FedEx-TNT Express Deal Clears Hurdle In Europe

January 09 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 1/9/16)

By Tom Fairless and Laura Stevens

BRUSSELS -- European Union regulators have unconditionally

approved FedEx Corp.'s acquisition of Dutch parcel company TNT

Express NV, ending a six-month antitrust investigation that was one

of the biggest hurdles facing the nearly $5 billion deal.

The merger, announced in April, would hand FedEx an extensive

ground network in Europe, making it a bigger player in the

burgeoning e-commerce market.

The approval had been expected since FedEx said in October that

European regulators wouldn't challenge the transaction. That was

seen as an unexpectedly easy pass from Europe's antitrust police,

who had blocked a similar deal between United Parcel Services Inc.

and TNT in 2013.

It is welcome news for FedEx, which suffered a black eye over

the holidays, as it said last-minute online orders and severe

weather resulted in some packages arriving late.

FedEx, which is based in Memphis. Tenn., is still awaiting

approvals for the TNT deal from several countries, most notably

China and Brazil. U.S. regulators approved the merger last

year.

China has emerged as something of a wild card for deal-makers

world-wide. Experts say the country's newly established antitrust

authority considers issues that go beyond traditional competition

law, including whether deals may harm Chinese national economic

development. It also has a smaller staff than many of its

peers.

As a result, China has held up some mergers for months after

they were approved by U.S. and EU antitrust authorities, including

Microsoft's Corp.'s $5.85 billion acquisition of Nokia Corp.'s

handset business.

Analysts largely expect FedEx to receive clearance from the

remaining countries, and FedEx said it is confident it will close

the deal in the first half of the year.

On an analyst call last month, FedEx Chief Executive Fred Smith

said TNT would be a welcome addition to the company's portfolio

amid a global economic slowdown. "Despite contraction of U.S.

exports due to the high U.S. dollar and low world [economic] and

trade growth, the overall market for international door-to-door

express continues to increase, also driven by e-commerce," he

said.

Up until now, FedEx has largely focused on delivery services in

and out of Europe, with limited shipping options between countries

within the region. Combining the two networks will make it the

third-largest player in Europe's international express-delivery

market, behind Deutsche Post AG's DHL and UPS. Its step-up in

ground delivery will allow it to better compete for e-commerce

shipments.

The European Commission opened a full investigation into the

deal in July, warning that a merger could lead to insufficient

competition on certain parcel delivery routes and, thus, higher

prices for businesses and consumers.

But on Friday, the regulator said it had concluded that the

delivery companies weren't particularly close competitors in Europe

and that the merged entity would "continue to face sufficient

competition from its rivals."

"We are extremely pleased to receive the European Commission's

unconditional approval," said David Binks, FedEx's regional

president for Europe. He said the deal would "provide significant

value to the employees, customers and shareholders of both

companies."

EU antitrust chief Margrethe Vestager said her agency had

"thoroughly assessed the markets affected" by the deal due to the

importance of affordable package delivery for many businesses and

consumers, particularly in the burgeoning e-commerce market.

"The conclusion is that European consumers will not be adversely

affected by the transaction," Ms. Vestager said.

Executives at both companies had maintained the deal was

substantially different from UPS's attempt because FedEx's

operations in Europe are much smaller than those of its

Atlanta-based rival.

UPS had revised its 5.2 billion euro proposal -- then valued at

nearly $7 billion but now $5.63 billion -- three times and made

plans to create a pan-European competitor in the

overnight-parcel-delivery market, but still failed to satisfy the

EU's concerns.

(END) Dow Jones Newswires

January 09, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

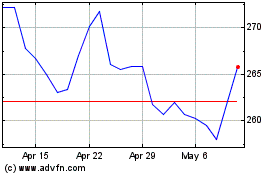

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

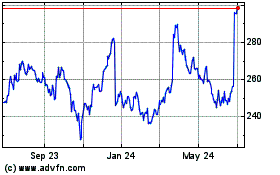

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024