Anheuser-Busch InBev Starts Trading on Johannesburg Stock Exchange

January 15 2016 - 5:50AM

Dow Jones News

JOHANNESBURG—The world's biggest brewer, Anheuser-Busch InBev

NV, began trading on the Johannesburg Stock Exchange Friday, the

latest in a series of multinational heavyweights to complete a

secondary listing in South Africa, strengthening the local bourse

even as the broader economy continues to decelerate.

Mega-brewer AB InBev's listing is the most recent step in its

more than $100 billion quest to acquire SABMiller PLC, which has

its ancestral home in South Africa.

SABMiller is the exchange's second-largest company by market

capitalization, and local investors had expressed concerns that an

acquisition by AB InBev could mean losing access to both a major

beer company as well as leave them with fewer options for tapping

global growth through the JSE. The secondary listing is AB InBev's

solution to that problem.

South African regulators allow pension funds to invest just a

quarter of their assets offshore. The remaining three-quarters have

to be invested in South African-listed companies, a designation for

which AB InBev now qualifies. The secondary-listings of major

multinationals on the JSE, including mining behemoth BHP Billiton

Ltd, luxury goods giant Cie. Financiè re Richemont SA and British

American Tobacco PLC, which sells one in eight cigarettes smoked

world-wide, have boosted the exchange, and the fortunes of local

investors, despite a declining domestic economy.

"Pensioners are a lot wealthier than what they would have been

as a result of the structure of our stock market," said Rhynhardt

Roodt, portfolio manager of the 9.3 billion South African rand

($562 million) Investec Equity Fund. "We were very fortunate. These

global multinationals just seem to continue to do well despite a

fragile local economy and the weakening rand."

Economists believe growth in South Africa could decelerate for

the third consecutive year in 2016 to less than 1% annually, as

demand for South Africa's minerals continues to fall and more of

its factories succumb to rising labor costs and erratic electricity

supplies. Meanwhile, the rand has been plumbing all-time lows

against the U.S. dollar and other currencies.

SABMiller's precursor South African Breweries relocated from

Johannesburg to the U.K. in 1999, amid a bout of corporate flight

from South Africa, which at the time—as now—was suffering from a

falling currency and limited access to international investors.

Still, AB InBev Chief Executive Carlos Brito said the listing of

the company in Johannesburg was "a significant vote of confidence

in South Africa as an investment destination."

Write to Alexandra Wexler at alexandra.wexler@wsj.com

(END) Dow Jones Newswires

January 15, 2016 05:35 ET (10:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

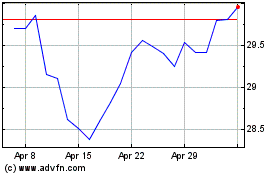

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

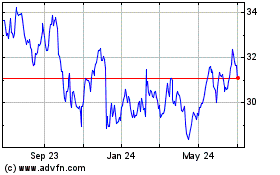

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Apr 2023 to Apr 2024