UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

The Alkaline Water Company Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

99-0367049 |

| (State or other jurisdiction of incorporation or

organization) |

(I.R.S. Employer Identification No.)

|

7730 E Greenway Road Ste. 203

Scottsdale, AZ

85260

(Address of Principal Executive Offices)(Zip Code)

2013 Equity Incentive Plan

(Full title of the

plan)

InCorp Services, Inc.

2360 Corporate Circle Ste.

400

Henderson, NV 89074-7722

(Name and address of

agent for service)

(702) 866-2500

(Telephone number, including

area code, of agent for service)

Copies of all communications to:

Clark Wilson LLP

Suite 900 - 885 West Georgia

Street

Vancouver, British Columbia V6C 3H1, Canada

Telephone: (604) 687-5700

Attention: Mr. Virgil Z. Hlus

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and smaller reporting company” in Rule 12b-2 of the Exchange

Act.

| Large accelerated filer |

[ ] |

Accelerated filer |

[ ] |

| Non-accelerated filer |

[ ] (Do not check if a smaller reporting

company) |

Smaller reporting company |

[X] |

CALCULATION OF REGISTRATION FEE

| |

|

|

|

|

Proposed |

|

|

Proposed |

|

|

|

|

| |

|

|

|

|

maximum |

|

|

maximum |

|

|

Amount of |

|

| Title of securities to |

|

Amount to be |

|

|

offering price |

|

|

aggregate offering |

|

|

registration |

|

| be

registered |

|

registered(1),(2) |

|

|

per share(3) |

|

|

price(3) |

|

|

fee |

|

| Common Stock |

|

7,000,000 |

|

|

$0.90 |

|

|

$6,300,000 |

|

|

$634.41 |

|

| (1) |

An indeterminate number of additional shares of common

stock shall be issuable pursuant to Rule 416 under the Securities Act of

1933 to prevent dilution resulting from stock splits, stock dividends or

similar transactions and in such an event the number of shares registered

shall automatically be increased to cover the additional shares in

accordance with Rule 416. |

| |

|

| (2) |

Consists of up to an additional 7,000,000 shares of our

common stock issuable pursuant to our 2013 Equity Incentive Plan. Our 2013

Equity Incentive Plan provides for the grant of awards covering a maximum

of 7,700,000 shares of our common stock, 300,000 of which (on a post-split

basis) have been previously registered under a registration statement on

Form S-8 (Registration No. 333-200837) filed on December 10, 2014, and

400,000 of which (on a post-split basis) have been previously registered

under a registration statement on Form S-8 (Registration No. 333-192601)

filed on November 27, 2013. |

| |

|

| (3) |

Estimated in accordance with Rule 457 (h) under the

Securities Act of 1933 solely for the purpose of computing the amount of

the registration fee, and based on the closing price per share ($0.90) for

our common stock on January 19, 2016, as reported by OTC Markets Group’s

OTCQB. |

EXPLANATORY NOTE

Effective as of October 7, 2013, our company adopted the 2013

Equity Incentive Plan, pursuant to which a total of 20,000,000 shares of our

common stock were issuable pursuant to the 2013 Equity Incentive Plan. Effective

as of October 31, 2014, our 2013 Equity Incentive Plan was amended to increase

the number of shares of common stock issuable under the 2013 Equity Incentive

Plan by 15,000,000 shares. Effective as of December 30, 2015, our company

effected a fifty for one reverse stock split of our authorized and issued and

outstanding shares of common stock which decreased the number of shares of our

common stock issuable pursuant to the 2013 Equity Incentive Plan from 35,000,000

shares to 700,000 shares.

Effective as of January 20, 2016, our 2013 Equity Incentive

Plan was amended to increase the number of shares of common stock issuable under

the 2013 Equity Incentive Plan by 7,000,000 shares.

We prepared this registration statement in accordance with the

requirements of Form S-8 under the Securities Act of 1933, to register an

aggregate of an additional 7,000,000 shares of our common stock that are

issuable pursuant to our 2013 Equity Incentive Plan. We have previously filed

registration statements on Form S-8 (Registration No. 333-200837 and

Registration No. 333-192601) to register 700,000 shares of our common stock (on

a post-split basis) that are issuable pursuant to our 2013 Equity Incentive

Plan.

The additional shares being registered in this registration

statement on Form S-8 are of the same class as securities covered by the

registration statement on Form S-8 (Registration No. 333-200837) filed on

December 10, 2014 and the registration statement on Form S-8 (Registration No.

333-192601) filed on November 27, 2013, the contents of which are incorporated

herein by reference in accordance with General Instruction E to Form S-8, to the

extent not otherwise amended or superseded by the content of this registration

statement.

The purpose of our 2013 Equity Incentive Plan is to (a) enable

our company and any of our affiliates to attract and retain the types of

employees, consultants and directors who will contribute to our company’s long

range success; (b) provide incentives that align the interests of employees,

consultants and directors with those of the stockholders of our company; and (c)

promote the success of our company’s business. A total of 7,700,000 shares of

our stock are available for the grant of awards under the 2013 Equity Incentive

Plan and awards that may be granted under the plan includes incentive stock options, non-qualified stock

options, stock appreciation rights, restricted awards and performance

compensation awards.

Pursuant to Rule 429 promulgated under the Securities Act of

1933, a prospectus relating to this registration statement is a combined

prospectus relating also to the registration statement on Form S-8 (Registration

No. 333-192601) filed on November 27, 2013, and the registration statement on

Form S-8 (Registration No. 333-200837) filed on December 10, 2014. In addition,

this registration statement, which is a new registration statement, also

constitutes a post-effective amendment to the registration statement on Form S-8

(Registration No. 333-192601) filed on November 27, 2013, and the registration

statement on Form S-8 (Registration No. 333-200837) filed on December 10,

2014.

The combined Section 10(a) prospectus for our 2013 Equity

Incentive Plan updates, among other things, certain information regarding our

equity incentive plan, including the increase in the number of shares issuable

under our equity incentive plan.

Under cover of this registration statement on Form S-8 is a

combined reoffer prospectus prepared in accordance with Part I of Form S-3 under

the Securities Act of 1933 (in accordance with Section C of the General

Instructions to Form S-8). The reoffer prospectus may be used for reoffers and

resales of up to an aggregate of 296,000 “control securities” (as such term is

defined in Form S-8) issuable upon exercise of the stock options granted

pursuant to our 2013 Equity Incentive Plan on a continuous or delayed basis in

the future. The combined reoffer prospectus updates, among other things, certain

information regarding the ownership of our common stock by the selling

stockholders and the number of shares of our common stock available for resale

by each selling shareholder.

Part I

INFORMATION REQUIRED IN THE SECTION 10(a)

PROSPECTUS

Item 1. Plan Information.*

Item 2. Registrant Information and Employee Plan Annual

Information.*

* The document(s) containing the information specified in Part

I of Form S-8 will be sent or given to participants of our 2013 Equity Incentive

Plan as specified by Rule 428(b)(1) under the Securities Act of 1933. Such

documents are not being filed with the Securities and Exchange Commission, but

constitute, along with the documents incorporated by reference into this

registration statement, a prospectus that meets the requirements of Section

10(a) of the Securities Act of 1933.

Reoffer Prospectus

296,000 Shares

The Alkaline Water Company Inc.

Common Stock

_________________________________

The selling stockholders identified in this reoffer prospectus

may offer and sell up to 296,000 shares of our common stock issuable upon

exercise of stock options. We granted the stock options to such selling

stockholders pursuant to our 2013 Equity Incentive Plan.

The selling stockholders may sell all or a portion of the

shares being offered pursuant to this reoffer prospectus at fixed prices, at

prevailing market prices at the time of sale, at varying prices or at negotiated

prices.

The selling stockholders and any brokers executing selling

orders on their behalf may be deemed to be “underwriters” within the meaning of

the Securities Act of 1933, in which event commissions received by such brokers

may be deemed to be underwriting commissions under the Securities Act of 1933.

We will not receive any proceeds from the sale of the shares of

our common stock by the selling stockholders. We may, however, receive proceeds

upon exercise of the stock options by the selling stockholders. We will pay for

expenses of this offering, except that the selling stockholders will pay any

broker discounts or commissions or equivalent expenses and expenses of their

legal counsel applicable to the sale of their shares.

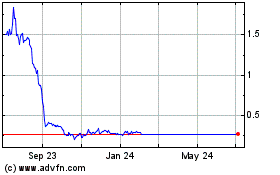

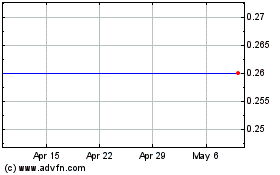

Our common stock is quoted on the OTC Markets Group’s OTCQB

under the symbol “WTERD”. On January 20, 2016, the closing price of our common

stock on the OTCQB was $0.76 per share.

_________________________________

Investing in our common stock involves risks. See “Risk

Factors” beginning on page 8.

_________________________________

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

_________________________________

The date of this reoffer prospectus is January 20, 2016.

5

Table of Contents

6

As used in this reoffer prospectus, the terms “we”, “us” “our”

and “Alkaline” refer to The Alkaline Water Company Inc., a Nevada corporation,

and its wholly-owned subsidiary, Alkaline Water Corp., and Alkaline Water

Corp.’s wholly-owned subsidiary, Alkaline 88, LLC, unless otherwise specified.

All dollar amounts refer to U.S. dollars unless otherwise indicated.

Prospectus Summary

Our Business

Our company offers retail consumers bottled alkaline water in

500ml, 700ml, 1-liter, 3-liter and 1-gallon sizes under the trade name

Alkaline88. Our product is produced through an electrolysis process that uses

specialized electronic cells coated with a variety of rare earth minerals to

produce our 8.8 pH drinking water without the use of any chemicals. Our product

also incorporates 84 trace Himalayan salts. The main reason consumers drink our

product is for the perceived benefit that a proper pH balance helps fight

disease and boosts the immune system and the perception that alkaline water

helps to maintain a proper body pH and keeps cells young and hydrated.

Alkaline 88, LLC, our operating subsidiary, operates primarily

as a marketing and distribution company. Alkaline 88, LLC has entered into

exclusive arrangements with Water Engineering Solutions LLC, an entity that is

controlled and owned by our President, Chief Executive Officer, Director and

major stockholder, Steven P. Nickolas, and our Vice-President, Secretary,

Treasurer and Director, Richard A. Wright, for the manufacture and production of

our alkaline generating electrolysis system machines. Alkaline 88, LLC has

entered into one-year agreement(s) with six different bottling companies in

Ohio, Georgia, California, Texas and Arizona to act as co-packers for our

product. Our current capacity at all plants exceeds $2,000,000 per month

wholesale. Our branding is being coordinated through 602 Design, LLC and our

component materials are readily available through multiple vendors. Our

principal suppliers are Plastipack Packaging, Polyplastics Co., West Coast

Manufacturing and Cactus Containers.

Our product is currently at the expansion phase of its

lifecycle. In March 2012 Alkaline 88, LLC did market research on the demand for

a bulk alkaline product at the Natural Product Expo West in Anaheim, California.

In January 2013, we began the formal launching of our product in Southern

California and Arizona. Since then, we have begun to deliver product through

approximately 16,000 retail outlets throughout the United States. We are

presently in all 50 States and the District of Columbia, although over 50% of

our current sales are concentrated in the Southwest and Texas. We have

distribution agreements with large national distributors (UNFI, KeHe, Tree of

Life and Natures Best, CoreMark and C&S), representing over 150,000 retail

establishments. Our current stores include convenience stores, natural food

products stores, large ethnic markets and national retailers. Currently, we sell

all of our products to our retailers through brokers and distributors. Our

larger retail clients bring the water in through their own warehouse

distribution network. Our current retail clients are made up of a variety of the

following; convenience stores, including 7-11’s; large national retailers,

including Albertson’s/Safeway, Kroger companies, and regional grocery chains

such as Schnucks, Smart & Final, Jewel-Osco, Sprouts, Bashas’, Bristol

Farms, Vallarta, Superior Foods, Brookshire’s, HEB and other companies

throughout the United States. In total we are now in 34 of the top 75 (by sales)

grocery retailers in the United States.

In April 2014 we entered into an exclusive territorial

distribution agreement with Kalil Bottling Co. on a new single serve 700ml

Bottle with a sport cap. This exclusivity is in Arizona and other areas in the

Southwestern United States. Kalil Bottling Co. is a direct to store distributor

(DSD). In the past fiscal year we have added a number of additional DSD’s in the

Southwest and have expanded our product offering to include 500ml and 1 liter

bottles.

In order to continue our expansion, we anticipate that we will

be required, in most cases, to continue to give promotional deals throughout

2016 and in subsequent years on a quarterly basis ranging from a 5%-15% discount

similar to all other beverage company promotional programs. It has been our

experience that most of the retailers have requested some type of promotional

introductory program which has included either a $0.25 -$0.50 per unit discount

on an initial order; a buy one get one free program; or a free-fill program

which includes 1-2 cases of free product per store location. Slotting has only

been presented and negotiated in the larger national grocery chains and, in most

cases, is offset by product sales. Our slotting fees with our current national

retailers do not exceed $400,000 in the aggregate and are offset through product

sales. In addition we participate in promotional activities of our distributors,

but these fees are not in excess of $500,000 and are offset through product

sales.

7

We have not yet established an ongoing source of revenues

sufficient to cover our operating costs and to allow us to continue as a going

concern. As of September 30, 2015, we had an accumulated deficit of $14,201,657.

Our ability to continue as a going concern is dependent on our company obtaining

adequate capital to fund operating losses until we become profitable. If we are

unable to obtain adequate capital, we could be forced to significantly curtail

or cease operations. In its report on the financial statements for the year

ended March 31, 2015, our independent registered public accounting firm included

an explanatory paragraph regarding substantial doubt about our ability to

continue as a going concern. Our financial statements do not include any

adjustments that might result from the outcome of this uncertainty.

The principal offices of our company are located at 7730 E

Greenway Road, Ste. 203, Scottsdale, AZ 85260. Our telephone number is (480)

656-2423.

The Offering

The selling stockholders identified in this reoffer prospectus

may offer and sell up to 296,000 shares of our common stock issuable upon

exercise of stock options. We granted the stock options to such selling

stockholders pursuant to our 2013 Equity Incentive Plan.

The selling stockholders may sell all or a portion of the

shares being offered pursuant to this reoffer prospectus at fixed prices, at

prevailing market prices at the time of sale, at varying prices or at negotiated

prices.

Number of Shares Outstanding

As of January 20, 2016, there were 3,819,039 shares of our

common stock issued and outstanding and 20,000,000 shares of our Series A

Preferred Stock issued and outstanding.

Use of Proceeds

We will not receive any proceeds from the sale of any shares of

our common stock by the selling stockholders. We may, however, receive proceeds

upon exercise of the stock options by the selling stockholders. If we receive

proceeds upon exercise of these stock options, we intend to use these proceeds

for working capital and general corporate purposes.

Risk Factors

An investment in our common stock involves a high degree of

risk. The risks described below include material risks to our company or to

investors purchasing shares of our common stock that are known to our company.

If any of the following risks actually occur, our business, financial condition

and results of operations could be materially harmed. As a result, the trading

price of our common stock could decline and you might lose all or part of your

investment. When determining whether to buy our common stock, you should also

refer to the other information contained in or incorporated by reference in this

reoffer prospectus.

Risks Related to Our Business

Because we have a limited operating history, our ability

to fully and successfully develop our business is unknown.

We were incorporated in June 6, 2011, and we have only begun

producing and distributing alkaline bottled water in 2013, and we have a limited

operating history from which investors can evaluate our business. Our ability to

successfully develop our products, and to realize consistent, meaningful

revenues and profit has not been established and cannot be assured. For us to

achieve success, our products must receive broad market acceptance by consumers.

Without this market acceptance, we will not be able to generate sufficient

revenue to continue our business operation. If our products are not widely

accepted by the market, our business may fail.

Our ability to achieve and maintain profitability and positive

cash flow is dependent upon our ability to generate revenues, manage development

costs and expenses, and compete successfully with our direct and indirect

competitors. We anticipate operating losses in upcoming future periods. This

will occur because there are expenses associated with the development,

production, marketing, and sales of our product.

8

Our independent registered public accounting firm has

expressed substantial doubt about our ability to continue as a going concern.

Our financial statements are prepared using generally accepted

accounting principles in the United States of America applicable to a going

concern, which contemplates the realization of assets and liquidation of

liabilities in the normal course of business. We have not yet established an

ongoing source of revenues sufficient to cover our operating costs and to allow

us to continue as a going concern. As of September 30, 2015, we had an

accumulated deficit of $14,201,657. Our ability to continue as a going concern

is dependent on our company obtaining adequate capital to fund operating losses

until we become profitable. If we are unable to obtain adequate capital, we

could be forced to significantly curtail or cease operations. In its report on

the financial statements for the year ended March 31, 2015, our independent

registered public accounting firm included an explanatory paragraph regarding

substantial doubt about our ability to continue as a going concern. Our

financial statements do not include any adjustments that might result from the

outcome of this uncertainty.

We will need additional funds to produce, market, and

distribute our product.

We will have to spend additional funds to produce, market and

distribute our product. If we cannot raise sufficient capital, we may have to

cease operations and you could lose your investment. We will need additional

funds to produce our product for distribution to our target market. Even after

we have produced our product, we will have to spend substantial funds on

distribution, marketing and sales efforts before we will know if we have

commercially viable and marketable/sellable products.

There is no guarantee that sufficient sale levels will be

achieved.

There is no guarantee that the expenditure of money on

distribution and marketing efforts will translate into sufficient sales to cover

our expenses and result in profits. Consequently, there is a risk that you may

lose all of your investment.

Our development, marketing, and sales activities are

limited by our size.

Because we are small and do not have much capital, we must

limit our product development, marketing, and sales activities. As such we may

not be able to complete our production and business development program in a

manner that is as thorough as we would like. We may not ever generate sufficient

revenues to cover our operating and expansion costs and you may, therefore, lose

your entire investment.

Changes in the non-alcoholic beverage business

environment and retail landscape could adversely impact our financial results.

The non-alcoholic beverage business environment is rapidly

evolving as a result of, among other things, changes in consumer preferences,

including changes based on health and nutrition considerations and obesity

concerns; shifting consumer tastes and needs; changes in consumer lifestyles;

and competitive product and pricing pressures. In addition, the non-alcoholic

beverage retail landscape is very dynamic and constantly evolving, not only in

emerging and developing markets, where modern trade is growing at a faster pace

than traditional trade outlets, but also in developed markets, where discounters

and value stores, as well as the volume of transactions through e-commerce, are

growing at a rapid pace. If we are unable to successfully adapt to the rapidly

changing environment and retail landscape, our share of sales, volume growth and

overall financial results could be negatively affected.

Intense competition and increasing competition in the

commercial beverage market could hurt our business.

The commercial retail beverage industry, and in particular its

non-alcoholic beverage segment, is highly competitive. Market participants are

of various sizes, with various market shares and geographical reach, some of

whom have access to substantially more sources of capital.

We compete generally with all liquid refreshments, including

bottled water and numerous specialty beverages, such as: SoBe; Snapple; Arizona;

Vitamin Water; Gatorade; and Powerade.

We compete indirectly with major international beverage

companies including but not limited to: the Coca-Cola Company; PepsiCo, Inc.;

Nestlé; Dr Pepper Snapple Group; Groupe Danone; Kraft Foods Group, Inc.; and

Unilever. These companies have established market presence in the United States,

and offer a variety of beverages that are substitutes to our product.

9

We face potential direct competition from such companies,

because they have the financial resources, and access to manufacturing and

distribution channels to rapidly enter the alkaline water market. We compete

directly with other alkaline water producers and brands focused on the emerging

alkaline beverage market including: Eternal; Essentia; Icelandic; Real Water;

Aqua Hydrate; Mountain Valley; Qure; Penta; and Alka Power. These companies

could bolster their position in the alkaline water market through additional

expenditure and promotion.

As a result of both direct and indirect competition, our

ability to successfully distribute, market and sell our product, and to gain

sufficient market share in the United States to realize profits may be limited,

greatly diminished, or totally diminished, which may lead to partial or total

loss of your investments in our company.

Alternative non-commercial beverages or processes could

hurt our business.

The availability of non-commercial beverages, such as tap

water, and machines capable of producing alkaline water at the consumer’s home

or at store-fronts could hurt our business, market share, and profitability.

Expansion of the alkaline beverage market or sufficiency

of consumer demand in that market for operations to be profitable are not

guaranteed.

The alkaline water market is an emerging market and there is no

guarantee that this market will expand or that consumer demand will be

sufficiently high to allow our company to successfully market, distribute and

sell our product, or to successfully compete with current or future competition,

all of which may result in total loss of your investment.

Our growth and profitability depends on the performance

of third-parties and our relationship with them.

Our distribution network and its success depend on the

performance of third parties. Any non-performance or deficient performance by

such parties may undermine our operations, profitability, and result in total

loss to your investment. To distribute our product, we use a

broker-distributor-retailer network whereby brokers represent our products to

distributors and retailers who will in turn sell our product to consumers. The

success of this network will depend on the performance of the brokers,

distributors and retailers of this network. There is a risk that a broker,

distributor, or retailer may refuse to or cease to market or carry our product.

There is a risk that the mentioned entities may not adequately perform their

functions within the network by, without limitation, failing to distribute to

sufficient retailers or positioning our product in localities that may not be

receptive to our product. Furthermore, such third-parties’ financial position or

market share may deteriorate, which could adversely affect our distribution,

marketing and sale activities. We also need to maintain good commercial

relationships with third-party brokers, distributors and retailers so that they

will promote and carry our product. Any adverse consequences resulting from the

performance of third-parties or our relationship with them could undermine our

operations, profitability and may result in total loss of your investment.

The loss of one or more of our major customers or a

decline in demand from one or more of these customers could harm our business.

We have 3 major customers that together account for 59% (31%,

18%, 10%, respectively) of accounts receivable at September 30, 2015, and 4

customers that together account for 58% (19% 15%, 14%, and 10%, respectively) of

the total revenues earned for the three months ended September 30, 2015. There

can be no assurance that such customers will continue to order our products in

the same level or at all. A reduction or delay in orders from such customers,

including reductions or delays due to market, economic or competitive

conditions, could have a material adverse effect on our business, operating

results and financial condition.

Health benefits of alkaline water is not guaranteed or

proven, rather it is perceived by consumers.

Health benefits of alkaline water are not guaranteed and have

not been proven. There is a consumer perception that drinking alkaline water has

beneficial health effects. Consequently, negative changes in consumers’

perception of the benefits of alkaline water or negative publicity surrounding

alkaline water may result in loss of market share or potential market share and

hence loss of your investment.

10

Water scarcity and poor quality could negatively impact

our production costs and capacity.

Water is the main ingredient in our product. It is also a

limited resource, facing unprecedented challenges from overexploitation,

increasing pollution, poor management, and climate change. As demand for water

continues to increase, as water becomes scarcer, and as the quality of available

water deteriorates, we may incur increasing production costs or face capacity

constraints that could adversely affect our profitability or net operating

revenues in the long run.

Increase in the cost, disruption of supply or shortage of

ingredients, other raw materials or packaging materials could harm our

business.

We and our bottlers will use water, 84 trace Himalayan salts,

packaging materials for bottles such as plastic and paper products. The prices

for these ingredients, other raw materials and packaging materials fluctuate

depending on market conditions. Substantial increases in the prices of our or

our bottlers’ ingredients, other raw materials and packaging materials, to the

extent they cannot be recouped through increases in the prices of finished

beverage products, would increase our operating costs and could reduce our

profitability. Increases in the prices of our finished products resulting from a

higher cost of ingredients, other raw materials and packaging materials could

affect the affordability of our product and reduce sales.

An increase in the cost, a sustained interruption in the

supply, or a shortage of some of these ingredients, other raw materials, or

packaging materials and containers that may be caused by a deterioration of our

or our bottlers’ relationships with suppliers; by supplier quality and

reliability issues; or by events such as natural disasters, power outages, labor

strikes, political uncertainties or governmental instability, or the like, could

negatively impact our net revenues and profits.

Changes in laws and regulations relating to beverage

containers and packaging could increase our costs and reduce demand for our

products.

We and our bottlers intend to offer our product in

nonrefillable, recyclable containers in the United States. Legal requirements

have been enacted in various jurisdictions in the United States requiring that

deposits or certain ecotaxes or fees be charged for the sale, marketing and use

of certain nonrefillable beverage containers. Other proposals relating to

beverage container deposits, recycling, ecotax and/or product stewardship have

been introduced in various jurisdictions in the United States and overseas, and

we anticipate that similar legislation or regulations may be proposed in the

future at local, state and federal levels in the United States. Consumers’

increased concerns and changing attitudes about solid waste streams and

environmental responsibility and the related publicity could result in the

adoption of such legislation or regulations. If these types of requirements are

adopted and implemented on a large scale in the geographical regions in which we

operate or intend to operate, they could affect our costs or require changes in

our distribution model, which could reduce our net operating revenues or

profitability.

Significant additional labeling or warning requirements

or limitations on the availability of our product may inhibit sales of affected

products.

Various jurisdictions may seek to adopt significant additional

product labeling or warning requirements or limitations on the availability of

our product relating to the content or perceived adverse health consequences of

our product. If these types of requirements become applicable to our product

under current or future environmental or health laws or regulations, they may

inhibit sales of our product.

Unfavorable general economic conditions in the United

States could negatively impact our financial performance.

Unfavorable general economic conditions, such as a recession or

economic slowdown, in the United States could negatively affect the

affordability of, and consumer demand for, our product in the United States.

Under difficult economic conditions, consumers may seek to reduce discretionary

spending by forgoing purchases of our products or by shifting away from our

beverages to lower-priced products offered by other companies, including

non-alkaline water. Consumers may also cease purchasing bottled water and

consume tap water. Lower consumer demand for our product in the United States

could reduce our profitability.

11

Adverse weather conditions could reduce the demand for

our products.

The sales of our products are influenced to some extent by

weather conditions in the markets in which we operate. Unusually cold or rainy

weather during the summer months may have a temporary effect on the demand for

our product and contribute to lower sales, which could have an adverse effect on

our results of operations for such periods.

Changes in, or failure to comply with, the laws and

regulations applicable to our products or our business operations could increase

our costs or reduce our net operating revenues.

The advertising, distribution, labeling, production, safety,

sale, and transportation in the United States of our product will be subject to:

the Federal Food, Drug, and Cosmetic Act; the Federal Trade Commission Act; the

Lanham Act; state consumer protection laws; competition laws; federal, state,

and local workplace health and safety laws, such as the Occupational Safety and

Health Act; various federal, state and local environmental protection laws; and

various other federal, state, and local statutes and regulations. Legal

requirements also apply in many jurisdictions in the United States requiring

that deposits or certain ecotaxes or fees be charged for the sale, marketing,

and use of certain non-refillable beverage containers. The precise requirements

imposed by these measures vary. Other types of statutes and regulations relating

to beverage container deposits, recycling, ecotaxes and/or product stewardship

also apply in various jurisdictions in the United States. We anticipate that

additional, similar legal requirements may be proposed or enacted in the future

at the local, state and federal levels in the United States. Changes to such

laws and regulations could increase our costs or reduce our net operating

revenues.

In addition, failure to comply with environmental, health or

safety requirements and other applicable laws or regulations could result in the

assessment of damages, the imposition of penalties, suspension of production,

changes to equipment or processes, or a cessation of operations at our or our

bottlers’ facilities, as well as damage to our image and reputation, all of

which could harm our profitability.

Our products are considered premium and healthy beverages

and are being sold at premium prices compared to our competitors; we cannot

provide any assurances as to consumers’ continued market acceptance of our

current and future products.

We will compete directly with other alkaline water producers

and brands focused on the emerging alkaline beverage market including Eternal,

Essentia, Icelandic, Real Water, Aqua Hydrate, Mountain Valley, Qure, Penta, and

Alka Power. Products offered by our direct competitors are sold in various

volumes and prices with prices ranging from approximately $1.39 for a half-liter

bottle to $2.99 for a one-liter bottle, and volumes ranging from half-liter

bottles to one-and-a half liter bottles. We currently offer our product in a

three-liter bottle for an SRP of $3.99, one-gallon bottle for an SRP of $4.99,

700 milliliter single serving at an SRP of $1.29, 1 liter at an SRP of $1.79 and

a 500 milliliter at an SRP of $.99. Our competitors may introduce larger sizes

and offer them at an SRP that is lower than our product. We can provide no

assurances that consumers will continue to purchase our product or that they

will not prefer to purchase a competitive product.

We rely on key executive officers, and their knowledge of

our business would be difficult to replace.

We are highly dependent on our two executive officers, Steven

P. Nickolas and Richard A. Wright. We do not have “key person” life insurance

policies for any of our officers. The loss of management and industry expertise

of any of our key executive officers could result in delays in product

development, loss of any future customers and sales and diversion of management

resources, which could adversely affect our operating results.

Our executive officers are not subject to supervision or

review by an independent board or audit committee.

Our board of directors consists of Steven P. Nickolas and

Richard A. Wright, our executive officers. Accordingly, we do not have any

independent directors. Also we do not have an independent audit committee. As a

result, the activities of our executive officers are not subject to the review

and scrutiny of an independent board of directors or audit committee.

12

Risk Related to Our Stock

Because Steven P. Nickolas controls a large percentage of

our voting stock, he has the ability to influence matters affecting our

stockholders.

Steven P. Nickolas, our President, Chief Executive Officer and

a director, exercises voting and dispositive power with respect to 776,000

shares of our common stock, which are beneficially owned by WiN Investments, LLC

and Lifewater Industries, LLC, and owns 10,000,000 shares of our Series A

Preferred Stock, which has 0.2 votes per share upon any matter submitted to our

stockholders for a vote. Accordingly, he controls a large percentage of the

votes attached to our outstanding voting securities. As a result, he has the

ability to influence matters affecting our stockholders, including the election

of our directors, the acquisition or disposition of our assets, and the future

issuance of our securities. Because he controls such large percentage of votes,

investors may find it difficult to replace our management if they disagree with

the way our business is being operated. Because the influence by Mr. Nickolas

could result in management making decisions that are in the best interest of Mr.

Nickolas and not in the best interest of the investors, you may lose some or all

of the value of your investment in our common stock.

Because we can issue additional shares of common stock,

our stockholders may experience dilution in the future.

We are authorized to issue up to 22,500,000 shares of common

stock and 100,000,000 shares of preferred stock, of which 3,819,039 shares of

common stock are issued and outstanding and 20,000,000 shares of Series A

Preferred Stock are issued and outstanding as of January 20, 2016. Our board of

directors has the authority to cause us to issue additional shares of common

stock and preferred stock, and to determine the rights, preferences and

privileges of shares of our preferred stock, without consent of our

stockholders. Consequently, the stockholders may experience more dilution in

their ownership of our stock in the future.

Trading on the OTCQB may be volatile and sporadic, which

could depress the market price of our common stock and make it difficult for our

stockholders to resell their shares.

Our common stock is quoted on the OTCQB operated by the OTC

Markets Group. Trading in stock quoted on the OTCQB is often thin and

characterized by wide fluctuations in trading prices, due to many factors that

may have little to do with our operations or business prospects. This volatility

could depress the market price of our common stock for reasons unrelated to

operating performance. Moreover, the OTCQB is not a stock exchange, and trading

of securities on the OTCQB is often more sporadic than the trading of securities

listed on a national securities exchange like the NASDAQ or the NYSE.

Accordingly, stockholders may have difficulty reselling any of our shares.

A decline in the price of our common stock could affect

our ability to raise further working capital, it may adversely impact our

ability to continue operations and we may go out of business.

A prolonged decline in the price of our common stock could

result in a reduction in the liquidity of our common stock and a reduction in

our ability to raise capital. Because we plan to acquire a significant portion

of the funds we need in order to conduct our planned operations through the sale

of equity securities, a decline in the price of our common stock could be

detrimental to our liquidity and our operations because the decline may cause

investors not to choose to invest in our stock. If we are unable to raise the

funds we require for all our planned operations, we may be forced to reallocate

funds from other planned uses and may suffer a significant negative effect on

our business plan and operations, including our ability to develop new products

and continue our current operations. As a result, our business may suffer, and

not be successful and we may go out of business. We also might not be able to

meet our financial obligations if we cannot raise enough funds through the sale

of our equity securities and we may be forced to go out of business.

Because we do not intend to pay any cash dividends on our

shares of common stock in the near future, our stockholders will not be able to

receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the

development and expansion of our business. We do not anticipate paying any cash

dividends on our common stock in the near future. The declaration, payment and

amount of any future dividends will be made at the discretion of the board of

directors, and will depend upon, among other things, the results of operations,

cash flows and financial condition, operating and capital requirements, and

other factors as the board of directors considers relevant. There is no

assurance that future dividends will be paid, and if dividends are paid, there

is no assurance with respect to the amount of any such dividend.

Unless we pay dividends, our stockholders will not be able to receive a return

on their shares unless they sell them.

13

Our stock is a penny stock. Trading of our stock may be

restricted by the SEC’s penny stock regulations, which may limit a stockholder’s

ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange

Commission (“SEC”) has adopted Rule 15g-9 which generally defines “penny stock”

to be any equity security that has a market price (as defined in Rule 15g-9)

less than $5.00 per share or an exercise price of less than $5.00 per share,

subject to certain exceptions. Our securities are covered by the penny stock

rules, which impose additional sales practice requirements on broker-dealers who

sell to persons other than established customers and “accredited investors”. The

term “accredited investor” refers generally to institutions with assets in

excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or

annual income exceeding $200,000 or $300,000 jointly with their spouse. The

penny stock rules require a broker-dealer, prior to a transaction in a penny

stock not otherwise exempt from the rules, to deliver a standardized risk

disclosure document in a form prepared by the SEC, which provides information

about penny stocks and the nature and level of risks in the penny stock market.

The broker-dealer also must provide the customer with current bid and offer

quotations for the penny stock, the compensation of the broker-dealer and its

salesperson in the transaction and monthly account statements showing the market

value of each penny stock held in the customer’s account. The bid and offer

quotations, and the broker-dealer and salesperson compensation information, must

be given to the customer orally or in writing prior to effecting the transaction

and must be given to the customer in writing before or with the customer’s

confirmation. In addition, the penny stock rules require that prior to a

transaction in a penny stock not otherwise exempt from these rules; the

broker-dealer must make a special written determination that the penny stock is

a suitable investment for the purchaser and receive the purchaser’s written

agreement to the transaction. These disclosure requirements may have the effect

of reducing the level of trading activity in the secondary market for the stock

that is subject to these penny stock rules. Consequently, these penny stock

rules may affect the ability of broker-dealers to trade our securities. We

believe that the penny stock rules discourage investor interest in and limit the

marketability of our common stock.

FINRA sales practice requirements may also limit a

stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules promulgated by the SEC,

the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that

require that in recommending an investment to a customer, a broker-dealer must

have reasonable grounds for believing that the investment is suitable for that

customer. Prior to recommending speculative low priced securities to their

non-institutional customers, broker-dealers must make reasonable efforts to

obtain information about the customer’s financial status, tax status, investment

objectives and other information. Under interpretations of these rules, FINRA

believes that there is a high probability that speculative low priced securities

will not be suitable for at least some customers. FINRA requirements make it

more difficult for broker-dealers to recommend that their customers buy our

common stock, which may limit your ability to buy and sell our stock.

Forward-Looking Statements

This reoffer prospectus contains forward-looking statements.

Forward-looking statements are projections in respect of future events or our

future financial performance. In some cases, you can identify forward-looking

statements by terminology such as “may”, “should”, “intend”, “expect”, “plan”,

“anticipate”, “believe”, “estimate”, “predict”, “potential”, or “continue” or

the negative of these terms or other comparable terminology. These statements

are only predictions and involve known and unknown risks, including the risks in

the section entitled “Risk Factors”, uncertainties and other factors, which may

cause our company’s or our industry’s actual results, levels of activity or

performance to be materially different from any future results, levels of

activity or performance expressed or implied by these forward-looking

statements. Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee future results,

levels of activity or performance. Except as required by applicable law,

including the securities laws of the United States, we do not intend to update

any of the forward-looking statements to conform these statements to actual

results.

14

The Offering

The selling stockholders identified in this reoffer prospectus

may offer and sell up to 296,000 shares of our common stock issuable upon

exercise of stock options. We granted the stock options to such selling

stockholders pursuant to our 2013 Equity Incentive Plan.

Use of Proceeds

We will not receive any proceeds from the sale of the shares of

our common stock by the selling stockholders. We may, however, receive proceeds

upon exercise of the stock options granted to the selling stockholders. If we

receive proceeds upon exercise of stock options, we intend to use these proceeds

for working capital and general corporate purposes.

Determination of Offering Price

The selling stockholders may sell all or a portion of the

shares being offered pursuant to this reoffer prospectus at fixed prices, at

prevailing market prices at the time of sale, at varying prices or at negotiated

prices.

Selling Stockholders

The selling stockholders may offer and sell, from time to time,

any or all of shares of our common stock issuable upon exercise of the stock

options granted pursuant to our 2013 Equity Incentive Plan.

The following table identifies the selling stockholders and

indicates (i) the nature of any material relationship that such selling

stockholder has had with us for the past three years, (ii) the number of shares

of our common stock held by the selling stockholders, (iii) the amount to be

offered for each of the selling stockholder’s account, and (iv) the number of

shares of our common stock and percentage of outstanding shares of our common

stock to be owned by each selling stockholder after the sale of the shares of

our common stock offered by them pursuant to this offering. The selling

stockholders are not obligated to sell the shares offered in this reoffer

prospectus and may choose not to sell any of the shares or only a part of the

shares that they receive.

The information provided in the following table with respect to

the selling stockholders has been obtained from each of the selling

stockholders. Because the selling stockholders may offer and sell all or only

some portion of the shares of our common stock being offered pursuant to this

reoffer prospectus, the numbers in the table below representing the amount and

percentage of these shares of our common stock that will be held by the selling

stockholders upon termination of the offering are only estimates based on the

assumption that each selling stockholder will sell all of his or her shares of

our common stock being offered in the offering. In addition, the selling

stockholders may have sold, transferred or otherwise disposed of, or may sell,

transfer or otherwise dispose of, at any time or from time to time since the

date on which he or she provided the information regarding the shares of common

stock beneficially owned by them, all or some portion of the shares of common

stock beneficially owned by them in transactions exempt from the registration

requirements of the Securities Act of 1933.

None of the selling stockholders is a broker-dealer or an

affiliate of a broker-dealer. We may require the selling stockholders to suspend

the sales of the shares of our common stock being offered pursuant to this

reoffer prospectus upon the occurrence of any event that makes any statement in

this reoffer prospectus or the related registration statement untrue in any

material respect or that requires the changing of statements in those documents

in order to make statements in those documents not misleading.

15

Name of

Selling Stockholder |

Shares Owned

by the

Selling

Stockholder

before the

Offering(1)

|

Total

Shares

Offered

in the Offering

|

Number of Shares to Be

Owned

by Selling Stockholder and Percent

of Total

Issued and Outstanding

Shares After the Offering

(1) |

# of

Shares(2)

|

% of

Class(2),(3)

|

| Steven P. Nickolas(4) |

924,000(5) |

148,000(6) |

776,000(7) |

18.9% |

| Richard A. Wright(8) |

148,000(9) |

148,000(10) |

Nil |

* |

| Totals |

1,072,000 |

296,000 |

776,000 |

18.9% |

| Notes |

|

| |

|

| * |

Less than 1%. |

| |

|

| (1) |

Beneficial ownership is determined in accordance with

Securities and Exchange Commission rules and generally includes voting or

investment power with respect to shares of common stock. Shares of common

stock subject to options, warrants and convertible preferred stock

currently exercisable or convertible, or exercisable or convertible within

60 days, are counted as outstanding for computing the percentage of the

person holding such options, warrants or convertible preferred stock but

are not counted as outstanding for computing the percentage of any other

person. We believe that the selling stockholders have sole voting and

investment powers over their shares. |

| |

|

| (2) |

We have assumed that the selling stockholders will sell

all of the shares being offered in this offering. |

| |

|

| (3) |

Based on 3,819,039 shares of our common stock issued and

outstanding as of January 20, 2016. Shares of our common stock being

offered pursuant to this reoffer prospectus by a selling stockholder are

counted as outstanding for computing the percentage of that particular

selling stockholder but are not counted as outstanding for computing the

percentage of any other person. |

| |

|

| (4) |

Effective as of May 31, 2013, Steven P. Nickolas was

appointed as chairman, president, chief executive officer, secretary and a

director of our company. On August 7, 2013, our board of directors

replaced Mr. Nickolas as secretary of our company with Richard A. Wright.

|

| |

|

| (5) |

Consists of 148,000 shares of our common stock subject to

vested stock options exercisable within 60 days, 430,000 shares of our

common stock owned by WiN Investments, LLC and 346,000 shares of our

common stock owned by Lifewater Industries, LLC. Steven P. Nickolas

exercises voting and dispositive power with respect to the shares of our

common stock that are beneficially owned by WiN Investments, LLC and

Lifewater Industries, LLC. Does not include 10,000,000 shares of Series A

Preferred Stock. The Series A Preferred Stock has 0.2 votes per share and

is not convertible into shares of our common stock. |

| |

|

| (6) |

Consists of 60,000 shares of our common stock issuable at

an exercise price of $7.50 per share until October 9, 2023 upon exercise

of the stock options granted pursuant to the stock option agreement dated

October 9, 2013 as amended October 31, 2014, 12,000 shares of our common

stock issuable at an exercise price of $8.25 per share until May 12, 2019

upon exercise of the stock options granted pursuant to the stock option

agreement dated May 12, 2014, 60,000 shares of our common stock issuable

at an exercise price of $7.275 per share until May 21, 2024 upon exercise

of the stock options granted pursuant to the stock option agreement dated

May 21, 2014, and 16,000 shares of our common stock issuable at an

exercise price of $5.75 per share until February 18, 2020 upon exercise of

the stock options granted pursuant to the stock option agreement dated

February 18, 2015. We granted these stock options pursuant to our 2013

Equity Incentive Plan. |

16

| (7) |

Consists of 430,000 shares of our common stock owned by

WiN Investments, LLC and 346,000 shares of our common stock owned by

Lifewater Industries, LLC. Steven P. Nickolas exercises voting and

dispositive power with respect to the shares of our common stock that are

beneficially owned by WiN Investments, LLC and Lifewater Industries, LLC.

Does not include 10,000,000 shares of Series A Preferred Stock. The Series

A Preferred Stock has 0.2 votes per share and is not convertible into

shares of our common stock. |

| |

|

| (8) |

Effective as of May 31, 2013, Richard A. Wright was

appointed as vice-president, treasurer and a director of our company. On

August 7, 2013, our board of directors appointed Mr. Wright as secretary

of our company. |

| |

|

| (9) |

Consists of 148,000 shares of our common stock subject to

vested stock options exercisable within 60 days. Does not include

10,000,000 shares of Series A Preferred Stock. The Series A Preferred

Stock has 0.2 votes per share and is not convertible into shares of our

common stock. |

| |

|

| (10) |

Consists of 60,000 shares of our common stock issuable at

an exercise price of $7.50 per share until October 9, 2023 upon exercise

of the stock options granted pursuant to the stock option agreement dated

October 9, 2013 as amended October 31, 2014, 12,000 shares of our common

stock issuable at an exercise price of $8.25 per share until May 12, 2019

upon exercise of the stock options granted pursuant to the stock option

agreement dated May 12, 2014, 60,000 shares of our common stock issuable

at an exercise price of $7.275 per share until May 21, 2024 upon exercise

of the stock options granted pursuant to the stock option agreement dated

May 21, 2014, and 16,000 shares of our common stock issuable at an

exercise price of $5.75 per share until February 18, 2020 upon exercise of

the stock options granted pursuant to the stock option agreement dated

February 18, 2015. We granted these stock options pursuant to our 2013

Equity Incentive Plan. |

Plan of Distribution

The selling stockholders may, from time to time, sell all or a

portion of the shares of our common stock on any market upon which our common

stock may be listed or quoted (currently the OTC Markets Group’s OTCQB), in

privately negotiated transactions or otherwise. Such sales may be at fixed

prices prevailing at the time of sale, at prices related to the market prices or

at negotiated prices. The shares of our common stock being offered for resale

pursuant to this reoffer prospectus may be sold by the selling stockholders by

one or more of the following methods, without limitation:

| |

1. |

block trades in which the broker or dealer so engaged

will attempt to sell the shares of our common stock as agent but may

position and resell a portion of the block as principal to facilitate the

transaction; |

| |

|

|

| |

2. |

purchases by broker or dealer as principal and resale by

the broker or dealer for its account pursuant to this reoffer

prospectus; |

| |

|

|

| |

3. |

an exchange distribution in accordance with the rules of

the applicable exchange or quotation system; |

| |

|

|

| |

4. |

ordinary brokerage transactions and transactions in which

the broker solicits purchasers; |

| |

|

|

| |

5. |

privately negotiated transactions; |

| |

|

|

| |

6. |

market sales (both long and short to the extent permitted

under the federal securities laws); |

| |

|

|

| |

7. |

at the market to or through market makers or into an

existing market for the shares; |

| |

|

|

| |

8. |

through transactions in options, swaps or other

derivatives (whether exchange listed or otherwise); |

| |

|

|

| |

9. |

a combination of any aforementioned methods of sale;

and |

| |

|

|

| |

10. |

Any other method permitted pursuant to applicable

law. |

In effecting sales, brokers and dealers engaged by the selling

stockholders may arrange for other brokers or dealers to participate. Brokers or dealers may receive commissions or

discounts from a selling stockholder or, if any of the broker-dealers act as an

agent for the purchaser of such shares, from a purchaser in amounts to be

negotiated which are not expected to exceed those customary in the types of

transactions involved. Broker-dealers may agree with a selling stockholder to

sell a specified number of the shares of our common stock at a stipulated price

per share. Such an agreement may also require the broker-dealer to purchase as

principal any unsold shares of our common stock at the price required to fulfill

the broker-dealer commitment to the selling stockholder if such broker-dealer is

unable to sell the shares on behalf of the selling stockholder. Broker-dealers

who acquire shares of our common stock as principal may thereafter resell the

shares of our common stock from time to time in transactions which may involve

block transactions and sales to and through other broker-dealers, including

transactions of the nature described above. Such sales by a broker-dealer could

be at prices and on terms then prevailing at the time of sale, at prices related

to the then-current market price or in negotiated transactions. In connection

with such resale, the broker-dealer may pay to or receive from the purchasers of

the shares commissions as described above.

17

The selling stockholders and any broker-dealers or agents that

participate with the selling stockholders in the sale of the shares of our

common stock may be deemed to be “underwriters” within the meaning of the

Securities Act of 1933 in connection with these sales. In that event, any

commissions received by the broker-dealers or agents and any profit on the

resale of the shares of common stock purchased by them may be deemed to be

underwriting commissions or discounts under the Securities Act of 1933.

From time to time, any of the selling stockholders may pledge

shares of our common stock pursuant to the margin provisions of customer

agreements with brokers. Upon a default by a selling stockholder, his or her

broker may offer and sell the pledged shares of our common stock from time to

time. Upon a sale of the shares of our common stock, we believe that the selling

stockholders will satisfy the prospectus delivery requirements under the

Securities Act of 1933. We intend to file any amendments or other necessary

documents in compliance with the Securities Act of 1933 which may be required in

the event any of the selling stockholders defaults under any customer agreement

with brokers.

To the extent required under the Securities Act of 1933, a

post-effective amendment to the registration statement of which this reoffer

prospectus forms a part will be filed disclosing the name of any broker-dealers,

the number of shares of our common stock involved, the price at which our common

stock is to be sold, the commissions paid or discounts or concessions allowed to

such broker-dealers, where applicable, that such broker-dealers did not conduct

any investigation to verify the information set out or incorporated by reference

in this reoffer prospectus and other facts material to the transaction.

We and the selling stockholders will be subject to applicable

provisions of the Securities Exchange Act of 1934 and the rules and regulations

under it, including, without limitation, Rule 10b-5 and, insofar as a selling

stockholder is a distribution participant and we, under certain circumstances,

may be a distribution participant, under Regulation M. All of the foregoing may

affect the marketability of our common stock.

All expenses for this reoffer prospectus and related

registration statement including legal, accounting, printing and mailing fees

are and will be borne by us. Any commissions, discounts or other fees payable to

brokers or dealers in connection with any sale of the shares of common stock

will be borne by the selling stockholders, the purchasers participating in such

transaction, or both.

Any shares of our common stock being offered pursuant to this

reoffer prospectus which qualify for sale pursuant to Rule 144 under the

Securities Act of 1933, may be sold under Rule 144 rather than pursuant to this

reoffer prospectus.

Under the Securities Exchange Act of 1934, any person engaged

in a distribution of the shares offered by this reoffer prospectus may not

simultaneously engage in market making activities with respect to our common

shares during the applicable “cooling off” periods prior to the commencement of

such distribution. In addition, and without limiting the foregoing, the selling

stockholders will be subject to applicable provisions of the Securities Exchange

Act of 1934 and the rules and regulations thereunder, which provisions may limit

the timing of purchases and sales of the shares by the selling stockholders.

18

Experts and Counsel

Our consolidated financial statements for the years ended March

31, 2015 and 2014 have been incorporated by reference in this reoffer prospectus

from our annual report on Form 10-K for the year ended March 31, 2015 filed with

the Securities and Exchange Commission on July 14, 2015 in reliance on the

report of Seale and Beers, CPAs, an independent registered public accounting

firm, which has also been incorporated by reference in this reoffer prospectus,

given on the authority of said firm as experts in auditing and accounting.

Clark Wilson LLP, of Suite 900 – 885 West Georgia Street,

Vancouver, British Columbia, Canada has provided an opinion on the validity of

the shares of our common stock being offered pursuant to this reoffer

prospectus.

Interest of Named Experts and Counsel

No expert named in the registration statement of which this

reoffer prospectus forms a part as having prepared or certified any part thereof

(or is named as having prepared or certified a report or valuation for use in

connection with such registration statement) or counsel named in this reoffer

prospectus as having given an opinion upon the validity of the securities being

offered pursuant to this reoffer prospectus or upon other legal matters in

connection with the registration or offering such securities was employed for

such purpose on a contingency basis. Also at the time of such preparation,

certification or opinion or at any time thereafter, through the date of

effectiveness of such registration statement or that part of such registration

statement to which such preparation, certification or opinion relates, no such

person had, or is to receive, in connection with the offering, a substantial

interest, direct or indirect, in our company or any of its parents or

subsidiaries. Nor was any such person connected with our company or any of its

parents or subsidiaries as a promoter, managing or principal underwriter, voting

trustee, director, officer or employee.

Material Changes

There have been no material changes to the affairs of our

company since March 31, 2015 which have not previously been described in a

report on Form 10-K, Form 10-Q or Form 8-K filed with the Securities and

Exchange Commission.

Incorporation of Certain Information by Reference

The following documents filed by our company with the

Securities and Exchange Commission are incorporated into this reoffer prospectus

by reference:

| 1. |

our annual report on Form 10-K filed on July 14,

2015; |

| |

|

| 2. |

our quarterly reports on Form 10-Q filed on August 18,

2015 and November 23, 2015; |

| |

|

| 3. |

our current reports on Form 8-K filed on April 14, 2015,

June 26, 2015, July 15, 2015, December 1, 2015, December 4, 2015 and

December 30, 2015; and |

| |

|

| 4. |

the description of our common stock contained in our

registration statement on Form 8-A filed on October 25, 2013, including

any amendments or reports filed for the purpose of updating such

description. |

In addition to the foregoing, all documents that we

subsequently file pursuant to Sections 13(a), 13(c), 14 and 15(d) of the

Securities Exchange Act of 1934, prior to the filing of a post-effective

amendment indicating that all of the securities offered pursuant to the

registration statement of which this reoffer prospectus forms a part have been

sold or deregistering all securities then remaining unsold, will be deemed to be

incorporated by reference into this reoffer prospectus and to be part hereof

from the date of filing of such documents. Any statement contained in a document

incorporated by reference in this reoffer prospectus will be deemed to be

modified or superseded for purposes of this reoffer prospectus to the extent

that a statement contained in this reoffer prospectus or in any subsequently

filed document that is also incorporated by reference in this reoffer prospectus

modifies or supersedes such statement. Any statement so modified or superseded

will not be deemed, except as so modified or superseded, to constitute a part of

this reoffer prospectus.

19

Where You Can Find More Information

We will provide to each person, including any beneficial owner,

to whom this reoffer prospectus is delivered, at no cost, upon written or oral

request, a copy of any or all of the information that has been incorporated by

reference in this reoffer prospectus but not delivered with this reoffer

prospectus. Requests for documents should be directed to The Alkaline Water

Company Inc., 7730 E Greenway Road, Ste. 203, Scottsdale, Arizona 85260,

Attention: President, telephone number (480) 656-2423. Exhibits to these filings

will not be sent unless those exhibits have been specifically incorporated by

reference in such filings.

We file annual, quarterly and current reports, proxy statements

and other information with the Securities and Exchange Commission. Such filings

are available to the public over the internet at the Securities and Exchange

Commission’s website at http://www.sec.gov. The public may also read and copy

any materials we file with the Securities and Exchange Commission at its public

reference room at 100 F Street, N.E. Washington, D.C. 20549. The public may

obtain information on the operation of the public reference room by calling the

Securities and Exchange Commission at 1-800-SEC-0330.

We have filed with the Securities and Exchange Commission a

registration statement on Form S-8 under the Securities Act of 1933 with respect

to the securities offered under this reoffer prospectus. This reoffer

prospectus, which forms a part of that registration statement, does not contain

all information included in the registration statement. Certain information is

omitted and you should refer to the registration statement and its exhibits.

You should only rely on the information incorporated by

reference or provided in this reoffer prospectus or any supplement. We have not

authorized anyone else to provide you with different information. This reoffer

prospectus does not constitute an offer to sell or a solicitation of an offer to

buy any of the securities offered hereby by anyone in any jurisdiction in which

such offer or solicitation is not authorized or in which the person making such

offer or solicitation is not qualified to do so or to any person to whom it is

unlawful to make such offer or solicitation. You should not assume that the

information in this reoffer prospectus or any supplement is accurate as of any

date other than the date of this reoffer prospectus.

20

296,000 Shares

The Alkaline Water Company Inc.

Common Stock

_______________________________

Reoffer Prospectus

_________________________________

January 20, 2016

21

Part II

INFORMATION REQUIRED IN THE REGISTRATION

STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by our company with the

Securities and Exchange Commission are incorporated into this registration

statement by reference:

| 1. |

our annual report on Form 10-K filed on July 14,

2015; |

| |

|

| 2. |

our quarterly reports on Form 10-Q filed on August 18,

2015 and November 23, 2015; |

| |

|

| 3. |

our current reports on Form 8-K filed on April 14, 2015,

June 26, 2015, July 15, 2015, December 1, 2015, December 4, 2015 and

December 30, 2015; and |

| |

|

| 4. |

the description of our common stock contained in our

registration statement on Form 8-A filed on October 25, 2013, including

any amendments or reports filed for the purpose of updating such

description. |

In addition to the foregoing, all documents that we

subsequently file pursuant to Sections 13(a), 13(c), 14 and 15(d) of the

Securities Exchange Act of 1934, prior to the filing of a post-effective

amendment indicating that all of the securities offered pursuant to this

registration statement have been sold or deregistering all securities then

remaining unsold, will be deemed to be incorporated by reference into this

registration statement and to be part hereof from the date of filing of such

documents. Any statement contained in a document incorporated by reference in

this registration statement will be deemed to be modified or superseded for

purposes of this registration statement to the extent that a statement contained

in this registration statement or in any subsequently filed document that is

also incorporated by reference in this registration statement modifies or

supersedes such statement. Any statement so modified or superseded will not be

deemed, except as so modified or superseded, to constitute a part of this

registration statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

No expert named in this registration statement as having

prepared or certified any part thereof (or is named as having prepared or

certified a report or valuation for use in connection with this registration