By Ellie Ismailidou and Sara Sjolin, MarketWatch

Biotech rallies 1.2%; Goldman Sachs shares drop to nearly 3-year

low

U.S. stocks trimmed deep losses scored early in the session as

oil futures extended a deep rout, with the Nasdaq Composite turning

positive in the final hour of trading.

The S&P 500 was down 14 points, or 0.7%, to 1,867 after

earlier diving as low as 1,812.22, its lowest level since February

2014.

On Wednesday morning, the index fell the farthest below its

200-day moving

(http://www.marketwatch.com/story/sp-500-drops-more-than-10-below-its-200-day-moving-average-2016-01-20)

average since the October 2011 correction, according to data

provided by FactSet. Wednesday afternoon, it was down 9.66% for the

month of January, on track for it worst January performance in its

history.

The energy sector was the worst performer on the S&P 500,

down 4.4% on the day and 14.7% since the beginning of the year, led

by Devon Energy Corp. (DVN), down 11.8% on the day.

The Dow Jones Industrial Average was down 152 points, or 15,863,

recovering from a 550-point-drop earlier on Wednesday afternoon,

its worst one-day point drop in the past 12 months, but still on

track for its worst January performance in history.

The Nasdaq Composite erased a 145-point drop to rise 25 points,

or 0.6%, to 4,503

The stock-market rout came as equities racked up sharp losses

world-wide, fueled by oil falling below $27

(http://www.marketwatch.com/story/oil-prices-hit-fresh-12-year-low-under-28-a-barrel-2016-01-20)

a barrel and worries over an economic slowdown in China and other

developing markets.

"The fledgling hope from yesterday that markets were on the turn

has been quashed by sharp overnight falls in Japan and Asia," said

Rebecca O'Keeffe, head of investment at stockbroker Interactive

Investor, in a note.

"With every upturn being followed by deeper falls, investors are

increasingly wary as it becomes more and more difficult to

determine what might happen next," O'Keeffe said.

What is more concerning is that "even as investors are turning

their focus to U.S. domestic fundamentals, we still don't see

equity support in terms of buying," said Howard Silverblatt, senior

index analyst at S&P Dow Jones Indices.

Including Wednesday morning, out of 46 issues on the S&P 500

that have reported earnings, 35 beat expectations, with 11 of 14

financials beating, according to data from S&P Dow Jones

Indices. Yet aggregate earnings per share for the S&P 500 were

estimated to drop nearly 6% year-over-year, according to data from

S&P Capital IQ.

"Earnings will be the main issue that will make or break the

market. By this time next week we will be so deep into the earnings

[season] that you can't miss it," Silverblatt added.

A few analysts pointed to margin calls as one of the main

drivers behind the bloodbath, as margin debt peaked in 2015 to its

highest level in 20 years, according to New York Stock Exchange

data.

Margin debt levels are closely correlated with the S&P 500

performance, said Mike Antonelli, equity sales trader at R.W Baird

& Co.

"This is a function of market psychology. As stocks rise, people

borrow more to buy more stocks...But when investors sell because

they're fearful and overleveraged, this adds to the negative

feedback loop," Antonelli added.

Meanwhile, a flurry of economic data offered a mixed picture of

the U.S. economy, but did little to hearten the gloomy sentiment

hurting the market.

The U.S. consumer-price index dropped 0.1% in December,

(http://www.marketwatch.com/story/inflation-falls-again-in-december-cpi-finds-2016-01-20)

but core CPI, which excludes food and energy, rose 0.1%. Though the

headline number came in lower than expected, the core was in line

with economists' expectations. For all of 2015 inflation rose just

0.7%, the second slowest rate in 50 years.

Housing starts fell 2.5% last month

(http://www.marketwatch.com/story/housing-starts-fall-25-in-final-month-of-2015-2016-01-20),

missing economists' expectations, and indicating that home builders

cut back slightly on new construction in the final month of

2015.

Meanwhile, in Asia

(http://www.marketwatch.com/story/hong-kong-stocks-hit-312-year-low-japan-nears-bear-market-2016-01-19),

Japan's Nikkei slid into bear market territory, which marks a 20%

slump from a recent high. And in Europe, markets were hit across

the board, with the Stoxx Europe 600 index tumbling over 3% to

close at its lowest level since late 2014

(http://www.marketwatch.com/story/european-stocks-tumbling-toward-lowest-close-in-more-than-a-year-2016-01-20).

Read:China's problems now spilling into Hong Kong

(http://www.marketwatch.com/story/have-investors-lost-faith-in-hong-kong-as-well-as-in-china-2016-01-19)

Oil blues: Crude oil hit fresh 12-year lows to settle below $27

a barrel

(http://www.marketwatch.com/story/oil-prices-hit-fresh-12-year-low-under-28-a-barrel-2016-01-20)

for the February contract, which expired at the end of trade

Wednesday.

The losses weighed on U.S. oil companies, with shares of Chevron

Corp. (CVX) down 5.6%, Exxon Mobil Corp. (XOM) off 5.8%, and

Anadarko Petroleum Corp. (APC) 2.8% lower. Seadrill Ltd. (SDRL.OS)

slid 13.2%.

Other movers and shakers: International Business Machines Corp.

shares (IBM), retreated 6% after the company late Tuesday reported

a drop in fourth-quarter earnings

(http://www.marketwatch.com/story/ibm-profit-falls-on-lower-revenue-2016-01-19-164854141).

Read:IBM needs software to save it from prolonged downfall

(http://www.marketwatch.com/story/ibm-needs-software-to-save-it-from-prolonged-downfall-2016-01-19)

Shares of Goldman Sachs Group Inc. (GS) slid 2.6%, falling to

the lowest level in nearly three years, after the Wall Street bank

reported a sharp slide in fourth-quarter profit

(http://www.marketwatch.com/story/goldman-sachs-profit-hurt-by-massive-settlement-2016-01-20).

Earnings were dented by the bank's agreement last week to pay the

largest regulatory penalty

(http://www.marketwatch.com/story/goldman-sachs-to-pay-record-5-billion-penalty-over-sale-of-mortgage-bonds-2016-01-15)

in its history over the sale of mortgage bonds.

U.S.-listed shares of Royal Dutch Shell PLC (RDSB.LN) dropped

5.4% after the oil giant forecast fourth-quarter profit fell as

much as 50%

(http://www.marketwatch.com/story/shell-profit-falls-up-to-50-as-oil-prices-slump-2016-01-20).

Netflix Inc. (NFLX) reversed premarket gains to drop 1.2%

Wednesday afternoon, after the media-streaming company late Tuesday

released earnings that beat expectations

(http://www.marketwatch.com/story/netflix-shares-up-on-earnings-beat-company-predicts-modest-q1-2016-01-19).

Restaurant operator Brinker International Inc. (EAT) fell 4.7%

after its second-quarter revenue missed expectations

(http://www.marketwatch.com/story/brinker-international-second-quarter-revenue-misses-reaffirms-2016-guidance-2016-01-20).

Energy-infrastructure company Kinder Morgan Inc. (KMI) reports

earnings after the market closes.

Other markets: The dollar slid to a one-year low against the yen

(http://www.marketwatch.com/story/yen-hammers-away-at-dollar-as-investors-go-looking-for-safety-again-2016-01-20),

but flirted with an all-time high against the ruble . The buck also

rose to a 13-year high against the Canadian dollar,

(http://www.marketwatch.com/story/the-canadian-dollar-is-getting-crushed-2016-01-12)

dragged down by falling energy prices.

Read: Wednesday is make-or-break day for Brazil's currency

(http://www.marketwatch.com/story/wednesday-is-a-make-or-break-day-for-brazils-currency-2016-01-19)

Most metals declined, but gold rose 1.2% as the financial market

volatility spooked investors into perceived as havens. Treasury

yields plunged as demand for U.S. government debt surged.

(http://www.marketwatch.com/story/treasury-yields-fall-as-investors-flee-to-safety-2016-01-20)

(END) Dow Jones Newswires

January 20, 2016 15:27 ET (20:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

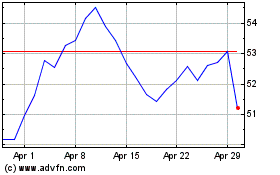

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

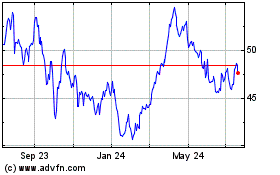

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Apr 2023 to Apr 2024