Captive Insurance Companies To Lose Federal Home Loan Bank Membership

January 12 2016 - 12:00PM

Dow Jones News

A top federal housing regulator on Tuesday shut the door on

mortgage investors who had been using a loophole to access

low-cost, government-backed financing.

The Federal Housing Finance Agency said so-called captive

insurance companies, which insure the risks of the companies that

own them, no longer will be eligible for membership in

government-backed federal home loan banks.

The 11 regional federal home loan banks advance loans to

commercial banks, savings banks, insurers and credit unions to help

fund mortgages and community investments.

The FHFA, which proposed the change in September 2014, said

captive insurers that joined before the proposal would have their

membership sunset over five years, while those that joined between

the proposal and final rule would have one year.

The move is likely to disappoint mortgage real-estate investment

trusts, their investors and others in the real-estate industry who

had argued the investment firms help promote mortgage lending by

buying loans as other big mortgage investors, such as the Federal

Reserve and mortgage-finance companies Fannie Mae and Freddie Mac,

wind down or prepare to wind down their portfolios.

On Tuesday, the FHFA also said it would withdraw two other

provisions related to FHLB membership that would have required

members to maintain a minimum level of investment in mortgage

assets.

Write to Joe Light at joe.light@wsj.com

(END) Dow Jones Newswires

January 12, 2016 11:45 ET (16:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

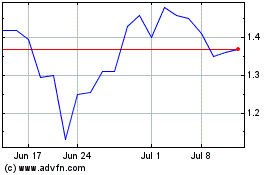

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

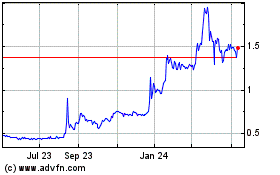

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Apr 2023 to Apr 2024