would have been entitled to receive a fractional share as a result of the process. Each common shareholder will hold the same percentage of the outstanding common stock immediately following the Reverse Split as that shareholder did immediately prior to the Reverse Split, subject to a reduction in voting power due to the increased voting power of the preferred stock and except for minor adjustment due to the additional shares that will need to be issued a result of the treatment of fractional shares.

For the above reasons, the Board of Directors believes that the Reverse Split is in the best interest of the Company and its shareholders. There can be no assurance, however, that the reverse stock split will have the desired benefits.

Effects

The Reverse Split will be effected by filing an amendment to the Company's Articles of Incorporation with the Nevada Secretary of State's office and will become effective upon such filing. The actual timing of any such filing will be made by the board of directors based upon its evaluation as to when the requisite approvals are received and the requisite waiting periods have passed.

The Company is currently authorized to issue 500,000,000 shares of its common stock of which 111,370,000 shares are currently issued and outstanding. The Reverse Split of the Company's common stock will not cause a decrease in the number of authorized shares of common stock. The Reverse Split will, however, reduce the number of issued and outstanding shares of common stock from 111,370,000 to approximately 371,233 shares. The Reverse Split will not have any effect on the stated par value of the common stock.

The effect of the Reverse Split upon existing shareholders of the common stock will be that the total number of shares of the Company's common stock held by each shareholder will automatically convert into the number of whole shares of common stock equal to the number of shares of common stock owned immediately prior to the Reverse Split divided by 300 with an adjustment for any fractional shares. (Fractional shares will be rounded up into a whole share).

Upon effectuation of the Reverse Split, each common shareholder's percentage ownership interest in the Company's common stock will remain virtually unchanged, subject to a reduction in voting power due to the increased voting power of the preferred stock and except for minor changes and adjustments that will result from rounding fractional shares into whole shares. The rights and privileges of the holders of shares of common stock of the Company will be substantially unaffected by the Reverse Split, except as described above in connection with the increase in relative voting power of the Series A preferred stock. All issued and outstanding options, warrants, and convertible securities would be appropriately adjusted for the Reverse Split automatically on the effective date of the Reverse Split. All shares, options, warrants or convertible securities that the Company has agreed to issue other than the preferred stock (or agrees to issue prior to the effective date of the Reverse Split), also will be appropriately adjusted for the Reverse Split, with the exception of the preferred stock which would be addressed in the Certificate of Designation for the preferred stock. As of the date of this Information Statement, there are no shares of preferred stock holding greater than .5% fractional interest will be rounded up to the nearest whole share.

As a result of the proposal to conduct a Reverse Split, the Company will have more authorized shares available for issuance than it currently has available and therefore, there is a significant risk of shareholder value represented by the common stock being further diluted by additional share issuances. The proposed Reverse Split creates a risk that current shareholders of the common stock will see the value of those shares diluted through the issuance of additional authorized but currently unissued shares. The current net tangible book value per share would be diluted if additional shares are issued without an increase taking place in the net book value of the assets of the Company. The current book value of shares held by existing shareholders would not be maintained in the event additional shares are issued. After the Reverse Split, if the board of directors would then issue the balance of the authorized shares, that action would have a material dilutive effect upon existing shareholders The board of directors may have future plans, understandings, agreements or commitments to issue additional shares of stock for any purpose, including financings. The Company currently has a financing plan that may include the issuance of preferred or common shares of stock in the Company The increased capital will provide the board of directors with the ability to issue additional shares of stock without further vote of the stockholders of the Company. The Company's stockholders do not have preemptive rights to subscribe to additional securities which may be issued by the Company which means that current stockholders do not have a prior right to purchase any new issuance of capital stock of the Company in order to maintain their proportionate ownership of the Company's stock.

After the taking of any action to conduct or authorize the Reverse Split is filed there is not a requirement that shareholders obtain new or replacement share certificates. Each of the holders of record of shares of the Company's common stock that is outstanding on the effective date of the Reverse Split may contact the Company's transfer agent to exchange the certificates for new certificates representing the number of whole shares of post-reverse stock split common shares into which the existing shares have been converted as a result of the Reverse Split.

BOARD OF DIRECTORS'

AND STOCKHOLDER APPROVAL

As our board of directors and holders of approximately 58.54% of our voting power signed a written consent in favor of the Reverse Split, we are authorized to file documentation with FINRA. The Reverse Split will be effective after the filing of an Issuer Notification Form and associated documents with FINRA, which is expected to occur as soon as reasonably practicable on or after the 10th day following the mailing of this Information Statement to stockholders.

The information contained in this Information Statement constitutes the only notice we will be providing stockholders.

DESCRIPTION OF SECURITIES

Description of Common Stock

Number of Authorized and Outstanding Shares

The Company's Articles of Incorporation authorizes the issuance of 500,000,000 shares of common stock, par value $0.001 per share of which 111,370,000 shares were outstanding on October 26, 2015. All of the outstanding shares of common stock are fully paid and non-assessable. The Company's Articles of Incorporation authorize the issuance of 50,000,000 shares of preferred stock of which 49,999,900 shares are designated as Series A and 100 shares are designated as Series B.

Voting Rights

Holders of shares of common stock are entitled to one vote for each share held of record on all matters to be voted on by the shareholders. Accordingly, the holders of in excess of 50% of the aggregate number of shares of common stock outstanding will be able to elect all of the directors of the Company and to approve or disapprove any other matter submitted to a vote of all shareholders. The holders of our common stock are entitled to receive ratably such dividends, if any, as may be declared by the Board of Directors out of funds legally available. We have not paid any dividends since our inception, and we presently anticipate that all earnings, if any, will be retained for development of our business. Any future disposition of dividends will be at the discretion of our Board of Directors and will depend upon, among other things, our future earnings, operating and financial condition, capital requirements, and other factors.

Other

Holders of common stock have no cumulative voting rights. Holders of common stock have no preemptive rights to purchase the Company's common stock. There are no conversion rights or redemption or sinking fund provisions with respect to the common stock.

Transfer Agent

Shares of common stock are registered at the transfer agent and are transferable at such office by the registered holder (or duly authorized attorney) upon surrender of the common stock certificate, properly endorsed. No transfer shall be registered unless the Company is satisfied that such transfer will not result in a violation of any applicable federal or state security laws. The Company's transfer agent for its common stock is Manhattan Transfer Registrar Company.

VOTE REQUIRED FOR APPROVAL

In accordance with Section 78.315 and 78.320 of the Nevada Revised Statutes, the following actions were taken based upon the unanimous recommendation and approval by the Company's Board of Directors and the written consent of the majority shareholders.

The Board of Directors of the Company has adopted, ratified and approved the Reverse Stock Split. The securities that are entitled to vote approval of the Reverse Stock Split consist of issued and outstanding shares of the Company's $0.001 par value common voting stock outstanding on October 26, 2015, the record date for determining shareholders who are entitled to notice of and to vote.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The Board of Directors fixed the close of business on October 26, 2015 as the record date for the determination of the common and preferred shareholders entitled to notice of the action by written consent.

At the record date, the Company had 500,000,000 shares of common stock authorized with a stated par value of $0.001, of which 111,370,000 shares of common stock were issued and outstanding. The holders of shares of common stock are entitled to one vote per share on matter to be voted upon by shareholders.

The holders of shares of common stock are entitled to receive pro rata dividends, when and if declared by the Board of Directors in its discretion, out of funds legally available therefore, but only if dividends on preferred stock have been paid in accordance with the terms of the outstanding preferred stock and there exists no deficiency in the sinking fund for the preferred stock.

Dividends on the common stock are declared by the Board of Directors. Payment of dividends on the common stock in the future, if any, will be subordinate to the preferred stock, must comply with the provisions of the Nevada Revised Statutes and will be determined by the Board of Directors. In addition, the payment of any such dividends will depend on the Company's financial condition, results of operations, capital requirements and such other factors as the board of directors deems relevant.

Shareholders and the holders of a controlling interest equaling approximately 58.54% of the voting power of the Company, as of the record date, have consented to the proposed amendments to the Articles of Incorporation. The shareholders have consented to the action required to adopt Proposal One above. This consent was sufficient, without any further action, to provide the necessary stockholder approval of the action.

IDENTIFICATION OF CURRENT DIRECTORS AND EXECUTIVE OFFICERS

All of the Company's directors hold office until the next annual general meeting of the shareholders or until their successors are elected and qualified. The Company's officers are appointed by its Board of Directors and hold office until their earlier death, retirement, resignation or removal.

The following table includes the names and positions held of our executive officers and directors during fiscal year ended December 31, 2014 and to current date. Our directors hold office for one-year terms or until their successors have been elected and qualified.

Name | | Position | | Age |

| | | | |

Bernardino Paolucci | | President/Chief Executive Officer, Secretary, Treasurer/Chief Financial Officer and a Director | | 65 |

H. Beth Carey | | Director | | 65 |

Drasko Karanovic | | Director | | 48 |

The biographies of our directors and officers are set forth below as follows:

Bernardino Paolucci. Mr. Paolucci is our President/Chief Executive Officer, Secretary and Treasurer/Chief Financial Officer and a member of the Board of Directors since February 2012. Mr. Paolucci has been the Chief Executive Officer and director and shareholder of D&R Technology since its inception in 2004. His duties as Chief Executive Officer of D&R Technology primarily focused on the financial and manufacturing sectors since inception. Mr. Paolucci also assumed the responsibilities of the purchasing division in April 2011 for D&R Technology. Mr. Paolucci has over thirty years experience in customer and quality-focused business and provides strategic vision and leadership qualities that drive operational process, productivity, efficiency and improvement at multisite manufacturing organizations. He is an expert in combining financial and business planning with tactical execution to optimize long-term gains in performance, revenues and profitability. His breadth of experience includes quality and manufacturing operations, lean concept, root cause and corrective action preventive action (CAPA) analysis, team concepts, total preventive maintenance, set-up reduction and standard work. Mr. Paolucci has been employed by D&R Technologies Inc. from 2004 through current date where he held the position of manufacturing supervisor. His previous responsibilities included: (i) manage and direct all electrical, mechanical, hydraulic and process functions within departments; (ii) continuously impact and improve the key performance indicators across the process such as machine mechanical, hydraulic, pneumatic and electrical build, process improvement, identification and sourcing of new equipment as well as the payout and reallocation of equipment and workforce; (iii) develop and initiate appropriate actions that lead to optimizing production capabilities of all machinery, equipment and resources resulting in improved machine utilization, labor efficiency, expense reduction and on-time delivery; (iv) recommend solutions to customers for preventative maintenance, machine layouts and configuration of machinery for the purpose of proaction planning as well as responding to day to day service issues; and (v) manage and develop department's team members by conducting regular appraisal, developing performance improvement plans, administering salary and compensation as per company policy and providing direction and support for the development of individuals within the department. The nature of his responsibilities discussed above, including the underlying requisite managerial and administrative skills, establish Mr. Paolucci's qualification as a member of our Board of Directors and as President/Chief Executive Officer. Mr. Paolucci also owned his own machine shop and was plant foreman for Dieco Technology Inc. for over ten years where he was responsible for production, inventory, purchasing, labor and overall supervision of the plant. Dieco Technology Inc. was a Canadian based company specializing in the production of tubular steel oriented components and assemblies for automotive industry, which ceased business operations in May 2004.

Drasko Karanovic. Mr. Karanovic is a member of our Board of Directors since February 2012. Mr. Karanovic has over twenty years of experience in progressive design, supervisory and management experience in engineering fields, comprehensive knowledge of engineering technology, strong management, communication, interpersonal and customer service skills, extensive knowledge of CAD systems and tooling engineering and development expertise. He was employed with Dieco Technology from 1994 through 2004 and D Mecatronics Inc. from 2004 to current date. His responsibilities included: (i) member of senior management team in setting strategic operation direction; (ii) prepare proposals, evaluating future equipment performance and recommend improvements for new and existing products; (iii) direct personnel activities of staff, i.e. hire, train, appraise, reward, motivate, discipline, recommend termination (iv) direct, coordinate and exercise functional authority for planning, organization, control, integration and completion of engineering projects; (v) supervising staff of mechanical, electrical and hydraulic designers, production engineering support staff in the custom design, development, improvement and modification of machinery; (vi) direct the research and development effort leading to new or improved products; and (vii) develop and maintain overall product development plan so that new or improved products are timely delivered to market. The nature of the responsibilities discussed above, including the underlying requisite managerial and administrative skills, establish Mr. Karanovic's qualification as a member of the Corporation's Board of Directors. Mr. Karanovic was the engineering manager for over three years at Dieco Technology Inc. Dieco Technology Inc. was a Canadian based company specializing in the production of tubular steel oriented components and assemblies for automotive industry. Mr. Karanovic earned a Bachelor of Mechanical Engineer degree. Mr. Karanovic is also the President and a director of D&R Technology since inception. He is also a member of the Board of Directors for D Mecatronics since inception.

H. Beth Carey. Ms. Carey has been a member of our Board of Directors since April 1, 2013. Ms. Carey has over thirty-five years of experience as a senior accountant involving various industries, including construction, service and manufacturing and non-profit. Ms. Carey was employed by Dieco Technologies from 2000 through 2003 as the assistant to the controller for the accounting department. Her duties included accounts receivables/collections, accounts payable, payroll -salary (hourly and commissions), accruals, month end journal entries, general ledger maintenance, costing spreadsheets for program engineers for all projects, sales support as required by salesmen, accounts receivable and payables, government remittances, work in process and collections.

In June 2005, Ms. Carey became employed by D&R Technology as the accountant. Ms. Carey was required to perform substantial number of duties required to keep accounting, payroll and purchasing functioning at a high level. She provided support to executive officers in sales and projects who needed financial information, such as job costing details. She further worked with executive officers in purchasing obtaining quotes for products in order to provide cost savings and customer service contact for spare parts and shipping. Ms. Carey also prepares all financial statements for our accountant and liasons with the accountant for the preparation of the quarterly and annual financial statements. She further provides support to the auditors during the audit of our financials. The nature of her responsibilities discussed above, including the underlying requisite financial and accounting skills, establish Ms. Carey's qualification as a member of our Board of Directors.

Ms. Carey earned a college degree in finance and accounting from Sheridan College-Mississauga and achieved Level 3 in the Certified General Accountants Course.

FAMILY RELATIONSHIPS

There are no family relationships among our directors or officers.

INVOLVEMENT IN CERTAIN LEGAL PROCEEDINGS

During the past five years, none of our directors, executive officers or persons that may be deemed promoters is or have been involved in any legal proceeding concerning: (i) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (ii) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (iii) being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction permanently or temporarily enjoining, barring, suspending or otherwise limiting involvement in any type of business, securities or banking activity; or (iv) being found by a court, the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law (and the judgment has not been reversed, suspended or vacated).

COMPLIANCE WITH SECTION 16(A) OF THE EXCHANGE ACT

Section 16(a) of the Exchange Act requires our directors and officers, and the persons who beneficially own more than ten percent of our common stock, to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Copies of all filed reports are required to be furnished to us pursuant to Rule 16a-3 promulgated under the Exchange Act. Based solely on the reports received by us and on the representations of the reporting persons, we believe that these persons filed their respective reports late but subsequently complied with all applicable filing requirements during the fiscal year ended December 31, 2014.

Code of Ethics

We have not adopted a Code of Ethics but expect to adopt a Code of Ethics and will require that each employee abide by the terms of such Code of Ethics.

Compliance With Section 16(A) of the Exchange Act

Section 16(a) of the Exchange Act requires the Company's directors and officers, and the persons who beneficially own more than ten percent of our common stock, to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Copies of all filed reports are required to be furnished to us pursuant to Rule 16a-3 promulgated under the Exchange Act. Based solely on the reports received by the Company and on the representations of the reporting persons, the Company believes that these persons have complied with all applicable filing requirements during the fiscal year ended December 31, 2012.

During fiscal year ended December 31, 2014 and 2013, our officers and directors earn certain salaries. Messrs. Paolucci and Karanovic each earn an annual salary of $208,000 and Ms. Carey earns an annual salary of $47,500.

SUMMARY COMPENSATION TABLE

The table below summarizes all compensation awarded to, earned by, or paid to the executive officers by any person for all services rendered in all capacities for the fiscal year ended December 31, 2014 and 2013.

SUMMARY COMPENSATION TABLE‡

Name and Principal Position | | Fiscal Year | | Salary ($) | | | Bonus ($) | | | Stock Awards ($) | | | Option Awards ($) | | | Nonequity Incentive Plan Compen- sation ($) | | | Non- Qualified Deferred Compen- sation Earnings ($) | | | All Other Compen- sation ($) | | | Total ($) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bernardino Paolucci | | 2014 | | $ | 208,000 | | | $ | -0- | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 208,000 | |

(Chief Executive Officer, | | 2013 | | $ | 208,000 | | | $ | 50,000 | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 258,000 | |

President,Treasurer/ Chief Financial Officer and Director) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

DIRECTOR COMPENSATION

We do not currently compensate our directors with cash for acting as such, although we may do so in the future. We reimburse our directors for reasonable expenses incurred in connection with their service as directors.

Name | | | Salary | | | Position |

| | | | | | | |

Bernardino Paolucci (1) | | | $ | 0 | | | Chairman of the Board, Director |

| | | | | | | | |

Drasko Karanovic (2) | | | $ | 250,000 | | | Director |

| | | | | | | | |

Beth Carey (3) | | | $ | 47,500 | | | Director |

_______________

(1) Mr. Paolucci earns an executive salary of $208,000, which is more fully discussed above in the Summary Compensation Table. Includes a $50,000 bonus granted in 2013.

(2) Mr. Karanovic earned a salary related to employment services of $208,000 during fiscal year ended December 31, 2014.

(3) Ms. Carey earned a salary related to employment services of $47,500 during fiscal year ended December 31, 2014.

EMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND CHANGE-IN-CONTROL ARRANGEMENTS

None of our executive officers or directors are parties to any employment contracts.

INDEMNIFICATION OF DIRECTORS AND OFFICERS

Under Nevada law, a corporation may indemnify its directors, officers, employees and agents under certain circumstances, including indemnification of such persons against liability under the Securities Act of 1933, as amended. In addition, a corporation may purchase or maintain insurance on behalf of its directors, officers, employees or agents for any liability incurred by him in such capacity, whether or not the corporation has the authority to indemnify such person.

Long-Term Incentive Plans and Awards

There were no awards made to a named executive officer in fiscal 2012 under any long-term incentive plan.

SECURITY OWNERSHIP OF EXECUTIVE OFFICERS, DIRECTORS

AND FIVE PERCENT STOCKHOLDERS

The following tables set forth information as of October 26, 2015 regarding the beneficial ownership of our common stock: (a) each stockholder who is known by us to own beneficially in excess of 5% of our outstanding common stock; (b) each director known to hold common or preferred stock; (c) our chief executive officer; and (d) the executive officers and directors as a group. Except as otherwise indicated, all persons listed below have (i) sole voting power and investment power with respect to their shares of stock, except to the extent that authority is shared by spouses under applicable law, and (ii) record and beneficial ownership with respect to their shares of stock. The percentage of beneficial ownership of common stock is based upon 111,370,000 shares of common stock outstanding as of October 26, 2015.

Name and Address of Beneficial Owner (1) | | Amount and Nature of Beneficial Ownership (1) | | | Percentage of Beneficial Ownership | |

Directors and Officers: | | | | | | |

Bernardino Paolucci 7669 Kimbal Street Mississauga, Ontario Canada L5S 1A7 | | | 51,404,000 | | | | 45.83 | % |

| | | | | | | | | |

Drasko Karanovic 7669 Kimbal Street Mississauga, Ontario Canada L5S 1A7 | | | 14,160,000 | | | | 12.71 | % |

| | | | | | | | | |

Beth Carey 7669 Kimbal Street Mississauga, Ontario Canada L5S 1A7 | | | -0- | | | | 0 | % |

| | | | | | | | | |

All executive officers and directors as a group (3 person) | | | 65,200,000 | | | | 58.54 | % |

| | | | | | | | | |

Beneficial Shareholders Greater than 10% | | | | | | | | |

| | | | | | | | | |

Manhattan Transfer Registrar Company (2) 57 Eastwood Road Miller Place, New York 11764 | | | 11,188,359 | (2) | | | 10.05 | % |

_______________

(1) | Under Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person's actual ownership or voting power with respect to the number of shares of common stock actually outstanding as of the date of this Annual Report. As of the date of this Information Statement, there are 111,370,000 shares issued and outstanding. |

| |

(2) | Manhattan Transfer Registrar Company was holding in escrow an aggregate 16,520,000 shares of common stock on behalf of those approximate 28% minority shareholders of D&R Technology for distribution. Of the 16,520,000 shares of common stock, 11,188,359 remain in escrow. Manhattan Transfer Registrar Company will not exercise any voting or dispositive power over the shares. |

FORWARD-LOOKING STATEMENTS

This information statement may contain certain "forward-looking" statements (as that term is defined in the Private Securities Litigation Reform Act of 1995 or by the U.S. Securities and Exchange Commission in its rules, regulations and releases) representing our expectations or beliefs regarding our company. These forward-looking statements include, but are not limited to, statements concerning our operations, economic performance, financial condition, and prospects and opportunities. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as "may," "will," "expect," "believe," "anticipate," "intend," "could," "estimate," "might," or "continue" or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. These statements, by their nature, involve substantial risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important factors, including factors discussed in this and other of our filings with the U.S. Securities and Exchange Commission.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended, and in accordance with the Securities Exchange Act, we file periodic reports, documents, and other information with the Securities and Exchange Commission relating to our business, financial statements, and other matters. These reports and other information may be inspected and are available for copying at the offices of the Securities and Exchange Commission, 100 F Street, N.E., Washington, DC 20549. Our SEC filings are also available to the public on the SEC's website at http://www.sec.gov.

INCORPORATION OF FINANCIAL INFORMATION

We "incorporate by reference" into this Information Statement the information in certain documents we file with the SEC, which means that we can disclose important information to you by referring you to those documents. We incorporate by reference into this information statement the following documents we have previously filed with the SEC: our Quarterly Report on Form 10-Q for quarterly periods ended September 30, 2015, June 30, 2015 and March 31, 2015, our Annual Report on Form 10-K for fiscal year ended December 31, 2014 and our Quarterly Reports on Form 10-Q for the quarterly periods ended September 30, 2014, June 30, 2014 and March 31, 2014. You may request a copy of these filings at no cost, by writing or telephoning us at the following address:

NOVUS ROBOTICS INC.

7669 Kimbal Street

Mississauga, Ontario

Canada L5S 1A7

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. This Information Statement is for informational purposes only. Please read this information statement carefully.

| By Order of the Board of Directors | |

| | | | |

| Dated: January 21, 2016 | By: | /s/ Bernardino Paolucci | |

| | Chief Executive Officer and Director | |

| | | |

16

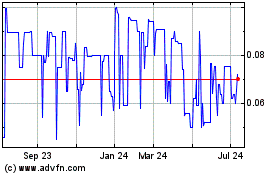

Novus Robotics (PK) (USOTC:NRBT)

Historical Stock Chart

From Mar 2024 to Apr 2024

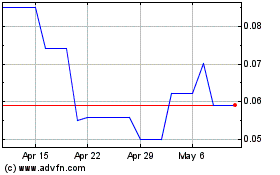

Novus Robotics (PK) (USOTC:NRBT)

Historical Stock Chart

From Apr 2023 to Apr 2024