Frontier Airlines Targets 'Overpriced' Routes in Expansion Push

January 13 2016 - 6:30PM

Dow Jones News

Frontier Airlines, one of a trio of discount carriers roiling

the U.S. airline industry, is sharply expanding service this spring

by targeting routes where it thinks it can substantially undercut

larger rivals, a top executive said.

Frontier this month announced 56 new routes it will begin by

June. Though that's a roughly 40% increase from the carrier's

current 120 routes, it represents about a 20% increase in total

capacity. That's because the Denver-based carrier will fly to many

of the new destinations just three or four days a week, rather than

daily.

In an interview, Frontier President Barry Biffle said the plan

is to connect medium-size cities to larger airports on routes that

typically don't have a lot of competition. He called the routes

"overpriced, overlooked and underserved." The idea is to bring

Frontier's ultralow basic fares—augmented by fees for seat

assignments, carry-on bags and checked luggage—to people who

wouldn't otherwise fly.

While Frontier accounts for just a tiny share of the U.S.

air-travel market, its expansion is likely to extend the battle

between discounters and established carriers. That clash has

intensified as cheap fuel makes it more practical to add flights

and lower fares.

Over the past two years, Frontier, previously owned by a

regional carrier, has transformed itself under new management into

an ultralow-cost carrier along the lines of Spirit Airlines Inc.,

which pioneered that niche in the U.S.

Frontier, whose owner is an investment firm with stakes in

budget airlines around the world, earned $114 million in the first

nine months of 2015 on revenue of $1.2 billion, according to data

it provided to the Transportation Department. For all of 2014, it

reported profit of $129 million on $1.57 billion of revenue.

Spirit has focused its recent growth on major routes between big

cities. Larger carriers have been cutting fares aggressively on

many such routes to match Spirit's prices. The stepped-up

competition has pummeled the airline's stock. Last week Ben

Baldanza, stepped down abruptly as Spirit's chief executive.

A third ultra-budget carrier, Allegiant Travel Co.'s Allegiant

Air, mainly links small cities to warm-weather vacation spots,

including Las Vegas and San Diego. It has avoided the fare fray

because it is the only operator on most of its routes.

Frontier is aiming for a middle ground. Some of its planned

routes have no nonstop competition. On others, mainly serving

business fliers, travelers may face a layover at a large airline's

hub before reaching their destination.

"There's no one with our cost structure on the vast majority of

these routes," said Mr. Biffle, a former Spirit executive. He said

Frontier can accommodate the planned expansion with nine new planes

that will enter its 56-aircraft fleet this year.

Success isn't guaranteed. Larger airlines could match Frontier's

fares or swamp the targeted routes with new flights. Frontier is

still recovering from a high rate of late and canceled flights last

year and a spike in customer complaints.

Its new routes are from cities such as Austin, Texas, Milwaukee

and Pittsburgh. Many will go to larger cities like San Francisco,

Chicago and Atlanta. By undercutting prevailing fares, Frontier

hopes to persuade people to fly.

From Columbus, Ohio, to Philadelphia, for example, the average

fare is $228 one-way, according to Transportation Department data.

Starting in June, Frontier plans thrice weekly service on that

route that will cost $59. "Leisure passengers aren't going to spend

$228 one way," Mr. Biffle said. American Airlines Group Inc. is

selling tickets for $377 roundtrip on the route in June, according

to Expedia.com.

For Frontier's Austin-Orlando flights, which will start in June

with service four days a week, the one-way fare will be $79. The

only nonstop that appeared on Expedia for travel in June was a

JetBlue Airways Corp. flight for $322 roundtrip. For its

Cincinnati-Los Angeles flights planned to start in April,

Frontier's planned one-way fare of $119 compared with a June

nonstop price of $671 roundtrip from Delta Air Lines Inc.,

according to Expedia.

Mr. Biffle said Frontier used to focus on larger routes and most

of its current network offers daily flights. But after pruning

flights in Denver, packing more seats on its planes and

diversifying its route network, he said, Frontier thinks smaller

routes "will provide the most growth opportunity." By flying a few

days a week, he said, "it lowers the risk profile for us and you

don't need as much demand to fill the planes."

Write to Susan Carey at susan.carey@wsj.com

(END) Dow Jones Newswires

January 13, 2016 18:15 ET (23:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

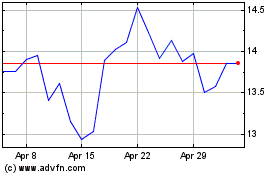

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

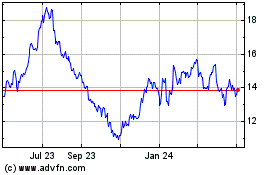

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024