Current Report Filing (8-k)

January 13 2016 - 2:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of report (Date of earliest event reported): January 5, 2016

Boreal Water Collection, Inc.

(Exact name of registrant as specified in its

charter)

| NV |

000-54776 |

98-0453421 |

| (State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

| of Incorporation) |

|

Identification No.) |

| 4496 State Road 42 North, Kiamesha Lake, New York |

12751 |

| (Address of Principal Executive Officers) |

(Zip Code) |

Registrant's telephone number, including area

code: (845) 794-0400

________________________________________

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

[_] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[_] Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Section 3 - Securities and Trading

Markets

3.02 Unregistered

Sales of Equity Securities

On January 5, 2016, Boreal Water Collection, Inc. entered into an

agreement with Mr. Abdul Aziz Al Athel (“subscriber”). The Agreement is for $250,000 of Secured Debentures and Common

Share Warrants in Units of $1000.00. Each Unit contains one 7.5% interest bearing Secured Debenture in the principal amount of

$1000.00 and a Warrant to purchase 1,352,532 common shares at an exercise price of $0.0075 per share. Interest is payable semi-annually.

The debenture is re-payable 24 months after the closing date. The security is a “mortgage on the assets of the company”

junior to the “existing bridge loan mortgage and line of credit.” The warrant exercise period is 2 years from the date

of issuance; and may be subscribed in whole or in part on a total of 2 occasions. If all the Warrants are exercised, a total of

338,133,000 common shares will be issued.

Section 9 - Financial Statements

and Exhibits

9.01 Financial

Statements and Exhibits.

(d) Exhibits

99.1 BOREAL

WATER COLLECTION INC. and MR. ABDUL AZIZ AL ATHEL TERM SHEET

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 13, 2016

| |

By: /s/ Mrs. Francine Lavoie |

| |

Mrs. Francine Lavoie, Principal Executive Officer, Principal Financial Officer, Controller and Sole Member of the Board of Directors |

Exhibit 99.1

BOREAL WATER COLLECTION

INC.

And

MR. ABDULAZIZ AL ATHEL

TERM SHEET

ISSUE OF $250,000 SECURED

DEBENTURES (“Units Offering”)

AND

ISSUE OF 338,133,000

SHARE WARRANTS (“Issue”)

Private

Placement of Units

(All amounts in US$)

This term sheet constitutes the principal terms

of the Issue as agreed by the Company and the Subscribers (collectively, the “Parties”, or individually a “Party”)

and shall be deemed to be binding upon the Company from the date of signature below until further definitive documentation is entered

into between the Parties with respect to the Units Offering and Issue (“Definitive Documents”). The transactions

contemplated herein are subject to any required regulatory approvals.

| Company: |

Boreal Water Collection Inc. of 4496 State Road 42 North Kiamesha Lake, NY 12751, USA, a company organised under the laws of Nevada. |

| Subscribers: |

Mr. Abdul Aziz Al Athel, 174 Prince Turki bin Abdulaziz Al Awal, Riyadh, Kingdom of Saudi Arabia (the “Subscriber”). |

| Issue: |

Issue of units (“Units”) of the Company. |

| Issue Price: |

$1,000.00 per Unit. |

| Issue Size: |

250 Units totalling $250,000.00 (the “Principal”). |

| Issue: |

1.

Issue of up to 250 secured debenture units of $1000 each (the “Debenture Units”) of the Company.

2.

Issue of 338,133,000 share warrants (the “Share Warrants”) for conversion into shares of the Company |

|

Units:

|

Each Unit will consist of one 7.5% interest

bearing secured debenture in the principal amount of $1,000 (a “Debenture” or the “Debentures”)

and 1,352,532 common share purchase warrants (a “Warrant”).

Each Warrant will entitle the holder to

purchase one common share of the Company (being the highest ranking share of the Company) (a “Share”) for a

period of 24 months from the date of issuance at a price of $0.0075 per Share (“Purchase Rights”). The

Subscriber may exercise its Purchase Rights in whole or in part and on a total of 2 occasions.

The Company will, within 5

Business Days of receipt by the Company of the funds from investors in relation to the Units Offering, issue to the

Subscriber the same number of Share Warrants as are issued under the Units Offering, enter the name of the Subscriber into

the register of the Company and issue to the Subscriber a certificate for all of the Share Warrants registered in its

name. |

| Transfer |

Share Warrants may be transferred by means of an instrument

of transfer in any usual form or any other form approved by the Board. |

| Reorganisation |

If the Company undergoes a subdivision, consolidation or

reclassification of its shares, then the Company shall adjust the Purchase Rights accordingly, so that the Subscriber is not in

any way prejudiced by any such event. |

| Authorities |

For so long as any Share Warrants remain exercisable, the

Company shall procure that the Board of the Company shall at all times during the exercise period have authority to grant

Share Warrants and to issue shares on exercise of any Purchase Rights in accordance with the terms set out herein. |

| Winding up |

If an effective resolution for the winding up of the Company

is passed, the Subscriber with unexercised Purchase Rights shall be treated as if it had, immediately before the passing of the

resolution, fully exercised its outstanding Purchase Rights. |

| Use of Proceeds: |

The proceeds of the Issue will be used to fund the Company’s working capital. |

| Security of Debentures: |

The Debentures shall be secured

by way of a mortgage on the assets of the Company, and will be ranked after the existing bridge loan mortgage and line ofcredit. |

| Debenture Interest Rate and payment terms: |

7.5% per annum, paid in cash on a semi-annual basis and up to the date on which the Debentures are redeemed. |

| Expressions of interest: |

Thursday 24 December 2015 (the “Closing Date”). |

| Repayment Date: |

24 months after the Closing Date (the “Repayment Date”). |

| Long Stop Date: |

If Definitive Documents have not been entered into within 3 weeks of the date below, all subscription monies must be immediately returned to the Subscriber together with all accrued interest. |

| Hold Period: |

The Debentures and Warrants will be subject to a hold period of 3 months and one day from the issue of the Debentures and/or Warrants, as the case may be. The Shares issuable in satisfaction of interest or upon conversion of Warrants may also be subject to a hold period, as required by applicable US securities laws. |

Representations

and Warranties |

The Company makes the following representations and warranties to

the Subscriber on the date of this term sheet:

Due incorporation

The Company is a duly incorporated company validly existing under

the law of its jurisdiction of incorporation; and has the power to own its assets and carry on its business as it is being conducted.

Powers

The Company has the power to enter into, deliver and perform, and

has taken all necessary action to authorise its entry into, delivery and performance of, this term sheet and all Definitive Documents.

No limit on its powers will be exceeded as a result of any of the terms of this term sheet.

Non-contravention

The entry into and performance by it of, and the transactions contemplated

by, this term sheet do not and will not contravene or conflict with:

the Company’s constitutional documents;

any agreement or instrument binding on it or its assets or constitute

a default or termination event (however described) under any such agreement or instrument; or

any law or regulation or judicial or official order, applicable

to it.

Authorisations

The Company has obtained all required or desirable authorisations

to enable it to enter into, exercise its rights and comply with its obligations under this term sheet. Any such authorisations

are in full force and effect.

Binding obligations

Subject to any general principles of law limiting its obligations

specifically referred to in any legal opinion that has been delivered to the Subscriber prior to the date below:

the Company’s obligations under this term sheet are legal,

valid, binding and enforceable; and the Units Offering and Issue under this term sheet creates:

valid, legally binding and enforceable obligations on the Company.

No filing or stamp taxes

Under the law of its jurisdiction of incorporation, it is not necessary

to file, record or enrol this term sheet with any court or other authority in that jurisdiction or pay any stamp, registration

or similar taxes.

No default

No Event of Default (as defined below) and, on the date of this

term sheet, potential Event of Default, is continuing or might reasonably be expected to result from the making of the Units Offering

and/or the Issue.

No other event or circumstance is outstanding which constitutes

(or, with the expiry of a grace period, the giving of notice, the making of any determination or any combination thereof, would

constitute) a default or termination event (howsoever described) under any other agreement or instrument which is binding on it

or to which any of its assets is subject which has or is likely to have a material adverse effect on the Company or its ability

to meet any of its obligations under this term sheet.

Information

The information, in written or electronic format, supplied by,

or on behalf of, the Company to the Subscriber in connection with the Units Offering and/or Issue was, at the time it was supplied

or at the date it was stated to be given (as the case may be):

if it was factual information, complete, true and accurate in all

material respects;

if it was a financial projection or forecast, prepared on the basis

of recent historical information and on the basis of reasonable assumptions and was arrived at after careful consideration;

if it was an opinion or intention, made after careful consideration

and was fair and made on reasonable grounds; and not misleading in any material respect, nor rendered misleading by a failure

to disclose other information,

except to the extent that it was amended, superseded or updated

by more recent information supplied by, or on behalf of, the Company to the Subscriber.

|

| |

Financial statements

Any financial statements delivered to the Subscriber by the Company

were prepared in accordance with consistently applied accounting principles, standards and practices generally accepted in its

jurisdiction of incorporation unless expressly disclosed to the Subscriber in writing to the contrary before the date below, and

fairly represents the Company's financial condition and operations during the relevant accounting period and was approved by the

Company's directors in compliance with laws and regulations of its jurisdiction.

No material adverse change

There has been no material adverse change in the business, assets,

financial condition, trading position or prospects of the Company since the date of the publication of its most recent financial

statements. The Company will continue to operate and be managed in the same way after the date below as it was before such date.

No litigation

No litigation, arbitration or administrative proceedings are taking

place, pending or, to the Company's knowledge, threatened against it, any of its directors or any of its assets.

No breach of law

The Company has not breached any law or regulation which breach

has or is likely to have a material adverse effect on the Company or its ability to repay.

Pari passu

The Company's payment obligations under this agreement rank at least

pari passu with all existing and future unsecured and unsubordinated obligations (including contingent obligations), except for

those mandatorily preferred by law applying to companies generally.

Ownership of assets

The Company is the sole legal and beneficial owner of, and has good,

valid and marketable title to, all its assets and no security exists over its assets except for any security approved by the Subscriber. |

| |

|

| Listing: |

The Debentures will not be listed for trading on any exchange. |

|

Company’s right to early redemption:

|

The Company has the right to redeem

the Debentures at any time after the expiry of the Hold Period but prior to the Repayment Date, subject to paying the Subscribers

(a) the Principal amount; (b) all interest accrued up to the date of redemption of the Debentures; and (c) an additional amount

of three months of interest calculated at 7.5% per annum on the Principal. For the avoidance of doubt any redemption of Debentures

will not have any effect upon the Warrants issued in the Units offering. |

| Default Events |

Each of the events listed below shall be an “Event of Default” (whether or not caused by

any reason whatsoever outside the control of the Company or any other person): |

| |

• |

the Company fails to pay any sum payable under this term sheet at the time and in the manner specified; or |

| |

• |

the Company fails to perform or comply with any provision of this term sheet and fails to remedy such breach within 14 days

of the service of a notice by the Subscriber notifying the Company of the default and requiring the default to be remedied; or |

| |

• |

the Company defaults in the performance of any other agreement for borrowed monies so

as to accelerate or render capable of acceleration the due date of repayment of any such borrowed monies is due on demand and

is not paid in full forthwith on such demand being made; or |

| |

• |

the Company has provided any false information under or in connection with this term sheet and the representations and warranties

in particular; or |

| |

• |

the Company takes on any more debt that ranks above the Units/Debentures; or |

| |

• |

a petition is presented for the winding up or administration of the Company or an order is made or a resolution is

passed for the winding up of the Company except for the purposes

of a reconstruction or amalgamation on terms previously approved in writing by the Subscriber; or |

| |

• |

a liquidator, administrator, administrative receiver, receiver, trustee, sequestrator or similar officer is appointed in

respect of the Company in respect of all or any of the assets of any of the Company; or |

| |

• |

the Company commences negotiations or enters into an arrangement with one or more of its creditors with a view to rescheduling any of its indebtedness; |

| |

• |

a distress, attachment, execution, sequestration or other legal process is levied against, or any forfeiture proceedings

are commenced against, any of the assets of the Company; or |

| |

• |

the Company suspends payment of its debts or is unable or is deemed by law or regulation in its local jurisdiction to be

unable to pay its debts; or |

| |

• |

any indebtedness of any of the Company becomes immediately due and payable, or capable of being declared so due and payable,

prior to its stated maturity, or the Company fails to discharge any indebtedness on its due date; or |

| |

• |

all or any part of this term sheet or a Debenture becomes invalid, unlawful, unenforceable, terminated, disputed or ceases

to have full force and effect; or |

| |

• |

any other event occurs or any other circumstances arise or develop including, without limitation a change in the financial

position, state of affairs or prospects of the Company, in the light of which the Subscriber reasonably considers that there is

a significant risk that the Company is, or will later become, unable to discharge its liabilities and obligations under this term

sheet as they fall due. |

|

If an Event of Default occurs and is continuing at any time

thereafter (unless the same has been remedied) the Debenture(s) and all other amounts accrued or outstanding under this term sheet

shall become immediately due and payable by the Company together with all accrued interest and all other sums then owed by the

Company.

The Company indemnifies the Subscriber on demand against all

reasonable claims, costs, losses and expenses certified by the Subscriber as incurred by the Subscriber as a consequence of default

by the Company in the due performance of any of the obligations expressed to be assumed by the Company in the term sheet.

A certificate of the Subscriber as to the amount for the time

being required to indemnify it in respect of any of the circumstances set out above, shall be conclusive evidence thereof in any

legal action or proceeding arising out of or in connection with the term sheet save in the case of manifest error. |

| Conditions: |

Execution and delivery of standard documentation, including the Subscription Agreement, satisfactory in form and substance to the Parties, and compliance with all applicable legal and regulatory requirements. |

| Assignment and Transfer |

The Company may not assign, transfer or otherwise dispose of any of its rights or obligations under this term sheet. |

| Capacity |

Each Party involved in this term sheet warrants that it has the necessary capacity, due authority and permission prior to entering into this term sheet. |

| Costs |

Except as expressly provided in this term sheet, each Party shall pay its own costs incurred in connection with the negotiation, preparation, and execution of this term sheet and any documents referred to in it. |

| Governing law and jurisdiction |

This term sheet and any dispute or claim arising out of or in connection with it or its subject matter or formation (including non-contractual disputes or claims) shall be governed by and construed in accordance with the law of New York State of the United States of America. |

The Parties agree to these terms as of 5 January

2016

By: /s/ Francine Lavoie

Boreal Water Collection Inc.

We hereby accept these terms and subscribe

for 250 Units for total consideration of $250,000

By: /s/Abdulaziz Mohammed Al Athel

on behalf of the Subscriber

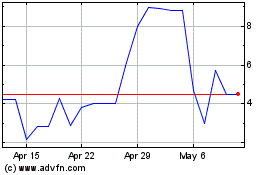

Birdie Win (PK) (USOTC:BRWC)

Historical Stock Chart

From Mar 2024 to Apr 2024

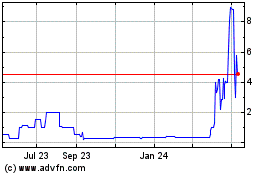

Birdie Win (PK) (USOTC:BRWC)

Historical Stock Chart

From Apr 2023 to Apr 2024