- GAAP Revenue Anticipated to Range

from $60.0 Million to $64.0 Million

- Expects GAAP Earnings Per Share of

$0.38 to $0.43 per share

- Expects Non-GAAP EPS of $0.66 to

$0.75 per share

SurModics, Inc. (Nasdaq:SRDX), a leading provider of medical

device and in vitro diagnostic technologies to the healthcare

industry, today announced updated guidance for the year ending

September 30, 2016. The revenue and earnings per share ranges

incorporate the acquisition of Creagh Medical, a developer and

manufacturer of percutaneous transluminal angioplasty (PTA) balloon

catheters.

According to Gary Maharaj, SurModics president and chief

executive officer, “Our recent acquisition provides the key

foundation to accelerate our transformation into a whole products

solutions medical device company. With the Creagh Medical

acquisition, SurModics plans to develop a robust pipeline of

interventional cardiology devices. Integrating Creagh Medical is a

top priority for us in fiscal 2016. Moreover, we will advance our

drug-coated balloon platform with a first-in-human clinical trial,

as we also continue to drive our core medical device and in vitro

diagnostics businesses. Our objective is to generate consistent

revenue growth in the mid-teens, on a constant currency basis, and

EBITDA margins greater than 30% within three years.”

SurModics now estimates GAAP revenue for fiscal 2016 to be in

the range of $60.0 million to $64.0 million. This includes an

aggregate of $3.5 million to $4.5 million from the acquisition of

Creagh Medical. Diluted GAAP earnings are expected to range from

$0.38 to $0.43 per share, which includes $4.4 million to $5.0

million, or $0.27 to $0.31 per share, of integration costs, as well

as amortization and contingent consideration accretion expenses

associated with the acquisition. Because the final purchase

accounting for the Creagh Medical acquisition has not been

completed, the amount of amortization and contingent consideration

accretion expenses may vary materially from preliminary

estimates.

Non-GAAP earnings are expected to range from $0.66 to $0.75 per

share. SurModics has provided a reconciliation of GAAP to non-GAAP

measures in the schedules attached to this press release. The

fiscal 2015 and 2014 results have been updated to reflect

acquisition-related amortization in a manner consistent with the

fiscal 2016 non-GAAP guidance.

Assumptions in the Company’s 2016 guidance include:

- No substantial changes in the US Dollar

and Euro exchange range in fiscal 2016 from current rates.

- SurModics anticipates research and

development expenses to be approximately mid-thirty percent of

revenue.

- Selling, general and administrative

expenses are projected to be approximately mid-twenty percent of

revenue.

- The income tax rate is expected to be

between 39.0% and 42.0%. This includes the benefit of the

re-enactment of the Federal R&D tax credit, offset by on-tax

benefited items including contingent consideration accretion and

transaction costs.

- SurModics estimates capital

expenditures to be between $4.5 million and $5.0 million, including

investments in Creagh Medical’s Irish facility.

Concluded Maharaj, “We expect fiscal 2016 to be a pivotal year

for us, and we enter it with enthusiasm about SurModics’ prospects

and initiatives. Our team is intently focused on evolving into a

highly relevant and valued provider of whole product medical device

solutions, as well as continuing to grow our global medical device

and in vitro diagnostic customer base.”

Live Webcast

SurModics will host a webcast at 7:30 a.m. CT (8:30 a.m. ET)

today to provide updated financial guidance for full fiscal year

2016 and to discuss the recent company acquisition of Creagh

Medical. To access the webcast, go to the investor relations

portion of the Company’s website at www.surmodics.com and click on

the webcast icon. A replay of the conference call will be available

by dialing 888-203-1112 and entering conference call ID passcode

2845259. The audio replay will be available beginning at 10:30 a.m.

CT on Friday, January 8, 2016, until 10:30 a.m. CT on Friday,

January 15, 2016.

About SurModics, Inc.

SurModics partners with the world’s leading and emerging medical

device, diagnostic and life science companies to develop and

commercialize innovative products designed to improve lives by

enabling the detection and treatment of disease. Our mission is to

be a trusted partner to our customers by providing the most

advanced surface modification technologies and in vitro diagnostic

chemical components that help enhance the well-being of patients.

The Company’s core offerings include surface modification coating

technologies that impart lubricity, prohealing, and

biocompatibility characteristics and components for in vitro

diagnostic test kits and microarrays. SurModics’ strategy is to

build on the product and technical leadership within these fields,

and expand the core offerings to generate opportunities for longer

term sustained growth. SurModics is headquartered in Eden Prairie,

Minnesota. For more information about the Company, visit

www.surmodics.com. The content of SurModics’ website is not part of

this press release or part of any filings that the Company makes

with the SEC.

Safe Harbor for Forward-Looking Statements

This press release contains forward-looking statements.

Statements that are not historical or current facts, including

statements about beliefs and expectations regarding the Company’s

performance in the near- and long-term, including our revenue,

earnings and cash flow expectations for fiscal 2016, and our

SurVeil Drug-Coated Balloon, are forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties, and important factors could cause actual results to

differ materially from those anticipated, including (1) our ability

to successfully develop, obtain regulatory approval for, and

commercialize our SurVeil Drug-Coated Balloon product; (2) our

reliance on third parties (including our customers and licensees)

and their failure to successfully develop, obtain regulatory

approval for, market and sell products incorporating our

technologies; (3) our ability to achieve our corporate goals; (4)

our ability to successfully identify and acquire target companies

or achieve expected benefits from acquisitions that are

consummated; (5) possible adverse market conditions and possible

adverse impacts on our cash flows, and (6) the factors identified

under “Risk Factors” in Part I, Item 1A of our Annual Report on

Form 10-K for the fiscal year ended September 30, 2015, and updated

in our subsequent reports filed with the SEC. These reports are

available in the Investors section of our website at

www.surmodics.com and at the SEC website at www.sec.gov.

Forward-looking statements speak only as of the date they are made,

and we undertake no obligation to update them in light of new

information or future events.

Use of Non-GAAP Financial Information

In addition to reporting financial results in accordance with

generally accepted accounting principles, or GAAP, SurModics is

reporting non-GAAP financial results including non-GAAP net income,

non-GAAP diluted net income per share, and EBITDA. We believe that

these non-GAAP measures provide meaningful insight into our

operating performance excluding certain event-specific matters, and

provide an alternative perspective of our results of operations. We

use non-GAAP measures, including those set forth in this release,

to assess our operating performance and to determine payout under

our executive compensation programs. We believe that presentation

of certain non-GAAP measures allows investors to review our results

of operations from the same perspective as management and our board

of directors and facilitates comparisons of our current results of

operations. The method we use to produce non-GAAP results is not in

accordance with GAAP and may differ from the methods used by other

companies. Non-GAAP results should not be regarded as a substitute

for corresponding GAAP measures but instead should be utilized as a

supplemental measure of operating performance in evaluating our

business. Non-GAAP measures do have limitations in that they do not

reflect certain items that may have a material impact on our

reported financial results. As such, these non-GAAP measures should

be viewed in conjunction with both our financial statements

prepared in accordance with GAAP and the reconciliation of the

supplemental non-GAAP financial measures to the comparable GAAP

results provided for the specific periods presented, which are

attached to this release.

SurModics, Inc., and Subsidiaries Estimated

Non-GAAP Net Income per Common Share Reconciliation For the

Fiscal Year Ended September 30, 2016 Full

Fiscal Year Estimate Low High

GAAP results $ 0.38 $ 0.43 Estimated due diligence and

integration costs (1) 0.18 0.20 Estimated amortization expense (2)

0.12 0.14 Federal research and development discrete tax item (3)

(0.02 ) (0.02 )

Adjusted results $ 0.66

$ 0.75 (1) These adjustments consist of (a)

due diligence and integration fees and (b) the contingent

consideration adjustments represent accounting adjustments to state

contingent consideration liabilities at their estimated fair value.

These adjustments can be highly variable depending on the assessed

likelihood and amount of future contingent consideration payments.

Due diligence and other fees include legal, tax, investment banker

and other expenses associated with acquisitions that can be highly

variable and not representative of on-going operations. (2)

Amortization expense is a non-cash expense and does not impact our

liquidity or compliance with the financial covenants included in

our credit facility agreement. Management removes the impact of

amortization from our operating performance to assist in assessing

our cash generated from operations. We believe this is a critical

metric for measuring our ability to generate cash and invest in our

growth. Therefore, amortization expense for the Creagh Medical and

other prior acquisitions is excluded from management's assessment

of operating performance and is also excluded from our operating

segments' measures of profit and loss used for making operating

decisions and assessing performance. Accordingly, management has

excluded amortization expense for purposes of calculating these

non-GAAP financial measures to facilitate an evaluation of our

current operating performance, particularly in terms of liquidity.

(3) Represents the estimated discrete income tax benefit associated

with the December 2015 signing of the Protecting Americans from Tax

Hikes Act of 2015— which retroactively reinstated federal R&D

income tax credits for calendar 2015.

SurModics, Inc.,

and Subsidiaries Net Income and Diluted EPS GAAP to Non-GAAP

Reconciliation For the Fiscal Year Ended September 30,

2015

(in thousands, except per share data)

(Unaudited)

TotalRevenue

OperatingIncome

OperatingIncomePercentage

Income

fromOperationsBeforeIncomeTaxes

NetIncome

DilutedEPS

GAAP $ 61,898 $ 19,089 30.8 % $ 18,241 $ 11,947 $

0.90 Adjustments: One-time royalty catch-up payments (1) (560 )

(560 ) (0.5 ) (560 ) (362 ) (0.03 ) Claim settlement (2) - 2,500

4.0 2,500 1,617 0.12 Impairment loss on strategic investment (3) -

- - 1,500 1,500 0.11 Gain on investment (4) - - - (523 ) (523 )

(0.04 ) Research and development tax credit (5) - - - - (201 )

(0.01 ) Amortization of intangible assets (6) -

619 1.0 619 400

0.03

Non-GAAP $ 61,338 $ 21,648

35.3 % $ 21,777 $ 14,378 $ 1.08 (1)

Represents a reduction in revenue for the portion of a

one-time customer royalty payment related to periods prior to

fiscal 2015 and the associated tax impact. (2) Reflects the

settlement of a customer claim and associated tax impact. (3) An

impairment charge associated with a strategic investment in

CeloNova BioSciences, Inc. (4) Reduction in net investment income

associated with the sale of Intersect ENT shares. There is no

income tax benefit as there was an offsetting release of capital

loss valuation allowance. (5) Represents a discrete income tax

benefit associated with the December 2014 signing of the Tax

Increase Prevention Act of 2014 which retroactively reinstated

federal R&D income tax credits for calendar 2014. (6) To

exclude amortization of acquisition related intangible assets and

associated tax impact.

SurModics, Inc., and

Subsidiaries

Income from Continuing Operations and Diluted EPS GAAP to

Non-GAAP Reconciliation For the Fiscal Year Ended September

30, 2014

(in thousands, except per share data)

(Unaudited)

TotalRevenue

OperatingIncome

OperatingIncomePercentage

Income

fromOperationsBeforeIncomeTaxes

NetIncome

DilutedEPS

GAAP $ 57,439 $ 18,576 32.3 % $ 18,472 $ 12,207 $

0.88 Adjustments: Board of Directors stock vesting acceleration (1)

- 914 1.6 914 580 0.04 Contingent milestone income (2) - - - (709 )

(709 ) (0.05 ) Impairment loss on strategic investment (3) - - -

1,184 1,184 0.09 Amortization of intangible assets (4) -

606 1.1 606 385

0.03

Non-GAAP $ 57,439 $ 20,096 35.0 % $ 20,467

$ 13,647 $ 0.99 (1) Adjusted to

reduce operating expenses associated with the acceleration of Board

of Director stock-based compensation awards and associated tax

impact. (2) Reflects a reduction in net investment income

associated with contingent milestone payments related to the sale

of Vessix Vascular shares which were sold in fiscal 2014. (3)

Represents net investment income associated with an investment

impairment charge associated with the strategic investment in

ThermopeutiX. (4) To exclude amortization of acquisition related

intangible assets and associated tax impact.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160108005161/en/

SurModics, Inc.Andy LaFrence, 952-500-7000Vice President of

Finance and Chief Financial Officer

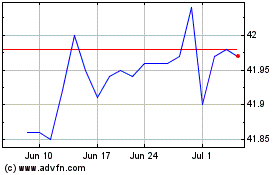

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

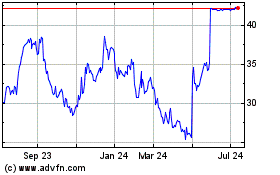

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Apr 2023 to Apr 2024